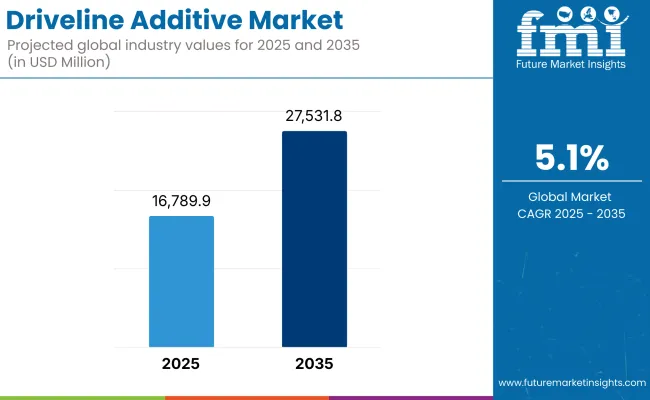

The global driveline additive market is projected to reach USD 16,789.9 million in 2025. By 2035, the market is expected to attain USD 27,531.8 million, growing at a compound annual growth rate (CAGR) of 5.1%. This trajectory is being shaped by shifts in transmission technology and OEM demands for optimized driveline fluid performance.

Increasing thermal loads and longer drain intervals have required the inclusion of advanced additive packages. Friction modifiers, corrosion inhibitors, and viscosity index improvers are now being embedded in new driveline fluids. In a 2025 technical bulletin, Afton Chemical Corporation confirmed the release of its e-axle additive platform engineered for electric transmissions operating under high-voltage conditions. These innovations support thermal stability and anti-wear performance in EV-specific applications.

OEMs remain the primary consumers of driveline additives. Their focus has been directed toward specifications that support fuel efficiency and system longevity. Eric Schnur, CEO of Lubrizol, noted during a 2025 investor address that the company has “expanded its OEM-aligned additive platforms to meet the frictional and load-bearing requirements of hybrid and electric vehicle powertrains.” Regulatory policies promoting carbon neutrality have accelerated these developments.

In January 2025, ENEOS Corporation announced the establishment of a driveline fluid blending facility in Gujarat, India. The facility aims to meet demand from rising light commercial vehicle sales in Southeast Asia, where synthetic gear oils embedded with enhanced additive formulations are in higher demand. According to company statements, the location was selected to optimize logistics and regional scalability.

North American markets continue to adopt driveline fluids engineered for ultra-low viscosity standards. In December 2024, ExxonMobil Chemical launched its latest additive series designed for API GL-5 gear oils. These were formulated to enhance shear stability, cold-start fluidity, and corrosion resistance in temperature-extreme environments.

Collaborations have become essential in driving innovation. A 2025 press release by Infineum International Ltd. detailed a strategic development partnership with a major European automaker. This initiative will produce a new additive system tailored for multi-speed BEV transmissions requiring load-bearing and thermal resistance beyond current market norms.

While advancements are being made, challenges remain. Base oil compatibility and additive solubility in synthetic fluids for EV platforms continue to require ongoing R&D. However, sustained investment in testing protocols and OEM partnerships has positioned the industry for stable growth. By 2035, the global driveline additive market will continue to be shaped by electrification, formulation precision, and region-specific innovation efforts.

Driveline Additive Market Analyzed by Top Investment Segments

The market is segmented based on product type, application, and region. By product type, the market is divided into transmission fluid additive and gear oil additive. In terms of application, it is segmented into passenger cars, commercial vehicles, and off-highway vehicles. Regionally, the market is classified into North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East & Africa.

The transmission fluid additive segment is projected to be the most lucrative in the driveline additive market, expected to expand at a CAGR of 4.8% through 2035. This growth is fueled by rising demand for smoother gear shifts, thermal stability, and anti-oxidation performance across both ICE and hybrid drivetrains.

Increasing use of automatic and dual-clutch transmissions in passenger and light commercial vehicles is driving OEM adoption of advanced fluid additives that enhance gear protection, reduce foaming, and improve viscosity control. These formulations also help OEMs comply with tightening emission and fuel economy standards by minimizing internal drag and optimizing power delivery.

The gear oil additive segment continues to play a vital role, particularly in high-torque applications within commercial vehicles and off-highway fleets. It is essential for managing extreme pressure conditions, minimizing wear and corrosion, and ensuring long-term durability of axle and differential components. However, its growth is relatively moderate due to slower drivetrain transitions in heavy-duty segments.

While both segments contribute to the market’s expansion, transmission fluid additives remain the central growth driver due to their broader application base and compatibility with advanced transmission architectures.

| Product Type Segment | CAGR (2025 to 2035) |

|---|---|

| Transmission Fluid Additive | 4.8% |

The passenger cars segment is projected to be the fastest-growing in the driveline additive market, registering a CAGR of 5.1% between 2025 and 2035. This growth is driven by the increasing global fleet of passenger vehicles and growing demand for fuel-efficient, low-emission powertrains.

Driveline additives used in these vehicles enhance the performance of transmission and gear oils by improving viscosity control, oxidation resistance, and friction stability-key features in modern cars equipped with CVTs, DCTs, and hybrid systems. Automakers are increasingly specifying high-performance additives to extend drain intervals, reduce mechanical wear, and meet stricter regulatory standards, especially in urban driving environments where stop-start operation is frequent.

The commercial vehicles segment continues to represent a stable and substantial share of the market, primarily due to the demand for durability and load-bearing efficiency in logistics, construction, and industrial operations. These vehicles rely on robust gear oil additives that perform under severe operating conditions and extended service cycles.

Meanwhile, off-highway vehicles, including those used in agriculture, mining, and heavy equipment sectors, require specialty additives formulated to handle extreme pressures and fluctuating temperatures, though the segment’s overall growth remains modest due to limited unit volumes.

| Application Segment | CAGR (2025 to 2035) |

|---|---|

| Passenger Cars | 5.1% |

Environmental Regulations & Sustainability

Stricter global environmental regulations are putting heavy limits on the lubricant emissions, the chemical compositions, and the disposal practices. For example, the USA’s EPA and Europe’s ECHA regulatory bodies are limiting volatile organic compounds (VOC), heavy metals, and environmental damaging additives in driveline fluids from being used. The sustainability issues are also increasing R&D costs, as manufacturers have to reformulate the additives in order to comply with eco-friendly standards.

Moreover, the movement towards biodegradable and renewable lubricants is associated with investment in research, testing, and certification of not merely money but also human resources. Thereby, the firms that bring forth premium quality, low-impact driveline additives would have a greater share of the market in the upcoming eco-friendly and green lubricant age.

Raw Material Price Volatility

The driveline additive market is extremely sensitive to the fluctuations in the raw material prices, interests in oil, and supply chain disruptions. For instance, base oils, synthetic lubricants, and chemical additives have all been challenged by trade restrictions and the rise of production costs due to geopolitical tensions. Additionally, the COVID-19 pandemic, labor shortages, and transportation bottlenecks were added torpedoes in the middle of the supply chains, which led to a severe price instability.

Therefore, producers are searching for alternative sources of supply, whether through cost-effective synthetic formulations or supply chain optimizations to counter the price surge. Bio-based and recycled lubricant materials are being prominently used to hedge inflation and assure the sustainability of product development.

Rising Demand for Electric Vehicle (EV) Driveline Fluids

The shift of the majority of the vehicle production into electric and hybrid vehicles is creating an opportunity for the driveline additive manufacturers. The reason for the difference is that the electric vehicle (EV) driveline requires different oil types, which have additional functionalities - like thermal stability, electrical insulation, and wear protection. The exponential growth of electric vehicle manufacturers means that the demand for low-viscosity, high-performance transmission fluids is constantly on the rise.

Moreover, the breakthroughs in battery chilling technologies and braking systems that recover energy are the main drivers of innovation in next-gen driveline additives. Companies tailoring their product lines towards this sector, permitting longer drain intervals and meiri efficiency are better positioned to take advantage of this fast-growing part of the market.

The preference for synthetic and bio-based driveline lubricants is growing exponentially and this constitutes a significant market opportunity. Such lubricants are characterized by high oxidation resistance, long service life, and low environmental effects, thus they are very attractive choices for automotive and industrial applications. Additionally, long drain intervals and increased efficiency reduce maintenance costs, thus these lubricants are becoming popular in commercial fleets, heavy-duty vehicles, and industrial machines.

With sustainability issues coming to the fore, the manufacturers are embarking on the quest for the next generation of driveline additives that will improve viscosity performance, anti-wear properties, and thermal efficiency. Companies that will be successful in the integration of both bio-based additives and synthetic technologies into their products will achieve a competitive advantage in the dynamically changing lubricant market.

The automotive lubricants market is driven by factors such as the implementation of efficiency regulations, the rise in vehicle production, and strong aftermarket sales of automotive lubricants. The Environmental Protection Agency (EPA) has made it mandatory for the automakers to use first-grade lubricants and driveline fluids that are designed to transmit power more effectively, as such regulations on fuel economy and carbon emissions.

Moreover, electric and hybrid vehicles are becoming a significant driver in the relevant market for alternative e-axle lubricants and specialized EV transmission fluids. The industrial and heavy machinery sector is raising the use of performance additives for driveline by means of high-performance driveline additives.

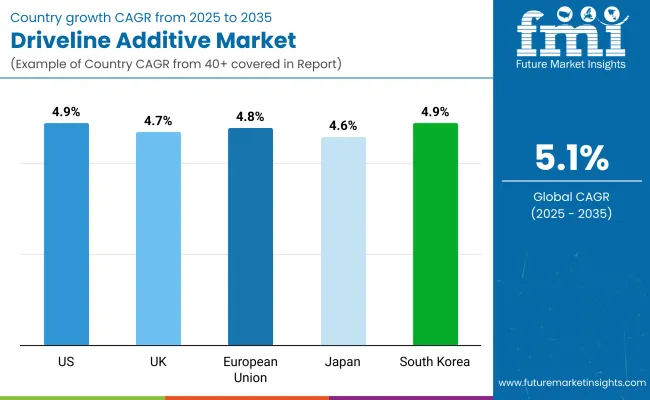

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.9% |

Owing to the increasing adoption of electric vehicles (EV), the strict regulations governing fuel efficiency, and the need for high-performance lubricants, the UK driveline additive market is moderately flourishing. The United Kingdom Parliament's transformative project to displace internal combustion engine (ICE) vehicles by 2035 is a strong force behind the triggering of the innovation in e-driveline fluids and advanced synthetic lubricants.

The country's target of drastically reducing carbon emissions is effectively steering the auto industry to the utilization of low-viscosity and friction-reducing additives in the transmission and axle fluids. The substantial market of the luxurious car and premium car segment is the additional reason for the parallel increase in the high-performance driveline additives demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.7% |

The European driveline additive market is on the upswing with the help of stringent EU emissions standards, innovative lubricant technologies, and robust automotive production. The new Euro 7 regulations, which are going to come into force and lower CO₂ emissions, are thus fueling the demand for high-efficiency transmission and axle lubricants.

Germany, France, and Italy are the leaders in automotive research and development and have been working on new driveline fluids for hybrid and electric powertrains. The rise of industrial automation and heavy machinery sectors is also propelling market growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.8% |

The Japanese driveline additive sector thrives chiefly because of high-tech automotive manufacturing, the growing uptake of hybrid vehicles, and the inventive lubricant technology. Intense competition in hybrid and electric vehicle production serves Japan with the necessity of specific transmission fluids as well as axle lubricants.

Mastery in high-precision engineering by the nation has been instrumental in evolving products such as friction-reducing and wear-resistant driveline additives. Besides, the induction of robotic and automated machinery is responsible for the demand of superior lubricants.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.6% |

The South Korean driveline additive market is witnessing rapid growth, fueled by the expansion of EV and hybrid vehicle production, advancements in transmission technology, and growing industrial applications. The major players in the automobile industry of South Korea, such as Hyundai and Kia, are putting lots of resources in the electrical power drive lubricants to increase efficiency and avoid friction.

On top of that, the increase in the use of machinery for industrial automation and smart manufacturing engineering is being fed by high-performance synthetic lubricants. The state refreshes the market with eco-friendly drives of motors in addition to the driveline additives first released.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.9% |

The Driveline Additive Market is a very important shoulder in the automotive and industry lubricants segment, heading due to the aim of making vehicles that consume less fuel, emit less, and are improved in general. Driveline additives are major components of the transmission fluids, gear oils and axle lubricants systems, providing benefits such as friction modification, wear protection, thermal stability, and oxidation resistance.

Global chemical manufacturers, as well as specialty lubricant producers comprise the leading players in the market, with the competition being focused on technological innovations, sustainability projects, and adherence to the strict emissions policies. The increase in the number of electric vehicles on the road has also caused the need for develop specialized additives for e- transmission fluids.

The global Driveline Additive market is projected to reach USD 16,789.9 million by the end of 2025.

The market is anticipated to grow at a CAGR of 5.1% over the forecast period.

By 2035, the Driveline Additive market is expected to reach USD 27,531.8 million.

The transmission fluid additives segment is expected to dominate due to increasing demand for enhanced fuel efficiency, improved thermal stability, and smoother gear shifting in modern vehicles.

Key players in the market include The Lubrizol Corporation, Afton Chemical Corporation, BASF SE, Chevron Oronite, and Infineum International Ltd.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Western Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: East Asia Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 117: East Asia Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Driveline Control Systems and Devices Market Size and Share Forecast Outlook 2025 to 2035

Additives for Metalworking Fluids Market Size and Share Forecast Outlook 2025 to 2035

Additive Manufacturing With Metal Powders Market Size and Share Forecast Outlook 2025 to 2035

Additive Manufacturing and Material Market Trends - Growth & Forecast 2025 to 2035

Additives for Floor Coatings Market

Ink Additives Market Growth – Trends & Forecast 2025 to 2035

Feed Additive Nosiheptide Premix Market Size and Share Forecast Outlook 2025 to 2035

Seed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fuel Additives Market Segmentation based on Type, Application, and Region: Forecast for 2025 and 2035

Global Food Additive Market Size, Growth, and Forecast for 2025 to 2035

Glass Additive Market Forecast and Outlook 2025 to 2035

Paint Additives Market Growth 2024-2034

Amine Additives in Paints and Coatings Market

Silage Additive Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Additive Manufacturing Machines Market Size and Share Forecast Outlook 2025 to 2035

Plastic Additive Market Size and Share Forecast Outlook 2025 to 2035

Coating Additives Market Growth – Trends & Forecast 2025 to 2035

Understanding Market Share Trends in Brewing Additives

Ceramic Additives Market

Foundry Additives Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA