The seismic survey market is experiencing robust growth driven by increasing exploration activities across offshore and onshore reserves, coupled with rising demand for accurate subsurface mapping. Advancements in data acquisition technologies, imaging techniques, and integrated processing software are enhancing precision and operational efficiency. Current market expansion is supported by the revival of upstream oil and gas investments and the growing need to optimize hydrocarbon recovery from mature fields.

Companies are increasingly focusing on digital transformation, employing AI and machine learning to improve seismic interpretation and reduce exploration risks. The future outlook indicates steady growth as governments and private players prioritize energy security and sustainable exploration practices.

Strategic collaborations and technological upgrades are expected to accelerate survey turnaround times and improve data accuracy Overall, market growth is being underpinned by continued exploration intensity, enhanced imaging solutions, and expansion into renewable and geothermal exploration domains, ensuring a stable trajectory for the seismic survey industry.

| Metric | Value |

|---|---|

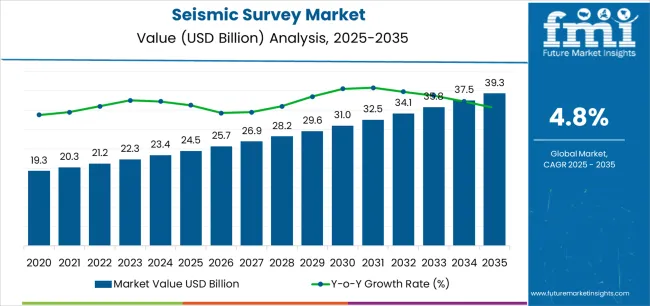

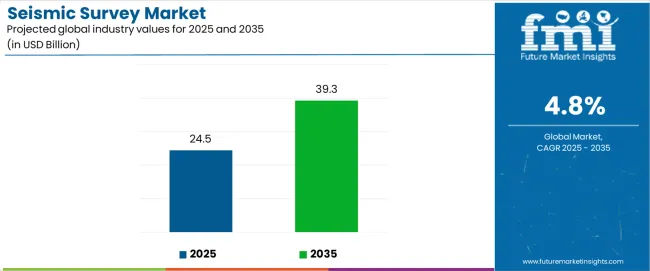

| Seismic Survey Market Estimated Value in (2025 E) | USD 24.5 billion |

| Seismic Survey Market Forecast Value in (2035 F) | USD 39.3 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

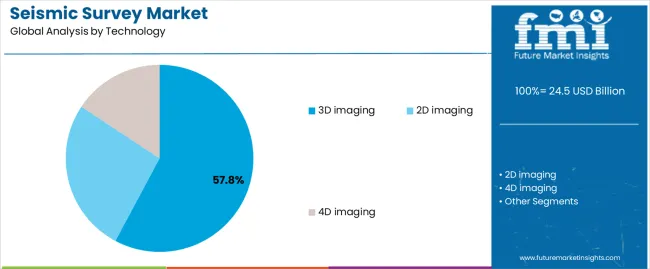

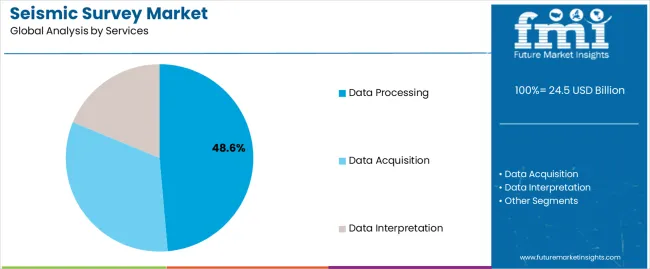

The market is segmented by Technology and Services and region. By Technology, the market is divided into 3D imaging, 2D imaging, and 4D imaging. In terms of Services, the market is classified into Data Processing, Data Acquisition, and Data Interpretation. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 3D imaging segment, holding 57.80% of the technology category, has emerged as the dominant segment due to its superior capability in providing detailed geological models and enhanced spatial resolution. Adoption has been accelerated by its proven ability to identify complex subsurface structures and improve drilling precision.

The segment’s leadership has been reinforced by continuous advancements in seismic sensors, data integration platforms, and imaging algorithms that deliver higher fidelity datasets. Increased exploration activity in deepwater and ultra-deepwater environments has further supported the demand for 3D imaging solutions.

Market participants are investing in real-time imaging and cloud-based analytics to streamline data interpretation and reduce processing time The combination of cost efficiency, improved data accuracy, and wide applicability in both oil and gas and renewable energy exploration is expected to sustain the dominance of 3D imaging over the forecast period.

The data processing segment, accounting for 48.60% of the services category, has maintained its leading position due to the critical role it plays in converting raw seismic data into actionable geological insights. Its prominence has been strengthened by the growing complexity of seismic datasets and the requirement for high-speed, high-accuracy interpretation.

Technological advancements such as artificial intelligence, cloud computing, and parallel processing have enhanced the efficiency and accuracy of seismic data workflows. Service providers are increasingly offering integrated data processing solutions that combine imaging, interpretation, and modeling capabilities to improve exploration success rates.

Rising adoption of digital twins and predictive analytics within the oil and gas sector has further expanded the relevance of data processing services As energy companies continue to pursue efficiency and de-risk exploration portfolios, demand for advanced data processing services is expected to remain strong, driving sustained revenue growth for this segment.

From 2020 to 2025, the seismic survey market experienced a CAGR of 6.7%. The adoption of 3D seismic surveys gained momentum, offering superior imaging resolution and enhanced subsurface interpretation compared to 2D surveys.

Technological innovations such as broadband seismic sensors, advanced imaging algorithms, and high-performance computing further improved the accuracy and efficiency of seismic data acquisition and processing.

The demand for 4D seismic surveys increased, driven by the need for reservoir monitoring and optimization in mature oil and gas fields. 4D seismic technology enables operators to track reservoir changes over time, optimize production strategies, and maximize hydrocarbon recovery.

The seismic survey market is expected to witness steady growth, driven by technological advancements, increasing E&P activities, and the exploration of unconventional resources. Projections indicate that the global seismic survey market is expected to experience a CAGR of 5.1% from 2025 to 2035.

| Historical CAGR 2020 to 2025 | 6.7 % |

|---|---|

| Forecast CAGR 2025 to 2035 | 5.1% |

The provided table highlights the top five countries in terms of revenue, with Japan and United Kingdom leading the list. Ongoing advancements in seismic imaging technology have improved data quality and interpretation accuracy, driving demand for high-resolution surveys in United Kingdom.

Japanese companies are known for their advancements in seismic imaging technology and data processing algorithms, driving growth and innovation in the seismic survey market.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 5.4% |

| The United Kingdom | 6.6% |

| China | 5.9% |

| Japan | 6.7% |

| South Korea | 2.9% |

The seismic survey market in the United States is expected to rise at a CAGR of 5.4% from 2025 to 2035. The emergence of shale gas and tight oil plays, such as the Permian Basin, Eagle Ford, Bakken, and Marcellus, has revolutionized the United State energy landscape.

Seismic surveys have played a crucial role in delineating and characterizing these unconventional reservoirs, driving demand for high-resolution 3D seismic data.

The United States has been at the forefront of seismic imaging technology innovation, with companies continuously investing in cutting-edge equipment, software, and techniques.

Advanced seismic acquisition systems, broadband sensors, and sophisticated imaging algorithms have improved data quality and interpretation accuracy, supporting exploration and development activities.

The seismic survey market in the United Kingdom is expected to rise at a CAGR of 6.6% from 2025 to 2035. There is increasing interest in renewable energy projects and carbon capture and storage (CCS) initiatives in the United Kingdom.

Seismic surveys may be utilized for site characterization, geotechnical assessments, and subsurface imaging in support of offshore wind farms, CCS infrastructure, and geothermal energy projects.

The United Kingdom has a strong track record of technological innovation in the oil and gas industry. Advances in seismic imaging technology, data processing algorithms, and reservoir monitoring techniques contribute to the demand for high-quality seismic surveys that provide detailed subsurface information for decision-making in exploration, development, and production activities.

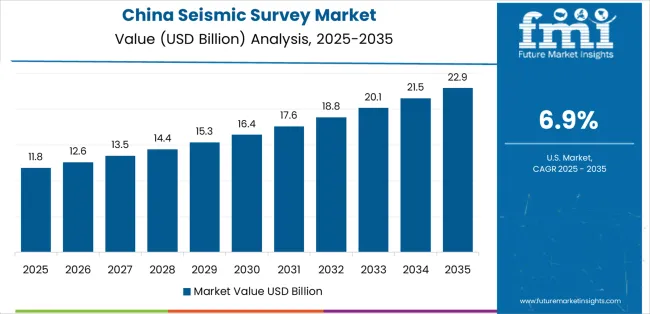

The seismic survey market in China is expected to rise at a CAGR of 5.9% from 2025 to 2035. The escalating demand for oil and gas in China, driven by economic expansion, urbanization, and industrial development, acts as a primary driver necessitating extensive exploration efforts, such as seismic surveys.

These activities are essential for pinpointing and exploiting fresh hydrocarbon reservoirs to fulfill the burgeoning energy requirements of the nation. Supportive policies and incentives implemented by the Chinese government serve as key drivers in fostering investment within the upstream oil and gas sector, particularly in exploration endeavors.

By offering tax incentives, subsidies, and enacting regulatory reforms, these initiatives aim to catalyze domestic resource development while also enticing foreign investment, thereby stimulating growth within the seismic survey market.

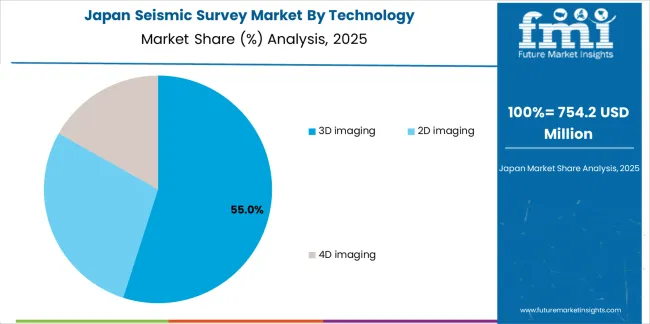

The seismic survey market in Japan is expected to rise at a CAGR of 6.7% from 2025 to 2035. Japan has significant geothermal energy potential, and seismic surveys are employed to characterize subsurface geology, map geothermal reservoirs, and assess resource viability for geothermal power generation projects.

Japan is prone to natural disasters, including earthquakes and tsunamis. Seismic surveys are utilized not only for oil and gas exploration but also for assessing seismic hazards, monitoring subsurface conditions, and enhancing disaster preparedness and mitigation efforts.

The robust seismic research and development ecosystem in Japan, spearheaded by top-tier institutions and companies, serves as a significant driver for the demand in seismic surveys. This thriving environment fosters the continual innovation of seismic technologies, data processing algorithms, and imaging techniques.

There is a sustained demand for seismic surveys propelled by ongoing research initiatives aimed at pushing the boundaries of seismic imaging capabilities and refining subsurface characterization methodologies.

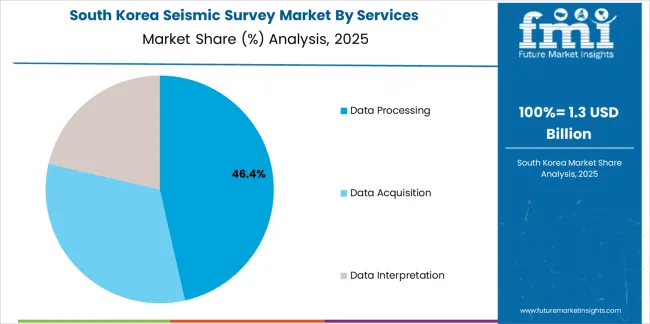

The seismic survey market in South Korea is expected to rise at a CAGR of 2.9% from 2025 to 2035. South Korea has been actively exploring its offshore waters for hydrocarbon reserves, particularly in the East Sea (Sea of Japan) and the Yellow Sea. Seismic surveys play a crucial role in identifying potential oil and gas prospects, delineating subsurface structures, and informing exploration drilling decisions.

South Korea is known for its advancements in technology across various industries, including oil and gas exploration. The development of innovative seismic imaging technologies, data processing algorithms, and imaging techniques by South Korean companies and research institutions drives the demand for seismic surveys and supports the country's exploration efforts.

The below section shows the leading segment. The 2D imaging segment is to rise at a CAGR of 4.9% from 2025 to 2035. Based on services, the data acquisition segment is anticipated to hold a dominant share through 2035. It is set to exhibit a CAGR of 4.7% from 2025 to 2035.

| Category | Forecast CAGR from 2025 to 2035 |

|---|---|

| 2D Imaging | 4.9% |

| Data Acquisition | 4.7% |

Based on the technology, the 2D imaging segment is anticipated to thrive at a CAGR of 4.9% from 2025 to 2035. 2D seismic surveys are generally more cost-effective compared to their 3D counterparts.

They require less time and resources for data acquisition, processing, and interpretation, making them an attractive option for exploration projects with budget constraints.

In regions where geological understanding is limited or exploration is in the early stages, 2D seismic surveys provide a cost-effective means of acquiring preliminary data and identifying potential hydrocarbon prospects. They offer a broad overview of subsurface structures and geological features, helping companies prioritize areas for further exploration.

For large-scale exploration projects covering extensive areas, such as basin-wide studies or regional reconnaissance surveys, 2D seismic surveys are often preferred due to their ability to cover more ground efficiently. They provide a regional perspective of the subsurface geology, facilitating basin-scale interpretation and resource assessment.

Based on service, the data acquisition segment is anticipated to thrive at a CAGR of 4.7% from 2025 to 2035. Data acquisition is a fundamental component of the seismic survey process.

It involves capturing seismic signals by deploying geophysical instruments, such as seismic sensors (geophones or hydrophones) and energy sources (vibrators or airguns), to generate subsurface images. As such, data acquisition services are essential for conducting seismic surveys, making them a core offering in the market.

Data acquisition service providers typically own and maintain a fleet of seismic acquisition equipment, including seismic recording systems, energy sources, and ancillary devices. This relieves clients of the burden of purchasing, maintaining, and operating expensive seismic equipment, allowing them to focus on their core exploration and production activities.

Companies invest heavily in research and development to develop cutting-edge seismic imaging technologies, data processing algorithms, and imaging techniques. Market players diversify their service offerings to cater to a broader range of client needs.

Seismic survey companies expand their geographic footprint by entering new markets and regions with untapped potential. Players are forming strategic partnerships, joint ventures, or acquisitions to gain access to new opportunities and leverage local expertise and market knowledge.

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 23.3 billion |

| Projected Market Valuation in 2035 | USD 38.2 billion |

| Value-based CAGR 2025 to 2035 | 5.1% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered |

North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East and Africa |

| Key Market Segments Covered |

Technology, Service, Region |

| Key Countries Profiled |

The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled |

Halliburton Company; CGG SA; PGS ASA; TGS ASA; Schlumberger NV; New Resolution Geophysics (NRG); Geokinetics; Fugro N.V.; Pulse Seismic Inc.; Dawson |

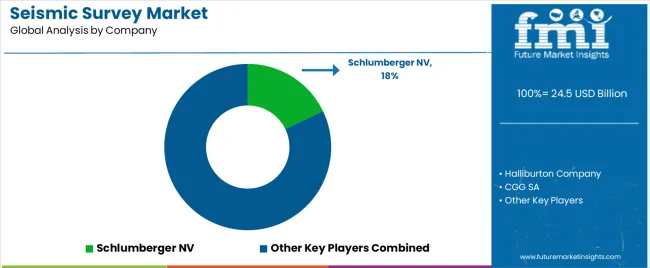

The global seismic survey market is estimated to be valued at USD 24.5 billion in 2025.

The market size for the seismic survey market is projected to reach USD 39.3 billion by 2035.

The seismic survey market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in seismic survey market are 3d imaging, 2d imaging and 4d imaging.

In terms of services, data processing segment to command 48.6% share in the seismic survey market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Seismic Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Seismic Protection Device Market Size and Share Forecast Outlook 2025 to 2035

Seismic Services Market Size and Share Forecast Outlook 2025 to 2035

Seismic Reinforcement Material Market Size and Share Forecast Outlook 2025 to 2035

Seismic Sensors Market Size and Share Forecast Outlook 2025 to 2035

Seismic Monitoring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Survey and Feedback Management Software Market

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA