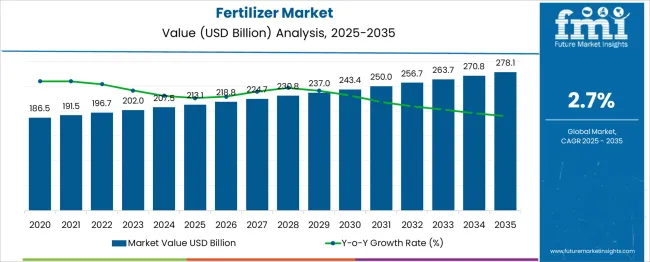

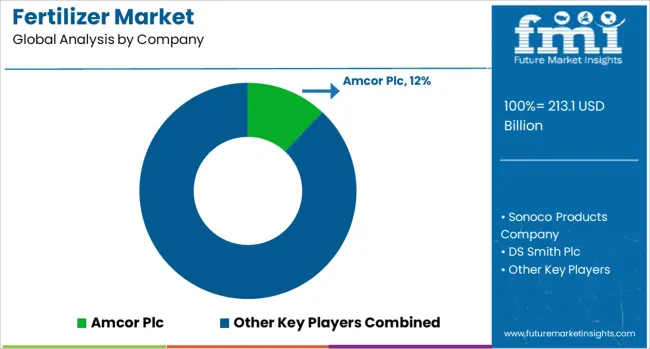

The Fertilizer Market is estimated to be valued at USD 213.1 billion in 2025 and is projected to reach USD 278.1 billion by 2035, registering a compound annual growth rate (CAGR) of 2.7% over the forecast period. Analyzing market share erosion or gain requires understanding the growth trajectory in relation to competing sectors or the overall industry expansion. The year-on-year increments indicate steady growth, averaging around USD 5.7 billion annually in the initial years, gradually increasing to nearly USD 7.3 billion by the end of the forecast period.

This consistent but modest expansion suggests the market is maintaining or slightly improving its position without rapid acceleration or decline. The steady growth points to sustained demand in traditional fertilizer segments, possibly driven by ongoing agricultural activities and incremental productivity improvements. However, the relatively low CAGR compared to more dynamic markets hints at potential competitive pressures or market saturation.

This can lead to limited share gains unless innovation or new applications emerge. From 2025 to 2035, the incremental USD 65 billion market growth represents an opportunity to consolidate or slightly expand market share. Still, given the slow pace, significant erosion is unlikely if current trends continue. Strategic focus on efficiency and differentiation will be essential for participants seeking to enhance market position amid stable but slow overall expansion.

| Metric | Value |

|---|---|

| Fertilizer Market Estimated Value in (2025 E) | USD 213.1 billion |

| Fertilizer Market Forecast Value in (2035 F) | USD 278.1 billion |

| Forecast CAGR (2025 to 2035) | 2.7% |

The fertilizer market is experiencing consistent growth driven by increasing global demand for food production and sustainable agricultural practices. Rising population pressures and the need to enhance crop yields have intensified fertilizer consumption, particularly in developing regions. Industry trends indicate a shift towards efficient nutrient management and balanced fertilizer use, which supports soil health and reduces environmental impact.

Innovations in formulation and application techniques are facilitating higher nutrient uptake and minimizing losses. Future growth is expected to be supported by government initiatives promoting agricultural productivity, adoption of precision farming technologies, and increasing awareness of sustainable farming among producers.

The market is also influenced by fluctuations in raw material prices and supply chain dynamics, which are shaping investment and production strategies. These factors collectively pave the way for the fertilizer market's sustained expansion and evolving segmentation.

The fertilizer market is segmented by form, product, application, and geographic regions. By form, the fertilizer market is divided into Dry and Liquid. In terms of the product, the fertilizer market is classified into Inorganic and organic Phosphorus. Based on the application, the fertilizer market is segmented into Agriculture, Horticulture, Gardening, and Others. Regionally, the fertilizer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

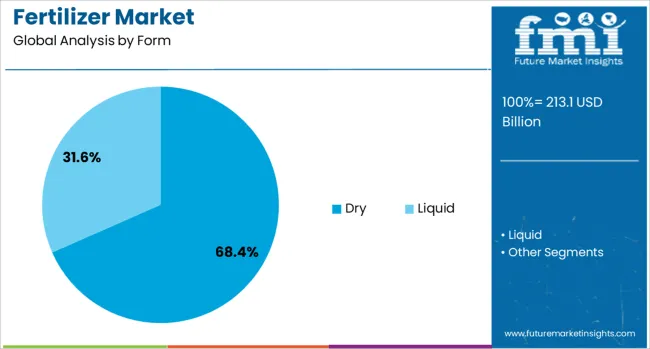

When segmented by form, the dry segment holds 68.40% of the total market revenue in 2025, establishing it as the leading form. This dominance can be attributed to the ease of storage, handling, and transport associated with dry fertilizers, which makes them highly suitable for large scale agricultural operations.

The extended shelf life and compatibility with mechanized application equipment further enhance their attractiveness to farmers. Additionally, dry fertilizers typically offer cost advantages and greater nutrient concentration, improving application efficiency.

Operational flexibility and the ability to tailor nutrient blends for specific crop requirements have also contributed to the preference for dry forms. These combined benefits have reinforced the dry segment’s leadership position in the fertilizer market.

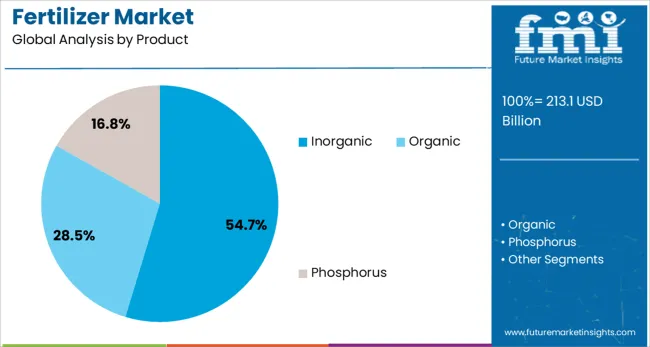

The inorganic segment is expected to account for 54.70% of the fertilizer market revenue in 2025, maintaining its position as the top product category. This segment’s growth is supported by its proven effectiveness in delivering essential nutrients rapidly to crops and its widespread availability.

Inorganic fertilizers have traditionally formed the backbone of global agricultural input due to their high nutrient content and relatively low cost. Their compatibility with precision farming practices and capacity to support large-scale monoculture farming systems have further driven demand.

Moreover, established supply chains and production infrastructure for inorganic fertilizers have enabled a consistent supply even in challenging market conditions. These factors collectively sustain the inorganic segment’s market leadership.

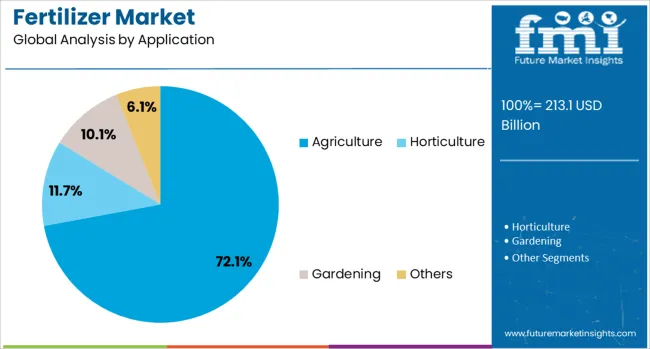

By application, agriculture dominates the fertilizer market, with a 72.10% revenue share in 2025, reflecting its critical role in enhancing crop productivity and ensuring food security. The high share is driven by the extensive use of fertilizers to enhance yields of staple crops such as cereals, pulses, fruits, and vegetables.

Agricultural stakeholders are increasingly adopting fertilizer products as part of an integrated nutrient management strategy to maximize crop output and improve soil health. Government policies promoting food self-sufficiency and subsidies for fertilizer use have also played a significant role in expanding the agricultural segment.

Furthermore, rising awareness among farmers about the benefits of balanced fertilization and precision application techniques has increased fertilizer adoption. These dynamics underpin agriculture’s dominant market share.

The market has been expanding as agricultural productivity continues to receive significant attention worldwide. Essential nutrients like nitrogen, phosphorus, and potassium have been supplied through various fertilizer formulations to enhance soil fertility and crop yields. Increasing demand for food due to population growth has necessitated the adoption of effective fertilization practices to maximize output on limited arable land. Technological advances in nutrient delivery systems and formulation methods have improved fertilizer efficiency and environmental safety. Governments and agricultural bodies have implemented measures promoting balanced fertilizer use to prevent nutrient depletion and environmental harm.

The rise in specialty fertilizer usage has been driven by the need for precise nutrient management in modern farming. Controlled-release and water-soluble fertilizers have been gaining popularity for their ability to deliver nutrients steadily and reduce losses caused by leaching or volatilization. These fertilizers are widely used in horticulture, high-value crops, and precision agriculture where nutrient efficiency is critical. Advances in coating technologies and nutrient formulations have enhanced product performance, allowing for customized solutions tailored to specific soil and crop requirements. Growing awareness among farmers about the benefits of specialty fertilizers has contributed to their increased adoption. Additionally, specialty fertilizers have been playing a key role in integrated nutrient management programs, supporting both productivity and environmental conservation. This segment is expected to continue driving growth within the broader fertilizer market.

Government initiatives and subsidy programs have been pivotal in shaping fertilizer demand and availability. Subsidies have made fertilizers more affordable for small-scale farmers, increasing access to essential nutrients. Policy frameworks promoting balanced fertilizer use have sought to prevent over-application and environmental degradation, encouraging more efficient practices. Import regulations, stockpiling, and price controls have been implemented in several countries to stabilize market supply and pricing. Incentives for the production and use of biofertilizers and environmentally friendly formulations have gained momentum as sustainability concerns rise. These government interventions have affected market dynamics by influencing production volumes, pricing structures, and consumption patterns. Continued policy support is anticipated to be a critical factor in ensuring fertilizer availability, affordability, and sustainable use in the future.

Price fluctuations in key raw materials such as natural gas, phosphate rock, and potash have significantly impacted fertilizer production costs and market pricing. Natural gas, a primary input for nitrogen fertilizer synthesis, has experienced volatility due to geopolitical tensions and supply constraints, leading to cost pressures on manufacturers. Disruptions in phosphate and potash supply chains have also contributed to price instability. These raw material dynamics have influenced profit margins, inventory management, and investment decisions within the fertilizer industry. To mitigate risks, producers have been exploring alternative sourcing strategies, increasing operational efficiency, and investing in regional manufacturing capacities. Raw material price trends have been closely monitored by market participants and farmers alike, as they directly affect fertilizer affordability and usage patterns. Such cost factors continue to play a significant role in shaping the competitive landscape of the fertilizer market.

Emerging economies across Asia, Africa, and Latin America have been driving increased fertilizer consumption due to agricultural expansion and food security efforts. Rising rural incomes and improved access to agricultural inputs have enabled farmers to invest more in fertilizers. These regions have witnessed growing cultivation of staple crops and cash crops, elevating nutrient requirements. Infrastructure developments in storage, distribution, and logistics have enhanced fertilizer availability in remote areas. Agricultural extension services and farmer education programs have promoted best practices, encouraging balanced fertilizer use. Furthermore, export-oriented agriculture has increased the need for consistent and high-quality fertilizer supplies. The expanding demand from emerging markets is expected to remain a key growth driver, attracting investments and innovations tailored to local soil and climatic conditions. This trend underlines the importance of these markets in the global fertilizer industry’s future outlook.

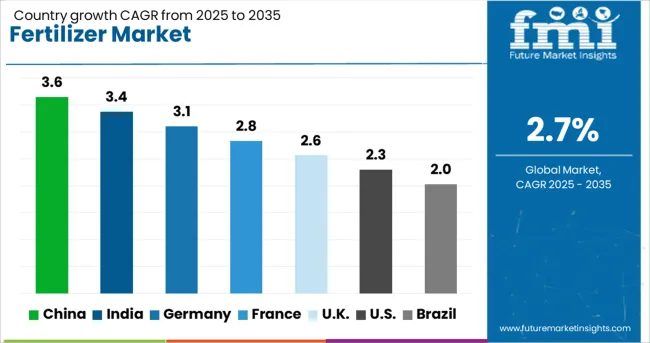

| Country | CAGR |

|---|---|

| China | 3.6% |

| India | 3.4% |

| Germany | 3.1% |

| France | 2.8% |

| UK | 2.6% |

| USA | 2.3% |

| Brazil | 2.0% |

The market is expected to grow at a CAGR of 2.7% between 2025 and 2035, driven by agricultural modernization, increased crop yield demands, and adoption of advanced nutrient formulations. China leads with a 3.6% CAGR, supported by government initiatives promoting sustainable farming and large-scale fertilizer production. India follows at 3.4%, benefiting from its vast agricultural base and focus on improving soil health. Germany, at 3.1%, advances through innovation in specialty fertilizers and precision agriculture. The UK, growing at 2.6%, sees steady demand driven by sustainable farming practices. The USA, at 2.3%, maintains growth due to technological adoption and efficient nutrient management. This report includes insights on 40+ countries; the top markets are shown here for reference.

China’s industry is projected to expand at a CAGR of 3.6% from 2025 to 2035, supported by the modernization of agricultural practices aimed at boosting crop productivity and ensuring food security. Integration of advanced nutrient management systems, including precision agriculture technologies, has increased fertilizer use efficiency while minimizing environmental impacts. Large domestic manufacturers are intensifying efforts in developing innovative, environmentally safe fertilizer formulations to meet evolving agricultural needs. Government programs advocating balanced fertilization and soil quality enhancement are also fueling steady demand, particularly in staple crop production regions. The expansion of rural distribution infrastructure ensures widespread fertilizer accessibility, maintaining China’s position as one of the world’s leading fertilizer consumers. This dynamic market continues to evolve with rising investments in research and development and sustainability-focused product innovations.

India is anticipated to grow at a CAGR of 3.4% between 2025 and 2035 due to intensification of agricultural activities and the increasing cultivation of commercial crops requiring targeted nutrient inputs. Efforts to optimize fertilizer use include promotion of custom fertilizer blends designed for diverse soil profiles across regions. The government’s subsidy schemes and rural outreach programs have improved fertilizer availability, especially in remote agricultural zones. Rising farmer awareness on balanced fertilization and integrated nutrient management has enhanced market penetration. Private sector players alongside public enterprises have expanded supply chain networks to fulfill growing demand. This market is expected to witness progressive innovation in slow-release and micronutrient-enriched fertilizers tailored for higher yields.

The German market is forecast to grow at a CAGR of 3.1% from 2025 to 2035, underpinned by a growing preference for organic and mineral fertilizer products that comply with strict environmental standards. Precision farming adoption is rising rapidly, integrating digital soil mapping and nutrient monitoring to optimize fertilizer use and reduce ecological footprints. Regulatory pressures encourage farmers to minimize chemical fertilizer applications, leading to an increased demand for bio-based and slow-release nutrient formulations. German producers emphasize research to develop high-performance fertilizers compatible with sustainable agriculture practices. The industry is further supported by government grants promoting soil health and nutrient recycling initiatives. These factors combine to maintain steady market growth despite regulatory constraints.

The fertilizer market in the United Kingdom is expected to grow at a CAGR of 2.6% from 2025 to 2035, driven by initiatives to improve soil nutrient management and reduce chemical dependency in farming systems. Government policies promote integrated nutrient management strategies, which include crop rotation and soil testing programs to optimize fertilizer application. Imports of advanced fertilizer blends complement domestic production to meet requirements of horticulture, arable, and livestock feed crops. The growing interest in slow-release and controlled-release fertilizers contributes to reduced nutrient losses and improved crop nutrient uptake. Market players are innovating to develop formulations tailored to local soil types and climatic conditions. The expansion of precision agriculture technologies is also supporting improved fertilizer efficiency.

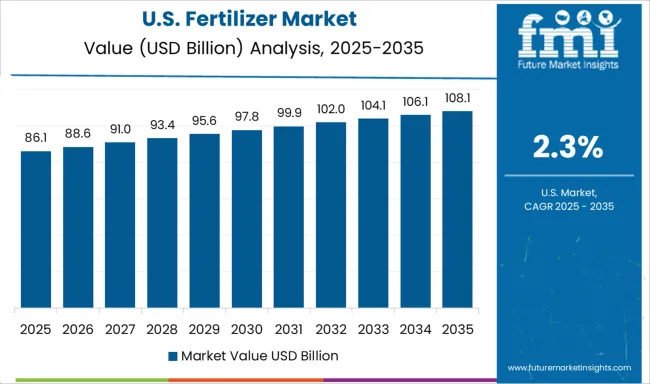

The fertilizer industry in the United States is projected to grow at a CAGR of 2.3% during 2025 to 2035, influenced by rising demand for nutrient efficiency and environmental stewardship in large-scale commercial agriculture. Advancements in precision nutrient management technologies enable farmers to optimize fertilizer application rates, reducing waste and runoff. Enhanced efficiency fertilizers and coated nutrient formulations are gaining traction to meet regulatory requirements and improve environmental compliance. Corn, soybean, and wheat production remain the primary drivers of fertilizer consumption. Increasing adoption of digital agriculture solutions and data analytics enhances fertilizer planning and usage accuracy. Regulatory frameworks continue to evolve, promoting sustainable fertilizer use practices.

The global fertilizer market presents opportunities for players to secure growth through a combination of strategic acquisitions, partnerships, product differentiation, and digital integration. Nutrien Ltd. expanded its presence in high-growth regions by acquiring regional distributors, ensuring stable feedstock supply and extensive distribution networks, while Yara International integrated conventional fertilizers with precision agriculture solutions to enhance nutrient efficiency and reduce environmental impact. CF Industries achieved rapid market entry in India and Southeast Asia through joint ventures with established local producers, avoiding the need for large-scale greenfield investments. Mosaic Co. strengthened its raw material security by acquiring phosphate and potash mines in North America, stabilizing production costs and ensuring a consistent supply.

Specialty and value-added products offer differentiation, with the ICL Group developing controlled-release, micronutrient-enriched, and biofertilizer formulations that enhance crop yields and attract premium pricing. Compliance with regional regulations, subsidy structures, and environmental standards guides operational decisions, while integration of digital agronomy platforms, such as Yara’s N-Tester and Atfarm, enables data-driven farmer engagement and accelerates adoption of high-efficiency fertilizers. Executives achieve competitive advantage by combining scale, local market access, high-performance product portfolios, and technology-enabled services, creating a robust foundation for sustainable revenue growth and long-term leadership in both commodity and specialty fertilizer segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 213.1 Billion |

| Form | Dry and Liquid |

| Product | Inorganic, Organic, and Phosphorus |

| Application | Agriculture, Horticulture, Gardening, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amcor Plc, Sonoco Products Company, DS Smith Plc, WestRock Company, Anchor Packaging, Inc., Placon Corp, Display Pack Inc., Pactiv LLC, Dart Container Corp., Constantia, RPC Group Plc, D&W Fine Pack, and Lacerta Group Inc. |

| Additional Attributes | Dollar sales by fertilizer type and crop application, demand dynamics across agriculture, horticulture, and turf management, regional trends in nutrient management adoption, innovation in bio-based and controlled-release formulations, environmental impact of nutrient runoff and carbon footprint, and emerging use cases in precision farming, vertical agriculture, and regenerative soil health programs. |

The global fertilizer market is estimated to be valued at USD 213.1 billion in 2025.

The market size for the fertilizer market is projected to reach USD 278.1 billion by 2035.

The fertilizer market is expected to grow at a 2.7% CAGR between 2025 and 2035.

The key product types in fertilizer market are dry and liquid.

In terms of product, inorganic segment to command 54.7% share in the fertilizer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fertilizer Packaging Market Forecast and Outlook 2025 to 2035

Fertilizer Tester Market Size and Share Forecast Outlook 2025 to 2035

Fertilizer Value Added Coatings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fertilizer Applicators Market Size and Share Forecast Outlook 2025 to 2035

Fertilizer Bags Market Growth - Demand & Forecast 2025 to 2035

Fertilizer Additive Market Report – Growth, Demand & Forecast 2025 to 2035

Fertilizer Injection Pumps Market

Biofertilizers Market Size and Share Forecast Outlook 2025 to 2035

NPK Fertilizers Market Analysis - Size, Share, and Forecast 2025 to 2035

Wet Fertilizer Spreaders Market

Nano Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Green Fertilizer Market Growth – Trends & Forecast 2024-2034

Market Share Distribution Among Liquid Fertilizer Providers

Organic Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Starter Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Silicon Fertilizer Market Analysis - Size, Growth, and Forecast 2025 to 2035

Organic Fertilizer Industry Analysis in North America Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Biochar Fertilizer Market Outlook – Growth, Demand & Forecast 2025 to 2035

Nitrogen Fertilizer Additives Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA