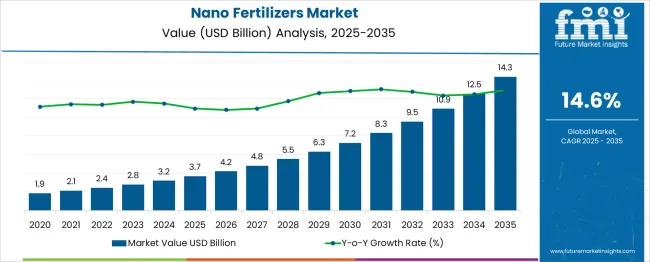

The Nano Fertilizers Market is estimated to be valued at USD 3.7 billion in 2025 and is projected to reach USD 14.3 billion by 2035, registering a compound annual growth rate (CAGR) of 14.6% over the forecast period. A key breakpoint occurs around 2025 when the market crosses USD 3.7 billion. This phase represents the early adoption period, driven by rising demand for precision agriculture and efficient nutrient delivery systems. Farmers are increasingly recognizing the benefits of nano fertilizers, such as improved crop yield, reduced chemical runoff, and enhanced soil health. Between 2020 and 2025, incremental growth reflects growing awareness and gradual regulatory support for sustainable farming solutions. The next significant breakpoint emerges between 2030 and 2035, as the market reaches USD 14.3 billion, reflecting accelerated adoption and technology maturation. Incremental revenue during this period is approximately USD 6 billion, driven by innovations in nanoparticle formulations, wider application in high-value crops, and increased global adoption in emerging markets. This period also sees investment opportunities for manufacturers, with a focus on R&D, product differentiation, and expansion of distribution channels.

| Metric | Value |

|---|---|

| Nano Fertilizers Market Estimated Value in (2025 E) | USD 3.7 billion |

| Nano Fertilizers Market Forecast Value in (2035 F) | USD 14.3 billion |

| Forecast CAGR (2025 to 2035) | 14.6% |

Growing global concern over declining soil health, inefficient nutrient delivery, and fertilizer runoff has positioned nano fertilizers as a strategic alternative to conventional inputs.

These fertilizers are being adopted for their ability to deliver nutrients in controlled and targeted forms, which results in higher uptake efficiency, reduced environmental footprint, and improved crop yield. Market momentum is further reinforced by increasing government support for sustainable agriculture and rising investment in agri-nanotechnology by both public institutions and private enterprises.

The future growth outlook remains optimistic, as nano-enabled fertilizers are expected to align with emerging regulatory frameworks emphasizing resource conservation and climate resilience. Advancements in nanoparticle encapsulation and delivery technologies are creating new opportunities to tailor nutrient release based on crop and soil conditions, supporting a transition toward more intelligent and sustainable nutrient management systems across global markets..

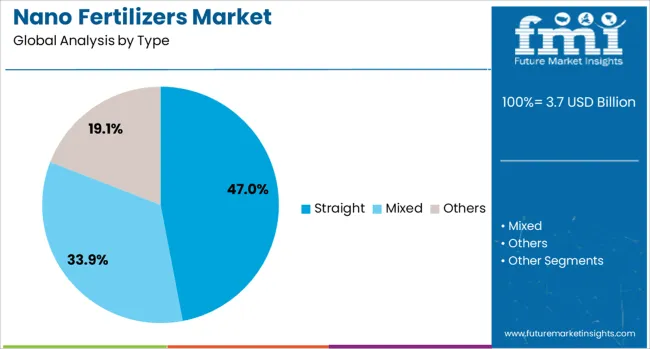

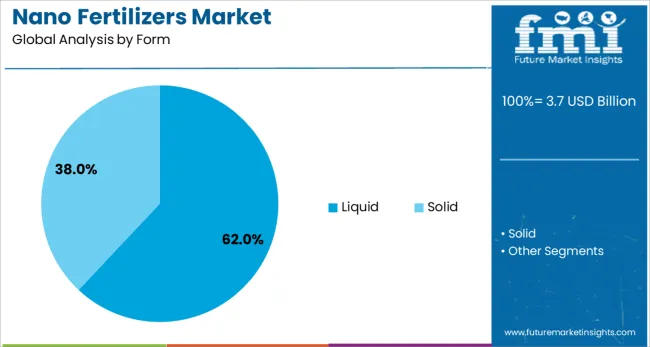

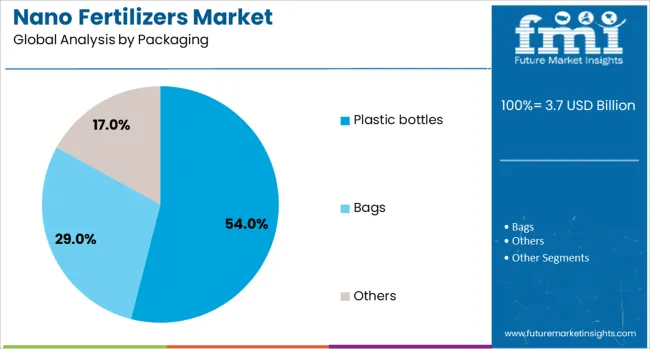

The nano fertilizers market is segmented by type, form, packaging, application, and geographic regions. The nano fertilizers market is divided into Straight, Mixed, and Others. In terms of form, the nano fertilizers market is classified into Liquid and Solid. Based on packaging of the nano fertilizers market is segmented into Plastic bottles, BagsOthers. The nano fertilizers market is segmented into Cereals & grains, Fruits, nuts & vegetables, Oilseeds & pulses, Turf & ornamentals, and others. Regionally, the nano fertilizers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The straight type segment is projected to contribute 47% of the Nano Fertilizers market revenue in 2025, positioning it as the leading type segment. Growth in this segment has been attributed to its ability to provide specific nutrients such as nitrogen, phosphorus, or potassium in isolated form, allowing for targeted soil and crop treatment. These fertilizers have been preferred in precision agriculture where nutrient-specific deficiencies are managed with high accuracy.

Straight nano fertilizers also offer better compatibility with controlled-release formulations and demonstrate improved bioavailability, making them suitable for both open field and protected cultivation. The demand for these single-nutrient formulations has increased in regions facing soil micronutrient imbalances, where tailored interventions are critical.

Additionally, research and field validation studies have supported their effectiveness in minimizing nutrient leaching and improving nutrient-use efficiency. As sustainability remains a priority for both producers and policymakers, the straight type segment is expected to remain dominant due to its alignment with focused nutrient delivery strategies..

The liquid form segment is expected to account for 62% of the Nano Fertilizers market revenue in 2025, emerging as the leading formulation. This preference has been driven by the ease of handling, compatibility with fertigation and foliar spray systems, and faster nutrient absorption by crops. Liquid nano fertilizers have been increasingly used in high-value horticulture and intensive farming systems where precision and speed of action are essential.

Their uniform distribution and rapid uptake have been critical in addressing transient nutrient deficiencies during key growth phases. Moreover, these fertilizers offer greater formulation flexibility, enabling integration with micronutrients and biostimulants to enhance plant resilience.

The liquid form has also gained traction in climate-sensitive regions where water availability is limited, as it supports efficient irrigation-linked nutrient delivery. With farmers seeking fast-acting and adaptable nutrient solutions, the liquid segment continues to lead in adoption due to its operational efficiency and agronomic advantages in modern farming practices..

The plastic bottles segment is anticipated to represent 54% of the Nano Fertilizers market revenue in 2025, marking it as the dominant packaging format. This leadership has been supported by the durability, portability, and cost-effectiveness of plastic bottle packaging, particularly for liquid nano formulations. Plastic bottles offer strong resistance to chemical degradation, spillage, and environmental exposure, ensuring product integrity during storage and transport.

Additionally, the packaging’s reusability and resealability have added value for end users, especially in smallholder and mid-sized farms. Manufacturers have favored plastic bottles for their design flexibility, enabling branding, dosage markings, and usage instructions to be clearly displayed.

As nano fertilizers often require precise application, the controlled dispensing mechanisms of bottle packaging have proven effective in minimizing waste and ensuring accurate dosing. Growing distribution through online and agri-retail channels has further enhanced the accessibility and appeal of bottled nano fertilizers, contributing to the segment’s leading market share..

The nano fertilizers market is expanding as farmers and agribusinesses seek ways to improve crop yield, nutrient efficiency, and soil health. Nano fertilizers deliver nutrients at a microscopic scale, enhancing absorption, reducing leaching, and supporting precise nutrient management. Rising global food demand, intensive farming practices, and the need to optimize input costs drive adoption worldwide. Europe and North America lead due to advanced agricultural research and infrastructure, while Asia-Pacific is witnessing increasing adoption to boost crop productivity. Innovations such as controlled-release and multi-nutrient formulations support effective plant growth, reduce environmental impact, and improve overall farm sustainability.

Nano fertilizers improve plant nutrient uptake efficiency compared to conventional fertilizers. Their microscopic particle size allows better absorption by roots and leaves, ensuring precise delivery of nitrogen, phosphorus, potassium, and micronutrients. This leads to higher crop productivity, improved quality, and uniform growth, especially in high-value crops like fruits, vegetables, and cereals. Reduced nutrient wastage also lowers fertilizer costs for farmers. Regions facing soil nutrient depletion benefit significantly from nano formulations. Adoption of nano fertilizers supports precision agriculture practices, reducing reliance on large volumes of traditional fertilizers while maintaining yield targets. Farmers increasingly rely on scientifically validated nano fertilizer products to optimize growth cycles, reduce environmental runoff, and enhance long-term soil fertility.

The market is evolving with novel formulations such as controlled-release nanoparticles, coated nutrient particles, and multi-nutrient composites. These formulations allow slow and targeted nutrient delivery, reducing environmental runoff and soil contamination. Researchers and manufacturers are focusing on compatibility with irrigation systems, foliar sprays, and seed coatings. Innovations in encapsulation techniques and particle stabilization improve nutrient retention, reduce degradation, and enhance overall fertilizer performance. Manufacturers collaborate with agricultural institutes to validate efficacy and safety, supporting wider adoption. The development of customized formulations for specific soil types, crop varieties, and climatic conditions further strengthens the market. Product differentiation through enhanced efficiency, environmental safety, and regulatory compliance drives competition and encourages investment in research-driven nano fertilizer solutions.

Nano fertilizers reduce nutrient loss, lower application frequency, and minimize labor and input costs. Higher absorption efficiency results in smaller doses, reducing wastage and lowering overall fertilizer expenditure. Enhanced nutrient delivery contributes to better crop resilience against diseases, drought, and soil stress. Farmers also benefit from improved crop uniformity, quality, and faster growth cycles, increasing profitability. Adoption is facilitated by ready-to-use nano fertilizer blends compatible with existing irrigation or foliar spray systems. Supply chain reliability for high-quality, certified nano fertilizers is critical, especially during peak planting periods. By improving operational efficiency and reducing environmental risks, nano fertilizers provide measurable economic benefits to both large-scale and smallholder farmers, making them a valuable tool in modern agricultural practices.

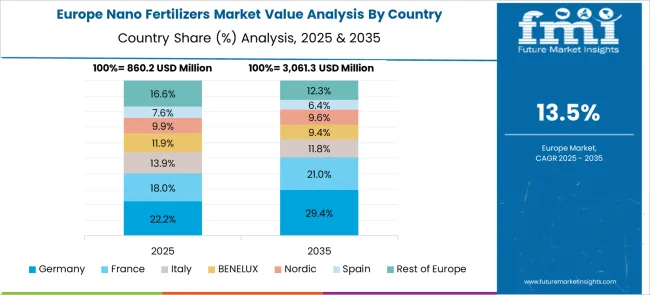

The nano fertilizers market is witnessing strong growth across Europe, North America, and Asia-Pacific. Europe and North America lead due to advanced research, regulatory support, and modern farming infrastructure. Asia-Pacific, driven by the need to boost food security and enhance crop yields, is emerging as a high-growth region. Latin America and the Middle East are increasingly adopting nano fertilizers to address nutrient-depleted soils and optimize crop production under challenging environmental conditions. Market players are focusing on region-specific product development, distribution networks, and farmer education programs. Strategic partnerships with distributors, agricultural research institutions, and government bodies enhance market reach. Regional dynamics, including soil type, crop patterns, and regulatory frameworks, shape adoption trends and ensure sustained growth in nano fertilizer consumption globally.

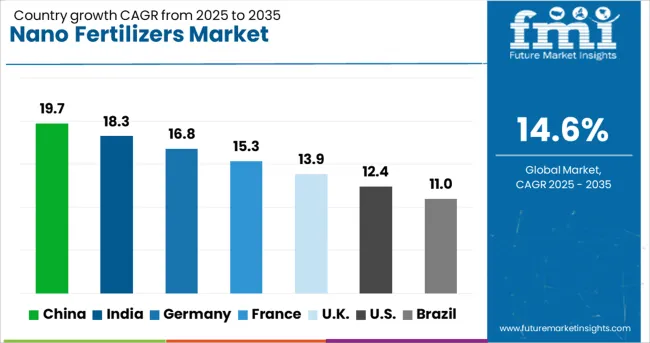

| Country | CAGR |

|---|---|

| China | 19.7% |

| India | 18.3% |

| Germany | 16.8% |

| France | 15.3% |

| UK | 13.9% |

| USA | 12.4% |

| Brazil | 11.0% |

The nano fertilizers market is witnessing rapid growth at a CAGR of 14.6%, driven by the increasing demand for precision agriculture and enhanced crop productivity. China leads with 19.7% growth, supported by large-scale adoption of advanced fertilizers and strong domestic production capabilities. India follows at 18.3%, fueled by government programs promoting modern farming practices and higher crop yields. Germany records 16.8% growth, reflecting its focus on technological farming solutions and efficiency in nutrient delivery. The UK grows at 13.9%, driven by interest in innovative farming techniques and soil management. The United States shows 12.4% growth, highlighting adoption in commercial agriculture and research on advanced nano-formulations. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the nano fertilizers market with a 19.7% growth rate. Rising demand for high-yield crops and precision agriculture drives adoption of nano-formulated nutrients that improve soil absorption and reduce chemical runoff. Compared to India, China benefits from advanced research facilities and large-scale agricultural production, enabling faster commercialization of nano fertilizers. Government support for modern farming techniques and sustainable crop management encourages farmers to adopt these innovative fertilizers. Key crops such as rice, wheat, and corn are primary beneficiaries, improving nutrient efficiency and boosting yields. Investments in smart agriculture technologies, including soil sensors and controlled-release formulations, enhance product effectiveness. Collaboration between research institutes and manufacturers further accelerates innovation. Overall, China’s combination of technological infrastructure, large farmlands, and policy support positions it as a dominant player in the global nano fertilizers market.

India’s nano fertilizers market grows at 18.3%, fueled by the need to improve crop productivity and reduce environmental impact. Compared to Germany, India focuses on cost-effective nano fertilizer solutions for rice, wheat, and pulses. Adoption is supported by government initiatives promoting balanced fertilization and soil health programs. Farmers increasingly recognize benefits such as reduced nutrient loss, improved water retention, and enhanced crop quality. Local manufacturing and partnerships with research institutions accelerate product availability and adaptation to regional soils. Awareness campaigns educate smallholder farmers about precision nutrient delivery and sustainable agriculture practices. The horticulture and vegetable sectors are emerging as major end users, leveraging nano fertilizers for improved yield and quality. Overall, India balances affordability and innovation to achieve significant market growth and gradually transition toward high-efficiency fertilizers across diverse farming practices.

Germany shows steady growth at 16.8% in the nano fertilizers market, driven by technologically advanced farming and strict environmental standards. Compared to the United Kingdom, German adoption emphasizes high-precision fertilizers that minimize chemical runoff and improve soil health. Greenhouse operators and high-value crop producers are early adopters, using nano formulations to optimize nutrient uptake and reduce environmental impact. Research investments focus on biodegradable carriers, controlled-release mechanisms, and improved nutrient delivery systems. Export opportunities to neighboring European countries further support production growth. Farmers prioritize efficiency, quality, and regulatory compliance, aligning with national policies on sustainable agriculture. Germany also emphasizes integration of nano fertilizers with modern irrigation systems and digital agriculture platforms, boosting adoption rates. Overall, technological innovation, regulatory support, and export demand ensure steady growth for the nano fertilizers market in Germany.

The United Kingdom nano fertilizers market grows at 13.9%, driven by horticulture, greenhouse cultivation, and specialty crops. Compared to the United States, the UK emphasizes environmentally friendly and controlled-release fertilizers that minimize chemical leaching. Farmers adopt nano fertilizers to enhance nutrient use efficiency, improve crop quality, and support sustainable practices. Government initiatives encourage research into innovative formulations and regional adoption programs. Market growth is also fueled by partnerships between manufacturers, distributors, and agricultural advisors that increase awareness and accessibility. Organic and high-value crops are adopting nano fertilizers to optimize growth while meeting sustainability certifications. Continuous research into soil-specific formulations ensures improved performance across varied agricultural conditions. Overall, the UK market combines sustainability priorities with innovation to achieve steady expansion and modernize nutrient management practices.

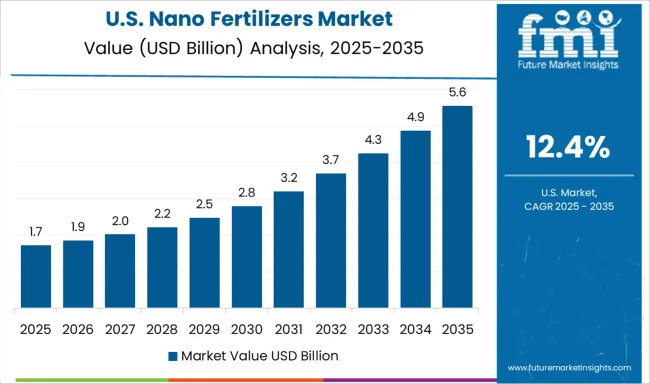

The United States advances in the nano fertilizers market at 12.4%, supported by precision agriculture, high-value crop production, and large-scale farms. Compared to China, the US emphasizes research into biodegradable and soil-specific nano fertilizers to improve nutrient absorption and reduce runoff. Adoption is strong in corn, soybean, and specialty vegetable cultivation. Government programs promoting efficient fertilizer use encourage sustainable farming practices and innovation in product formulations. Collaboration between manufacturers, research institutes, and agritech companies drives the development of controlled-release and sensor-integrated fertilizers. Market growth is further supported by increasing demand for environmentally friendly farming solutions and high-efficiency nutrient management. Overall, the United States leverages advanced agricultural technologies and sustainability initiatives to ensure consistent adoption of nano fertilizers, providing steady growth for the market.

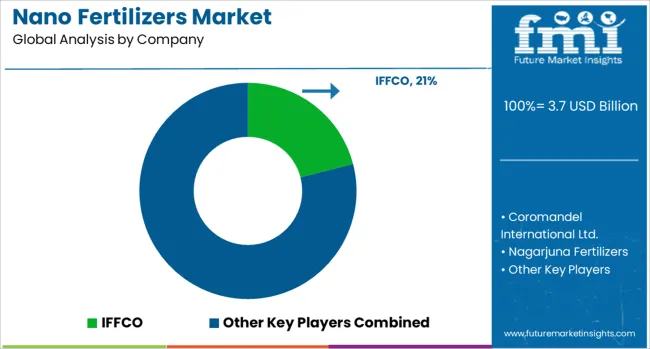

The nano fertilizers market is emerging rapidly in precision agriculture, driven by the need for enhanced nutrient efficiency, reduced environmental impact, and improved crop yields. IFFCO and Coromandel International Ltd. lead the market in India, leveraging advanced nano-encapsulation and controlled-release technologies to optimize nutrient delivery and minimize wastage. Nagarjuna Fertilizers focuses on research-driven formulations, combining micronutrients with nano-scale carriers to improve soil health and plant growth efficiency.

Indian Potash Ltd. emphasizes potassium-based nano fertilizers, addressing both yield enhancement and sustainable farming practices. Rashtriya Chemicals & Fertilizers Ltd. integrates nano nutrient technologies into its existing fertilizer portfolio, targeting large-scale commercial agriculture with cost-effective and environmentally responsible solutions. Market competition is increasingly shaped by innovations in nano-carrier materials, slow-release mechanisms, and multi-nutrient formulations. Regulatory compliance, cost-effectiveness, and farmer education also play a critical role in adoption, pushing suppliers to differentiate through product performance, research partnerships, and regional distribution strategies.

Sulvaris Inc. was awarded the inaugural IFA Science & Innovation Award in March 2025 for its Micronized Sulphur Technology (MST®). This technology enhances sulfur absorption in crops, addressing deficiencies in soils and optimizing sulfur use efficiency. The award recognized MST® for its novelty, sustainability, scalability, and practical implementation. Sulvaris presented this innovation at the IFA Cultivating Tomorrow 2025 Conference in Barcelona.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.7 Billion |

| Type | Straight, Mixed, and Others |

| Form | Liquid and Solid |

| Packaging | Plastic bottles, Bags, and Others |

| Application | Cereals & grains, Fruits, nuts & vegetables, Oilseeds & pulses, Turf & ornamentals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | IFFCO, Coromandel International Ltd., Nagarjuna Fertilizers, Indian Potash Ltd., Rashtriya Chemicals & Fertilizers Ltd., and Others |

| Additional Attributes | Dollar sales in the nano fertilizers market vary by type including nitrogen-based, phosphorus-based, and potassium-based fertilizers, application across cereals, fruits & vegetables, and cash crops, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising demand for sustainable agriculture, enhanced crop yield, and precision farming technologies. |

The global nano fertilizers market is estimated to be valued at USD 3.7 billion in 2025.

The market size for the nano fertilizers market is projected to reach USD 14.3 billion by 2035.

The nano fertilizers market is expected to grow at a 14.6% CAGR between 2025 and 2035.

The key product types in nano fertilizers market are straight, mixed and others.

In terms of form, liquid segment to command 62.0% share in the nano fertilizers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nanoscale Zero-Valent Iron Market Size and Share Forecast Outlook 2025 to 2035

Nanoscale Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Nano Coating Market Size and Share Forecast Outlook 2025 to 2035

Nano Fibers Market Size and Share Forecast Outlook 2025 to 2035

Nanotechnology Photocatalysis Surface Coating Industry Analysis in AMEA Size and Share Forecast Outlook 2025 to 2035

Nanosensors Market Size and Share Forecast Outlook 2025 to 2035

Nano Precipitated Calcium Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Nanocatalysts Market Size and Share Forecast Outlook 2025 to 2035

Nano Suspension Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Nanotechnology Packaging Market Size and Share Forecast Outlook 2025 to 2035

Nanocellulose Coating Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Nanocrystalline cellulose Market Size and Share Forecast Outlook 2025 to 2035

Nanocellulose Barrier Coating Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Nano Zinc Oxide Market Size and Share Forecast Outlook 2025 to 2035

Nano Composite Zirconia Market Size and Share Forecast Outlook 2025 to 2035

Nano Dentistry Market Size and Share Forecast Outlook 2025 to 2035

Nanomaterial Supercapacitors Market Size and Share Forecast Outlook 2025 to 2035

Nanosilver Market Size and Share Forecast Outlook 2025 to 2035

Nanographic Printing Market Size and Share Forecast Outlook 2025 to 2035

Nanoparticle Technology Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA