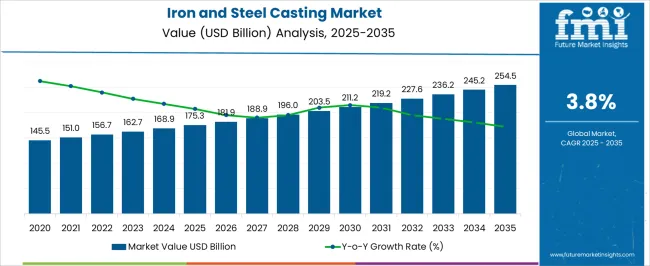

The iron and steel casting market is expected to grow from USD 175.3 billion in 2025 to USD 254.5 billion by 2035, reflecting a compound annual growth rate (CAGR) of 3.8%. This steady growth trajectory suggests that the market will continue to benefit from strong demand in sectors such as automotive, construction, and manufacturing.

As industries focus on increasing productivity, the demand for high-strength, durable, and efficient castings is being fueled by evolving manufacturing needs. The market is anticipated to remain stable, driven by long-term demand from established industries that rely on castings for critical machinery and infrastructure.

Over the next decade, the market’s growth will likely be characterized by a shift toward precision casting techniques to meet the rising demand for complex, high-performance components. Key industry players are expected to capitalize on improvements in material handling, enhanced processing technologies, and greater efficiency in production lines. Increased demand for lightweight and high-tensile strength products will drive the adoption of advanced casting methods. The iron and steel casting market is expected to see strong growth in automotive manufacturing, where weight reduction and component strength are becoming increasingly important. The market’s dynamics will thus remain positively influenced by evolving industrial demands and consistent investments in production optimization.

| Metric | Value |

|---|---|

| Iron and Steel Casting Market Estimated Value in (2025 E) | USD 175.3 billion |

| Iron and Steel Casting Market Forecast Value in (2035 F) | USD 254.5 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

The iron and steel casting market has established a solid presence within its parent industries, driven by its critical role in the production of high-strength components used across diverse industrial applications. Within the metal casting market, iron and steel castings account for approximately 40–45% share, due to their widespread use in manufacturing a range of products from automotive parts to machinery components. In the steel manufacturing market, the segment represents around 18–20%, as casting processes are crucial for shaping steel products for the construction, automotive, and machinery sectors. Within the foundry equipment market, iron and steel castings contribute roughly 25–28%, highlighting their importance in requiring specialized casting equipment for precision and high-volume production.

In the automotive components market, the segment holds a share of approximately 10–12%, with cast iron and steel being central to the production of engine blocks, exhaust systems, and other heavy-duty parts. Within the heavy machinery and equipment market, iron and steel castings represent about a 15–17% share, with these materials being fundamental in the production of large-scale industrial machines, pumps, and turbines. Despite challenges like material price volatility, the iron and steel casting market remains a cornerstone of global manufacturing.

The iron and steel casting market is expanding steadily, driven by rising demand from automotive, construction, heavy machinery, and energy sectors. Industry developments and manufacturing reports have emphasized the role of cast components in delivering high strength, durability, and design flexibility for complex industrial applications. Advancements in metallurgy, molding technology, and quality control systems have improved casting precision and reduced defects, enhancing adoption across end-use industries. Global infrastructure investment programs, along with sustained growth in transportation manufacturing, have further stimulated market demand.

Additionally, the shift toward lightweight yet high-performance alloys in certain applications has encouraged producers to optimize both ferrous and non-ferrous casting capabilities. Strategic investments in foundry automation, energy efficiency, and environmentally compliant production methods are supporting market competitiveness. Over the forecast period, the market is expected to be shaped by the continued dominance of iron-based materials, the operational efficiency of sand casting processes, and strong demand from the automotive sector, which remains a key consumer of precision cast parts.

The iron and steel casting market is segmented by material, process, application, and geographic regions. By material, iron and steel casting market is divided into Iron and Steel. In terms of process, iron and steel casting market is classified into Sand Casting and Die Casting. Based on application, iron and steel casting market is segmented into Automotive, Industrial Machinery, Pipe, Fittings & Valves, Power & Electrical, and Sanitary. Regionally, the iron and steel casting industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

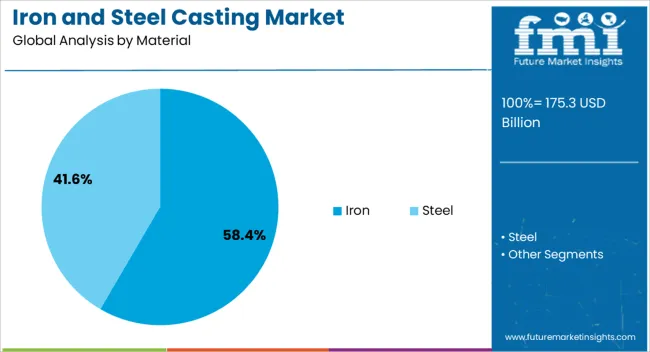

The iron segment is projected to hold 58.40% of the iron and steel casting market revenue in 2025, maintaining its leadership due to its cost-effectiveness, mechanical strength, and suitability for a wide range of industrial applications.

Foundry data and industry usage patterns indicate that gray iron and ductile iron remain preferred choices for components requiring high wear resistance, excellent machinability, and vibration damping. Iron casting production benefits from well-established global supply chains and abundant raw material availability, enabling consistent output at competitive costs. Additionally, its adaptability in producing components of varied shapes and sizes has reinforced its position across the automotive, construction, and machinery industries. Technological advancements in alloying and heat treatment have enhanced iron’s performance in high-stress environments, further increasing its demand. This combination of economic and functional advantages is expected to sustain the iron segment’s dominant role in the market.

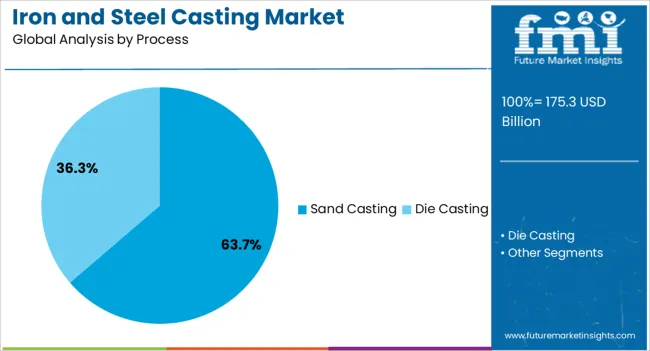

The sand casting segment is projected to account for 63.70% of the iron and steel casting market revenue in 2025, holding its position as the most widely used casting process.

This segment’s growth is supported by the method’s versatility in producing complex shapes, its compatibility with a wide range of alloys, and relatively low tooling costs. Foundries favor sand casting for its scalability, accommodating both small-batch production and high-volume manufacturing.

The process’s ability to handle large, heavy components makes it especially relevant in automotive, construction, and industrial machinery applications. Advances in sand binder technology, mold design, and automated handling systems have improved dimensional accuracy and surface finish, increasing its appeal in precision-driven industries. The widespread availability of raw materials and the process’s adaptability to recycled materials further contribute to its sustained market share.

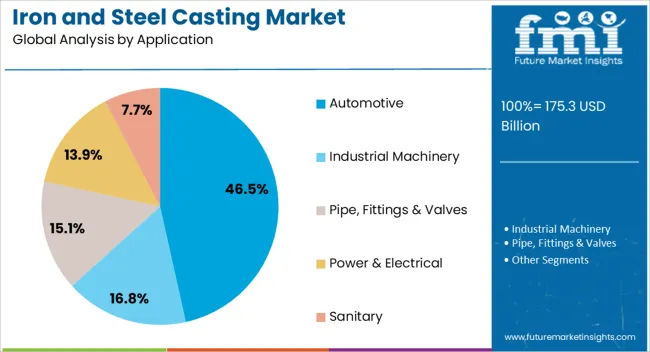

The automotive segment is projected to contribute 46.50% of the iron and steel casting market revenue in 2025, reflecting its central role in global casting demand.

Cast components are extensively used in the automotive sector for engine blocks, brake components, transmission parts, and structural elements, where strength, durability, and thermal resistance are critical. Automotive manufacturing trends have favored iron and steel castings for their ability to meet safety, performance, and cost requirements.

Industry reports have highlighted continued investment in lightweighting strategies that still rely on optimized ferrous casting solutions for high-stress parts. The expansion of electric and hybrid vehicle production has introduced new casting requirements for motor housings, suspension components, and thermal management systems, supporting steady demand. With global automotive output rebounding and emerging markets increasing vehicle production capacity, the automotive segment is expected to remain a dominant consumer of iron and steel cast products.

The iron and steel casting market is growing due to rising demand in the infrastructure, automotive, and manufacturing sectors. Opportunities lie in high-performance alloys and customized casting solutions, while trends highlight automation and sustainability. Challenges include raw material price volatility and regulatory compliance. Overall, the market outlook remains positive, driven by advancements in casting technologies and a focus on cost-efficient, eco-friendly production processes to meet the evolving needs of industrial applications worldwide.

The iron and steel casting market is witnessing strong demand due to the expanding infrastructure, automotive, and manufacturing sectors. Increased investments in construction projects, automotive production, and industrial machinery are pushing the need for high-quality castings. These castings are essential for producing durable, high-strength components for heavy machinery, vehicles, and structural elements. Additionally, growing industrialization in emerging markets, combined with a demand for improved performance, is driving the adoption of iron and steel castings for applications in construction, automotive, and energy industries worldwide.

There are significant opportunities in the development of high-performance alloy castings designed for specialized applications. As industries demand more robust materials, there is increasing adoption of castings made from high-strength and corrosion-resistant alloys for extreme conditions, such as high-temperature environments in the aerospace and energy sectors. Customization of castings to meet specific design requirements for automotive, marine, and defense applications further enhances market growth. Collaboration between casting manufacturers and end-users enables tailored solutions that optimize performance, reduce material wastage, and improve overall efficiency.

A key trend in the iron and steel casting market is the growing shift toward automated production processes and green manufacturing practices. The implementation of robotic systems for casting production, inspection, and quality control enhances precision and reduces labor costs. Additionally, eco-friendly practices, including recycling scrap metal and reducing energy consumption during production, are gaining traction. These efforts not only help reduce the environmental footprint but also support the industry’s compliance with increasing environmental regulations. This trend toward automation and sustainability is transforming casting production, ensuring higher quality and cost-effectiveness.

The iron and steel casting market faces challenges related to raw material price volatility, particularly fluctuations in steel and iron prices. These fluctuations impact production costs and pricing stability for manufacturers, making cost management more challenging. Moreover, compliance with stringent environmental regulations regarding emissions and waste management further adds to operational complexities.

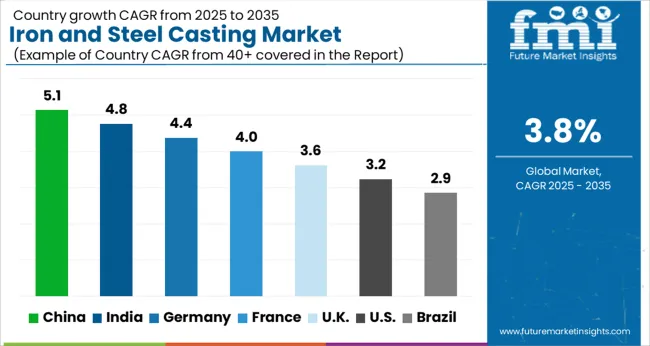

| Country | CAGR |

|---|---|

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| France | 4.0% |

| UK | 3.6% |

| USA | 3.2% |

| Brazil | 2.9% |

The global iron and steel casting market is projected to grow at a CAGR of 3.8% from 2025 to 2035. China leads with a growth rate of 5.1%, followed by India at 4.8% and Germany at 4.4%. The United Kingdom records a growth rate of 3.6%, while the United States shows the slowest growth at 3.2%. Market expansion is driven by increasing demand from industries such as automotive, construction, and machinery, as well as the need for high-quality, durable castings in these sectors. Emerging economies like China and India experience higher growth due to rapid industrialization, increased manufacturing capabilities, and government policies supporting infrastructure development. In contrast, more developed markets like the USA, UK, and Germany focus on improving production technologies, regulatory compliance, and meeting global demand for high-quality steel products. This report includes insights on 40+ countries; the top markets are shown here for reference.

The iron and steel casting market in China is projected to grow at a CAGR of 5.1%. Growth is driven by increased demand from the automotive, construction, and machinery sectors. China’s large manufacturing base, coupled with infrastructure expansion and rising industrialization, continues to support the demand for iron and steel castings. Investments in modern production technologies, such as automated and high-performance casting processes, are enhancing quality standards. Government initiatives aimed at promoting industrial growth, energy efficiency, and improved manufacturing capabilities further accelerate market development.

The iron and steel casting market in India is expected to grow at a CAGR of 4.8%. Demand is primarily driven by the automotive, machinery, and construction industries, supported by expanding infrastructure projects and rising manufacturing output. The country’s strong industrial base and increasing urbanization are further boosting the demand for castings in various sectors. Local manufacturers are focusing on improving production techniques, such as precision casting and high-quality finishes. Government initiatives promoting manufacturing, including the "Make in India" campaign, contribute to market expansion.

The iron and steel casting market in Germany is projected to grow at a CAGR of 4.4%. Germany's market is driven by robust demand from the automotive and machinery sectors, with the need for high-performance, durable castings. The country’s emphasis on automation and technological advancements in casting processes continues to enhance quality. Investments in eco-friendly technologies and energy-efficient solutions are also contributing to growth. Additionally, Germany's strong export-oriented manufacturing sector supports a growing demand for premium-quality castings.

The iron and steel casting market in the United Kingdom is expected to grow at a CAGR of 3.6%. Demand for castings is driven by the automotive, aerospace, and construction industries, with a focus on high-strength and lightweight materials. UK manufacturers are investing in sustainable production practices, including energy-efficient and environmentally friendly casting technologies. As a result, regulatory compliance and innovation are at the forefront of the market, helping manufacturers meet the growing demand for high-quality castings in global markets.

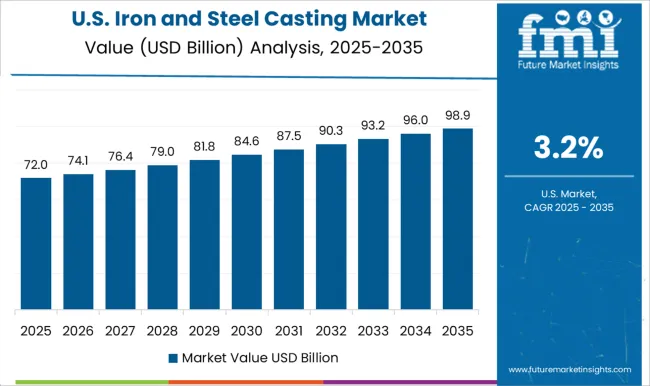

The iron and steel casting market in the United States is projected to grow at a CAGR of 3.2%. Growth is supported by the demand for high-quality castings in the automotive, construction, and industrial sectors. USA manufacturers focus on improving efficiency, reducing costs, and ensuring product quality through the adoption of modern production techniques. The market is further driven by government incentives and policies that encourage manufacturing activities and the development of energy-efficient technologies.

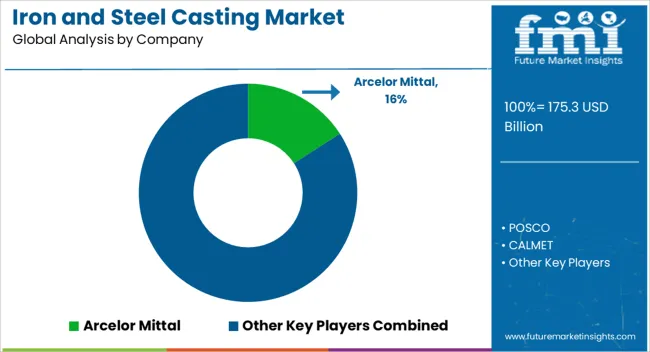

The iron and steel casting market is led by industry giants and specialized manufacturers competing on casting precision, material strength, and operational efficiency. ArcelorMittal, POSCO, and Nippon Steel Corporation dominate with brochures highlighting high-performance alloys, advanced casting technologies, and cost-effective solutions for large-scale production. Marketing materials emphasize precision, durability, and superior surface finish for critical applications in automotive, construction, and machinery manufacturing. CALMET, Waupaca Foundry Inc., and Hyundai Steel differentiate through customized solutions, offering specialized alloys for high-stress applications and energy-efficient casting processes. Their brochures focus on sustainability, shorter lead times, and advanced quality control systems to meet the diverse needs of the industrial market.

Mid-sized players such as Uniabex, Merck KGaA, Nucor Corporation, and Kobe Steel leverage regional advantages and niche expertise, targeting specific industries such as power generation, rail, and infrastructure. Brochures highlight customized alloy compositions, rapid prototyping, and design flexibility.

Competition in this market is driven by product reliability, metallurgical expertise, and after-sales support. Marketing strategies rely heavily on brochure-driven content that communicates technical capabilities, material performance, and cost advantages. Brochures serve as essential tools to demonstrate quality standards, certifications, and manufacturing flexibility, positioning suppliers as trusted partners in the global supply chain for iron and steel casting solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 175.3 Billion |

| Material | Iron and Steel |

| Process | Sand Casting and Die Casting |

| Application | Automotive, Industrial Machinery, Pipe, Fittings & Valves, Power & Electrical, and Sanitary |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Arcelor Mittal, POSCO, CALMET, Waupaca Foundry Inc, Uniabex, Merck KGaA, Nippon Steel Corporation, Hyundai Steel, Nucor Corporation, and Kobe Steel |

| Additional Attributes | Dollar sales by casting type (sand casting, die casting, investment casting) and application (automotive, construction, industrial machinery, defense) are key metrics. Trends include rising demand for lightweight, high-strength materials, growth in automotive and machinery manufacturing, and increasing adoption of advanced casting technologies. Regional adoption, technological advancements, and cost-efficiency are driving market growth. |

The global iron and steel casting market is estimated to be valued at USD 175.3 billion in 2025.

The market size for the iron and steel casting market is projected to reach USD 254.5 billion by 2035.

The iron and steel casting market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in iron and steel casting market are iron, _white iron, _ductile iron, _gray iron and steel.

In terms of process, sand casting segment to command 63.7% share in the iron and steel casting market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Iron Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Ironing Table Market Size and Share Forecast Outlook 2025 to 2035

Iron Powder Market - Trends & Forecast 2025 to 2035

Iron Oxide Market Report - Growth, Demand & Forecast 2025 to 2035

Iron Ore Pellets Market Growth - Trends & Forecast 2025 to 2035

Environmental Radiation Monitor Market Size and Share Forecast Outlook 2025 to 2035

Environmental Test Chambers Market Size and Share Forecast Outlook 2025 to 2035

Environmental Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Environmental Sensor Market Size and Share Forecast Outlook 2025 to 2035

Environmental Test Equipment Market Growth - Trends & Forecast 2025 to 2035

Environmental Remediation Technology Market - Size, Share & Forecast 2025 to 2035

Environmental Catalysts Market Trends & Growth 2025 to 2035

Environmental Monitoring Market Report – Trends & Forecast 2024-2034

Environment Health and Safety Market Size and Share Forecast Outlook 2025 to 2035

Environment Testing, Inspection and Certification Market Report – Demand, Growth & Industry Outlook 2025 to 2035

Total Iron-Binding Capacity Reagents Market

Lithium Iron Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Lithium Iron Phosphate (LIP) Battery Market Size and Share Forecast Outlook 2025 to 2035

Reduced Iron Powder Market Analysis by Product, Application and Distribution Channel Through 2035

Curling Irons Market Analysis – Growth, Sales & Demand 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA