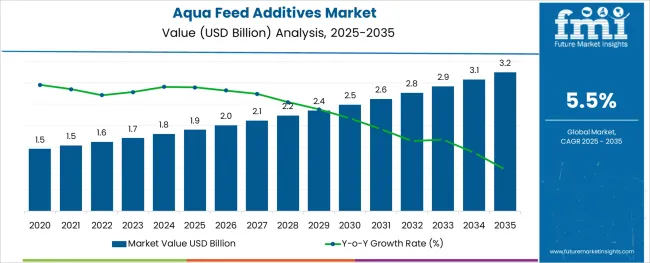

The aqua feed additives market is expected to be worth USD 1.8 billion by 2024. For aqua feed additives demand, a growth warranted since 2025, where the global market would exceed USD 1.9 billion by 2025. The highest growth is predicted in the Asia Pacific over the projection period (2025 to 2035) gaining 45% sales, globally sales at that point are approximately USD 3.2 billion in sales value at a 5.5% CAGR.

The expansion of aquaculture to meet growing demand for seafood worldwide is driving growth of this market. Animal feed fillers have become a key ingredient for improving the health, growth rate and productivity of aquaculture species, from fish to crustaceans to mollusks. Additives including amino acids, vitamins, prebiotics, and enzymes are growing in adoption for enhancement of feed efficiency, nutrient absorption and immunity in the aquatic animals.

These issues are now core themes within aquaculture, with a guardian angel on their shoulder in the form of sustainable standards. These factors makes the manufacturers to focus on organic and functional feed additives which improves gut health and minimize antibiotic usage. Companies like Cargill, ADM, Nutreco, and Alltech are making strides in innovation in this area with species-targeted nutraceutical and bioactive solutions.

| Attributes | Description |

|---|---|

| Estimated Global Aqua Feed Additives Industry Size (2025E) | USD 1.9 billion |

| Projected Global Aqua Feed Additives Industry Value (2035F) | USD 3.2 billion |

| Value-based CAGR (2025 to 2035) | 5.5% |

As regulatory pressures continue to rise to reduce harmful substances from aquatic ecosystems, the growth of sustainable aquafeed is also on the rise. As alternatives to fishmeal for additive enrichment, feed manufacturers are considering algae-based ingredients, fermented proteins, and insect meals as protein sources. Additionally, growing cases of aquatic diseases have propelled demand for immuno-stimulants and stress-reducing agent compounded feeds.

CAGR was calculated for both the base year (2024) and current year (2025) for the global aqua feed additives industry, and the table below shows a comparative analysis of changes in CAGR over 6 months. It reflects crucial performance shifts and shows how revenue realization is happening that comes in handy for giving stakeholders a deeper insight into how the growth in a year progressed.

H1, or the first half of the year, is from January to June. The H2 refers to the latter months, from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 5.2% (2024 to 2034) |

| H2 | 5.3% (2024 to 2034) |

| H1 | 5.4% (2025 to 2035) |

| H2 | 5.5% (2025 to 2035) |

The industry is expected to expand at a compound annual growth rate (CAGR) of 5.4% in H1 of the decade from 2025 to 2035, and grow to 5.5% in H2. This sustained performance underlines the evergreen trend towards premium, health- and eco-focused aquafeed. Scrub the stats, seeing a 20 BPS improvement in H1 followed by a 20 BPS improvement in H2, which tests further positive momentum in the entire sector.

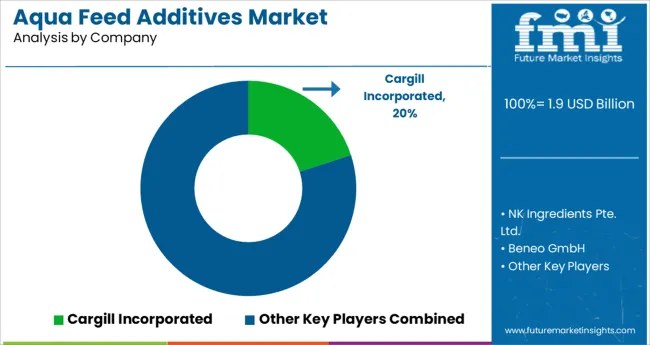

Tier 1 companies dominate the global aqua feed additives market in revenue, innovation capacity, and multi-regional distribution networks. These firms are closely integrated into the aquaculture value chain and invest heavily in R&D, sustainability and digital farming solutions.

One of the major players is Cargill Incorporated which provides a comprehensive range of feed solutions and additives for various aquatic species. Its global footprint, backed by strong technical support and sustainability initiatives, gives it a leading edge in the market.

Another important Tier 1 company is Nutreco N.V., via Skretting division. Nutreco also emphasizes mass nutrition, precision nutrition, and innovation in functional feed additives, and has operations in over 40 countries.

Evonik Industries, a leading chemical producer, is well prepared in this area through its specialty amino acids and probiotics, which offer performance-enhancing solutions at scale. Through volume, influence, and technology, these Tier 1 players lead the way for the industry.

Tier 2 comprises companies with significant market presence and targeted product offerings but with smaller size and geographical reach. Denmark-based Biomar A/S has a strong presence in functional additives and sustainable aquafeeds. The brand, which specializes in eco-positive innovations and traceable supply chains.

Norwegian giant Aker Biomarine plays a major role in the supply of krill-based feed additives with a heavy focus on omega-3 for engendering performance and immune support for aquatic animals. Coppens International B.V. was an independent feed company with a focus on innovative high-performance feeds for various species, which was acquired by Alltech and is well established in Europe.

Focusing on Mediterranean aquaculture, Dibaq A.S. provides highly tailored additive formulations tailored for local species and farming systems. These companies tend to focus on more niche applications, like immune boosters or gut health, and compete by differentiating their products.

Tier 3 represents emerging and regionally active players, gaining traction through innovation, specific product lines, or low-cost offerings. NK Ingredients Pte. Ltd., a producer in Singapore that specializes in natural additives such as squalene and omega-rich supplements.

Info/48.5 Cover-feature-- Growel Feeds: Expanding in India, the growing and progressing South Asian market with cost-effective aquafeeds and performance solutions including additives. Companies like Beneo GmbH, which focus largely on human nutrition, also play in the animal nutrition space, with plant-based additives such as prebiotic fibers being of interest for gut health in fish.

Move Towards Functional Additives For Fish Immunity And Gut Health

Shift: As aquaculture expands, there is a greater need to keep fish healthy and limit antibiotics use. Farmers have a demand for feed additives that increase the immune defense in fish, enhance bacteria growth in the gastrointestinal tract and/or decrease mortality from prevalent diseases like EMS and White Spot Syndrome in shrimp or sea lice in salmon.

You see this in markets throughout Southeast Asia as well as in Norway and Chile, where there is increased regulatory scrutiny regarding antibiotics, and disease management is a top priority.

Strategic Response: Cargill launched its IntelliBond Aqua trace mineral range, targeted to boost fish immune function. This also resulted in 7.5% year-on-year growth in additive sales throughout India and Indonesia. The probiotic strain and enzyme-containing GutPlus® Aqua of Evonik showed 9% sales growth in Europe, particularly among tilapia and trout farmers.

The rise in revenue achieved in Latin America’s shrimp market of 10.2% was primarily due to the use of Nutreco’s Protec® functional additive blend, which increases shrimp resistance to Vibrio, particularly in Ecuador and Brazil.

Increase in Preference for Phytogenic and Natural Additives

Shift: Demand is therefore increasing for natural, plant-derived additives-such as essential oils, herbs and spices-as consumers become more cautious about synthetic inputs. These phytogenics are generally chosen for their beneficial anti-inflammatory, antimicrobial, and appetite-enhancing properties. The trend is particularly pronounced in the Asia-Pacific and Middle Eastern aquaculture sectors, especially in markets exporting to health-oriented markets.

Strategic Response: NK Ingredients Pte. Ltd. released herbal immunity boosters based on garlic and oregano oil for seabass and tilapia that helped increase sales to aquafeed producers in Thailand and the UAE by 10%. Beneo GmbH incorporated chicory-derived inulin prebiotics into aquafeed compositions in Turkey and Vietnam, fueling a 7.4% rise in its Asia-MENA sales. In the Middle East, Dibaq A.S. introduced a series of phytogenic blends for trout and seabream, increasing their export share by 9.2% year-on-year.

Higher Focus TowardsPalatability Enhancers for High-Density Aquaculture

Shift: In intensive production systems, especially those breeding carnivorous species such as shrimp, sea bass and groupers, palatability of feed is essential to optimizing feed efficiency and waste reduction. As a result, there is an increased demand for amino acid-based and enzymatically hydrolyzed protein additives that increase feed intake.

Strategic Response: A hydrolyzed fish protein additive to raise the palatability in extreme density salmon net pens was introduced by Coppens International to create a 12.3% increase on product uptake across Norway. Nutreco launched a krill peptide-based enhancer through its Selko brand, driving a 9.5% increase in sales of Chilean shrimp and seabass additives. Growel Feeds incorporated amino-acid boosters into its premium shrimp feeds, part of a 10% increase in sales in India, fueled by Andhra Pradesh and Tamil Nadu.

Concentrate on Dye-Inducing and Cosmetic Additives

Shift: The aesthetic aspects of farmed fish are a very important quality factor for premium markets like Japan, South Korea, and Europe, especially with salmon, koi and ornamental species (Yamamoto, 2004). Feed additives that improve pigmentation or scale brightness, such as astaxanthin and spirulina extracts are in great demand among feed integrators.

Strategic Response: Cargill counseled Haematococcus pluvialis obtained astaxanthin to its premium salmon feeds, boosting marketplace enhance with a 9.4% increase in sales adoption from Scottish and Canadian hatcheries. In Asia-Pacific, krill meal re-formulated to boost pigmentation effects in ornamental koi helped Aker Biomarine achieve 8.2% sales growth. With the launch of an enhancer based on spirulina by Coppens International, the aesthetic feed category grew by 7.5% in Europe and UAE ornamental fish markets.

Diversifying into Species-Specific Additive Solutions

Shift: Aquaculture operations now insist on species-specific feed additives rather than broad-spectrum blends. As farming of species such as pangasius, barramundi and catfish has expanded, producers need specialized solutions that meet specific metabolic and environmental needs.

Strategic Response: Dibaq A.S. launched a species-focused additive portfolio for barramundi, leading to 11.3% growth in its Asia-Pacific feed additive sales. Growel Feeds developed a dedicated pangasius growth promoter and demand has increased by 9.6% in Bangladesh and Eastern India. Exported minerals and probiotics for shrimp-only diets through Nutreco increased 10.1% in Southeast Asia, driven by Vietnam and Malaysia.

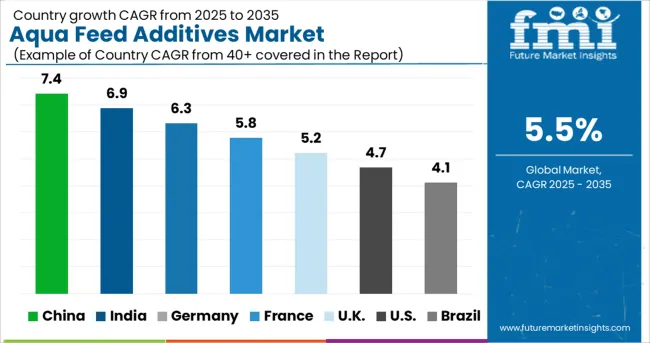

The following table shows the estimated growth rates of the top five territories projected to exhibit high consumption through 2035.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 3.1% |

| Germany | 2.6% |

| China | 5.9% |

| Japan | 1.2% |

| India | 6.7% |

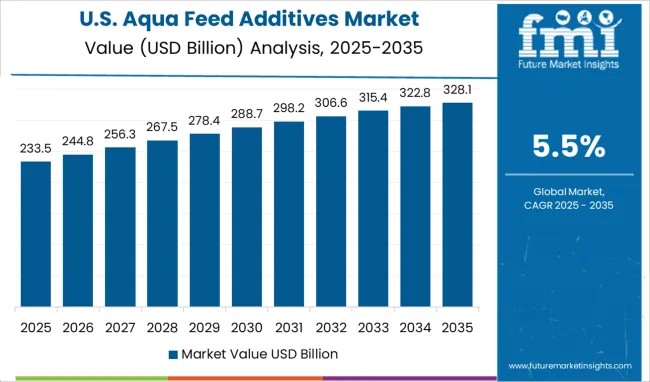

The USA aqua feed additives markets is multi-faceted due to factors like advancements in functional nutrition, an increasing emphasis on sustainability, and the focus on fish health and biosecurity. With the aim to enhance fish growth, reduce feed conversion ratio and improve resistance among fishes to diseases, aquaculture operations in the USA, especially trout, catfish, and tilapia are increasingly using additives including probiotics, enzymes, and immune boosters.

The FDA and environmental groups have put immense regulatory pressure on the industry to seiner post antibiotic growth promoters in favour of natural interlopers like phytogenics and organic acids as alternatives in animal feed. Response to consumer demand for sustainable seafood and eco-efficient farming practices is another area producers are investing in through research and development.

Germany, which is a smaller aquaculture producer in the EU, is investing in high-value fish farming and sustainable feed strategies. Aqua feed additives are essential in promoting feed efficiency and supporting fish welfare, which is crucial for trout and carp species.

As consumers call for traceable, organic and non-GMO products, producers in Germany are adding functional additives that boost immunity, limit the usage of antibiotics and maximize nutrient absorption. That fierce emphasis on environmental sustainability is helping drive the adoption of prebiotics and plant-based alternatives at the same time. Related trends resonate with the broader organic agriculture movement in Germany and help to establish its aquaculture sector competitively within the EU.

As the world’s largest producer and consumer of aquaculture products, China has rising demand for aqua feed additives. The evolution of the industry from extensive to intensive farming systems has led to the need for feed formulations with high efficiency and fortifying components.

Enzymes, amino acids, and phytobiotics as additives are important for the optimization of the water quality, digestion, and disease in the carp, tilapia, and shrimp culture. There are also the Chinese government that is still cracking down on the overuse of antibiotics, promoting the natural additives. Additionally, increasing export market demand for residue-free aquatic products is driving innovation and cleaner formulations in the feed industry.

Japan’s aquaculture industry-though advanced and comparatively steady-is working on quality enhancement, sustainability, and minimizing environmental impact. Premium species such as yellowtail, sea bream, and eel are being fed with additives to achieve better health, taste, and color.

Consumers expect high standards of safety and taste, so manufacturers are harnessing amino acids, carotenoids, and digestive enzymes to enhance performance. Functional feed additives are also being more widely used in Japan’s coastal aquaculture operations to help animals cope with stress or disease in ever-changing marine environments. Despite slow growth, the evolving nature of innovation and quality preservation serve to guarantee that additives continue to be a core segment of the premium seafood production process.

India is the fastest-growing of any of the top five countries, due to rapid growth in shrimp and freshwater fish farming. The use of intensive aquaculture systems are widespread across Andhra Pradesh, Odisha and West Bengal leading to a greater dependence on quality formulated feed and performance-enhancing additives.

Important additives-like probiotics, binders, hepatoprotectors-are utilized to boost gut health, immunity, and survival rates. Export pressures, especially from the United States and European Union, are driving producers to reduce residues of chemicals and adopt clean-label practices. Supporting the embrace of sustainable aquaculture and rising domestic consumption which, in turn, are further increasing the uptake of additives across the Indian fish-farming ecosystem.

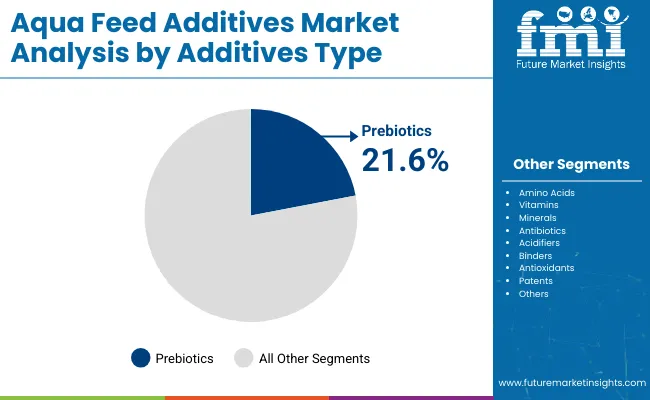

| Segment | Value Share (2025) |

|---|---|

| Prebiotics (By Additives Type) | 21.6% |

The aqua feed additives market is experiencing a the prebiotics segment are the prebiotics segment, driven by increased global demand for global sustainable aquaculture practices and improved fish health. They can help in improving the gut bacterial environment, leading to better nutrient absorption and enhanced immune response in fish and shrimp by acting as prebiotics.

The use of antibiotics is met with regulatory pressure and consumer concerns, so that the global aquaculture industry is moving away from it, which brings prebiotics to relatively preferred alternatives of disease prevention and performance enhancement.

Novel prebiotic formulations are now making their way into feeds for high value species, such as salmon, carp and tilapia, which aim to optimize survival rates and feed conversion efficiency. Prebiotics are primarily natural and eco-friendly, thereby offering healthy growth potential to the category as sustainability emerges as a core selling point in the seafood markets. Increased scrutiny on antibiotic-free production and clean label feed formulations will further drive demand for prebiotic additives in commercial aquaculture.

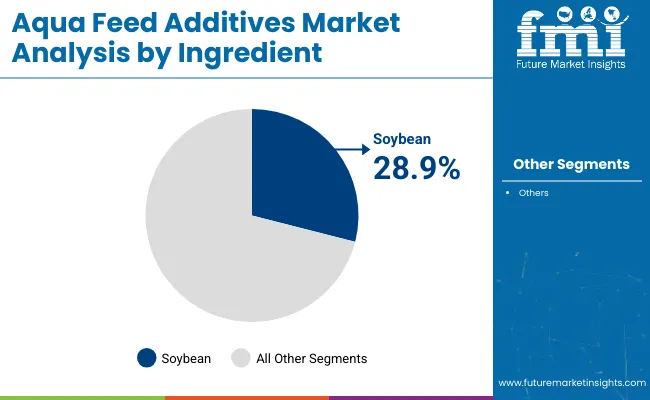

| Segment | Value Share (2025) |

|---|---|

| Soybean (By Ingredient) | 28.9% |

Market Dominance Soy-Based Ingredients affect Aqua Feed Additives Producers test for a plant-based protein alternative to fishmeal. Soybean meal and soybean concentrates are becoming widely accepted in the diets of species like tilapia, carp and catfish because they are rich sources of essential amino acids and cheaper than the use of other protein sources.

Increasing worldwide focus on sustainable aquaculture and decreasing dependence on overfished marine resources as input for farm-raised fish can be the main reason for the transition to soy. In addition, novel processing methods have enhanced the digestibility and nutrient profile of soy-derived molecules, allowing their inclusion in diets for carnivorous species, such as salmonids.

Top aqua feed manufacturers are developing well-balanced diets consisting of soybean and supplementary additives such as amino acids and prebiotics in order to achieve optimal growth and feed utilization. Soy is an essential ingredient as aquaculture moves into its next phase and continues to evolve towards being more sustainable with availability, scalable future growth, and a positive price structure.

Leading Players in the global aqua feed additives market absorbing stronger presence through wide location-wise R&D, adaptive sustainable feed solutions, innovations include Cargill Incorporated, Nutreco N.V., Biomar A/S.

These companies also played a key role in helping shape the development of the market by providing specialized feed additives, including amino acids, probiotics, enzymes and antioxidants, designed to enhance the health and nutrient conversion efficiency of the aquatic species.

Their diversification allows them to meet the diverse dietary requirements among types of fish, shrimp, and other marine livestock, and to serve both commercial aquaculture operations and niche segments.Innovations include better digestibility, improved immunity, and a reduction in environmental impact. Using Takara™ Safe and Save preservatives, feed manufacturers are investing in optimized technologies that help with feed conversion ratios as well as water quality; both important factors for sustainable aquaculture.

There is also increasing interest in natural and functional additives to produce antibiotic-free, eco-friendly seafood, like phytogenics and omega-3s from algae.These firms’ global competitiveness hinges on strategic collaborations, facility expansions and acquisitions.

Asia-Pacific and Latin America are witnessing rapid growth in terms of aquaculture and return dominant regions, also prominent players in these markets necessarily strengthen their supply chain and local production capabilities to assure the availability of supplies along with an authorized portfolio.

For instance:

In this segment, the industry has been categorized into Amino Acids, Vitamins, Minerals, Antibiotics, Acidifiers, Binders, Antioxidants, Prebiotics, Patents, and Others.

By species type, the industry has been categorized into Crustaceans, Catfish, Salmonids, Carp, Tilapia, Mollusks, and Mullet.

Ingredient types such as Corn, Soybean, Fish Oil, Peas, Sunflower Seed, and Others are included in the report.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, and Oceania.

The global industry is estimated at a value of USD 1.9 billion in 2025.

Some of the leaders in this industry include Cargill Incorporated, NK Ingredients Pte. Ltd., Beneo GmbH, Aker Biomarine, Nutreco N.V., Evonik Industries, Coppens International B.V., Growel Feeds, Dibaq A.S., Biomar A/S, and others.

Asia Pacific is expected to dominate the market by 2025, supported by robust aquaculture industries in countries such as China, India, Vietnam, and Indonesia.

The aqua feed additives industry is projected to grow at a forecast CAGR of 5.5% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

A detailed global analysis of Brand Share Analysis for Aqua Feed Additives Industry

USA Aqua Feed Additives Market Trends – Growth, Demand & Forecast 2025–2035

Europe Aqua Feed Additives Market Report – Demand, Trends & Forecast 2025–2035

Australia Aqua Feed Additives Market Insights – Size, Share & Trends 2025-2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Aqua Gym Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aquarium Decor Market Size and Share Forecast Outlook 2025 to 2035

Aqua Probiotic Market Size and Share Forecast Outlook 2025 to 2035

Aquatic Plant-Sourced Retinoids Market Size and Share Forecast Outlook 2025 to 2035

Aquaculture Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aquarium Hydrometers Market Size and Share Forecast Outlook 2025 to 2035

Aquaponics Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Aquaculture Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Aquaculture Vaccines Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Aquarium Protein Skimmers Market Growth - Trends & Demand Forecast 2025 to 2035

Aquarium Heaters and Chillers Market - Growth & Forecast 2025 to 2035

Aquarium Water Treatment Market Growth - Trends & Forecast 2025 to 2035

Aquarium & Fish Bowls Market Growth - Trends & Forecast to 2035

Aquarium Pumps & Filters Market Demand 2024 to 2034

Aquaculture Market – Growth, Demand & Sustainable Practices

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA