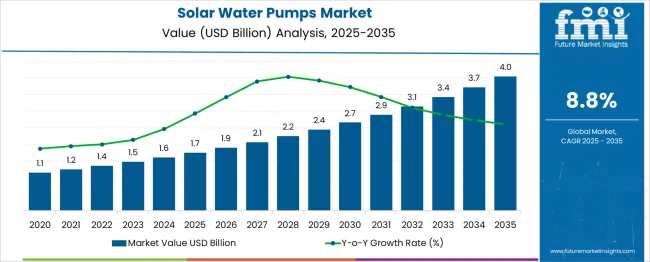

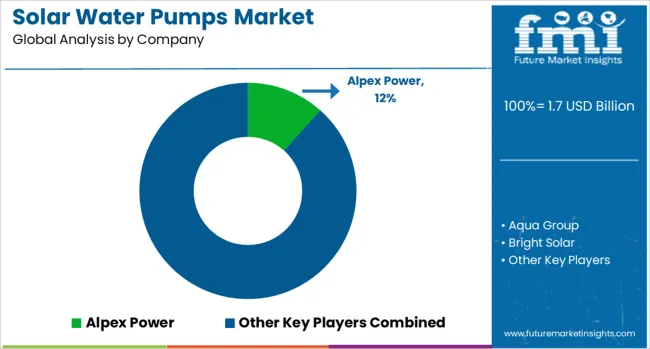

The Solar Water Pumps Market is estimated to be valued at USD 1.7 billion in 2025 and is projected to reach USD 4.0 billion by 2035, registering a compound annual growth rate (CAGR) of 8.8% over the forecast period.

| Metric | Value |

|---|---|

| Solar Water Pumps Market Estimated Value in (2025 E) | USD 1.7 billion |

| Solar Water Pumps Market Forecast Value in (2035 F) | USD 4.0 billion |

| Forecast CAGR (2025 to 2035) | 8.8% |

The solar water pumps market is gaining significant traction due to the growing emphasis on sustainable irrigation practices, rising energy costs, and increased government support for renewable technologies. These systems offer a cost-effective and environmentally friendly alternative to conventional diesel and electric-powered pumps, particularly in off-grid and remote agricultural areas.

The ongoing shift toward clean energy and electrification of rural regions is fostering widespread adoption of solar-powered solutions. Enhanced efficiency, reduced operational costs, and minimal maintenance requirements make solar water pumps highly attractive for farmers and rural communities.

Additionally, favorable policies, subsidies, and financing schemes aimed at promoting solar technologies are accelerating market penetration across Asia-Pacific, Africa, and Latin America. As technological improvements continue to lower system costs and boost performance, the solar water pumps market is expected to witness sustained growth across residential, agricultural, and industrial applications.

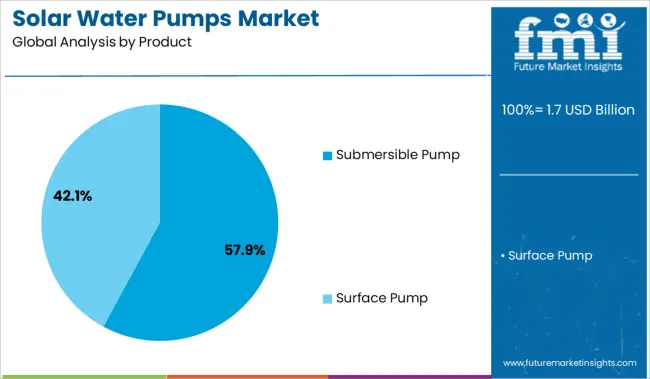

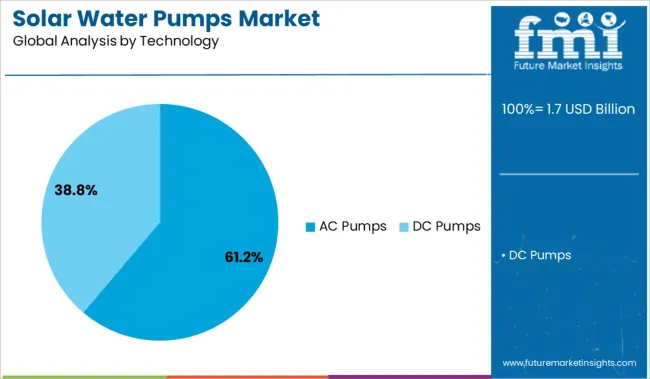

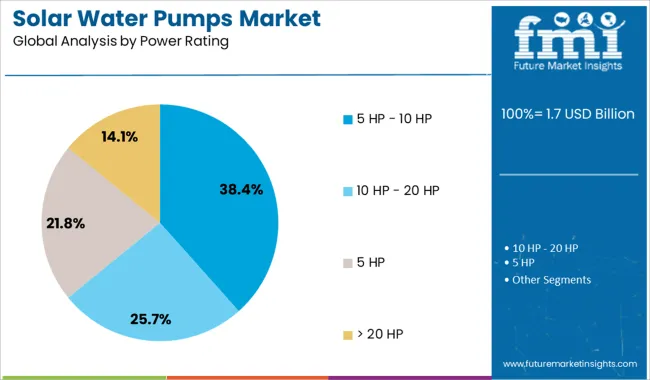

The solar water pumps market is segmented by product, technology, power rating, and application and geographic regions. By product of the solar water pumps market is divided into Submersible Pump and Surface Pump. In terms of technology of the solar water pumps market is classified into AC Pumps and DC Pumps. Based on power rating of the solar water pumps market is segmented into 5 HP - 10 HP, 10 HP - 20 HP, 5 HP, and > 20 HP. By application of the solar water pumps market is segmented into Agriculture, Water Supply, and Others. Regionally, the solar water pumps industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The submersible pump segment commands a dominant 57.9% share in the solar water pumps market, reflecting its suitability for deep well applications and its high efficiency in delivering water directly from underground sources. These pumps are favored for their ability to operate below the water surface, eliminating priming issues and ensuring consistent water flow, particularly in regions with low or fluctuating water tables.

The segment’s growth is driven by increasing demand for groundwater irrigation in agriculture-dominated economies, supported by initiatives promoting solar adoption among small and medium farmers. Additionally, submersible pumps are known for their minimal maintenance and strong durability in harsh environments, making them ideal for remote installations.

As water scarcity and energy access remain critical concerns globally, the submersible pump segment is expected to maintain its lead, supported by technological enhancements in motor efficiency and solar panel integration.

The AC pumps segment leads the technology category with a substantial 61.2% market share, driven by the compatibility of these systems with existing electrical infrastructure and their ability to handle higher power loads. AC solar water pumps are widely used in both agricultural and industrial settings where consistent and high-volume water delivery is required.

Their dominance is further reinforced by their ease of integration with grid-tied and hybrid systems, allowing users to switch between solar and conventional energy sources as needed. Manufacturers have increasingly focused on improving inverter technology and motor control systems to enhance AC pump efficiency and reliability.

This segment continues to benefit from its widespread availability, scalability, and relatively lower initial cost for medium-to-large scale operations. As demand rises for flexible and powerful pumping solutions, the AC pumps segment is expected to retain its prominence in the overall market landscape.

The 5 HP - 10 HP segment represents 38.4% of the solar water pumps market by power rating, highlighting its relevance for medium-scale agricultural and commercial applications. This power range offers an optimal balance between capacity and cost, making it suitable for irrigating larger land areas, community water supply projects, and livestock watering systems.

Demand in this segment is largely driven by government-backed solar pump deployment programs targeting energy access in rural regions, particularly in India, Africa, and Southeast Asia. These pumps are preferred for their ability to support moderate to high water flow rates while maintaining energy efficiency and operational stability.

As solar panel efficiency and battery storage technologies improve, the adoption of pumps within this power bracket is expected to expand further. Continued emphasis on cost reduction and energy independence in water-intensive sectors will likely drive sustained growth for this segment.

The Solar Water Pumps market is growing rapidly due to rising demand for efficient water management, especially in agriculture, driven by low costs and government support. However, challenges like high initial costs, infrastructure limitations, and intense competition hinder widespread adoption and profitability.

The Solar Water Pumps market is witnessing significant growth due to increasing demand for efficient and sustainable water management systems, particularly in agriculture and remote areas. With global water scarcity concerns, solar-powered solutions are becoming more attractive due to their low operating costs and independence from grid electricity. Government initiatives and subsidies aimed at promoting renewable energy have contributed to market growth. As rural electrification continues to improve in emerging economies, the adoption of solar pumps for irrigation, livestock, and domestic use is expected to rise. Rising agricultural activities, coupled with favorable weather conditions, are further fueling the demand for solar-powered pumps, driving both market expansion and technological advancements.

Despite the growth prospects, the Solar Water Pumps market faces challenges related to the high initial installation costs and limited awareness in certain regions. The adoption rate is still hindered by the lack of adequate infrastructure in rural areas and challenges in financing. Although the market is growing, it remains fragmented, with numerous local and international players vying for market share. Competition in the market is intensifying, as companies strive to innovate in terms of pump efficiency, solar panel integration, and durability. This is driving investments in R&D, aiming to reduce costs and improve product performance. Pricing pressures from low-cost suppliers could impact profit margins for established brands.

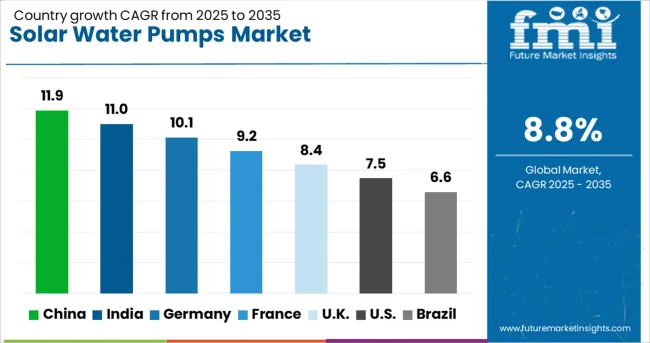

| Country | CAGR |

|---|---|

| China | 11.9% |

| India | 11.0% |

| Germany | 10.1% |

| France | 9.2% |

| UK | 8.4% |

| USA | 7.5% |

| Brazil | 6.6% |

The solar water pumps industry, expected to grow at a global CAGR of 8.8% from 2025 to 2035, is seeing varied growth across key countries. A 11.9% CAGR is being led by China, a member of the BRICS group, driven by significant investments in renewable energy and large-scale agricultural solar pump adoption. India follows closely with an 11.0% CAGR, as the nation’s rural electrification and solar irrigation initiatives continue to grow rapidly. Germany is exhibiting a 10.1% CAGR, fueled by strong market demand for solar-powered pumps and its leadership in the renewable energy sector. Moderate growth rates are being recorded in the United Kingdom, an OECD member, and the United States, also an OECD member, with 8.4% and 7.5% CAGRs, respectively. This is primarily due to stable industry demand and adoption in agricultural sectors, along with the implementation of renewable energy policies. The report covers a detailed analysis of 40+ countries, with the top five countries outlined as a reference.

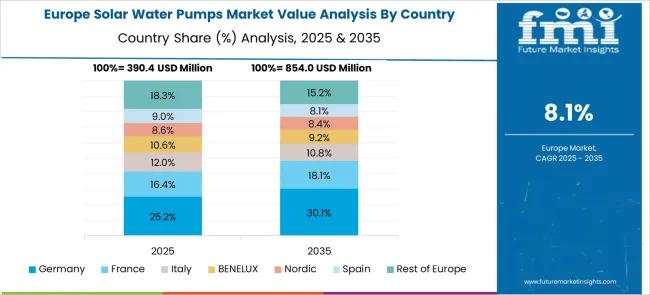

The CAGR in Germany advanced from nearly 6.4% during 2020-2024 to about 10.1% in 2025-2035, supported by rising adoption of off-grid irrigation systems and integration with renewable-powered microgrids. Subsidy-driven programs from the Federal Ministry for Economic Affairs enabled higher penetration among small farms and rural cooperatives. Manufacturers collaborated with European R&D centers to optimize solar-driven pump efficiency under varying climatic conditions. Market participants prioritized inverter-compatible solutions with Germany’s clean energy roadmap, creating favorable conditions for scale-up. Deployment in residential water supply systems further accelerated demand after updated municipal water directives encouraged renewable pumping technologies for sustainability compliance.

The CAGR in the United Kingdom increased from around 3.4% during 2020-2024 to about 8.4% between 2025 and 2035, with the global CAGR benchmark of 8.8%. Early adoption was constrained by high capital costs and limited subsidy access; however, the scenario changed post-2025 with stronger government incentives for solar energy integration in rural water infrastructure. Market adoption was further driven by agriculture modernization schemes and greenhouse irrigation programs. Water utilities began exploring solar pumping for remote water distribution under climate resilience initiatives, improving efficiency and reducing grid dependency. Off-grid installations gained momentum with government-backed green finance programs targeting small farmers and livestock producers.

The CAGR in China progressed from approximately 7.5% in 2020-2024 to about 11.9% for 2025-2035, driven by large-scale rural electrification and expansion of solar agriculture programs under government directives. High-efficiency pumps were deployed in integrated smart irrigation projects across northern provinces to address water scarcity challenges. Local manufacturers benefited from strong policy, receiving tax incentives for renewable energy equipment production. Solar pump deployment in livestock farms and aquaculture supported market penetration. Provincial subsidies and digital agriculture initiatives increased demand for automated solar pumping systems, ensuring minimal maintenance and high operational uptime.

The CAGR value moved up from nearly 6.8% in 2020-2024 to about 11.0% during 2025-2035, primarily supported by policy-backed rural electrification drives, and the KUSUM scheme incentivizes farmers to adopt solar irrigation. Strong financing support from NABARD and microcredit institutions enabled faster affordability among smallholder farmers. Deployment expanded across semi-arid zones for drip and sprinkler irrigation systems, improving water use efficiency. Leading pump manufacturers introduced high-output AC and DC solar pump solutions tailored for varying crop cycles. Partnerships with agritech startups enhanced service availability in remote areas, supporting preventive maintenance and real-time monitoring.

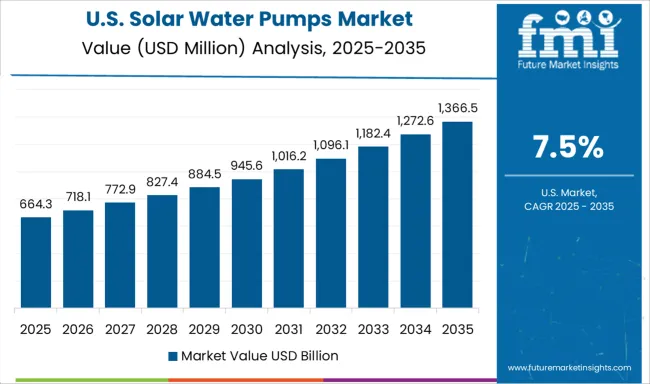

The CAGR in the United States improved from nearly 5.2% during 2020-2024 to around 7.5% in 2025-2035, driven by growing adoption of sustainable irrigation solutions in western drought-prone states. Federal water conservation programs and state-level renewable energy credits accelerated penetration across the agriculture and landscaping sectors. Solar water pumping gained traction in off-grid livestock watering applications and community water systems under rural development grants. Technological improvements in variable frequency drives (VFD) and advanced control systems enhanced energy efficiency, reducing lifecycle costs. Manufacturers focused on IoT-enabled pumps compatible with precision agriculture tools, supporting operational efficiency gains.

In the solar water pumps market, leading players are focusing on product efficiency, off-grid adaptability, and long-lifecycle performance to meet agricultural and community water needs. Companies such as Alpex Power, Aqua Group, Bright Solar, and Crompton Greaves are investing in robust pump designs integrated with smart controllers for rural irrigation and livestock water supply.

Brands like Dankoff Solar, EcoSoch, and Ecozen are enabling IoT-enabled systems to monitor water flow and optimize energy consumption for farmers. Global specialists such as Franklin Electric and Grundfos Pumps dominate high-performance segments, leveraging precision engineering and inverter compatibility for hybrid installations. Regional players like Jakson Group, Lorentz, Lubi, and Novergy Energy Solutions are expanding their reach through localized manufacturing and financing partnerships.

Shakti Pumps, Surya International, and Oswal are strengthening their presence with AC/DC pump variants designed for smallholder farms and large irrigation systems. Emerging brands such as Symtech Solar Group, TATA Solar Power, USA Solar Pumps, and Wenling Jintai Pump Factory are gaining traction by targeting off-grid water infrastructure projects, leveraging cost competitiveness and modular designs to address diverse pumping needs across developing and developed regions.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 Billion |

| Product | Submersible Pump and Surface Pump |

| Technology | AC Pumps and DC Pumps |

| Power Rating | 5 HP - 10 HP, 10 HP - 20 HP, 5 HP, and > 20 HP |

| Application | Agriculture, Water Supply, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Alpex Power, Aqua Group, Bright Solar, Crompton Greaves, Dankoff Solar, EcoSoch, Ecozen, Franklin Electric, Grundfos Pumps, Jakson Group, Lorentz, Lubi, Novergy Energy Solutions, Oswal, Shakti Pumps, Surya International, Symtech Solar Group, TATA Solar Power, US Solar Pumps, and Wenling Jintai Pump Factory |

| Additional Attributes | Dollar sales by pump type (surface, submersible, hybrid) and power configuration (solar-only, solar + battery), demand dynamics driven by agricultural irrigation, rural drinking water supply, and livestock applications, regional trends dominated by Asia-Pacific with Africa and Latin America accelerating adoption under subsidy programs, innovation in IoT-enabled monitoring, hybrid energy integration, and modular storage-backed designs, and strategic impact of water security policies, financing models such as pay-as-you-go, and government-led renewable energy mandates. |

The global solar water pumps market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the solar water pumps market is projected to reach USD 4.0 billion by 2035.

The solar water pumps market is expected to grow at a 8.8% CAGR between 2025 and 2035.

The key product types in solar water pumps market are submersible pump and surface pump.

In terms of technology, ac pumps segment to command 61.2% share in the solar water pumps market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Agriculture Solar Water Pumps Market Size and Share Forecast Outlook 2025 to 2035

Solar Pumps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Water Desalination Plant Market Size and Share Forecast Outlook 2025 to 2035

Solar Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Sea Water Pumps Market Growth - Trends & Forecast 2025 to 2035

Europe Water Pumps Market – Trends & Forecast 2025 to 2035

UK Sea Water Pumps Market Outlook – Share, Growth & Forecast 2025-2035

Seawater Cooling Pumps Market

USA Sea Water Pumps Market Trends – Growth, Demand & Forecast 2025-2035

Sea Water Injection Pumps Market

Japan Sea Water Pumps Market Report – Trends & Innovations 2025-2035

ASEAN Sea Water Pumps Market Analysis - Size, Demand & Forecast 2025-2035

Industrial Solar Water Heaters Market Growth – Trends & Forecast 2025 to 2035

Germany Sea Water Pumps Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Demand for Industrial Solar Water Heaters in USA Size and Share Forecast Outlook 2025 to 2035

Solar Module Recycling Service Market Size and Share Forecast Outlook 2025 to 2035

Water Vapor Permeability Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Solar Tracking Module Market Size and Share Forecast Outlook 2025 to 2035

Water and Waste Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water-cooled Walk-in Temperature & Humidity Chamber Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA