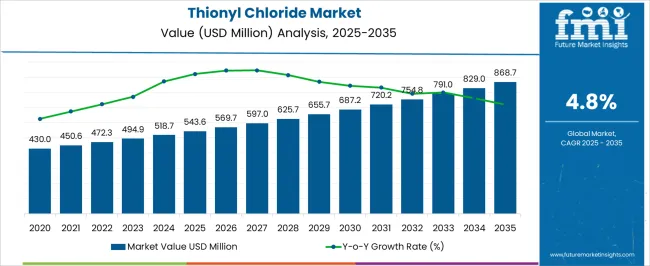

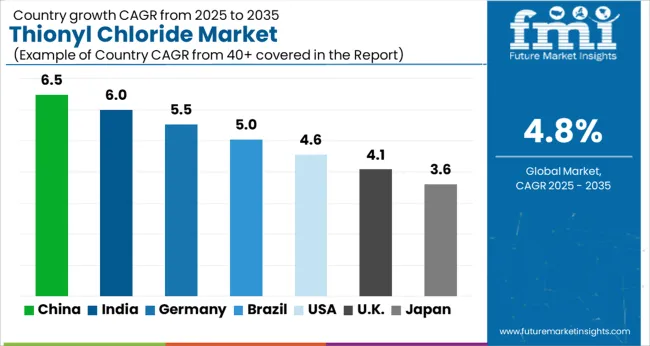

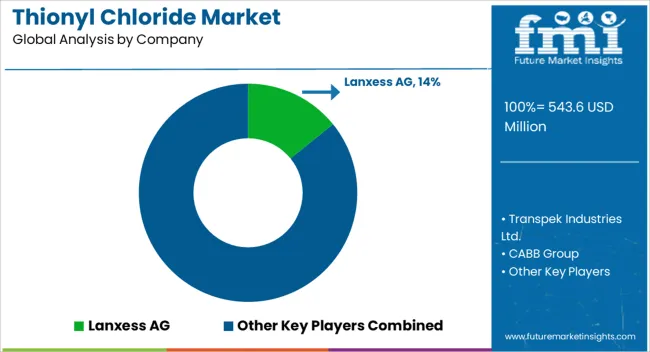

The Thionyl Chloride Market is estimated to be valued at USD 543.6 million in 2025 and is projected to reach USD 868.7 million by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

| Metric | Value |

|---|---|

| Thionyl Chloride Market Estimated Value in (2025 E) | USD 543.6 million |

| Thionyl Chloride Market Forecast Value in (2035 F) | USD 868.7 million |

| Forecast CAGR (2025 to 2035) | 4.8% |

The thionyl chloride market is progressing steadily, supported by its critical role as a chemical intermediate across diverse industrial applications. Demand growth has been reinforced by its wide usage in agrochemicals, pharmaceuticals, and dyes, where it serves as an essential chlorinating agent. Industry announcements and company reports have emphasized the expanding consumption of thionyl chloride in the synthesis of crop protection chemicals, reflecting the rising global need for food security and higher agricultural yields.

Additionally, the pharmaceutical sector has utilized thionyl chloride in active ingredient production, further strengthening its market relevance. Advances in production efficiency and investments in modernized chemical facilities have improved capacity utilization while reducing operational costs.

However, regulatory scrutiny over environmental emissions and workplace safety has driven manufacturers to adopt cleaner and more controlled production technologies. Looking forward, the market is expected to grow through increased use in specialty chemical manufacturing, the adoption of sustainable production practices, and rising demand from emerging economies with expanding agrochemical and pharmaceutical industries.

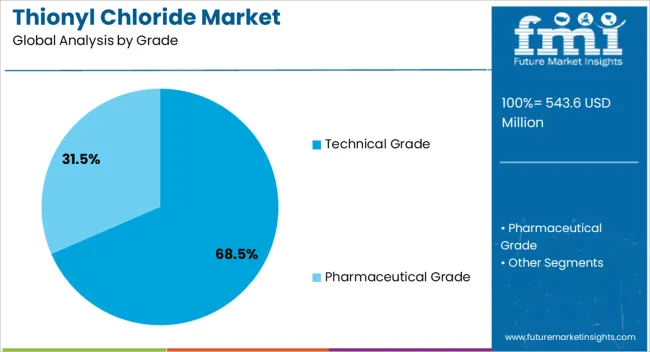

The Technical Grade segment is projected to account for 68.5% of the thionyl chloride market revenue in 2025, making it the dominant grade. This leadership has been shaped by the extensive use of technical grade thionyl chloride in large-scale industrial applications, particularly agrochemicals and dyes, where ultra-high purity is not a critical requirement.

The cost-effectiveness of technical grade products has supported their preference in bulk manufacturing, providing a balance between performance and affordability. Chemical industry disclosures have also noted that the availability of technical grade thionyl chloride in large volumes allows producers to meet high-demand cycles efficiently.

As downstream industries expand production capacity, technical grade consumption has risen due to its suitability for non-pharmaceutical applications. This segment’s position is expected to remain strong, supported by its widespread applicability and lower price point relative to higher purity grades.

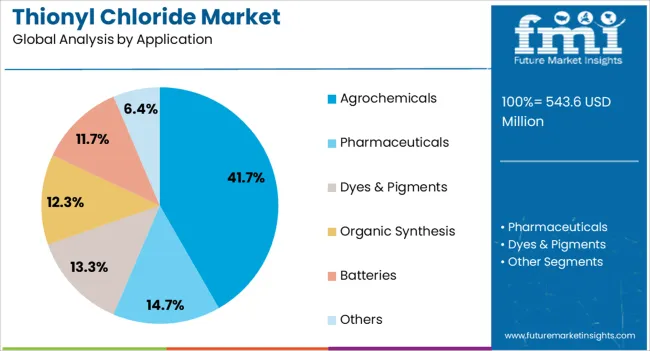

The Agrochemicals segment is projected to contribute 41.7% of the thionyl chloride market revenue in 2025, reflecting its leading role among applications. Growth has been driven by the increasing use of thionyl chloride in the synthesis of herbicides, pesticides, and insecticides.

Agricultural sector reports have emphasized rising global food demand, which has intensified the need for crop protection chemicals, thereby boosting thionyl chloride consumption. Agrochemical manufacturers have relied on thionyl chloride for its effectiveness in producing intermediates with consistent yield and chemical stability.

Additionally, the segment’s growth has been reinforced by government policies supporting higher agricultural productivity and the expansion of cultivated land in emerging economies. With global agricultural input markets expanding and continuous innovation in crop protection formulations, the Agrochemicals segment is expected to sustain its leadership in thionyl chloride demand.

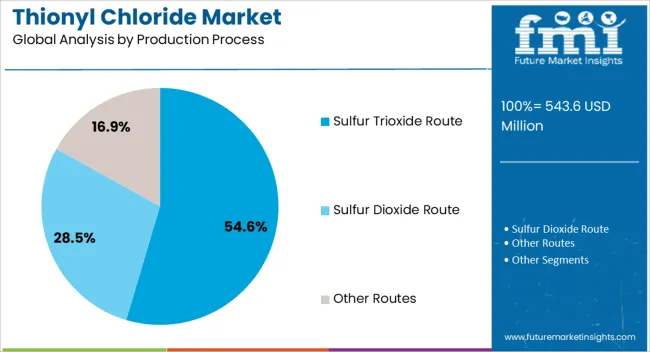

The Sulfur Trioxide Route segment is projected to account for 54.6% of the thionyl chloride market revenue in 2025, establishing it as the leading production process. This dominance has been supported by the route’s cost efficiency, high yield, and scalability compared to alternative production methods.

Chemical engineering studies and industry updates have highlighted that the sulfur trioxide route allows consistent quality output while enabling manufacturers to achieve greater economies of scale. Additionally, the route has been favored due to its relative ease of integration with existing sulfur-based chemical production facilities, reducing capital investment requirements.

Environmental considerations have also prompted producers to refine this process, improving emission control and waste management practices. As global demand for thionyl chloride continues to rise, the sulfur trioxide route is expected to remain the preferred production pathway, balancing production efficiency with compliance to evolving environmental regulations.

The thionyl chloride industry is assured significant growth opportunities due to its diverse range of applications across various manufacturing units. Thionyl compound is extensively utilized as a major intermediate in chemical synthesis, particularly in the pharmaceutical and agrochemical sectors.

The industry is poised for steady growth during the expected period, driven by its indispensable role in chemical synthesis and its wide-ranging application across diverse industries. Thionyl chloride can efficiently convert carboxylic acids into acyl chlorides, contributing to the rising demand.

The sector indicates that growing research and development activities aim to expand the compound's efficiency and create innovative applications. The increasing popularity of lithium-ion batteries has led to the adoption of thionyl chloride as a vital component in battery electrolytes, amplifying demand in the electronics industry.

The toxic nature and potential environmental hazards of thionyl chloride necessitate stringent regulatory compliance. Variations in raw material costs and geopolitical factors impacting the distribution network can affect industrial dynamics.

Asia Pacific has emerged as a substantial region due to a strong base of manufacturing units, the fastest escalating pharmaceutical sector, and growing demand for agrochemicals. The region is also experiencing increased consumption of thionyl chloride due to the burgeoning electronics sector for battery formulation.

Thionyl chloride's role in pharmaceutical synthesis is increasing due to the growth of the pharmaceutical industry and the demand for new drugs. Increased environmental awareness may push for sustainable chemical production methods. Research and development could lead to innovative chemical synthesis methods.

Changes in the global economic and geopolitical landscapes could influence thionyl chloride's production and consumption patterns. Evolving regulations regarding chemical manufacturing, handling, and environmental safety could affect the thionyl chloride market dynamics.

In the dynamic landscape of the chemical industry, technical-grade thionyl chloride emerges as a star player, poised to capture a whopping 70.4% of the industry share in 2025. Technical grade thionyl chloride is predominantly utilized in the industrial setting in various areas like chemical production, insecticides, and herbicides.

Versatility and compatibility in multiple processes make it essential for production purposes to nurture progress and expansion. The technical grade plays a main role in the chemical sectors as essential intermediates in pharmaceutical and agrochemical manufacturing, enhancing demand.

| Attributes | Details |

|---|---|

| Grade | Technical Grade |

| Market Share (2025) | 70.4% |

In a magnificent symphony of chemical speculation, the pharmaceutical industry takes center stage, poised to claim a substantial 28.8% slice of the thionyl chloride market share in 2025. Thionyl chloride is a versatile reagent that transforms organic compounds into potent pharmaceuticals, and it plays a major role in purification processes.

Thionyl chlorides are popular as drug-crafting maestros, acting as key components in building blocks for life-saving compounds. Despite its unassuming nature, thionyl chloride plays a significant role in the pharmaceutical industry and is crucial in the continued supply for drug synthesis formulations.

| Attributes | Details |

|---|---|

| Applications | Pharmaceuticals |

| Market Share (2025) | 28.8% |

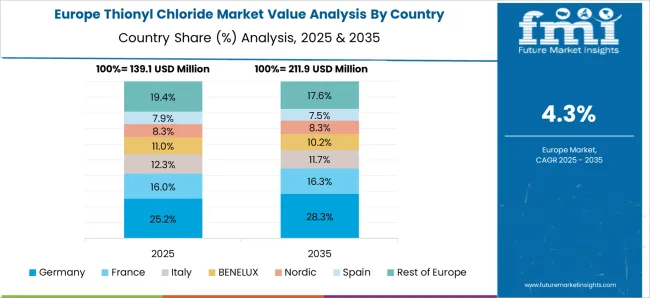

The industry is witnessing a surge in demand globally. Demand for thionyl chloride varies by region, with North America and Europe being major contributors to market growth. Meanwhile, Asia Pacific and Latin America are expected to witness significant growth due to the rise in chemical manufacturing activities and the implementation of stringent environmental regulations.

Demand for thionyl chlorides is anticipated to exhibit a gradual increase in the United States, with a CAGR of 2.7% over the next decade until 2035. The pharmaceutical sector is a main driver for thionyl chloride as it is highly utilized in the drug and medicinal development process.

Agrochemical formulations rely on thionyl chloride, including pesticides and herbicides, fueling the demand for synthesis chemicals. The technological advancements are significant as manufacturers pursue efficient reagents, which surge the demand.

The thionyl chloride industry in Spain is forecasted to experience sluggish growth, maintaining a CAGR of 3.6% until 2035. There is escalating demand for chemical applications in various industries in Spain, including construction, automotive, and the medicinal sector. This amplifies the utilization of thionyl chloride for multi-purpose applications in manufacturing units.

Key players are showing interest in the research and development zone to innovate new products and applications. The growing concern over water treatment may drive and shape the industry’s growth trajectory.

The thionyl chloride market is likely to demonstrate restrained expansion in France, characterized by a 3.4% CAGR through 2035. Specialty chemicals play a major role in France's chemical sector due to their exclusive properties and tailored functionalities, increasing the demand for multiple chemical processes.

France serves green chemistry during this; the processing entities are aiming at sustainable practices, eco-friendly processes, and bio-based materials. The collaboration between academia and industry fosters commitment toward innovation. These multifaceted drivers outline the sector’s growth.

Thionyl chloride market growth in China is expected to be moderate, with a projected CAGR of 5.4% until 2035. The thionyl chloride sector in China has witnessed significant growth due to multiple industry-specific factors and governmental initiatives. Regulatory figures have intensified their focus on environmental protection.

The latest directives emphasize stricter monitoring of chemical manufacturing facilities. Industries ensure reporting transparency and accountability to local environmental protection bureaus, gaining trust in the industry and driving the growth rate.

The growth rate of the thionyl chloride market in India is projected to be modest, with a CAGR of 7.2% expected through 2035. Increasing awareness of chemical synthesis indirectly influences industry dynamics by encouraging sustainable practices and demanding quality products.

As people become more health-conscious, they recognize the importance of pharmaceuticals in maintaining health and well-being. Thionyl chlorides are vital components in various industries, including the medicine industry, amplifying the surge in demand.

The thionyl chloride sector boasts a highly consolidated community of influential players, dominating the industry. The top nine industries account for 50% of the total revenue. To maintain this position, companies are aiming to develop strategic collaborations with government entities and end users. This helps them secure long-term contracts and confirm a stable revenue stream.

The increasing demand for thionyl chloride in multiple sectors fuels growth over the expected duration. Moreover, the increasing investment in research and development projects by key players is improving the quality of products and is expected to boost industry growth.

Several prominent players

The industry is divided into technical grade and pharmaceutical grade depending on grade.

Thionyl chloride finds application across agrochemicals, pharmaceuticals, dyes & pigments, organic synthesis, batteries, and others

Based on production, the industry is categorized into sulfur trioxide route, sulfur dioxide route, and other routes

The industry analysis has been conducted across key regions including North America, Latin America, Europe, East Asia, South Asia, Middle East and Africa, as well as Oceania.

The global thionyl chloride market is estimated to be valued at USD 543.6 million in 2025.

The market size for the thionyl chloride market is projected to reach USD 868.7 million by 2035.

The thionyl chloride market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in thionyl chloride market are technical grade and pharmaceutical grade.

In terms of application, agrochemicals segment to command 41.7% share in the thionyl chloride market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Zinc Chloride Market Analysis - Size, Share, and Forecast 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Allyl Chloride Market Size and Share Forecast Outlook 2025 to 2035

Barium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Ferric Chloride Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Cupric Chloride Companies

Calcium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Choline Chloride Market Size and Share Forecast Outlook 2025 to 2035

Valeryl Chloride Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Chloride Hexahydrate Market Size and Share Forecast Outlook 2025 to 2035

Pivaloyl Chloride Market Size and Share Forecast Outlook 2025 to 2035

Ammonium Chloride Food Grade Market Growth - Demand & Trends 2025 to 2035

Cyanuric Chloride Market

Polyvinyl Chloride (PVC) Packaging Film Market Forecast and Outlook 2025 to 2035

Magnesium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Copper Oxychloride Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Chloride Market Analysis - Size, Share & Forecast 2025 to 2035

Potassium Chloride Market Growth - Trends & Forecast 2025 to 2035

Polyvinyl Chloride Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA