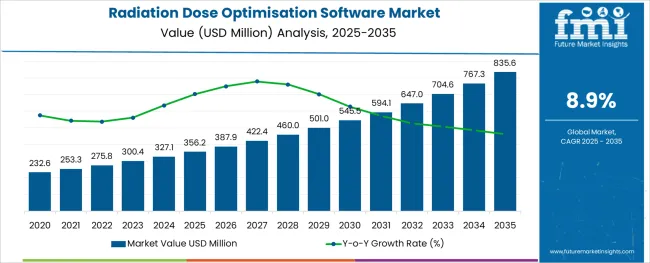

The Radiation Dose Optimisation Software Market is estimated to be valued at USD 356.2 million in 2025 and is projected to reach USD 835.6 million by 2035, registering a compound annual growth rate (CAGR) of 8.9% over the forecast period.

The radiation dose optimisation software market is undergoing significant evolution as healthcare providers prioritize patient safety, diagnostic accuracy, and regulatory compliance in imaging practices. Growing concerns regarding radiation overexposure in diagnostic radiology have prompted global efforts to standardize dose levels and enforce reporting requirements.

Healthcare institutions are adopting intelligent software systems that leverage machine learning and historical imaging data to recommend optimal scanning protocols and adjust dose parameters in real time. These platforms are increasingly integrated with PACS and RIS systems to provide seamless workflow compatibility.

Rising demand for personalized imaging, increased adoption of advanced modalities such as CT and hybrid imaging, and international regulatory pressure from bodies focused on radiological protection are all contributing to the market’s upward trajectory. Future growth is expected to be driven by cloud-based deployment models, AI-powered dose monitoring tools, and clinical decision support features tailored to patient-specific risk profiles and imaging needs.

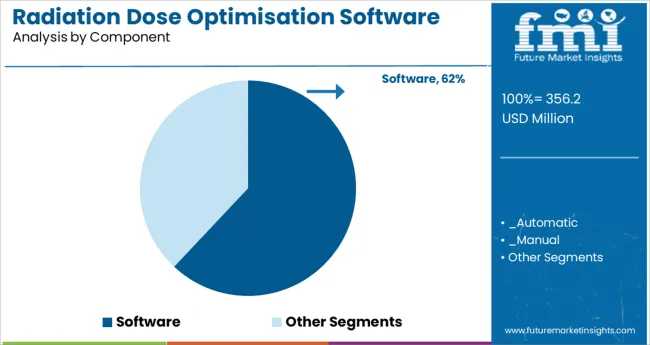

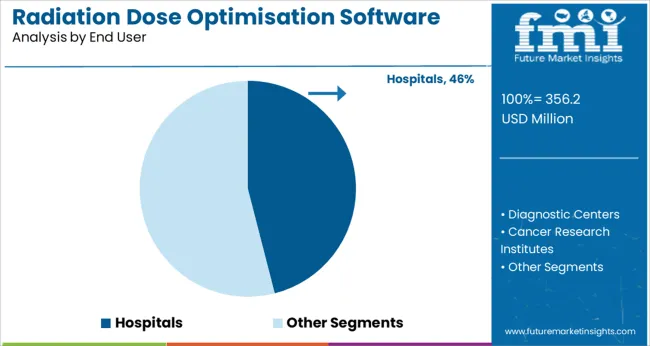

The market is segmented by Component and End User and region. By Component, the market is divided into Software and Services. In terms of End User, the market is classified into Hospitals, Diagnostic Centers, Cancer Research Institutes, and Others.

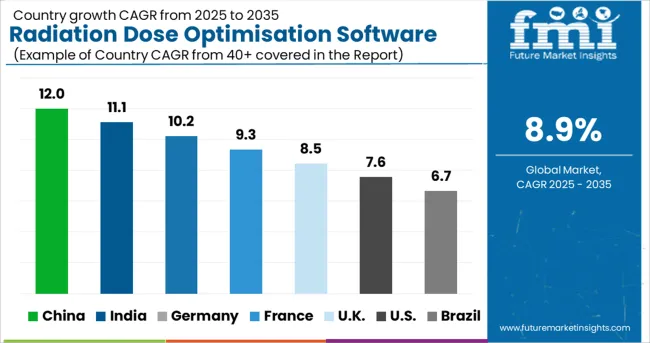

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The software component segment is anticipated to lead the market with a 62.0% revenue share in 2025, reinforcing its central role in dose optimisation strategies. This dominance is attributed to the critical function software plays in enabling real time monitoring, dose tracking, and protocol standardisation across diverse imaging systems.

Vendors have focused on developing interoperable platforms that can integrate with existing imaging infrastructure while providing intuitive dashboards, audit-ready reporting tools, and AI-assisted dose recommendations. As imaging volumes increase and reimbursement models link to quality metrics, healthcare providers have been prioritizing investment in software that not only ensures patient safety but also improves operational efficiency and compliance.

The flexibility offered by modular software solutions in accommodating various imaging environments and regulatory frameworks has further cemented their leading position in the component landscape.

Hospitals are projected to account for 46.0% of total revenue in the radiation dose optimisation software market in 2025, making them the leading end user group. This leadership is being driven by high imaging volumes, comprehensive diagnostic service offerings, and the institutional responsibility to meet safety and accreditation standards.

Hospitals are increasingly adopting enterprise-wide dose monitoring solutions that offer cross-departmental integration, enabling centralised oversight of patient exposure levels. These systems facilitate compliance with international guidelines, reduce risk of radiation-induced complications, and support clinical decision-making by aligning dose protocols with diagnostic requirements.

The growing number of accreditation programs tied to dose tracking and optimisation, alongside the rise in advanced imaging modalities used in hospitals, has reinforced the need for scalable and intelligent software tools. As patient safety, regulatory alignment, and digital transformation remain top priorities in hospital imaging departments, their share in the market is expected to remain prominent.

| Market Statistics | Details |

|---|---|

| H1,2024 (A) | 27.1% |

| H1,2025 Projected (P) | 27.4% |

| H1,2025 Outlook (O) | 28.0% |

| BPS Change : H1,2025 (O) - H1,2025 (P) | (+) 60 ↑ |

| BPS Change : H1,2025 (O) - H1,2024 (A) | (+) 90 ↑ |

The concentration of cancer cure hospitals for making sure the security of patients together with increasing the security of workers working in radiotherapy centres is promoting hospitals to set up radiation dose optimization software. Many vendors are providing radiation dose optimization software and are constantly improving their product offerings to become competitive in the radiation dose optimization software market.

According to the Future Market Insights analysis, the BPS values interpreted in the radiation dose optimization software market in H1,2025-(O) (Outlook) over H1,2025 (P) are projected to show a growth of +60 units. The reason for the growth of BPS values is the high focus on research and development in the healthcare sector, leading to higher adoption of modern technologies by healthcare providers is the major factor driving the market growth.

The BPS change: H1, 2025 (O) over H1,2024 (A) shows a growth of +90 units. The crucial reason for this growth of BPS values is a rise in the need for radiation dose optimization software in hospitals because of the growing number of medical X-ray imaging, computed tomography scans, and other diagnosis carried out in hospitals is the major factor driving the market growth.

Radiation dose optimisation software is available in automatic as well as manual operating modes. The automatic mode is extensively favoured by end users such as diagnostic centres, hospitals, cancer research institutes, and others as it decreases errors that are likely to occur from human interference.

The software solution automatically measures, examines, gathers, and reports a patient’s radiation exposure data in groups as well as on an individual basis, and also allows real-time staff exposure measurements.

Doctors are using radiation dose optimisation software for the purpose of observing and governing radiation doses in patients. Also, radiation dose optimisation software is used for controlling multiple aspects related to the dose. The radiation dose quantity varies as per the patient and the disease.

Given the humungous number of hospitals present in the world, the market for radiation dose optimisation software is expected to increase shortly. Moreover, the healthcare sector comprises a significant amount of market share in the global industry. Further, there is a high focus on research and development in the healthcare sector, leading to heavy adoption of the latest technologies by healthcare providers, which is expected to significantly impact the market growth of radiation dose optimisation software.

Hospitals are a key target area for radiation dose optimisation software vendors, accounting for over half the overall radiation dose optimisation software market. An increase in the demand for radiation dose optimisation software in hospitals is due to the increasing number of X-ray examinations, CT scans, and other examinations conducted in hospitals.

Diagnostic centres occupied a share of 22.0% in 2020 and are expected to witness a downfall in market share by the end of 2035. Despite witnessing a downfall, diagnostic centres will remain the second leading end user in terms of deployment of radiation dose optimisation software as the need to diagnose chronic diseases will trigger demand for the software. Cancer diagnosis will play a crucial role in the development of this sector in particular with radiation monitoring being the need of the hour.

The global radiation dose optimisation software market is estimated to be valued at USD 356.2 million in 2025.

It is projected to reach USD 835.6 million by 2035.

The market is expected to grow at a 8.9% CAGR between 2025 and 2035.

The key product types are software, _automatic, _manual, services, _education & training and _support.

hospitals segment is expected to dominate with a 46.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Radiation Tolerant LED Light Market Size and Share Forecast Outlook 2025 to 2035

Radiation Hardened Electronics Market Size and Share Forecast Outlook 2025 to 2035

Radiation Protection Cabins Market Size and Share Forecast Outlook 2025 to 2035

Radiation-Free Fetal Heart Rate Monitor Market Size and Share Forecast Outlook 2025 to 2035

Radiation Hardened Microcontrollers Market Size and Share Forecast Outlook 2025 to 2035

Radiation Detection Device Market Size and Share Forecast Outlook 2025 to 2035

Radiation Curable Coatings Market Size and Share Forecast Outlook 2025 to 2035

Radiation Toxicity Treatment Market Size and Share Forecast Outlook 2025 to 2035

Radiation-Induced Myelosuppression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Radiation Tester Market Growth – Trends & Forecast 2025 to 2035

Radiation-Induced Fibrosis Treatment Market - Growth & Forecast 2025 to 2035

Radiation Proctitis Treatment Market

Radiation Therapy Software Market Size and Share Forecast Outlook 2025 to 2035

Irradiation Apparatus Market Trends – Growth & Industry Outlook 2024-2034

Food Irradiation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food Irradiation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Medical Radiation Detectors Market

Internal Radiation Therapy Market Trends – Growth & Forecast 2024-2034

Cutaneous Radiation Injury Treatment Market

Superficial Radiation Therapy System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA