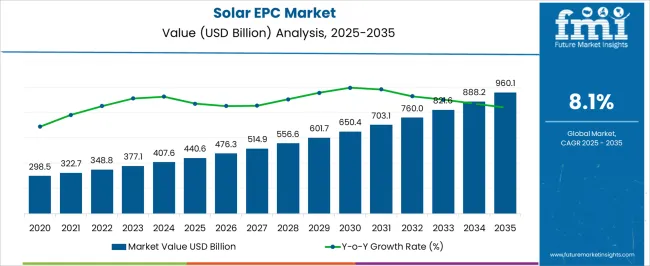

The solar EPC market is estimated to be valued at USD 440.6 billion in 2025 and is projected to reach USD 960.1 billion by 2035, registering a compound annual growth rate (CAGR) of 8.1% over the forecast period.

The expansion reflects a compound annual growth rate (CAGR) of 8.1%, underlining the rising role of engineering, procurement, and construction services in scaling solar energy infrastructure. Between 2025 and 2030, the market will advance steadily, driven by increasing investments in large-scale utility projects, ongoing expansion of commercial solar parks, and heightened interest in distributed generation. The consistent increase highlights how EPC contractors are becoming central players in project execution, providing integrated solutions that cover feasibility studies, system design, supply chain management, and commissioning. From 2030 to 2035, the market is expected to continue its strong trajectory, adding significant value by reaching USD 960.1 billion.

This phase of growth will be influenced by expanding installation capacities, government-led tenders, and growing reliance on solar EPC firms to deliver complex projects within cost and time constraints. The absolute sales opportunity created in this decade reflects both replacement demand for older infrastructure and expansion of new generation capacity across global markets. The trajectory shows a stable yet aggressive curve, signaling that EPC contractors who expand service depth and optimize cost structures will be best positioned to capture opportunities. This outlook confirms solar EPC as a cornerstone of the renewable energy buildout, offering consistent growth avenues for stakeholders across regions.

| Metric | Value |

|---|---|

| Solar EPC Market Estimated Value in (2025 E) | USD 440.6 billion |

| Solar EPC Market Forecast Value in (2035 F) | USD 960.1 billion |

| Forecast CAGR (2025 to 2035) | 8.1% |

The solar EPC market secures a critical position within broader energy and infrastructure domains, with its share shaped by the increasing scale of solar deployment and the need for turnkey project execution. Within the renewable energy EPC market, solar EPC contributes about 35%, highlighting its dominance compared with wind, hydro, and biomass projects. In the broader power generation EPC market, its share is close to 12%, as conventional thermal, nuclear, and hydro projects continue to occupy large portions of investment. Within the solar energy market itself, EPC services represent approximately 25%, covering engineering, procurement, and construction as a substantial segment alongside module manufacturing, financing, and operations.

In the utility-scale renewable projects market, solar EPC accounts for nearly 30%, reflecting its significance in developing large solar parks that drive renewable expansion targets globally. Finally, in the energy infrastructure and grid integration market, solar EPC contributes around 10%, as interconnection and transmission systems for solar capacity form part of larger network investments. Collectively, these percentages illustrate that solar EPC maintains its strongest role in renewable-specific categories, particularly in utility-scale projects and the renewable EPC segment, while holding a more modest but steady share in overall power generation and infrastructure markets. This balance underlines its central importance in advancing the global energy transition and expanding renewable energy infrastructure.

The solar EPC (Engineering, Procurement, and Construction) market is witnessing robust growth, driven by favorable regulatory policies, declining solar panel costs, and the rising urgency for clean energy deployment across utility and commercial segments. Government incentives, net metering schemes, and large-scale project announcements have created an enabling environment for EPC contractors to scale operations.

Additionally, growing investor confidence and easier access to project financing have encouraged utility-scale installations across emerging economies. Technological advancements, workforce specialization, and streamlined permitting processes are improving execution speed and project ROI, further strengthening market demand.

As the global shift toward net-zero intensifies, EPC players will continue playing a vital role in executing high-efficiency, time-bound solar projects at scale.

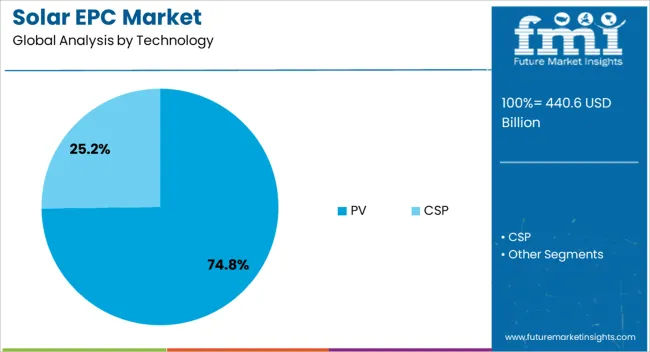

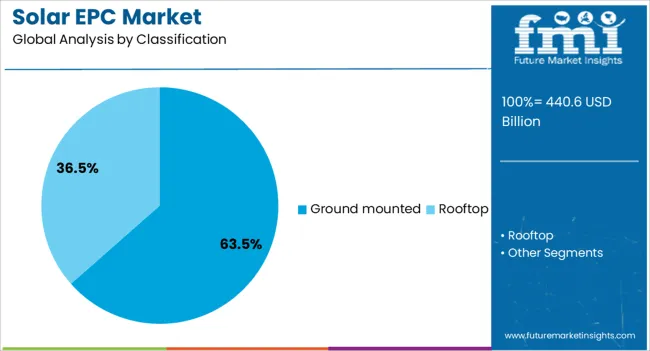

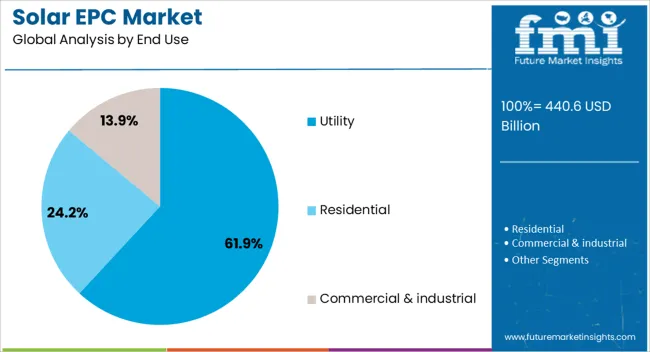

The solar EPC market is segmented by technology, classification, end use, and geographic regions. By technology, solar EPC market is divided into PV and CSP. In terms of classification, solar EPC market is classified into ground mounted and rooftop. Based on end use, solar EPC market is segmented into utility, residential, and commercial & industrial. Regionally, the solar EPC industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Photovoltaic (PV) systems are expected to dominate the market with a 74.80% share in 2025, making them the leading solar technology within EPC contracts. The dominance of PV is largely due to its modular nature, ease of installation, and rapidly falling costs per watt. It also benefits from broad adaptability across rooftops, ground installations, and floating platforms. Technological improvements in PV efficiency and the rise of bifacial modules are further improving energy yield and cost-effectiveness. The simplicity of PV system design allows for faster project turnaround, which is critical for utility-scale developers and investors seeking predictable timelines and returns. As decentralized and grid-connected projects grow, PV remains the preferred EPC technology.

Ground mounted installations are anticipated to capture 63.50% of the EPC market share in 2025, positioning them as the leading classification. These systems are the preferred choice for large-scale projects due to their scalability, optimal sun tracking configurations, and lower installation complexity in expansive rural or semi-urban areas. Ground mounted systems also enable better maintenance access and can integrate advanced tracking systems that maximize output. Governments and independent power producers favor these setups for their efficient land utilization and ability to support megawatt-scale power generation. As countries pursue utility-scale energy targets, ground mounted solar EPC projects will continue to be prioritized for their cost-per-megawatt advantages and grid contribution.

Utility-scale projects are projected to account for 61.90% of the solar EPC market in 2025, maintaining their position as the top end-use segment. Utility-scale demand is being propelled by ambitious national renewable energy targets, energy security concerns, and the economic viability of solar at scale. EPC firms operating in this space benefit from high-value, long-duration contracts that allow for resource optimization and repeatable project frameworks. The availability of large land parcels, streamlined permitting for bulk infrastructure, and long-term power purchase agreements (PPAs) contribute to strong investor interest. As utilities look to decarbonize grids and meet climate mandates, the EPC sector will play a central role in delivering high-capacity solar generation assets efficiently.

The solar EPC market is accelerating as governments, corporations, and investors push for rapid expansion of solar power capacity worldwide. Opportunities are strengthening in storage-linked hybrid projects and underserved regions, while trends highlight faster deployment, digital tools, and yield-enhancing technologies. Persistent obstacles remain in supply chain stability, price volatility, and regulatory challenges. In my opinion, firms that master cost management, secure flexible procurement models, and embrace digital execution methods will be best positioned to thrive, securing leadership in the evolving solar EPC industry.

The solar EPC market has witnessed growing traction as large-scale solar farms and rooftop projects dominate global capacity additions. EPC firms are increasingly tasked with delivering end-to-end services ranging from design and procurement to timely construction, ensuring reliable energy output. National energy policies and corporate procurement agreements have amplified the pace of solar deployment across industrial, commercial, and utility-grade projects. In my opinion, demand will continue to surge as solar energy cements its role as a mainstream, cost-competitive choice for electricity generation worldwide.

Opportunities are widening through integration of energy storage with solar EPC projects, enhancing reliability and round-the-clock availability. Markets in Africa, Asia, and island nations are relying on solar-plus-storage EPC solutions to improve grid stability and reduce dependence on imported fuels. Corporate buyers are also turning toward storage-linked captive solar projects for uninterrupted energy supply. I believe EPC players that expand expertise in hybrid installations, while offering modular solutions adaptable to both rural and urban requirements, will capture substantial long-term opportunities across diverse geographies.

Trends shaping the solar EPC landscape emphasize the role of digitalization in expediting project delivery. Tools such as drone-based surveying, predictive software, and prefabricated module assembly are streamlining site development and installation processes. Growing adoption of bifacial solar panels and single-axis trackers has further improved efficiency, strengthening the economics of large EPC projects. In my opinion, these shifts highlight that competitive EPC firms will no longer be judged solely on cost but also on execution speed, digital adaptability, and yield-optimizing design strategies.

Challenges in this market arise from volatile module pricing, raw material shortages, and exposure to unpredictable regulatory changes. EPC firms face difficulties in securing consistent supply contracts while balancing thin profit margins. Land acquisition hurdles and complex permitting frameworks also delay project execution. Smaller contractors often lack the financial and logistical strength to withstand such pressures. In my assessment, only those EPC providers with diversified supplier networks, strategic financial planning, and strong regulatory navigation skills will manage to stay competitive in this high-stakes industry.

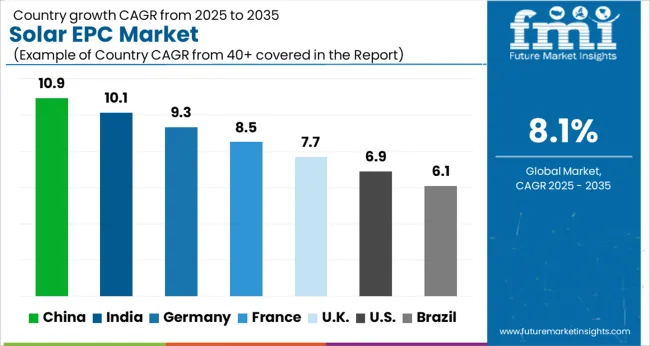

| Country | CAGR |

|---|---|

| China | 10.9% |

| India | 10.1% |

| Germany | 9.3% |

| France | 8.5% |

| UK | 7.7% |

| USA | 6.9% |

| Brazil | 6.1% |

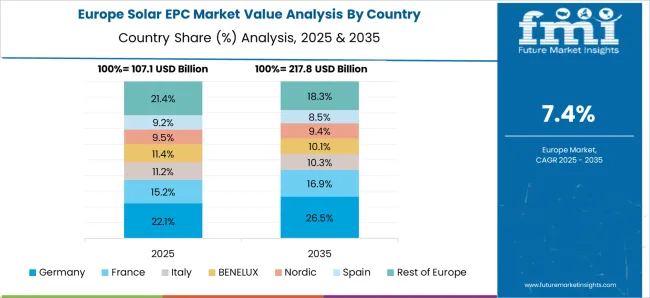

The global solar EPC (Engineering, Procurement, and Construction) market is projected to grow at a CAGR of 8.1% from 2025 to 2035. China leads with a growth rate of 10.9%, followed by India at 10.1%, and France at 8.5%. The United Kingdom records a growth rate of 7.7%, while the United States shows the slowest growth at 6.9%. Expansion is being driven by rising investments in renewable energy capacity, declining solar module costs, and government-backed initiatives supporting clean power generation. Emerging markets such as China and India are rapidly scaling capacity with state-backed programs and private sector investments, while mature economies like the USA, UK, and France emphasize large-scale solar parks, integration with storage solutions, and grid modernization. This report includes insights on 40+ countries; the top markets are shown here for reference.

The solar EPC market in China is projected to grow at a CAGR of 10.9%. China continues to dominate global solar capacity additions, supported by large-scale government programs and heavy investments in utility-scale projects. Domestic EPC contractors are focusing on cost reduction through economies of scale and technological integration. Grid upgrades and expansion of distributed solar installations in urban and rural regions further fuel adoption. China’s strong solar module manufacturing ecosystem provides EPC firms with a competitive cost advantage, making it the largest EPC market worldwide.

The solar EPC market in India is expected to grow at a CAGR of 10.1%. Rapidly increasing energy demand, coupled with government policies such as the National Solar Mission, is boosting solar adoption. Utility-scale projects dominate, but rooftop solar installations are also expanding across urban regions. Indian EPC providers are forming alliances with global players to deliver high-efficiency and large-scale solar projects. Financial support mechanisms, including subsidies and tariff incentives, further encourage adoption. With ambitious renewable energy targets, India is becoming one of the fastest-growing EPC markets.

The solar EPC market in France is projected to grow at a CAGR of 8.5%. France is focusing on scaling renewable capacity to meet EU targets, with solar playing a central role. EPC companies are investing in large-scale ground-mounted projects and solar farms integrated with storage solutions. Strong regulatory frameworks, along with feed-in tariffs and auction-based procurement, are supporting steady growth. France’s emphasis on innovation in hybrid solar projects, combining photovoltaics with agriculture or building integration, is expanding applications.

The solar EPC market in the UK is projected to grow at a CAGR of 7.7%. Growth is supported by increasing renewable energy commitments and the country’s push toward decarbonization. Utility-scale solar parks are being developed, often paired with battery storage to provide grid stability. EPC providers are also focusing on rooftop solar for commercial and residential projects. Despite slower growth compared to Asia, steady demand is supported by government-backed auction programs and the need to modernize power infrastructure.

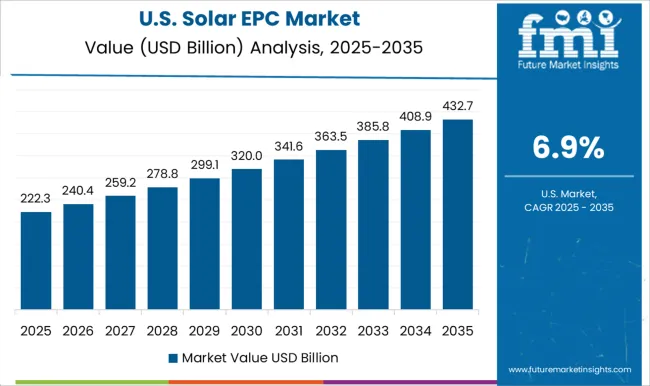

The solar EPC market in the USA is projected to grow at a CAGR of 6.9%. Demand is driven by federal tax credits, state-level renewable portfolio standards, and utility-scale solar projects. EPC companies are increasingly focusing on integrating solar farms with energy storage systems to meet grid reliability requirements. The USA market is also characterized by strong investments from private equity firms and utilities into large solar parks. While growth is slower compared to Asia, innovation in project design, financing models, and regulatory support ensures steady adoption.

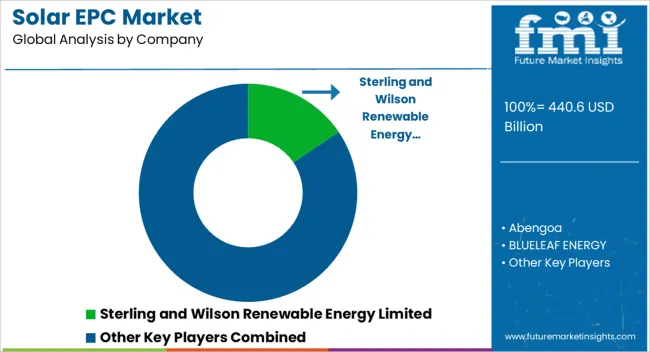

Competition in the solar EPC space is driven by execution capacity, geographic reach, and integration with module supply. Sterling and Wilson Renewable Energy Limited, L&T Construction, and Tata Power Solar anchor the Indian market with large-scale utility projects and rooftop programs, while Mahindra Susten, Vikram Solar, Jakson Group, and Waaree Energies reinforce domestic strength with combined EPC and module offerings. Global leaders such as Bechtel Corporation and Black & Veatch compete for mega-scale international projects, emphasizing design depth and financing capability. European specialists like BELECTRIC, JUWI, Sunel Group, and Eternia Solar prioritize turnkey solutions with strong project management across multiple geographies. Canadian Solar and Chint Solar leverage vertical integration by combining EPC services with module supply, while Siemens Gamesa and Abengoa focus on hybrid and complex projects requiring grid stability expertise.

BLUELEAF ENERGY positions itself with long-term ownership models, highlighting its role as both EPC and investor. This landscape reflects intense competition between global EPC giants, integrated manufacturers, and regional contractors. Strategies revolve around scale, financing support, and digitalized project delivery. Indian EPC firms emphasize competitive pricing, localized sourcing, and grid-tied reliability, while European players highlight technical execution and project bankability. Bechtel and Black & Veatch promote risk management frameworks and deep engineering expertise to secure government and corporate contracts. Canadian Solar and Chint Solar stress efficiency gains by bundling modules, inverters, and EPC services, streamlining procurement.

Siemens Gamesa differentiates with hybrid solar-wind EPC packages, appealing to utilities seeking multi-resource projects. Product brochures highlight turnkey delivery, performance guarantees, O&M support, and digital monitoring dashboards. Visuals often showcase completed solar parks, project timelines, and efficiency simulations. Messaging underscores assured delivery, predictable costs, and lifecycle performance. By combining technical rigor with financial and operational credibility, brochures act as confidence-building tools for investors, developers, and utilities seeking EPC partners that deliver both scale and certainty in solar deployment.

| Item | Value |

|---|---|

| Quantitative Units | USD 440.6 billion |

| Technology | PV and CSP |

| Classification | Ground mounted and Rooftop |

| End Use | Utility, Residential, and Commercial & industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sterling and Wilson Renewable Energy Limited, Abengoa, BLUELEAF ENERGY, Black & Veatch Holding Company, Bechtel Corporation, BELECTRIC, Canadian Solar, Chint Solar, Eternia Solar, JUWI, Jakson Group, Mahindra Susten, L&T Construction, Sola Group, Siemens Gamesa Renewable Energy, Sunel Group, Tata Power Solar Systems, Vikram Solar, and Waaree Energies |

| Additional Attributes | Dollar sales by project type (utility-scale, commercial, residential), Dollar sales by service scope (engineering, procurement, construction, O&M), Trends in large-scale solar deployment and financing models, Use in grid-connected and off-grid installations, Growth in corporate PPAs and government tenders, Regional project execution patterns across Asia-Pacific, North America, and Europe. |

The global solar EPC market is estimated to be valued at USD 440.6 billion in 2025.

The market size for the solar EPC market is projected to reach USD 960.1 billion by 2035.

The solar EPC market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in solar EPC market are PV and csp.

In terms of classification, ground mounted segment to command 63.5% share in the solar EPC market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rooftop Solar Epc Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar PV EPC Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Ground Mounted Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Solar Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Solar Aluminum Alloy Frame Market Size and Share Forecast Outlook 2025 to 2035

Solar Grade Monocrystalline Silicon Rods Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Solar PV Module Market Size and Share Forecast Outlook 2025 to 2035

Solar Encapsulation Market Size and Share Forecast Outlook 2025 to 2035

Solar Pumps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Solar PV Recycling Market Size and Share Forecast Outlook 2025 to 2035

Solar Tracker for Power Generation Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Market Size and Share Forecast Outlook 2025 to 2035

Solar-Powered Active Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Panel Recycling Management Market Size and Share Forecast Outlook 2025 to 2035

Solar Photovoltaic (PV) Market Size and Share Forecast Outlook 2025 to 2035

Solar-Powered UAV Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA