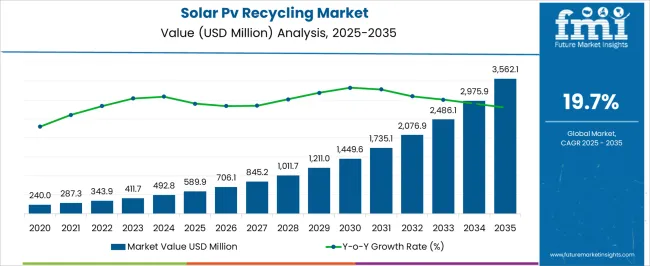

The solar PV recycling market is valued at USD 589.9 million in 2025 and is expected to reach USD 3,562.1 million by 2035, reflecting a CAGR of 19.7%. From 2021 to 2025, the market grows from USD 240.0 million to USD 589.9 million, marking an initial rapid expansion driven by increasing end-of-life solar panel volumes, regulatory mandates for recycling, and rising awareness of circular economy principles in the energy sector. Annual increments show steady gains, with the market reaching USD 287.3 million in 2022, USD 343.9 million in 2023, USD 411.7 million in 2024, and USD 492.8 million just before the 2025 milestone. This early stage reflects significant untapped potential, with demand primarily concentrated in regions with high solar installations and nascent recycling infrastructure.

Between 2026 and 2030, the market rises sharply from USD 589.9 million to USD 1,449.6 million. Intermediate values increase to USD 706.1 million in 2026, USD 845.2 million in 2027, USD 1,011.7 million in 2028, USD 1,211.0 million in 2029, and USD 1,449.6 million in 2030. This phase captures accelerated adoption of recycling technologies, expansion of collection networks, and greater investments by manufacturers to recover valuable materials from end-of-life modules.

From 2031 to 2035, the market continues upward to USD 3,562.1 million. Values progress to USD 1,735.1 million in 2031, USD 2,076.9 million in 2032, USD 2,486.1 million in 2033, USD 2,975.9 million in 2034, culminating at USD 3,562.1 million in 2035.

| Metric | Value |

|---|---|

| Solar Pv Recycling Market Estimated Value in (2025 E) | USD 589.9 million |

| Solar Pv Recycling Market Forecast Value in (2035 F) | USD 3562.1 million |

| Forecast CAGR (2025 to 2035) | 19.7% |

The solar PV recycling market is shaped by several parent markets that drive its demand, positioning it at the intersection of energy, waste management, and materials recovery. The solar energy market serves as the largest parent, with solar PV recycling accounting for nearly 20-25%. With installations increasing worldwide, large volumes of modules are approaching end-of-life, creating the need for recycling processes that recover silicon, silver, aluminum, and other valuable materials. The e-waste and electronic waste management market contributes about 15-18%, since PV modules are classified as electronic waste once decommissioned.

Recycling frameworks developed for electronics are increasingly being adapted to manage solar panel waste streams efficiently. The renewable energy infrastructure market adds around 10-12% to this sector, as the replacement of aging panels in utility-scale plants and residential systems drives recycling demand. This link is particularly strong in regions undergoing repowering projects, where older modules are replaced with higher-efficiency designs.

The materials recovery and recycling market plays an important role, with about 8-10% of the share. Here, solar PV recycling is part of larger systems designed to reclaim metals, semiconductors, and glass through cost-effective and high-yield recovery methods. Lastly, the waste management and circular economy market contributes nearly 7-9%, as PV recycling integrates into broader efforts to reduce landfill waste and increase resource reuse.

The market is experiencing substantial growth as the global solar industry matures and the number of decommissioned photovoltaic modules increases. Rising environmental regulations and extended producer responsibility directives are driving structured recycling initiatives, ensuring that valuable materials are recovered efficiently. The market is being supported by advancements in recycling technologies that enhance recovery rates and reduce operational costs, making large-scale recycling economically viable.

Growing awareness of resource scarcity, particularly for materials like silver, aluminum, and rare metals, has strengthened the emphasis on closed-loop systems in the solar industry. The integration of automated sorting, advanced separation processes, and AI-driven material recovery is further improving efficiency and sustainability outcomes.

Increasing solar capacity installations worldwide are creating a pipeline of end-of-life modules, which is anticipated to fuel consistent recycling demand in the coming years. The market outlook remains promising, with strong policy support, corporate sustainability goals, and circular economy initiatives reinforcing its long-term growth trajectory.

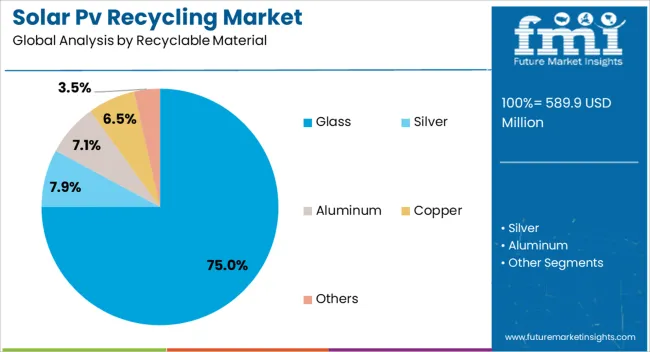

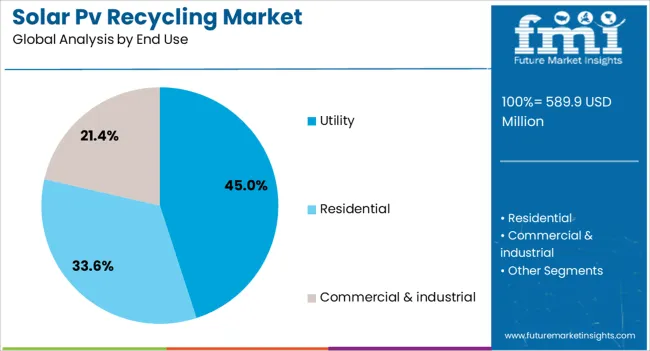

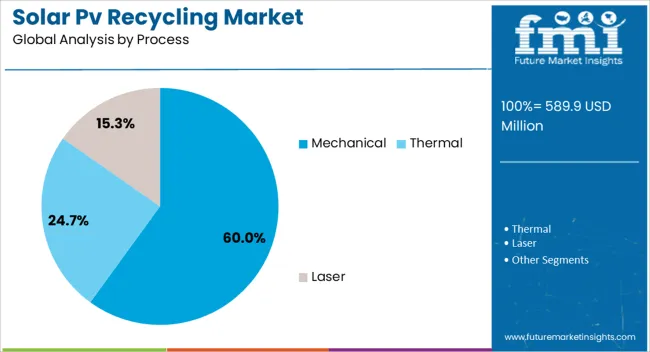

The solar PV recycling market is segmented by recyclable material, end use, process, and geographic regions. By recyclable material, solar PV recycling market is divided into Glass, Silver, Aluminum, Copper, and Others. In terms of end use, solar PV recycling market is classified into Utility, Residential, and Commercial & industrial. Based on process, solar PV recycling market is segmented into Mechanical, Thermal, and Laser. Regionally, the solar PV recycling industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The glass recyclable material segment is projected to hold 75% of the market revenue share in 2025, making it the leading material recovered from end-of-life solar panels. This dominance has been attributed to the fact that glass constitutes the largest proportion of a photovoltaic module’s weight, enabling high recovery volumes at comparatively lower processing costs.

The maturity of glass recycling infrastructure and its compatibility with existing industrial processes have further accelerated adoption. The high quality and purity levels achievable through mechanical and chemical separation techniques have increased the potential for recycled glass to be reused in the solar manufacturing process or other industries.

Growing environmental compliance requirements and the cost savings from reusing recycled glass have driven its demand in both domestic and international markets. The scalability of glass recycling processes and the minimal degradation in material quality over multiple cycles have positioned it as a primary focus area in PV recycling operations, reinforcing its sustained market leadership.

The utility end use segment is expected to account for 45% of the market revenue share in 2025, establishing its position as the dominant application. This segment’s growth has been driven by the large-scale deployment of utility solar farms over the past two decades, which are now entering their replacement and repowering phase. The high concentration of end-of-life panels in these installations creates substantial economies of scale in collection and recycling operations, reducing per-unit costs.

Utility operators are increasingly entering into take-back and recycling partnerships to comply with regulatory frameworks and sustainability commitments. The higher volume of panels recycled from utility projects, compared to residential or commercial systems, has strengthened the segment’s dominance.

Additionally, policy-driven mandates for renewable energy asset decommissioning have ensured a steady supply of recyclable material from this category. The strategic integration of recycling into utility-scale solar asset management plans continues to reinforce its leading role in the overall market.

The mechanical process segment is anticipated to hold 60% of the market revenue share in 2025, emerging as the leading recycling method. This process’s dominance is linked to its cost-effectiveness, scalability, and ability to process large quantities of photovoltaic modules with minimal chemical waste generation. Mechanical recycling involves steps such as dismantling, crushing, and separation, which can be optimized using automated machinery to increase throughput.

The technology’s adaptability to handle varying panel designs and material compositions has made it a preferred choice for recyclers worldwide. Lower capital investment requirements compared to advanced chemical or thermal processes have encouraged widespread adoption, especially in markets with growing volumes of end-of-life solar panels.

Mechanical processes also offer the benefit of recovering a broad range of materials, including glass, aluminum, and certain metals, with high purity levels. As recycling infrastructure expands globally, mechanical methods are expected to maintain their leadership due to their operational efficiency and environmental compliance advantages.

The solar PV recycling market is growing as aging solar modules create demand for structured disposal and material recovery. Drivers include rising installations, government regulations, and the economic benefits of reclaiming valuable materials. Challenges remain in high costs, complex processing, and limited recycling infrastructure. Opportunities are emerging from secondary markets for recovered metals and closed-loop manufacturing practices. With regulatory support and industry collaborations shaping global expansion, recycling is becoming a core part of the solar energy ecosystem, ensuring efficient waste management and stronger resource recovery practices worldwide.

With large-scale solar installations aging, demand for structured recycling processes is growing to recover valuable materials like silicon, glass, silver, and aluminum. Governments are mandating recycling frameworks, while manufacturers adopt strategies to manage waste responsibly. Recycling not only addresses disposal concerns but also reduces dependency on primary raw material extraction, offering economic advantages. The increase in utility-scale and rooftop installations ensures that demand for recycling solutions will continue to expand over the coming decades. Industries are seeking reliable recycling systems to handle the volume of discarded panels, creating opportunities for specialized companies and technology providers. As solar adoption grows across both developed and developing regions, structured recycling systems are becoming an integral part of the solar value chain.

Solar panels are made of composite materials, requiring advanced separation and processing techniques to recover valuable elements efficiently. High-temperature and chemical-intensive processes increase costs and limit scalability for many recyclers. Limited standardization in panel design also makes recycling more difficult, as different technologies such as crystalline silicon and thin-film panels require separate processes. Transporting and handling large quantities of end-of-life panels adds logistical challenges, especially in regions without dedicated facilities. Many markets also lack established recycling infrastructure, forcing companies to rely on landfills or basic disposal methods. Without clear regulatory enforcement or cost-sharing mechanisms, smaller firms and individual consumers may avoid recycling due to high expenses. These barriers slow adoption and highlight the need for innovation in cost-efficient and scalable recycling solutions.

High-value materials such as silver, copper, and rare metals are increasingly targeted for recovery, offering significant revenue potential. Innovations in chemical and mechanical recycling methods are enabling higher recovery rates and improving economic viability. Manufacturers are beginning to integrate recycled materials into new solar modules, creating a closed-loop ecosystem that reduces dependency on virgin resources. Secondary markets for recovered materials in electronics, batteries, and construction are also strengthening demand for advanced recycling systems. Partnerships between solar developers, recycling firms, and technology providers are creating integrated models that combine waste management with material recovery. These opportunities highlight how recycling can transform from a compliance-driven activity into a profitable and strategically important part of the solar energy sector.

Regions such as Europe have established directives mandating panel recycling, while other countries are introducing policies to ensure proper waste management. The creation of extended producer responsibility frameworks is pushing manufacturers to account for end-of-life disposal as part of their business models. Industry collaborations and joint ventures are emerging to develop large-scale recycling plants, particularly in regions where solar deployment is high. Technology innovation, including automated dismantling and selective recovery processes, is improving efficiency and reducing costs. The global focus on energy transition is encouraging countries to build circular economies for solar technologies, ensuring that recycling becomes a standard practice rather than an optional service. This trend underscores the market’s evolution into a critical enabler of long-term energy infrastructure.

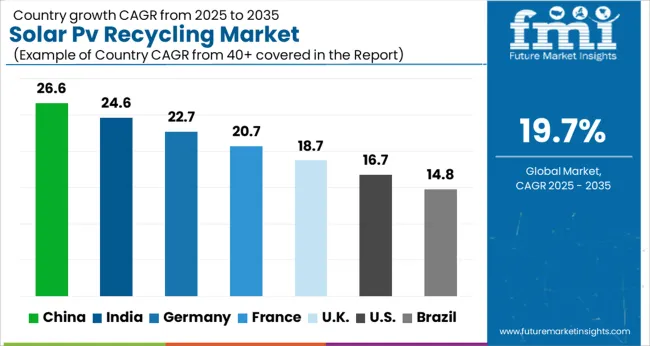

| Country | CAGR |

|---|---|

| China | 26.6% |

| India | 24.6% |

| Germany | 22.7% |

| France | 20.7% |

| UK | 18.7% |

| USA | 16.7% |

| Brazil | 14.8% |

The solar PV recycling market is projected to expand globally at a CAGR of 19.7% between 2025 and 2035. China leads at 26.6%, followed by India at 24.6% and France at 20.7%, while the United Kingdom records 18.7% and the United States trails at 16.7%. China and India achieve the largest growth premiums of +6.9% and +4.9% above the baseline, driven by large-scale solar adoption, government initiatives, and strong domestic manufacturing bases. France remains a European leader through regulatory frameworks and structured recycling networks. The UK and USA, though slower, show consistent growth supported by policy mandates, research activity, and industrial partnerships. The analysis covers over 40 countries, with the leading markets shown below.

China is projected to dominate the global solar PV recycling market, growing at a CAGR of 26.6% between 2025 and 2035. The country’s aggressive expansion in solar power capacity has created a pressing need for recycling solutions to manage end-of-life photovoltaic modules. The rise of large-scale solar farms and widespread adoption of rooftop installations are leading to increasing volumes of decommissioned panels. Domestic policies encouraging circular use of materials and strong investments in recycling infrastructure are boosting market growth. Local companies are enhancing capabilities to recycle glass, silicon, and rare metals from retired panels, while collaborations with international firms are advancing technological efficiency. E-commerce-driven energy solutions and rapid modernization of utility grids are further fueling demand for efficient recycling.

The solar PV recycling market in India is forecasted to expand at a CAGR of 24.6% from 2025 to 2035. The rapid solar deployment under national energy missions is creating an urgent demand for end-of-life management solutions for panels. Rising focus on energy security and the push for expanding renewable capacity are contributing to the growing recycling ecosystem. India’s solar parks, distributed rooftop projects, and industrial-scale installations are generating significant panel waste. Companies are investing in recycling technologies for recovering silicon wafers, aluminum frames, and glass. Growing partnerships between domestic manufacturers and global recyclers are enhancing capacity and knowledge transfer. Government initiatives promoting waste management frameworks are also driving adoption.

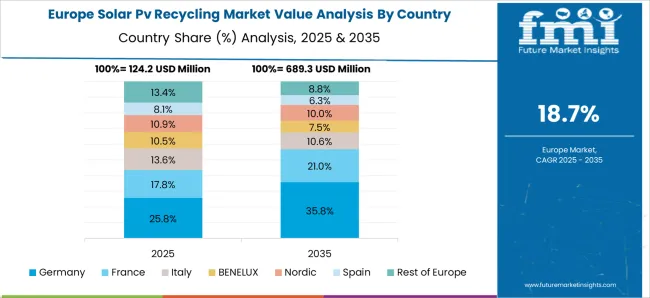

France is projected to grow at a CAGR of 20.7% in the solar PV recycling market from 2025 to 2035. The country’s strong regulatory framework on electronic waste and renewable energy has driven higher demand for structured recycling systems. Solar power deployment across residential and commercial buildings has increased, creating growing volumes of used panels requiring systematic processing. France has been a pioneer in Europe in developing recycling networks dedicated to PV modules, with companies investing in specialized facilities for recovering valuable materials such as silver and silicon. Research institutions are collaborating with recycling firms to improve recovery yields and efficiency. Expansion of solar cooperatives and household-level solar adoption is further adding to recycling requirements.

The United Kingdom is expected to record a CAGR of 18.7% from 2025 to 2035 in the solar PV recycling market. The country’s maturing solar infrastructure, including rooftop and commercial installations, is leading to growing panel waste volumes. Recycling has gained prominence due to compliance with waste management rules and the need to recover valuable materials like aluminum, copper, and silicon. Companies are investing in automated facilities for disassembly and material recovery, supported by partnerships with European recycling firms. Rooftop solar installations in urban areas are particularly contributing to panel waste generation. The UK’s research sector is also exploring advanced recovery processes, aiming to reduce recycling costs and improve efficiency.

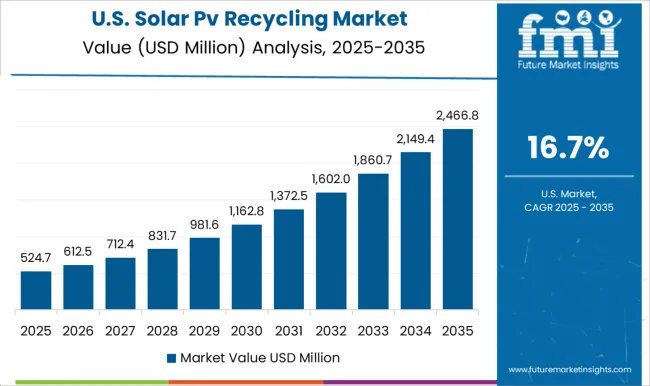

The United States is forecasted to grow at a CAGR of 16.7% between 2025 and 2035 in the solar PV recycling market. As one of the largest solar power producers, the USA is facing rising challenges in managing decommissioned panels from utility-scale solar farms and residential rooftops. Recycling companies are developing advanced methods for extracting valuable raw materials like silicon, silver, and aluminum. State-level policies are beginning to shape regulations for solar waste management, though federal guidelines remain limited. Large energy companies are partnering with recyclers to manage panel disposal efficiently. Research programs funded by government agencies are exploring next-generation recycling technologies to reduce costs and maximize recovery.

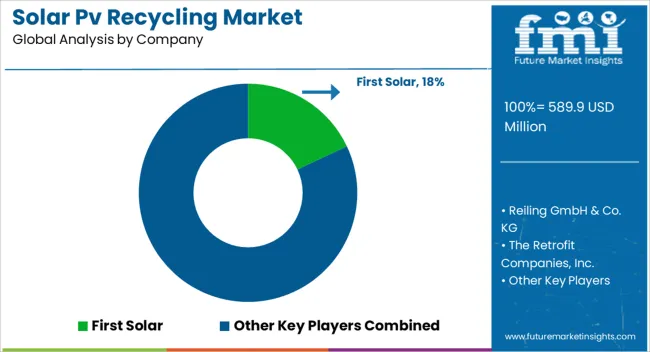

In the solar PV recycling market, competition is driven by recovery efficiency, scalability of recycling plants, and partnerships with module manufacturers and utilities. First Solar stands out as both a panel producer and recycler, operating dedicated facilities to recover high-value materials such as cadmium and tellurium from thin-film modules. Reiling GmbH & Co. KG specializes in recycling crystalline silicon modules in Europe, emphasizing glass, aluminum, and silicon recovery through mechanical and thermal processes.

The Retrofit Companies, Inc. positions itself in the USA market with integrated recycling services that handle end-of-life solar panels alongside other electronic waste, offering turnkey compliance for businesses and municipalities. Solarcycle, a USA-based company, competes through advanced chemical and mechanical recycling processes designed to recover high-purity silver, silicon, copper, and aluminum, while promoting closed-loop solutions with manufacturers. Veolia leverages global recycling expertise, operating Europe’s first large-scale solar panel recycling plant in France, designed in partnership with PV Cycle to process crystalline modules efficiently. We Recycle Solar competes in the USA through decommissioning and recycling services that combine logistics, testing, resale, and material recovery. Canadian Solar, while a major panel manufacturer, is expanding its role in recycling by supporting take-back programs and collaborating with recycling firms to ensure compliance with emerging regulations. Strategies across these players emphasize compliance with waste regulations, maximization of recovered materials, and integration into the circular economy.

| Item | Value |

|---|---|

| Quantitative Units | USD 589.9 Million |

| Recyclable Material | Glass, Silver, Aluminum, Copper, and Others |

| End Use | Utility, Residential, and Commercial & industrial |

| Process | Mechanical, Thermal, and Laser |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | First Solar, Reiling GmbH & Co. KG, The Retrofit Companies, Inc., Solarcycle / Solarcycle (US), Veolia, SOLARCYCLE / We Recycle Solar, Canadian Solar, and Other regional/local recyclers |

| Additional Attributes | Dollar sales by module type (crystalline silicon, thin-film), recycling process (mechanical, chemical, thermal), and recovered materials (glass, silicon, metals). Demand dynamics are driven by growing solar PV deployment, regulatory requirements for responsible disposal, and rising focus on circular economy practices. Regional trends indicate strong adoption in North America, Europe, and Asia-Pacific, supported by government mandates, environmental policies, and increasing utility-scale PV retirements. |

The global solar PV recycling market is estimated to be valued at USD 589.9 million in 2025.

The market size for the solar PV recycling market is projected to reach USD 3,562.1 million by 2035.

The solar PV recycling market is expected to grow at a 19.7% CAGR between 2025 and 2035.

The key product types in solar PV recycling market are glass, silver, aluminum, copper and others.

In terms of end use, utility segment to command 45.0% share in the solar PV recycling market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Solar Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Solar Aluminum Alloy Frame Market Size and Share Forecast Outlook 2025 to 2035

Solar Grade Monocrystalline Silicon Rods Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Solar Encapsulation Market Size and Share Forecast Outlook 2025 to 2035

Solar Pumps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Solar Tracker for Power Generation Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Market Size and Share Forecast Outlook 2025 to 2035

Solar-Powered Active Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Solar-Powered UAV Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Solar Salt Market Size and Share Forecast Outlook 2025 to 2035

Solar Control Window Films Market Size and Share Forecast Outlook 2025 to 2035

Solar Street Lighting Market Size and Share Forecast Outlook 2025 to 2035

Solar Reflective Glass Market Size and Share Forecast Outlook 2025 to 2035

Solar Water Desalination Plant Market Size and Share Forecast Outlook 2025 to 2035

Solar Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Solar Silicon Wafer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA