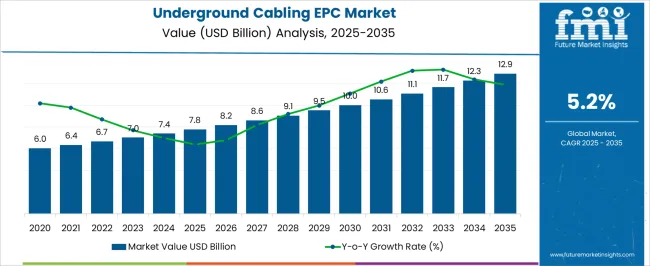

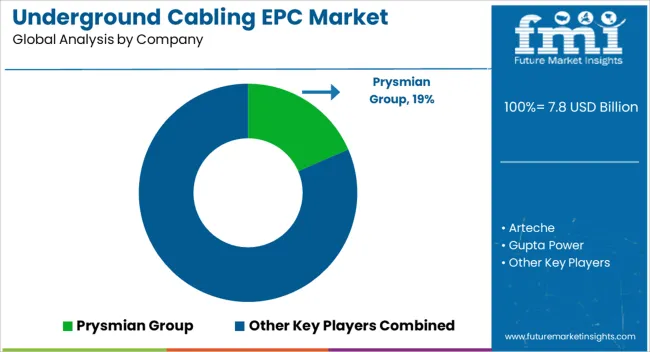

The underground cabling EPC market is estimated to be valued at USD 7.8 billion in 2025 and is projected to reach USD 12.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

Between 2025 and 2030, the market is expected to expand from USD 7.8 billion to USD 10.0 billion, showing a consistent year-on-year increase. This growth block highlights rising investments in underground cabling infrastructure, particularly for power transmission and telecommunication networks. Increasing focus on grid reliability, reduced transmission losses, and improved safety standards is pushing demand for underground cabling projects. The clear progression from USD 8.2 billion in 2026 to USD 9.5 billion in 2029 reflects the role of EPC contractors in delivering turnkey solutions that meet rising infrastructure needs across both developed and emerging regions. From 2030 to 2035, the market is expected to rise further from USD 10.0 billion to USD 12.9 billion, continuing its smooth upward curve. This second half of the forecast is supported by the growing complexity of urban infrastructure, rising energy consumption, and the increasing requirement for reliable communication and distribution networks.

Underground cabling EPC projects are gaining momentum as stakeholders prioritize long-term reliability, reduced maintenance, and improved aesthetics in densely populated areas. The stable growth curve indicates sustained opportunities for engineering, procurement, and construction firms to expand their portfolios, particularly through collaborations with utilities and telecom operators. This trajectory reinforces the position of underground cabling as a critical enabler of modern infrastructure, with steady demand ensuring long-term value creation for market participants.

| Metric | Value |

|---|---|

| Underground Cabling EPC Market Estimated Value in (2025 E) | USD 7.8 billion |

| Underground Cabling EPC Market Forecast Value in (2035 F) | USD 12.9 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The underground cabling EPC market secures an essential share across several infrastructure and utility-driven parent markets, with its role defined by the growing demand for reliable, safe, and resilient power and communication networks. Within the power transmission and distribution infrastructure market, underground cabling EPC accounts for about 15%, reflecting its growing replacement of overhead lines in urban and sensitive regions. In the broader electrical EPC market, its share stands at nearly 10%, as cabling projects form a significant yet specialized part of larger electrical installations. Within the renewable energy integration infrastructure market, underground cabling EPC contributes around 12%, given the reliance on secure cable networks to connect solar and wind farms to grids.

In the urban utilities and smart grid infrastructure market, underground cabling holds close to 14%, driven by rising adoption in metropolitan regions where underground systems reduce outages and enhance safety. Finally, in the telecom and data network cabling market, its share is smaller at approximately 6%, as optical fiber and low-voltage data cables represent only part of the EPC scope compared to power-focused installations. Collectively, these percentages highlight that underground cabling EPC maintains its strongest relevance in transmission, distribution, and urban infrastructure projects, while its modest but critical role in telecom and renewable energy underscores its importance as a backbone for modern, resilient grids and digital connectivity.

The underground cabling EPC market is witnessing steady growth driven by increasing urbanization, rising demand for uninterrupted power supply, and the need to enhance the reliability and aesthetics of power infrastructure. With governments pushing for smart grid modernization and improved urban planning, underground systems are being favored over overhead alternatives due to their safety, lower maintenance, and resilience to environmental disruptions.

Investments in renewable energy integration and expansion of high-load capacity transmission networks further accelerate underground deployment.

The shift toward sustainable infrastructure and city beautification initiatives, particularly in high-density regions, continues to reinforce demand for underground electrical EPC solutions.

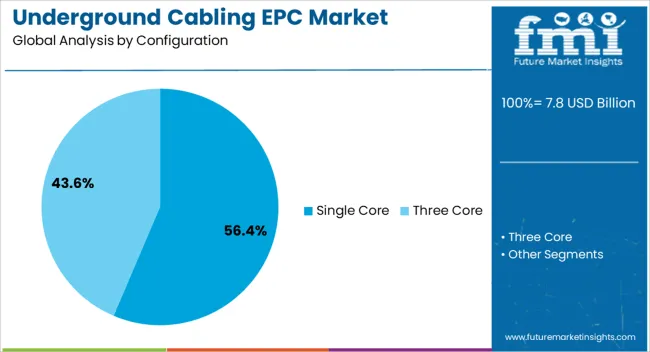

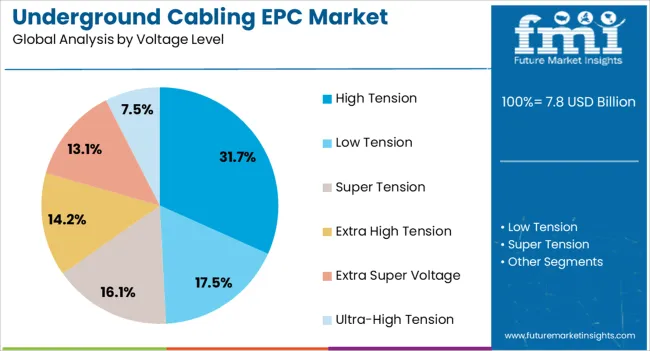

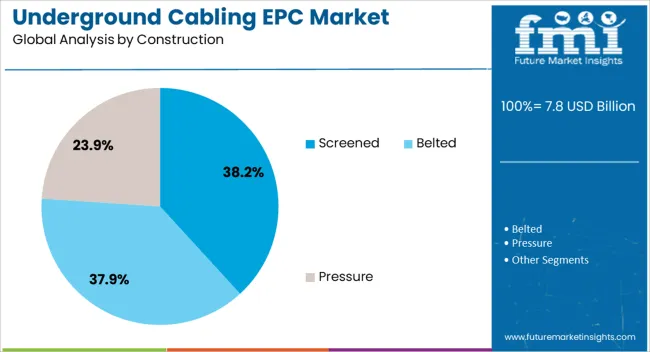

The underground cabling EPC market is segmented by configuration, voltage level, construction, insulation, installation, and geographic regions. By configuration, underground cabling EPC market is divided into single core and three core. In terms of voltage level, underground cabling EPC market is classified into high tension, low tension, super tension, extra high tension, extra super voltage, and ultra-high tension. Based on construction, underground cabling EPC market is segmented into screened, belted, and pressure. By insulation, underground cabling EPC market is segmented into XLPE, PVC, and rubber. By installation, underground cabling EPC market is segmented into direct buried, trough, tunnels, and GILs. Regionally, the underground cabling EPC industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Single core cables are projected to account for 56.40% of the underground cabling EPC market share by 2025, emerging as the dominant configuration segment. Their simplicity, flexibility, and efficient thermal performance make them ideal for high-voltage power transmission, especially across long distances and in space-constrained installations. These cables offer reduced reactance and are particularly favored for high-current load applications where low electromagnetic interference is required. Utility providers prefer single core layouts for their ease of maintenance and scalability in complex grid extensions, reinforcing their growing application across urban and industrial corridors.

High tension cables are expected to capture 31.70% of the market share in 2025, making them the leading voltage level category. Their expanding use is attributed to the rising energy demands from infrastructure projects, industrial expansions, and high-rise urban developments requiring robust and efficient power distribution. High tension underground networks are essential for minimizing transmission losses while ensuring safety in densely populated zones. The segment is further supported by national grid upgrades, smart city rollouts, and increasing deployment of high-capacity renewable power assets necessitating stable and secure underground transmission.

Screened construction is anticipated to lead with a 38.20% share in the underground cabling EPC market by 2025. The popularity of screened cables stems from their enhanced insulation integrity, effective control over electrical fields, and superior performance in high-frequency environments. These cables reduce partial discharge and increase overall safety, making them crucial in critical infrastructure, industrial zones, and urban utility corridors. Growing emphasis on electrical safety standards and fault-tolerant design in modern EPC contracts is boosting the adoption of screened constructions. As demand rises for durable and high-performance underground systems, this segment is expected to maintain its prominence.

The underground cabling EPC market is expanding as utilities and governments seek reliable, resilient, and efficient transmission systems. Opportunities are growing in urban, industrial, and renewable integration projects, while trends emphasize HVDC deployment, smart grids, and advanced insulation technologies. Challenges remain in high costs, long project durations, and regulatory complexities. In my opinion, companies with strong engineering capabilities, financial strength, and turnkey project execution expertise will gain a competitive advantage, ensuring long-term success in the global underground cabling EPC industry.

Demand for underground cabling EPC services has been reinforced by the need for secure, efficient, and long-lasting power transmission systems. Unlike overhead lines, underground cabling provides better protection against environmental disruptions, accidents, and outages, making it preferred for urban and industrial zones. Governments and utilities are investing heavily in underground grids to enhance reliability and reduce maintenance interruptions. In my opinion, demand will remain strong as regions continue to modernize their electricity infrastructure and prioritize resilience in both transmission and distribution networks.

Opportunities are emerging in large-scale urban development, renewable energy integration, and industrial corridors requiring underground cabling solutions. High-voltage and extra-high-voltage projects are gaining traction as nations expand capacity to meet growing electricity needs. Telecom and data center operators are also contributing to demand for underground EPC projects to support stable connectivity. I believe EPC contractors offering turnkey capabilities, technical expertise, and strong execution track records will capture significant opportunities, particularly in markets undergoing infrastructure transformation and renewable integration initiatives.

Trends highlight the adoption of underground cabling in high-voltage direct current (HVDC) projects and smart grid developments. Utilities are increasingly deploying underground solutions to enhance efficiency, reduce transmission losses, and support renewable energy integration across long distances. Another visible trend is the preference for XLPE-insulated cables due to their higher performance and thermal resistance. In my opinion, these trends reflect a decisive industry transition, where underground cabling is evolving from selective use to a mainstream infrastructure solution driving future grid modernization worldwide.

Challenges in underground cabling EPC projects stem from high upfront installation costs, longer project timelines, and complex regulatory approvals. Excavation, route planning, and environmental clearances add layers of difficulty compared to overhead networks. Limited technical expertise in some regions further restricts adoption. In my assessment, only EPC contractors with strong engineering resources, advanced project management, and efficient cost-control mechanisms will succeed in overcoming these barriers, while smaller players may find it difficult to compete in this capital-intensive and highly specialized industry.

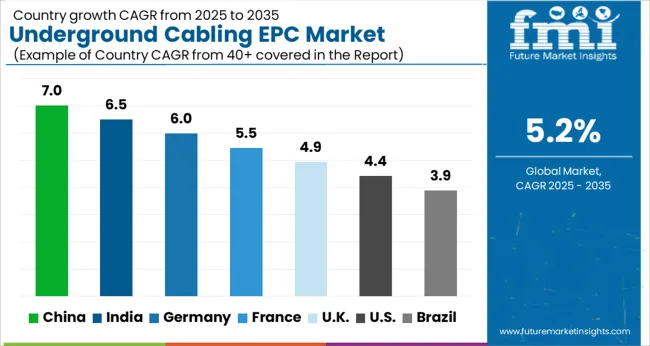

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

The global underground cabling EPC (Engineering, Procurement, and Construction) market is projected to grow at a CAGR of 5.2% from 2025 to 2035. China leads with a growth rate of 7%, followed by India at 6.5%, and Germany at 6%. The United Kingdom records a growth rate of 4.9%, while the United States shows the slowest growth at 4.4%. Growth is driven by rising electricity demand, replacement of overhead lines with underground networks, and integration of smart grid and renewable energy projects. Emerging markets such as China and India are expanding due to urban infrastructure investments and grid reliability concerns, while developed economies like Germany, the UK, and the USA emphasize modernization, safety, and regulatory compliance. This report includes insights on 40+ countries; the top markets are shown here for reference.

The underground cabling EPC market in China is projected to grow at a CAGR of 7%. Strong demand stems from expanding urban power networks, smart grid investments, and large-scale renewable energy integration. The government is promoting underground cabling to improve grid resilience and reduce transmission losses. Domestic EPC contractors are also focusing on advanced cable technologies and high-capacity transmission projects. Rapid industrialization and expansion of metro rail and transport infrastructure are further driving adoption. China’s scale and investment capacity make it a key driver of global underground cabling EPC projects.

The underground cabling EPC market in India is expected to grow at a CAGR of 6.5%. Rising electricity consumption, coupled with government programs to reduce technical losses, is driving demand for underground distribution networks. The focus on replacing overhead lines in urban centers and critical industrial zones is shaping the market. Private EPC contractors and state utilities are collaborating on projects aimed at improving power reliability and minimizing outage risks. India’s emphasis on renewable energy transmission and expanding metro and smart city projects is also contributing to long-term demand.

The underground cabling EPC market in Germany is projected to grow at a CAGR of 6%. Germany is prioritizing underground cabling to support its energy transition and renewable integration. Expansion of wind and solar capacity requires high-capacity underground transmission systems to ensure stability. Regulatory emphasis on safety and grid modernization is boosting EPC contracts. The country is also focusing on interconnections within Europe to balance supply and demand, further raising the need for advanced cabling infrastructure. Strong local EPC expertise and adoption of innovative cable technologies reinforce Germany’s leadership in Europe.

The underground cabling EPC market in the UK is projected to grow at a CAGR of 4.9%. Market demand is shaped by grid modernization efforts, renewable energy integration, and replacement of aging infrastructure. The UK is focusing on undergrounding lines in urban centers to improve reliability and reduce visual impact. Expansion of offshore wind projects is also driving demand for high-capacity underground transmission systems. EPC providers are collaborating with utilities to deliver cost-efficient and technologically advanced projects, ensuring continued adoption despite slower growth compared to Asia.

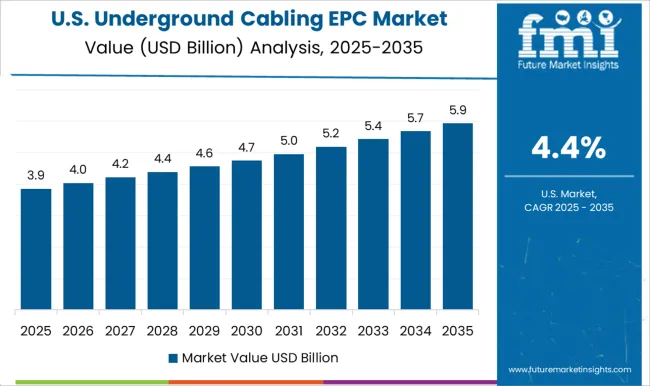

The underground cabling EPC market in the USA is projected to grow at a CAGR of 4.4%. Growth is supported by the replacement of aging power infrastructure, expansion of renewable generation, and resilience requirements in storm-prone regions. Utilities are investing in underground networks to reduce outage risks and improve safety. However, high installation costs compared to overhead lines are limiting faster adoption. The USA market continues to see strong activity in urban centers and critical infrastructure, supported by federal incentives for grid modernization and renewable integration.

Competition in the underground cabling EPC sector is defined by turnkey execution, supply reliability, and integration of high-capacity transmission systems. Prysmian Group and Nexans dominate with global projects, delivering EHV and HV cables alongside design, trenching, and commissioning services. Indian players like Gupta Power, KEC International, and Polycab emphasize scale in regional networks, coupling cable manufacturing with installation capabilities to win state and utility contracts. ZTT strengthens its position with fiber-integrated cable solutions, while MasTec leverages its North American footprint in infrastructure projects. Arteche contributes specialized equipment integration, ensuring underground systems meet advanced protection and monitoring requirements. The field is shaped by global leaders driving technical standards and regional firms securing market share through cost-effective execution and local expertise. Strategies highlight end-to-end EPC delivery, project financing, and grid modernization support.

Prysmian and Nexans differentiate by offering high-capacity cable systems with digital monitoring and turnkey trench-to-substation execution. Gupta Power and Polycab leverage vertical integration, ensuring seamless supply of cables and accessories while lowering project costs. ZTT markets hybrid power-fiber solutions to utilities aiming for smarter grids, while MasTec anchors competitiveness in project scale and timeliness in the USA Product brochures emphasize cable performance, installation techniques, safety standards, and lifecycle cost savings, supported with visuals of laying machinery, jointing kits, and thermal monitoring systems. Messages reinforce resilience under harsh soil conditions, reduced line losses, and improved reliability of underground power distribution. By blending engineering depth with turnkey service assurances, brochures act as both technical reference and sales material, underscoring underground EPC execution as a critical enabler of modern transmission infrastructure.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.8 billion |

| Configuration | Single Core and Three Core |

| Voltage Level | High Tension, Low Tension, Super Tension, Extra High Tension, Extra Super Voltage, and Ultra-High Tension |

| Construction | Screened, Belted, and Pressure |

| Insulation | XLPE, PVC, and Rubber |

| Installation | Direct Buried, Trough, Tunnels, and GILs |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Prysmian Group, Arteche, Gupta Power, KEC International, MasTec, Nexans, Polycab, and ZTT |

| Additional Attributes | Dollar sales by project type (transmission vs distribution), Dollar sales by cable type (XLPE, oil-impregnated, gas-insulated), Trends in grid modernization and renewable integration, Use in urban power transmission and industrial zones, Growth of high-voltage infrastructure projects, Regional deployment patterns across Asia-Pacific, Europe, and North America. |

The global underground cabling EPC market is estimated to be valued at USD 7.8 billion in 2025.

The market size for the underground cabling EPC market is projected to reach USD 12.9 billion by 2035.

The underground cabling EPC market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in underground cabling EPC market are single core and three core.

In terms of voltage level, high tension segment to command 31.7% share in the underground cabling EPC market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Underground Mining Equipment Market Size and Share Forecast Outlook 2025 to 2035

Underground Hydrogen Storage Market Size and Share Forecast Outlook 2025 to 2035

Underground Coal Gasification Industry Analysis in Asia Pacific Size and Share Forecast Outlook 2025 to 2035

Underground Mining Automation Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Underground Mining Equipment Market Share

Underground Storage Tanks Market

Underground Service Locator Market

North America Underground Mining Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Copper Cabling Systems Market Size and Share Forecast Outlook 2025 to 2035

Structured Cabling Market Size and Share Forecast Outlook 2025 to 2035

Data Center Cabling Market Size and Share Forecast Outlook 2025 to 2035

Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Rooftop Solar Epc Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar PV EPC Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Ground Mounted Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Virtualized Evolved Packet Core (vEPC) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA