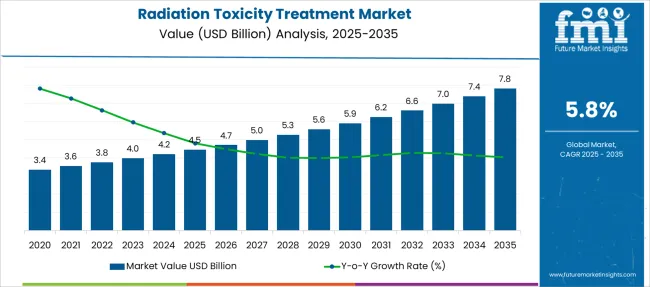

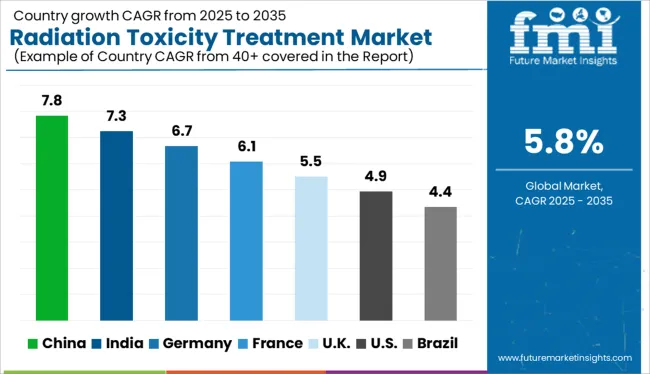

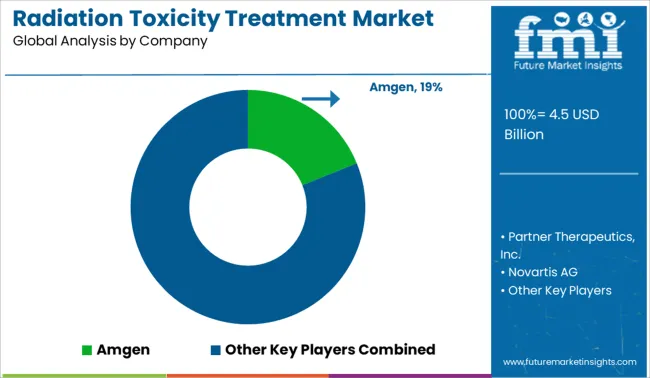

The Radiation Toxicity Treatment Market is estimated to be valued at USD 4.5 billion in 2025 and is projected to reach USD 7.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

| Metric | Value |

|---|---|

| Radiation Toxicity Treatment Market Estimated Value in (2025 E) | USD 4.5 billion |

| Radiation Toxicity Treatment Market Forecast Value in (2035 F) | USD 7.8 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The radiation toxicity treatment market is witnessing steady growth, shaped by increasing awareness of radiation-related health risks, rising geopolitical concerns around nuclear exposure, and continued investment in emergency preparedness infrastructure. The market is further supported by the advancement of pharmacological countermeasures targeting hematopoietic and gastrointestinal sub-syndromes.

Government stockpiling programs, particularly by defense and disaster management agencies, have accelerated demand for effective therapies. Continued research funding by global health bodies and regulatory fast-tracking for radiation antidotes have created a favorable development landscape.

Moreover, rising application of ionizing radiation in cancer therapy and industrial settings is indirectly contributing to the demand for mitigative treatments in case of accidental exposure. Moving forward, a combination of biodefense strategy, clinical innovation, and improved supply chain networks is expected to drive the market’s trajectory.

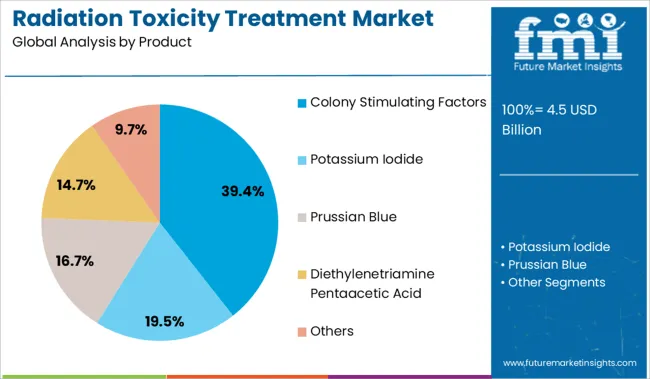

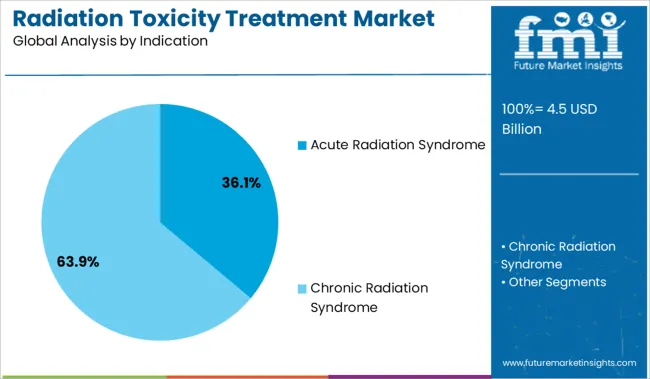

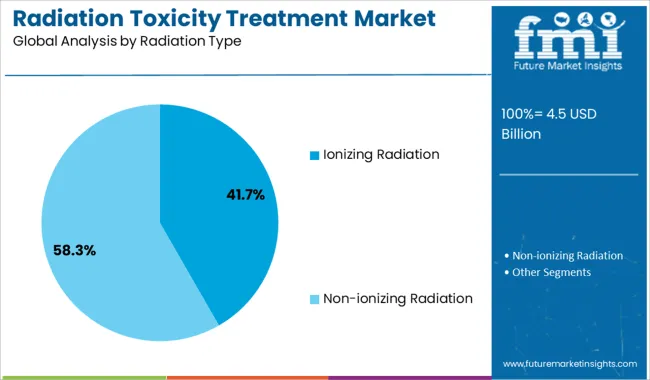

The market is segmented by Product, Indication, Radiation Type, and End-User and region. By Product, the market is divided into Colony Stimulating Factors, Potassium Iodide, Prussian Blue, Diethylenetriamine Pentaacetic Acid, and Others. In terms of Indication, the market is classified into Acute Radiation Syndrome and Chronic Radiation Syndrome. Based on Radiation Type, the market is segmented into Ionizing Radiation and Non-ionizing Radiation. By End-User, the market is divided into Hospitals and Research & Academic Institutes. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Colony stimulating factors are anticipated to lead the market with a 39.40% revenue share in 2025. This leadership position is driven by their proven efficacy in treating hematopoietic injuries resulting from radiation exposure.

These agents have been widely adopted for their ability to accelerate neutrophil recovery, reduce infection risk, and improve survival outcomes in radiation-affected patients. Their inclusion in government emergency stockpiles and endorsements by health security agencies have further supported large-scale procurement.

The relatively established safety profiles and scalable manufacturing capabilities of these biologics contribute to their prominence in both civilian and military radiation emergency protocols.

Acute radiation syndrome is expected to hold 36.10% of the overall market share in 2025, making it the dominant indication segment. This segment’s growth is attributed to its classification as a high-priority threat in public health and homeland security frameworks.

The condition’s multi-organ impact necessitates immediate pharmacological intervention, reinforcing the demand for fast-acting countermeasures. Clinical readiness and focused research on radiation mitigation pathways have led to an increase in FDA-approved or fast-tracked therapies.

Additionally, global preparedness programs and simulation drills have emphasized ARS-specific treatment regimens, further reinforcing the segment’s dominance in the treatment landscape.

Ionizing radiation is projected to account for 41.70% of the market share in 2025, positioning it as the leading radiation type addressed by treatment protocols. Its dominance is driven by the prevalence of ionizing radiation in medical imaging, cancer radiotherapy, industrial applications, and potential nuclear incidents.

The ability of ionizing radiation to cause severe cellular and DNA damage has led to heightened regulatory and healthcare preparedness. Ongoing development of radioprotective agents and post-exposure therapies specifically targeting ionizing radiation injuries continues to shape research pipelines.

Moreover, training programs for emergency responders and hospital readiness strategies frequently prioritize this radiation type, further solidifying its top-tier focus in treatment strategies.

| Particulars | Details |

|---|---|

| H1, 2024 | 5.74% |

| H1, 2025 Projected | 5.79% |

| H1, 2025 Outlook | 5.69% |

| BPS Change - H1, 2025 (O) – H1, 2025 (P) | (-) 10 ↓ |

| BPS Change – H1, 2025 (O) – H1, 2024 | (-) 05 ↓ |

Regulatory compliances and clinical outcomes of treatment are dynamics that impact the market for radiation toxicity treatment. The market is subject to be influenced by macro, regulatory, and industrial factors. Developing radiation-drug combinations, and implementing non-ionic radiations for therapeutic use are key market developments.

According to FMI analysis, the radiation toxicity treatment market will show a decline in H1-2025 (O) growth rate as compared to H1-2024 by nearly 5 BPS. Additionally, a comparison of the growth rate for the projected H1-2025 and Outlook H1-2025 period also showed a dip of nearly 10 BPS.

Acute radiation damage, distal atrophy and necrosis, and radiation injury are factors that are leading toward a reduction in the BPS value for the radiation toxicity treatment market.

Development of treatment systems that use modulated beams of photons and protons to improve cancer outcomes by irradiating cancerous tissues in ways that lead to improved control of tumors and by reducing doses to healthy tissues to reduce treatment complications are two key factors that display a progressive approach towards growth for the overall radiation toxicity treatment market.

Conversely, other market segments are expected to perform objectively and achieve lucrative growth prospects in the next half of the projection period, owing to the clinical development of novel drug-radiotherapy.

Sales of the radiation toxicity treatment market grew at a CAGR of 4.9% between 2014 and 2024. In 2024, the global market of radiation toxicity treatment accounts for approx. 38% of the overall toxicology drug screening market which accounts for around USD 9.4 Billion.

Radiation used in the treatment also damages the healthy cells present around cancer tumors in the human body, resulting in side effects such as dry mouth, mouth and gum sores, difficulty in swallowing, stiffness in the jaw, nausea, and others, after a duration ranging from days, months, to years.

For the prevention of damage to healthy cells, radiologists and dosimetrists are focusing on using software such as treatment planning software, radiation dose management, and others for providing the right amount of radiation doses to the patients at targeted locations, without harming the healthy cells around the tumor.

With technological evolution in the field of radiation, automation is successfully implemented in radiotherapy. Radiation therapy centers are increasingly using advanced software, such as treatment planning software, for developing a treatment plan for each beamline route for estimating the direction in which the therapy system will deliver radiotherapy to a patient hence, the demand for radiation toxicity treatment will increase and will drive the market.

The radiation toxicity treatment market is expected to grow in the future, as the healthcare profession continues to evolve as a result of the need to discover newer technologies to effectively diagnose any issue.

In addition, the market's growth is expected to be boosted by rising acceptance and quick expansion of new technologies in emerging economies throughout the forecast period. Leading companies are concentrating their efforts on the launch of new products as well as research and development.

Considering this, FMI expects the global radiation toxicity treatment to grow at a CAGR of 5.8% through 2035.

Lack of guidance regarding rare diseases such as acute radiation syndrome-specific research methodologies and identifying patients for a study, especially including very impaired or minimally impaired patients in research remains a challenge.

There also exist various legal and ethical issues to finding an adequate sample size for clinical research. Selecting appropriate outcomes and their measurement is difficult due to heterogeneity in treatment and the effect of various diseases in patients due to the absence of validated outcomes. Also, a lack of disease knowledge and diversity in terms of epidemiology, diagnosis, prognosis, and treatment affects the clinical trial design and planning.

In cases of rare diseases such as acute radiation syndrome, the patient–physician relationship may not fit with the traditional assumptions of medical care. The lack of disease-related expertise among healthcare professionals and psychological challenges associated with the diagnosis of an incurable disease may lead to improper treatment. Due to poor knowledge of rare diseases and limited therapeutic options of treatments, physicians may not act as competent technical experts who provide relevant information to patients.

To avoid this, disease specialists should be trained to deal with patients with rare diseases and they must learn to cope with assertive and well-informed expert patients. Educational associations and institutions in healthcare should encourage physicians to practice and improve their skills in this area.

This can prove to be a major restraining factor for the product segment of the radiation toxicity treatment market.

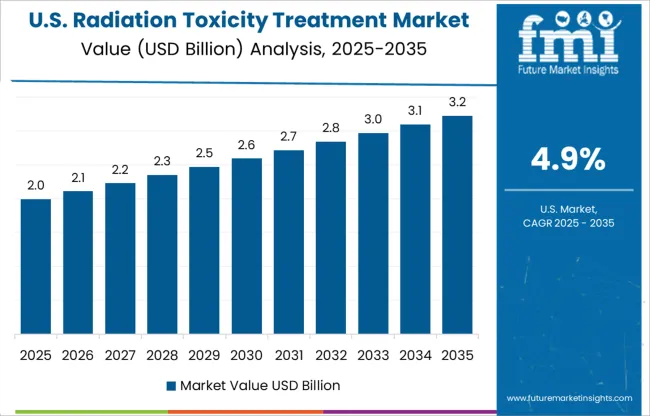

In 2024, the USA dominated the North American market, with more than 91% of the market share. The United States of America has the largest market for radiation toxicity treatment. The market is driven by factors such as rising cancer incidence and mortality, the replacement of older therapies with newer ones, and the provision of reimbursements for radiation toxicity therapy, the United States of America is expected to reflect similar market trends over the projection timeframe. Furthermore, in the United States of America, the implementation of safety rules and policies, improved treatment outcomes of radiation toxicity therapy, and significant investments by key manufacturers in product development and distribution are boosting the radiation toxicity treatment market growth.

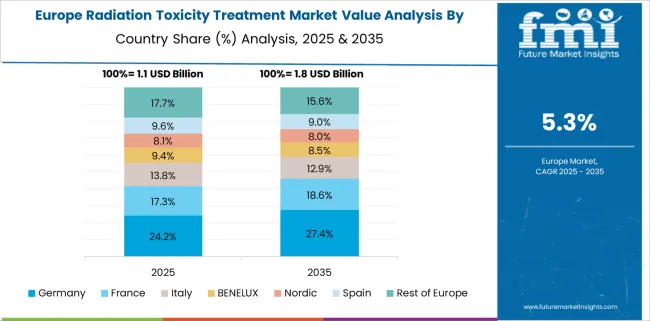

Germany dominated the European radiation toxicity treatment market and accounted for approx. 20.6% of the market share in 2024, owing to the increased use of PET and single-photon emission computed tomography scanning machines across various diagnostic centers. Furthermore, favorable health coverage policies and stringent regulations have boosted the market growth in the region.

While Europe is identified as a lucrative market, stakeholders are particularly eying the profits in East and South Asia. These regional markets are turning attractive with the increasing per capita healthcare expenditure and multiple government programs for integrated healthcare systems.

The radiation toxicity treatment market in China is projected to grow at a 10.4% CAGR in East Asia throughout the forecast period. Rising awareness about advanced radiation toxicity treatments, as well as improving healthcare infrastructure, are expected to fuel the growth of the China radiation toxicity treatment market throughout the forecast period. Furthermore, China's radiation toxicity treatment market is expected to rise at a faster rate by 2035 as a result of a strong focus on research and development in the region.

India is an emerging market for radiation toxicity treatment and accounts for the largest share of more than 48% of the South Asia radiation toxicity treatment market due to improving healthcare infrastructure, the large patient base for target diseases, and the growing presence of leading market players in the region to grab the advantage of the rising opportunities given in India. These are the main drivers of the radiation toxicity treatment market growth in this region.

Colony-stimulating factors are the leading segment and are expected to gain more than 78% of revenue share in 2024 owing to the increasing adoption of colony-stimulating factors (CSFs).

The management of febrile neutropenia in cancer patients has become increasingly important as chemotherapy doses have been increased and the variety of available treatment lines has grown. Colony-stimulating factors (CSFs) are growth hormones that prevent chemotherapy-induced neutropenia.

They include granulocyte-colony stimulating factors (G-CSF) and granulocyte macrophage-colony stimulating factors (GM-CSF). They are utilized in frail patients undergoing chemotherapy and patients undergoing highly haematotoxic programs.

Acute radiation syndrome is caused by irradiation of the entire body by a high dose of penetrating radiation in a very short period of time. The acute radiation syndrome segment by indication is projected to account for 87.8% of the total market share in 2024 as acute radiation syndrome is highly progressive by nature and can affect patients in less than 24 hours of exposure to radiation.

Representing a whopping 89.6% share of the global market in 2024, ionizing radiation remains the highly preferred radiation toxicity treatment, particularly in developed countries. On the other side, it also continues to witness growing traction within developing regional markets. Under ionizing radiation, the gamma radiation method accounts for over 55.8% share, while alpha and beta radiation methods are observing significant adoption.

The hospital segment accounts for the highest share of over 88% in 2024 by the end user due to increasing adoption and increasing footfalls to seek effective radiation toxicity treatment at hospitals, availability of advanced devices, and the presence of qualified medical personnel in the hospital.

The global radiation toxicity treatment market is highly consolidated. Leading players in the radiation toxicity treatment market are also emphasizing collaboration with distributors or local manufacturers to enhance their distribution channels in emerging economies.

For instance, In September 2024, the AI-Rad Companion Organs RT, the latest AI-Rad Companion artificial intelligence-based software assistant from Siemens Healthineers, received FDA approval. As part of the radiation therapy planning workflow, AI-Rad Companion Organs RT uses deep-learning AI algorithms to autonomously outline organs at risk (OARs) on computed tomography (CT) images, facilitating precision medicine.

In May 2020, Partner Therapeutics signed a distribution agreement with Tanner Pharma Group for the distribution of Leukine in areas outside the USA and Canada.

In January 2020, Jubilant Life Sciences Limited signed a long-term contract with distribution networks in the USA for the supply of products used for diagnostic and therapeutic products with Montreal Canada (JDI).

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2014 to 2024 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia and Pacific; East Asia; and Middle East & Africa |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Argentina, Germany, United Kingdom, France, Italy, Spain, Benelux, Russia, China, Japan, South Korea, India, Thailand, Indonesia, Malaysia, Thailand, Indonesia, Australia and New Zealand, Egypt, Turkey, South Africa, North Africa, and GCC Countries |

| Key Segments Covered | Product, Indication, End User, Radiation and Region |

| Key Companies Profiled | Amgen; Partner Therapeutics, Inc.; Novartis AG; Mylan NV; Coherus BioSciences Inc.; Jubilant Life Sciences; Siegfried Holdings; Heyl Chemisch-pharmazeutische Fabrik GmbH & Co. KG; Recipharm AB; Mission Pharmacal Company |

| Report Coverage | Market Forecast, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global radiation toxicity treatment market is estimated to be valued at USD 4.5 billion in 2025.

The market size for the radiation toxicity treatment market is projected to reach USD 7.8 billion by 2035.

The radiation toxicity treatment market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in radiation toxicity treatment market are colony stimulating factors, potassium iodide, prussian blue, diethylenetriamine pentaacetic acid and others.

In terms of indication, acute radiation syndrome segment to command 36.1% share in the radiation toxicity treatment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Radiation Tolerant LED Light Market Size and Share Forecast Outlook 2025 to 2035

Radiation Hardened Electronics Market Size and Share Forecast Outlook 2025 to 2035

Radiation Protection Cabins Market Size and Share Forecast Outlook 2025 to 2035

Radiation-Free Fetal Heart Rate Monitor Market Size and Share Forecast Outlook 2025 to 2035

Radiation Hardened Microcontrollers Market Size and Share Forecast Outlook 2025 to 2035

Radiation Detection Device Market Size and Share Forecast Outlook 2025 to 2035

Radiation Curable Coatings Market Size and Share Forecast Outlook 2025 to 2035

Radiation Dose Optimisation Software Market Size and Share Forecast Outlook 2025 to 2035

Radiation Therapy Software Market Size and Share Forecast Outlook 2025 to 2035

Radiation Tester Market Growth – Trends & Forecast 2025 to 2035

Radiation Proctitis Treatment Market

Radiation-Induced Fibrosis Treatment Market - Growth & Forecast 2025 to 2035

Radiation-Induced Myelosuppression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Irradiation Apparatus Market Trends – Growth & Industry Outlook 2024-2034

Food Irradiation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food Irradiation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Medical Radiation Detectors Market

Internal Radiation Therapy Market Trends – Growth & Forecast 2024-2034

Cutaneous Radiation Injury Treatment Market

Superficial Radiation Therapy System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA