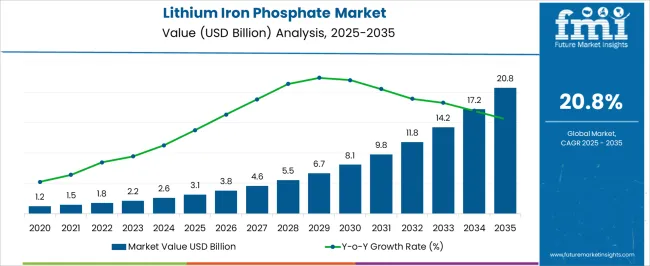

The lithium iron phosphate market is poised for impressive growth, with the market size expected to expand from USD 3.1 billion in 2025 to USD 20.8 billion by 2035, reflecting a compound annual growth rate (CAGR) of 20.8%. From 2025 to 2030, the market will grow steadily from USD 3.1 billion to USD 8.1 billion, driven by the increasing adoption of lithium iron phosphate (LFP) batteries in electric vehicles (EVs), energy storage systems, and consumer electronics. The growing demand for safe, high-performance batteries with longer life cycles and higher energy efficiency is a key factor driving the adoption of LFP technology, which is seen as an alternative to traditional lithium-ion batteries in many applications.

From 2030 to 2035, the lithium iron phosphate market is expected to accelerate, reaching USD 20.8 billion. This phase of growth will be fueled by the increasing shift towards renewable energy storage solutions and the rapid expansion of the electric vehicle market. LFP batteries, known for their superior safety and thermal stability, are expected to capture a larger share of the battery market as manufacturers look for more efficient and cost-effective solutions.

As both public and private sectors increase investments in clean energy solutions and EV infrastructure, the market for lithium iron phosphate will continue to thrive, presenting significant opportunities for market participants.

| Metric | Value |

|---|---|

| Lithium Iron Phosphate Market Estimated Value in (2025 E) | USD 3.1 billion |

| Lithium Iron Phosphate Market Forecast Value in (2035 F) | USD 20.8 billion |

| Forecast CAGR (2025 to 2035) | 20.8% |

The Lithium Iron Phosphate (LFP) battery market is a specialized segment within the broader lithium-ion battery market. Within the global lithium-ion battery market, LFP batteries account for approximately 40% of the total market share. In the electric vehicle (EV) battery market, LFP batteries have gained significant traction, comprising about 65% of the market share, driven by their cost-effectiveness and safety features.

Within the energy storage systems (ESS) market, LFP batteries hold a substantial share of approximately 80%, owing to their long cycle life and thermal stability, making them ideal for grid-scale applications. In the consumer electronics battery market, LFP batteries represent a smaller portion, around 5%, as lithium cobalt oxide (LCO) batteries are more prevalent in this sector due to their higher energy density. Lastly, in the renewable energy storage market, LFP batteries account for about 10% of the market share, as their characteristics align well with the requirements of storing energy from renewable sources like solar and wind.

These figures highlight the growing adoption of LFP batteries across various sectors, driven by their safety, cost advantages, and suitability for specific applications.

The Lithium Iron Phosphate market is experiencing significant growth, driven by rising demand for safe, stable, and long-life energy storage solutions. This growth is being supported by increasing adoption of electric vehicles, renewable energy integration, and grid-scale storage projects where reliability and safety are paramount. The chemical stability, high thermal tolerance, and long cycle life of lithium iron phosphate have positioned it as a preferred material in modern battery manufacturing.

Advancements in production processes and supply chain efficiency are further improving cost competitiveness, encouraging wider adoption across both developed and emerging markets. The market is also benefiting from policy support for clean energy technologies and the global shift toward decarbonization.

Continuous research is enabling higher energy densities and enhanced charging capabilities, making lithium iron phosphate increasingly viable for a broader range of applications. As industries prioritize performance, safety, and sustainability, the market is expected to maintain strong momentum in the coming years.

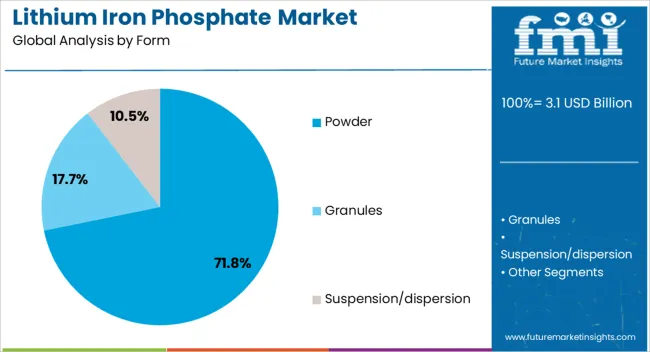

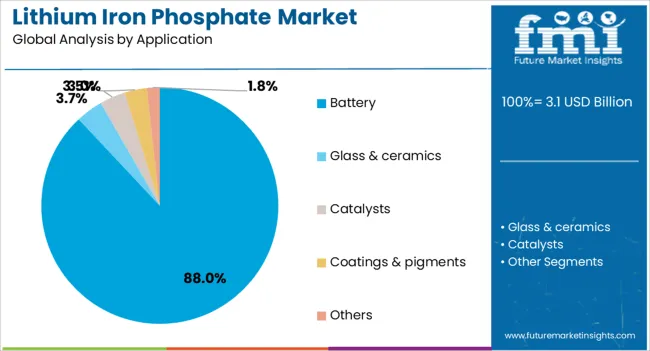

The lithium iron phosphate market is segmented by form, application, and geographic regions. By form, lithium iron phosphate market is divided into Powder, Granules, and Suspension/dispersion. In terms of application, lithium iron phosphate market is classified into Battery, Glass & ceramics, Catalysts, Coatings & pigments, and Others. Regionally, the lithium iron phosphate industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The powder form segment is projected to hold 71.80% of the Lithium Iron Phosphate market revenue share in 2025, making it the dominant form. This growth has been driven by the powder form’s suitability for consistent material quality, optimal particle size distribution, and enhanced electrochemical performance in battery manufacturing.

The ease of integration into electrode production processes and compatibility with advanced coating technologies have reinforced its preference among battery producers. Powder form lithium iron phosphate is also valued for its high purity levels, which contribute to improved battery efficiency and extended cycle life.

Its stable supply availability and cost-effective production processes have made it an attractive option for large-scale applications, especially in high-volume electric vehicle and energy storage projects The ability to meet stringent performance and safety requirements has ensured the powder form maintains a competitive advantage, supporting its leading position in the market.

The battery application segment is expected to account for 88% of the Lithium Iron Phosphate market revenue share in 2025, underscoring its central role in market growth. This dominance has been supported by rapid electrification in transportation, expansion of renewable energy systems, and increased demand for energy storage solutions in residential, commercial, and utility sectors.

Lithium iron phosphate’s superior thermal stability, long cycle life, and safety profile have made it a preferred choice for batteries used in electric vehicles, stationary storage, and backup power systems. Software-aided battery management integration has further optimized performance, while advancements in cell design have enabled higher power output and faster charging.

Global initiatives to phase out fossil fuels and enhance grid resilience have accelerated investment in lithium iron phosphate-based battery systems The combination of reliability, cost efficiency, and sustainability has reinforced the segment’s leadership, ensuring its sustained growth within the overall market.

The lithium iron phosphate market is growing rapidly, driven by rising demand in electric vehicles and renewable energy storage systems. Opportunities in energy storage and cost reductions are contributing to the market’s expansion. However, challenges related to energy density limitations and competition from other battery technologies remain.

As improvements in performance and cost efficiency continue, LFP batteries are expected to play a key role in the future of energy storage and electric mobility.

The lithium iron phosphate (LFP) market is witnessing rising demand, primarily driven by the increasing adoption of electric vehicles (EVs). LFP batteries offer several advantages, including enhanced safety, long cycle life, and cost-effectiveness, making them a preferred choice for automakers looking for reliable power storage solutions. As the global shift towards electric mobility accelerates, LFP is gaining traction, particularly in the low- and mid-range EV segments. This growing demand from the automotive industry is expected to drive substantial market growth in the coming years.

The shift towards renewable energy has opened significant opportunities for the LFP market, especially in energy storage systems (ESS). LFP batteries are well-suited for storing energy from solar and wind farms due to their stability, long cycle life, and affordable pricing. As governments and industries invest in green energy infrastructure, the need for efficient, reliable, and cost-effective energy storage solutions is growing. The integration of LFP batteries in renewable energy projects will continue to fuel market expansion as the global energy transition accelerates.

A major trend in the lithium iron phosphate market is the continued improvement in battery performance and cost reduction. Manufacturers are working to enhance the energy density of LFP batteries while reducing production costs, which will make these batteries more competitive against other lithium-ion technologies. These improvements are driven by increasing demand for affordable, high-performance batteries in applications like EVs and renewable energy storage. As performance enhancements continue, LFP batteries are expected to maintain their position as a preferred choice for many industries.

Despite the benefits, the lithium iron phosphate market faces challenges related to limited energy density compared to other lithium-ion battery chemistries, such as nickel manganese cobalt (NMC) batteries. LFP batteries typically offer lower energy density, making them less suitable for applications requiring high energy output, such as long-range electric vehicles. Moreover, competition from other battery technologies and the ongoing search for superior battery chemistries may hinder the broader adoption of LFP batteries. Balancing performance and cost will remain critical in overcoming these challenges.

-battery-market-cagr-analysis-by-country.webp)

| Countries | CAGR |

|---|---|

| China | 28.1% |

| India | 26.0% |

| Germany | 23.9% |

| France | 21.8% |

| UK | 19.8% |

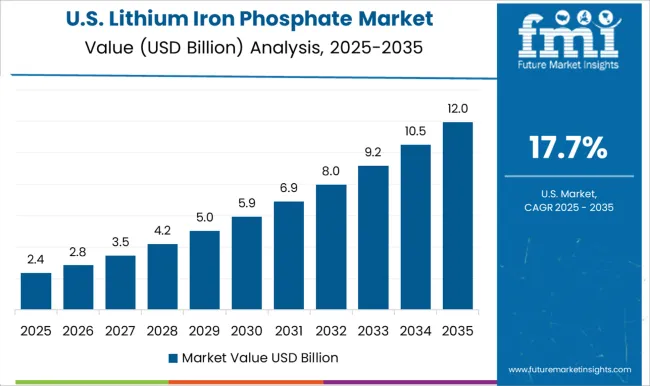

| USA | 17.7% |

| Brazil | 15.6% |

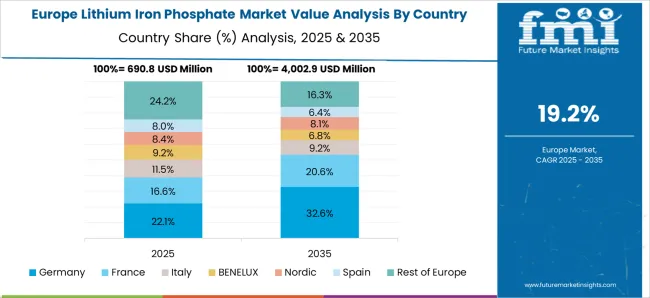

The global lithium iron phosphate market is projected to grow at a CAGR of 20.8% from 2025 to 2035. China leads with a growth rate of 28.1%, followed by India at 26%, and France at 21.8%. The United Kingdom records a growth rate of 19.8%, while the United States shows the slowest growth at 17.7%. The rising demand for electric vehicles (EVs), energy storage systems, and renewable energy applications is driving the growth of lithium iron phosphate (LFP) batteries. China and India are experiencing rapid growth due to government incentives, the shift towards cleaner energy, and the increasing adoption of EVs, while developed markets such as the USA and the UK focus on energy transition, grid stability, and storage solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The lithium iron phosphate market in China is projected to grow at an impressive CAGR of 28.1%. China’s dominance in the EV market, driven by government incentives and a strong push for cleaner energy solutions, significantly accelerates the demand for LFP batteries. The country’s vast manufacturing capabilities and technological advancements in battery production, coupled with its rapidly expanding energy storage and renewable energy sectors, are key drivers of the market. The adoption of LFP batteries for energy storage systems, alongside increasing demand from the electric vehicle sector, further propels market growth.

The lithium iron phosphate market in India is expected to grow at a CAGR of 26%. The growing demand for electric vehicles, combined with the country’s efforts to reduce dependence on fossil fuels, is significantly boosting market adoption. Government policies such as subsidies for electric vehicles and energy storage systems are further promoting the adoption of LFP batteries. The increased focus on renewable energy sources and sustainable infrastructure also contributes to the growing demand for efficient and cost-effective battery solutions.

The lithium iron phosphate market in France is projected to grow at a CAGR of 21.8%. France’s commitment to energy transition and sustainability, particularly in the automotive and energy storage sectors, continues to drive the demand for LFP batteries. Government policies promoting cleaner energy solutions, alongside the growing popularity of electric vehicles, are contributing to the adoption of LFP technology. France’s investment in renewable energy and grid stability further supports market expansion.

The lithium iron phosphate market in the UK is projected to grow at a CAGR of 19.8%. The UK’s push towards a low-carbon economy and the adoption of electric vehicles continue to fuel the demand for LFP batteries. The government’s green energy initiatives and commitment to sustainable transportation are expected to drive the use of LFP batteries in both commercial and residential sectors. Furthermore, the growing interest in energy storage systems and the expansion of renewable energy sources support market growth.

The lithium iron phosphate market in the USA is projected to grow at a CAGR of 17.7%. Although the USA market grows at a slower pace compared to emerging economies, the demand for LFP batteries remains strong due to the increasing adoption of electric vehicles and energy storage solutions. The shift towards renewable energy, coupled with the focus on grid stability and clean power, continues to fuel the adoption of LFP technology. Furthermore, technological innovations and government incentives are expected to support steady market growth.

The lithium iron phosphate (LFP) market is shaped by dominant players such as Hunan Yuneng, Dynanonic, and LOPAL, each focusing on enhancing production capabilities and expanding their market reach. Hunan Yuneng (YUNENG) is a leading force in the market, offering high-quality LFP products for electric vehicle (EV) batteries, energy storage systems, and other applications. The company's emphasis on providing cost-effective and reliable LFP solutions has secured a strong foothold in both the domestic and international markets.

Dynanonic, specializing in manufacturing advanced LFP materials, has positioned itself as a key supplier by continuously expanding its production capacity and optimizing material performance for energy storage applications. LOPAL (LBM) competes with a strong product portfolio, focusing on consistent product quality and supplying LFP batteries that meet the increasing demand for efficient and high-energy storage solutions. Other key players, including RT-Hitech, WANRUN, Anda Energy, and FULIN .SH, further contribute to a competitive environment by offering differentiated LFP products designed to address various market needs.

RT-Hitech focuses on high-performance materials for both EVs and large-scale energy storage, while WANRUN has garnered attention for its cost-effective production techniques, making its products attractive to budget-conscious consumers.

Anda Energy and FULIN .SH position themselves in niche segments of the market, providing specialized solutions that cater to specific industry requirements. GOTION HIGH-TECH and TERUI have made significant strides in advancing LFP materials for the growing electric vehicle market, focusing on product durability and performance. Pulead Technology Industry, a leader in the global market, continues to expand its offerings, contributing to the market's rapid growth.

As demand for LFP products surges, these companies' competitive strategies focus on product optimization, cost efficiency, and meeting the diverse needs of the energy storage and electric vehicle sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.1 Billion |

| Form | Powder, Granules, and Suspension/dispersion |

| Application | Battery, Glass & ceramics, Catalysts, Coatings & pigments, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hunan Yuneng (YUNENG), Dynanonic, LOPAL (LBM), RT-Hitech, WANRUN, Anda Energy, FULIN .SH, GOTION HIGH-TECH, TERUI, Pulead Technology Industry, and Others |

| Additional Attributes | Dollar sales by application (electric vehicles, energy storage systems, consumer electronics, industrial applications), Dollar sales by product type (cell, battery pack, modules), Trends in high-energy density and long-cycle life adoption, Growth in demand for sustainable and cost-effective battery solutions, Regional patterns of lithium iron phosphate adoption across the automotive and renewable energy sectors. |

The global lithium iron phosphate market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the lithium iron phosphate market is projected to reach USD 20.8 billion by 2035.

The lithium iron phosphate market is expected to grow at a 20.8% CAGR between 2025 and 2035.

The key product types in lithium iron phosphate market are powder, granules and suspension/dispersion.

In terms of application, battery segment to command 88.0% share in the lithium iron phosphate market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA