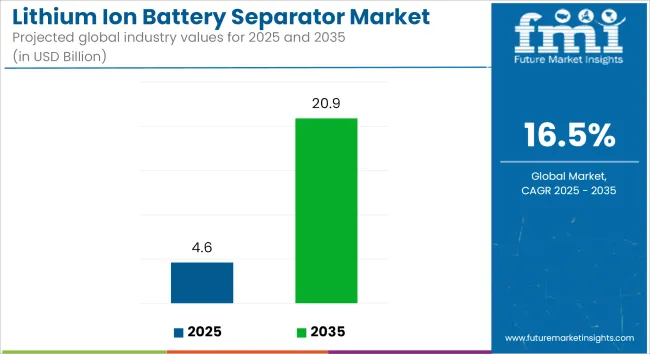

The global lithium ion battery separator market is estimated to account for USD 4.6 billion in 2025 and is projected to reach USD 20.9 billion by 2035, advancing at a CAGR of 16.5% during the forecast period. Market expansion is being driven by increased adoption of electric vehicles (EVs), growth in portable consumer electronics, and the rising deployment of stationary energy storage systems.

| Attributes | Description |

|---|---|

| Estimated Market Size (2025E) | USD 4.6 Billion |

| Projected Market Value (2035F) | USD 20.9 Billion |

| Value-based CAGR (2025 to 2035) | 16.5% |

Lithium-ion battery separators are being utilized to maintain physical separation between the anode and cathode while permitting the flow of lithium ions during charge and discharge cycles. These separators, typically manufactured from polyethylene or polypropylene, play a critical role in preventing internal short circuits and ensuring thermal stability. Their effectiveness directly influences battery safety, energy density, and lifecycle performance.

With the electrification of transportation gaining momentum globally, the demand for high-performance batteries is accelerating. Separator manufacturers are responding by investing in advanced technologies to improve thermal resistance, porosity, electrolyte wettability, and mechanical strength. Multi-layer composite separators and ceramic-coated variants are being introduced to meet the performance requirements of high-capacity EV batteries.

In consumer electronics, where device miniaturization and fast charging are key trends, separators are being developed to support compact designs with enhanced safety features. Similarly, in grid-level energy storage systems, separators are being optimized for long-duration stability and high cyclability under varied environmental conditions.

Ongoing research is being directed toward incorporating functional coatings and novel polymers to extend separator lifespan and reduce degradation under high-voltage operation. The industry is also witnessing growing interest in separator recycling technologies and solvent-free production methods aimed at reducing environmental impact.

Regulatory compliance for battery safety standards across regions is influencing product development, with separator performance increasingly evaluated under stringent abuse and thermal runaway testing. As lithium-ion battery technology continues to evolve toward higher energy densities and faster charge rates, separators are expected to remain a critical area of focus for material innovation and supply chain optimization.

The lithium-ion battery separator market is expected to maintain rapid growth through 2035, supported by advancements in electric mobility, energy storage infrastructure, and enhanced separator engineering.

| Premium Product Quality/Performance | Standard Product Quality/Performance |

|---|---|

| High-Performance, High-Cost Separators: These companies focus on advanced materials and innovative separators with high thermal stability, ionic conductivity, and safety features. They cater to high-end applications such as electric vehicles (EVs) and energy storage systems. | Expensive but Standard Separators: These companies offer reliable separators with average performance. While still high in quality, they do not incorporate cutting-edge technologies but may still be suitable for consumer electronics or automotive applications that do not require top-tier performance. |

| Affordable High-Quality Separators: These companies provide cost-effective separators but still offer high performance, good safety features, and reliable quality for applications like renewable energy storage and low-cost EV batteries. | Low-Cost Standard Separators: Companies that provide affordable separators with essential performance for mass-market applications such as consumer electronics and entry-level electric vehicles. These separators are optimized for high-volume production at a low cost. |

Premium Product Quality/Performance (High-Cost, High-Quality Separators)

These separators are made for high-end applications that demand cutting-edge features like solid-state qualities, ceramic coatings, or nano-coatings to guarantee increased performance, safety, and efficiency.

Companies like Asahi Kasei and Toray Industries are known for their premium quality separators used in electric vehicles (EVs) and high-energy applications, offering cutting-edge technology at a higher price.

Standard Product Quality/Performance (High-Cost, Standard Quality Separators)

These separators are of reliable quality but may not offer the advanced features of premium products. They cater to less demanding applications where high performance is essential but not at the same level as premium-tier products.

Companies offering reliable separators for consumer electronics and mass-market automotive applications without extensive advanced features would fall into this category.

Affordable High-Quality Separators (Low-Cost, High-Quality Separators)

These companies offer high-quality separators at competitive prices by focusing on cost-efficiency in manufacturing while maintaining good performance and safety. These separators are used in industries like renewable energy and affordable EVs, where quality is essential, but there is pressure to keep costs low.

Entek International and Daramic provide separators with strong safety features at more affordable prices for applications that do not demand top-tier premium products.

Low-Cost Standard Separators (Low-Cost, Low-Quality Separators)

These separators are essential in performance and suitable for mass-market applications like consumer electronics, entry-level electric vehicles, or battery storage systems. The key focus is on reducing cost while still offering basic functionality.

Companies offering separators made from polyethylene (PE) and polypropylene (PP) that meet standard requirements for cost-sensitive applications such as budget consumer electronics and low-end EV batteries.

Growth in Electric Vehicle (EV) Demand

One of the main factors propelling the Lithium ion battery industry is the rise in the use of electric vehicles, which directly affects the need for battery separators. High-performance batteries are essential to EVs, and separators are necessary for improving energy density and safety.

Rising Demand for Energy Storage Systems

Efficient energy storage systems are necessary due to the growing integration of renewable energy sources like solar and wind. The need for separators is further increased by the fact that Lithium ion batteries, which come with superior separators, are essential to energy storage systems.

Technological Advancements

Innovations in battery technologies, such as the development of solid-state batteries, are improving the performance and safety of Lithium ion batteries. This is driving demand for separators that can handle higher capacities and deliver better safety features (e.g., thermal stability and high porosity).

Material and Production Cost

Large-scale adoption may be hampered by the high cost of high-performance separator materials (such as ceramic-coated separators, polyethylene, and polypropylene). Additionally, manufacturers may be unable to purchase these separators due to the complicated and costly production methods.

Environmental Impact and Recycling

After their lives are over, Lithium ion batteries and their separators cause environmental problems because they are difficult to recycle and improperly disposed of. As sustainability becomes a key concern, there is increasing pressure to provide recyclable and eco-friendly separators.

Competition from Alternative Technologies

The market for Lithium ion batteries may face competition from continuous research into other energy storage technologies, such as solid-state or sodium-ion batteries. The need for Lithium ion battery separators may decline if these technologies develop and become more economically feasible.

Research and Development (R&D) Opportunities

Development of advanced separators with enhanced properties, such as higher safety standards (e.g., fire-resistant separators) and higher energy density.

Emerging Markets for EVs and Energy Storage

Substantial potential in developing regions with rising usage of electric vehicles and renewable energy, such as China, India, and Latin America.

Eco-friendly and Sustainable Solutions

Growing consumer demand for recyclable and biodegradable separators may present new business prospects for new and existing companies.

Battery Recycling Redefined

Separators that are simpler to recycle will be required as the market for battery recycling expands, opening the door for new product offers.

Development of Solid-State Batteries

Lithium ion technology's next-generation answer is solid-state batteries (SSBs). By substituting a solid electrolyte for a liquid electrolyte, these batteries increase energy density, longevity, and safety. Impact-wise, the solid-state batteries require new separators that offer better stability and ionic conductivity than traditional separators.

These separators are also be non-flammable and have a high degree of thermal stability. For instance, Companies such as QuantumScape and Ionic Materials are developing solid-state battery separators to improve battery performance and energy density.

Nanotechnology in Separator Materials

Nanotechnology is revolutionizing the development of separators for Lithium ion batteries. Nanofiber-based separators and nano-coatings are being developed to improve thermal stability, mechanical strength, and conductivity.

In terms of impact, nanofiber separators can help prevent short-circuiting and thermal runaway, while nano-coatings can improve ion conductivity and battery safety. As an example, startups such as Nanoramic Laboratories leverage nanotechnology to enhance separator performance, particularly for high-energy applications like electric vehicles.

Ceramic-Coated Separators

Traditional separators, which are usually composed of polypropylene and polyethylene, are coated with ceramic materials to improve their electrolyte compatibility, chemical resistance, and thermal stability. By impact, ceramic-coated separators help prevent thermal runaway by providing a robust barrier in extreme temperatures.

This technology is beneficial in high-performance batteries used in electric vehicles (EVs) and energy storage systems. As an example, Asahi Kasei and Toray Industries have developed ceramic-coated separators to improve the safety and performance of Lithium ion batteries.

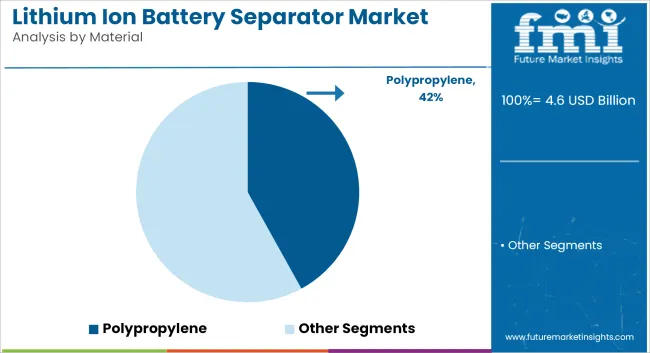

Polypropylene (PP) separators are estimated to account for approximately 42% of the global lithium-ion battery separator market share in 2025 and are projected to grow at a CAGR of 16.7% through 2035. PP offers high dimensional stability, low shrinkage under heat, and chemical compatibility with common electrolyte systems, making it a preferred material in cylindrical and prismatic lithium-ion cells.

Manufacturers are focusing on multilayer and coated PP separators to enhance shutdown performance and prevent thermal runaway, particularly for electric vehicle batteries and grid-scale storage. The segment continues to benefit from rising global demand for safe, lightweight, and thermally stable separators tailored for high-energy-density battery systems.

The 20µm segment is projected to hold approximately 38% of the global lithium-ion battery separator market share in 2025 and is expected to grow at a CAGR of 16.6% through 2035. This thickness range provides optimal trade-offs between safety, energy efficiency, and manufacturing cost, making it suitable for a wide variety of lithium-ion batteries used in electric vehicles, power tools, and consumer electronics.

Separator manufacturers are increasingly deploying advanced stretching and coating technologies to maintain uniform porosity and prevent dendrite penetration at this thickness level. With battery makers demanding thinner, more efficient separators that meet stringent safety and performance benchmarks, the 20µm segment remains a cornerstone in separator design and commercialization strategies.

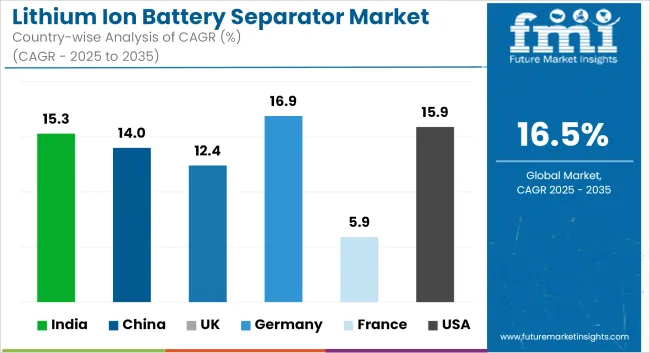

| Countries | CAGR |

|---|---|

| India | 15.3% |

| China | 14.0% |

| UK | 12.4% |

| Germany | 16.9% |

| France | 5.9% |

| USA | 15.9% |

India is experiencing rapid growth in adopting electric vehicles (EVs), consumer electronics, and renewable energy storage systems, which drives demand for Lithium ion batteries and, consequently, battery separators. Strong government policies supporting electric vehicles (EVs), increasing urbanization, and growth in the electronics manufacturing sector.

China accounts for the largest Lithium industry, posing as a global leader in the EV market, consumer electronics, and energy storage. The country is also home to significant battery manufacturers such as CATL and BYD, which increases the demand for separators. Key Drivers include leading EV production, government incentives for clean energy, and the shift toward green technology.

The UK's Lithium ion battery separator market is expanding with the increasing adoption of electric vehicles and initiatives to establish local battery production and energy storage solutions. The major growth factors include the commitment to green energy transition, the rise in EV adoption, and advanced manufacturing capabilities in the battery sector.

Germany is a leader in the European automotive market, particularly in adopting electric vehicles (EVs). The country is also a key player in battery technology development and energy storage systems. Automotive manufacturing (EV-focused), advancements in battery technology, and the EU’s Green Deal encouraging renewable energy sources.

France is focusing on the transition to electric mobility and renewable energy storage, which has increased the demand for Lithium ion battery separators. The French government is investing in local battery production to support the growing EV market. Growth in EV adoption, renewable energy investments, and local battery manufacturing initiatives.

The USA is a major player in the global Lithium ion battery separator market, driven by the strong demand for electric vehicles, consumer electronics, and the increasing push for renewable energy and energy storage systems.

Key Drivers: Strong EV adoption, investments in clean energy infrastructure, and growth in domestic battery production (e.g., Tesla, gigafactories).

Advancements in the lithium-ion battery separator market are driven by the growing demand for electric vehicles (EVs) and energy storage systems. The industry is focused on developing separators that enhance battery safety, stability, and cycle life, addressing challenges like dendrite formation and thermal instability.

Companies are prioritizing the localization of supply chains, with new manufacturing facilities being established to produce next-generation separators for lithium-metal and high-performance lithium-ion batteries. Efforts are also being directed towards creating customizable separator solutions that offer tailored porosity, improved energy density, and enhanced electrolyte wettability, catering to diverse battery applications.

As demand for EVs and energy storage solutions accelerates, the industry is shifting towards scalable and engineered separator technologies that meet the evolving needs of high-performance batteries.

Partnerships with Renewable Energy Providers

Construct customized separators for grid, wind, and solar energy storage applications. Businesses can position their separators as crucial parts of large-scale energy storage systems and capitalize on the expanding clean energy market by working with renewable energy suppliers.

Innovation with Automotive Manufacturers

Work closely with electric vehicle (EV) manufacturers to jointly develop advanced separators that improve battery performance and safety. This could involve creating custom separators optimized for high-capacity, fast-charging batteries, giving a competitive edge in the expanding EV market.

Battery Recycling and Upcycling Collaborations

Team up with battery recycling companies to design separators that can be reused or repurposed in second-life battery applications. This approach promotes a circular economy for separators and appeals to sustainability-conscious customers, while helping to meet growing recycling and waste reduction regulations.

Integration of Smart Separator Technologies

Incorporate innovative features such as sensors within separators to monitor the internal environment of the battery. This could provide real-time data on factors like temperature, ion flow, and battery health, offering valuable insights to users and manufacturers and enhancing both safety and performance.

According to the material, the Lithium ion battery separator market is divided into polypropylene, polyethylene, nylon, and other materials-based.

According to the temperature, the Lithium ion battery separator market is divided into 10°C- 25°C and 130°C- 135°C.

According to the thickness, the Lithium ion battery separator market is divided into 16µm, 20µm and 25µm.

According to the region, the Lithium ion battery separator market is divided into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, and Middle East & Africa.

The Lithium ion battery separator market is estimated at USD 4.6 billion in 2025 and is projected to grow to USD 20.9 billion by 2035, with a CAGR of 16.5%.

Sales are expected to rise significantly, driven by the demand for electric vehicles, consumer electronics, and energy storage systems, with a CAGR of 16.5% from 2025 to 2035.

Major manufacturers include Asahi Kasei, Daramic, Entek International, Targray Technology, and Freudenberg & Co.

China, India, and the USA are key regions with strong growth potential, driven by the rise in electric vehicles, energy storage, and technology advancements.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lithium-Ion Battery Market Size and Share Forecast Outlook 2025 to 2035

Lithium Ion Battery Dispersant Market Growth – Trends & Forecast 2024-2034

Lithium Ion Battery Material Market Growth – Trends & Forecast 2024-2034

Lithium ion Stationary Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Stationary Lithium-Ion Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Lithium & Lithium-ion Battery Electrolyte Market Size and Share Forecast Outlook 2025 to 2035

Lithium and Lithium Ion Battery Electrolyte Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Silicon Anode Lithium Ion Battery Market Size and Share Forecast Outlook 2025 to 2035

Demand for Lithium & Lithium-ion Battery Electrolyte in EU Size and Share Forecast Outlook 2025 to 2035

Lithium Battery Thermal Runaway Sensor Modules Market Size and Share Forecast Outlook 2025 to 2035

Lithium Battery Shear Wrenches Market Size and Share Forecast Outlook 2025 to 2035

Battery Separator Paper Market Size and Share Forecast Outlook 2025 to 2035

Lithium Ion Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Battery Separators Film Market

Traction Battery Market Growth - Trends & Forecast 2025 to 2035

Stationary Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Lithium Extraction From Brine Technology Market Size and Share Forecast Outlook 2025 to 2035

Lithium Silicon Battery Market Size and Share Forecast Outlook 2025 to 2035

Sodium Ion battery Market

Stationary VRLA Battery Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA