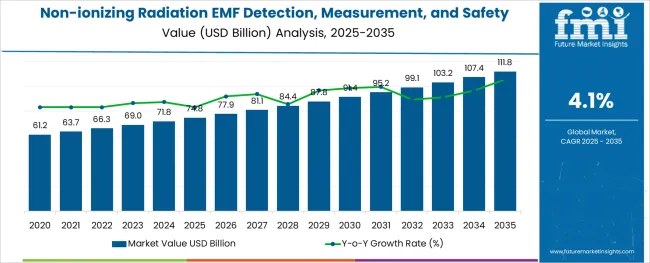

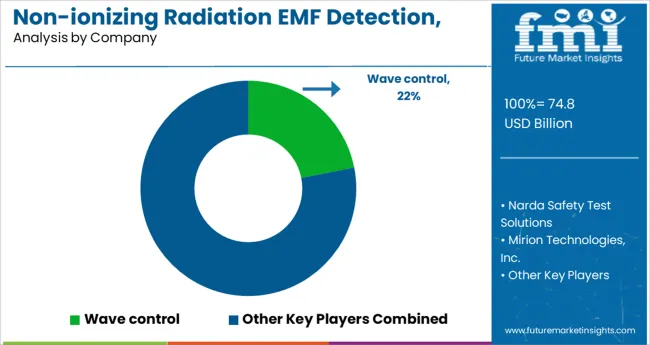

The Non-ionizing Radiation EMF Detection, Measurement, and Safety Market is estimated to be valued at USD 74.8 billion in 2025 and is projected to reach USD 111.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

The non-ionizing radiation EMF detection, measurement, and safety market has gained pronounced attention in recent years, largely due to the rapid expansion of wireless communication infrastructure, increased use of consumer electronics, and rising public awareness of potential electromagnetic field exposure risks. Growing deployment of 5G networks, IoT devices, and smart home technologies has elevated concerns around high-frequency EMF emissions, subsequently amplifying the demand for accurate detection and monitoring solutions.

Regulatory agencies across various economies have also intensified guidelines around permissible exposure limits, creating a favorable business environment for manufacturers and service providers operating within this space. Looking ahead, the market is expected to experience steady growth driven by increased integration of EMF monitoring features into consumer wearables and professional-grade safety instruments.

Emerging applications in electric vehicle charging infrastructure, smart grid networks, and data centers are anticipated to further boost the need for reliable EMF safety solutions. As industrial and residential ecosystems adopt connected devices on a larger scale, the emphasis on continuous EMF exposure management will remain a key growth driver for the market.

The market is segmented by Detector, Device, and End-use and region. By Detector, the market is divided into High-frequency, Low-frequency, and Others. In terms of Device, the market is classified into Personal Monitoring Devices, Handheld Monitoring Devices, and Area Monitoring Devices. Based on End-use, the market is segmented into Residential, Healthcare, Military and Homeland Security, Manufacturing, Laboratory and Education, Telecommunication, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

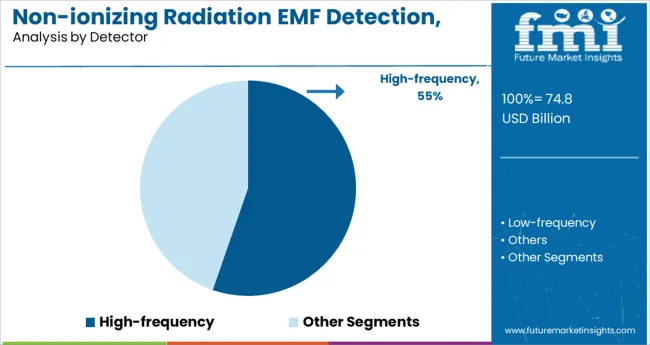

The high-frequency segment accounted for approximately 55.3% of the total non-ionizing radiation EMF detection, measurement, and safety market share, establishing itself as the largest category within detector types. The segment’s dominance has been driven by the accelerated adoption of 5G base stations, wireless communication devices, and industrial equipment operating within high-frequency EMF ranges.

Rising public health concerns regarding prolonged exposure to radiofrequency radiation have fueled demand for specialized detection and monitoring devices capable of addressing frequencies in this range. Technological advancements in sensor accuracy, portability, and wireless connectivity have further reinforced the commercial viability of high-frequency detectors across multiple end-use applications.

Industrial environments, healthcare facilities, and smart city infrastructures represent key sectors contributing to the sustained uptake of these devices. As governments tighten regulatory standards surrounding high-frequency EMF exposure, continued investments in advanced detection solutions are expected to strengthen this segment’s market position in the coming years.

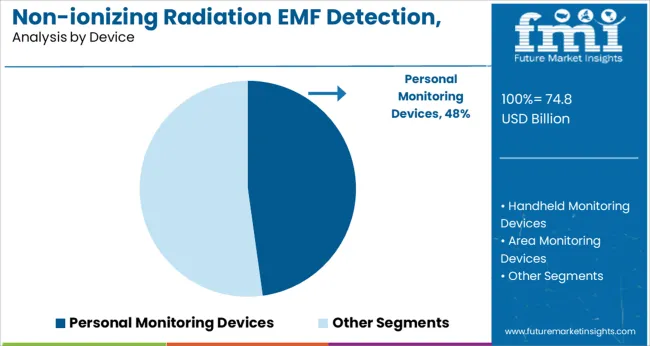

Within the device category, personal monitoring devices held a leading market share of 47.8%, reflecting rising consumer and occupational health awareness regarding electromagnetic field exposure. The increased proliferation of mobile devices, smart home systems, and wearable technology has driven individuals and professionals alike to seek reliable, real-time monitoring solutions that offer mobility and ease of use.

These devices have gained popularity among telecom technicians, industrial workers, and health-conscious consumers for their ability to provide continuous EMF exposure data in both residential and workplace environments. Improvements in battery life, compact design, and multi-frequency detection capabilities have further elevated product adoption rates.

The trend towards integrating EMF detection functionalities into personal wearables and consumer electronics is expected to support sustained demand in this category. Moreover, as industry players innovate with feature-rich, user-friendly models tailored for both professional and non-professional users, the personal monitoring devices segment is anticipated to reinforce its market leadership.

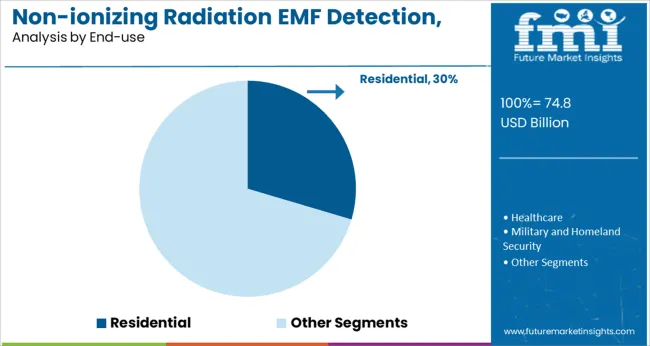

The residential segment captured a market share of 29.6%, marking it as a critical end-use category in the non-ionizing radiation EMF detection, measurement, and safety market. Heightened awareness of potential health risks associated with continuous EMF exposure from home appliances, Wi-Fi routers, smart meters, and personal electronics has driven a surge in demand for EMF detection solutions within households.

Increasing adoption of smart home technologies and the ongoing rollout of high-speed wireless networks have intensified scrutiny over domestic EMF levels, prompting consumers to invest in both professional-grade and personal EMF measurement devices. Manufacturers have responded by offering user-friendly, affordable, and portable detection equipment tailored for residential applications.

As governments and health agencies promote awareness campaigns about electromagnetic radiation safety, the residential segment is expected to witness consistent growth. The incorporation of EMF monitoring capabilities into smart home systems and consumer electronics is also projected to expand the application scope of detection devices in domestic settings.

During the forecast period, the global demand for non-ionizing radiation/EMF detection, measurement, and safety is predicted to develop due to the increased use of electronic gadgets and electrical devices.

As per the non-ionizing radiation EMF detection, measurement, and safety market analysis, in both the home and industrial sectors, the use of electronics and electrical gadgets has expanded dramatically. As a result, there has been an increase in non-ionizing radiation-related electromagnetic pollution.

The application of wireless technology in various sectors has increased dramatically around the world. In addition, demand for consumer devices such as tablets, smartphones, and laptops has skyrocketed. Rising public awareness of the health dangers associated with exposure to such radiation has resulted in a major increase in the use of radiation detection and measurement devices and solutions and also changed the non-ionizing radiation EMF detection, measurement, and safety market trends.

Over the forecast period, the global non-ionizing radiation/EMF detection, measurement, and safety market are predicted to develop due to increased usage of electronic support measures (ESM).

In the recent past, there has been considerable growth in non-lethal attacks in warfare using non-ionizing and ionizing solutions to damage the nation's military's electromagnetic transmissions. Such attacks can pose serious security and financial risks to a country.

Emerging trends in the non-ionizing radiation EMF detection, measurement, and safety market indicate that cyber-attacks can also compromise data that is essential to a country's security. Electronic support measures (ESM) allow countries to concentrate on equipping their military forces with technology and systems for detecting and recognizing threats from intruding systems.

During the forecast period, technological challenges are likely to stymie the expansion of the global demand for non-ionizing radiation EMF detection, measurement, and safety.

The government's strict regulatory restrictions on radiofrequency and other non-ionizing radiation exposure make it critical to manufacturing goods with sufficient sensitivity and accuracy criteria. Manufacturers in the industry must design items to accommodate new technologies and meet the needs of various end-users. As a result, these constraints are likely to stifle the non-ionizing radiation EMF detection, measurement, and safety market growth in the foreseeable future.

As per the non-ionizing radiation EMF detection, measurement, and safety market future trends, the rising demand for mobile devices could provide significant growth potential. Radiation detection equipment comes in a variety of forms, including area monitoring devices, handheld devices, and personal monitoring devices.

Owing to their simplicity of use and handling, handheld devices have seen a larger demand than the other two types of gadgets. With continual advances in these gadgets, demand for handheld devices is likely to skyrocket in the near future, presenting a profitable potential for non-ionizing radiation EMF detection, measurement, and safety industry participants.

Increased usage of medical radiation detection and measurement could result in significant non-ionizing radiation EMF detection, measurement, and safety market opportunities.

One of the most common end-use sectors for non-ionizing radiation EMF detection, measurement, and safety in healthcare. The healthcare business has begun to include cutting-edge technology and novel ideas that are crucial in the development of cutting-edge equipment. Hyperthermia therapy, radiofrequency ablation (RFA), pulse oximetry, and the use of UV to correct dental misalignment and jaundice are all medical uses that use non-ionizing radiation.

The non-ionizing radiation EMF detection, measurement, and safety market share are divided into three categories based on device type: personal monitoring devices, handheld monitoring devices, and area monitoring devices. In 2024, the handheld monitoring devices segment had the biggest market share, with 47 percent. Because of their ease of use, the demand for handheld devices has been higher than for other sorts of devices.

The demand for non-ionizing radiation EMF detection, measurement, and safety is divided into high-frequency and low-frequency segments based on detector type. Residential, healthcare, military and homeland security, manufacturing, laboratory and education, and telecommunication are the end-user segments of the non-ionizing radiation EMF detection, measurement, and safety market.

Military & Homeland Security leads the non-ionizing radiation EMF detection, measurement, and safety market share with a projected CAGR of 3.7% by 2035.

The non-ionizing radiation EMF detection, measurement, and safety industry are likely to develop as electronic support measures (ESM) become more widely used. Furthermore, attacks in warfare using non-ionizing methods have increased in order to disrupt the nation's military's electromagnetic broadcasts.

Such attacks can pose serious security and financial risks to a country. Electronic support measures (ESM) allow countries to concentrate on equipping their military forces with technology and systems for detecting and recognizing threats from intruding systems. This is impacting the non-ionizing radiation EMF detection, measurement, and safety market outlook.

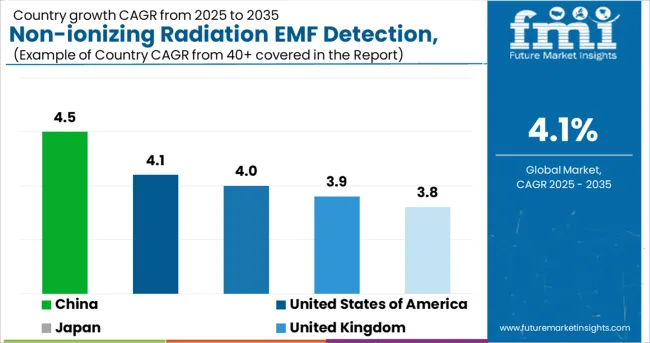

| Regions | CAGR (2025 to 2035) |

|---|---|

| United States of America | 4.1% |

| United Kingdom | 3.9% |

| China | 4.5% |

| Japan | 4% |

| India | 3.8% |

The non-ionizing radiation EMF detection, measurement, and safety market have been divided into North America, South America, the Middle East and Africa, Europe, and the Asia Pacific on a geographical basis. North America emerged as the top regional market for non-ionizing radiation EMF detection, measurement, and safety. A large number of non-ionizing radiation/EMF detector manufacturers is thought to be the main driver of this regional market's growth.

Owning to the technical improvements in this industry, analysts in non-ionizing radiation EMF detection, measurement, and safety market analysis estimate the North American non-ionizing radiation EMF detection, measurement, and safety market to maintain its lead over the next few years. Due to rising consumer awareness, Asia Pacific is expected to see an increase in demand for non-ionizing radiation EMF detection, measurement, and safety in the near future.

In the USA, the market for non-ionizing radiation EMF detection, measurement, and safety is expected to reach USD 71.8 billion by 2024. China, the world's second-largest economy, is expected to reach a projected market size of USD 111.8 billion by 2035, representing a 4.1 percent CAGR from 2024 to 2035.

Japan and Canada are two more important geographic markets, with forecasted growth rates of 4% and 3.7 percent, respectively, from 2024 to 2035. Germany's non-ionizing radiation EMF detection, measurement, and safety market are expected to expand at a CAGR of around 4.2 percent in Europe.

The emerging trends in the non-ionizing radiation EMF detection, measurement, and safety market estimate that because of the government's rigorous regulatory restrictions on radiofrequency and other non-ionizing radiation exposure, it's vital to manufacturing goods that meet the necessary sensitivity and accuracy standards.

In order to accommodate new technologies and suit the needs of varied end-users, non-ionizing radiation EMF detection, measurement, and safety manufacturers and key players are focusing on value creation. As a result, non-ionizing radiation EMF detection, measurement, and safety market growth are likely to be stifled over the projection period.

Although present devices are adequate for detecting and measuring non-ionizing radiations, there is a strong demand for more advanced and automated technologies. Significant research and development are required for such technology.

Small and medium-sized enterprises cannot afford to engage heavily in research and development, which will hamper growth in the global non-ionizing radiation EMF detection, measurement, and safety market over the forecast period.

The global non-ionizing radiation emf detection, measurement, and safety market is estimated to be valued at USD 74.8 billion in 2025.

It is projected to reach USD 111.8 billion by 2035.

The market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types are high-frequency, low-frequency and others.

personal monitoring devices segment is expected to dominate with a 47.8% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Radiation Tolerant LED Light Market Size and Share Forecast Outlook 2025 to 2035

Radiation Hardened Electronics Market Size and Share Forecast Outlook 2025 to 2035

Radiation Protection Cabins Market Size and Share Forecast Outlook 2025 to 2035

Radiation-Free Fetal Heart Rate Monitor Market Size and Share Forecast Outlook 2025 to 2035

Radiation Hardened Microcontrollers Market Size and Share Forecast Outlook 2025 to 2035

Radiation Detection Device Market Size and Share Forecast Outlook 2025 to 2035

Radiation Curable Coatings Market Size and Share Forecast Outlook 2025 to 2035

Radiation Toxicity Treatment Market Size and Share Forecast Outlook 2025 to 2035

Radiation-Induced Myelosuppression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Radiation Dose Optimisation Software Market Size and Share Forecast Outlook 2025 to 2035

Radiation Therapy Software Market Size and Share Forecast Outlook 2025 to 2035

Radiation Tester Market Growth – Trends & Forecast 2025 to 2035

Radiation-Induced Fibrosis Treatment Market - Growth & Forecast 2025 to 2035

Radiation Proctitis Treatment Market

Irradiation Apparatus Market Trends – Growth & Industry Outlook 2024-2034

Food Irradiation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food Irradiation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Medical Radiation Detectors Market

Internal Radiation Therapy Market Trends – Growth & Forecast 2024-2034

Cutaneous Radiation Injury Treatment Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA