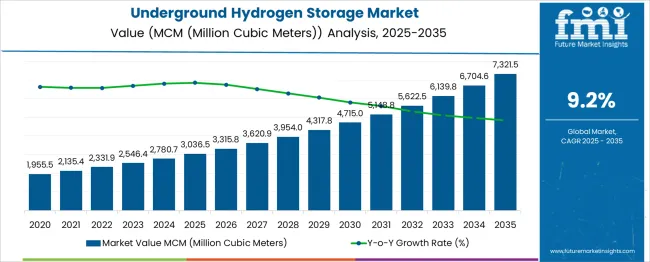

The global underground hydrogen storage market is anticipated to expand from USD 3036.5 million in 2025 to approximately USD 7321.5 million by 2035, recording an absolute increase of USD 4,284.98 million over the forecast period. This translates into a total growth of 141.1%, with the market forecast to expand at a CAGR of 9.2% between 2025 and 2035. The market size is expected to grow by approximately 2.41X during the same period, supported by increasing renewable energy deployment, rising hydrogen economy development, and growing focus on large-scale energy storage solutions for grid stability and industrial applications.

Between 2025 and 2030, the underground hydrogen storage market is projected to expand from USD 3036.5 million to USD 4,892.15 million, resulting in a value increase of USD 1,855.66 million, which represents 43.3% of the total forecast growth for the decade. This phase of growth will be shaped by accelerating green hydrogen production initiatives, expanding renewable energy integration requirements, and growing government support for hydrogen infrastructure development. Energy companies and industrial gas manufacturers are expanding their underground storage capabilities to address the increasing demand for large-scale hydrogen storage solutions that can support seasonal energy storage and industrial supply chain requirements.

| Metric | Value |

|---|---|

| Estimated Value in 2025 | USD 3036.5 million |

| Forecast Value in 2035 | USD 7321.5 million |

| Forecast CAGR 2025 to 2035 | 9.2% |

From 2030 to 2035, the market is forecast to grow from USD 4,892.15 million to USD 7321.5 million, adding another USD 2,429.32 million, which constitutes 56.7% of the ten-year expansion. This period is expected to be characterized by widespread commercial deployment of hydrogen storage projects, integration with carbon capture and storage infrastructure, and development of hydrogen trading hubs. The growing adoption of hydrogen as a clean fuel alternative and establishment of international hydrogen supply chains will drive demand for large-scale underground storage facilities with enhanced safety protocols and operational efficiency.

Between 2020 and 2025, the underground hydrogen storage market experienced substantial expansion, driven by increasing focus on energy security and growing recognition of hydrogen's role in decarbonisation strategies. The market developed as governments and energy companies recognized the need for effective large-scale storage solutions to support intermittent renewable energy sources and enable hydrogen economy development. Policy support and investment incentives began to focus on the importance of underground storage infrastructure in national energy transition plans for achieving carbon neutrality goals.

Market expansion is being supported by the increasing global focus on renewable energy transition and the corresponding need for large-scale energy storage solutions that can address seasonal variations in renewable energy production. Modern energy systems require reliable storage mechanisms that can store excess renewable energy during peak production periods and release it during high-demand phases. Underground hydrogen storage provides proven technology for massive-scale energy storage with the capacity to store hydrogen equivalent to several terawatt-hours of energy in geological formations.

The growing focus on energy security and supply chain resilience is driving investment in domestic hydrogen storage infrastructure as countries seek to reduce dependence on fossil fuel imports. Government policies supporting clean energy transitions are creating opportunities for underground storage projects that can support both industrial hydrogen supply and grid-scale energy storage applications. The rising development of hydrogen economies worldwide and establishment of hydrogen trading markets is also contributing to increased demand for storage infrastructure across different geological regions and industrial clusters.

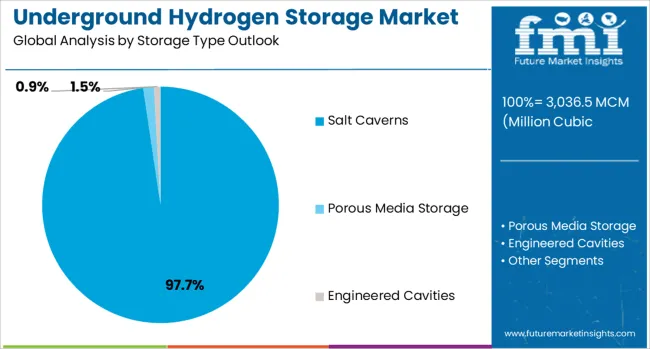

The market is segmented by storage type, application, and region. By storage type, the market is divided into salt caverns, porous media storage, engineered cavities, and aquifer storage. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

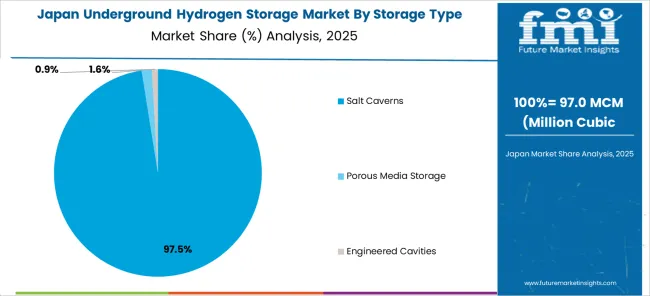

The salt caverns storage type is projected to account for 97.66% of the underground hydrogen storage market in 2025, reaffirming its position as the dominant technology for large-scale hydrogen storage applications. Salt formations provide ideal geological conditions for hydrogen storage due to their impermeability, structural integrity, and proven track record in hydrocarbon storage operations. The technology offers excellent containment properties that prevent hydrogen leakage while maintaining gas purity levels required for industrial and energy applications.

This storage type forms the foundation of most commercial hydrogen storage projects, as it represents the most technically mature and economically viable solution for massive-scale storage requirements. Industry experience from natural gas storage operations and ongoing technological improvements continue to strengthen confidence in salt cavern storage systems. With increasing demand for seasonal energy storage and industrial hydrogen supply, salt caverns align with both utility-scale storage goals and industrial supply chain requirements. Their proven scalability and operational reliability ensure continued dominance, making them the central technology driver of underground hydrogen storage market expansion.

The underground hydrogen storage market is advancing rapidly due to increasing renewable energy deployment and growing demand for large-scale energy storage solutions. However, the market faces challenges including high initial capital requirements, geological site limitations, and regulatory framework development. Innovation in storage technologies and expanding hydrogen economy infrastructure continue to influence project development and market expansion patterns worldwide.

The growing deployment of renewable energy sources is creating unprecedented demand for large-scale storage solutions that can address seasonal variations in energy production and consumption. Underground hydrogen storage provides utilities and grid operators with the capability to store excess renewable energy during peak production periods and release it during high demand phases. Grid modernization initiatives worldwide are incorporating hydrogen storage as essential infrastructure for maintaining system reliability while achieving high renewable energy penetration targets.

The establishment of hydrogen economies across major industrial regions is driving investment in storage infrastructure that can support industrial supply chains and energy trading markets. Governments and private sector organizations are developing comprehensive hydrogen strategies that include storage infrastructure for supporting domestic production, imports, and distribution networks. International hydrogen trade development and establishment of hydrogen hubs require storage facilities that can handle large volumes while ensuring supply security and price stability for industrial customers and energy markets.

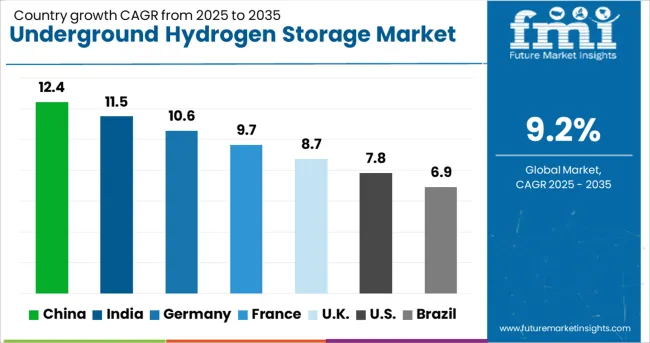

| Country | CAGR 2025-2035 |

|---|---|

| China | 12.4% |

| India | 11.5% |

| Germany | 10.6% |

| France | 9.7% |

| UK | 8.7% |

| USA | 7.8 % |

| Brazil | 6.9% |

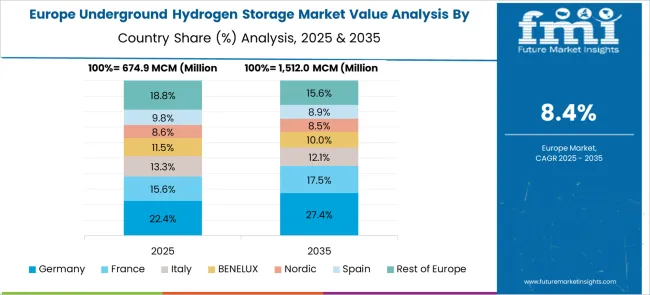

The underground hydrogen storage market is experiencing robust growth globally, with China leading at a 12.4 % CAGR through 2035, driven by massive renewable energy deployment, government support for hydrogen economy development, and substantial investment in energy storage infrastructure. India follows at 11.5%, supported by renewable energy expansion goals, industrial growth, and increasing focus on energy security through domestic storage capabilities. Germany shows strong growth at 10.6%, focusing on hydrogen strategy implementation and industrial cluster development. France records 9.6 %, focusing on nuclear-hydrogen integration and European energy cooperation. The United Kingdom shows 8.7 % growth, prioritizing industrial decarbonisation and offshore renewable integration.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

Revenue from underground hydrogen storage in China is projected to exhibit exceptional growth with a CAGR of 12.42% through 2035, driven by the country's commitment to carbon neutrality by 2060 and massive renewable energy deployment requiring large-scale storage solutions. China's expanding industrial base and growing hydrogen production capacity are creating significant demand for underground storage infrastructure that can support both domestic consumption and potential export markets. Major state-owned enterprises and private companies are establishing comprehensive storage networks to serve growing industrial clusters across key provinces.

Revenue from underground hydrogen storage in India is expanding at a CAGR of 11.5%, supported by the National Green Hydrogen Mission and increasing renewable energy capacity requiring seasonal storage solutions. The country's growing industrial sector and rising energy security concerns are driving demand for domestic hydrogen storage infrastructure that can support manufacturing, power generation, and transportation applications. Government initiatives and private sector investment are establishing storage projects in states with suitable geological conditions and renewable energy resources.

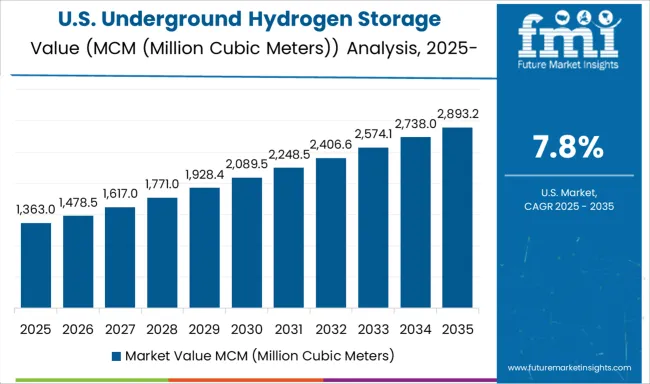

Demand for underground hydrogen storage in the USA is projected to grow at a CAGR of 7.82%, supported by federal infrastructure investment and state-level hydrogen strategies focusing on industrial decarbonization. American energy companies are developing storage projects in regions with suitable geology and existing industrial infrastructure, particularly in Texas, Louisiana, and other Gulf Coast states. The market is characterized by strong private sector investment and collaboration between energy companies and industrial users.

Revenue from underground hydrogen storage in Japan is projected to grow at a CAGR of 8.9% through 2035, driven by the country's hydrogen strategy focusing energy security and industrial competitiveness through advanced storage technologies. Japanese companies are developing innovative storage solutions that integrate with existing LNG infrastructure and industrial complexes while supporting import-dependent hydrogen supply chains.

Revenue from underground hydrogen storage in the UK is projected to grow at a CAGR of 8.74% through 2035, supported by government strategy focusing on industrial clusters and offshore renewable energy integration requiring large-scale storage solutions. British companies are developing storage projects that serve industrial decarbonization while supporting export potential to European markets through existing and planned hydrogen infrastructure.

Revenue from underground hydrogen storage in Germany is projected to grow at a CAGR of 10.58% through 2035, supported by the national hydrogen strategy and European Green Deal objectives requiring large-scale storage infrastructure for renewable energy integration. German companies are developing storage projects that serve both domestic industrial demand and European hydrogen market development through cross-border infrastructure cooperation.

The underground hydrogen storage market is characterized by competition among established industrial gas companies, energy infrastructure developers, and specialized storage service providers. Companies are investing in geological assessment capabilities, advanced storage technologies, safety systems, and project development expertise to deliver reliable, scalable, and cost-effective hydrogen storage solutions. Technical expertise, geological access, and operational experience are central to strengthening competitive positions and market presence.

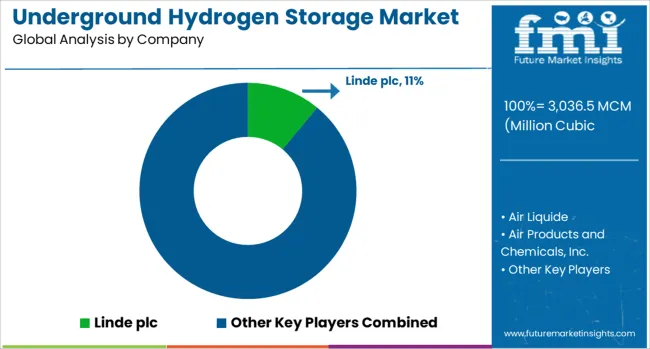

Linde plc, Germany-based, leads the market with 11% global value share, offering comprehensive hydrogen storage solutions with focus on industrial supply chain integration and operational safety. Air Liquide, France-based, provides extensive storage services with focus on industrial clusters and integrated hydrogen supply systems. Air Products and Chemicals Inc., USA-based, delivers large-scale storage projects with advanced safety protocols and operational efficiency. Engie, France-based, focuses on renewable energy integration and utility-scale storage applications.

Texas Brine Company LLC, USA-based, specializes in salt cavern development and underground storage infrastructure with extensive geological expertise. Uniper SE, Germany-based, provides comprehensive energy storage services across European markets with focus on grid integration and wholesale energy trading. WSP, Canada-based, offers engineering and consulting services for storage project development with focus on geological assessment and regulatory compliance.

| Items | Values |

|---|---|

| Quantitative Units 2025 | USD 3036.5 million |

| Storage Type | Salt caverns, Porous media storage, Engineered cavities, Aquifer storage |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Linde plc, Air Liquide, Air Products and Chemicals Inc., Engie, Texas Brine Company LLC, Uniper SE, WSP |

| Additional Attributes | Storage capacity by geological formation type, regional infrastructure development trends, competitive landscape analysis, technology adoption patterns, integration with renewable energy systems, regulatory framework development, safety protocols, and international trade considerations |

The global underground hydrogen storage market is estimated to be valued at USD 3,036.5 mcm (million cubic meters) in 2025.

The market size for the underground hydrogen storage market is projected to reach USD 7,321.5 mcm (million cubic meters) by 2035.

The underground hydrogen storage market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in underground hydrogen storage market are salt caverns, porous media storage and engineered cavities.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA