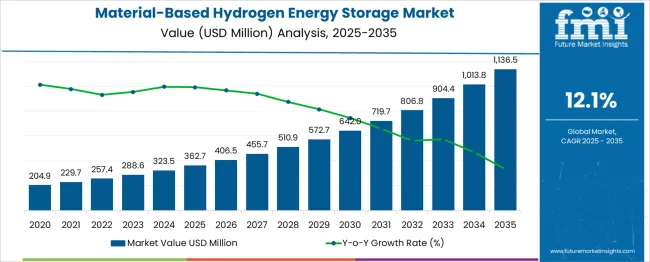

The Material-Based Hydrogen Energy Storage Market is estimated to be valued at USD 362.7 million in 2025 and is projected to reach USD 1136.5 million by 2035, registering a compound annual growth rate (CAGR) of 12.1% over the forecast period. The material-based hydrogen energy storage market is projected to grow significantly from USD 204.9 million in 2024 to approximately USD 1,136.5 million by 2039, representing an overall increase of USD 931.6 million during the 16-year period. Between 2024 and 2029, the market value rises from USD 204.9 million to USD 406.5 million, adding USD 201.6 million, driven by accelerating investments in renewable energy integration, the need for long-duration storage solutions, and early adoption in stationary power applications.

Advancements in metal hydrides, chemical hydrogen carriers, and solid-state storage materials enhance safety, energy density, and storage efficiency, making these solutions increasingly viable for grid balancing and backup power systems. From 2030 to 2034, the market expands from USD 455.7 million to USD 806.8 million, contributing USD 351.1 million in gains, as commercial-scale deployments increase across industrial hydrogen hubs, heavy-duty transport fueling infrastructure, and remote energy supply projects. This phase benefits from cost reductions achieved through scaling production and innovations in reversible hydrogen storage technologies.

| Metric | Value |

|---|---|

| Material-Based Hydrogen Energy Storage Market Estimated Value in (2025 E) | USD 362.7 million |

| Material-Based Hydrogen Energy Storage Market Forecast Value in (2035 F) | USD 1136.5 million |

| Forecast CAGR (2025 to 2035) | 12.1% |

The material-based hydrogen energy storage market is gaining traction as the global energy transition prioritizes decarbonization and long-duration energy storage solutions. Unlike conventional storage systems, material-based methods such as metal hydrides, chemical hydrogen storage, and complex hydrides are enabling higher volumetric density, improved safety, and stable discharge characteristics. These solutions are being increasingly favored for their scalability in stationary applications and their ability to store excess renewable energy in a chemically bound form.

Industry players are focusing on the development of materials with faster kinetics and lower desorption temperatures, which is enhancing feasibility in real-world industrial and utility-scale use cases. Policy support for hydrogen as a clean fuel, combined with national hydrogen strategies and net-zero targets, is further driving investment into next-generation hydrogen storage technologies.

As hydrogen infrastructure matures, material-based storage is expected to play a pivotal role in energy balancing, backup power, and decoupling generation from demand, particularly in high-load sectors. Advancements in material science and system integration are expected to accelerate the commercialization of these systems globally.

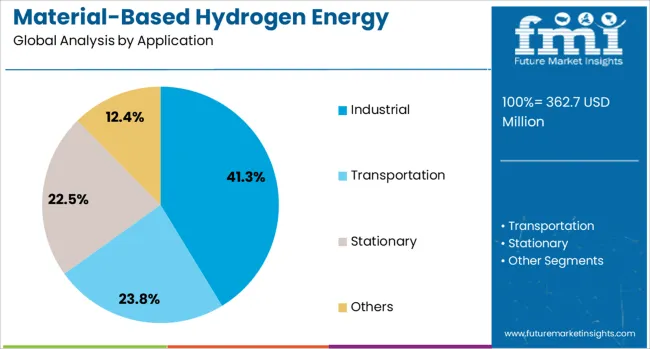

The material-based hydrogen energy storage market is segmented by application and geographic regions. By application, the material-based hydrogen energy storage market is divided into Industrial, Transportation, Stationary, and Others. Regionally, the material-based hydrogen energy storage industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The industrial application segment is projected to account for 41.3% of the material-based hydrogen energy storage market revenue share in 2025, marking its position as the dominant end-use segment. This prominence is being driven by the increasing reliance on hydrogen for decarbonizing hard-to-abate sectors such as refining, chemicals, steel, and heavy manufacturing. Material-based hydrogen storage systems are being integrated into industrial processes to ensure a stable and high-capacity supply while minimizing the risks associated with high-pressure or cryogenic storage.

The adaptability of these systems in managing peak demands and ensuring energy resilience has reinforced their value in industrial operations. Additionally, their ability to store hydrogen in a compact and thermodynamically stable form enables efficient on-site storage for captive use.

The transition toward green hydrogen produced via electrolysis has further elevated the need for safe and high-density storage solutions, especially in facilities with renewable integration. Industrial stakeholders are increasingly investing in pilot projects and infrastructure upgrades, reinforcing the segment's leading role in the evolving hydrogen ecosystem.

Material-based hydrogen energy storage is expanding due to growing long-duration storage needs, efficiency improvements in storage media, and cross-sector integration opportunities. Policy backing and strategic initiatives are further accelerating adoption worldwide.

Growing reliance on intermittent renewable energy sources has created a need for storage technologies capable of holding energy for extended periods. Material-based hydrogen storage offers a viable solution through its ability to store hydrogen in solid or chemical form with high density and stability. This approach allows energy to be produced during periods of excess supply and released when demand peaks or generation dips. Applications extend from utility-scale grid balancing to industrial energy reserves, reducing curtailment of renewable power. Governments and energy providers are exploring these solutions to secure energy supply while addressing peak-load requirements. The increasing focus on long-duration capabilities positions this segment as a strategic component in future energy systems.

Research and development in metal hydrides, chemical hydrides, and sorbent-based storage media are driving efficiency gains, improving both energy density and charging/discharging rates. These materials can be engineered to optimize hydrogen absorption and desorption temperatures, enhancing system performance across climates and applications. Improved efficiency not only reduces storage system footprints but also supports deployment in space-limited or transport-constrained scenarios. Energy companies are increasingly targeting material optimization to achieve faster refueling cycles for hydrogen-powered transport and smoother integration into industrial energy processes. These advancements have expanded commercial interest and encouraged partnerships between storage technology developers, material scientists, and large-scale energy infrastructure operators.

Material-based hydrogen storage is finding adoption in both stationary energy facilities and mobile platforms. Stationary uses include grid-scale backup, renewable energy integration, and off-grid supply, while mobile applications involve maritime transport, aerospace systems, and hydrogen-powered vehicles. The flexibility to serve diverse sectors strengthens investment confidence, as companies can target multiple markets with a single technological base. System design innovations are allowing seamless integration into existing infrastructure, reducing barriers for end users. The cross-sector adaptability supports market resilience by distributing demand drivers and reducing reliance on a single application type, thus broadening opportunities for commercialization and long-term adoption.

Policies and funding programs are accelerating the adoption of material-based hydrogen storage, particularly in regions prioritizing low-carbon energy solutions and energy security. Incentives for hydrogen infrastructure, grants for R&D, and inclusion in national hydrogen strategies are encouraging large-scale trials and pilot deployments. Strategic projects link renewable energy generation with material-based hydrogen storage to create self-sufficient energy hubs. Defense, remote industrial sites, and disaster-resilient infrastructure are also emerging as high-priority applications. Government engagement not only accelerates technology readiness but also encourages private sector investment by reducing financial risk. This alignment between public policy and commercial ambition is expected to shape the sector’s growth trajectory in the coming years.

| Country | CAGR |

|---|---|

| China | 16.3% |

| India | 15.1% |

| Germany | 13.9% |

| France | 12.7% |

| UK | 11.5% |

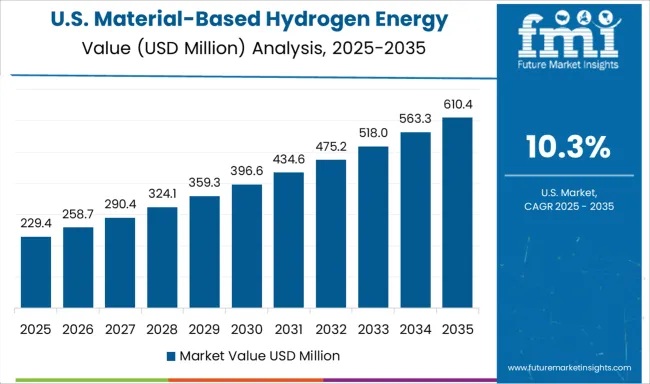

| USA | 10.3% |

| Brazil | 9.1% |

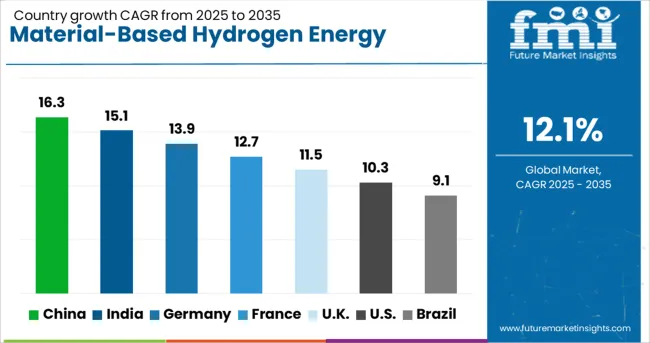

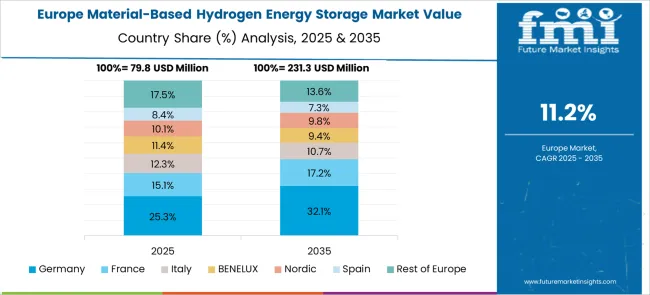

The material-based hydrogen energy storage market is projected to grow globally at a CAGR of 12.1% between 2025 and 2035, supported by advancements in solid-state hydrogen storage media, grid-scale renewable integration projects, and increasing adoption in transport and industrial energy applications. China leads with a CAGR of 16.3%, driven by large-scale hydrogen infrastructure investments, expansion of renewable hydrogen production, and government-backed pilot deployments for energy security. India follows at 15.1%, fueled by industrial decarbonization programs, hydrogen blending initiatives in natural gas grids, and the localization of storage system manufacturing. France grows at 12.7%, supported by strategic hydrogen valley projects, strong policy incentives, and integration with offshore wind energy. The United Kingdom posts 11.5%, with growth linked to hydrogen storage in energy transition hubs, defense readiness applications, and industrial cluster decarbonization. The United States records 10.3%, reflecting steady adoption in mobility, backup power, and distributed energy systems, alongside private sector-led R&D in advanced storage materials. The analysis spans over 40 countries, with these six representing benchmarks for technology adoption strategies, infrastructure integration priorities, and investment-driven growth in the global material-based hydrogen energy storage industry.

China is projected to post a 16.3% CAGR during 2025–2035, well above the global 12.5% baseline, as national hydrogen strategies accelerate material-based storage deployment in both industrial clusters and renewable integration projects. Between 2020–2024, CAGR stood at around 13.4%, supported by pilot-scale storage systems in hydrogen refueling stations and early adoption in heavy transport sectors. The acceleration is tied to large-scale hydrogen pipeline projects, strategic reserves for industrial decarbonization, and rapid localization of advanced hydride and sorbent manufacturing. With coordinated investment from state-owned enterprises, research institutes, and private developers, China is positioned to dominate both domestic deployment and global exports of storage technologies.

India is expected to grow at a 15.1% CAGR during 2025–2035, exceeding the global average, as hydrogen blending initiatives in gas networks and renewable storage mandates gain traction. From 2020–2024, CAGR averaged 11.8%, with growth anchored in industrial decarbonization pilots and small-scale renewable storage integration. The step-up reflects national hydrogen mission funding, domestic manufacturing of storage tanks using advanced alloys, and the expansion of hydrogen hubs in coastal and industrial states. Partnerships between public-sector oil and gas companies, engineering firms, and research bodies are accelerating commercial-scale adoption, making India a competitive player in both stationary and transport-related hydrogen storage solutions.

France is projected to record a 12.7% CAGR during 2025–2035, slightly above the global trend, driven by integration into offshore wind and nuclear-powered hydrogen production systems. Between 2020–2024, CAGR was near 9.6%, with adoption led by demonstration projects in maritime logistics and backup power systems. The increase is supported by European hydrogen corridor development, incentives for localized hydrogen storage manufacturing, and R&D in low-temperature hydride materials. National policy alignment with EU hydrogen directives is attracting both domestic and cross-border investments, ensuring France remains a critical hub for material-based hydrogen storage innovation and deployment in Western Europe.

The United Kingdom is expected to post an 11.5% CAGR for 2025–2035, slightly below the global 12.5% baseline. Between 2020–2024, CAGR was about 8.4%, reflecting early-stage adoption focused on defense readiness, small island grid systems, and research-led pilot plants. The increase to 11.5% stems from large-scale hydrogen storage integration into energy transition hubs, expanded industrial cluster decarbonization, and material innovation partnerships with universities. Policy frameworks supporting storage for offshore wind surplus and heavy transport refueling are further driving growth. The shift from fragmented trials to cohesive commercial-scale programs is accelerating project pipelines and attracting both domestic and foreign investment.

The United States is projected to grow at a 10.3% CAGR for 2025–2035, below the global average, with adoption driven by private-sector investment in stationary energy storage, mobility, and backup power solutions. Between 2020–2024, CAGR was around 7.9%, anchored by DOE-funded demonstration projects and regional hydrogen hub development. The acceleration to 10.3% is supported by expanded tax incentives, defense procurement for mobile energy units, and commercialization of high-density sorbent materials. While regulatory fragmentation poses challenges, strong OEM participation and strategic partnerships with material science companies are reinforcing the USA position in high-value hydrogen storage segments.

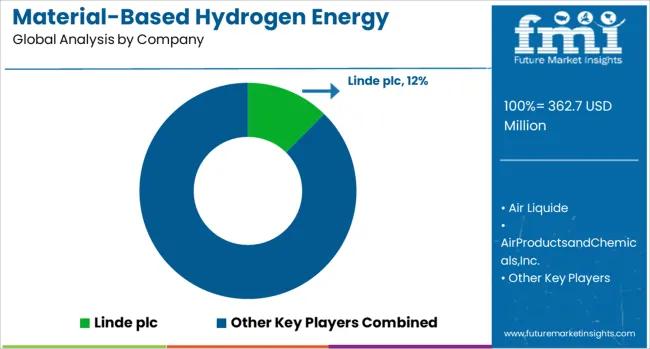

The material-based hydrogen energy storage market features a mix of industrial gas giants, clean energy innovators, and technology specialists competing on storage efficiency, cost optimization, and scalability. Linde plc holds a leading position, leveraging its global hydrogen production and distribution network to deploy advanced solid and chemical storage solutions for industrial and mobility applications.

Air Liquide focuses on high-density hydrogen storage technologies integrated with renewable hydrogen production projects, enhancing supply chain resilience. Air Products and Chemicals, Inc. invests in large-scale hydrogen hubs, coupling production with advanced material storage systems to serve both stationary and transport sectors. ENGIE develops renewable-powered hydrogen projects with integrated material-based storage for grid balancing and long-duration energy supply.

FuelCell Energy, Inc. contributes through fuel cell and storage system integration, targeting utility and commercial applications. ITM Power PLC advances material-based storage in conjunction with electrolyzer systems for efficient hydrogen handling. McPhy Energy S.A. specializes in modular storage units compatible with both industrial use and refueling networks. Nel ASA focuses on coupling production equipment with high-performance hydrogen storage technologies.

Cockerill Jingli Compressed Hydrogen and GKN Compressed Hydrogen offer specialized engineering for high-pressure material storage solutions. SSE invests in energy storage integration within renewable infrastructure, while Gravitricity Ltd explores hybrid storage models linking hydrogen with gravity-based systems.

Key strategies include scaling localized manufacturing of storage materials, forming joint ventures to accelerate commercialization, optimizing storage density for various climate zones, and integrating storage systems within hydrogen corridors. Industry leaders are prioritizing R&D in metal hydrides, chemical hydrides, and sorbent-based solutions, alongside partnerships with government-backed hydrogen initiatives to ensure technology readiness and market penetration.

| Item | Value |

|---|---|

| Quantitative Units | USD 362.7 Million |

| Application | Industrial, Transportation, Stationary, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Linde plc, Air Liquide, AirProductsandChemicals,Inc., ENGIE, FuelCellEnergy,Inc., ITMPowerPLC, McPhyEnergyS.A., NelASA, CockerillJingliCompressedhydrogen, GKNCompressedHydrogen, SSE, and GravitricityLtd |

| Additional Attributes | Dollar sales, share, regional adoption trends, competitive technology benchmarks, cost-per-kWh metrics, supply chain resilience, policy incentives, and long-term demand forecasts. |

The global material-based hydrogen energy storage market is estimated to be valued at USD 362.7 million in 2025.

The market size for the material-based hydrogen energy storage market is projected to reach USD 1,136.5 million by 2035.

The material-based hydrogen energy storage market is expected to grow at a 12.1% CAGR between 2025 and 2035.

The key product types in material-based hydrogen energy storage market are industrial, transportation, stationary and others.

In terms of , segment to command 0.0% share in the material-based hydrogen energy storage market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Stationary Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Transportation Based Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Energy Storage Sodium Ion Battery Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tank And Transportation Market Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks and Transportation Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Energy Storage Devices Market

Battery Energy Storage System Industry Analysis by Battery Type, Connection Type, Ownership, Energy Capacity, Storage System, Application, and Region through 2025 to 2035

Advanced Energy Storage System Market Size and Share Forecast Outlook 2025 to 2035

Flywheel Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Automotive Energy Storage System Market Size and Share Forecast Outlook 2025 to 2035

Liquefied Hydrogen Storage Market Size and Share Forecast Outlook 2025 to 2035

Data Center Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Energy-saving Constant Humidity Storage Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Underground Hydrogen Storage Market Size and Share Forecast Outlook 2025 to 2035

Compressed Air Energy Storage (CAES) Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Solar Wind Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Lithium Ion Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA