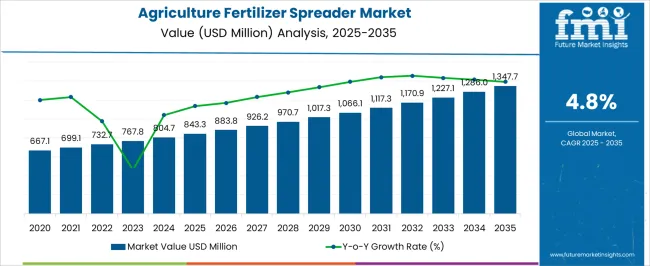

The agriculture fertilizer spreader market is projected to reach USD 843.3 million in 2025 to USD 1347.7 million in 2035, growing at a CAGR of 4.8%. During the early adoption phase (2020–2024), usage was primarily limited to large-scale farms and pilot projects evaluating efficiency and coverage. As the market enters the scaling phase in 2025, broader adoption occurs among medium and small-scale farms.

Manufacturers expand production capacity and distribution networks, while dealers focus on customer training and support. Increasing demand for higher yields and optimized fertilizer application drives consistent revenue growth, with the market steadily moving toward wider acceptance across diverse agricultural regions. From 2030 to 2035, the market is expected to reach USD 1,347.7 million, maintaining a CAGR of 4.8%. The consolidation phase sees leading manufacturers solidifying market share through acquisitions, expanded service networks, and improved fleet availability. Smaller players either specialize in niche segments or exit. Adoption plateaus as most potential users are engaged, prompting companies to focus on operational efficiency, cost-effectiveness, and customer retention. By 2035, the market exhibits stable, predictable growth, with mature competitive dynamics and established industry standards shaping long-term market performance.

| Metric | Value |

|---|---|

| Agriculture Fertilizer Spreader Market Estimated Value in (2025 E) | USD 843.3 million |

| Agriculture Fertilizer Spreader Market Forecast Value in (2035 F) | USD 1347.7 million |

| Forecast CAGR (2025 to 2035) | 4.8% |

Vegetable & Horticulture Farming contributes 18%, driven by precise fertilizer distribution for high-value crops. Oilseed & Pulses account for 15%, as uniform application ensures crop quality and reduces input waste. Fruit Orchards represent 12%, adopting spreaders for both efficiency and soil management.

Dairy & Pasture Management contributes 10%, supporting nutrient distribution across grazing lands. Plantation Crops (tea, coffee, sugarcane) hold 8%, where mechanized spreading improves productivity. Greenhouse & Controlled Environment Agriculture represents 5%, using specialized spreaders for compact or sensitive setups. Seed & Fertilizer Service Providers account for 4%, offering mechanized application solutions to farmers on contract. Remaining niche segments, including Organic Farms and Experimental Research Farms, make up 0–2%, focusing on small-scale or experimental use. Revenue contribution from these sectors follows the market trajectory: from USD 667.1 million in 2020 to USD 843.3 million in 2025 and projected USD 1,347.7 million in 2035, reflecting a consistent CAGR of 4.8%. Cereal & Grain and Vegetable & Horticulture segments dominate adoption, while Fruit, Pasture, and Plantation sectors show steady growth, collectively shaping overall market expansion.

The agriculture fertilizer spreader market is expanding steadily due to the rising emphasis on precision farming, efficiency in nutrient application, and sustainable agricultural practices. Increasing awareness of optimal fertilizer usage to enhance crop yield while minimizing environmental impact is driving adoption across diverse farm sizes.

Farmers are increasingly investing in equipment that ensures uniform distribution, reduces wastage, and supports various soil and crop types. Advances in spreading technologies, integration with GPS guidance, and compatibility with a range of fertilizers are enhancing operational productivity.

Government initiatives promoting modern agricultural machinery and subsidy programs are further encouraging adoption. The market outlook remains optimistic as agricultural stakeholders prioritize mechanization, precision application, and long term soil health management.

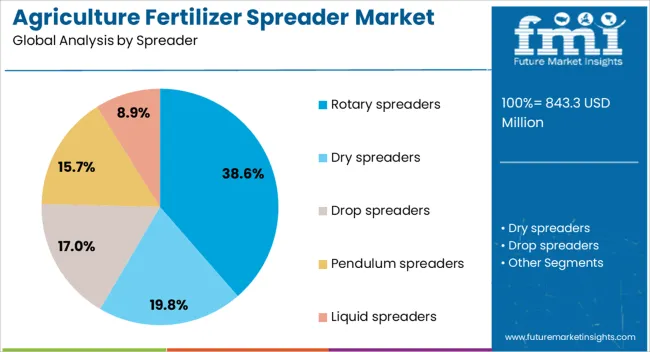

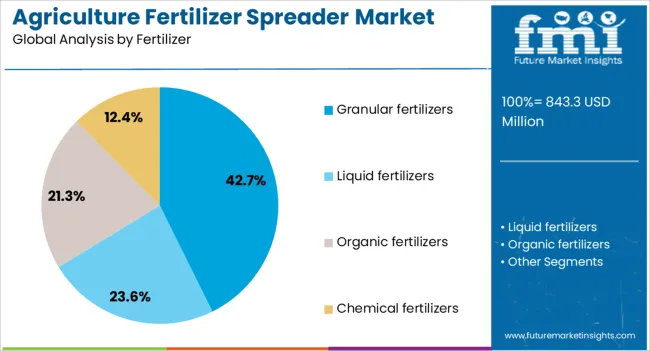

The agriculture fertilizer spreader market is segmented by spreader, fertilizer, technology, power source, application, distribution channel, and geographic regions. By spreader, agriculture fertilizer spreader market is divided into Rotary spreaders, Dry spreaders, Drop spreaders, Pendulum spreaders, and Liquid spreaders. In terms of fertilizer, agriculture fertilizer spreader market is classified into Granular fertilizers, Liquid fertilizers, Organic fertilizers, and Chemical fertilizers.

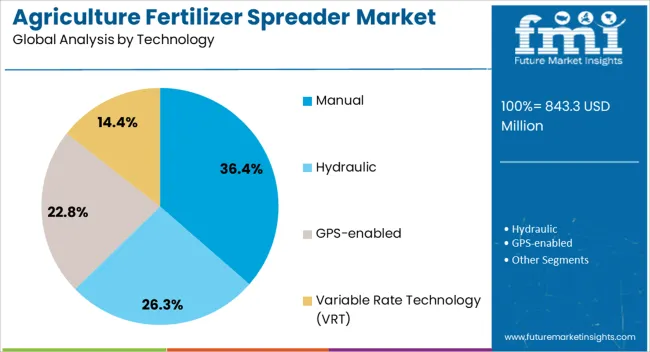

Based on technology, agriculture fertilizer spreader market is segmented into Manual, Hydraulic, GPS-enabled, and Variable Rate Technology (VRT). By power source, agriculture fertilizer spreader market is segmented into Tractor-mounted, Self-propelled, Hand-pushed, and ATV/UTV mounted. By application, agriculture fertilizer spreader market is segmented into Row crops, Orchards, and Commercial lawns & gardens. By distribution channel, agriculture fertilizer spreader market is segmented into Direct sales, Retail, and Online platforms. Regionally, the agriculture fertilizer spreader industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The rotary spreaders segment is anticipated to hold 38.60% of total revenue by 2025 within the spreader category, making it the leading type. This dominance is driven by their ability to cover large areas quickly, distribute fertilizers evenly, and handle various application rates effectively.

Their design facilitates consistent spreading patterns and operational flexibility, which is valued in both small scale and large scale farming.

Ease of maintenance, durability, and cost effectiveness further strengthen the adoption of rotary spreaders in modern agricultural operations.

The granular fertilizers segment is projected to account for 42.70% of the market within the fertilizer category by 2025, positioning it as the most preferred type. Granular formulations are favored for their ease of storage, long shelf life, and controlled nutrient release properties.

They allow for precise dosage and compatibility with a range of spreader equipment.

Farmers value granular fertilizers for their ability to support targeted application schedules and enhance crop nutrition efficiency.

The manual technology segment is expected to capture 36.40% of total revenue by 2025 within the technology category, making it a significant contributor.

Its prominence is attributed to affordability, simplicity of operation, and suitability for small farms or regions with limited access to mechanized equipment.

Manual spreaders are valued for their low maintenance requirements and adaptability across various crop types and terrains, ensuring accessibility to cost-conscious farmers while maintaining effective fertilizer distribution.

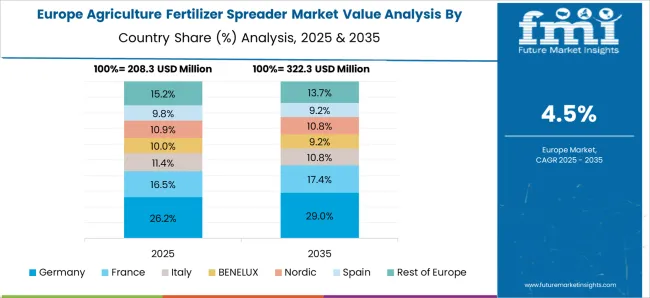

The agriculture fertilizer spreader market is expanding due to rising demand for efficient nutrient application, precision farming, and mechanization in crop production. North America and Europe lead with advanced, GPS-enabled, and automated spreaders that improve productivity and reduce waste. Asia-Pacific is witnessing rapid growth driven by smallholder adoption, large-scale crop cultivation, and government agricultural initiatives. Manufacturers differentiate through variable-rate technology, material durability, and machine versatility. Regional variations in farm size, mechanization levels, and crop types influence adoption, operational efficiency, and competitiveness globally.

Adoption of agriculture fertilizer spreaders is increasingly influenced by precision technology and GPS-enabled operations. North America and Europe prioritize spreaders with real-time rate control, automated navigation, and uniform nutrient distribution to optimize yields and reduce fertilizer wastage. Asia-Pacific markets focus on cost-effective, semi-automated spreaders for small to medium farms where labor efficiency is key. Differences in precision levels, automation capabilities, and technology adoption affect fertilizer efficiency, crop productivity, and operational costs. Leading suppliers provide GPS-based variable-rate spreaders, software integration, and advanced sensors, while regional manufacturers deliver durable, practical solutions. Precision and technology contrasts shape adoption, yield optimization, and market competitiveness globally.

The versatility and operational capacity of fertilizer spreaders are critical adoption factors. North America and Europe focus on large, multi-purpose spreaders capable of handling granular, powder, and liquid fertilizers for diverse crops. Asia-Pacific markets prioritize smaller, robust spreaders suitable for different terrain types and medium-scale cultivation. Differences in machine versatility and hopper capacity affect application efficiency, farm coverage, and maintenance requirements. Leading suppliers offer modular designs, adjustable spread widths, and multi-fertilizer compatibility, while regional manufacturers provide simple, cost-effective units. Versatility and capacity contrasts drive adoption, operational efficiency, and competitive positioning across the global agriculture fertilizer spreader market.

Environmental regulations and fertilizer application guidelines strongly influence spreader adoption. North America and Europe enforce strict standards to minimize nutrient runoff, soil contamination, and greenhouse gas emissions, requiring precision and certification in spreaders. Asia-Pacific regulations vary, with advanced economies adhering to international standards while emerging countries follow local guidelines prioritizing cost and scalability. Differences in compliance requirements affect procurement, operational methodology, and market acceptance. Suppliers providing certified, regulation-compliant spreaders gain premium adoption, while regional players deliver practical, low-cost alternatives. Regulatory and environmental contrasts shape adoption, operational sustainability, and competitiveness in global fertilizer spreader markets.

Operational cost, maintenance needs, and durability influence the adoption of fertilizer spreaders. North America and Europe emphasize high-quality spreaders with low-wear components, automated calibration, and long service intervals to reduce the total cost of ownership. Asia-Pacific markets prioritize affordable, low-maintenance units suitable for extensive farm operations and challenging terrain. Differences in cost-effectiveness and maintenance infrastructure affect purchase decisions, productivity, and adoption rates. Leading suppliers invest in robust materials, automated systems, and after-sales support, while regional manufacturers focus on practical, low-cost solutions. Cost and reliability contrasts drive adoption, operational efficiency, and market competitiveness globally.

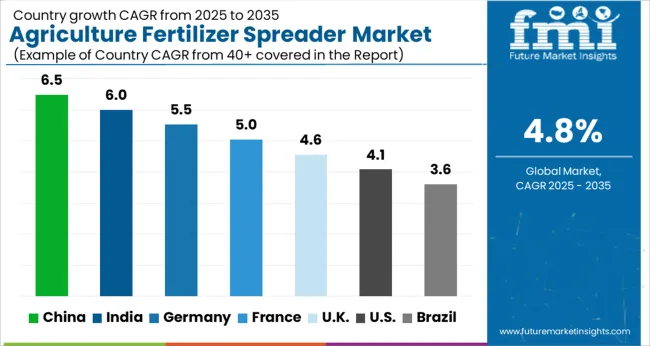

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

The global agriculture fertilizer spreader market is projected to grow at a 4.8% CAGR through 2035, driven by demand in crop production, farm mechanization, and large-scale agricultural operations. Among BRICS nations, China led with 6.5% growth as production and distribution facilities were commissioned and adherence to agricultural equipment standards was enforced, while India at 6.0% growth expanded manufacturing and service capacity to meet rising regional demand. In the OECD region, Germany at 5.5% maintained steady output under strict regulatory frameworks, while the United Kingdom at 4.6% operated moderate-scale facilities serving commercial and industrial farming applications. The USA, growing at 4.1%, supported consistent demand across crop production and agricultural mechanization projects, ensuring compliance with federal and state-level quality and safety regulations. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The agriculture fertilizer spreader market in China is expected to grow at a CAGR of 6.5% as modernization of farming practices and mechanized agriculture increase adoption. The market is being supported by demand for precision equipment that enables uniform fertilizer application, reduces wastage, and improves crop yield. Manufacturers are being encouraged to provide durable, efficient, and cost effective spreaders suitable for large scale farming. Distribution through agricultural equipment dealers, cooperative societies, and authorized suppliers is being strengthened. Research in improved spreading mechanisms, automation integration, and soil specific calibration is being conducted. Expanding agricultural land, government subsidy programs, and rising demand for high productivity are considered key factors driving growth of the agriculture fertilizer spreader market in China.

The agriculture fertilizer spreader market in India is projected to grow at a CAGR of 6.0% due to rising adoption of mechanized farming and precision nutrient management. Adoption is being driven by equipment that ensures uniform fertilizer distribution, reduces labor requirements, and enhances crop productivity. Manufacturers are being encouraged to supply cost effective, durable, and high performance spreaders. Distribution through agricultural equipment suppliers, cooperatives, and authorized dealers is being strengthened. Technical workshops and training programs are being conducted to promote correct installation and operation. Expanding agricultural operations, government support for mechanization, and increasing crop demand are recognized as primary drivers of growth for the agriculture fertilizer spreader market in India.

Germany is witnessing growth in the agriculture fertilizer spreader market at a CAGR of 5.5%, supported by precision agriculture practices and sustainable nutrient management. The market is being strengthened by adoption of advanced spreaders that provide accurate fertilizer application, reduce wastage, and ensure consistent yields. Manufacturers are being encouraged to provide high quality, efficient, and technologically advanced equipment. Distribution through agricultural suppliers, machinery dealers, and cooperatives is being maintained. Research in GPS guided spreading, automated calibration, and improved mechanical efficiency is being conducted. Adoption of precision farming, strict regulatory standards, and optimization of crop productivity are considered key contributors to the growth of the agriculture fertilizer spreader market in Germany.

Increasing adoption of precision and mechanized farming practices is driving the agriculture fertilizer spreader market in the United Kingdom, which is expected to grow at a CAGR of 4.6%. Adoption is being emphasized for spreaders that reduce fertilizer waste, improve efficiency, and enhance crop yield. Manufacturers are being encouraged to provide durable, reliable, and cost effective equipment. Distribution through authorized agricultural suppliers, cooperatives, and dealers is being strengthened. Awareness programs and technical demonstrations are being conducted to promote proper use and calibration. Expansion of arable land, mechanized farming initiatives, and rising crop productivity are recognized as important growth factors for the agriculture fertilizer spreader market in the United Kingdom.

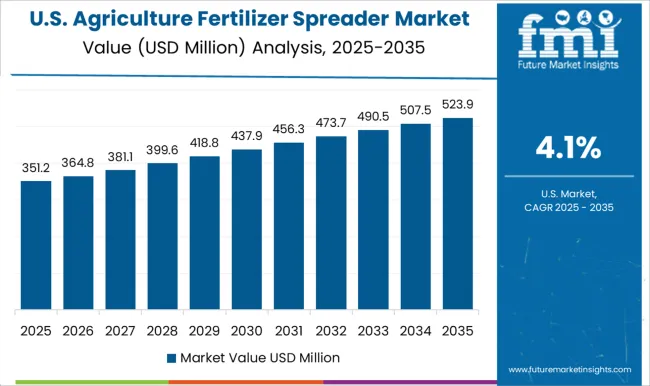

The agriculture fertilizer spreader market in the United States is projected to grow at a CAGR of 4.1%, supported by adoption of modern farming equipment and precision nutrient application practices. Adoption is being strengthened by spreaders that ensure uniform distribution, reduce labor dependency, and improve efficiency. Manufacturers are being encouraged to supply high performance, durable, and technologically advanced equipment. Distribution through agricultural machinery suppliers, cooperatives, and authorized dealers is being maintained. Research into automated calibration, GPS guidance, and improved mechanical efficiency is being conducted. Expansion of large scale farms, government support for mechanization, and increasing crop productivity are considered key drivers of growth for the agriculture fertilizer spreader market in the United States.

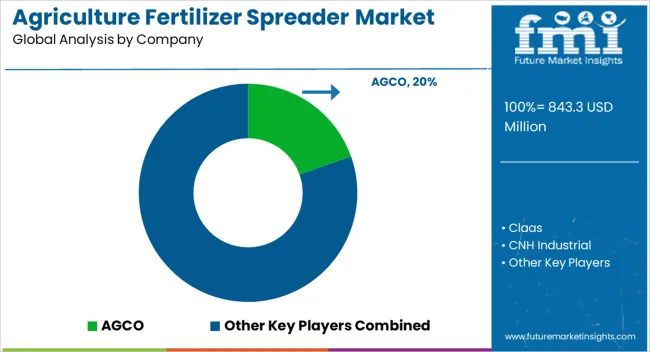

The agriculture fertilizer spreader market has been expanding rapidly as farmers increasingly adopt mechanized solutions to enhance productivity and efficiency. Fertilizer spreaders are used for the uniform distribution of nutrients across fields, ensuring optimal soil fertility and crop yield. Leading suppliers like AGCO, Claas, CNH Industrial, IRIS Spreaders, John Deere, Kubota, Kuhn Group, Kverneland, Mahindra & Mahindra, and Maschio Gaspardo have been at the forefront of delivering technologically advanced equipment that meets the modern agricultural demands. Their products range from traditional tow-behind models to high-capacity, tractor-mounted, and GPS-enabled spreaders, catering to diverse farm sizes and crop requirements.

Technological innovation remains a key driver for these market leaders. Companies are increasingly integrating precision farming solutions into their fertilizer spreaders, such as variable-rate application systems, automated calibration, and smart sensors. These features allow farmers to optimize nutrient application, reduce wastage, and maintain soil health. Collaborations and strategic partnerships are being leveraged by these suppliers to enhance R&D capabilities and accelerate the rollout of innovative products.

| Item | Value |

|---|---|

| Quantitative Units | USD 843.3 Million |

| Spreader | Rotary spreaders, Dry spreaders, Drop spreaders, Pendulum spreaders, and Liquid spreaders |

| Fertilizer | Granular fertilizers, Liquid fertilizers, Organic fertilizers, and Chemical fertilizers |

| Technology | Manual, Hydraulic, GPS-enabled, and Variable Rate Technology (VRT) |

| Power Source | Tractor-mounted, Self-propelled, Hand-pushed, and ATV/UTV mounted |

| Application | Row crops, Orchards, and Commercial lawns & gardens |

| Distribution Channel | Direct sales, Retail, and Online platforms |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AGCO, Claas, CNH Industrial, IRIS Spreaders, John Deere, Kubota, Kuhn Group, Kverneland, Mahindra & Mahindra, and Maschio Gaspardo |

| Additional Attributes | Dollar sales vary by spreader type, including broadcast, drop, and pneumatic spreaders; by application, such as crop fields, orchards, and pasture lands; by end-use, spanning commercial farms, small-scale farmers, and agricultural service providers; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising mechanization in agriculture, demand for efficient fertilizer application, and increasing crop yields. |

The global agriculture fertilizer spreader market is estimated to be valued at USD 843.3 million in 2025.

The market size for the agriculture fertilizer spreader market is projected to reach USD 1,347.7 million by 2035.

The agriculture fertilizer spreader market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in agriculture fertilizer spreader market are rotary spreaders, dry spreaders, drop spreaders, pendulum spreaders and liquid spreaders.

In terms of fertilizer, granular fertilizers segment to command 42.7% share in the agriculture fertilizer spreader market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Agriculture Gateway Market Size and Share Forecast Outlook 2025 to 2035

Agriculture Solar Water Pumps Market Size and Share Forecast Outlook 2025 to 2035

Agriculture Packaging Market Size and Share Forecast Outlook 2025 to 2035

Agriculture Analytics Market Size and Share Forecast Outlook 2025 to 2035

Agriculture IoT Market Size and Share Forecast Outlook 2025 to 2035

Agriculture Enzyme Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Market Share Breakdown of Agriculture Packaging Solutions

Agriculture Bags Market

Agriculture Testing Services Market Growth – Trends & Forecast 2018-2028

Non-Agriculture Smart Irrigation Controllers Market Size and Share Forecast Outlook 2025 to 2035

Smart Agriculture Market Size and Share Forecast Outlook 2025 to 2035

Ai In Agriculture Market Size and Share Forecast Outlook 2025 to 2035

Smart Agriculture Solution Market Analysis by Component Type, Application, and Region Through 2035

Precision Agriculture Market

Regenerative Agriculture Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Agriculture and Food Supply Chain Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Agriculture Market Analysis – Size, Share & Forecast 2024-2034

Controlled Environment Agriculture (CEA) Market Size and Share Forecast Outlook 2025 to 2035

Fertilizer Packaging Market Forecast and Outlook 2025 to 2035

Fertilizer Tester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA