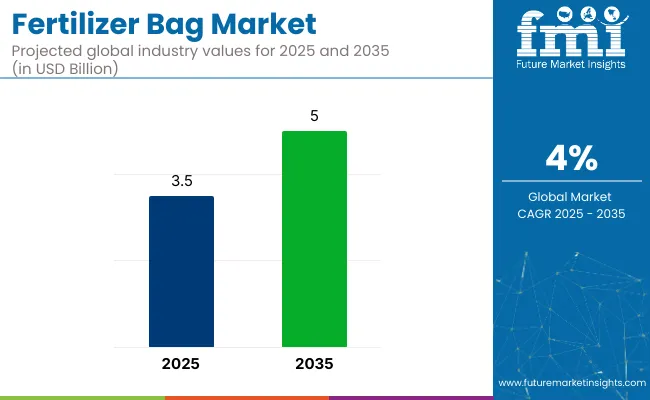

The global fertilizer bags market is projected to grow from USD 3.5 billion in 2025 to USD 5.0 billion by 2035, registering a CAGR of 4% during the forecast period. This growth is primarily attributed to the increasing demand for fertilizers to boost agricultural productivity worldwide.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 3.5 billion |

| Projected Value (2035F) | USD 5.0 billion |

| CAGR (2025 to 2035) | 4% |

Fertilizer bags play a crucial role in ensuring safe storage, transportation, and handling of fertilizers while maintaining product quality and minimizing waste. The market's expansion is further driven by the growing emphasis on sustainable and recyclable materials, as well as advancements in packaging technologies that improve strength and protection.

In 2022, Mondi Group, a global leader in packaging and paper, announced an investment of nearly €65 million to expand its Consumer Flexibles packaging plants in Europe. This investment aims to meet the growing demand for sustainable pet food packaging solutions, including the production of pre-made retort stand-up pouches. The expansion includes upgrades to facilities in Austria and Germany, enhancing production capacity and supporting customers’ goals.

Recent innovations in the fertilizer bag market have centered around enhancing sustainability, functionality, and adaptability to diverse applications. Manufacturers are increasingly adopting biodegradable and recyclable materials, such as bio-based polymers, to produce eco-friendly fertilizer bags that align with stringent environmental regulations and cater to the growing consumer demand for sustainable packaging solutions.

Advancements in coating technologies have led to the development of bags with improved moisture resistance, UV protection, and anti-slip properties, ensuring better performance in various environmental conditions. Additionally, the integration of smart technologies, including RFID tags and sensor-embedded bags, is enabling better inventory management, product tracking, and real-time monitoring of environmental conditions, aligning with the growing trend of smart packaging and logistics.

The fertilizer bag market is expected to witness significant growth in emerging economies, particularly in the Asia-Pacific region, driven by rapid industrialization, urbanization, and infrastructural development. Countries like China, India, and Indonesia are experiencing a surge in demand for durable and sustainable materials in construction, agriculture, and packaging sectors.

The expansion of the e-commerce industry and the increasing need for efficient logistics and protective packaging solutions further propel the market's growth in these regions. Manufacturers are anticipated to focus on developing cost-effective, sustainable, and customizable fertilizer bag solutions to cater to diverse industry needs and comply with evolving regulatory standards. Strategic collaborations, technological advancements, and investments in local production facilities are likely to play a crucial role in capturing market share and driving growth in these regions.

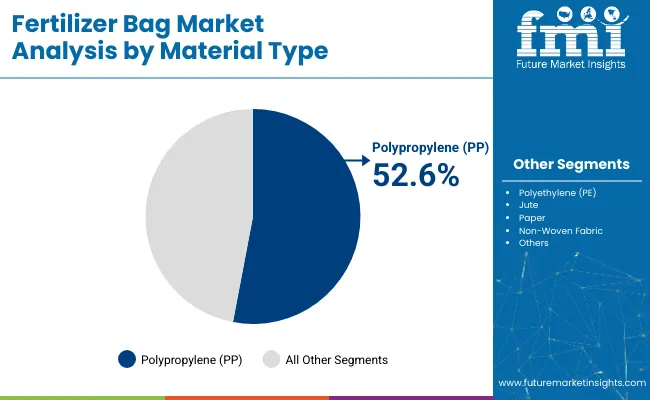

The market has been segmented based on material, size, closure type, application, and region. By material, polyethylene (PE), polypropylene (PP), jute, paper, and non-woven fabric are utilized to balance cost-efficiency, moisture protection, breathability, and environmental sustainability in agricultural packaging.

Size segmentation includes less than 10 kg, 10-25 kg, 25-50 kg, 50-100 kg, and more than 100 kg, addressing packaging needs across small-scale farming, retail fertilizer distribution, and bulk industrial supply. Closure types include drawstring, plastic tie, wire tie, sewn closure, and glued closure-each supporting secure sealing, reusability, or tamper resistance.

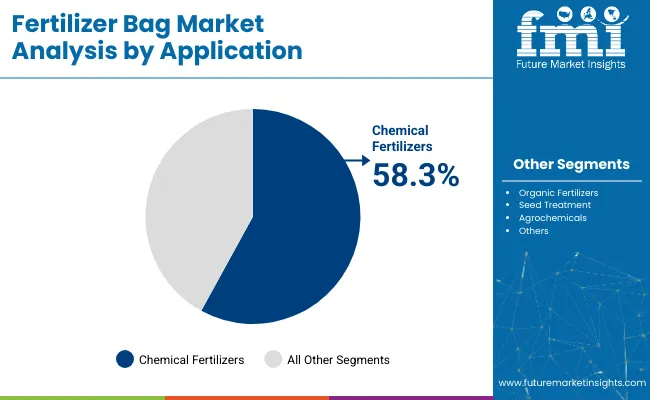

Application areas include chemical fertilizers, organic fertilizers, seed treatment, and agrochemicals, reflecting the sector’s need for both barrier functionality and compatibility with varied material formulations. Regional segmentation spans North America, Europe, Latin America, Asia Pacific, and the Middle East and Africa, capturing shifts in agricultural intensity, packaging regulation, and fertilizer consumption patterns.

The polypropylene (PP) segment is expected to dominate the material category with a 52.6% share in the fertilizer bag market by 2025, driven by its exceptional mechanical strength, chemical resistance, and adaptability to heavy-duty agricultural use. PP bags-especially woven and laminated variants-are widely used for packaging fertilizers due to their ability to endure rough handling, prolonged storage, and varied climatic conditions.

Woven PP bags offer excellent tensile strength, lightweight properties, and breathability, while laminated PP bags provide enhanced moisture and UV protection-essential for maintaining fertilizer integrity during transit and warehouse storage. Moreover, PP bags are easily printable, allowing manufacturers to brand packaging while complying with regulatory labeling norms regarding nutrient content and safety handling instructions.

The cost-efficiency and recyclability of polypropylene also contribute to its dominance. Many producers are now investing in circular packaging models, introducing PP bags made from post-industrial and post-consumer recycled content to meet sustainability goals. As agricultural output expands across emerging economies and global fertilizer demand rises, PP bags are expected to remain the material of choice, particularly in bulk and export applications.

The chemical fertilizers segment is projected to account for the largest share of 58.3% in the fertilizer bag market by 2025, primarily driven by global demand for nitrogenous, phosphatic, and potassic fertilizers in high-yield crop production. These fertilizers are typically packed in 10-50 kg PP or laminated kraft bags to ensure durability, safe handling, and product stability throughout distribution.

The dominance of this segment is underpinned by the intensification of agriculture to feed growing populations, especially in Asia-Pacific, Latin America, and Sub-Saharan Africa. Fertilizer manufacturers and distributors require packaging that prevents caking, resists puncture, and allows stackability features that scrim-reinforced or laminated chemical fertilizer bags offer effectively.

Moreover, strict labeling and safety regulations concerning chemical fertilizer handling have increased the adoption of multi-layer bags with anti-counterfeit features, batch traceability, and enhanced UV resistance. As climate-resilient farming practices and mechanized fertilizer distribution systems expand, packaging formats are evolving toward high-barrier, easy-to-handle bags that optimize shelf life and minimize material loss. Given the continued dominance of chemical fertilizers in global agriculture, this segment will drive volume growth and innovation in bag manufacturing, especially in high-capacity SKUs and region-specific climate-adaptive formats.

Environmental Concerns and Regulatory Compliance

Stringent regulations on single-use plastics and increasing environmental awareness regarding plastic waste threaten the growth of the fertilizer bags market. Polypropylene and polyethylene are the two main constituent elements of normal fertilizer bags, which are a source of non-biodegradable waste and the cause of pollution, resulting in further scrutiny from local government authorities.

Governments around the world implement stringent packaging waste management legislation that mandates manufacturers to transition to recyclable, biodegradable, or reusable materials. But designing economically viable, environmentally friendly replacements that do not sacrifice longevity and anti-dampness is still a huge challenge for the sector.

Demand for Sustainable and High-Performance Packaging Solutions

Growing focus on sustainable agriculture and environmentally-friendly packaging represents a major growth opportunity of the fertilizer bags market. However, companies are developing biodegradable, compostable, and recyclable packaging solutions to meet regulatory standards and consumer demand.

Aesthetic enhancement comes with economic sustainability, multi-layer barrier film, water-resistant coating, and UV-stabilized bags all contribute to making bags economically viable but they also have to keep environmental sustainability in mind during development. Virtual incorporation and QR codes and smart packaging and use of 3D printing are intended to improve product observability and branding, driving improvements in the agro-industry.

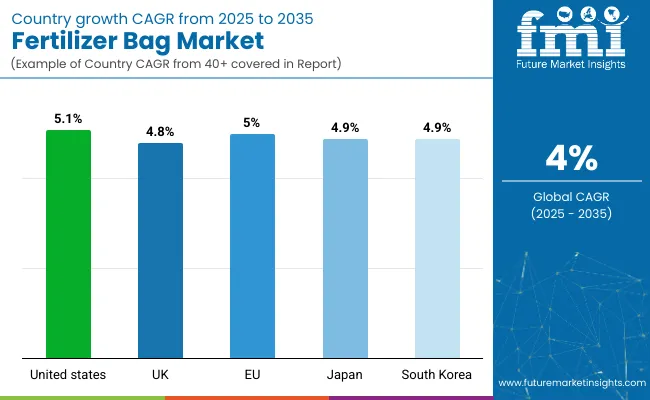

The USA fertilizer bags market is anticipated to grow at a significant rate during the forecast period due to the growth of the agriculture sector, rising demand for fertilizers, and innovations in eco-friendly packaging technology. So, requirements for durable, moisture resistant and eco-friendly fertilizer bags are increasing with the rise in precision farming and large-scale agricultural production.

Government initiatives aimed at sustainable packaging solutions have prompted manufacturers to produce biodegradable and recyclable fertilizer bags. Furthermore, the increasing utilization of bulk and flexible intermediate bulk containers (FIBCs) for large-scale fertilizer transport is also strongly propelling market growth. The long-term market growth is being ensured by the presence of some of the leading agrochemical companies as well as growing investments in advanced polymer based packaging.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.1% |

This expansion is being driven by agricultural modernization, sustainability regulation, as well as a growing demand for high-strength packaging solutions. Fertilizer packaging made of biodegradable and recyclable materials is being promoted by the UK government to cut plastic waste.

The increasing trend towards organic farming and precision agriculture has led to usage of customized, multi-layered and UV-resistant fertilizer bags that extend the shelf-life of the product, which is further bolstering the demand for fertilizer bags. Further, rising agrochemical distribution channels and increasing online agricultural supply chains also create potential demand avenue for lightweight yet durable fertilizer packaging solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.8% |

The European Union fertilizers bags market is growing steadily, owing to sustainability-cantered agricultural policies, growing consumption of fertilizers, and innovations in packaging materials. The European sustainable and recyclable fertilizer packaging market is currently being led by countries, including Germany, France and the Netherlands, offering new investments in sustainable and recyclable solutions.

European Union (EU) regulations to reduce plastic packaging waste are forcing manufacturers to use bio-based and compostable packaging alternatives. The increasing demand for bulk packaging solutions in commercial agriculture is also one of the factors fuelling the adoption of woven polypropylene (PP) bags and the FIBCs.

The same factor has increased demand for moisture-resistant and anti-leak fertilizer bags, as precision farming techniques proliferate and controlled-release fertilizers (CRFs) have become increasingly widespread.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.0% |

The companies in Japan are steadily adopting the use of fertilizer bags owing to the advancements in agricultural packaging technology, increasing demand for specialty fertilizers as well as rigorous sustainability initiatives. The country has very little arable land and the plants grown using controlled-environment farming methods, and therefore, there is a growing need for high-barrier, long-lasting fertilizer packaging solutions.

All of this translates to enhanced supply chain efficiency for fertilizers, aided by smart packaging solutions like QR-coded and RFID-enabled bags for traceability. In fact, Japan’s push to reduce plastic waste is aiding the development of biodegradable and reusable fertilizer packaging materials. Moreover, the need for lightweight, durable bags for liquid and granular fertilizers is further stimulating the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.9% |

The South Korea fertilizer bags market is driven by growing agricultural mechanization, the increasing need for high strength packaging products, and the trend towards eco-friendly fertilisers. Commercialization of low-waste and recyclable fertilizer packaging solutions has been envisaged with a view to achieving sustainable development goals set by the government.

Blue and Green in top-down view cropped image with close-up some Japanese horticulture business tried to use smart and tamper-proof packaging to store and transport the fertilizer. Furthermore, the expansion of urban and vertical farming is contributing to the demand for small and medium-sized fertilizer bags providing high moisture resistance. The increase in agricultural product exports is also driving up the demand for bulk and high-durability fertilizer packaging solutions, further fuelling market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.9% |

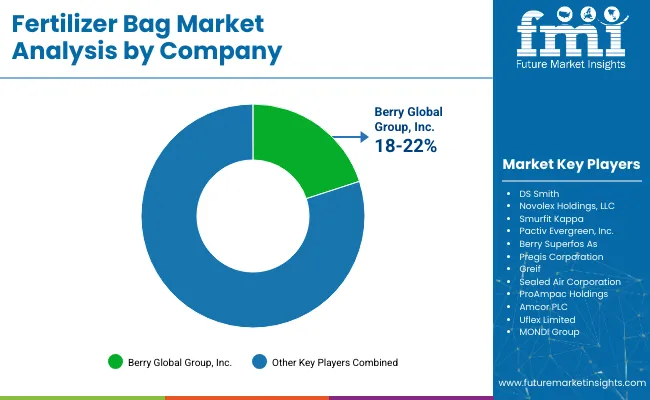

The fertilizer bags market is a competitive market which is also functionality driven due to the rising demand for strong, cost-efficient and eco-friendly packaging systems for fertilizers. These bags are made in such a way that they prevent moisture absorption and contamination thus ensuring safe storage, transport, and handling of fertilizers.

Prominent manufacturers concentrate on high-key barrier packing components, biodegradable substitutes, and improved durability to meet the needs of agriculture and industry. The competition within the market encompasses global packaging corporations, specialized polymer producers, as well as regional vendors providing tailor-made offerings.

The overall market size for the fertilizer bags market was USD 3.5 billion in 2025.

The fertilizer bags market is expected to reach USD 5.0 billion in 2035.

The increasing demand for efficient and durable packaging solutions, rising agricultural activities, and growing focus on sustainable and recyclable materials fuel the fertilizer bags market during the forecast period.

The top 5 countries driving the development of the fertilizer bags market are the USA, UK, European Union, Japan, and South Korea.

Agriculture leads market growth to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fertilizer Packaging Market Forecast and Outlook 2025 to 2035

Fertilizer Tester Market Size and Share Forecast Outlook 2025 to 2035

Fertilizer Value Added Coatings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fertilizer Applicators Market Size and Share Forecast Outlook 2025 to 2035

Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Fertilizer Additive Market Report – Growth, Demand & Forecast 2025 to 2035

Fertilizer Injection Pumps Market

Biofertilizers Market Size and Share Forecast Outlook 2025 to 2035

NPK Fertilizers Market Analysis - Size, Share, and Forecast 2025 to 2035

Wet Fertilizer Spreaders Market

Nano Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Green Fertilizer Market Growth – Trends & Forecast 2024-2034

Market Share Distribution Among Liquid Fertilizer Providers

Organic Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Starter Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Silicon Fertilizer Market Analysis - Size, Growth, and Forecast 2025 to 2035

Organic Fertilizer Industry Analysis in North America Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Biochar Fertilizer Market Outlook – Growth, Demand & Forecast 2025 to 2035

Nitrogen Fertilizer Additives Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA