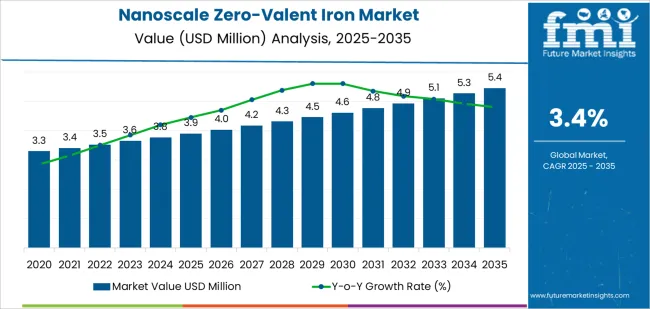

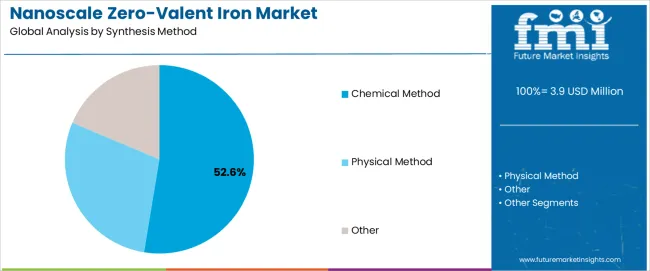

The nanoscale zero-valent iron market is projected to expand from USD 3.9 million in 2025 to USD 5.5 million by 2035, registering a CAGR of 3.4% and an absolute gain of USD 1.6 million, reflecting a total growth of 41%. This 1.4X expansion is underpinned by global momentum in groundwater and soil remediation, where nanoscale zero-valent iron (nZVI) demonstrates superior reactivity for in-situ treatment of chlorinated solvents, heavy metals, and persistent organic contaminants. Early-period growth from 2025 to 2030 will be propelled by government-mandated site cleanups, industrial redevelopment programs, and the adoption of chemical synthesis methods, which account for 52.6% share, given their scalability and controllable particle size production.

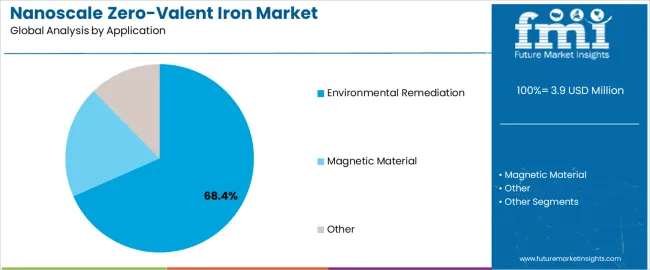

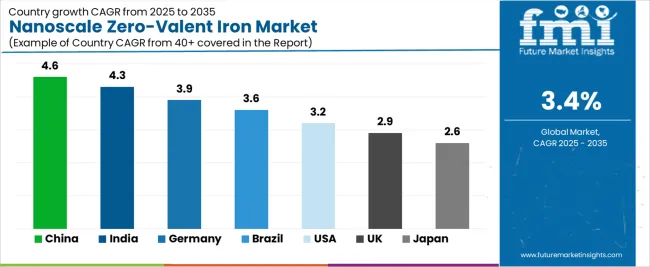

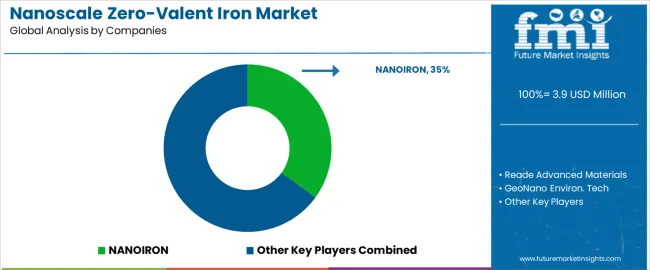

The market’s evolution will emphasize stabilized nanoparticle formulations, surface modification, and advanced delivery mechanisms that improve subsurface transport and contact efficiency. Environmental remediation applications, commanding 68.4% share, will remain the core driver, supported by Superfund and brownfield restoration initiatives in the United States and expanding soil rehabilitation mandates across Europe and Asia. China (4.6% CAGR) and India (4.3%) lead global growth, supported by industrial cleanup regulations and domestic nanomaterial production capacity. Germany (3.9%) and Brazil (3.6%) continue as high-value markets where remediation technology integration is reinforced by strong environmental enforcement, while the United States (3.2%) sustains mature, large-scale deployment driven by regulatory frameworks and proven field performance. Key participants such as NANOIRON, Reade Advanced Materials, and GeoNano Environ. Tech are focusing on particle stabilization chemistry, hybrid synthesis innovation, and eco-safe nanomaterial deployment.

Growing emphasis on environmental sustainability is driving demand for nanomaterials that offer superior reactivity and penetration capabilities compared to conventional remediation technologies, enabling treatment of previously inaccessible contamination zones and reducing long-term monitoring costs. The development of stabilized nanoparticle formulations and improved delivery mechanisms is addressing earlier limitations related to particle aggregation and mobility, facilitating adoption in diverse geological conditions and contamination scenarios.

Regulatory mandates for site cleanup, particularly in developed economies with legacy industrial contamination, are creating sustained demand for innovative remediation technologies that demonstrate cost-effectiveness and environmental safety. The market is characterized by ongoing research and development activities focused on synthesis method optimization, surface modification techniques, and application-specific formulations that enhance performance while addressing concerns related to nanoparticle transport, longevity, and potential ecological impacts in treatment zones.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 3.9 million |

| Market Forecast Value (2035) | USD 5.5 million |

| Forecast CAGR (2025-2035) | 3.4% |

| ENVIRONMENTAL REMEDIATION DEMANDS | TECHNOLOGY ADVANCEMENT FACTORS | REGULATORY & SUSTAINABILITY DRIVERS |

|---|---|---|

|

|

|

| Category | Segments Covered |

|---|---|

| By Synthesis Method | Chemical Method, Physical Method, Other |

| By Application | Environmental Remediation, Magnetic Material, Other |

| By Region | China, India, Germany, Brazil, United States, United Kingdom, Japan |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Chemical Method |

|

| Physical Method |

|

| Other |

|

| Segment | 2025 to 2035 Outlook |

|---|---|

| Environmental Remediation |

|

| Magnetic Material |

|

| Other |

|

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

|

|

|

| Region | Market Value 2025 (USD Million) | Market Value 2035 (USD Million) | CAGR (2025-2035) |

|---|---|---|---|

| China | 1.4 | 3.5 | 4.6% |

| India | 0.1 | 0.2 | 4.3% |

| Germany | 3.3 | 4.5 | 3.9% |

| Brazil | 3.4 | 4.6 | 3.6% |

| United States | 3.7 | 4.9 | 3.2% |

| United Kingdom | 3.8 | 5.1 | 2.9% |

| Japan | 4 | 5.3 | 2.6% |

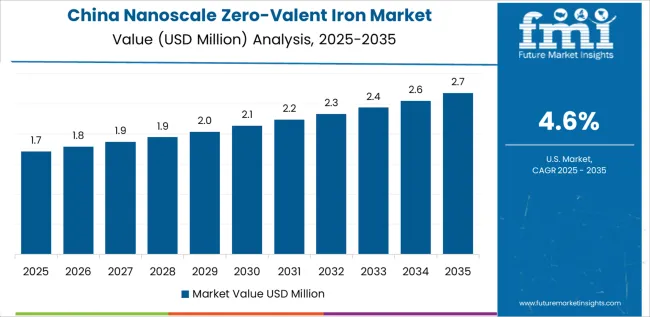

Revenue from nanoscale zero-valent iron in China is projected to reach USD 3.5 million by 2035, driven by extensive environmental remediation programs and government initiatives addressing industrial pollution creating substantial opportunities for advanced nanomaterial applications across contaminated site cleanup and groundwater protection projects. The country's large industrial base and historical contamination legacy from manufacturing operations are creating sustained demand for cost-effective remediation technologies. National environmental protection policies and soil pollution prevention action plans are mandating cleanup of contaminated industrial sites before redevelopment, with nanoscale zero-valent iron emerging as a preferred technology for treating chlorinated solvents and heavy metal contamination.

Provincial and municipal authorities are investing in pilot projects demonstrating nanoparticle remediation effectiveness, with successful implementations driving broader adoption across industrial zones. Domestic manufacturers are developing production capabilities for nanoscale zero-valent iron materials, benefiting from local supply chains, cost advantages, and proximity to application sites. Research institutions and universities are collaborating with environmental companies to optimize synthesis methods, improve particle stability, and develop application protocols suited to Chinese geological conditions and contamination profiles. The focus on green remediation approaches and minimizing secondary environmental impacts aligns with broader sustainability goals, supporting adoption of nanomaterial-based solutions over more disruptive conventional technologies.

Revenue from nanoscale zero-valent iron in India is expanding to reach USD 0.2 million by 2035, supported by growing environmental awareness and regulatory pressure addressing industrial contamination creating emerging demand for innovative remediation technologies. The country's expanding industrial sector and increasing environmental compliance requirements are driving interest in advanced treatment methods for addressing groundwater contamination from industrial operations, particularly in manufacturing clusters and chemical processing zones. State pollution control boards are implementing stricter enforcement of environmental regulations, creating incentives for industries to adopt effective remediation technologies for historical contamination issues.

Research institutions are conducting studies on nanoscale zero-valent iron applications adapted to Indian conditions including high temperatures, varied soil compositions, and specific contaminant profiles typical of local industrial operations. Cost sensitivity remains a significant market characteristic with emphasis on demonstrating economic viability compared to alternative remediation approaches. Technical support and knowledge transfer from international environmental firms is facilitating early adoption, with pilot projects providing performance data and building confidence in nanoparticle-based remediation approaches among Indian environmental consultants and regulatory authorities.

Demand for nanoscale zero-valent iron in Germany is projected to reach USD 4.5 million by 2035, supported by the country's stringent environmental standards and advanced remediation technology sector requiring sophisticated nanomaterial solutions for complex contamination scenarios. German environmental regulations mandate comprehensive site investigations and risk-based remediation approaches, with nanoscale zero-valent iron applications demonstrating compliance with technical requirements and safety standards. The market is characterized by emphasis on thorough characterization, environmental fate studies, and long-term monitoring protocols ensuring responsible nanoparticle deployment.

German environmental engineering firms maintain expertise in advanced remediation technologies, with established capabilities for nanoparticle application including injection system design, distribution modeling, and performance verification. Research institutions and technology providers collaborate on developing next-generation formulations with enhanced stability, controlled reactivity, and improved environmental compatibility. Regulatory framework requires comprehensive risk assessments addressing potential nanoparticle impacts on soil microbiomes, groundwater quality, and human health, creating thorough approval processes that favor well-characterized products with extensive safety documentation. The focus on sustainable remediation and lifecycle assessment drives adoption of technologies demonstrating superior environmental profiles compared to energy-intensive alternatives.

Revenue from nanoscale zero-valent iron in Brazil is growing to reach USD 4.6 million by 2035, driven by industrial contamination legacy and regulatory requirements for site cleanup creating opportunities for advanced remediation technologies across petroleum facilities, chemical plants, and manufacturing sites. The country's oil and gas sector and historical industrial operations have created significant subsurface contamination requiring treatment, with conventional remediation approaches often proving cost-prohibitive or technically challenging. State environmental agencies are implementing contaminated site management programs, establishing registries of affected properties and requiring responsible parties to develop and implement cleanup plans.

Nanoscale zero-valent iron is gaining recognition as a viable technology for treating chlorinated solvent contamination and petroleum hydrocarbons in challenging geological conditions including clayey soils and heterogeneous subsurface environments. Environmental consulting firms are building technical capabilities for nanoparticle applications, supported by international technology providers offering training, technical support, and product supply. Economic considerations favor remediation approaches demonstrating shorter treatment timeframes and reduced long-term monitoring requirements compared to natural attenuation strategies. Challenges include limited local manufacturing capacity requiring imports and the need for adaptation of application protocols to tropical climate conditions and local subsurface characteristics.

Revenue from nanoscale zero-valent iron in United States is projected to reach USD 4.9 million by 2035, supported by mature environmental remediation industry and extensive contaminated site inventory creating sustained demand for innovative treatment technologies. The country's Superfund program, state voluntary cleanup initiatives, and private sector remediation activities provide diverse market opportunities for nanoscale zero-valent iron applications. Decades of industrial activity have created widespread groundwater contamination from chlorinated solvents, heavy metals, and other persistent pollutants, with thousands of sites requiring ongoing treatment or active remediation.

Environmental consulting firms and remediation contractors have accumulated substantial experience with nanoparticle applications, developing best practices for site characterization, injection system design, and performance monitoring. Regulatory acceptance has evolved through successful project demonstrations and comprehensive environmental fate studies addressing initial concerns regarding nanoparticle deployment. The USA Environmental Protection Agency and state agencies have established guidance documents for nanoparticle remediation, providing framework for project approvals and monitoring requirements. Market maturity brings focus on optimizing cost-effectiveness, improving longevity of treatment zones, and addressing challenging contaminants including 1,4-dioxane and emerging per- and polyfluoroalkyl substances where nanoscale zero-valent iron shows promising treatment capabilities.

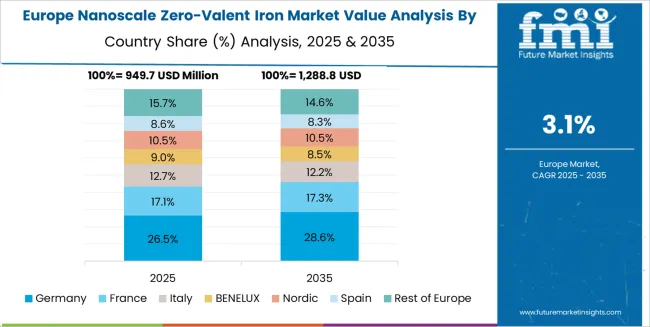

The nanoscale zero-valent iron market in Europe is projected to grow from USD 3.6 million in 2025 to USD 4.8 million by 2035, registering a CAGR of 2.9% over the forecast period. Germany is expected to maintain its leadership position with a 34.7% market share in 2025, projected to reach 35.2% by 2035, supported by its stringent environmental regulations and comprehensive contaminated site management programs addressing industrial legacy pollution.

The United Kingdom follows with a 28.3% share in 2025, anticipated to stabilize at 28.1% by 2035, driven by ongoing remediation projects at former industrial sites and military installations. France holds a 19.4% share, while Netherlands accounts for 12.8% in 2025, reflecting active contaminated land management programs and technical expertise in advanced remediation technologies. The Rest of Europe region is projected to maintain approximately 4.8% collectively through 2035, with Nordic countries, Belgium, and Eastern European nations implementing nanoparticle-based remediation as environmental regulations strengthen and contaminated site inventories expand.

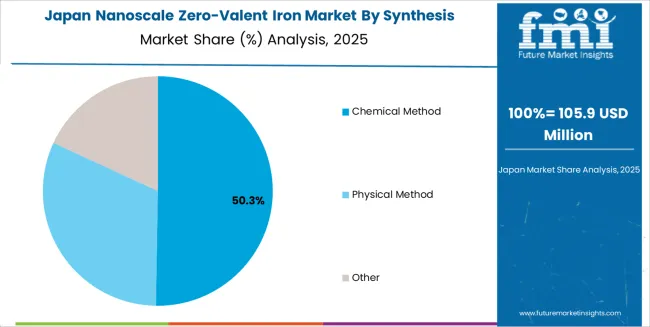

Japanese nanoscale zero-valent iron operations reflect the country's emphasis on environmental safety and rigorous technology validation. Environmental authorities and remediation practitioners maintain comprehensive evaluation protocols for nanomaterial applications, requiring extensive laboratory testing, pilot-scale demonstrations, and long-term monitoring data before approving full-scale deployments. This creates extended project timelines but ensures thorough risk assessment and stakeholder confidence. The Japanese market demonstrates unique requirements for nanoparticle formulations adapted to local geological conditions including volcanic soils, high groundwater tables, and seismic considerations affecting subsurface injection strategies.

Regulatory oversight through the Ministry of the Environment emphasizes precautionary approaches with requirements for comprehensive fate and transport studies, ecotoxicological assessments, and contingency plans for managing unintended nanoparticle migration. Environmental consulting firms and research institutions maintain collaborative relationships, conducting joint studies on nanoparticle behavior in Japanese subsurface conditions and developing application protocols suitable for local site characteristics. The focus on minimizing environmental disruption drives interest in nanoscale zero-valent iron for in-situ treatment, particularly at sites where excavation would be disruptive or economically prohibitive. Technical emphasis includes development of monitoring techniques for tracking nanoparticle distribution, verifying treatment effectiveness, and documenting long-term stability of remediated zones.

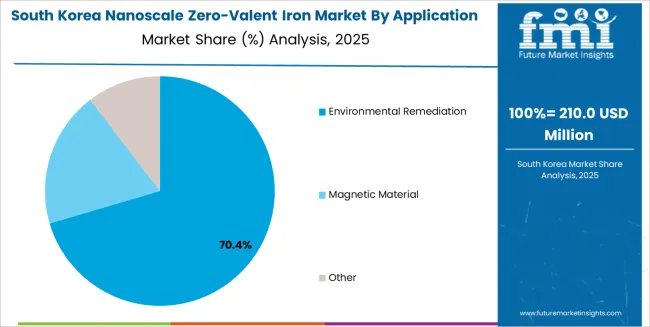

South Korean nanoscale zero-valent iron operations reflect the country's growing environmental awareness and industrial contamination legacy from rapid industrialization. The Ministry of Environment has established contaminated soil management framework requiring systematic site investigation and risk-based remediation approaches. Nanoscale zero-valent iron applications are gaining recognition as viable technologies for treating chlorinated solvents and heavy metals at industrial sites, particularly in cases where conventional methods prove technically or economically challenging.

Korean environmental engineering firms are building technical capabilities through collaboration with international technology providers, implementing pilot projects that demonstrate nanoparticle effectiveness in local conditions. Research institutions including Korea Institute of Science and Technology and environmental research centers conduct fundamental studies on nanoparticle synthesis, characterization, and environmental interactions. Regulatory framework emphasizes environmental safety with requirements for comprehensive risk assessments addressing potential impacts on soil ecosystems, groundwater quality, and public health.

This creates thorough approval processes favoring well-documented technologies with international track records. Market development faces challenges including limited local manufacturing capacity, reliance on imported materials, and need for building practitioner expertise in nanoparticle application techniques. However, government support for green technologies and increasing corporate environmental responsibility commitments are supporting market expansion as nanoscale zero-valent iron demonstrates cost-effectiveness and technical performance in Korean remediation projects.

The nanoscale zero-valent iron market demonstrates concentration among specialized nanomaterial producers and environmental technology companies. Profit focus centers on application-specific formulations, technical support services, and integrated remediation solutions rather than commodity nanoparticle sales. Value migration favors companies demonstrating successful project track records, regulatory approval experience, and comprehensive technical capabilities spanning synthesis, characterization, and field application support. Several competitive archetypes define market dynamics: specialized nanomaterial manufacturers focusing on production optimization and product quality control; environmental remediation companies integrating nanoparticle production with application services; research-based organizations commercializing proprietary synthesis methods and formulations; and distributors connecting manufacturers with environmental consultants and remediation contractors.

Market barriers include technical expertise requirements for synthesis and quality control, regulatory knowledge for navigating environmental approvals, and field application experience necessary for successful project implementation. Competition centers on demonstrating superior nanoparticle characteristics including reactivity, stability, and mobility properties that translate to better field performance and cost-effectiveness. Differentiation strategies emphasize proprietary stabilization techniques, customized formulations for specific contaminant types, and comprehensive technical support including site characterization assistance, injection system design, and performance monitoring protocols. Market dynamics favor established players with proven project portfolios and regulatory acceptance, creating challenges for new entrants lacking field demonstration data and stakeholder relationships.

Innovation opportunities exist in developing next-generation formulations addressing current limitations including particle aggregation, limited treatment zone persistence, and challenges treating complex contaminant mixtures. Strategic partnerships between nanomaterial producers and environmental engineering firms are common, combining production capabilities with application expertise and market access. The modest market size limits pure-play participants, with most companies maintaining diversified portfolios across environmental technologies or nanomaterials serving multiple applications.

| Items | Values |

|---|---|

| Quantitative Units | USD 3.9 million |

| Synthesis Method | Chemical Method, Physical Method, Other |

| Application | Environmental Remediation, Magnetic Material, Other |

| Regions Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan |

| Key Companies Profiled | NANOIRON, Reade Advanced Materials, GeoNano Environ. Tech, Zhejiang Yamei Nano Technology, Redox, Hongwu International Group |

| Additional Attributes | Dollar sales by synthesis method and application, regional demand across key markets, competitive landscape, remediation technology adoption patterns, nanoparticle characterization requirements, and environmental fate research driving contaminated site cleanup, groundwater protection, and sustainable remediation practices |

The global nanoscale zero-valent iron market is estimated to be valued at USD 3.9 million in 2025.

The market size for the nanoscale zero-valent iron market is projected to reach USD 5.4 million by 2035.

The nanoscale zero-valent iron market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in nanoscale zero-valent iron market are chemical method, physical method and other.

In terms of application, environmental remediation segment to command 68.4% share in the nanoscale zero-valent iron market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nanoscale Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Nanoscale Chemicals Market Growth - Trends & Forecast 2025 to 2035

Iron and Steel Counterweight Market Size and Share Forecast Outlook 2025 to 2035

Iron and Steel Casting Market Size and Share Forecast Outlook 2025 to 2035

Iron Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Ironing Table Market Size and Share Forecast Outlook 2025 to 2035

Iron Powder Market - Trends & Forecast 2025 to 2035

Iron Oxide Market Report - Growth, Demand & Forecast 2025 to 2035

Iron Ore Pellets Market Growth - Trends & Forecast 2025 to 2035

Environmentally Friendly RPET Webbing Market Size and Share Forecast Outlook 2025 to 2035

Environment Health and Safety Market Size and Share Forecast Outlook 2025 to 2035

Environmental Radiation Monitor Market Size and Share Forecast Outlook 2025 to 2035

Environmental Test Chambers Market Size and Share Forecast Outlook 2025 to 2035

Environmental Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Environmental Sensor Market Size and Share Forecast Outlook 2025 to 2035

Environmental Test Equipment Market Growth - Trends & Forecast 2025 to 2035

Environment Testing, Inspection and Certification Market Report – Demand, Growth & Industry Outlook 2025 to 2035

Environmental Remediation Technology Market - Size, Share & Forecast 2025 to 2035

Environmental Catalysts Market Trends & Growth 2025 to 2035

Environmental Monitoring Market Report – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA