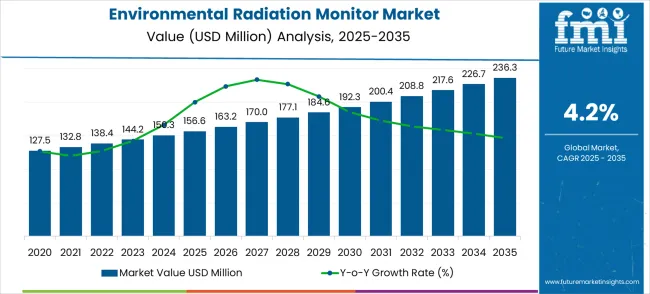

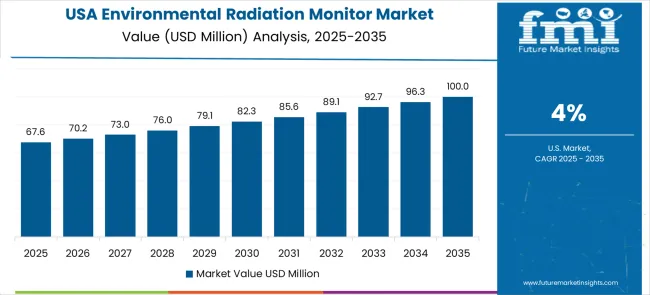

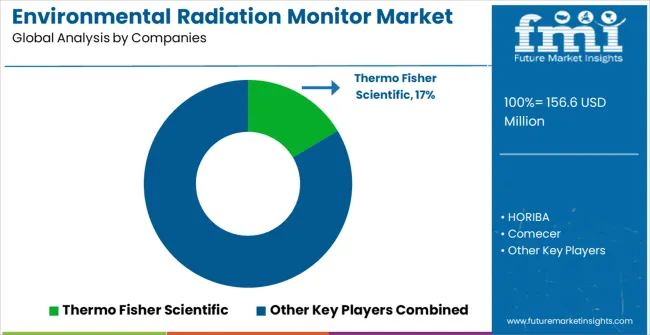

The environmental radiation monitor market is anticipated to expand from USD 156.6 million in 2025 to USD 236.3 million by 2035, reflecting steady growth over the decade. Analyzing the 10-year growth trajectory highlights the differences between early- and late-stage market dynamics. In the first half of the period, from 2025 to 2030, growth is largely driven by adoption in nuclear power plants, industrial facilities, and environmental monitoring initiatives. Increasing awareness about radiation safety, along with government mandates and compliance requirements, encourages the deployment of advanced monitoring systems. This early phase establishes a strong foundation for the market, with moderate but consistent gains that shape the growth curve.

From 2030 to 2035, expansion accelerates as stricter environmental regulations, rising industrialization in emerging regions, and investments in safety infrastructure drive higher adoption rates. Technological improvements such as enhanced sensitivity, real-time data analytics, and integration with smart monitoring platforms contribute to the later-stage growth. The 10-year comparison illustrates a transition from foundational adoption to broader market penetration, with early growth building awareness and infrastructure, while the latter phase benefits from regulatory pressures, regional expansion, and technological upgrades. This pattern indicates a market characterized by steady, cumulative gains with periods of stronger uptake aligning with policy and technology developments.

The environmental radiation monitor market serves nuclear power plants (36%), research laboratories and academic institutions (25%), healthcare facilities including radiology centers (17%), industrial and manufacturing sectors handling radioactive materials (12%), and specialty applications such as environmental agencies and emergency response units (10%). Nuclear power plants lead demand due to continuous monitoring requirements for occupational safety and regulatory compliance. Research labs and academic institutions utilize monitors for experiments involving radioactive isotopes. Healthcare facilities rely on them to ensure safe radiological procedures, while industrial applications employ radiation monitoring to protect workers and equipment. Specialty agencies use monitors for environmental surveillance, contamination detection, and rapid response to incidents.

Emerging trends include integration of wireless connectivity, real-time data analytics, and compact portable systems for enhanced deployment flexibility. Manufacturers are innovating with high-sensitivity detectors, low-power designs, and multi-radiation type detection capabilities. Growing adoption in urban monitoring, nuclear site expansion, and environmental protection programs is driving market growth. Partnerships between device producers and regulatory bodies are enabling customized, accurate, and reliable monitoring solutions, reinforcing safety, operational efficiency, and regulatory compliance globally.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 156.6 million |

| Forecast Value in (2035F) | USD 236.3 million |

| Forecast CAGR (2025 to 2035) | 4.2% |

Market expansion is being supported by the increasing number of nuclear power facilities worldwide and the corresponding need for continuous environmental radiation monitoring to ensure public safety and regulatory compliance. Modern nuclear operations require sophisticated monitoring systems that can detect radiation levels across large geographical areas and provide real-time alerts for any anomalous readings. The growing prioritize on environmental protection and nuclear safety regulations mandates comprehensive monitoring networks that can track radiation dispersal patterns and assess potential environmental impact.

The expanding use of radioactive materials in medical applications, industrial processes, and research facilities creates demand for specialized monitoring equipment that can detect various radiation types and energy levels. Environmental monitoring agencies require advanced detection systems capable of measuring background radiation, identifying radioactive contamination, and tracking radiation source movements across diverse environmental conditions. The rising awareness of radiation health effects and environmental contamination risks drives demand for reliable monitoring solutions that provide accurate measurement and long-term data collection capabilities.

The market is segmented by product type, application, and region. By product type, the market is divided into fixed monitors, portable monitors, and personal dosimeters. By application, the market is categorized into environmental protection, nuclear power plants, healthcare facilities, and other industrial applications. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

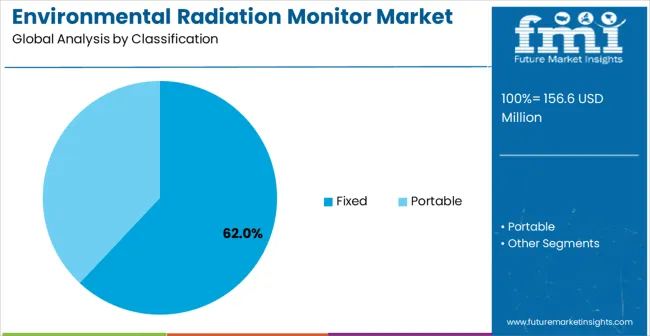

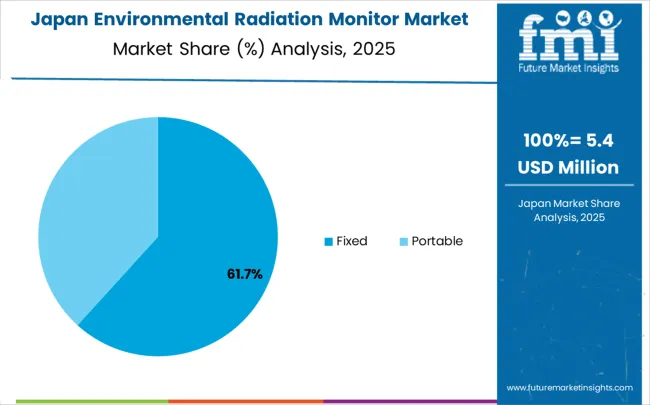

Fixed environmental radiation monitors are anticipated to account for 62% of the environmental radiation monitor market in 2025, establishing market leadership through their capability to provide continuous, unattended monitoring of radiation levels across large geographical areas. This leading share reflects the widespread deployment of permanent monitoring networks around nuclear facilities, urban centers, and environmental monitoring stations that require 24-hour surveillance capabilities. Fixed monitors provide reliable, long-term measurement capabilities with advanced data logging and communication systems that support comprehensive environmental assessment programs.

The segment benefits from government mandates requiring permanent monitoring installations around nuclear facilities and sensitive environmental areas. Fixed monitoring systems offer superior detection sensitivity, weatherproof operation, and integration capabilities with centralized monitoring networks that enable coordinated radiation tracking across multiple locations. These systems provide critical infrastructure for emergency response planning and environmental protection programs that require continuous radiation surveillance capabilities.

Cost advantages emerge from reduced operational requirements compared to portable monitoring programs, as fixed systems eliminate the need for personnel deployment and provide automated data collection with minimal maintenance requirements. The segment maintains technological leadership through continuous advancement in detector technologies, communication systems, and power management solutions that enhance monitoring capability while reducing operational costs. Modern fixed monitors incorporate solar power systems, satellite communication, and advanced analytics that improve monitoring effectiveness across diverse environmental conditions.

Portable environmental radiation monitors represent 28% of the market share in 2025, positioning these devices as essential tools for field measurements, emergency response, and site-specific radiation assessment applications. This substantial market presence reflects growing demand from environmental consultants, emergency response teams, and research organizations that require flexible monitoring capabilities for diverse measurement scenarios. Portable monitors provide immediate radiation measurement capabilities with user-friendly interfaces and rugged construction suitable for field operations across various environmental conditions.

The segment demonstrates strong value proposition through versatility and mobility advantages that enable comprehensive radiation surveys, contamination assessment, and emergency response applications. Professional users favor portable solutions for initial site assessment, contamination mapping, and verification measurements that complement fixed monitoring networks. These devices support regulatory compliance activities, environmental consulting services, and research applications that require precise measurement capabilities in diverse locations.

Strategic market positioning focuses on applications where mobility and immediate results are essential for decision-making processes. The segment benefits from technological advancement in battery technology, detector miniaturization, and wireless connectivity that improve device performance while reducing size and weight constraints. Growth opportunities emerge from expanding environmental consulting services, increased emergency preparedness requirements, and growing demand for radiation safety training programs that utilize portable monitoring equipment for hands-on instruction and field experience applications.

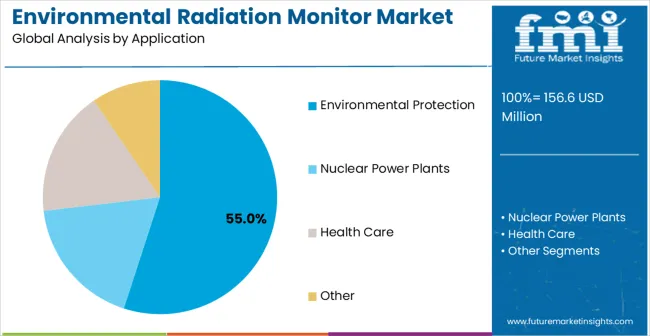

Environmental protection applications dominate the environmental radiation monitor market with a commanding 55% share in 2025, reflecting the critical importance of radiation monitoring in maintaining public safety and environmental health standards. This leading position stems from government regulations requiring comprehensive radiation monitoring around nuclear facilities, industrial sites, and urban areas to detect potential contamination and assess environmental radiation exposure levels. Environmental protection agencies deploy extensive monitoring networks that provide continuous surveillance of background radiation levels and early warning capabilities for radiation release events.

The segment encompasses diverse monitoring applications including air quality assessment, water contamination detection, soil radiation measurement, and vegetation monitoring that require specialized detection capabilities for various radiation types and energy levels. Regulatory compliance drives consistent demand for monitoring equipment that meets strict accuracy and reliability standards for environmental assessment programs. Government agencies and environmental organizations invest in comprehensive monitoring systems that provide long-term data collection capabilities supporting environmental impact assessment and public health protection initiatives.

Growth drivers include increasing environmental awareness, expanding nuclear facility operations, and strengthening regulatory requirements for radiation monitoring in populated areas. Technological advancement in detector sensitivity, data transmission capabilities, and network integration strengthens the value proposition for environmental protection applications. The segment benefits from established relationships with government agencies, environmental consultants, and research institutions that provide stable demand patterns while supporting advanced monitoring technology development and deployment across diverse environmental monitoring applications.

Growth Accelerators

The environmental radiation monitor market advances through multiple accelerating factors that create sustained demand across government, industrial, and research sectors. Primary growth acceleration comes from expanding global nuclear power generation programs and associated regulatory requirements for comprehensive environmental monitoring around nuclear facilities and transportation corridors. Government investment in nuclear energy infrastructure creates substantial demand for sophisticated monitoring systems that provide continuous surveillance of radiation levels with real-time reporting capabilities and emergency response integration. International atomic energy agreements and safety protocols establish standardized monitoring requirements that drive consistent demand for certified radiation detection equipment across diverse geographic regions.

Secondary acceleration emerges from increasing awareness of radiation health effects and environmental contamination risks that drive public demand for transparent radiation monitoring and reporting programs. Growing urbanization around existing nuclear facilities creates population exposure concerns that require enhanced monitoring capabilities and public information systems. Climate change initiatives promoting nuclear energy as clean power source acceleration nuclear facility development programs while simultaneously increasing environmental monitoring requirements to ensure public safety and regulatory compliance across expanding operational areas.

Third-level acceleration develops through technological advancement in detection capabilities, wireless communication systems, and data analytics platforms that enable more comprehensive and cost-effective monitoring network deployment. IoT integration and cloud-based data management systems reduce operational costs while improving monitoring accuracy and response capabilities, making advanced radiation monitoring accessible to broader range of end users including smaller municipalities and industrial facilities that previously relied on limited monitoring capabilities.

Market expansion encounters resistance from high capital costs and technical complexity requirements that limit adoption among smaller end users and developing regions with limited technical infrastructure. Advanced environmental radiation monitoring systems require substantial initial investment in detection equipment, communication infrastructure, and technical support capabilities that may exceed budget constraints for smaller government agencies and industrial facilities. Maintenance and calibration requirements for precision radiation detection equipment create ongoing operational costs that can strain organizational resources, particularly in regions with limited technical support availability and challenging environmental conditions.

Technical limitations including detector sensitivity constraints, environmental interference effects, and power supply requirements in remote locations create operational challenges that may limit monitoring network effectiveness. False alarm incidents and measurement uncertainty issues can reduce confidence in monitoring system reliability, potentially impacting public trust and regulatory compliance effectiveness. Regulatory complexity and varying international standards create market fragmentation that increases compliance costs and limits standardization benefits across different geographic markets and application sectors.

Personnel training requirements and technical expertise needs for operating sophisticated monitoring equipment create human resource constraints that may limit market expansion in regions with limited technical education infrastructure. Rapid technological change cycles can create obsolescence concerns that discourage long-term investment in monitoring equipment, particularly among government agencies with extended procurement cycles and budget approval processes.

The environmental radiation monitor market demonstrates clear evolution toward integrated monitoring networks and intelligent analytics systems that transform traditional radiation measurement into comprehensive environmental intelligence platforms. Advanced data analytics and machine learning integration enable predictive monitoring capabilities and automated anomaly detection that improve response times while reducing false alarm rates. Cloud connectivity facilitates centralized monitoring management and data sharing capabilities that support coordinated emergency response planning and environmental impact assessment across multiple jurisdictions and organizations.

Product development trends focus on modular system architectures that enable customizable monitoring configurations and scalable network deployment while maintaining cost competitiveness across diverse application requirements. Manufacturers increasingly offer software-defined monitoring capabilities that allow post-deployment feature upgrades and functionality expansion through firmware updates and subscription-based service models. Integration with existing emergency management systems, environmental databases, and public information networks creates comprehensive monitoring ecosystems that enhance community safety while supporting advanced research and policy development applications.

Wireless technology advancement and energy-efficient design approaches enable extended deployment capabilities in remote locations while reducing infrastructure requirements and operational costs. Solar power integration and battery management improvements extend monitoring station operational capabilities in areas with limited electrical infrastructure while maintaining measurement accuracy and communication reliability across diverse environmental conditions.

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 4.8% |

| Brazil | 4.4% |

| United States | 4.0% |

| United Kingdom | 3.6% |

| Japan | 3.2% |

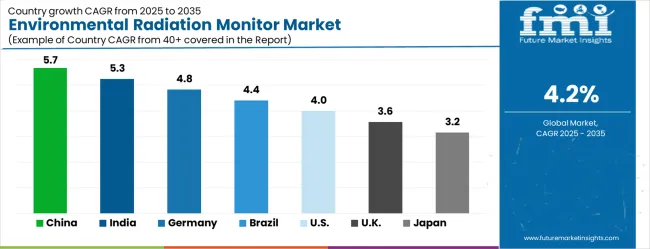

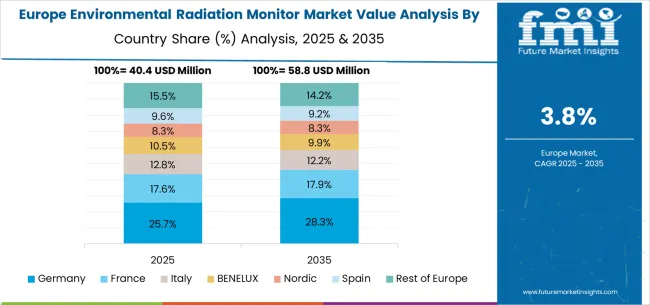

The environmental radiation monitor market is experiencing steady growth globally, with China leading at a 5.7% CAGR through 2035, driven by rapid nuclear power expansion, increasing environmental regulations, and growing industrial radioactive material usage. India follows closely at 5.3%, supported by ambitious nuclear energy programs and expanding healthcare applications requiring radiation monitoring. Germany shows solid growth at 4.8%, prioritizing precision monitoring and environmental safety standards. Brazil records 4.4%, focusing on nuclear facility development and environmental protection initiatives. The United States demonstrates 4.0% growth, prioritizing advanced monitoring technologies and regulatory compliance. The United Kingdom and Japan show 3.6% and 3.2% respectively, focusing on nuclear decommissioning and advanced monitoring system integration.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

The environmental radiation monitors market in China is likely to exhibit the highest growth rate with a CAGR of 5.7% through 2035, driven by rapid expansion of nuclear power generation capacity and comprehensive environmental monitoring requirements across industrial and urban areas. The country's aggressive nuclear energy development program creates substantial demand for sophisticated monitoring systems that provide continuous surveillance around new nuclear facilities and existing operational sites. Major cities including Beijing, Shanghai, Shenzhen, and Guangzhou implement comprehensive radiation monitoring networks that support public safety initiatives and environmental protection programs.

Government policies promoting clean energy development and environmental protection create favorable market conditions for radiation monitoring adoption across both public and private sectors. The expanding nuclear industry requires comprehensive monitoring capabilities that address facility operations, waste management, and transportation safety across diverse geographic regions.

The environmental radiation monitors market in India is anticipated to expand at a CAGR of 5.3%, supported by ambitious nuclear energy development programs and growing awareness of radiation safety requirements across healthcare and industrial applications. The country's nuclear power expansion creates significant demand for comprehensive monitoring systems that address facility operations, environmental impact assessment, and public safety requirements. Major nuclear facility locations including Kudankulam, Tarapur, and Rajasthan require sophisticated monitoring networks that provide continuous environmental surveillance and emergency response capabilities.

The expanding healthcare sector drives substantial demand for radiation monitoring equipment as hospitals, diagnostic centers, and research institutions require specialized detection systems for facility safety and regulatory compliance. Government initiatives promoting nuclear medicine and radiotherapy applications create opportunities for monitoring system deployment across diverse medical facilities. Industrial development programs incorporate radiation monitoring requirements for facilities utilizing radioactive materials in manufacturing, research, and quality control applications.

The environmental radiation monitors market in Germany is projected to reach at a CAGR of 4.8%, supported by the country's focus on environmental protection, nuclear facility safety, and precision measurement technologies. German environmental agencies and nuclear operators implement comprehensive monitoring programs that combine advanced detection systems with sophisticated data analysis capabilities. The nuclear phase-out program creates specific monitoring requirements for decommissioning activities, waste management, and site remediation that require specialized detection equipment and long-term surveillance capabilities.

Environmental protection initiatives focus on comprehensive radiation monitoring as part of broader air quality and public health programs that integrate multiple measurement technologies. Research institutions and universities drive innovation in monitoring technology development, focusing on improved detector sensitivity, wireless communication capabilities, and automated data analysis systems. Industrial applications including medical isotope production, research facilities, and waste management operations require specialized monitoring equipment that meets stringent accuracy and reliability standards.

The environmental radiation monitors market in Brazil is projected to grow at a CAGR of 4.4%, driven by nuclear power facility operations, expanding medical applications, and increasing environmental monitoring requirements across industrial sectors. The country's nuclear power program centered at Angra Nuclear Power Plant requires comprehensive environmental monitoring that addresses facility operations, environmental impact assessment, and emergency response preparedness. Government nuclear energy policies support continued facility development and associated monitoring infrastructure expansion across southeastern regions.

The healthcare sector drives significant demand for radiation monitoring equipment as medical facilities expand nuclear medicine capabilities and radiotherapy services across major metropolitan areas. Mining operations involving radioactive materials require environmental monitoring systems that address workplace safety, environmental protection, and regulatory compliance across diverse geographic regions.

Demand for environmental radiation monitors in the United States is projected to expand at a CAGR of 4.0%, driven by comprehensive nuclear facility operations, advanced healthcare applications, and sophisticated emergency response preparedness programs. The country's extensive nuclear infrastructure requires continuous environmental monitoring that addresses facility safety, environmental protection, and public health across diverse geographic regions. Federal agencies including EPA, NRC, and DOE implement comprehensive monitoring networks that utilize advanced detection technologies and centralized data management systems.

Healthcare sector applications drive substantial demand for radiation monitoring equipment as medical facilities expand nuclear medicine capabilities, research programs, and specialized treatment options. National laboratory systems and research institutions require sophisticated monitoring capabilities that support nuclear research, weapons facility operations, and environmental remediation programs. Industrial applications including isotope production, waste management, and specialized manufacturing create diverse market opportunities for both fixed and portable monitoring systems.

Demand for environmental radiation monitors in the United Kingdom is projected to grow at a CAGR of 3.6%, supported by extensive nuclear decommissioning programs, environmental protection initiatives, and advanced research facility operations. The country's nuclear legacy management program creates substantial demand for specialized monitoring equipment that addresses contamination assessment, remediation progress tracking, and long-term surveillance requirements. Major decommissioning projects at sites including Sellafield, Dounreay, and Windscale require comprehensive monitoring capabilities that support worker safety and environmental protection throughout multi-decade cleanup operations.

Healthcare applications drive continued demand for radiation monitoring systems as NHS facilities and private medical centers expand nuclear medicine capabilities and specialized treatment programs. Research institutions including universities and national laboratories require sophisticated monitoring capabilities that support nuclear research, environmental science programs, and radiation protection training. Environmental agencies implement comprehensive monitoring networks that provide public health protection and environmental assessment capabilities across urban and rural areas.

The environmental radiation monitors market in Japan is projected to grow at a CAGR of 3.2%, reflecting the country's focus on advanced monitoring technologies, comprehensive nuclear safety programs, and sophisticated emergency response capabilities. Japanese nuclear facility operators and government agencies implement state-of-the-art monitoring networks that combine precision detection systems with advanced data analytics and public information platforms. Post-Fukushima safety enhancements drive continuous investment in monitoring infrastructure that provides enhanced detection capabilities and improved emergency response integration.

The country's technological leadership in detector development, electronics integration, and data management systems supports domestic manufacturing capabilities and export opportunities in radiation monitoring equipment. Healthcare applications require sophisticated monitoring systems that support advanced nuclear medicine programs, research facilities, and regulatory compliance across diverse medical institutions. Industrial applications including isotope production, research facilities, and specialized manufacturing create demand for precision monitoring equipment that meets stringent quality and safety standards.

The environmental radiation monitor market in Europe demonstrates mature development across major economies with Germany showing strong presence through its systematic approach to nuclear safety monitoring and comprehensive regulatory framework for environmental radiation tracking. The country leverages advanced engineering capabilities and stringent safety standards to develop sophisticated monitoring networks that provide continuous surveillance around nuclear facilities and industrial sites. German manufacturers and technology companies contribute significantly to monitoring system innovation, combining precision instrumentation with robust data management platforms that meet both domestic and international radiation monitoring requirements.

France represents a significant market driven by its extensive nuclear power infrastructure and comprehensive approach to environmental radiation monitoring across multiple facility types and geographic regions. French nuclear operators and government agencies implement comprehensive monitoring networks that integrate fixed and portable detection systems with centralized data analysis capabilities. The country's nuclear industry expertise supports continuous advancement in monitoring technology development and deployment strategies that influence European monitoring standards and best practices.

The UK exhibits considerable growth through its focus on environmental protection and nuclear decommissioning activities that require specialized monitoring capabilities for contamination assessment and remediation progress tracking. British environmental agencies and nuclear facility operators focus on innovative monitoring approaches that combine traditional detection methods with advanced analytics and public information systems. Italy and Spain show expanding interest in radiation monitoring solutions, particularly for nuclear research facilities and medical waste management applications that require specialized detection capabilities. BENELUX countries contribute through their focus on cross-border monitoring cooperation and standardized measurement protocols, while Eastern Europe and Nordic regions display growing potential driven by expanding nuclear programs and increasing regulatory requirements for comprehensive environmental surveillance across diverse industrial and research applications.

The environmental radiation monitor market is characterized by competition among established instrumentation companies, specialized radiation detection manufacturers, and technology providers focused on environmental monitoring solutions. Companies are investing in advanced detector technologies, wireless communication systems, data analytics platforms, and integrated monitoring solutions to deliver reliable, accurate, and user-friendly radiation detection systems. Product innovation, regulatory compliance, and technical support capabilities are central to strengthening market position and customer relationships across diverse application sectors.

Thermo Fisher Scientific, USA-based, leads the market through comprehensive radiation detection solutions with focus on accuracy, reliability, and regulatory compliance across government and industrial applications. HORIBA, Japan, provides advanced monitoring systems with focus on precision measurement and integrated data management capabilities. Comecer, Italy, specializes in nuclear medicine and research applications with customized monitoring solutions. Bertin Instruments, France, offers environmental monitoring systems with prioritize on wireless connectivity and remote operation capabilities.

Mirion Technologies, USA, delivers comprehensive radiation safety solutions with focus on nuclear facility applications and emergency response systems. NUVIATech Instruments, France, provides specialized detection systems for environmental and industrial monitoring applications. ALOKA, Japan, offers medical and research monitoring equipment with focus on precision and user-friendly operation. Senstate, Netherlands, focuses on smart monitoring technologies with IoT integration and cloud-based data management. InsTech Netherlands and Shanghai Renji Instrument Co., Ltd. provide regional solutions with prioritizing on cost-effectiveness and local technical support capabilities.

The environmental radiation monitor market represents a critical safety and compliance instrumentation sector valued at $156.6 million in 2024, projected to reach $236.3 million by 2032 with a 4.2% CAGR. These essential monitoring systems provide continuous surveillance of radiation levels to protect public health, ensure regulatory compliance, and maintain safe operations around nuclear facilities. The market encompasses fixed and portable configurations serving environmental protection ($56.5 million), nuclear power plants, healthcare, and other safety-critical applications across key regions including China (5.7% market share), India (5.3%), Germany (4.8%), and Brazil (4.4%).

How Governments Could Strengthen Radiation Safety Infrastructure?

National Radiation Monitoring Networks: Establish comprehensive environmental radiation monitoring networks with standardized equipment deployment around nuclear facilities, urban centers, and border crossings to ensure continuous public safety surveillance.

Emergency Response Preparedness: Integrate radiation monitoring systems into national emergency response frameworks, enabling rapid detection and coordinated response to radiological incidents or nuclear emergencies.

Regulatory Compliance Enforcement: Mandate installation of certified radiation monitoring equipment at nuclear power plants, medical facilities, research institutions, and industrial sites handling radioactive materials.

Public Health Protection Programs: Fund ambient radiation monitoring in populated areas, particularly near nuclear installations, to provide transparent public information and ensure compliance with radiation exposure limits.

International Cooperation and Standards: Participate in global radiation monitoring networks and contribute to international nuclear safety databases while maintaining national monitoring sovereignty and security.

How Nuclear Safety Organizations Could Advance Monitoring Standards?

Detection Technology Standards: Develop comprehensive specifications for radiation detection sensitivity, response time, measurement accuracy, and environmental durability across different monitoring applications and radiation types.

Data Quality and Reporting Protocols: Establish standardized data collection, transmission, and reporting procedures that ensure consistent radiation measurements and enable effective inter-agency coordination.

Calibration and Maintenance Standards: Create systematic procedures for equipment calibration, performance verification, and preventive maintenance that maintain measurement accuracy throughout equipment lifecycles.

Training and Certification Programs: Develop specialized training for radiation safety officers, monitoring technicians, and emergency responders responsible for operating and interpreting radiation monitoring systems.

Risk Assessment and Alert Systems: Design protocols for radiation level assessment, threshold determination, and automated alert generation that support timely decision-making during radiological events.

How Technology Manufacturers Could Enhance Detection Capabilities?

Advanced Detection Technologies: Develop next-generation radiation sensors with improved sensitivity, spectroscopic capabilities, and reduced false alarm rates for accurate environmental monitoring across diverse conditions.

Real-Time Data Integration: Engineers monitoring systems with sophisticated data logging, wireless communication, and cloud-based analytics that enable continuous surveillance and rapid anomaly detection.

Environmental Ruggedization: Design radiation monitors capable of reliable operation in harsh environmental conditions, including extreme temperatures, humidity, electromagnetic interference, and severe weather events.

Multi-Parameter Monitoring: Integrate radiation detection with meteorological sensors, air quality monitors, and other environmental parameters to provide comprehensive situational awareness.

Autonomous Operation Features: Develop self-diagnosing systems with predictive maintenance alerts, automatic calibration verification, and remote troubleshooting capabilities that minimize maintenance requirements.

How End-User Organizations Could Optimize Monitoring Operations?

Strategic Monitoring Network Design: Implement scientifically-based monitor placement strategies that optimize detection coverage, account for meteorological patterns, and ensure regulatory compliance with minimum infrastructure investment.

Data Analysis and Trending: Utilize historical monitoring data to establish baseline radiation levels, identify seasonal variations, and develop predictive models for environmental radiation assessment.

Emergency Response Integration: Integrate radiation monitoring systems with emergency response protocols, evacuation planning, and public communication systems to ensure rapid coordinated response capabilities.

Quality Assurance Programs: Establish comprehensive quality control procedures, including regular calibration checks, cross-validation between monitors, and participation in inter-laboratory comparison programs.

Stakeholder Communication: Develop transparent public reporting systems that communicate radiation monitoring results, explain measurement significance, and maintain public confidence in nuclear safety programs.

How Financial Partners Could Support Safety Infrastructure Development?

Critical Infrastructure Financing: Provide specialized financing for radiation monitoring network deployment, including long-term payment structures that accommodate government budget cycles and public safety priorities.

Technology Development Investment: Fund research into advanced radiation detection technologies, artificial intelligence integration, and improved environmental monitoring capabilities.

Public-Private Partnership Models: Support innovative financing arrangements that combine public safety requirements with private sector efficiency in radiation monitoring system deployment and operation.

International Development Finance: Provide development financing for emerging markets, establishing nuclear safety infrastructure, supporting global nuclear security and non-proliferation objectives.

Insurance and Risk Management: Develop specialized insurance products that protect against radiation monitoring system failures, data loss, and liability associated with radiological incident response.

This framework addresses the mission-critical nature of environmental radiation monitoring, where public safety, regulatory compliance, and emergency preparedness drive investment decisions in a sector characterized by long equipment lifecycles, stringent reliability requirements, and evolving nuclear security challenges.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 156.6 million |

| Product Type | Fixed monitors, Portable monitors, Personal dosimeters |

| Application | Environmental protection, Nuclear power plants, Healthcare facilities, Other industrial applications |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Thermo Fisher Scientific, HORIBA, Comecer, Bertin Instruments, Mirion, NUVIATech Instruments, ALOKA, Senstate, InsTech Netherlands, Shanghai Renji Instrument Co., Ltd. |

| Additional Attributes | Dollar sales by detection type and sensitivity level, regional demand trends, competitive landscape, buyer preferences for fixed versus portable systems, integration with IoT platforms and cloud-based data management, innovations in detector technology, wireless communication capabilities, and development of integrated monitoring networks with enhanced connectivity, automated reporting, and emergency response coordination for comprehensive environmental protection and public safety applications |

The global environmental radiation monitor market is estimated to be valued at USD 156.6 million in 2025.

The market size for the environmental radiation monitor market is projected to reach USD 236.3 million by 2035.

The environmental radiation monitor market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in environmental radiation monitor market are fixed and portable.

In terms of application, environmental protection segment to command 55.0% share in the environmental radiation monitor market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Environmentally Friendly RPET Webbing Market Size and Share Forecast Outlook 2025 to 2035

Environmental Test Chambers Market Size and Share Forecast Outlook 2025 to 2035

Environmental Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Environmental Sensor Market Size and Share Forecast Outlook 2025 to 2035

Environmental Test Equipment Market Growth - Trends & Forecast 2025 to 2035

Environmental Remediation Technology Market - Size, Share & Forecast 2025 to 2035

Environmental Catalysts Market Trends & Growth 2025 to 2035

Environmental Monitoring Market Report – Trends & Forecast 2024-2034

AI In Environmental Sustainability Market Size and Share Forecast Outlook 2025 to 2035

Radiation Tolerant LED Light Market Size and Share Forecast Outlook 2025 to 2035

Radiation Hardened Electronics Market Size and Share Forecast Outlook 2025 to 2035

Radiation Protection Cabins Market Size and Share Forecast Outlook 2025 to 2035

Radiation Hardened Microcontrollers Market Size and Share Forecast Outlook 2025 to 2035

Radiation Detection Device Market Size and Share Forecast Outlook 2025 to 2035

Radiation Curable Coatings Market Size and Share Forecast Outlook 2025 to 2035

Radiation Toxicity Treatment Market Size and Share Forecast Outlook 2025 to 2035

Radiation-Induced Myelosuppression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Radiation Dose Optimisation Software Market Size and Share Forecast Outlook 2025 to 2035

Radiation Therapy Software Market Size and Share Forecast Outlook 2025 to 2035

Radiation Tester Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA