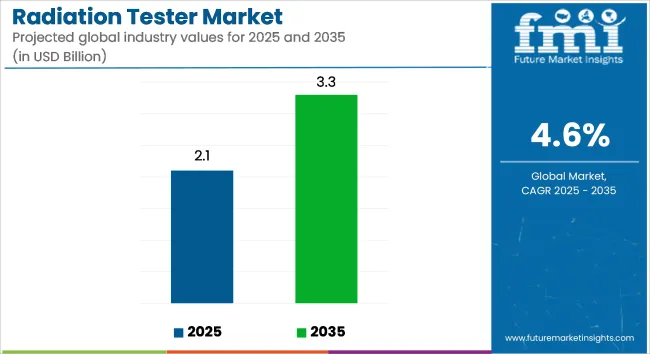

The global radiation tester market is projected to reach USD 2.1 billion by 2025, rising from USD 1.7 billion in 2020. Between 2025 and 2035, the market is expected to register a CAGR of 4.6%, surpassing USD 3.3 billion by the end of the forecast period. This growth is driven by heightened safety monitoring requirements in nuclear facilities, laboratories, and medical imaging centers.

In 2024, Kromek introduced its new-generation RayMon detector, a high-performance handheld spectrometer designed to enhance radiation detection capabilities. The RayMon features interchangeable probes, including a high-resolution Cadmium Zinc Telluride (CZT) probe, a high-sensitivity Sodium Iodide (NaI) smart probe, and an Alpha Beta probe. These additions aim to provide outstanding protection for critical national infrastructure by enabling precise identification and measurement of various radiation types.

Advancements in radiation detection technology have also been documented in recent intellectual property filings. Patent CN218445721U, published on August 22, 2023, discloses a radiation dose measuring instrument featuring a digital display system and alarm function. The design enhances on-site usability for personnel by enabling accurate dose threshold warnings and data logging functionality. Such innovations are expected to improve compliance with international radiation safety standards.

The adoption of handheld and wearable dosimeters is increasing in occupational health programs, particularly in sectors with potential radiation exposure. These devices are being integrated into safety protocols to ensure continuous monitoring and immediate response to radiation levels, thereby safeguarding personnel and maintaining regulatory compliance.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.1 billion |

| Industry Value (2035F) | USD 3.3 billion |

| CAGR (2025 to 2035) | 4.6% |

With the ongoing expansion of nuclear energy projects and the growing emphasis on radiation safety in medical and industrial applications, the demand for advanced radiation testing equipment is anticipated to remain strong. The integration of innovative technologies and the development of user-friendly, accurate detection devices will continue to play a crucial role in meeting the evolving needs of radiation monitoring and protection.

Rising regulatory scrutiny and stringent safety norms are expected to drive the demand for radiation testers globally. With expanding applications in nuclear energy, medical diagnostics, industrial processing, and homeland security, regulatory agencies have mandated continuous monitoring and adherence to permissible exposure limits. The International Atomic Energy Agency (IAEA) and national regulatory bodies such as the USA Nuclear Regulatory Commission (NRC) and the European Atomic Energy Community (EURATOM) have reinforced the need for advanced radiation monitoring devices to ensure worker and public safety.

Frequent safety audits and leak detection protocols have made real-time, portable dosimetry equipment essential. New policies emphasize the detection of even low-dose radiation leaks in sensitive facilities such as radiopharmaceutical labs, nuclear waste storage, and oncology centers. These mandates are encouraging the integration of handheld spectrometers, smart alarm systems, and digital dose tracking solutions into occupational safety frameworks.

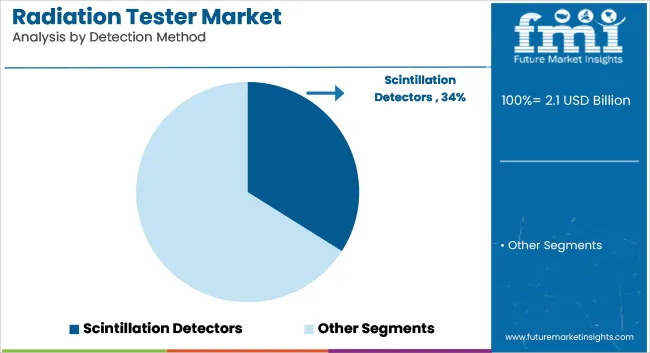

Scintillation detectors are projected to hold the largest share-approximately 34%-of the global radiation detection and monitoring equipment market by 2025. The segment is expected to grow at a CAGR of 5.5% between 2025 and 2035, marginally above the industry average of 5.2%. These detectors are widely favored for their high detection efficiency, fast response time, and adaptability to both gamma and X-ray radiation sources.

Scintillation-based systems are extensively used in applications requiring precise radiation measurement, including nuclear power plant safety systems, medical diagnostics (particularly PET and CT scanners), and homeland security screening. Advancements in photomultiplier tubes, inorganic scintillators like NaI(Tl), CsI(Tl), and CeBr₃, and hybrid detector modules have further improved energy resolution and stability, making them suitable for both field deployment and stationary use. Their modular design also enables integration with digital processing units, supporting real-time monitoring and data analysis across various industrial and clinical settings.

The power industry is anticipated to remain the largest end user of radiation detection equipment, accounting for approximately 39% of global market share in 2025, with the segment projected to expand at a CAGR of 5.4% through 2035. The sector’s reliance on nuclear energy production and associated regulatory frameworks around radiation safety have sustained demand for advanced detection solutions.

Radiation monitoring systems are being deployed across reactor sites, waste storage facilities, fuel reprocessing units, and decommissioning operations to ensure occupational safety and environmental compliance.

With aging nuclear infrastructure in North America and Europe, retrofitting and system upgrades have become critical priorities, driving procurement of modern, automated radiation detectors. In Asia-Pacific, the expansion of new nuclear plants and the adoption of Generation IV reactor technologies are further propelling investment in reliable radiation control systems.

Challenges

High Cost of Advanced Radiation Testing Equipment

It is worth noting that radiation testers, such as high-precision dosimeters, sometimes even real-time gamma-ray spectrometers and automated detection systems, have to be bought at quite a significant upfront price. The implementation of AI, IoT, and real-time monitoring capabilities constitutes a further burden on the total system expenses thus turning the environment into the non-adoption of these systems in money-sensitive markets.

Furthermore, regular maintenance, calibration, and the adherence to radiation safety standards, for which the small industrial users and new healthcare facilities find it difficult to afford, are additional concerns in the long run. In order to solve these problems, manufacturers are turning to low-cost technology-based radiation detection, leasing models, and modular radiation testers for different end-users, which provide scalability and affordability.

Limited Radiation Safety Awareness and Regulatory Variations

In spite of the amplified alarm about radiation exposure hazards, a large number of enterprises and territories do not have the recommended guidelines, training programs, and the important radiation monitoring protocols. The different legal systems which are in place in other nations have a negative impact on global radiation tester manufacturers who find it necessary to adapt product compliance to the different radiation safety standards.

Additionally, insufficient training and lack of knowledge among industrial and healthcare staff can cause the ineffective implementation of radiation monitoring systems. To mitigate this, industry stakeholders are collaborating with regulatory agencies to establish universal radiation safety standards, awareness campaigns, and specialized training programs for end-users.

Opportunities

Expansion of Nuclear Energy and Radiation Safety Regulations

The world-wide movement towards cleaner energy is the driver behind the increase of nuclear power plant installations and reactor refurbishments, which will in turn create a demand for advanced radiation monitoring and safety solutions. Governments together with regulatory bodies are adopting radiation exposure limits which are stricter, and occupational safety mandates also, in addition to this, they have introduced environmental monitoring programs that require the industries to purchase the high-accuracy radiation testers.

In addition, the growth of the nuclear waste management sector and decommissioning projects are likely to offer new channels for portable, automated, and AI-powered radiation testing technologies.

Growing Adoption of Digital and AI-Powered Radiation Detection

The combination of data loggers, AI algorithms for radiation chance evaluation, and IoT real-time monitoring systems giving access to applications on the web with a network of connected devices is changing the quality, usability, and speed of radiation tests.

New testers with advanced technologies such as Tracking of High Dose Radiation, Remote Radiation Mapping, Predictive Exposure Alerts are gaining popularity in the fields of healthcare, defense, and industrial safety. Wearable radiation monitoring devices, associated cloud-based radiation safety platforms, and automatic compliance reporting tools are believed to facilitate high-tech radiation testers in diversifying the adoption across sectors.

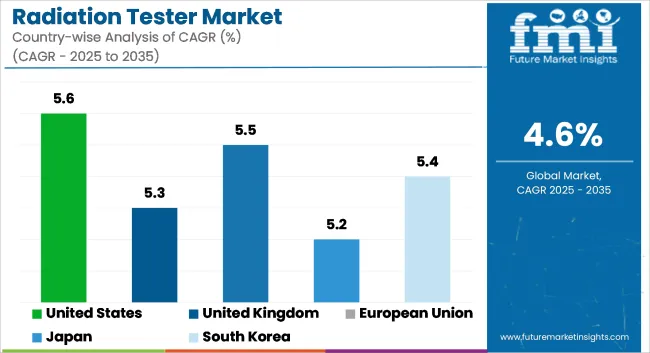

The United States radiation tester market is developing at a very good speed as the regulatory requirements are on the rise, the nuclear energy investments are becoming more and more, and the interest in radiation safety is becoming more and more.

The USA Nuclear Regulatory Commission (NRC) and Environmental Protection Agency (EPA) have signed the agreement that the strict safety rules will be applied which leads to the demand for radiation measuring and monitoring devices in industrial, medical, and military fields.

The healthcare sector, especially in radiation therapy and medical diagnostics, has indeed become a driving force for the acquisition of top-notch radiation testers by hospitals and research laboratories. Also, the fear of being exposed to radiation at the nuclear power plants and military facilities has resulted in the rising of the use of individual and real-time monitoring equipment.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.6% |

The United Kingdom radiation tester market is on the rise due to the influence of nuclear security monitoring, increased usage of radiation detection in medical diagnostics, and the innovation in industrial radiography. The UK Health Security Agency (UKHSA) and the Office for Nuclear Regulation (ONR) are making adherence to strict radiation exposure limits necessary, consequently, creating the need for radiation testers in hospitals, nuclear power plants, and research institutions.

Furthermore, the addition of nuclear decommissioning projects and the increase in radiation-based security screening in airports and border control are also reasons for the market growth. The technical progress in establishing real-time remote radiation monitoring solutions is one of the main sources for the growth of smart radiation testers in the high-risk industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.3% |

The European Union radiation tester market is witnessing a rapid rise owing to the stringent regulatory arrangements, the rising trend of using radiation for medical treatments, as well as the burgeoning of the nuclear energy sector. Countries such as Germany, France, and Sweden are the primary forces in radiation safety compliance and nuclear power plant oversight, thereby creating a vast market for high-precision radiation sensors.

The EU's concentration on monitoring environmental radiation and its applicability in industries are other factors that are propelling the market's growth. The flourishing of medical radiology and radiopharmaceutical industries is boosting the requirement for handheld and high-sensitivity radiation detectors in hospitals and laboratory research departments as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.5% |

The Japan radiation tester market is on the rise, primarily due to the increased nuclear power plant monitoring, the technological innovations in radiation detection, and the robust government incentives for radiation safety. In the aftermath of the Fukushima Daiichi nuclear incident, Japan imposed stringent regulatory on the radiation monitoring section boosting the demand for the high-precision radiation testers to be utilized in nuclear decontamination, environmental safety, and industrial applications easily doing that.

The continuous growth of the medical imaging sector in Japan and the radiopharmaceutical sectors are also significant factors for the demand of portable and automated radiation testers. In the same way, as the electronics and the semiconductor industry flourished, the requirement for radiation protection and contamination testing equipment tests has increased.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.2% |

The South Korean radiation tester market is broadening because of the increasing nuclear energy investments, the growth of industrial radiation safety solutions sector, and the rise of applications in radiation-based medical fields. South Korea's nuclear power industry is among the contemporary ones in the world that are constantly improving their systems, such as the implementation of real-time radiation monitoring to ensure worker and environmental safety.

Moreover, South Korean medical and research novelties are increasingly depending on radiation-therapy, radiopharmaceuticals, and advanced diagnostic imaging, thus, giving rise to the demand for handheld and laboratory-grade radiation testers. The will embark on the journey to strengthen security and measure the radiation risks which is the main element of the transition from traditional radiation threat detection solutions to advanced spatial area security equipment.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.4% |

Thermo Fisher Scientific Inc.

Thermo Fisher, a primary supplier of detectors of radiation, offers both hand-held and stationary radiation measuring instruments for industrial, medical, and environmental use. The company's RadEye series and Thermo Scientific radiation monitoring systems are the most common radiation measuring instruments used by workers at nuclear power plants, rescues, and in laboratory research. The company constantly develops new AI-integrated radiation monitoring processes, which ensure the real-time safety and compliance with world radiation regulations.

Mirion Technologies, Inc.

Mirion Technologies is a firm that has carved a niche for itself in the field of the development and manufacturing of high-precision radiation detection and monitoring technologies. The company, which has a wider market among nuclear energy, medical diagnostics, and defense sectors, is also into the medical instruments development business.

The solutions are real-time, which means any radiation area monitoring by Mirion also detects contamination with the same high reliability and correct exposure measurement. The firm is now focusing on digital and cloud computing radiation monitoring solutions, which allow remote access and predictive safety analytics for radiation-controlled environments.

Ludlum Measurements, Inc.

Ludlum Measurements is reputed for delicate yet sturdy portable devices for radiation detection, which are available in the Geiger counters, survey meters, and spectrometers categories for various applications in health care, defense, and industry.

The company puts effort on developers of cost-effective, GUI-driven radiation testers for which very little time is required for them to be up and running in hazardous areas. Ludlum has been contributing to research and development of power to weight ratio technologies, which as a result, will be of benefit to the workers in the nuclear and radiation high-risk facilities.

FLIR Systems (Teledyne Technologies)

FLIR Systems, a Teledyne Technologies subsidiary, is engaged in thermal imaging and radiation detection applied to nuclear safety, security, and industrial monitoring. Using infrared imaging and radiation detection technology, the company offers system integration that complies with the dual-threat identification rule for both emergency responders and security personnel. FLIR’s system is a typical example in its application to border security, military operations, and environmental hazard detection.

Polimaster Inc.

Polimaster is a prominent organization that specializes in compact and portable models of radiation detection instruments. It has three primary target market segments for these instruments, namely homeland security, first responders, and personal radiation monitoring.

Early radiation dosimeters and spectrometric detectors developed by the company are specifically suited for minimizing radiation exposure during and after emergency situations. The Polimaster brand is widening its filter of geographical distributors through focusing on its primary marketing efforts on rapid response and industrial radiation safety teams.

Geiger-Müller (GM) Counter, Scintillation Detector, Ionization Chamber, Solid-State Detector, Proportional Counter, Neutron Detector

Power Industry, Medical & Healthcare, Environment Monitoring, Research & Academia

North America, Latin America, Wesrtern Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The global radiation tester market is projected to reach USD 2.1 billion by the end of 2025.

The market is anticipated to grow at a CAGR of 5.2% over the forecast period.

By 2035, the radiation tester market is expected to reach USD 3.3 billion.

According to reports, the healthcare and nuclear energy sector, which is likely to become the highest selling is due to the upsurge in radiation monitoring needs for the cancer treatment and medical imaging fields.

Key players in the radiation tester market include Fluke Corporation, Mirion Technologies, Thermo Fisher Scientific Inc., Ludlum Measurements, Inc., and Polimaster Inc.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End Use, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End Use, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Radiation Tolerant LED Light Market Size and Share Forecast Outlook 2025 to 2035

Radiation Hardened Electronics Market Size and Share Forecast Outlook 2025 to 2035

Radiation Protection Cabins Market Size and Share Forecast Outlook 2025 to 2035

Radiation-Free Fetal Heart Rate Monitor Market Size and Share Forecast Outlook 2025 to 2035

Radiation Hardened Microcontrollers Market Size and Share Forecast Outlook 2025 to 2035

Radiation Detection Device Market Size and Share Forecast Outlook 2025 to 2035

Radiation Curable Coatings Market Size and Share Forecast Outlook 2025 to 2035

Radiation Toxicity Treatment Market Size and Share Forecast Outlook 2025 to 2035

Radiation-Induced Myelosuppression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Radiation Dose Optimisation Software Market Size and Share Forecast Outlook 2025 to 2035

Radiation Therapy Software Market Size and Share Forecast Outlook 2025 to 2035

Radiation-Induced Fibrosis Treatment Market - Growth & Forecast 2025 to 2035

Radiation Proctitis Treatment Market

Irradiation Apparatus Market Trends – Growth & Industry Outlook 2024-2034

5G Tester Market Growth – Trends & Forecast 2019-2027

RF Tester Market Growth – Trends & Forecast 2019-2027

LAN tester Market Size and Share Forecast Outlook 2025 to 2035

SCC Tester Market Size and Share Forecast Outlook 2025 to 2035

LED Tester Market

DSL Tester Market Growth – Trends & Forecast 2019-2027

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA