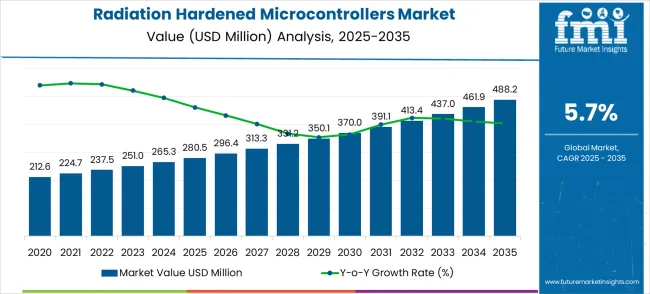

The radiation-hardened microcontrollers market is expected to expand from USD 280.5 million in 2025 to USD 488.2 million by 2035, reflecting a CAGR of 6%. The market growth curve displays a steady upward trajectory, shaped by gradual adoption in aerospace, defense, and space applications where reliability under extreme conditions is critical.

In the early phase, 2025 to 2028, growth is driven by the deployment of new satellites, spacecraft, and defense electronics requiring robust microcontrollers capable of withstanding radiation exposure. This initial phase creates a noticeable incline in the curve, reflecting adoption by early movers in specialized sectors.

From 2028 to 2032, the curve maintains a consistent slope as demand broadens across additional aerospace programs, commercial satellites, and industrial applications that benefit from radiation-hardened solutions. Incremental growth during this period is supported by improvements in microcontroller performance, miniaturization, and power efficiency.

By 2032 to 2035, growth continues steadily, fueled by replacement cycles, expansion of space programs in emerging regions, and integration of advanced control systems. The overall shape indicates a market characterized by steady, predictable expansion, where early adoption establishes a base and subsequent adoption and technological enhancements sustain long-term growth. This trajectory allows manufacturers to plan production, innovation, and market deployment over the decade effectively.

The radiation hardened microcontrollers market serves aerospace and defense systems (41%), satellite and space applications (27%), nuclear energy facilities (15%), industrial automation in high-radiation environments (10%), and specialty medical and research devices (7%). Aerospace and defense lead demand due to critical reliance on microcontrollers that withstand extreme radiation in avionics, missiles, and military electronics. Satellite and space applications adopt these controllers to ensure reliability in orbit under cosmic radiation.

Nuclear energy facilities use them for monitoring, control, and safety systems. Industrial applications include semiconductor fabrication and high-energy physics labs, while specialty medical and research devices deploy radiation-hardened microcontrollers for imaging and experimental equipment

Key trends include enhanced fault-tolerant architectures, advanced CMOS design techniques, and integration with low-power systems. Manufacturers are innovating with smaller form factors, higher clock speeds, and extended operational life in radiation-heavy environments. Growth is driven by increased space missions, defense modernization programs, and nuclear infrastructure expansion. Collaborations between microcontroller producers and system integrators enable customized, high-reliability solutions, reinforcing global market growth.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 280.5 million |

| Forecast Value in (2035F) | USD 488.2 million |

| Forecast CAGR (2025 to 2035) | 6% |

Market expansion is being supported by the rapid increase in space missions and satellite deployment programs worldwide, creating corresponding demand for computing solutions that can withstand intense radiation environments while maintaining operational reliability over extended mission durations. Modern space missions require sophisticated processing capabilities for autonomous navigation, scientific data collection, communication systems, and mission-critical decision-making processes that must function flawlessly in high-radiation environments including Van Allen belts, solar particle events, and cosmic ray exposure.

The growing complexity of defense electronics and increasing emphasis on autonomous military systems are driving demand for radiation hardened microcontrollers that can operate reliably in challenging environments including nuclear facilities, military satellites, and strategic defense applications. Advanced defense systems require computing platforms that can withstand electromagnetic pulse events, nuclear radiation exposure, and other extreme environmental conditions while maintaining operational integrity and mission readiness. Regulatory requirements and military specifications are establishing stringent radiation tolerance standards that require specialized microcontroller technologies with validated performance characteristics.

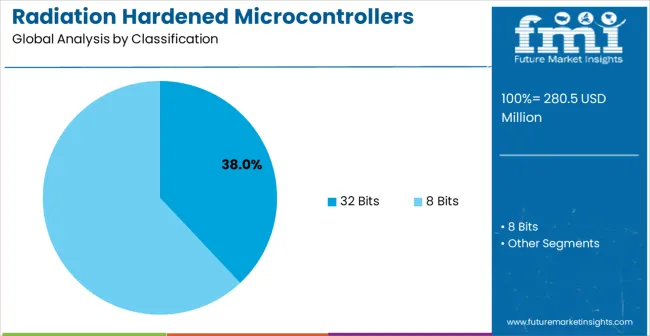

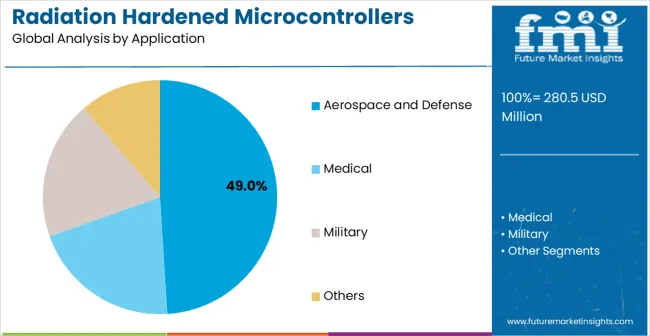

The market is segmented by microcontroller type, end-use industry, and region. By microcontroller type, the market is divided into 32 bits and 8 bits. Based on end-use industry, the market is categorized into aerospace and defense, medical, military, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

32 bits radiation hardened microcontrollers are projected to account for 38.0% of the radiation hardened microcontrollers market in 2025. This leading share is supported by the superior processing capabilities and memory addressing capacity required for modern space and defense applications requiring complex computational tasks.

32-bit architectures provide the necessary computational power for autonomous system operation, real-time data processing, and sophisticated control algorithms in spacecraft, satellites, and defense systems operating in radiation-intensive environments. The segment benefits from established radiation hardening techniques, comprehensive qualification databases, and extensive software development ecosystems that facilitate adoption across diverse mission-critical applications.

32 bits radiation hardened microcontroller technology continues advancing through development of enhanced processing architectures, improved radiation tolerance mechanisms, and integrated fault-tolerant features that support next-generation space and defense applications. The segment growth reflects increasing adoption of complex autonomous systems, advanced scientific instruments, and sophisticated communication platforms that require substantial computational resources while maintaining radiation resistance. Manufacturers are developing next-generation 32-bit radiation hardened microcontrollers with integrated machine learning capabilities, advanced error correction systems, and comprehensive built-in self-test features that address evolving mission requirements and emerging technology applications.

Aerospace and defense applications are expected to represent 49% of radiation hardened microcontroller demand in 2025. This dominant share reflects the critical importance of reliable computing systems in space missions, satellite operations, and defense applications where radiation exposure poses significant operational risks.

Modern aerospace and defense systems depend on radiation hardened microcontrollers for flight control, navigation, communication, and payload management functions that must operate flawlessly throughout mission durations ranging from months to decades. The segment benefits from ongoing government investments in space exploration programs, satellite constellation deployments, and defense modernization initiatives that require advanced radiation-resistant computing solutions.

Aerospace and defense industry transformation toward autonomous systems and advanced mission capabilities is driving significant radiation hardened microcontroller demand as operators implement more sophisticated spacecraft designs, satellite technologies, and defense platforms requiring enhanced computational performance and reliability.

The segment expansion reflects increasing emphasis on mission success rates, operational autonomy, and system reliability that depend on superior radiation hardening performance and comprehensive fault tolerance capabilities. Advanced aerospace and defense applications are incorporating artificial intelligence algorithms, predictive maintenance systems, and autonomous decision-making capabilities that require sophisticated microcontroller technologies with validated radiation resistance and long-term reliability characteristics.

The radiation hardened microcontrollers market is advancing steadily due to increasing space mission frequency and growing demand for autonomous space systems. The market faces challenges including high development costs, lengthy qualification processes, and complex design requirements for radiation tolerance validation. Technological advancement efforts and industry standardization programs continue to influence product development and market expansion patterns across diverse applications.

The growing implementation of sophisticated fault-tolerant architectures and comprehensive error correction mechanisms in radiation hardened microcontrollers is enabling enhanced reliability, automatic fault recovery, and mission continuity in extreme radiation environments. Advanced fault tolerance technologies provide real-time error detection, automatic system recovery, and comprehensive data integrity protection that ensure mission success despite radiation-induced failures. These technological advances enable space and defense systems to achieve higher levels of operational reliability and mission completion rates while reducing ground intervention requirements and operational risks.

Microcontroller manufacturers are developing advanced radiation hardening techniques and specialized materials that provide superior radiation tolerance while maintaining competitive performance characteristics and power efficiency. Next-generation hardening technologies enable enhanced single-event upset immunity, improved total ionizing dose tolerance, and comprehensive latch-up protection that address evolving mission requirements and emerging radiation environments. These technological innovations support broader market adoption by providing enhanced performance characteristics that meet demanding space and defense applications while maintaining cost-effective manufacturing approaches.

Opportunity Pathway – Radiation-Hardened Microcontrollers Market The radiation-hardened microcontrollers market (USD 280.5M → USD 488.2M by 2035, CAGR ~6%) is being pulled by rising satellite deployments, autonomous spacecraft, and demand for certified rugged electronics in safety-critical systems. Together, targeted go-to-market and product strategies across the pathways below unlock USD 180–230 million in incremental revenue opportunities by 2035 (the central estimate aligns with the ~USD 208M market expansion).

Pathway A – Aerospace & Defense Mission Systems. Radiation-hardened microcontrollers remain core to flight computers, avionics and payload controllers for satellites and tactical platforms. The largest near-term pool: USD 60–70M.

Pathway B – Small-sat & Mega-constellation Nodes. Low-cost, space-qualified 32-bit controllers designed for high-volume small-sat builds (with simplified hardening and supply guarantees) capture scale. Incremental pool: USD 40–50M.

Pathway C – Deep-Space & High-Radiation Missions. High-assurance processors for missions to lunar, Jovian, and solar environments require advanced hardening and long-lifetime validation — premium, lower-volume demand. Expected pool: USD 15–25M.

Pathway D – Military & Avionics Upgrades. Ground and airborne platforms retrofitting legacy controllers with modern, hardened MCUs for secure comms, guidance and EW systems represent steady, high-value demand. Opportunity: USD 30–38M.

Pathway E – Medical & Critical Healthcare Electronics. Ruggedized microcontrollers for sterilizable, implantable, and mobile critical-care devices (where EMI/radiation tolerance and reliability matter) open a specialized niche. Pool: USD 7–10M.

Pathway F – Nuclear, Energy & Industrial Control. Controllers hardened for high-radiation zones (nuclear plants, particle accelerators) and industrial safety systems provide dependable replacement cycles. Pool: USD 8–12M.

Pathway G – COTS-to-Space Hardening & Qualification Services. Offering selective hardening, qualification testing, and guaranteed supply packages (COTS→RHIC conversion) shortens time-to-flight for many customers. Service + add-on revenue: USD 10–15M.

Pathway H – Secure, AI-Enabled On-Board Processing. Integrating lightweight ML accelerators, secure boot and cryptographic engines in hardened MCUs enables autonomous decisioning on-orbit — smaller but strategic. Disruptive pool: USD 5–10M.

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| Brazil | 6.0% |

| United States | 5.4% |

| United Kingdom | 4.8% |

| Japan | 4.3% |

The radiation hardened microcontrollers market demonstrates varied growth patterns across key countries, with China leading at a 7.7% CAGR through 2035, driven by aggressive space program expansion, government investments in satellite technology, and growing defense electronics capabilities. India follows at 7.1%, supported by cost-effective space missions, expanding satellite programs, and increasing domestic defense technology development. Germany records 6.6% growth, emphasizing precision engineering, advanced aerospace technologies, and European Space Agency leadership. Brazil shows steady growth at 6.0%, developing space technology capabilities and expanding defense electronics infrastructure. The United States maintains 5.4% growth, focusing on commercial space development and advanced defense systems. The United Kingdom demonstrates 4.8% expansion, supported by space industry growth and defense technology innovation. Japan records 4.3% growth, leveraging technological excellence and precision manufacturing capabilities.

The market for radiation hardened microcontrollers in China is expanding at a CAGR of 7.7%, above the global average. Growth is supported by increasing domestic satellite launches, space exploration programs, and defense electronics development. Local manufacturers are investing in designing microcontrollers with enhanced reliability, high-temperature tolerance, and radiation resistance. Industrial and research clusters are integrating these components into satellites, aerospace electronics, and high-altitude unmanned vehicles. Pilot projects demonstrate improved system durability and performance under harsh environmental conditions. Suppliers focus on scalability, precision, and rapid prototyping to meet growing domestic and export demand. Government support for space and defense programs accelerates adoption while collaborative research with universities enhances material design and circuit reliability.

India is projected to grow at a CAGR of 7.1%, above the global average. Expansion is driven by satellite programs, aerospace research, and defense electronics initiatives. Radiation hardened microcontrollers are deployed in low-earth-orbit satellites, communication systems, and UAVs. Manufacturers focus on automation and precision fabrication to enhance reliability and consistency. Industrial clusters and space research centers integrate microcontrollers into critical electronics assemblies. Pilot programs demonstrate improved thermal and radiation tolerance, reducing mission failure risks. Public-private collaborations accelerate adoption in high-tech industrial zones. Suppliers optimize supply chains to ensure timely availability for aerospace, defense, and communications applications.

Germany grows at a CAGR of 6.6%, above the global average. Growth is driven by aerospace, automotive, and defense sectors requiring reliable high-performance microcontrollers. Radiation hardened devices are integrated into satellites, industrial electronics, and autonomous vehicle systems. Suppliers focus on precision engineering, quality assurance, and energy-efficient designs. Industrial research collaborations improve fault tolerance and durability under radiation and temperature extremes. Pilot installations in aerospace testbeds demonstrate reliability in long-duration missions. Integration with advanced simulation and control systems improves operational efficiency and component longevity. Regulatory compliance ensures safety and quality in mission-critical applications.

The Brazilian market grows at a CAGR of 6.0%, slightly above the global average. Expansion is driven by satellite communication programs, space research initiatives, and emerging defense electronics projects. Radiation hardened microcontrollers are adopted in communication satellites, industrial sensors, and aerospace electronics. Suppliers focus on cost-efficient, durable devices that withstand high-radiation environments and tropical conditions. Pilot programs demonstrate operational reliability and performance consistency in high-altitude and harsh environmental applications. Local distributors provide maintenance support and technical training to optimize usage. Collaborative efforts with research institutions enhance material design and circuit protection for aerospace applications.

The United States grows at a CAGR of 5.4%, slightly below the global average. Slower growth is influenced by a mature aerospace and defense electronics market with existing installations. Radiation hardened microcontrollers are deployed in satellites, spacecraft, and high-altitude UAVs. Suppliers focus on high-reliability devices with strict quality control and precision. Industrial hubs prioritize integration with advanced simulation and automated control systems. Pilot programs demonstrate reduced failure rates and improved operational reliability under extreme conditions. R&D initiatives continue to optimize radiation shielding, thermal tolerance, and energy efficiency for space and defense applications.

The UK market grows at a CAGR of 4.8%, below the global average. Slower adoption is due to limited satellite launches and reliance on imported microcontrollers for aerospace and defense projects. Devices are integrated into communication satellites, industrial sensors, and research spacecraft. Suppliers emphasize precision, reliability, and ease of integration. Pilot projects demonstrate operational stability and reduced risk of system failure. Industrial clusters prioritize maintenance support, technical training, and small-scale deployment for testing purposes. Adoption gradually increases in aerospace research facilities and niche defense electronics programs.

Japan grows at a CAGR of 4.3%, below the global average. Slower growth results from a mature market with limited new satellite programs and high reliance on imported devices. Radiation hardened microcontrollers are used in industrial electronics, research satellites, and aerospace systems. Suppliers focus on high-precision, durable devices with enhanced reliability and fault tolerance. Pilot projects demonstrate improved operational performance and component longevity in extreme conditions. Industrial clusters integrate microcontrollers into automated testing and aerospace assembly lines. R&D initiatives continue to refine circuit design, thermal stability, and radiation resistance to meet high-quality standards.

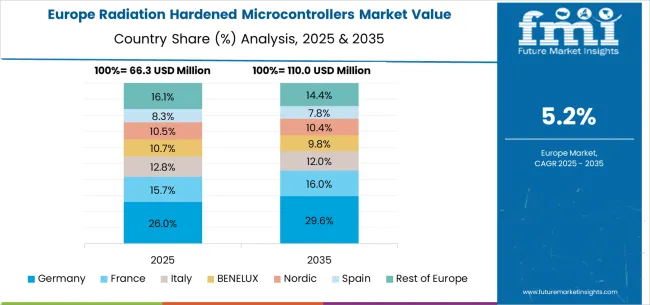

The radiation hardened microcontrollers market in Europe is projected to expand from USD 75.9 million in 2025 to USD 132.1 million by 2035, registering a CAGR of 6% over the forecast period. Germany is expected to maintain its leadership with 31.8% market share in 2025, projected to grow to 32.3% by 2035, supported by its extensive aerospace industry infrastructure and European Space Agency participation. France follows with 21.4% market share in 2025, expected to reach 21.8% by 2035, driven by space technology development and defense electronics capabilities.

The Rest of Europe region is projected to maintain stable share at 18.2% throughout the forecast period, attributed to emerging space technology initiatives in Eastern European countries and expanding defense electronics programs. United Kingdom contributes 16% in 2025, projected to reach 15.4% by 2035, supported by space industry development and defense technology advancement. Italy maintains 12.9% share in 2025, expected to grow to 13.5% by 2035, while other European countries demonstrate steady growth patterns reflecting regional space technology development and defense electronics advancement initiatives.

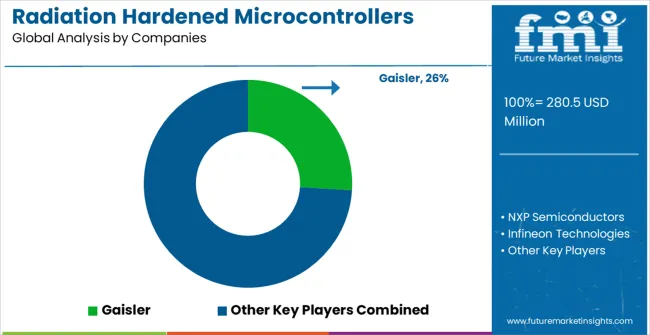

The radiation hardened microcontrollers market is characterized by competition among specialized semiconductor companies, aerospace technology providers, and defense electronics manufacturers. Companies are investing in advanced radiation hardening technologies, comprehensive testing capabilities, fault-tolerant architectures, and long-term reliability programs to deliver mission-critical microcontroller solutions. Strategic partnerships, technological innovation, and qualification program development are central to strengthening product portfolios and market presence.

Gaisler, Sweden-based, offers specialized radiation hardened microcontrollers with focus on space applications, fault-tolerant design, and comprehensive development tool support for mission-critical systems. NXP Semiconductors, Netherlands, provides advanced radiation hardened solutions emphasizing automotive-grade reliability, comprehensive qualification programs, and integrated system capabilities. Infineon Technologies AG, Germany, delivers comprehensive microcontroller portfolios with focus on reliability, radiation tolerance, and advanced manufacturing processes.

Microchip Technology, Inc., USA, emphasizes cost-effective radiation hardened solutions with comprehensive support services and established qualification databases for diverse applications. Renesas Electronics Corporation, Japan, offers specialized space-grade microcontrollers with focus on low power consumption, extended temperature operation, and comprehensive reliability features.

Silicon Labs, USA, provides innovative radiation hardened solutions with emphasis on integrated functionality and comprehensive development support ecosystems. Other key players including STMicroelectronics, VORAGO Technologies, Atmel, Texas Instruments, Inc., Avnet, and Silica contribute specialized expertise and comprehensive technical capabilities across global and regional markets.

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 280.5 million |

| Microcontroller Type | 32 Bits and 8 Bits |

| End-Use Industry | Aerospace and Defense, Medical, Military, and Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Gaisler, NXP Semiconductors, Infineon Technologies AG, Microchip Technology, Inc., Renesas Electronics Corporation, Silicon Labs, STMicroelectronics, VORAGO Technologies, Atmel, Texas Instruments, Inc., Avnet, Silica |

| Additional Attributes | Dollar sales by microcontroller type and end-use industry segments, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established semiconductor manufacturers and specialized radiation hardening technology providers, buyer preferences for 32-bit versus 8-bit architectures, integration with advanced space systems and defense platforms, innovations in fault-tolerant architectures and error correction mechanisms, and adoption of next-generation radiation hardening technologies and materials for enhanced reliability and mission success in extreme radiation environments. |

The global radiation hardened microcontrollers market is estimated to be valued at USD 280.5 million in 2025.

The market size for the radiation hardened microcontrollers market is projected to reach USD 488.2 million by 2035.

The radiation hardened microcontrollers market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in radiation hardened microcontrollers market are 32 bits and 8 bits.

In terms of application, aerospace and defense segment to command 49.0% share in the radiation hardened microcontrollers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Radiation Tolerant LED Light Market Size and Share Forecast Outlook 2025 to 2035

Radiation Protection Cabins Market Size and Share Forecast Outlook 2025 to 2035

Radiation-Free Fetal Heart Rate Monitor Market Size and Share Forecast Outlook 2025 to 2035

Radiation Detection Device Market Size and Share Forecast Outlook 2025 to 2035

Radiation Curable Coatings Market Size and Share Forecast Outlook 2025 to 2035

Radiation Toxicity Treatment Market Size and Share Forecast Outlook 2025 to 2035

Radiation-Induced Myelosuppression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Radiation Dose Optimisation Software Market Size and Share Forecast Outlook 2025 to 2035

Radiation Therapy Software Market Size and Share Forecast Outlook 2025 to 2035

Radiation Tester Market Growth – Trends & Forecast 2025 to 2035

Radiation-Induced Fibrosis Treatment Market - Growth & Forecast 2025 to 2035

Radiation Proctitis Treatment Market

Radiation Hardened Electronics Market Size and Share Forecast Outlook 2025 to 2035

Irradiation Apparatus Market Trends – Growth & Industry Outlook 2024-2034

Food Irradiation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food Irradiation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Medical Radiation Detectors Market

Internal Radiation Therapy Market Trends – Growth & Forecast 2024-2034

Cutaneous Radiation Injury Treatment Market

Superficial Radiation Therapy System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA