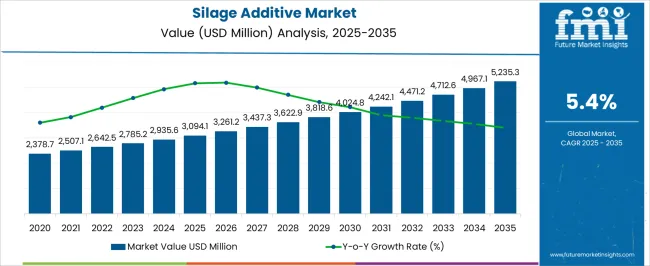

The Silage Additive Market is estimated to be valued at USD 3094.1 million in 2025 and is projected to reach USD 5235.3 million by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

The silage additive market is growing steadily, driven by the increasing demand for high-quality livestock feed and improved forage preservation practices. Rising global meat and dairy consumption has heightened the need for efficient feed management, leading to greater adoption of silage additives that enhance fermentation quality and nutrient retention.

The market benefits from advancements in microbial inoculant formulations and the rising use of biotechnology in agricultural inputs. Cost-effective preservation methods are critical for minimizing post-harvest losses, especially in regions with variable climatic conditions.

As livestock producers prioritize feed efficiency and herd productivity, silage additives are becoming integral to modern forage management systems. The outlook remains positive, with continued product innovation and expanding adoption among both small-scale and industrial farming operations.

| Metric | Value |

|---|---|

| Silage Additive Market Estimated Value in (2025 E) | USD 3094.1 million |

| Silage Additive Market Forecast Value in (2035 F) | USD 5235.3 million |

| Forecast CAGR (2025 to 2035) | 5.4% |

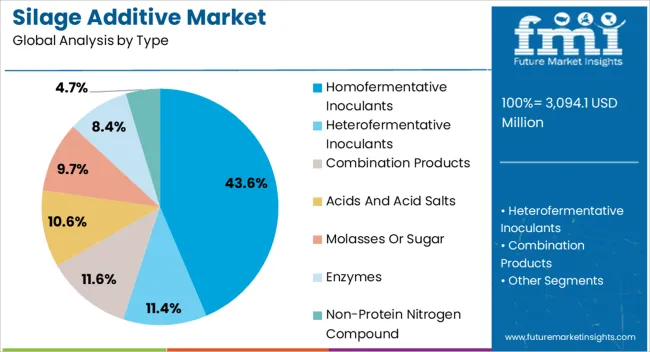

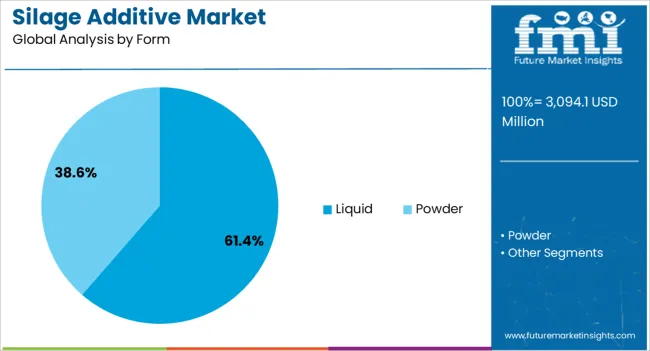

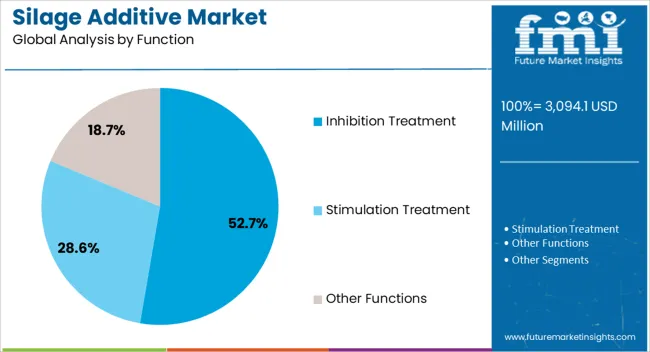

The market is segmented by Type, Form, Function, and Function (Crop) and region. By Type, the market is divided into Homofermentative Inoculants, Heterofermentative Inoculants, Combination Products, Acids And Acid Salts, Molasses Or Sugar, Enzymes, and Non-Protein Nitrogen Compound. In terms of Form, the market is classified into Liquid and Powder. Based on Function, the market is segmented into Inhibition Treatment, Stimulation Treatment, and Other Functions. By Function (Crop), the market is divided into Corn, Alfalfa, Sorghum, Oats, Barley, Rye, and Other Crops. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The homofermentative inoculants segment dominates the type category, holding approximately 43.6% share. This segment’s leadership stems from its ability to ensure rapid lactic acid fermentation, leading to reduced pH levels and enhanced silage stability.

The use of these inoculants minimizes dry matter loss and spoilage, improving feed palatability and nutritional value. Dairy and beef producers favor homofermentative strains for their consistent performance and predictable fermentation outcomes.

The segment’s growth is supported by the development of strain-specific products tailored to different crop types and storage conditions. With increasing awareness of feed quality optimization and profitability, demand for homofermentative inoculants is projected to remain strong across global markets.

The liquid segment leads the form category with approximately 61.4% share, driven by its ease of application, uniform distribution, and superior bacterial activation compared to dry formulations. Liquid additives are particularly favored in large-scale silage production where mechanized application ensures efficiency and consistency.

The segment benefits from advancements in liquid stabilization techniques that extend shelf life and simplify storage. Cost-effectiveness and quick mixing capability have further supported widespread adoption.

With increasing mechanization in farming and the emphasis on process uniformity, the liquid segment is expected to retain its dominant share in the foreseeable future.

The inhibition treatment segment accounts for approximately 52.7% share of the function category, emphasizing its importance in controlling spoilage organisms and preserving silage quality. This treatment type is widely used to inhibit unwanted microbial growth, particularly yeasts and molds, during both fermentation and feed-out phases.

The segment’s prominence is driven by its role in maintaining aerobic stability and reducing nutrient loss, which directly impacts livestock performance. Modern formulations combine microbial inoculants with chemical inhibitors for enhanced efficacy under variable environmental conditions.

As feed producers continue to prioritize consistency and safety, inhibition treatments are expected to remain central to silage additive strategies worldwide.

| Market Statistics | Details |

|---|---|

| Jul to Dec (H2), 2025 (A) | 6.8% |

| Jan to Jun (H1), 2025 (A) | 6.2% |

| Jan to Jun (H1), 2025 Projected (P) | 7.3% |

| Jan to Jun (H1), 2025 Outlook (O) | 6.9% |

| Jan to Jun (H1), 2025 Projected (P) | 9.2% |

| Jul to Dec (H2), 2025 Outlook (O) | 6.9% |

| Jul to Dec (H2), 2025 Projected (P) | 7.9% |

Global sales of silage additives increased at a 4.1% CAGR from 2020 to 2025. Over the next ten years, the global market for silage additives is expected to thrive at a CAGR of 5.4%.

Global silage additives sales are predicted to increase significantly between 2025 and 2035. The formation of significant organizations, such as the European Feed Additives Manufacturers Association (FEFANA) and the British Association of Feed Supplement & Additive Manufacturers (BAFSAM), is crucial in promoting a community amongst cattle and ruminant owners.

This community-building initiative has increased members' awareness regarding optimal practices for the betterment of the dairy industry. By diligently studying various animal feed additives, specialty ingredients, and feed ingredients, these associations aim to boost productivity collectively. Additionally, they facilitate cross-border communication, fostering a more efficient exchange of ideas and innovation.

As exemplified by Lallemand Animal Nutrition, manufacturers are actively working to enhance knowledge about properly cutting and storing silage. Companies are instituting expert panels and support teams to streamline the application of silage additives, ensuring a hassle-free experience for users. Notably, Ecosyl, a subsidiary of Volac International Limited, has strategically deployed regional experts to provide continuous assistance for optimal outcomes.

To further encourage the adoption of silage additives, manufacturers are offering free consultation services, a move expected to positively influence consumer perceptions and drive increased consumption of Silage Additives. This proactive approach by industry associations and manufacturers signals a concerted effort to advance knowledge, streamline application processes, and ultimately contribute to the overall improvement of the global dairy industry.

| Regions | North America |

|---|---|

| Countries | United States |

| Value CAGR (2025 to 2035) | 4.4% |

| Regions | Europe |

|---|---|

| Countries | United Kingdom |

| Value CAGR (2025 to 2035) | 7.5% |

| Regions | Europe |

|---|---|

| Countries | Germany |

| Value CAGR (2025 to 2035) | 4.5% |

| Regions | Asia Pacific |

|---|---|

| Countries | India |

| Value CAGR (2025 to 2035) | 6.2% |

| Regions | Asia Pacific |

|---|---|

| Countries | Japan |

| Value CAGR (2025 to 2035) | 6.0% |

The silage additives industry in the United States is expected to exhibit a 4.4% CAGR through 2035.

The silage additive market growth in the United Kingdom is estimated at a 7.5% CAGR through 2035.

The sales of silage additives in Germany are anticipated to surge at a 4.5% CAGR through 2035.

The demand for silage additives in India is expected to rise at a CAGR of 6.2% and hold a dominant market share of 40.0% in the South Asia region.

The demand for silage additives in Japan is anticipated to rise at a 6.0% CAGR through 2035.

| Segment | Heterofermentative Inoculants (Product Type) |

|---|---|

| Value (2025) | USD 3094.1.0 million |

Based on product type, the heterofermentative inoculants segment garnered USD 3094.1.0 million in 2025.

| Segment | Liquid (Form) |

|---|---|

| Value (2025) | USD 2,550.0 million |

Based on form, the liquid form segment generated USD 2,550.0 million in 2025.

The silage additive market has a diverse and dynamic competitive landscape. Leading companies specializing in various fields focus on research and development, sustainable sourcing, and new formulations. These companies emphasize environmentally friendly practices, product certifications, and satisfying the increased demand for natural and sustainable ingredients.

Additionally, it attempts to preserve its market position and benefit from the growing demand by focusing on innovation, quality, and matching customer preferences.

Recent Developments

| Attribute | Details |

|---|---|

| Market Size Value in 2025 | USD 3094.1 million |

| Market Forecast Value in 2035 | USD 5235.3 million |

| Global Growth Rate | 5.4% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Volume (MT) and Value (US$ million) |

| Key Regions Covered | Latin America, Europe, North America, South Asia, East Asia, Oceania, and MEA |

| Key Countries Covered | the United States, Brazil, Mexico, Chile, Argentina, Peru, Italy, Spain, Germany, France, Canada, the United Kingdom, the Belgium, Russia, Netherlands, the Nordic region, Poland, Japan, South Korea, China, India, Thailand, Singapore, Australia, Indonesia, Malaysia, Gulf Cooperation Council countries, New Zealand, Central Africa, and South Africa |

| Key Market Segments Covered | Product Type, Form, Function, Silage Crop, and Region |

| Pricing | Available upon Request |

The global silage additive market is estimated to be valued at USD 3,094.1 million in 2025.

The market size for the silage additive market is projected to reach USD 5,235.3 million by 2035.

The silage additive market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in silage additive market are homofermentative inoculants, heterofermentative inoculants, combination products, acids and acid salts, molasses or sugar, enzymes and non-protein nitrogen compound.

In terms of form, liquid segment to command 61.4% share in the silage additive market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Silage Tube Market Size and Share Forecast Outlook 2025 to 2035

Silage Inoculants and Enzymes Market Segmentation Based on Type, Species, Enzymes and Region - A Forecast for 2025 to 2035

Key Companies & Market Share in the Silage Bags Sector

Market Share Insights for Silage Tube Providers

Silage Bags Market by PE & PP Materials Forecast 2024 to 2034

Silage Inoculants Market

Fish Silage Market Analysis by Fish, Fish Type, Application and Form Through 2035

Corn Silage Market Analysis – Growth, Trends & Forecast 2024-2034

Additives for Metalworking Fluids Market Size and Share Forecast Outlook 2025 to 2035

Additive Manufacturing With Metal Powders Market Size and Share Forecast Outlook 2025 to 2035

Additive Manufacturing and Material Market Trends - Growth & Forecast 2025 to 2035

Additives for Floor Coatings Market

Ink Additives Market Growth – Trends & Forecast 2025 to 2035

Seed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fuel Additives Market Segmentation based on Type, Application, and Region: Forecast for 2025 and 2035

Global Food Additive Market Size, Growth, and Forecast for 2025 to 2035

Feed Additive Nosiheptide Premix Market – Growth & Industry Trends

Glass Additive Market Forecast and Outlook 2025 to 2035

Paint Additives Market Growth 2024-2034

Amine Additives in Paints and Coatings Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA