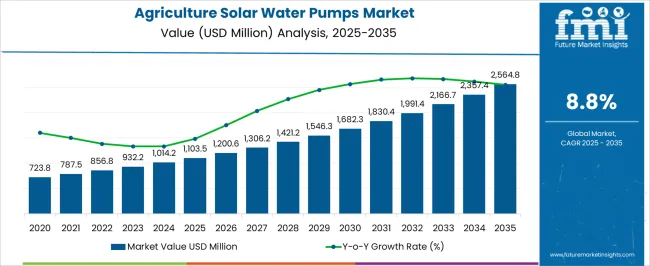

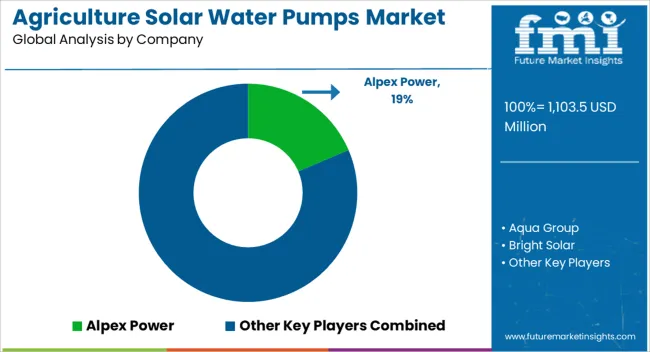

The agriculture solar water pumps market is projected at USD 1,103.5 million in 2025 and anticipated to reach USD 2,564.8 million by 2035, advancing at a CAGR of 8.8 percent, indicating a distinctly upward growth curve. The shape of this curve reflects a progressive acceleration phase, where early adoption is transitioning into large-scale deployment across both developed and emerging agricultural regions.

In the initial years between 2025 and 2030, the curve shows a steady climb, moving from USD 1,103.5 million to nearly USD 1,682.3 million, fueled by government-backed subsidies, farmer education programs, and decreasing photovoltaic panel costs. As the decade progresses, the curve steepens, signaling broader acceptance of solar-driven irrigation due to rising diesel costs and growing water management concerns.

By 2035, the trajectory reaches USD 2,564.8 million, confirming a strong long-term expansion pattern. This shape is neither flat nor erratic but consistent with markets experiencing structural shifts toward energy independence in agriculture. The curve highlights the sector’s potential to evolve from subsidy-driven growth to self-sustained adoption, with technology integration and financing models ensuring accessibility. Overall, the shape signifies a maturing yet expanding market that blends policy support with economic and environmental drivers for long-term stability.

| Metric | Value |

|---|---|

| Agriculture Solar Water Pumps Market Estimated Value in (2025 E) | USD 1103.5 million |

| Agriculture Solar Water Pumps Market Forecast Value in (2035 F) | USD 2564.8 million |

| Forecast CAGR (2025 to 2035) | 8.8% |

The agriculture solar water pumps market is strongly shaped by five interconnected parent markets that collectively drive adoption and long-term growth. The agricultural irrigation systems market holds the largest share at 38%, as farmers depend on solar-powered pumps to ensure reliable water supply for crops, reducing dependence on grid electricity or diesel. The renewable energy market contributes 25%, with solar integration playing a central role in lowering operational costs and supporting rural electrification. The water management and conservation market accounts for 15%, as solar pumps provide efficient solutions for groundwater extraction, drip irrigation, and sustainable water usage. The rural development and infrastructure market represents 12%, driven by government-backed programs, subsidies, and financing initiatives that expand accessibility for small and marginal farmers.

The off-grid power solutions market contributes 10%, reflecting demand in remote areas where conventional power infrastructure is limited or absent. Irrigation, renewable energy, and water management account for nearly 80% of total demand, highlighting that the core drivers of this sector are linked to food security, cost reduction, and water efficiency. Emerging opportunities in rural infrastructure and off-grid energy solutions are expected to broaden adoption, positioning solar pumps as both an agricultural and rural development enabler globally.

The agriculture solar water pumps market is expanding steadily as farmers increasingly shift toward sustainable and cost efficient irrigation solutions. Rising fuel costs and limited grid access in rural areas have positioned solar powered pumps as a viable and long term alternative to traditional diesel or electric pumps.

Government incentives and subsidy programs supporting solar infrastructure adoption in the agriculture sector are accelerating deployment across developing economies. Technological advancements in photovoltaic panels, motor efficiency, and remote monitoring capabilities are enhancing system reliability and reducing maintenance costs.

Additionally, the integration of solar water pumps into micro irrigation systems is promoting water conservation and energy optimization in crop production. With global focus intensifying on sustainable agriculture and resource efficiency, the market is expected to see continuous growth driven by supportive policies, economic benefits, and climate resilience goals.

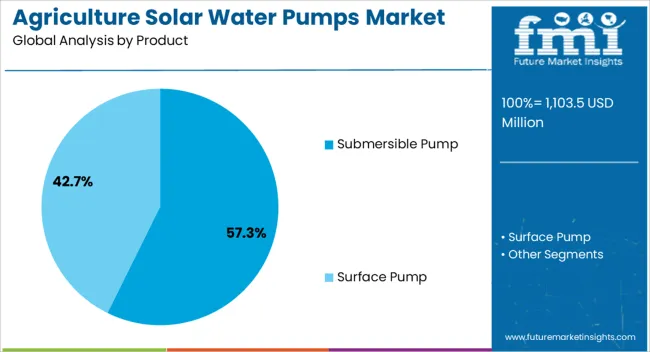

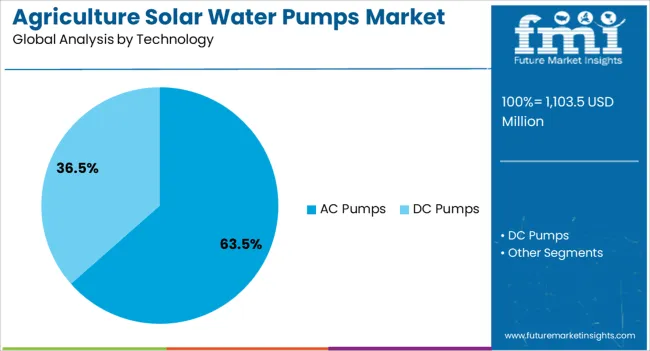

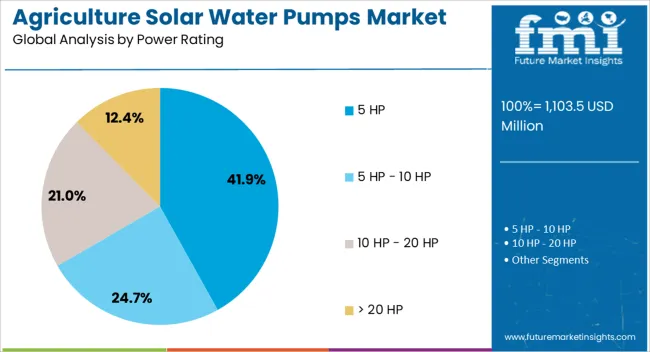

The agriculture solar water pumps market is segmented by product, technology, power rating, and geographic regions. By product, agriculture solar water pumps market is divided into Submersible Pump and Surface Pump. In terms of technology, agriculture solar water pumps market is classified into AC Pumps and DC Pumps. Based on power rating, agriculture solar water pumps market is segmented into 5 HP, 5 HP - 10 HP, 10 HP - 20 HP, and > 20 HP.

Regionally, the agriculture solar water pumps industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The submersible pump segment is projected to account for 57.30% of the total market revenue by 2025 within the product category, making it the most dominant segment. This growth is attributed to its capability to operate efficiently in deep water sources such as borewells and its suitability for regions with low water tables.

Submersible pumps are preferred in agricultural applications requiring high-volume water output and continuous operation. Their enclosed motor design minimizes the risk of overheating and mechanical wear, leading to longer service life and reduced maintenance costs.

The durability and operational efficiency of submersible pumps in challenging field conditions have reinforced their dominance in the agriculture solar water pumps market.

AC pumps are anticipated to contribute 63.50% of the total market revenue by 2025 within the technology category, positioning them as the leading segment. Their dominance is driven by high energy efficiency, compatibility with existing irrigation systems, and the ability to deliver higher flow rates.

AC pump systems benefit from mature technology infrastructure, easy availability of components, and broad scalability across various farm sizes. They are also favored in regions where farmers have already adopted AC powered systems and seek to convert them to solar operations without major technical adjustments.

These factors have made AC pumps the most widely adopted technology in the market.

The 5 HP segment is projected to hold 41.90% of the total market share by 2025 under the power rating category, representing the most prominent power range. This rating is considered ideal for small to medium scale farms that require efficient water lifting capacity without incurring excessive installation or energy costs.

The 5 HP pumps offer a balance between performance and affordability, making them suitable for irrigation of a variety of crops across different geographies. Their compatibility with both surface and submersible installations further enhances their versatility.

As farmers prioritize dependable and cost effective solar pumping solutions, the 5 HP segment continues to gain preference within the market.

The agriculture solar water pumps market is driven by cost-effective irrigation demand, supportive policies, and efficiency improvements, while financing barriers and low awareness remain challenges to overcome.

The agriculture solar water pumps market is expanding as farmers increasingly prioritize affordable irrigation methods. Traditional diesel-powered pumps face rising operational costs, while grid-based electricity remains inconsistent in rural areas. Solar water pumps provide a cost-effective alternative, reducing recurring fuel expenses and minimizing downtime. Governments are promoting adoption through subsidies, training, and financing programs that make systems more accessible to small and medium farmers. The consistent supply of water enabled by solar pumps helps improve crop yields and ensures agricultural resilience. With economic benefits driving adoption, the use of solar pumps is transitioning from a niche solution to a mainstream agricultural practice.

Policy frameworks and subsidy programs are central to the growth of solar-powered pumps in agriculture. Many governments are offering financial incentives, reduced import duties on solar equipment, and interest-free credit schemes for farmers. These initiatives have accelerated deployment, especially in developing countries where grid connectivity is weak.

By promoting solar-based irrigation, authorities aim to reduce reliance on fossil fuels and enhance rural self-sufficiency. Public-private partnerships are emerging, combining technical expertise with funding models that ensure wider adoption. The presence of clear policies provides market stability and instills confidence among investors, encouraging continued expansion and technological improvements in pump systems.

Energy storage and efficiency improvements have significantly enhanced the functionality of agriculture solar water pumps. Integration with battery storage allows farmers to use pumps even during cloudy weather or nighttime, overcoming earlier limitations. Enhanced pump designs now support deeper water extraction and higher discharge rates, expanding their suitability across diverse agricultural landscapes. These advancements make solar pumps viable for both small-scale farmers and large agricultural estates. Manufacturers are focusing on delivering durable, high-performance systems that maintain efficiency under varying conditions. With improved reliability and reduced maintenance needs, solar pumps are becoming an integral part of irrigation infrastructure worldwide.

Despite rapid growth, challenges in financing and awareness hinder the broader adoption of solar water pumps. High upfront costs remain a barrier for small farmers, even when subsidies are available. Limited awareness about long-term benefits and operational advantages reduces confidence in making initial investments. Financing models involving microcredit, leasing, and pay-as-you-go structures are being developed to overcome these hurdles.

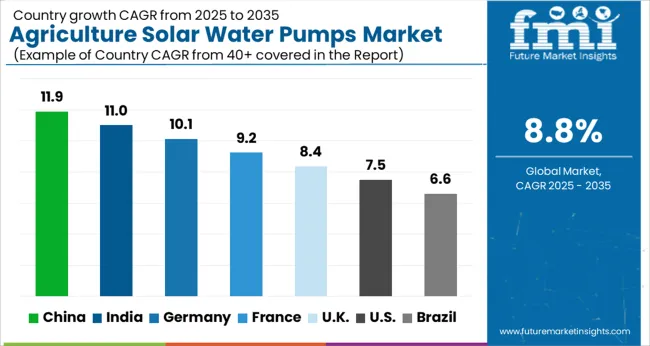

| Country | CAGR |

|---|---|

| China | 11.9% |

| India | 11.0% |

| Germany | 10.1% |

| France | 9.2% |

| UK | 8.4% |

| USA | 7.5% |

| Brazil | 6.6% |

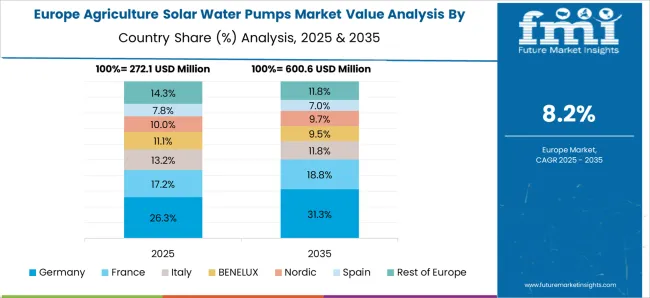

The global agriculture solar water pumps market is projected to grow at a CAGR of 8.8% from 2025 to 2035. China leads growth at 11.9%, followed by India at 11.0%, Germany at 10.1%, France at 9.2%, the UK at 8.4%, and the USA at 7.5%. Expansion is fueled by government-backed subsidies, farmer-centric financing schemes, and the rising need for reliable irrigation in water-stressed regions. BRICS economies, particularly China and India, are accelerating adoption through large-scale solar irrigation projects, rural electrification efforts, and integration with micro-financing programs. OECD nations such as Germany, France, the UK, and the USA emphasize advanced pump efficiency, battery integration, and water conservation initiatives, aligning with broader energy and agricultural modernization policies. Growing diesel costs, expanding off-grid farming needs, and increasing climate resilience strategies further shape the momentum of this sector globally. The analysis includes over 40+ countries, with the leading markets detailed below.

The agriculture solar water pumps market in China is projected to grow at a CAGR of 11.9% from 2025 to 2035. Provincial programs that support distributed solar and irrigation upgrades have encouraged rapid procurement by cooperatives and agribusinesses. Declining module prices and local manufacturing of controllers, motors, and pumps have improved affordability and service access. Large fruit, vegetable, and aquaculture belts are adopting solar pumping to stabilize water availability during peak seasons, reducing exposure to diesel cost swings. Microfinance, lease to own, and EPC packages have widened participation among smallholders. Field performance data from early pilots has been used to standardize sizing, filtration, and storage practices, lifting reliability. With after sales networks expanding into county levels, adoption is expected to remain above the global baseline through 2035.

The agriculture solar water pumps market in India is expected to rise at a CAGR of 11.0% between 2025 and 2035. Central and state schemes offer capital subsidies and feeder programs that favor solar powered irrigation. Vendors partner with banks and NBFCs to deploy loans and pay as you grow models that reduce upfront burden for small and marginal farmers. Adoption is spreading from arid belts into horticulture and dairy clusters, where reliable daytime pumping supports fodder and micro irrigation. Discom integration with smart meters enables surplus export in selected pilots, improving economics. Training given by Krishi Vigyan Kendras and NGOs is improving installation quality and maintenance practices. With distribution partners building regional spares inventories, downtime is being reduced across high demand seasons.

The agriculture solar water pumps market in France is projected to advance at a CAGR of 9.2% from 2025 to 2035. Vineyards, orchards, and livestock farms are prioritizing reliable irrigation and watering with lower operating costs. Regional agencies support on farm electrification with grants that cover pumps, controllers, and water storage. Producers in drought prone zones are integrating solar pumping with drip systems and telemetry to moderate draw and schedule irrigation windows. Cooperatives are negotiating framework contracts that secure installation, warranty, and periodic inspections. Technical advisors are emphasizing water quality, intake screening, and sediment control to protect pump life. With emphasis on predictable OPEX, solar powered systems are being adopted as a hedge against fuel volatility and feeder constraints.

The agriculture solar water pumps market in the United Kingdom is anticipated to grow at a CAGR of 8.4% during 2025 to 2035. Mixed farms and estates require pumping for livestock watering, polytunnels, and remote field taps where grid access is limited. Landowners are pairing ground mounted arrays with battery or elevated tank storage to extend pumping windows beyond peak sun hours. Water authorities promote efficient abstraction and monitoring, which encourages metered systems with data logging. Rural installers have developed standardized kits for boreholes and surface sources that shorten commissioning time. Grant programs and green finance products support capex recovery for small and medium holdings. With a focus on reliability and documented performance, adoption is expected to build steadily across counties.

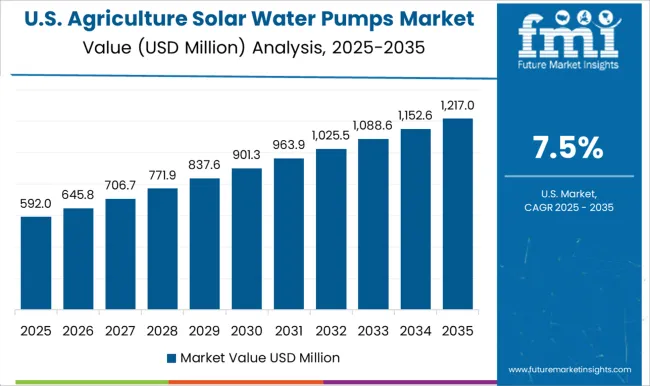

The agriculture solar water pumps market in the United States is expected to expand at a CAGR of 7.5% from 2025 to 2035. Ranch operations in the West and Midwest are adopting solar pumping for remote livestock tanks, reducing diesel runs and maintenance trips. Specialty crops in California, Arizona, and the Southeast use solar powered booster pumps to stabilize pressure for drip and microsprinklers. USDA and state programs provide grants and low interest financing that improve payback periods. Integrators bundle arrays, variable speed drives, and telemetry to deliver turnkey systems with fault alerts and pump curve monitoring. Water districts favor solutions that support responsible abstraction with flow logging. With broader dealer networks and strong focus on lifecycle service, steady growth is anticipated through the horizon.

The agriculture solar water pumps market is shaped by global renewable energy equipment manufacturers, regional solar pump producers, and specialized irrigation solution providers. Leading players such as Grundfos, Lorentz, Shakti Pumps, and Tata Power Solar hold strong positions by offering diversified portfolios of solar-powered water pumps for irrigation, livestock, and rural water supply applications. Competitive differentiation is driven by pump efficiency, solar panel integration, durability under harsh field conditions, ease of installation, and cost-effectiveness. Regional manufacturers, particularly in Asia-Pacific and Africa, compete by providing localized technical support, customized solutions for smallholder farmers, and affordable financing options to enhance adoption.

Strategic partnerships with government agencies, agricultural cooperatives, and microfinance institutions strengthen market reach and credibility. Innovation in high-efficiency motors, smart controllers, and hybrid solar-grid solutions further enhances competitive positioning. Companies prioritizing regulatory compliance, robust after-sales service, and scalable supply chains are well-positioned to capture significant market share.

| Item | Value |

|---|---|

| Quantitative Units | USD 1103.5 Million |

| Product | Submersible Pump and Surface Pump |

| Technology | AC Pumps and DC Pumps |

| Power Rating | 5 HP, 5 HP - 10 HP, 10 HP - 20 HP, and > 20 HP |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Alpex Power, Aqua Group, Bright Solar, Crompton Greaves, Dankoff Solar, EcoSoch, Ecozen, Franklin Electric, Grundfos Pumps, Jakson Group, KSB SE & Co., LORENTZ, Novergy Energy Solutions, Oswal, Shakti Pumps, Surya International, Symtech Solar Group, TATA Solar Power, US Solar Pumps, and Wenling JINTAI Pump Factory |

| Additional Attributes | Dollar sales, share, regional adoption trends, government subsidies, financing models, competitive strategies, material costs, irrigation demand patterns, and future growth opportunities. |

The global agriculture solar water pumps market is estimated to be valued at USD 1,103.5 million in 2025.

The market size for the agriculture solar water pumps market is projected to reach USD 2,564.8 million by 2035.

The agriculture solar water pumps market is expected to grow at a 8.8% CAGR between 2025 and 2035.

The key product types in agriculture solar water pumps market are submersible pump and surface pump.

In terms of technology, ac pumps segment to command 63.5% share in the agriculture solar water pumps market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Agriculture Gateway Market Size and Share Forecast Outlook 2025 to 2035

Agriculture Fertilizer Spreader Market Size and Share Forecast Outlook 2025 to 2035

Agriculture Packaging Market Size and Share Forecast Outlook 2025 to 2035

Agriculture Analytics Market Size and Share Forecast Outlook 2025 to 2035

Agriculture IoT Market Size and Share Forecast Outlook 2025 to 2035

Agriculture Enzyme Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Market Share Breakdown of Agriculture Packaging Solutions

Agriculture Bags Market

Agriculture Testing Services Market Growth – Trends & Forecast 2018-2028

Non-Agriculture Smart Irrigation Controllers Market Size and Share Forecast Outlook 2025 to 2035

Smart Agriculture Market Size and Share Forecast Outlook 2025 to 2035

Ai In Agriculture Market Size and Share Forecast Outlook 2025 to 2035

Smart Agriculture Solution Market Analysis by Component Type, Application, and Region Through 2035

Precision Agriculture Market

Regenerative Agriculture Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Agriculture and Food Supply Chain Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Agriculture Market Analysis – Size, Share & Forecast 2024-2034

Controlled Environment Agriculture (CEA) Market Size and Share Forecast Outlook 2025 to 2035

Solar Tracking Module Market Size and Share Forecast Outlook 2025 to 2035

Solar Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA