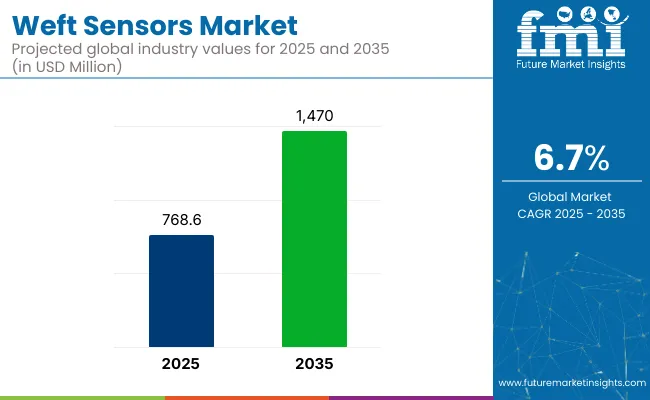

The global weft sensors market is valued at USD 768.6 million in 2025 and is anticipated to reach USD 1,470 million by 2035, reflecting a CAGR of 6.7%.

| Metric | Value |

|---|---|

| 2025 Market Size | USD 768.6 million |

| 2035 Market Size | USD 1,470 million |

| CAGR (2025 to 2035) | 6.7% |

This growth is being driven by increasing demand for automation in textile production, rising adoption of AI-powered weaving technologies, and integration of IoT-enabled sensors for real-time monitoring. Additionally, supportive government initiatives in emerging economies are expected to fuel market expansion, especially as manufacturers aim for greater operational efficiency and sustainability compliance.

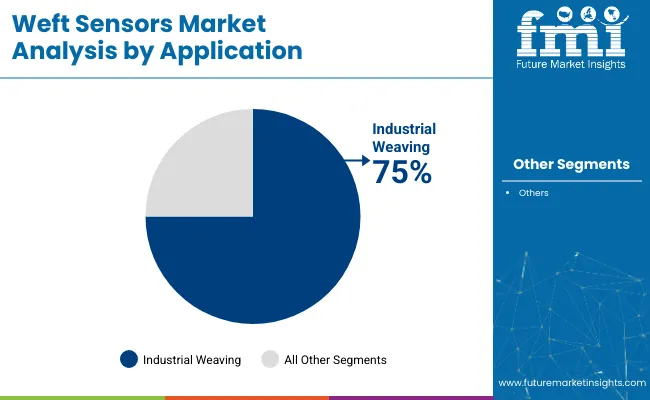

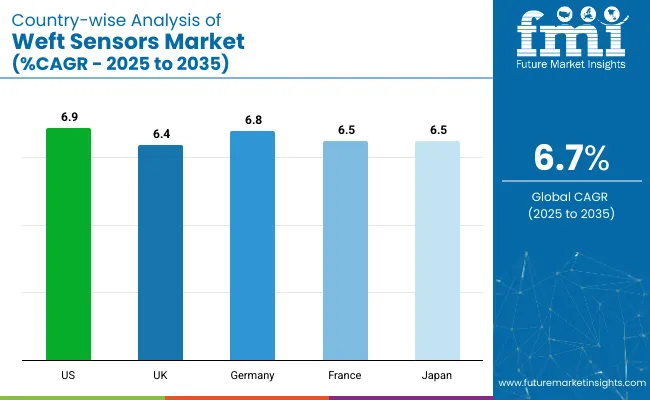

Among leading countries, the USA is expected to register a CAGR of 6.9% from 2025 to 2035, driven by advancements in AI-based weaving technologies and domestic automation investments. Germany is projected to grow at a 6.8% CAGR, supported by strong technical textile manufacturing and Industry 4.0 adoption. Japan is anticipated to expand at a 6.5% CAGR, driven by its focus on precision-driven, high-tech textile production. Industrial weaving remains the dominant application segment, holding an estimated 75% market share globally, while on loom is expected to lead the mounting location segment with 68% market share in 2025.

Government regulations are expected to play a critical role in shaping the weft sensors market over the forecast period. Strict standards such as CE marking in Europe, BIS certification in India, and CCC requirements in China have been enforced to ensure quality, safety, and environmental compliance in textile automation. In South Korea, the KC Mark is mandated for electronic components, including sensors.

Weft sensors hold a small yet critical percentage within the broader textile machinery and automation market. Globally, weft sensors account for approximately 2-3% of the total textile machinery market value, as they are niche components embedded within weaving systems rather than standalone revenue generators. However, within the weaving machinery segment specifically, weft sensors represent a higher share of around 8-10%, reflecting their importance in enabling defect detection, yarn insertion accuracy, and process automation.

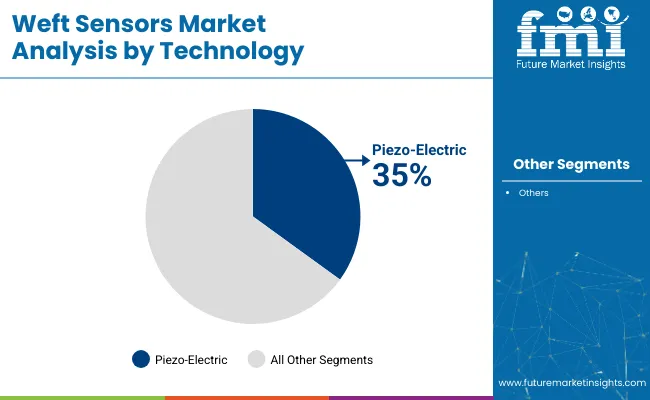

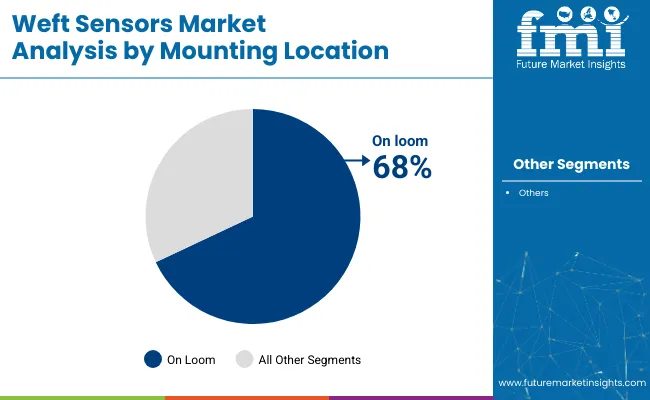

The weft sensors market is segmented by technology, mounting location, application, and region. By technology, the market is categorized into piezo-electric, optical, and capacitive. Based on mounting location, the market is segmented into on loom and off loom.

By application, the market is classified into industrial weaving and handloom weaving. Regionally, the market is segmented into North America, Latin America, Western Europe, Eastern Europe, Central Asia, Russia & Belarus, Balkan & Baltic Countries, Middle East and Africa (MEA), East Asia, and South Asia and Pacific.

The piezo-electric segment is expected to dominate the weft sensors market, holding a 35% share in 2025.

The on loom segment is expected to dominate the weft sensors market, accounting for approximately 68% share in 2025.

The industrial weaving segment is expected to remain the dominant application within the weft sensors market, accounting for 75% share in 2025.

The global weft sensors market is experiencing steady growth, driven by rising demand for textile automation, increasing adoption of AI-powered weaving technologies, and rapid integration of IoT-enabled sensors for real-time defect detection and operational efficiency.

Recent Trends in the Weft Sensors Market

Key Challenges in the Weft Sensors Market

The USA is projected to grow at the highest CAGR of 6.9% from 2025 to 2035 in the weft sensors market, driven by AI-based quality control and strong government support. Germany follows closely with a 6.8% CAGR, supported by its leadership in technical textiles and Industry 4.0 integration.

France and Japan are each expected to grow at 6.5% CAGR, with France benefiting from industrial automation subsidies and Japan from its niche high-tech textile segment. The UK will see a slightly lower CAGR of 6.4%, supported by sustainability compliance and growing demand for automated weaving technologies.

This report covers in depth-analysis of 40+ countries; five top-performing OECD Countries are highlighted below.

The USA weft sensors market is projected to grow at a CAGR of 6.9% from 2025 to 2035. Growth is driven by AI-based quality control, government support, and textile automation investments.

The weft sensors revenue in the UK is anticipated to grow at a CAGR of 6.4% between 2025 and 2035. Growth is being driven by a focus on automated textile production, sustainability compliance under the Net Zero Strategy, and increasing use of energy-efficient sensors to reduce fabric waste in the country’s established apparel and technical textile sectors.

Sales of weft sensors in Germanyare expected to register a CAGR of 6.8% from 2025 to 2035.

France’s weft sensors revenue is projected to grow at a CAGR of 6.5% between 2025 and 2035.

Sales of weft sensorsin Japan are anticipated to grow at a CAGR of 6.5% from 2025 to 2035.

The weft sensors market is moderately fragmented, with a mix of global leaders and strong regional players competing based on pricing, technological innovation, and strategic partnerships. Top companies such as Loepfe Brothers Ltd, Eltex, and Hill Electronics Pvt Ltd maintain significant market shares due to their advanced sensor technologies, precision manufacturing standards, and strong distribution networks in Europe and Asia.

Loepfe Brothers Ltd is competing by focusing on high-precision piezo-electric sensors and integrating AI-powered defect detection systems into their weaving solutions. Eltex has been enhancing its offerings with IoT-enabled monitoring features to meet Industry 4.0 demands, while Hill Electronics Pvt Ltd continues to cater to industrial weaving applications with durable, cost-effective sensors.

Recent Weft Sensors Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 768.6 million |

| Projected Market Size (2035) | USD 1,470 million |

| CAGR (2025 to 2035) | 6.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD million /Volume (Units) |

| By Technology | Piezo-Electric, Optical, and Capacitive |

| By Mounting Location | On Loom and Off Loom |

| By Application | Industrial Weaving and Handloom Weaving |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Loepfe Brothers Ltd, Eltex , Hill Electronics Pvt Ltd, Sino Textile, Jiangsu Soho International Group Wuxi Co., Ltd. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

Piezo-Electric, Optical, and Capacitive

Industrial Weaving and Handloom Weaving

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and The Middle East & Africa

The market is valued at USD 768.6 million in 2025.

It is projected to reach USD 1,470 million by 2035.

The market is expected to grow at a CAGR of 6.7% during this period.

Piezo-electric sensors hold the largest share with approximately 35%.

The USA is the fastest-growing market, registering a CAGR of 6.9%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Weft Feeder Market Trend Analysis Based on Type, Operation, Application, and Region 2025 to 2035

Sensors Market Analysis by Type, Technology, End User & Region - Forecast from 2025 to 2035

Biosensors Market Trends – Growth & Future Outlook 2025 to 2035

UV Sensors Market Analysis by Type, End User, and Region from 2025 to 2035

Nanosensors Market Size and Share Forecast Outlook 2025 to 2035

VOC Sensors and Monitors Market Analysis - Size, Growth, and Forecast 2025 to 2035

Rain Sensors Market Size and Share Forecast Outlook 2025 to 2035

Skin Sensors Market Size, Growth, and Forecast for 2025 to 2035

ADAS Sensors Market Growth - Trends & Forecast 2025 to 2035

PM2.5 Sensors for Home Appliances Market Size and Share Forecast Outlook 2025 to 2035

Image Sensors Market Growth – Trends & Forecast through 2034

Chest Sensors Market

PPG Biosensors Market – Size, Share & Growth Forecast 2025 to 2035

Motion Sensors Market

EMG Biosensors Market

Airbag Sensors Market

Shutter Sensors Market Size and Share Forecast Outlook 2025 to 2035

Printed Sensors Market Size and Share Forecast Outlook 2025 to 2035

Quantum Sensors Market Size and Share Forecast Outlook 2025 to 2035

Seismic Sensors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA