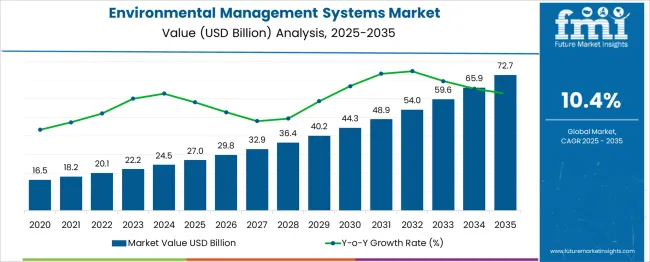

The global environmental management systems market is anticipated to grow from USD 27 billion in 2025 to approximately USD 72.7 billion by 2035, recording an absolute increase of USD 45.7 billion over the forecast period. This translates into a total growth of 169.3%, with the market forecast to expand at CAGR of 10.4% between 2025 and 2035. Market size is expected to grow by nearly 2.69X during the same period, supported by increasing regulatory compliance requirements, rising environmental awareness among enterprises, and growing adoption of digital transformation initiatives across industries.

Between 2025 and 2030, the environmental management systems market is projected to expand from USD 27 billion to USD 44.3 billion, resulting in a value increase of USD 17.3 billion, which represents 37.9% of the total forecast growth for the decade. This phase of growth will be shaped by rising corporate eco-efficiency initiatives, increasing government regulations for environmental compliance, and growing penetration of cloud-based EMS solutions in emerging markets. Technology companies are expanding their environmental management portfolios to address the growing demand for integrated eco-efficiency and compliance solutions.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 27 billion |

| Forecast Value in (2035F) | USD 72.7 billion |

| Forecast CAGR (2025 to 2035) | 10.4% |

From 2030 to 2035, the market is forecast to grow from USD 44.3 billion to USD 72.7 billion, adding another USD 28.4 billion, which constitutes 62.1% of the overall ten-year expansion. This period is expected to be characterized by expansion of artificial intelligence and machine learning integration, development of IoT-enabled environmental monitoring systems, and advancement of predictive analytics capabilities. The growing adoption of ESG reporting standards and carbon neutrality commitments will drive demand for comprehensive environmental management platforms with enhanced data analytics and real-time monitoring capabilities.

Between 2020 and 2025, the environmental management systems market experienced robust expansion, driven by increasing focus on eco-efficiency reporting and growing awareness of environmental risks. The market developed as organizations recognized the need for systematic approaches to environmental compliance and risk management. Digital transformation trends and remote monitoring requirements accelerated during the COVID-19 pandemic, emphasizing the importance of cloud-based EMS solutions for maintaining operational continuity and regulatory compliance.

Market expansion is being supported by the increasing regulatory pressure for environmental compliance and the corresponding demand for comprehensive environmental monitoring and reporting solutions. Modern enterprises are increasingly focused on sustainable business practices that can reduce environmental impact, ensure regulatory compliance, and enhance operational efficiency. Environmental Management Systems' proven efficacy in streamlining compliance processes and supporting eco-efficiency initiatives makes them essential tools for organizations across various industries.

The growing emphasis on ESG (Environmental, Social, and Governance) reporting and corporate eco-efficiency commitments is driving demand for integrated EMS solutions that can provide comprehensive environmental data management and reporting capabilities. Organizations' preference for cloud-based platforms that offer scalability, real-time monitoring, and advanced analytics is creating opportunities for innovative solutions. The rising influence of stakeholder expectations and investor requirements for environmental transparency is also contributing to increased adoption across different industry sectors and organizational sizes.

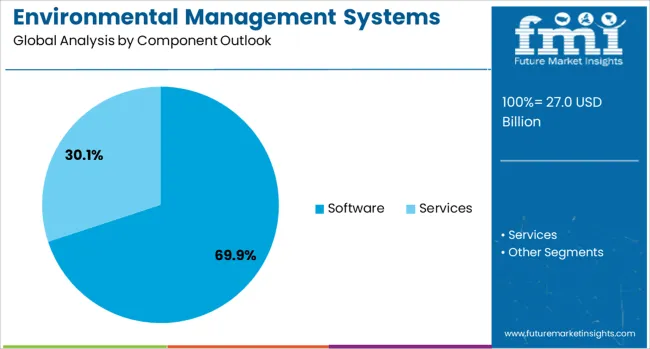

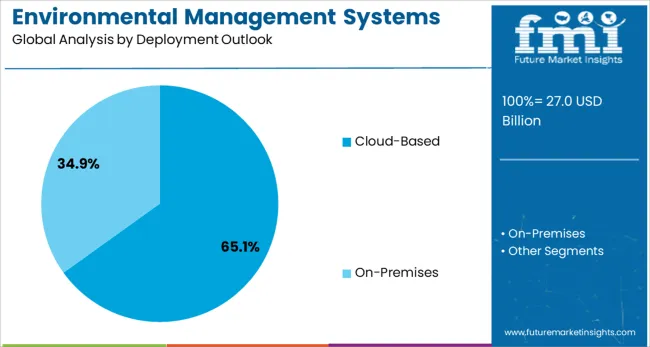

The market is segmented by component, deployment, enterprise size, end-use, and region. By component, the market is divided into software and services. Based on deployment, the market is categorized into cloud-based and on-premises solutions. In terms of enterprise size, the market is segmented into large enterprises and small and medium enterprises (SMEs). By end-use industry, the market is classified into manufacturing, construction, energy and utilities, chemicals, automotive, pharmaceuticals, food and beverage, government and public sector, and others. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The software component is projected to account for 69.9% of the environmental management systems market in 2025, reaffirming its position as the category's core offering. Organizations increasingly understand the importance of integrated software platforms that can manage environmental data, automate compliance reporting, and provide real-time monitoring capabilities. Software solutions directly address these requirements by offering comprehensive functionality for environmental risk assessment, regulatory compliance management, and eco-efficiency reporting.

This component forms the foundation of most EMS implementations, as it represents the most critical and feature-rich element of environmental management platforms. Vendor innovations and ongoing technological advancements continue to enhance software capabilities with AI-powered analytics, predictive modeling, and automated compliance workflows. With organizations seeking comprehensive solutions that can integrate with existing enterprise systems, software components align with both operational efficiency and regulatory compliance goals. Their broad applicability across industries ensures sustained dominance, making them the central growth driver of Environmental Management Systems demand.

Cloud-based deployment is projected to represent 65.1% of environmental management systems demand in 2025, underscoring its role as the preferred deployment model for scalable environmental management solutions. Organizations gravitate toward cloud-based systems for their flexibility, cost-effectiveness, and ability to provide real-time access to environmental data from multiple locations. Positioned as modern, efficient solutions, cloud-based EMS offer both operational benefits, such as reduced IT infrastructure costs, and strategic advantages, including enhanced collaboration and data accessibility.

The segment is supported by the growing trend of digital transformation initiatives, where cloud platforms play a central role in modernizing environmental management processes. Additionally, vendors are increasingly offering cloud-native solutions with advanced features like IoT integration, mobile accessibility, and automatic updates, enhancing appeal and providing better return on investment. As organizations prioritize agility and scalability in their technology investments, cloud-based Environmental Management Systems will continue to dominate deployment preferences, reinforcing their position as the preferred platform within the environmental management market.

The large enterprises segment is forecasted to contribute 68.4% of the environmental management systems market in 2025, reflecting the complex environmental management requirements and regulatory compliance obligations of large organizations. Large enterprises face more stringent environmental regulations, have multiple facility locations, and require comprehensive reporting capabilities that sophisticated EMS solutions can provide. This aligns with their need for enterprise-grade platforms that can handle large volumes of environmental data and support complex organizational structures.

Compliance requirements and stakeholder expectations provide additional justification for large enterprises to invest in comprehensive EMS solutions, reassuring decision-makers about the strategic value and operational benefits. The segment also benefits from large organizations' willingness to invest in advanced environmental management technologies that can provide competitive advantages through improved eco-efficiency performance and risk management. With increasing focus on corporate environmental responsibility and ESG reporting requirements, large enterprises serve as primary drivers of growth and innovation in the Environmental Management Systems category.

The manufacturing industry is projected to represent 28.6% of environmental management systems demand in 2025, demonstrating its position as the largest end-use sector for environmental management solutions. Manufacturing operations generate significant environmental impacts through resource consumption, waste production, and emissions, requiring comprehensive monitoring and management systems. EMS solutions directly address these challenges by providing tools for environmental performance tracking, regulatory compliance, and eco-efficiency reporting.

The segment benefits from increasing regulatory pressure on manufacturing companies to reduce their environmental footprint and comply with various environmental standards and regulations. Manufacturing organizations also face growing pressure from customers and stakeholders to demonstrate environmental responsibility, making EMS solutions essential for maintaining competitive positioning. With ongoing trends toward sustainable manufacturing practices and circular economy principles, the manufacturing sector will continue to drive significant demand for Environmental Management Systems, supporting market growth and technological advancement.

The environmental management systems market is advancing rapidly due to increasing regulatory compliance requirements and growing corporate focus on eco-efficiency initiatives. However, the market faces challenges including high implementation costs, complexity of system integration, and varying regulatory requirements across different regions. Innovation in cloud technologies, artificial intelligence integration, and IoT connectivity continue to influence product development and market expansion patterns.

The growing adoption of stringent environmental regulations and ESG reporting standards is driving organizations to implement comprehensive environmental management systems. Regulatory bodies worldwide are introducing more detailed environmental compliance requirements, creating demand for sophisticated monitoring and reporting capabilities. ESG investment criteria and stakeholder expectations are influencing corporate decision-making, particularly among publicly traded companies seeking to demonstrate environmental responsibility.

Modern EMS providers are incorporating advanced technologies such as artificial intelligence, machine learning, and Internet of Things (IoT) sensors to enhance environmental monitoring and predictive analytics capabilities. These technologies improve the accuracy of environmental data collection while enabling proactive risk management and automated compliance reporting. Advanced analytics and real-time monitoring capabilities provide organizations with better insights into their environmental performance and enable more effective decision-making.

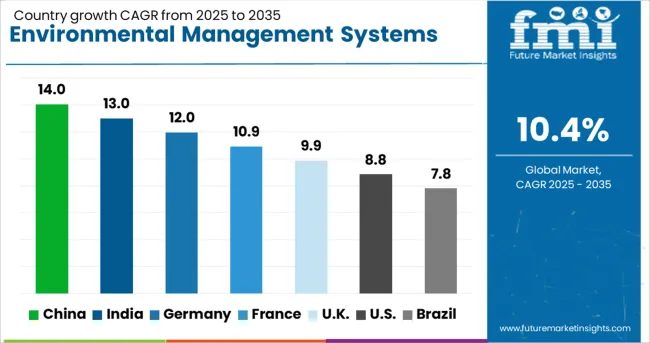

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 14% |

| India | 13% |

| Germany | 12% |

| France | 10.9% |

| UK | 9.9% |

| USA | 8.8% |

The environmental management systems market is experiencing robust growth globally, with China leading at a 14% CAGR through 2035, driven by aggressive environmental policies, carbon neutrality commitments, and massive industrial modernization initiatives. India follows closely at 13%, supported by rapid industrial growth, increasing environmental regulations, and growing corporate eco-efficiency awareness. Germany shows strong growth at 12%, emphasizing advanced manufacturing technologies and stringent environmental compliance requirements. France records 10.9%, focusing on green technology adoption and EU regulatory compliance. The UK shows 9.9% growth, prioritizing post-Brexit environmental standards and corporate eco-efficiency initiatives.

The report covers an in-depth analysis of 40+ countries; six top-performing countries are highlighted below.

Revenue from Environmental Management Systems in China is projected to exhibit exceptional growth with a CAGR of 14% through 2035, driven by the government's carbon neutrality commitment by 2060 and comprehensive environmental protection regulations. The country's massive manufacturing sector and ongoing industrial modernization are creating significant demand for advanced environmental management solutions. Major domestic and international technology providers are establishing comprehensive service networks to serve the growing population of environmentally conscious enterprises across tier-1 and tier-2 cities.

Revenue from Environmental Management Systems in India is expanding at a CAGR of 13%, supported by rapid industrial development, increasing environmental awareness, and growing regulatory compliance requirements. The country's expanding manufacturing sector and rising corporate eco-efficiency commitments are driving demand for comprehensive environmental management solutions. International technology providers and domestic software companies are establishing distribution channels to serve the growing demand for environmental compliance and eco-efficiency reporting tools.

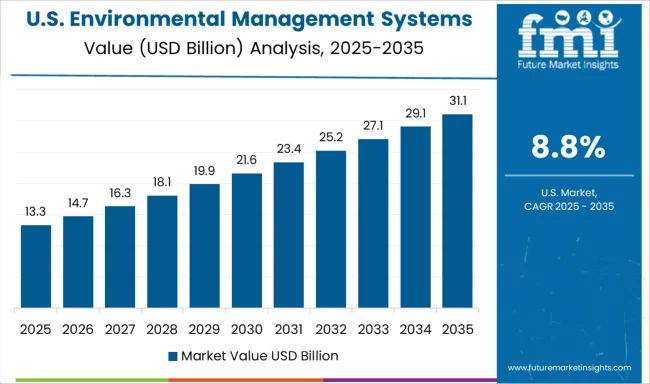

Demand for Environmental Management Systems in the USA is projected to grow at a CAGR of 8.8%, supported by mature regulatory framework, corporate eco-efficiency initiatives, and advanced technology adoption. American organizations are increasingly focused on integrated environmental management platforms that can support complex compliance requirements and ESG reporting standards. The market is characterized by strong demand for cloud-based solutions that combine environmental monitoring with advanced analytics and predictive capabilities.

Revenue from Environmental Management Systems in Germany is projected to grow at a CAGR of 12% through 2035, driven by the country's strong environmental regulations, advanced manufacturing sector, and commitment to Industry 4.0 initiatives. German organizations consistently demand high-quality, comprehensive solutions that can support complex environmental compliance requirements while enhancing operational efficiency.

Revenue from Environmental Management Systems in the UK is projected to grow at a CAGR of 9.9% through 2035, supported by post-Brexit environmental standards, corporate eco-efficiency commitments, and growing focus on net-zero emissions targets. British organizations value comprehensive environmental management platforms that can support complex regulatory compliance and eco-efficiency reporting requirements.

Revenue from Environmental Management Systems in France is projected to grow at a CAGR of 10.9% through 2035, supported by EU environmental regulations, corporate eco-efficiency initiatives, and growing focus on green technology adoption. French organizations prioritize comprehensive environmental management solutions that can support regulatory compliance while enhancing operational eco-efficiency performance.

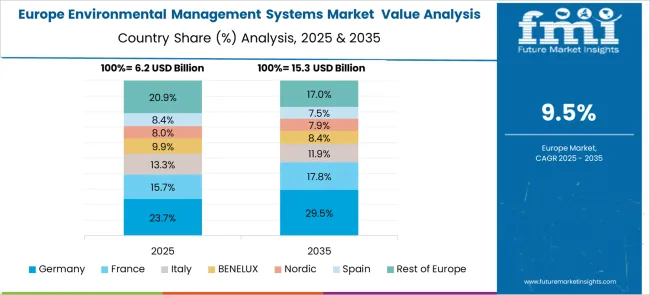

The European Environmental Management Systems market demonstrates sophisticated development across major economies with Germany leading through its precision environmental technology excellence and advanced regulatory compliance capabilities, supported by companies like SAP SE pioneering comprehensive EMS solutions with focus on software platforms, cloud-based deployment, and manufacturing applications while emphasizing regulatory adherence and eco-efficiency reporting. The UK shows strength in post-Brexit environmental standards and corporate eco-efficiency initiatives, with companies specializing in advanced environmental management technologies that meet strict compliance requirements and provide consistent performance outcomes.

France contributes through companies delivering integrated environmental management solutions and EU regulatory leadership for comprehensive industrial applications. Italy and Spain demonstrate growth in specialized EMS formulations for manufacturing and energy sectors. The market benefits from stringent EU environmental regulations, established technology infrastructure, and growing emphasis on ESG reporting standards positioning Europe as key center for advanced environmental management technologies.

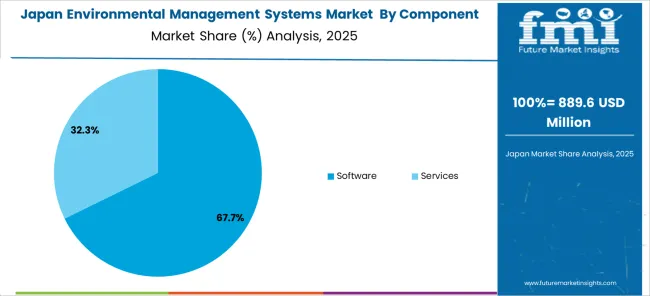

The Japanese Environmental Management Systems market demonstrates steady growth driven by precision technology focus, advanced environmental management capabilities, and enterprise preference for high-quality EMS platforms ensuring superior compliance and eco-efficiency performance throughout industrial operations. International companies establish presence through cutting-edge environmental technologies aligning with Japan's sophisticated manufacturing industry and stringent quality standards while incorporating AI integration and IoT monitoring capabilities.

The market emphasizes automated environmental monitoring systems, precision compliance excellence, and advanced eco-efficiency innovations reflecting Japanese technology precision and attention to detail in environmental management processes. Growing investment in digital transformation supports intelligent EMS platforms with real-time monitoring, predictive analytics, and optimized environmental performance. Japanese enterprises prioritize system reliability, consistent compliance outcomes, and regulatory adherence, creating opportunities for premium environmental management solutions delivering exceptional performance across manufacturing, energy, and industrial applications requiring highest quality standards.

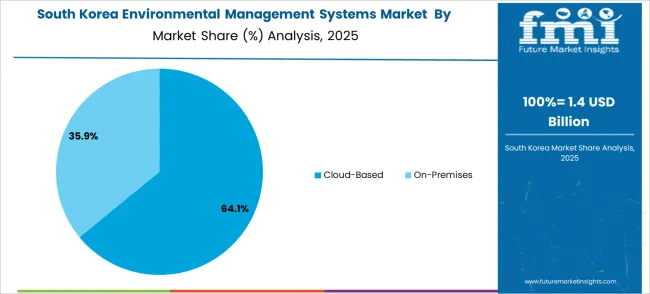

The South Korean Environmental Management Systems market shows exceptional growth potential driven by expanding industrial infrastructure, increasing adoption of digital environmental technologies, and growing corporate eco-efficiency awareness requiring efficient and comprehensive EMS solutions. The market benefits from South Korea's technological advancement capabilities and increasing focus on environmental competitiveness driving investment in modern environmental management technologies meeting international compliance standards and regulatory requirements.

Korean enterprises increasingly adopt cloud-based EMS platforms, advanced environmental monitoring systems, and integrated eco-efficiency technologies improving compliance efficiency and environmental performance while ensuring regulatory adherence. Growing influence of Korean technology companies in global markets supports demand for sophisticated environmental management solutions ensuring regulatory excellence while maintaining cost-effectiveness. Integration of Industry 4.0 principles and smart environmental technologies creates opportunities for intelligent EMS systems with IoT connectivity, predictive capabilities, and real-time environmental optimization across diverse industrial applications.

The environmental management systems market is characterized by competition among established enterprise software providers, specialized environmental technology companies, and emerging cloud-based solution providers. Companies are investing in advanced analytics capabilities, cloud platform development, artificial intelligence integration, and industry-specific customization to deliver comprehensive, scalable, and user-friendly environmental management solutions. Technology innovation, regulatory expertise, and customer success are central to strengthening market position and expanding customer base.

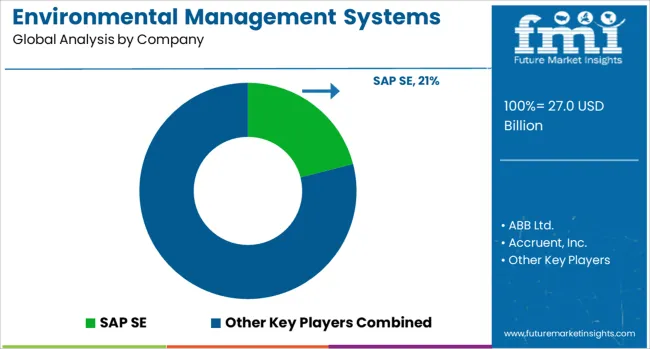

SAP SE, Germany-based, leads the market with 21.0% global value share, offering comprehensive enterprise environmental management solutions with integrated ERP functionality and advanced analytics capabilities. IBM Corporation provides cloud-based environmental management platforms with artificial intelligence and IoT integration capabilities. Intelex Technologies Inc. delivers specialized environmental management software with focus on regulatory compliance and risk management. Bentley Systems, Incorporated focuses on infrastructure and environmental management solutions for engineering and construction industries.

ABB Ltd. and Dassault Systèmes SE, operating globally, provide integrated environmental management solutions across multiple industrial sectors and deployment models. Accruent Inc. emphasizes facility and environmental management with comprehensive asset management integration. IFS AB offers enterprise software solutions with environmental management modules for manufacturing and industrial organizations. Wolters Kluwer N.V. and UL LLC provide specialized compliance and regulatory expertise with technology-enabled environmental management platforms.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 27 billion |

| Component | Software, Services |

| Deployment | Cloud-Based, On-Premises |

| Enterprise Size | Large Enterprises, Small and Medium Enterprises |

| End Use | Manufacturing, Construction, Energy and Utilities, Chemicals, Automotive, Pharmaceuticals, Food and Beverage, Government & Public Sector, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | SAP SE, ABB Ltd., Accruent Inc., Bentley Systems, Incorporated, Dassault Systèmes SE, Enviance Inc. (Cority), IBM Corporation, Intelex Technologies Inc., IFS AB, IsoMetrix Pty Ltd., Sphera Solutions Inc., Tetra Tech Inc., UL LLC, VelocityEHS, Wolters Kluwer N.V. |

| Additional Attributes | Revenue analysis by deployment model and enterprise size, regional adoption trends, competitive landscape analysis, customer preferences for cloud versus on-premises solutions, integration with ESG reporting frameworks, innovations in AI-powered analytics, IoT integration capabilities, and regulatory compliance automation |

The global environmental management systems market is estimated to be valued at USD 27.0 billion in 2025.

The market size for the environmental management systems market is projected to reach USD 72.7 billion by 2035.

The environmental management systems market is expected to grow at a 10.4% CAGR between 2025 and 2035.

The key product types in environmental management systems market are software and services.

In terms of deployment outlook, cloud-based segment to command 65.1% share in the environmental management systems market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Environmentally Friendly RPET Webbing Market Size and Share Forecast Outlook 2025 to 2035

Environmental Radiation Monitor Market Size and Share Forecast Outlook 2025 to 2035

Environmental Test Chambers Market Size and Share Forecast Outlook 2025 to 2035

Environmental Sensor Market Size and Share Forecast Outlook 2025 to 2035

Environmental Test Equipment Market Growth - Trends & Forecast 2025 to 2035

Environmental Remediation Technology Market - Size, Share & Forecast 2025 to 2035

Environmental Catalysts Market Trends & Growth 2025 to 2035

Environmental Monitoring Market Report – Trends & Forecast 2024-2034

AI In Environmental Sustainability Market Size and Share Forecast Outlook 2025 to 2035

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

Key Management as a Service Market

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Risk Management Market Size and Share Forecast Outlook 2025 to 2035

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Pain Management Devices Market Growth - Trends & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA