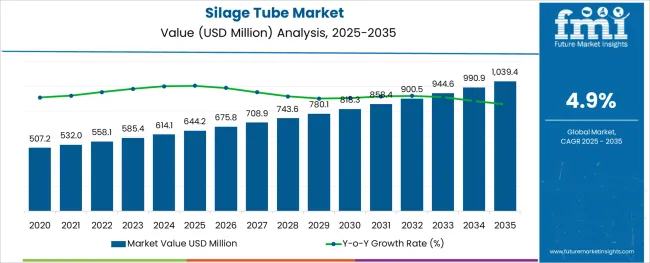

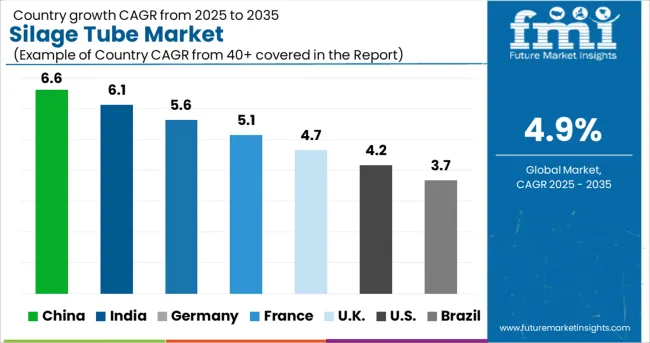

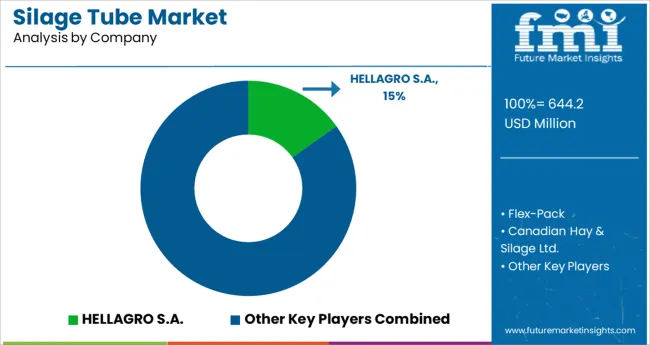

The Silage Tube Market is estimated to be valued at USD 644.2 million in 2025 and is projected to reach USD 1039.4 million by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

The silage tube market is witnessing steady expansion driven by increasing adoption of efficient storage solutions in livestock and dairy farming. The need for preserving forage, wet grains, and other feed inputs in variable climatic conditions has prompted the demand for advanced silage tubes with enhanced strength, UV resistance, and barrier properties.

Agricultural producers are focusing on minimizing post-harvest losses and ensuring feed consistency, particularly in regions with growing dependence on mechanized silage storage. Manufacturers are responding with multilayer polymer films, oxygen-limiting technologies, and custom sizes to meet the evolving requirements of large-scale farms and contract silage producers.

Additionally, the rise of precision farming and feed quality monitoring is influencing the integration of silage tubes that align with animal nutrition planning. As input costs rise and farm margins tighten, silage tube adoption is expected to accelerate further, particularly in developing regions where investment in livestock productivity is increasing.

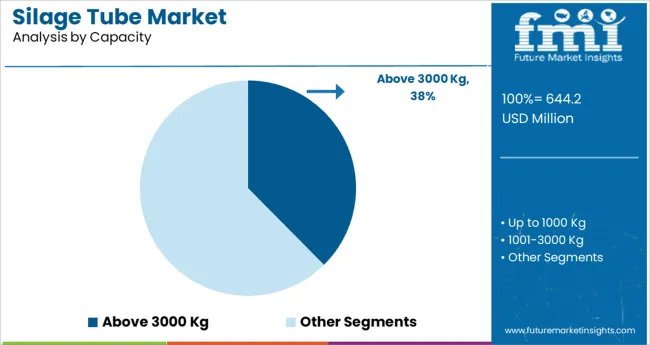

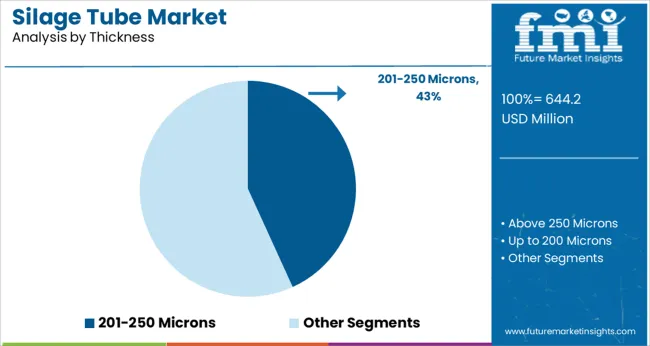

The market is segmented by Capacity, Thickness, and Application and region. By Capacity, the market is divided into Above 3000 Kg, Up to 1000 Kg, and 1001-3000 Kg. In terms of Thickness, the market is classified into 201-250 Microns, Above 250 Microns, and Up to 200 Microns.

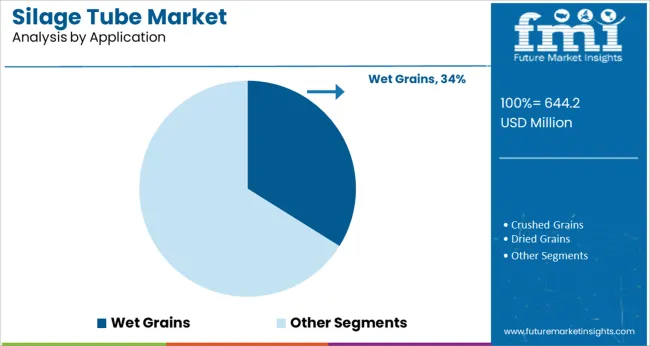

Based on Application, the market is segmented into Wet Grains, Crushed Grains, Dried Grains, and Dry Grains. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The above 3000 kg capacity segment is projected to account for 37.6% of the total revenue in 2025, marking it as the leading capacity range in the silage tube market. This dominance is attributed to the growing preference among commercial dairy and livestock operations for large-volume storage solutions that minimize handling frequency and reduce operational downtime.

The segment benefits from cost efficiencies gained through bulk storage while supporting extended fermentation and nutrient retention over long periods. Larger capacity tubes are also being favored in regions with high forage production and large herd sizes, where the economics of scale significantly influence packaging decisions.

Manufacturers are offering heavy-duty options within this category, ensuring mechanical resistance and puncture protection during both filling and storage. These functional advantages have reinforced the leadership of the above 3000 kg capacity segment.

The 201–250 microns segment is anticipated to hold 43.2% of market revenue in 2025 within the thickness category, establishing it as the dominant range. This position is supported by its ability to balance durability, flexibility, and cost-effectiveness across varied climatic and storage conditions.

Silage tubes in this thickness range offer reliable protection against punctures, UV degradation, and microbial infiltration, which are essential for preserving feed quality. The segment also addresses handling efficiency by offering ease of sealing, transport, and deployment in both automated and manual filling systems.

Farmers and feed contractors are selecting this thickness range for its proven performance during long-term storage, especially for high-moisture crops. With technological advancements in co-extrusion and multilayer film development, this category continues to serve as the industry standard for reliable and scalable silage storage.

Wet grains are expected to contribute 33.9% of the silage tube market’s revenue in 2025, making it the leading application segment. This leadership is driven by increasing grain moisture variability at harvest and the rising use of whole crop preservation techniques in ruminant feeding systems.

Silage tubes offer a controlled anaerobic environment that reduces spoilage and mycotoxin development in high-moisture grains. Their use enables extended storage without compromising nutritional quality, which is particularly valuable during supply chain disruptions or seasonal feed planning. The wet grains application segment has gained traction among producers looking to enhance feed digestibility and reduce drying costs.

As input efficiency and animal nutrition outcomes become key priorities, the utility of silage tubes in preserving wet grains has been widely recognized across large commercial farms and contract silage operations, thereby securing its dominant position in this segment.

Sales of silage tubes are effectively rising while making their way in the agricultural industry as it ensures the protection of fodder and silage against adverse climatic conditions.

Acceptance of silage tubes among farmers all across the globe is expected to drive the demand for silage tubes and the growth of the silage tube market share during the forecast period. Also, the silage tube can be sealable so that once the required quantity of fodder is taken, the bag can be sealed again. Sealing also allows the preservation of humidity at the desired level, which is one of the primary factors driving the sales of silage tubes.

The demand for silage tubes is anticipated to rise as it is effective when used with a vast range of crops, including high moisture grains, dry grains, and chopped dry forage, which are meant to feed cattle.

These factors are expected to drive the sales of silage tubes and aid the growth of the global silage tube market share during the forecast period. Silage tube is available in various thicknesses and sizes depending on the requirement of the farmer.

Small farmers who cannot invest in large silo systems are preferring to silage tubes as their short-term requirement, which is anticipated to boost the demand for silage tubes. This factor further boosts the sales of silage tubes as well as the growth of the silage tube market share during the next decade.

However, the availability of different alternatives, including containers, ditches, and bunkers, can hamper the growth prospects of the silage tube market during the forecast period.

Countries such as Australia, India, and other parts of the Asia Pacific region are expected to witness high demand for silage tubes nowadays owing to changing climatic conditions.

In the Middle East and Africa region, African countries used silage tubes to keep fodder and silage to feed cattle. It is due to low rainfall in various parts of the region. African countries with low rainfall are opting for silage tubes on a mass basis. European countries such as Germany, the UK, Italy, and others are expected to witness slower growth in the silage tube market share owing to the availability of various alternatives in the regions, including bunkers, containers, and others.

Similar trends are followed in the USA and Canada. The silage tube market is expected to witness stagnant growth in the North American region. However, Brazil and Mexico are expected to witness average growth in the silage tube market during the forecast period.

The key players in the silage bags market are Silo Bags India (India), Flex Pack (Holland), RKW groups (Germany), Silo Bags International limited (China), Silo bag grain (Australia), Grain Bags Canada (Canada), The Panama Group (India), Ipesa - Rio Chico S.A. (Argentina), etc.

| Report Attribute | Details |

|---|---|

| Growth rate | CAGR of 4.9% from 2025 to 2035 |

| The base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis, |

| Segments Covered | capacity, grain types, region |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East Africa; ASEAN; South Asia; Rest of Asia; Australia and New Zealand |

| Country scope | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | Silo Bags India (India); Flex Pack (Holland); RKW groups (Germany); Silo Bags International Limited (China); Silo bag grain (Australia); Grain Bags Canada (Canada); The Panama Group (India); Ipesa - Rio Chico S.A. (Argentina) |

| Customization scope | Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global silage tube market is estimated to be valued at USD 644.2 million in 2025.

It is projected to reach USD 1,039.4 million by 2035.

The market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types are above 3000 kg, up to 1000 kg and 1001-3000 kg.

201-250 microns segment is expected to dominate with a 43.2% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Insights for Silage Tube Providers

Silage Additive Market Size and Share Forecast Outlook 2025 to 2035

Silage Inoculants and Enzymes Market Segmentation Based on Type, Species, Enzymes and Region - A Forecast for 2025 to 2035

Key Companies & Market Share in the Silage Bags Sector

Silage Bags Market by PE & PP Materials Forecast 2024 to 2034

Silage Inoculants Market

Fish Silage Market Analysis by Fish, Fish Type, Application and Form Through 2035

Corn Silage Market Analysis – Growth, Trends & Forecast 2024-2034

Tube and Core Market Size and Share Forecast Outlook 2025 to 2035

Tube Tester Market Size and Share Forecast Outlook 2025 to 2035

Tube Rotator Market Size and Share Forecast Outlook 2025 to 2035

Tuberculosis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Tube Laminating Films Market Size and Share Forecast Outlook 2025 to 2035

Tube Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Tube Ice Machine Market Size and Share Forecast Outlook 2025 to 2035

Tube Closures Market Size and Share Forecast Outlook 2025 to 2035

Tube Sealing Machines Market Analysis by Tube type, Technology type, End User, and Region through 2025 to 2035

Tuberculous Meningitis Treatment Market - Demand & Innovations 2025 to 2035

Tube Feeding Formula Market Analysis by Product Type, Form, End User, Primary Condition and Distribution Channel Through 2035

Market Share Distribution Among Tube Filling Machine Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA