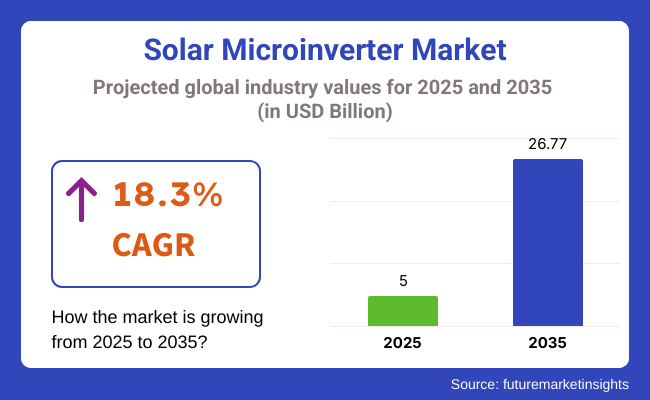

The global solar microinverter market has been valued at USD 5.0 billion in 2025, reflecting a significant increase from its estimated valuation of USD 2.1 billion in 2020. A year-on-year growth rate of 18.3% was recorded in 2025, indicating strong and sustained demand for distributed solar energy solutions.

Over the forecast period from 2025 to 2035, the market is projected to grow at a CAGR of 18.3%, reaching a total market size of approximately USD 26.77 billion by 2035. This robust expansion is being driven by multiple converging factors, including increasing deployment of residential and commercial solar photovoltaic (PV) systems, supportive policy frameworks, and ongoing technological innovation in inverter architecture and grid integration.

Solar microinverters have gained wide acceptance in recent years due to their ability to optimize energy production at the individual panel level. In contrast to traditional string inverters, microinverter technology enables each solar module to operate independently, allowing systems to minimize power loss due to shading, debris, or mismatch conditions.

This characteristic has been particularly beneficial for residential and small-scale commercial installations, where rooftop layouts and sun exposure may vary significantly across modules. As a result, microinverters have increasingly been selected for projects that demand higher efficiency and long-term reliability under variable operating conditions.

A key driver of recent market acceleration has been the rising adoption of standalone solar microinverters, which provide flexible system design, ease of installation, and greater adaptability to complex rooftops and modular expansion. These units are favored in retrofit applications, off-grid settings, and projects where scalability is a priority. In regions such as North America and Western Europe, residential system owners have increasingly turned to microinverter-based solutions to maximize energy yield and improve system visibility through real-time monitoring platforms. Falling component costs, combined with tax credits and net metering incentives, have further supported the adoption of this technology in both mature and emerging markets.

In addition to standalone solutions, the market is witnessing strong growth in integrated solar microinverter systems, which are projected to register one of the highest growth rates during the forecast period. These integrated units combine the microinverter with additional system components such as power optimizers, energy monitoring hardware, and communication modules, offering a simplified installation and maintenance process.

Their ability to reduce wiring complexity and lower overall balance-of-system costs is contributing to their rising popularity among installers and EPC (engineering, procurement, and construction) firms. This integration not only enhances system efficiency but also improves long-term reliability, making it an attractive choice for residential and commercial rooftop applications.

Another factor driving adoption is the increasing need for smart energy management systems that integrate seamlessly with storage, monitoring, and grid interaction features. As residential and commercial users seek greater control over energy usage and autonomy from traditional utility providers, solar-plus-storage systems have gained momentum.

Microinverters play a vital role in this ecosystem by enabling module-level monitoring, enhancing safety through rapid shutdown capability, and facilitating easier integration with battery systems and energy management software. These functions are aligned with global trends toward digitalization of the energy sector and customer-driven electrification of homes and businesses.

Policy support has also played a significant role in accelerating market adoption. Government programs promoting net-zero energy buildings, incentives for rooftop PV installations, and mandates for module-level power electronics (MLPE) in jurisdictions such as the United States and parts of the European Union have provided a strong regulatory foundation for microinverter adoption. The continued decentralization of energy generation, driven by climate commitments and national energy transition strategies, is expected to further boost the demand for advanced solar inverter technologies in the coming years.

Overall, the solar microinverter market is poised for transformative growth, driven by evolving energy consumption patterns, improved return on investment for solar customers, and the expanding role of distributed renewable energy in global energy systems. With manufacturers continuing to innovate in efficiency, integration, and digital compatibility, the market is well-positioned to meet the performance and scalability needs of next-generation solar infrastructure through 2035.

The annual growth rates of the Solar Microinverter market from 2025 to 2035 are illustrated below in the table. Starting with the base year 2024 and going up to the present year 2025, the report examined how the industry growth trajectory changes from the first half of the year, i.e. January through June (H1) to the second half consisting of July through December (H2). This gives stakeholders a comprehensive picture of the sector’s performance over time and insights into potential future developments.

The table provided shows the growth of the sector for each half-year between 2024 and 2025. The market was projected to grow at a CAGR of 18.1% in the first half (H1) of 2024. However, in the second half (H2), there is a noticeable increase in the growth rate.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 18.2% (2024 to 2034) |

| H2 2024 | 18.3% (2024 to 2034) |

| H1 2025 | 18.3% (2025 to 2035) |

| H2 2025 | 18.4% (2025 to 2035) |

Moving into the subsequent period, from H1 2024 to H2 2024, the CAGR is projected as 18.3% in the first half and grow to 18.4% in the second half. In the first half (H1) and second half (H2), the market witnessed an increase of 10 BPS each.

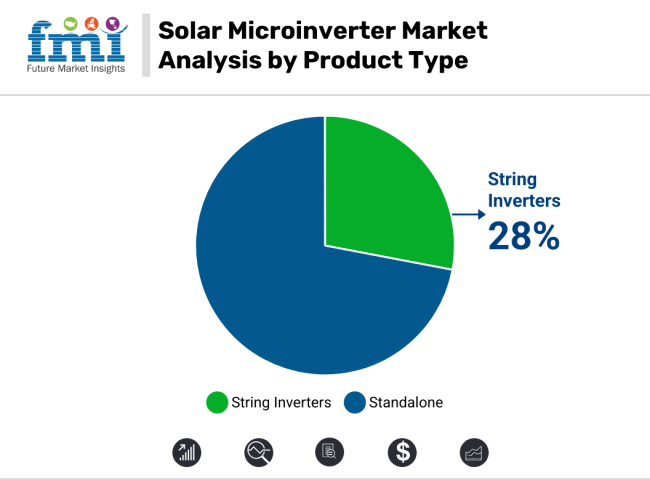

The global solar microinverter market is segmented by product type and application, with standalone microinverters and residential systems expected to remain dominant throughout the forecast period. However, other segments such as string inverters and commercial applications also continue to contribute significantly to overall market value.

In 2025, the string inverter segment is expected to hold around 28% of the global solar inverter market by value. Steady growth is projected through 2035, at a CAGR of 5.7%. Adoption is being supported by the cost-effectiveness and reliability of string inverters, especially in large-scale, commercial, and utility-based solar projects. These inverters are typically installed at a central point and convert electricity from multiple solar panels into usable AC power.

Wider use has been observed in systems where panel layout is uniform and shading is minimal. In such setups, string inverters can offer consistent performance with lower installation and maintenance costs. Their straightforward design and compatibility with standard monitoring and grid connection systems have made them a preferred choice for developers working on budget-sensitive solar installations. Although string inverters do not allow for panel-level energy optimization, their ability to manage high power output in ground-mounted or rooftop systems has ensured continued relevance in the market. Projects with predictable conditions and standard designs tend to benefit most from string inverter configurations.

By comparison, standalone microinverters are projected to account for around 61.4% of the market in 2025. These systems operate at the module level, allowing each solar panel to perform independently. Microinverters are more commonly used in residential and small-scale applications, where roof angles vary or partial shading occurs. While string inverters focus on centralized control and cost savings, microinverters are designed to maximize energy yield and system flexibility. Both technologies are expected to play important roles in the solar industry, depending on system size, location, and design priorities. String inverters are likely to remain favored in standardized, high-capacity systems, while microinverters are expected to be chosen for more complex or decentralized installations.

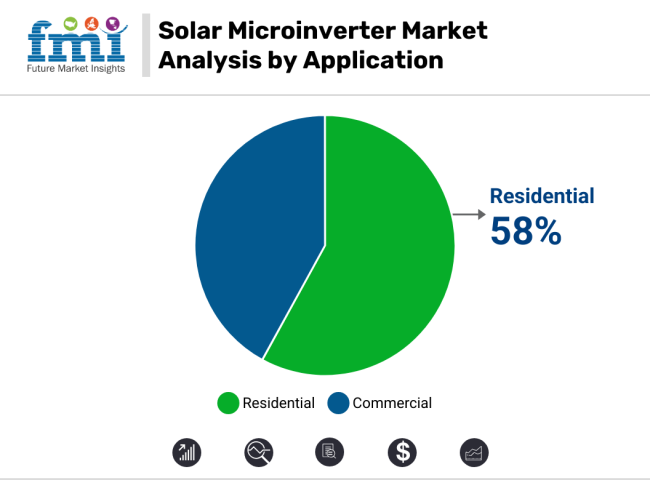

The residential segment is expected to dominate solar microinverter applications, accounting for 58% of global market value in 2025. This segment is forecast to grow at a CAGR of 5.5% through 2035. Adoption is being driven by a combination of consumer interest in clean energy, rising household electricity costs, and expanding access to financing and incentive programs across key solar markets.

The user-friendly nature of microinverters, combined with their ability to optimize each panel independently, has made them especially attractive in residential installations. The elimination of single-point failure risks and the benefits of per-panel data insights have further strengthened their appeal to homeowners. In addition, governments across Europe, North America, and Asia Pacific continue to support rooftop solar deployment through feed-in tariffs, tax credits, and net metering policies, making residential solar projects more financially viable.

Standalone microinverters have found success in this segment due to their ability to support non-uniform rooftops, simplify maintenance, and provide plug-and-play installation options. The segment’s momentum is further fueled by the growing demand for energy autonomy, smart home integration, and compatibility with residential battery systems. Homeowners are also increasingly motivated by the environmental and financial benefits of solar adoption, contributing to the sustained dominance of residential applications in the global market.

While the commercial and industrial (C&I) segment continues to grow, especially in regions such as the USA, Germany, and Japan, residential demand remains the primary driver of volume and innovation in the microinverter space. As urban solar adoption increases and new housing developments integrate rooftop solar systems as standard, the residential segment is expected to retain its leadership in application-level demand through 2035.

Increased Use of Solar Inverters in Residential Application

The growing adoption of solar energy, especially in residential applications is a key driver for the increased demand for solar microinverters. Homeowners are becoming more focusing towards install solar systems due to rising electricity costs, environmental concerns, and the increasing availability of solar incentives. Microinverters allow each individual solar panel to operate independently for optimizing energy production, especially in homes with complex roof structures, shading, or panels with varying orientations.

Additionally, advantageous in residential settings where shading or mismatched panels can otherwise lower the performance of a traditional solar system. As homeowners seek energy independence and cost savings, microinverters, with their higher energy yield and efficient panel-level optimization, present an attractive solution for making the most out of their solar energy installations.

Improved Safety through Low Voltage DC Functioning

For the widely used of solar microinverters is their improved safety relative to conventional string inverters. In contrast to string inverters that necessitate high-voltage DC (600V+), microinverters function with a significantly lower and safer 30V DC sourced from each panel. This considerable decrease in voltage aids in lowering the likelihood of electrical dangers, rendering microinverters a more secure choice for property owners and installers alike. Furthermore, in emergencies, microinverters can deactivate nearly immediately within 100 milliseconds upon loss of AC power, greatly lowering the fire catch.

This rapid shutdown response is 100 times faster than the safety code standards for string inverters, providing an extra level of security. The installation of a microinverter under each solar panel, functioning at low voltage, greatly enhances the system's safety, especially in comparison to conventional high-voltage systems. Innovation in Solar Microinverter such as coatings made up of upcycled textile waste

Improved Panel-Level Monitoring and Customized Control for Enhanced Solar System Efficiency

The growing use of solar microinverters is attributed to their capability to provide detailed monitoring and control at the panel level, distinguishing them from systems based on string inverters. In comparison to conventional systems that assess overall efficiency, microinverters enable the tracking of each solar panel separately. This personal monitoring offers precise and real time information on the effectiveness of every panel, assisting in swiftly spotting panels that are underperforming or facing problems. If a panel produces lower energy than anticipated, it can be swiftly identified, allowing for corrective measures to be implemented without impacting the overall output of the system.

Microinverters provide improved and tailored control over energy generation, allowing for the establishment of a zero energy discharge system for each individual panel. Equipped with three-phase networks and the capability to regulate power factor and power restrictions, microinverters enhance the stability and effectiveness of the complete solar setup. This degree of regulation guarantees that every panel performs at its best, fostering a more dependable and sustainable energy solution.

Microinverter Price and Maintenance Trade-offs helps in Evaluating Long-Term Efficiency

Although microinverters provide notable advantages like enhanced system efficiency and optimization for each panel, they entail greater initial expenses in comparison to string inverters. This variation in price is an important aspect to take into account, particularly when assessing the system's long-term worth. Microinverters are generally placed on the roof, which making maintenance work more difficult and costly, especially if product is in warranty and labor expenses are not considered as paid. Conversely, string inverters are typically mounted on the exterior of the house, allowing for more convenient access for maintenance and repairs.

Another factor to consider is "clipping," which happens when a solar panel's power output surpasses what the microinverter can convert. In those situations, surplus energy is wasted, thereby decreasing the system's overall efficiency. When the power rating of the microinverter is less than the output of the panel, clipping restricts the system's capacity to fully utilize the panel's capabilities, affecting total energy generation.

Tier 1 companies comprise players with a revenue of above USD 1600 million capturing a significant share of 40-45% in the global market. These players are characterized by high production capacity and a wide product portfolio. These leaders are distinguished by their extensive expertise in manufacturing and reconditioning across multiple Solar Microinverter applications and a broad geographical reach, underpinned by a robust consumer base. Prominent companies within Tier 1 include Enphase Energy Inc., Altenergy Power System Inc., DARFON, ABB Ltd, Siemens AG, and other players.

Tier 2 companies include mid-size players with revenue of below USD 1500 million having a presence in specific regions and highly influencing the local industry. These are characterized by a strong presence overseas and strong industry knowledge. These players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include Zhejiang Envertech Corporation Limited, Omnik New Energy, Sunpower Corporation, ReneSolaPower, AEconversion GmbH & Co. KG and other player.

The section below covers the industry analysis for Solar Microinverter demand in different countries. The demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia Pacific, Western Europe, Eastern Europe, Middle East, and Africa is provided.

USA will lead the market share with 42.3% in North America due to solar adoption is high and the demand for microinverters is growing due to their superior panel-level optimization and safety features. The China is second dominating to capture 19.1% in East Asia because of leading manufacturing solar panels and the increasing shift toward microinverters with support of government incentives and large-scale solar installations. Germany dominating Western Europe with 11.4% due to increasing use of high-efficiency renewable energy solutions and energy independence has increased demand for microinverters in both residential and commercial sectors. So these countries are creating demand as well as dominate the market for solar microinverters.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 16.8% |

| India | 20.5% |

| Australia | 19.4% |

| Germany | 13.6% |

| China | 11.3% |

North America contributes in for the solar microinverter market, where USA is leading way for the market. The USA market has experienced significant growth driven by a rise in demand for renewable energy, government support, and heightened awareness of the ecological advantages of solar power. The awareness of residential solar systems increasing demand, especially in areas such as California and Florida, has boosted the use of microinverters due to their better performance in optimizing individual panels and enhancing safety. With the USA progressing in its clean energy efforts, microinverters are anticipated to remain a significant player in the market.

China commands a considerable portion of the worldwide solar microinverter market and demonstrates strong expansion in solar energy utilization. Although the nation is better known for producing solar panels, the need for solar microinverters is rising as a result of a surge in residential solar system setups and a transition towards smarter and more efficient solar technologies. The market's growth is driven by governmental support, significant investments in renewable energy, and the increasing demand for energy self-sufficiency.

Germany remains one of the leading markets for solar microinverters in Europe. Thanks to a robust renewable energy framework and solid governmental backing, the nation has steadily expanded its solar energy capabilities. The increase in market continues to be robust because of Germany’s initiative for energy transition (Energiewende) and the increasing uptake of solar energy systems, especially in residential areas and commercial sectors.

Key companies producing Solar Microinverter are slightly consolidate the market with about 40-45% share that are prioritizing technological advancements, integrating sustainable practices, and expanding their footprints in the region. Customer satisfaction remains paramount, with a keen focus on producing Solar Microinverter to meet diverse applications. These industry leaders actively foster collaborations to stay at the forefront of innovation, ensuring their Solar Microinverter align with the evolving demands and maintain the highest standards of quality and adaptability.

Recent Industry Developments

The Product Type segment is further categorized into Integrated and Standalone.

The Application Material segment is classified into Single Phase and Three Phase.

The End Use segment is classified into Residential, Commercial and Industrial / Utility.

Regions considered in the study include North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East and Africa.

The global market is expected to reach USD 26.77 billion by 2035, growing from USD 5 billion in 2025, at a CAGR of 18.3% over the assessment period.

The residential segment is projected to dominate the market, driven by increasing adoption of home solar systems, rising energy efficiency awareness, and growing demand for decentralized and reliable solar solutions.

Key drivers include surging residential solar installations, advancements in inverter technologies, growing focus on maximizing energy harvest, and increased emphasis on grid independence and energy reliability.

Residential applications lead the market growth, supported by favorable government incentives, declining solar costs, and increasing consumer preference for efficient, easy-to-install microinverter-based solar systems.

Top companies include Enphase Energy, APsystems, Altenergy Power System Inc., Darfon Electronics Corp., and Chilicon Power, recognized for technological innovation, product reliability, and expansive global distribution networks.

Table 01: Global Market Value (US$ Million) and Volume (MW) Historical Data 2017 to 2021 and Forecast 2022 to 2032 by System Type

Table 02: Global Market Value (US$ Million) and Volume (MW) Historical Data 2017 to 2021 and Forecast 2022 to 2032 by End-Use

Table 03: Global Market Value (US$ Million) and Volume (MW) Historical Data 2017 to 2021 and Forecast 2022 to 2032 by Region

Table 04: North America Market Value (US$ Million) and Volume (MW) Historical Data 2017 to 2021 and Forecast 2022 to 2032 By Country

Table 05: North America Market Value (US$ Million) and Volume (MW) Historical Data 2017 to 2021 and Forecast 2022 to 2032 by System Type

Table 06: North America Market Value (US$ Million) and Volume (MW) Historical Data 2017 to 2021 and Forecast 2022 to 2032 by End-Use

Table 07: Latin America Market Volume (MW) and Value (US$ Million) Historical Data 2017 to 2021 and Forecast 2022 to 2032 By Country

Table 08: Latin America Market Value (US$ Million) and Volume (MW) Historical Data 2017 to 2021 and Forecast 2022 to 2032 by System Type

Table 09: Latin America Market Value (US$ Million) and Volume (MW) Historical Data 2017 to 2021 and Forecast 2022 to 2032 by End-Use

Table 10: Europe Market Value (US$ Million) and Volume (MW) Historical Data 2017 to 2021 and Forecast 2022 to 2032 By Country

Table 11: Europe Market Value (US$ Million) and Volume (MW) Historical Data 2017 to 2021 and Forecast 2022 to 2032 by System Type

Table 12: Europe Market Value (US$ Million) and Volume (MW) Historical Data 2017 to 2021 and Forecast 2022 to 2032 by End-Use

Table 13: East Asia Market Value (US$ Million) and Volume (MW) Historical Data 2017 to 2021 and Forecast 2022 to 2032 By Country

Table 14: East Asia Market Value (US$ Million) and Volume (MW) Historical Data 2017 to 2021 and Forecast 2022 to 2032 by System Type

Table 15: East Asia Market Value (US$ Million) and Volume (MW) Historical Data 2017 to 2021 and Forecast 2022 to 2032 by End-Use

Table 16: South Asia & Pacific Market Value (US$ Million) and Volume (MW) Historical Data 2017 to 2021 and Forecast 2022 to 2032 By Country

Table 17: South Asia & Pacific Market Value (US$ Million) and Volume (MW) Historical Data 2017 to 2021 and Forecast 2022 to 2032 by System Type

Table 18: South Asia & Pacific Market Value (US$ Million) and Volume (MW) Historical Data 2017 to 2021 and Forecast 2022 to 2032 by End-Use

Table 19: Middle East & Africa Market Value (US$ Million) and Volume (MW) Historical Data 2017 to 2021 and Forecast 2022 to 2032 By Country

Table 20: Middle East & Africa Market Value (US$ Million) and Volume (MW) Historical Data 2017 to 2021 and Forecast 2022 to 2032 by System Type

Table 21: Middle East & Africa Market Value (US$ Million) and Volume (MW) Historical Data 2017 to 2021 and Forecast 2022 to 2032 by End-Use

Figure 01: Global Market Historical Demand, 2017 to 2021

Figure 02: Global Market Demand Forecast, 2022 to 2032

Figure 03: Global Market Historical Value (US$ Million), 2017 to 2021

Figure 04: Global Market Value (US$ Million) Forecast, 2022 to 2032

Figure 05: Global Market Absolute $ Opportunity, 2022 to 2032

Figure 06: Global Market Share and BPS Analysis by System Type– 2022 to 2032

Figure 07: Global Market Y-o-Y Growth Projections by System Type, 2021 to 2032

Figure 08: Global Market Attractiveness by System Type, 2022 to 2032

Figure 09: Global Market Absolute $ Opportunity 2021 to 2032, by Standalone Segment

Figure 10: Global Market Absolute $ Opportunity 2021 to 2032, by Integrated segment

Figure 11: Global Market Share and BPS Analysis by End-Use 2022 to 2032

Figure 12: Global Market Y-o-Y Growth Projections by End-Use, 2021 to 2032

Figure 13: Global Market Attractiveness by End-Use, 2022 to 2032

Figure 14: Global Market Absolute $ Opportunity, 2021 to 2032, by Residential segment

Figure 15: Global Market Absolute $ Opportunity, 2021 to 2032, by Commercial segment

Figure 16: Global Market Absolute $ Opportunity, 2021 to 2032, by Utility segment

Figure 17: Global Market Share and BPS Analysis by Region 2022 to 2032

Figure 18: Global Market Y-o-Y Growth Projections by Region, 2021 to 2032

Figure 19: Global Market Attractiveness by Region, 2022 to 2032

Figure 20: Global Market Absolute $ Opportunity 2021 to 2032, by North America

Figure 21: Global Market Absolute $ Opportunity 2021 to 2032, by Latin America

Figure 22: Global Market Absolute $ Opportunity 2021 to 2032, by Europe

Figure 23: Global Market Absolute $ Opportunity 2021 to 2032, by East Asia

Figure 24: Global Market Absolute $ Opportunity 2021 to 2032, by South Asia & Pacific

Figure 25: Global Market Absolute $ Opportunity 2021 to 2032, by Middle East & Africa

Figure 26: North America Market Share and BPS Analysis by Country 2022 to 2032

Figure 27: North America Market Y-o-Y Growth Projections by Country, 2021 to 2032

Figure 28: North America Market Attractiveness by Country, 2022 to 2032

Figure 29: U.S. Market Absolute $ Opportunity, 2021 to 2032

Figure 30: Canada Market Absolute $ Opportunity, 2021 to 2032

Figure 31: North America Market Share and BPS Analysis by System Type 2022 to 2032

Figure 32: North America Market Y-o-Y Growth Projections by System Type, 2021 to 2032

Figure 33: North America Market Attractiveness by System Type, 2022 to 2032

Figure 34: North America Market Share and BPS Analysis by End-Use 2022 to 2032

Figure 35: North America Market Y-o-Y Growth Projections by End-Use, 2021 to 2032

Figure 36: North America Market Attractiveness by End-Use, 2022 to 2032

Figure 37: Latin America Market Share and BPS Analysis by Country 2022 to 2032

Figure 38: Latin America Market Y-o-Y Growth Projections by Country, 2021 to 2032

Figure 39: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 40: Brazil Market Absolute $ Opportunity, 2021 to 2032

Figure 41: Mexico Market Absolute $ Opportunity, 2021 to 2032

Figure 42: Rest of Latin America Market Absolute $ Opportunity, 2021 to 2032

Figure 43: Latin America Market Share and BPS Analysis by System Type 2022 to 2032

Figure 44: Latin America Market Y-o-Y Growth Projections by System Type, 2021 to 2032

Figure 45: Latin America Market Attractiveness by System Type, 2022 to 2032

Figure 46: Latin America Market Share and BPS Analysis by End-Use 2022 to 2032

Figure 47: Latin America Market Y-o-Y Growth Projections by End-Use, 2021 to 2032

Figure 48: Latin America Market Attractiveness by End-Use, 2022 to 2032

Figure 49: Europe Market Share and BPS Analysis by Country 2022 to 2032

Figure 50: Europe Market Y-o-Y Growth Projections by Country, 2021 to 2032

Figure 51: Europe Market Attractiveness by Country, 2022 to 2032

Figure 52: Germany Market Absolute $ Opportunity, 2021 to 2032

Figure 53: Italy Market Absolute $ Opportunity, 2021 to 2032

Figure 54: France Market Absolute $ Opportunity, 2021 to 2032

Figure 55: U.K. Market Absolute $ Opportunity, 2021 to 2032

Figure 56: Spain Market Absolute $ Opportunity, 2021 to 2032

Figure 57: BENELUX Market Absolute $ Opportunity, 2021 to 2032

Figure 58: Russia Market Absolute $ Opportunity, 2021 to 2032

Figure 59: Rest of Europe Market Absolute $ Opportunity, 2021 to 2032

Figure 60: Europe Market Share and BPS Analysis by System Type 2022 to 2032

Figure 61: Europe Market Y-o-Y Growth Projections by System Type, 2021 to 2032

Figure 62: Europe Market Attractiveness by System Type, 2022 to 2032

Figure 63: Europe Market Share and BPS Analysis by End-Use 2022 to 2032

Figure 64: Europe Market Y-o-Y Growth Projections by End-Use, 2021 to 2032

Figure 65: Europe Market Attractiveness by End-Use, 2022 to 2032

Figure 66: East Asia Market Share and BPS Analysis by Country 2022 to 2032

Figure 67: East Asia Market Y-o-Y Growth Projections by Country, 2021 to 2032

Figure 68: East Asia Market Attractiveness by Country, 2022 to 2032

Figure 69: China Market Absolute $ Opportunity, 2021 to 2032

Figure 70: Japan Market Absolute $ Opportunity, 2021 to 2032

Figure 71: South Korea Market Absolute $ Opportunity, 2021 to 2032

Figure 72: East Asia Market Share and BPS Analysis by System Type 2022 to 2032

Figure 73: East Asia Market Y-o-Y Growth Projections by System Type, 2021 to 2032

Figure 74: East Asia Market Attractiveness by System Type, 2022 to 2032

Figure 75: East Asia Market Share and BPS Analysis by End-Use 2022 to 2032

Figure 76: East Asia Market Y-o-Y Growth Projections by End-Use, 2021 to 2032

Figure 77: East Asia Market Attractiveness by End-Use, 2022 to 2032

Figure 78: South Asia & Pacific Market Share and BPS Analysis by Country 2022 to 2032

Figure 79: South Asia & Pacific Market Y-o-Y Growth Projections by Country, 2021 to 2032

Figure 80: South Asia & Pacific Market Attractiveness by Country, 2022 to 2032

Figure 81: India Market Absolute $ Opportunity, 2021 to 2032

Figure 82: ASEAN Market Absolute $ Opportunity, 2021 to 2032

Figure 83: Australia & New Zealand Market Absolute $ Opportunity, 2021 to 2032

Figure 84: Rest of SAP Market Absolute $ Opportunity, 2021 to 2032

Figure 85: South Asia & Pacific Market Share and BPS Analysis by System Type 2022 to 2032

Figure 86: South Asia & Pacific Market Y-o-Y Growth Projections by System Type, 2021 to 2032

Figure 87: South Asia & Pacific Market Attractiveness by System Type, 2022 to 2032

Figure 88: South Asia & Pacific Market Share and BPS Analysis by End-Use 2022 to 2032

Figure 89: South Asia & Pacific Market Y-o-Y Growth Projections by End-Use, 2021 to 2032

Figure 90: South Asia & Pacific Market Attractiveness by End-Use, 2022 to 2032

Figure 91: Middle East & Africa Market Share and BPS Analysis by Country 2022 to 2032

Figure 92: Middle East & Africa Market Y-o-Y Growth Projections by Country, 2021 to 2032

Figure 93: Middle East & Africa Market Attractiveness by Country, 2022 to 2032

Figure 94: GCC Countries Market Absolute $ Opportunity, 2021 to 2032

Figure 95: Turkey Market Absolute $ Opportunity, 2021 to 2032

Figure 96: South Africa Market Absolute $ Opportunity, 2021 to 2032

Figure 97: Rest of MEA Market Absolute $ Opportunity, 2021 to 2032

Figure 98: Rest of South Asia & Pacific Market Absolute $ Opportunity, 2021 to 2032

Figure 99: Middle East & Africa Market Share and BPS Analysis by System Type 2022 to 2032

Figure 100: Middle East & Africa Market Y-o-Y Growth Projections by System Type, 2021 to 2032

Figure 101: Middle East & Africa Market Attractiveness by System Type, 2022 to 2032

Figure 102: Middle East & Africa Market Share and BPS Analysis by End-Use 2022 to 2032

Figure 103: Middle East & Africa Market Y-o-Y Growth Projections by End-Use, 2021 to 2032

Figure 104: Middle East & Africa Market Attractiveness by End-Use, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Solar Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Solar Aluminum Alloy Frame Market Size and Share Forecast Outlook 2025 to 2035

Solar Grade Monocrystalline Silicon Rods Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Solar PV Module Market Size and Share Forecast Outlook 2025 to 2035

Solar Encapsulation Market Size and Share Forecast Outlook 2025 to 2035

Solar Pumps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Solar PV Recycling Market Size and Share Forecast Outlook 2025 to 2035

Solar Tracker for Power Generation Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Market Size and Share Forecast Outlook 2025 to 2035

Solar-Powered Active Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Panel Recycling Management Market Size and Share Forecast Outlook 2025 to 2035

Solar Photovoltaic (PV) Market Size and Share Forecast Outlook 2025 to 2035

Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Solar-Powered UAV Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Solar Salt Market Size and Share Forecast Outlook 2025 to 2035

Solar Control Window Films Market Size and Share Forecast Outlook 2025 to 2035

Solar Street Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA