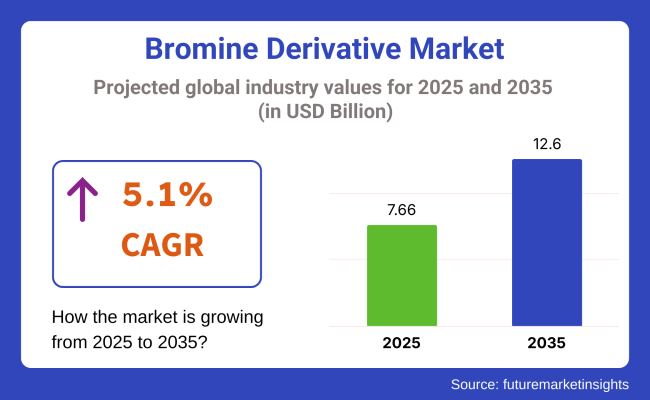

The bromine derivative market is expected to grow from USD 7.66 billion in 2025 to USD 12.60 billion by 2035, expanding at a compound annual growth rate (CAGR) of 5.1% during the forecast period. The increasing use of bromine derivatives in various industries, including chemicals, agriculture, pharmaceuticals, and electronics, is driving the growth of this market.

Bromine derivatives are key components in the production of flame retardants, water treatment chemicals, and agricultural products, making them crucial to a wide array of manufacturing processes.

One of the primary factors propelling the market is the increasing demand for flame retardants, which are used to enhance the fire resistance of a wide range of materials, including textiles, plastics, and electronics. As stringent fire safety regulations continue to be enforced globally, the demand for effective and sustainable flame retardants, many of which are bromine-based, is expected to rise. Additionally, bromine derivatives are increasingly being used in the production of water treatment chemicals, where their ability to effectively control microbial growth makes them indispensable.

Recent developments in the bromine derivative market have seen significant advancements in technology, particularly in the production of more sustainable and environmentally friendly derivatives. Companies are focusing on reducing the environmental impact of bromine production by investing in greener technologies and enhancing the efficiency of their manufacturing processes. This includes efforts to develop more effective bromine-based solutions that reduce the release of harmful by-products during production.

On March 11, 2025, ICL Group Ltd. (NYSE: ICL) announced a significant expansion of its bromine derivatives production capacity at its Dead Sea facility in Israel. This strategic move aims to meet the increasing global demand for flame retardants and water treatment solutions. The expansion is expected to enhance ICL's position in the bromine derivatives market, catering to industries such as electronics, construction, and agriculture. This was officially announced in the company's press release.

With the increasing emphasis on sustainability and the rising need for advanced chemical solutions, the bromine derivative market is poised for substantial growth over the next decade. The market’s expansion will be further supported by the ongoing innovations and advancements in bromine derivative technologies.

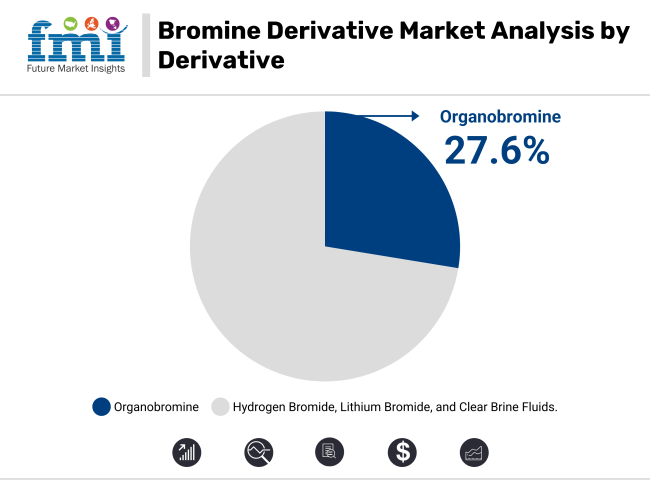

The global bromine derivative market is projected to experience significant growth from 2025 to 2035. Key segments contributing to this expansion include organobromine derivatives and biocide applications. These segments benefit from increasing demand across various industries, including agriculture, pharmaceuticals, and water treatment. Leading companies like Albemarle Corporation and Israel Chemicals Ltd. are continuously innovating to enhance their product offerings.

Organobromine derivatives are expected to account for 27.6% of the market share in 2025. This segment's growth is driven by the widespread use of organobromine compounds in various industrial applications, including flame retardants, agricultural chemicals, and pharmaceuticals.

Organobromine compounds, such as brominated flame retardants (BFRs), are essential in reducing flammability in materials used in the construction, electronics, and automotive industries. Their ability to improve safety in these sectors has led to a growing demand for these derivatives.

Key players like Albemarle Corporation and Lanxess are driving innovations in the organobromine segment by developing more efficient, environmentally friendly alternatives to traditional brominated flame retardants. The market is also witnessing a shift toward sustainable solutions, with companies focusing on creating products that comply with stricter environmental regulations. Furthermore, the use of organobromine in agrochemicals for pest control and growth enhancement is increasing, further supporting the segment's dominance in the market.

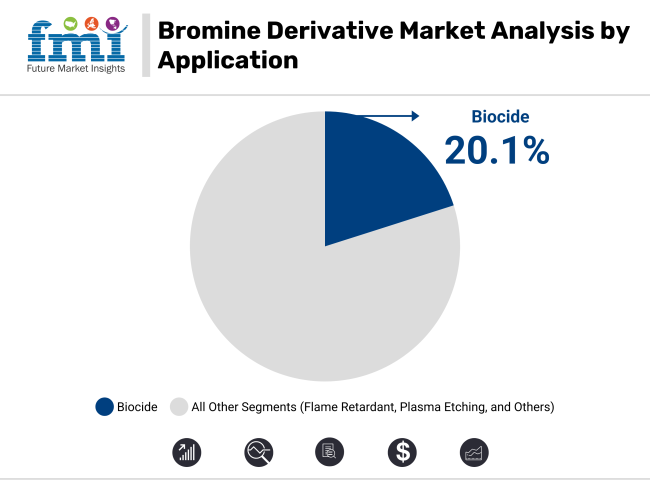

The biocide application segment is anticipated to hold 20.1% of the market share in 2025. This segment is experiencing steady growth, driven by the rising demand for disinfectants, preservatives, and sanitizers in a wide range of industries, including healthcare, agriculture, and water treatment.

Bromine-based biocides are particularly effective in controlling microbial growth in industrial cooling systems, swimming pools, and drinking water supplies. The increasing emphasis on water quality and public health, especially following the COVID-19 pandemic, has heightened the need for effective biocidal products.

Leading players like Lonza Group and Dow Chemical are focusing on expanding their biocide product lines by introducing new formulations with enhanced efficacy and lower environmental impact. Additionally, the biocide segment benefits from the growing awareness of hygiene in both consumer and industrial settings.

Regulatory bodies around the world are also enforcing stricter standards for water treatment, which is further driving the demand for bromine-based biocides. The ongoing research into safer biocide products is expected to sustain the growth of this segment, ensuring its prominence in the market for years to come.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| United States | 3.20% |

| China | 6.70% |

| Germany | 2.10% |

| Japan | 5.80% |

| United Kingdom | 2.60% |

The CAGR of the bromine derivative market for the forecast period in the United States is anticipated to be 3.20%. The expansion of the pharmaceutical industry is expected to drive the demand for bromine derivatives in the region.

Bromine derivatives such as potassium bromide and sodium bromide are used in the manufacture of sedatives, anticonvulsants, and other drugs. With the aging population in the United States, the demand for these drugs is expected to increase. This is leading to a corresponding increase in demand for bromine derivatives.

The market is expected to register a CAGR of 6.70% in China through 2034. China is one of the largest producers and users of bromine-infused goods at present. The country possesses extensive bromine reserves throughout its territory, providing it with a significant edge in the global bromine derivative market. This domestic availability of raw materials ensures a consistent supply of bromine derivatives, decreasing reliance on imports and fueling industry development.

The market is expected to progress at a CAGR of 2.10% in Germany for the forecast period. Germany is renowned for its robust vehicle sector. As regulatory regulations for passenger fire safety become increasingly stringent, there is a substantial demand for bromine derivatives in Germany’s automotive sector. Bromine derivatives enhance fire safety by being employed in a wide range of components and materials, such as wire harnesses, seat foams, dashboard materials, and insulation.

The bromine derivative market in the United Kingdom is expected to progress at a CAGR of 2.60% throughout the forecast period. Manufacturers and business owners in the country are increasingly recognizing the need for sustainable and ecologically friendly fire retardant solutions in the industrial sector.

This sustainability shift has directly benefited the market. Manufacturers are also investing in research and development activities to find new ways to produce bromine compounds with a lesser environmental impact.

The market is expected to progress at a CAGR of 5.80% in Japan. Upsurge in high-quality products in industries requiring flame retardant chemicals for safety is presumed to increase demand for bromine derivatives in the country. Also, the need for pesticides and drug discoveries is driving industry growth in Japan.

The increasing competition in the market creates barriers for new players to enter. Established companies are expanding their portfolios and offering innovative products to their consumers. Moreover, several bromine producers are seen involved in producing downstream derivatives. Also, by applying market strategies such as brand promotion, partnerships, and collaboration, manufacturers are ready to gain substantial market share in upcoming years.

Albemarle Corporation

Albemarle Corporation is a global specialty chemicals company that operates in various markets, including lithium, bromine specialties, and refining catalysts. The company was founded in 1994 and is headquartered in Charlotte, North Carolina, United States.

Albemarle is a leader in the production of bromine derivatives, which are used in a variety of applications, including flame retardants, oil and gas drilling fluids, water treatment chemicals, and pharmaceuticals. The company's bromine derivatives portfolio includes products such as ethylene dibromide, clear brine fluids, and flame retardants.

Jordan Bromine Company

Jordan Bromine Company Ltd. (JBC) is a leading producer of bromine and its derivatives, with a focus on the production of flame retardants and oilfield chemicals. The company was founded in 1999 and is headquartered in Amman, Jordan.

JBC has a significant presence in the production of bromine derivatives, which are used in various applications such as flame retardants, oil and gas drilling fluids, water treatment chemicals, and pharmaceuticals. The company's bromine derivatives portfolio includes products such as tetrabromobisphenol A, decabromodiphenyl oxide, and flame retardant blends.

Recent Developments

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 7.66 billion |

| Projected Market Size (2035) | USD 12.60 billion |

| CAGR (2025 to 2035) | 5.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for dollar sales |

| Derivatives Analyzed (Segment 1) | Organobromine, Hydrogen Bromide, Lithium Bromide, Clear Brine Fluids (CBF) |

| Applications Analyzed (Segment 2) | Biocide, Flame Retardant, Oil & Gas Drilling, Plasma Etching, PTA Synthesis, Fumigant Synthesis, Others |

| End-uses Analyzed (Segment 3) | Oil & Gas, Chemicals, Pharmaceuticals & Cosmetics, Electronics & Consumer Goods, Textile, Medical, Agricultural & Pesticides, Automotive, Building & Construction, Water Treatment, Other Industrial |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Bromine Derivative Market | Israel Chemicals Limited, Albemarle Corporation, Tosoh Corporation, Tata Chemicals Limited, LANXESS AG, Sumitomo Chemical Co.Ltd, Perekop Bromine, Archean Group, Jordan Bromine Company, Gulf Resources Inc., Hindustan Salts Limited |

| Additional Attributes | dollar sales, CAGR trends, derivative segmentation, application demand shifts, end-use industry share, competitor dollar sales & market share, regional growth patterns, regulatory impacts |

The industry is expected to grow at a CAGR of 5.1% from 2025 to 2035.

The industry size is expected to be worth USD 7.66 billion in 2025.

The market is estimated to get as big as USD 12.60 billion by 2035.

The CAGR of the industry in the United States from 2025 to 2035 is estimated to be 3.20%.

The CAGR of the market in China from 2025 to 2035 is estimated to be 6.70%.

The market can be divided into the following segments: derivative, application, end use, and region.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Tons) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Derivative, 2019 to 2034

Table 4: Global Market Volume (Tons) Forecast by Derivative, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 6: Global Market Volume (Tons) Forecast by Application, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 8: Global Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Derivative, 2019 to 2034

Table 12: North America Market Volume (Tons) Forecast by Derivative, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 14: North America Market Volume (Tons) Forecast by Application, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 16: North America Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Derivative, 2019 to 2034

Table 20: Latin America Market Volume (Tons) Forecast by Derivative, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 22: Latin America Market Volume (Tons) Forecast by Application, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 24: Latin America Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Derivative, 2019 to 2034

Table 28: Western Europe Market Volume (Tons) Forecast by Derivative, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 30: Western Europe Market Volume (Tons) Forecast by Application, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 32: Western Europe Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Derivative, 2019 to 2034

Table 36: Eastern Europe Market Volume (Tons) Forecast by Derivative, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 38: Eastern Europe Market Volume (Tons) Forecast by Application, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 40: Eastern Europe Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Derivative, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Tons) Forecast by Derivative, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Derivative, 2019 to 2034

Table 52: East Asia Market Volume (Tons) Forecast by Derivative, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 54: East Asia Market Volume (Tons) Forecast by Application, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 56: East Asia Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Derivative, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Tons) Forecast by Derivative, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Tons) Forecast by Application, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Tons) Forecast by End Use, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Derivative, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by End Use, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Tons) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Derivative, 2019 to 2034

Figure 10: Global Market Volume (Tons) Analysis by Derivative, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Derivative, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Derivative, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 14: Global Market Volume (Tons) Analysis by Application, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 18: Global Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 21: Global Market Attractiveness by Derivative, 2024 to 2034

Figure 22: Global Market Attractiveness by Application, 2024 to 2034

Figure 23: Global Market Attractiveness by End Use, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Derivative, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Derivative, 2019 to 2034

Figure 34: North America Market Volume (Tons) Analysis by Derivative, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Derivative, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Derivative, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 38: North America Market Volume (Tons) Analysis by Application, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 42: North America Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 45: North America Market Attractiveness by Derivative, 2024 to 2034

Figure 46: North America Market Attractiveness by Application, 2024 to 2034

Figure 47: North America Market Attractiveness by End Use, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Derivative, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Derivative, 2019 to 2034

Figure 58: Latin America Market Volume (Tons) Analysis by Derivative, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Derivative, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Derivative, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 62: Latin America Market Volume (Tons) Analysis by Application, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 66: Latin America Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Derivative, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 71: Latin America Market Attractiveness by End Use, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Derivative, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Derivative, 2019 to 2034

Figure 82: Western Europe Market Volume (Tons) Analysis by Derivative, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Derivative, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Derivative, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 86: Western Europe Market Volume (Tons) Analysis by Application, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 90: Western Europe Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Derivative, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by End Use, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Derivative, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Derivative, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Tons) Analysis by Derivative, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Derivative, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Derivative, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Tons) Analysis by Application, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Derivative, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by End Use, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Derivative, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by End Use, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Derivative, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Tons) Analysis by Derivative, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Derivative, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Derivative, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Derivative, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by End Use, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Derivative, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by End Use, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Derivative, 2019 to 2034

Figure 154: East Asia Market Volume (Tons) Analysis by Derivative, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Derivative, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Derivative, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 158: East Asia Market Volume (Tons) Analysis by Application, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 162: East Asia Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Derivative, 2024 to 2034

Figure 166: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 167: East Asia Market Attractiveness by End Use, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Derivative, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by End Use, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Derivative, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Tons) Analysis by Derivative, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Derivative, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Derivative, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Tons) Analysis by Application, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Derivative, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by End Use, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bromine Market Size, Share, and Forecast Analysis from 2025 to 2035

Bromine Flame Retardant Market Growth – Trends & Forecast 2024-2034

Aeroderivative Sensor Market Size and Share Forecast Outlook 2025 to 2035

Aeroderivative Gas Turbine Service Market Size and Share Forecast Outlook 2025 to 2035

Rice Derivative Market Size and Share Forecast Outlook 2025 to 2035

Cocoa Derivatives Market Analysis by Type, Category, Application and Region through 2035

Starch Derivatives Market by Product Type, Source, End Use and Region through 2035

Animal Derivatives Market

Soybean Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Saffron Derivatives Market Analysis by Product Type, Form, Application, Distribution Channel, and Region Through 2035

Collagen Derivatives Market Analysis by Source, Dosage Form and Application Through 2035

Diketene Derivatives Market Growth – Trends & Forecast 2022 to 2032

Cellulose Derivative Market Size and Share Forecast Outlook 2025 to 2035

Rice Bran Derivatives Market Size and Share Forecast Outlook 2025 to 2035

UK Starch Derivatives Market Report – Size, Share & Innovations 2025-2035

Cocoa Bean Derivatives Market Size and Share Forecast Outlook 2025 to 2035

USA Starch Derivatives Market Analysis – Demand, Trends & Outlook 2025-2035

Castor Oil Derivatives Market Growth - Trends & Forecast 2025 to 2035

Naphthalene Derivatives Market Growth & Demand 2025 to 2035

Analysis and Growth Projections for Lactose and Derivative Business

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA