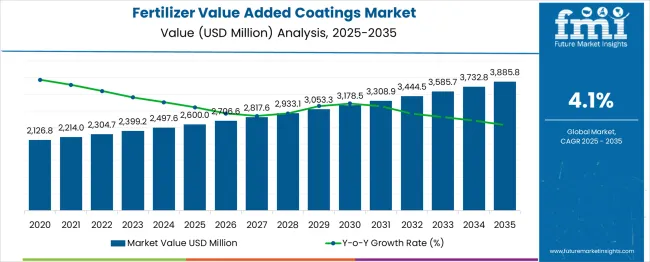

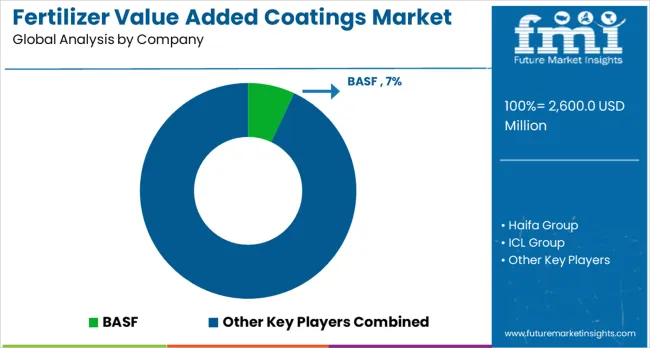

The global fertilizer value added coatings market is projected to grow from USD 2,600.0 million in 2025 to approximately USD 3,885.8 million by 2035, recording an absolute increase of USD 1,285.9 million over the forecast period. This translates into a total growth of 49.5%, with the market forecast to expand at a compound annual growth rate (CAGR) of 4.1% between 2025 and 2035. The overall market size is expected to grow by nearly 1.49X during the same period, supported by the rising demand for enhanced-efficiency fertilizers and increasing focus on sustainable agricultural practices that optimize nutrient utilization.

Between 2025 and 2030, the fertilizer value added coatings market is projected to expand from USD 2,600.0 million to USD 3,178.6 million, resulting in a value increase of USD 578.6 million, which represents 45.0% of the total forecast growth for the decade. This phase of growth will be shaped by increasing adoption of precision agriculture practices, growing awareness about fertilizer efficiency and environmental sustainability, and expanding application in high-value crop segments. Agricultural producers are increasingly investing in coated fertilizer technologies to address nutrient loss challenges and improve crop yields while reducing environmental impact.

From 2030 to 2035, the market is forecast to grow from USD 3,178.6 million to USD 3,885.8 million, adding another USD 707.3 million, which constitutes 55.0% of the overall ten-year expansion. This period is expected to be characterized by technological advancement in coating materials, development of specialized formulations for different crop requirements, and expansion of biological and micronutrient-enhanced coating systems. The growing emphasis on sustainable agriculture and regulatory pressure for reduced nutrient runoff will drive demand for more sophisticated coating technologies and specialized application methods.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2,600.0 million |

| Forecast Value in (2035F) | USD 3,885.8 million |

| Forecast CAGR (2025 to 2035) | 4.1% |

Between 2020 and 2025, the fertilizer value added coatings market experienced steady expansion from USD 2,204.0 million to USD 2,600.0 million, driven by increasing adoption of enhanced-efficiency fertilizers, growing awareness of nutrient management benefits, and expansion of coated fertilizer manufacturing capabilities. The market developed as agricultural producers recognized the value of controlled-release and slow-release fertilizer technologies in optimizing nutrient availability and reducing application frequency.

Market expansion is being supported by the increasing global focus on sustainable agriculture practices and the need for improved nutrient use efficiency in crop production systems. Modern agricultural operations face pressure to maximize crop yields while minimizing environmental impact, driving demand for fertilizer technologies that provide controlled nutrient release and reduce losses through leaching, volatilization, and runoff. Value-added coatings enable precise nutrient timing and availability that align with crop uptake patterns.

The growing complexity of agricultural production systems and increasing regulatory requirements for environmental protection are driving demand for advanced fertilizer coating technologies from certified manufacturers with proven efficacy and environmental safety profiles. Agricultural producers are increasingly requiring comprehensive performance documentation and sustainability credentials to meet market access requirements and environmental compliance standards. Regulatory frameworks and industry standards are establishing specifications for coated fertilizer performance that require specialized manufacturing capabilities and quality control systems.

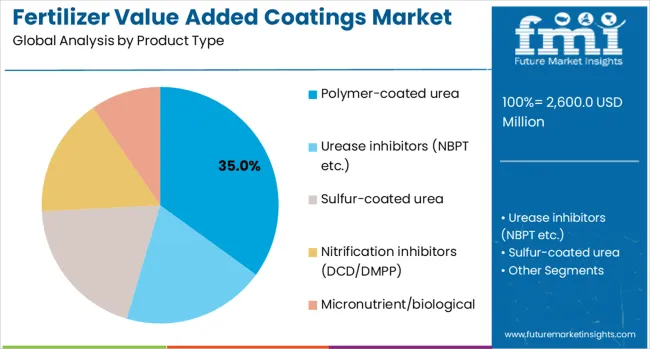

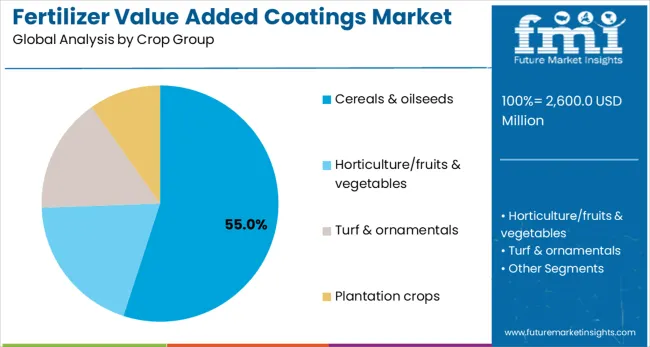

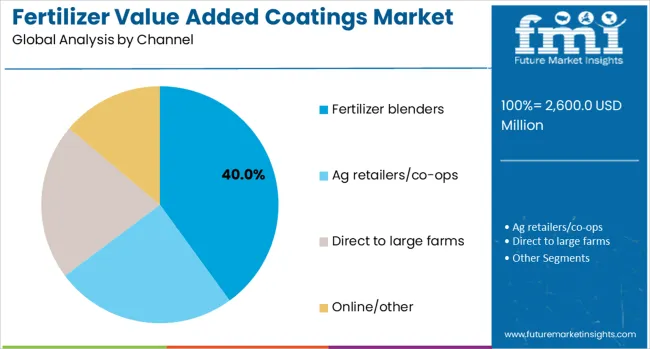

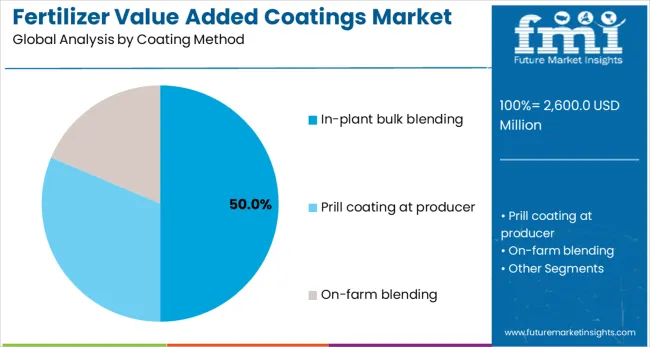

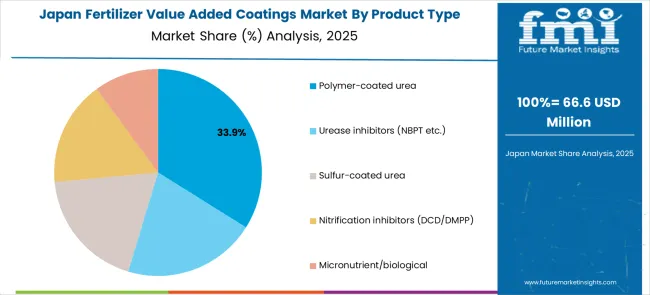

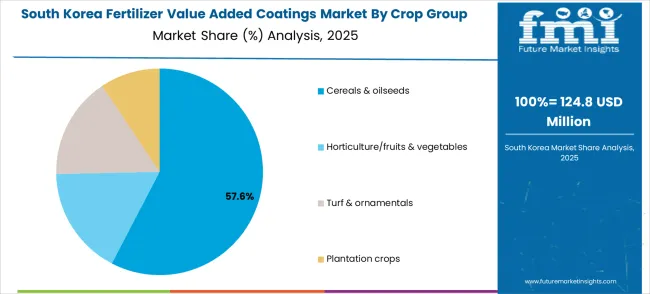

The market is segmented by product type, crop group, channel, coating method, and region. By product type, the market is divided into polymer-coated urea, urease inhibitors (NBPT etc.), sulfur-coated urea, nitrification inhibitors (DCD/DMPP), and micronutrient/biological. Based on crop group, the market is categorized into cereals & oilseeds, horticulture/fruits & vegetables, turf & ornamentals, and plantation crops. In terms of channel, the market is segmented into fertilizer blenders, ag retailers/co-ops, direct to large farms, and online/other. By coating method, the market is classified into in-plant bulk blending, prill coating at producer, and on-farm blending.

The polymer-coated urea segment is projected to account for 35% of the fertilizer value added coatings market in 2025, reflecting its leadership as the most widely adopted coated fertilizer type. Polymer coatings enable controlled and predictable nitrogen release, extending nutrient availability to align with crop growth cycles. This reduces nutrient loss from leaching and volatilization while improving overall fertilizer efficiency. Polymer-coated urea is particularly valued for its weather resistance, consistency across different soil conditions, and compatibility with both broad-acre and specialty crop applications.

The segment benefits from mature manufacturing processes, established field performance, and broad acceptance among growers worldwide. With nitrogen efficiency increasingly emphasized due to environmental regulations and sustainability goals, polymer-coated urea remains the benchmark for controlled-release fertilizers. Its ability to reduce application frequency while enhancing yields ensures its continued dominance across diverse agricultural production systems.

Cereals and oilseeds are expected to represent 55% of fertilizer value added coatings demand in 2025, underscoring their central role in global agricultural production. Crops such as corn, wheat, rice, and soybeans dominate planting areas worldwide and have some of the highest nutrient requirements of all cropping systems. Controlled-release fertilizers like coated urea align nutrient release with key growth phases, ensuring optimal plant uptake and reducing environmental losses.

Farmers increasingly integrate coated fertilizers into standard agronomic practices, supported by precision agriculture technologies that allow site-specific nutrient application. This segment also benefits from rising global demand for grains and oilseeds driven by food, feed, and biofuel markets. As agricultural producers balance yield optimization with sustainability and regulatory compliance, the adoption of coated fertilizers in cereal and oilseed systems continues to expand, making this the largest and most influential crop group in the market.

The fertilizer blenders segment is projected to contribute 40% of the fertilizer value added coatings market in 2025, highlighting its importance in delivering customized solutions for regional farming needs. Fertilizer blenders incorporate coating technologies into custom blends tailored to specific soil conditions, crop types, and local agronomic requirements. These facilities leverage specialized equipment to ensure consistent coating application and maintain strong relationships with coating suppliers and agricultural retailers.

Their flexibility allows integration of multiple coating types, from polymers to sulfur or micronutrient layers, enabling farmers to adopt comprehensive nutrient strategies. This customization capability is increasingly important as precision agriculture practices expand, requiring site-specific fertilizer blends for maximum efficiency. Fertilizer blenders play a critical role in bridging large-scale coating technology with on-the-ground agricultural practices, ensuring accessibility and adaptability for diverse farming operations across global markets.

The in-plant bulk blending method is estimated to account for 50% of the fertilizer value added coatings market in 2025, reflecting its efficiency and cost-effectiveness. By incorporating coating materials during the fertilizer production process, bulk blending operations deliver uniform, high-quality coated products at scale. This approach benefits from economies of scale, reducing per-unit costs while ensuring consistent performance across large agricultural markets.

Bulk blending supports the growing demand for controlled-release fertilizers in high-volume crops such as cereals, oilseeds, and corn, where standardization and reliability are critical. In addition, in-plant blending provides superior coating coverage compared to smaller-scale methods, enhancing product durability and nutrient release control. As demand for sustainable and efficient nutrient management increases globally, in-plant bulk blending remains the dominant method, supporting both large-scale production and the scalability of advanced coating technologies.

The fertilizer value added coatings market is advancing steadily due to increasing focus on sustainable agriculture and growing recognition of nutrient efficiency benefits. However, the market faces challenges including higher product costs compared to conventional fertilizers, need for specialized application equipment and training, and varying performance under different soil and climate conditions. Technology development and performance validation continue to influence product adoption and market expansion patterns.

The growing development of coating systems that incorporate biological additives and micronutrients is enabling comprehensive plant nutrition solutions that address multiple crop requirements simultaneously. Advanced coatings containing beneficial microorganisms, enzyme inhibitors, and essential micronutrients provide integrated plant nutrition and soil health benefits. These systems are particularly valuable for high-value crops and intensive production systems that require precise nutrient management and enhanced plant performance.

Modern coated fertilizer manufacturers are incorporating smart coating technologies that respond to soil conditions, temperature, and moisture levels to optimize nutrient release timing. Integration of sensor technologies and data analytics enables real-time monitoring of nutrient availability and plant uptake patterns. Advanced coating systems support precision agriculture applications by providing predictable nutrient release that aligns with variable rate application technologies and site-specific crop management strategies.

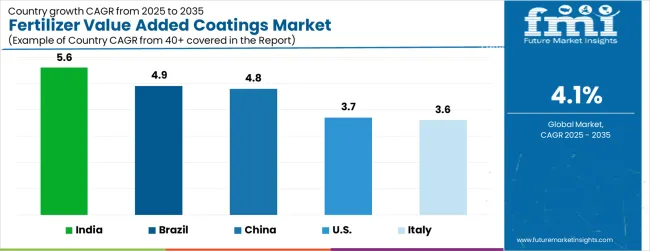

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.6% |

| Brazil | 4.9% |

| China | 4.8% |

| United States | 3.7% |

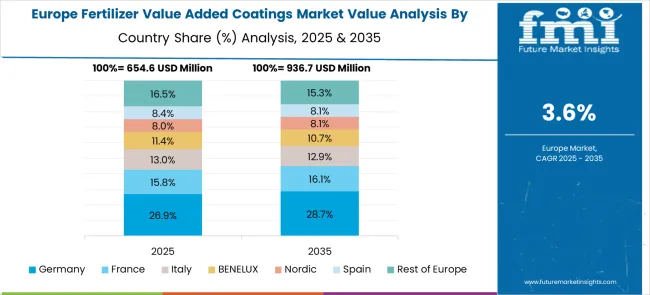

| Italy | 3.6% |

The fertilizer value added coatings market is growing rapidly, with India leading at a 5.6% CAGR through 2035, driven by increasing adoption of precision agriculture, government support for fertilizer efficiency programs, and expanding high-value crop production. Brazil follows at 4.9%, supported by large-scale agricultural operations, growing emphasis on sustainable farming practices, and increasing coated fertilizer manufacturing capacity. China grows steadily at 4.8%, integrating coating technologies into its extensive fertilizer production infrastructure. The USA records 3.7%, emphasizing precision agriculture adoption and environmental compliance requirements. Italy shows 3.6% growth, focusing on specialty crop applications and sustainable agriculture practices. Overall, India and Brazil emerge as the leading drivers of global fertilizer value added coatings market expansion.

The report covers an in-depth analysis of 40+ countries; five top-performing countries are highlighted below.

Revenue from fertilizer value added coatings in India is projected to exhibit the highest growth rate with a CAGR of 5.6% through 2035, driven by government initiatives promoting fertilizer efficiency and sustainable agriculture practices. The country's expanding agricultural sector and increasing adoption of enhanced-efficiency fertilizers are creating significant demand for coated fertilizer technologies. Major fertilizer manufacturers and agricultural input companies are establishing comprehensive coating capabilities to serve the growing market for precision agriculture solutions across diverse crop systems.

Revenue from fertilizer value added coatings in Brazil is expanding at a CAGR of 4.9%, supported by extensive grain and oilseed production systems and increasing adoption of precision agriculture technologies. The country's advanced agricultural sector and established fertilizer industry provide strong foundation for coated fertilizer adoption. Major agricultural producers and fertilizer companies are investing in coating technologies to optimize nutrient management in large-scale crop production systems.

Revenue from fertilizer value added coatings in China is growing at a CAGR of 4.8%, driven by integration of coating technologies into the country's extensive fertilizer manufacturing infrastructure and increasing focus on agricultural sustainability. China's large-scale fertilizer production capacity and growing emphasis on precision agriculture provide strong market foundation. Fertilizer manufacturers are incorporating coating capabilities to serve both domestic and export markets for enhanced-efficiency fertilizers.

Demand for fertilizer value added coatings in the United States is projected to grow at a CAGR of 3.7%, supported by advanced precision agriculture adoption and increasing environmental regulations affecting fertilizer use. American agricultural producers are implementing coated fertilizer technologies that optimize nutrient timing and reduce environmental impact. The market is characterized by focus on performance validation, environmental compliance, and integration with precision agriculture systems.

Demand for fertilizer value added coatings in Italy is expanding at a CAGR of 3.6%, driven by specialty crop production and increasing emphasis on sustainable agriculture practices. Italian agricultural producers are adopting coated fertilizer technologies for high-value crops including fruits, vegetables, and specialty grains that require precise nutrient management. The market benefits from advanced agricultural expertise and established relationships between fertilizer manufacturers and specialty crop producers.

In Japan, the fertilizer value added coatings market is led by polymer-coated urea, which holds a 33.9% share in 2025, reflecting strong adoption in rice production and specialty crop applications requiring extended nutrient release. Urease inhibitors account for 28–29%, supported by emphasis on nitrogen efficiency and reduced volatilization losses in intensive agricultural systems. Sulfur-coated urea contributes around 20%, while nitrification inhibitors hold 12–13%, driven by regulatory pressure to reduce nitrous oxide emissions and nitrogen leaching. Micronutrient and biological coatings represent the remaining 7–8%, reflecting emerging adoption in high-value crop systems and integrated plant nutrition strategies.

In South Korea, the market is expected to remain dominated by cereals & oilseeds applications, which holds nearly 57.6% share in 2025. These crop systems benefit from controlled-release technologies that optimize nutrient availability during critical growth periods. Horticulture/fruits & vegetables applications account for 30% market share, supported by intensive production systems that require precise nutrient management. Turf & ornamentals contribute 15%, driven by professional landscaping and sports turf applications that demand consistent nutrient release and appearance quality.

The European fertilizer value added coatings market demonstrates sophisticated development across major economies with Germany leading through its advanced chemical manufacturing capabilities and precision agriculture initiatives, supported by companies like BASF pioneering innovative coating technologies for enhanced nutrient efficiency and environmental protection. The Netherlands shows significant strength through international players like Yara International, leveraging expertise in sustainable agriculture and nutrient management solutions. France and Spain exhibit expanding adoption in precision agriculture applications, driven by EU environmental regulations and sustainable farming practices.

Nordic countries emphasize environmentally-friendly coating solutions and climate-smart agriculture, while Eastern European markets show growing interest in modern fertilizer technologies and agricultural modernization. The market benefits from strict environmental regulations, sustainability mandates, and the region's leadership in precision agriculture, positioning Europe as a key innovation center for next-generation fertilizer coating solutions across diverse agricultural applications requiring enhanced nutrient efficiency, environmental protection, and sustainable farming practices supporting food security and climate objectives.

The fertilizer value added coatings market is defined by competition among specialized coating material manufacturers, integrated fertilizer producers, and agricultural technology companies. Companies are investing in advanced coating technologies, manufacturing capabilities, product development, and technical service to deliver effective, reliable, and cost-competitive coating solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening product portfolios and market presence.

BASF, Germany-based with 7% market share, offers comprehensive coating technologies with focus on polymer systems, biological additives, and environmental sustainability. Haifa Group, Israel, provides specialized coating solutions integrated with fertilizer production and precision agriculture applications. ICL Group, Israel, delivers technologically advanced coating systems with emphasis on controlled-release and enhanced-efficiency fertilizers. Jiangsu Lianye Chemical, China, emphasizes cost-effective coating solutions for large-scale agricultural applications.

Kingenta Ecological, China, offers integrated fertilizer and coating technologies with focus on sustainable agriculture. Koch Agronomic Services, USA, provides comprehensive coating solutions with emphasis on precision agriculture and environmental stewardship. Nutrien, Canada, delivers coating technologies integrated with fertilizer distribution and agricultural services. SQM, Chile, offers specialty coating materials for high-value crop applications. The Andersons (EEF), USA, and Yara International, Norway, provide specialized coating expertise and comprehensive product portfolios across global and regional markets.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 2,600.0 million |

| Product Type | Polymer-coated urea, Urease inhibitors, Sulfur-coated urea, Nitrification inhibitors, Micronutrient/biological |

| Crop Group | Cereals & oilseeds, Horticulture, Turf & ornamentals, Plantation crops |

| Channel | Fertilizer blenders, Ag retailers, Direct to farms, Online/other |

| Coating Method | In-plant blending, Prill coating, On-farm blending |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, China, Japan, South Korea, Brazil, India, Italy and 40+ countries |

| Key Companies Profiled | BASF, Haifa Group, ICL Group, Jiangsu Lianye Chemical, Kingenta Ecological, Koch Agronomic Services, Nutrien, SQM, The Andersons (EEF), and Yara International |

| Additional Attributes | Dollar sales by coating material and nutrient release profile, regional demand trends, competitive landscape, buyer preferences for biodegradable versus polymer coatings, integration with precision agriculture practices, innovations in nanocoatings, smart-release mechanisms, and sustainable formulation technologies |

The global fertilizer value added coatings market is estimated to be valued at USD 2,600.0 million in 2025.

The market size for the fertilizer value added coatings market is projected to reach USD 3,885.8 million by 2035.

The fertilizer value added coatings market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in fertilizer value added coatings market are polymer-coated urea, urease inhibitors (nbpt etc.), sulfur-coated urea, nitrification inhibitors (dcd/dmpp) and micronutrient/biological.

In terms of crop group, cereals & oilseeds segment to command 55.0% share in the fertilizer value added coatings market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fertilizer Packaging Market Forecast and Outlook 2025 to 2035

Fertilizer Tester Market Size and Share Forecast Outlook 2025 to 2035

Fertilizer Applicators Market Size and Share Forecast Outlook 2025 to 2035

Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Fertilizer Bags Market Growth - Demand & Forecast 2025 to 2035

Fertilizer Additive Market Report – Growth, Demand & Forecast 2025 to 2035

Fertilizer Injection Pumps Market

Biofertilizers Market Size and Share Forecast Outlook 2025 to 2035

NPK Fertilizers Market Analysis - Size, Share, and Forecast 2025 to 2035

Wet Fertilizer Spreaders Market

Nano Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Green Fertilizer Market Growth – Trends & Forecast 2024-2034

Market Share Distribution Among Liquid Fertilizer Providers

Organic Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Starter Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Silicon Fertilizer Market Analysis - Size, Growth, and Forecast 2025 to 2035

Organic Fertilizer Industry Analysis in North America Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Biochar Fertilizer Market Outlook – Growth, Demand & Forecast 2025 to 2035

Nitrogen Fertilizer Additives Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA