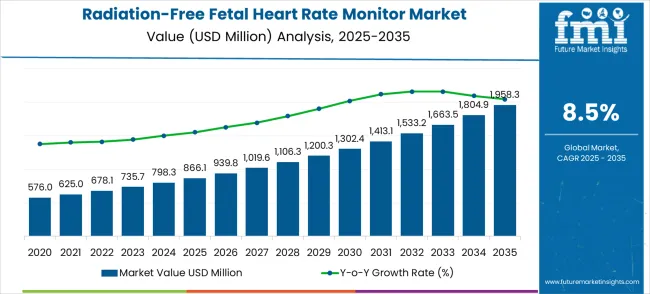

The global radiation-free fetal heart rate monitor market is expected to grow from USD 866.1 million in 2025 to USD 1,958.3 million by 2035, advancing at a CAGR of 8.5%, recording an absolute increase of USD 1,092.2 million over the forecast period. The market is valued at 866.1 million in 2025 and is set to rise at a CAGR of 8.5% during the assessment period.

The overall market size is expected to grow by nearly 2.26x during the same period, supported by increasing awareness about prenatal care safety and growing preference for non-invasive monitoring solutions. High initial equipment costs and technical complexity in rural healthcare settings may temper growth momentum.

Between 2025 and 2030, the radiation-free fetal heart rate monitor market is projected to expand from USD 866.1 million to USD 1,302.3 million, resulting in a value increase of USD 436.2 million, which represents 39.9% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for prenatal safety monitoring, product innovation in wireless connectivity and mobile applications, and expanding healthcare accessibility in emerging markets. Companies are establishing competitive positions through investment in sensor technology advancement, portable device development, and strategic market expansion across hospitals, clinics, and home-use channels.

From 2030 to 2035, the market is forecast to grow from USD 1,302.3 million to USD 1,958.3 million, adding another USD 656.0 million, which constitutes 60.1% of the overall ten-year expansion. This period is expected to be characterized by the expansion of artificial intelligence integration, including predictive analytics and automated risk assessment tailored for specific patient populations, strategic collaborations between medical device manufacturers and healthcare providers, and telemedicine integration with real-time data transmission capabilities. The growing emphasis on personalized prenatal care and preventive healthcare will drive demand for advanced monitoring technologies across diverse clinical and home-care applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 866.1 million |

| Market Forecast Value (2035) | USD 1,958.3 million |

| Forecast CAGR (2025 to 2035) | 8.5% |

Market expansion is driven by healthcare providers seeking safer prenatal monitoring alternatives that eliminate radiation exposure risks while maintaining diagnostic accuracy. Rising awareness about radiation-free monitoring benefits among expectant mothers, coupled with technological advances in Doppler ultrasound and photoelectric sensors, creates strong demand for non-invasive fetal monitoring solutions.

The shift toward preventive healthcare and early detection of fetal complications supports adoption across hospitals, clinics, and home-care settings. Growing birth rates in developing regions and increasing healthcare infrastructure investments expand market accessibility.

Premium healthcare segments prioritize patient safety and comfort, driving preference for radiation-free monitoring technologies. Budget constraints in developing healthcare systems and training requirements for advanced monitoring equipment may limit widespread adoption rates.

The radiation-free fetal heart rate monitor market (USD 866.1M → 1,958.3M by 2035, CAGR ~8.5%) is propelled by rising maternal health awareness, demand for safe and non-invasive monitoring technologies, and the shift toward home-based and portable healthcare devices. Growth is driven by the adoption of Doppler monitors, increasing innovation in photoelectric sensor technologies, and regional expansion in Asia-Pacific. Together, product innovation and care-setting diversification unlock ~USD 1.1B in incremental revenue opportunities by 2035.

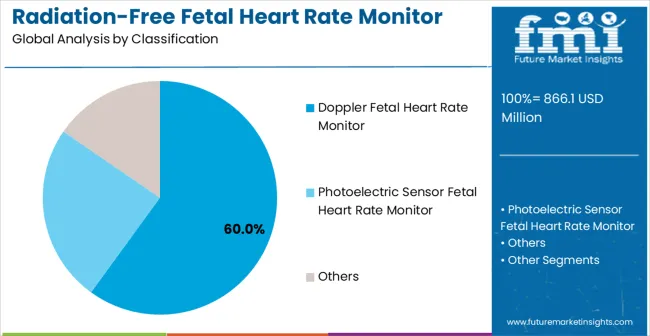

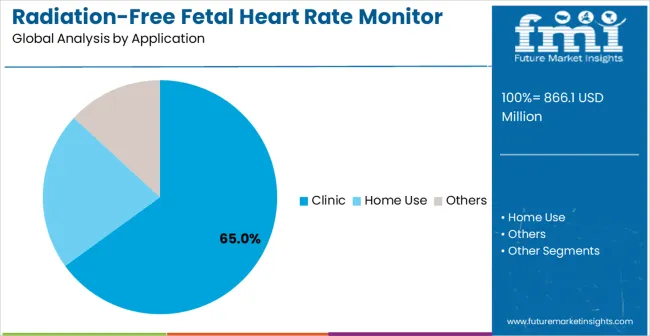

The market is segmented by product type, end-user, and region. By product type, the market is divided into Doppler fetal heart rate monitors, photoelectric sensor fetal heart rate monitors, and others. By end-user, the market is categorized into clinics, home use, and others. Regionally, the market is divided into North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

Doppler fetal heart rate monitors are projected to hold a 60% share of the radiation-free fetal heart rate monitor market in 2025, reflecting their widespread adoption and clinical reliability. The leading market position of this segment is attributed to its proven effectiveness in detecting fetal heartbeats even during early stages of pregnancy.

Healthcare professionals prefer Doppler monitors for routine prenatal care because they provide accurate, real-time audio feedback without exposing patients to radiation. Advances in device sensitivity, portability, and user interface design have enhanced usability for both clinical and home applications.

Modern Doppler monitors use digital signal processing to filter out ambient noise while amplifying fetal heartbeat sounds, ensuring clear detection. Professional-grade models support high-risk pregnancy monitoring, while portable home-use devices empower expectant parents to track fetal wellbeing safely. Continuous product innovation, combined with established clinical acceptance, ensures the Doppler segment maintains its dominant market position.

Advanced doppler algorithms enhance signal clarity by reducing background noise interference during monitoring sessions, ensuring accurate detection even in busy clinical or home environments, and providing reliable feedback for healthcare providers and expectant parents alike.

Clinics are expected to account for 65% of radiation-free fetal heart rate monitor demand in 2025, reflecting the central role of clinical facilities in prenatal care delivery. This dominant share is driven by routine fetal monitoring requirements throughout pregnancy and the integration of radiation-free monitoring into standard prenatal care protocols.

Clinics offer professional-grade devices that provide consistent performance across multiple patients while supporting diagnostic accuracy for early pregnancy assessment and ongoing fetal health evaluation. Healthcare facilities benefit from trained staff capable of using and maintaining equipment, ensuring proper calibration, hygiene, and optimal performance.

Clinic-based monitoring also enables accurate record-keeping and coordinated care when high-risk situations arise. The segment’s growth is supported by increasing patient awareness of radiation-free monitoring, adoption of non-invasive technologies, and demand for reliable, multi-patient systems capable of handling frequent clinical use. Routine prenatal check-ups in clinics incorporate radiation-free fetal heart rate monitoring as a standard patient safety practice, enhancing confidence in fetal health assessments while ensuring non-invasive, timely evaluations during each visit.

Market growth is driven by increasing awareness of radiation exposure risks during pregnancy, technological advances in non-invasive monitoring solutions, and growing emphasis on patient safety in prenatal care. Healthcare providers prioritize radiation-free alternatives that maintain diagnostic accuracy while eliminating potential risks to developing fetuses. Rising birth rates in developing regions and expanding healthcare infrastructure create new market opportunities for portable, cost-effective monitoring solutions. Government healthcare initiatives promoting maternal safety drive institutional adoption of radiation-free monitoring protocols. Insurance coverage expansion for prenatal monitoring services reduces financial barriers for patients seeking advanced monitoring technologies. Professional medical associations recommend radiation-free monitoring as preferred practice that supports comprehensive prenatal care delivery.

Market growth faces restraints including high initial equipment costs that limit adoption in resource-constrained healthcare settings, technical complexity requiring specialized training for optimal device operation, and regulatory approval processes that delay new product introductions. Limited healthcare infrastructure in rural areas restricts access to advanced monitoring technologies. Competition from traditional monitoring methods and budget constraints in developing healthcare systems may slow adoption rates. Device sensitivity variations across different patient populations require careful calibration and interpretation. Maintenance requirements and technical support needs create ongoing operational expenses that affect total cost of ownership.

Key trends include integration of artificial intelligence for predictive analytics and automated risk assessment, development of smartphone-compatible monitoring devices that enable home-use applications, and expansion of telemedicine platforms incorporating real-time fetal monitoring data. Manufacturers focus on portable, user-friendly designs that support both clinical and home-care environments. Strategic partnerships between device manufacturers and healthcare providers accelerate product adoption and market penetration across diverse healthcare settings. Cloud-based data management systems enable comprehensive monitoring records while supporting care coordination among healthcare teams. Regulatory harmonization across international markets facilitates global product distribution and market expansion strategies.

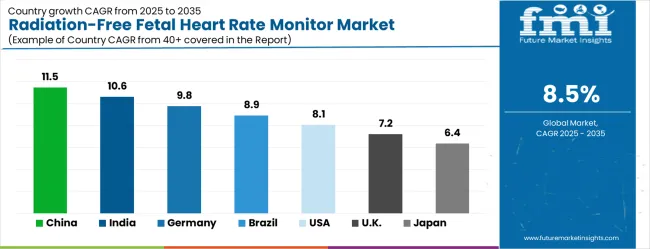

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 11.5% |

| India | 10.6% |

| Germany | 9.8% |

| Brazil | 8.9% |

| United States | 8.1% |

| United Kingdom | 7.2% |

| Japan | 6.4% |

The radiation-free fetal heart rate monitor market is gathering pace worldwide, with China taking the lead thanks to rapid healthcare infrastructure development and increasing birth rates. Close behind, India benefits from expanding prenatal care awareness and growing middle-class healthcare spending, positioning itself as a strategic growth hub. Germany shows steady advancement, where integration of advanced medical technologies strengthens its role in the regional supply chain. Brazil is sharpening focus on maternal healthcare improvements and public health initiatives, signaling an ambition to capture niche opportunities. Meanwhile, the United States stands out for its established healthcare infrastructure, and the United Kingdom and Japan continue to record consistent progress. Together, China and India anchor the global expansion story, while the rest build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from radiation-free fetal heart rate monitors in China is projected to grow at a CAGR of 11.5%, driven by government healthcare reform initiatives promoting maternal safety and the rapid adoption of advanced medical technologies across urban and rural healthcare facilities. Expansion of the middle class has created strong demand for premium prenatal care services prioritizing patient safety, comfort, and convenience.

Healthcare modernization programs are encouraging widespread adoption of radiation-free monitoring in hospitals, clinics, and maternal care centers throughout major metropolitan regions such as Beijing, Shanghai, and Shenzhen. Growing birth rates following policy adjustments and family planning initiatives provide sustained demand for comprehensive prenatal monitoring solutions. The private healthcare sector is also expanding, offering additional opportunities for advanced fetal monitoring technologies.

Continuous professional training programs ensure healthcare providers are proficient in device operation, contributing to improved patient outcomes and operational efficiency. Government healthcare initiatives mandate radiation-free monitoring protocols across public maternal care facilities in tier-1 and tier-2 cities, driving consistent technology adoption while emphasizing patient safety and compliance standards.

Market for radiation-free fetal heart rate monitors is expected to grow at a CAGR of 10.6%, fueled by rising awareness of prenatal care importance and expanding access to advanced healthcare services in urban and semi-urban regions. The country’s large population of expectant mothers, coupled with government maternal health initiatives and private healthcare expansion, creates a robust demand for affordable, reliable, and safe monitoring solutions.

Urban healthcare infrastructure expansion in metropolitan centers such as Chennai, Mumbai, and Delhi enables widespread adoption of radiation-free monitoring technologies. Middle-class families increasingly seek premium prenatal care services that prioritize safety, comfort, and technological sophistication.

Professional development and training programs for healthcare providers enhance technical competency for operating advanced monitoring equipment, ensuring quality outcomes for diverse patient populations while maintaining adherence to prenatal care standards. Urban healthcare expansion provides opportunities for adoption of advanced prenatal monitoring technologies across metropolitan and emerging city markets, supporting better access and patient-centric care.

Demand for radiation-free fetal heart rate monitors in Germany is projected to grow at a CAGR of 9.8%, supported by the country’s leadership in medical technology innovation and strict healthcare quality standards. German healthcare providers prioritize precision monitoring devices that deliver superior diagnostic accuracy while meeting rigorous safety and compliance requirements. Strong medical device manufacturing capabilities and comprehensive healthcare infrastructure facilitate widespread adoption across hospitals, clinics, and specialized maternal care centers.

Continuous research and development initiatives improve monitoring technology performance, user interface design, and patient experience. Health insurance coverage ensures financial accessibility for prenatal monitoring services, further supporting market growth. The combination of advanced technology, regulatory oversight, and professional healthcare provider expertise maintains Germany’s position as a leader in the European radiation-free fetal heart rate monitor market. Medical device innovation centers continuously develop next-generation radiation-free monitoring technologies with enhanced accuracy, user-friendly interfaces, and high reliability, improving patient safety and clinical workflow efficiency.

Market in Brazil for radiation-free fetal heart rate monitors is projected to grow at a CAGR of 8.9%, driven by government investments in maternal healthcare infrastructure and expanding adoption of advanced technologies in the private healthcare sector. The country’s comprehensive public healthcare system integrates radiation-free monitoring to improve prenatal care quality and accessibility across urban and rural regions. Increased awareness of prenatal care importance among different population segments creates a growing demand for safe and effective monitoring solutions.

Professional development programs for healthcare providers enhance technical capabilities and ensure proper device utilization. Rising healthcare expenditure and economic development facilitate procurement of advanced monitoring equipment, further enabling public and private healthcare facilities to deliver superior prenatal care services. Public healthcare modernization incorporates radiation-free monitoring as a standard prenatal care protocol through systematic infrastructure development, improving access and quality of maternal and fetal health services nationwide.

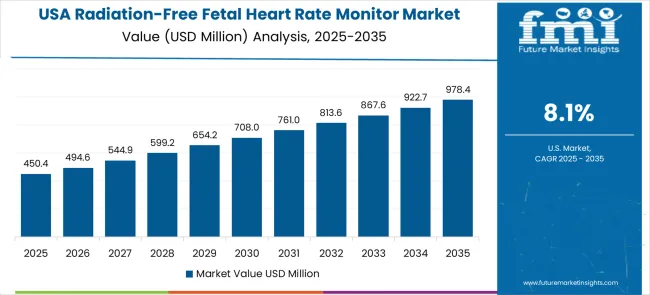

In the United States, revenue from radiation-free fetal heart rate monitors is projected to grow at a CAGR of 8.1%, driven by established healthcare infrastructure, strong patient safety protocols, and integration of advanced medical technologies in prenatal care. Large healthcare networks and specialized maternal care facilities maintain comprehensive monitoring capabilities that cater to diverse patient needs.

Health insurance coverage reduces financial barriers, enabling broader access to advanced monitoring technologies. Integration with electronic health records and telemedicine platforms ensures seamless clinical operations and efficient patient management. Liability considerations motivate providers to adopt non-invasive, radiation-free monitoring devices to mitigate potential legal risks while maintaining diagnostic accuracy.

The USA market also benefits from technological innovation, including portable, user-friendly devices that support both hospital and community-based prenatal care delivery. Consolidation of healthcare networks standardizes radiation-free monitoring protocols across multiple facilities, enhancing patient safety, operational efficiency, and data management capabilities in prenatal care services.

The United Kingdom’s radiation-free fetal heart rate monitor market is projected to grow at a CAGR of 7.2%, driven by National Health Service initiatives promoting maternal safety and private healthcare adoption of advanced prenatal monitoring technologies. Radiation-free monitoring is integrated into standard prenatal care protocols, minimizing risks while maintaining diagnostic effectiveness. Healthcare providers increasingly invest in portable, user-friendly devices suitable for both clinical and community-based care.

NHS guidelines ensure evidence-based adoption of monitoring technologies that prioritize patient safety. The private healthcare sector provides additional opportunities for premium devices, appealing to patients seeking enhanced prenatal care services. Telemedicine integration expands access to monitoring in remote or underserved areas, improving maternal health coverage across diverse regions. NHS guidelines systematically implement radiation-free monitoring as the preferred prenatal care practice, enhancing safety standards across hospitals, clinics, and community health services while ensuring uniform adoption.

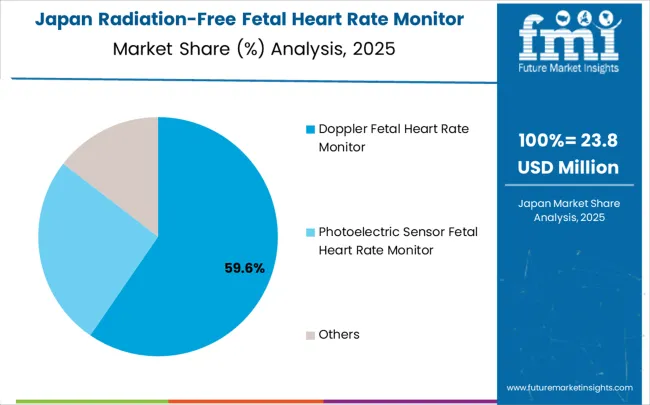

Japan’s market for radiation-free fetal heart rate monitors is projected to grow at a CAGR of 6.4%, driven by advanced medical technology adoption, precision-focused prenatal care protocols, and an emphasis on patient safety. Sophisticated monitoring systems are widely used in hospitals, clinics, and specialized maternal care centers, integrating seamlessly with electronic health records and telemedicine platforms. Japan’s aging population and unique demographic trends increase demand for high-quality, reliable prenatal monitoring services.

Collaboration between medical technology companies and healthcare institutions supports development of innovative, user-friendly devices tailored to local population health needs. Regulatory oversight ensures stringent quality standards while encouraging innovation in portable and high-precision monitoring devices. Healthcare provider training programs enhance operational expertise, ensuring devices are used effectively to optimize maternal and fetal outcomes. Advanced technology integration enables comprehensive prenatal monitoring, combining electronic health records, telemedicine connectivity, and precise data tracking to support maternal care management across hospital and home environments.

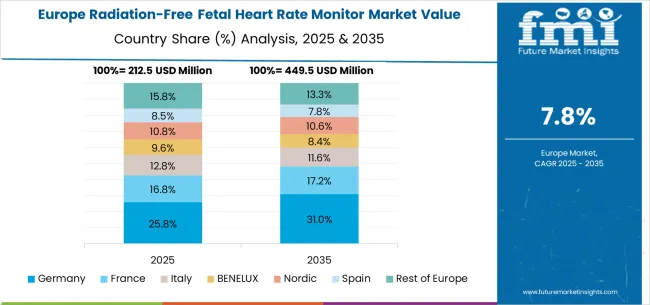

The radiation-free fetal heart rate monitor market in Europe demonstrates steady growth supported by established healthcare infrastructure and strong emphasis on patient safety in maternal care. Germany maintains market leadership through advanced medical device manufacturing capabilities and comprehensive healthcare coverage that supports widespread adoption of radiation-free monitoring technologies. The United Kingdom follows with significant market presence driven by NHS initiatives promoting safer prenatal care practices.

France and Italy contribute substantial market shares through expanding healthcare modernization programs and increasing private healthcare investment. Nordic countries demonstrate strong adoption rates due to comprehensive social healthcare systems that prioritize advanced monitoring technologies. BENELUX region shows consistent growth supported by cross-border healthcare collaboration and technology sharing initiatives. Eastern European countries expand market participation through healthcare infrastructure development and increasing healthcare expenditure allocation.

The radiation-free fetal heart rate monitor market features competition among established medical device manufacturers, specialized prenatal care technology companies, and emerging portable device developers. Companies invest in advanced sensor technologies, wireless connectivity capabilities, mobile application integration, and user-friendly designs to deliver accurate, convenient, and cost-effective monitoring solutions. Strategic partnerships with healthcare providers, technological innovation in artificial intelligence integration, and geographic market expansion remain central to strengthening product portfolios and market presence across diverse healthcare environments.

Market leaders include Philips, which leverages comprehensive healthcare technology expertise and global distribution networks to maintain strong market position through professional-grade monitoring solutions. Beurer focuses on consumer-friendly devices that combine clinical accuracy with home-use convenience. Dräger emphasizes hospital-grade monitoring systems that integrate with existing healthcare infrastructure. Medtronic brings extensive medical device experience and regulatory compliance capabilities to support clinical adoption. Nihon Kohden specializes in precision monitoring technologies that meet stringent healthcare quality requirements.

Challengers include Huntleigh Healthcare, which develops specialized prenatal monitoring solutions, and CONTEC, which offers cost-effective monitoring devices for emerging markets. Specialist providers include Babyfun, focusing on consumer-oriented home-use devices, Banglijian, emphasizing portable monitoring solutions, and emerging companies like Yuwell, Cofoe, and Cosonic Intelligent, which target specific market segments through innovative product designs and competitive pricing strategies that expand market accessibility.

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 866.1 million |

| Product Type | Doppler Fetal Heart Rate Monitor, Photoelectric Sensor Fetal Heart Rate Monitor, Others |

| End-User | Clinic, Home Use, Others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Philips, Beurer, Dräger, Medtronic, Nihon Kohden, Huntleigh Healthcare, Babyfun, CONTEC, Banglijian, Yuwell, Cofoe, Cosonic Intelligent |

| Additional Attributes | Dollar sales by product type and end-user categories, regional prenatal care demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established medical device manufacturers and emerging technology providers, healthcare provider preferences for clinical versus home-use monitoring solutions, integration with telemedicine platforms and mobile health applications, innovations in wireless connectivity and artificial intelligence capabilities, and development of portable monitoring devices with enhanced sensor accuracy and user-friendly interfaces for improved patient care outcomes. |

The global radiation-free fetal heart rate monitor market is estimated to be valued at USD 866.1 million in 2025.

The market size for the radiation-free fetal heart rate monitor market is projected to reach USD 1,958.3 million by 2035.

The radiation-free fetal heart rate monitor market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in radiation-free fetal heart rate monitor market are doppler fetal heart rate monitor, photoelectric sensor fetal heart rate monitor and others.

In terms of application, clinic segment to command 65.0% share in the radiation-free fetal heart rate monitor market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fetal And Neonatal Care Equipment Market Size and Share Forecast Outlook 2025 to 2035

The Cell-free Fetal DNA Testing Market is segmented by kits, sample type and end user from 2025 to 2035

Neonatal and Fetal Monitors Market Size and Share Forecast Outlook 2025 to 2035

Monitoring Tool Market Size and Share Forecast Outlook 2025 to 2035

Pet Monitoring Camera Market Size and Share Forecast Outlook 2025 to 2035

Brix Monitor Market Size and Share Forecast Outlook 2025 to 2035

Pain Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Dose Monitoring Devices Market - Growth & Demand 2025 to 2035

Brain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Motor Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Neuro-monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Media Monitoring Tools Market Size and Share Forecast Outlook 2025 to 2035

Noise Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Nerve Monitoring Devices Market Insights - Growth & Forecast 2025 to 2035

Yield Monitor Market Growth – Trends & Forecast 2025 to 2035

Power Monitoring Market Report - Growth, Demand & Forecast 2025 to 2035

Urine Monitoring Systems Market Analysis - Size, Trends & Forecast 2025 to 2035

Brain Monitoring Systems Market is segmented by Lateral Flow Readers and Kits and Reagents from 2025 to 2035

Flare Monitoring Market

Yield Monitoring Systems Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA