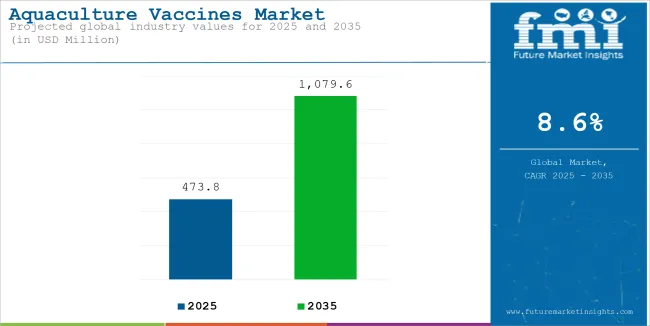

The global aquaculture vaccines market is estimated to be valued at USD 473.8 million in 2025 and is forecast to grow to USD 1,079.6 million by 2035, advancing at a CAGR of 8.6% during the forecast period.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 473.8 Million |

| Market Size in 2035 | USD 1,079.6 Million |

| CAGR (2025 to 2035) | 8.6% |

The aquaculture vaccines market has been experiencing steady growth, underpinned by the intensification of fish farming practices and the rising economic impact of infectious diseases on global aquaculture output. Regulatory frameworks have increasingly prioritized vaccination strategies as sustainable alternatives to antibiotic use, aligning with public health mandates to mitigate antimicrobial resistance.

Demand has been reinforced by investments in hatchery biosecurity, health monitoring infrastructure, and the integration of vaccination protocols across commercial fish production cycles. Manufacturers have expanded their portfolios to include targeted vaccines covering prevalent bacterial and viral pathogens, supported by continuous improvements in adjuvant systems and administration techniques.

Over the forecast period, the market is expected to advance as climate change and global trade elevate pathogen transmission risks, prompting stricter disease management policies. The expansion of high-value aquaculture species and technological innovations in oral and immersion vaccines are anticipated to create sustained opportunities for vaccine producers, distributors, and integrated farming operations.

The global aquaculture vaccines market compound annual growth rate (CAGR) for the first half of 2024 and 2025 is compared in the table below. This analysis provides important insights into the performance of the industry by highlighting significant shifts and trends in revenue generation.

The first half (H1) is the period from January to June, and the second half (H2) is July to December. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 9.5%, followed by a slightly lower growth rate of 9.2% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 9.5% |

| H2 (2024 to 2034) | 9.2% |

| H1 (2025 to 2035) | 8.6% |

| H2 (2025 to 2035) | 8.2% |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 8.6% in the first half and remain relatively lower at 8.2% in the second half. In the first half (H1) the industry witnessed a decrease of 90 BPS while in the second half (H2), the industry witnessed a decrease of 100 BPS.

Inactivated vaccines have been observed to account for 52.3% of total revenue in 2025, with a projected CAGR of 2.1% over the forecast horizon. Segment leadership has been attributed to the extensive regulatory endorsement and established safety profile of inactivated formulations. Utilization has been supported by their stability under varying storage conditions and their suitability for mass administration in diverse aquaculture environments.

Fish farmers have prioritized inactivated vaccines due to reduced risk of reversion to virulence and predictable immunogenicity, reinforcing adoption across both small-scale and industrial production systems. Technical advancements in inactivation processes and adjuvant optimization have improved vaccine efficacy, driving consistent treatment outcomes.

Furthermore, training programs and extension services have enhanced practitioner confidence in handling and administering inactivated products. These combined factors have consolidated inactivated vaccines as the dominant modality in aquatic disease prevention strategies.

Salmon has been identified as the leading fish species segment, contributing 38.6% of revenue share in 2025 and achieving a CAGR of 2.5% through the forecast period. The segment’s prominence has been driven by the high commercial value of salmon farming and the susceptibility of this species to bacterial and viral pathogens that threaten yield and profitability. Demand for vaccines has been reinforced by stringent biosecurity regulations and certification standards governing international salmon exports.

Large-scale producers have integrated comprehensive vaccination programs as essential components of health management protocols, contributing to elevated procurement volumes. Investments in research and development have produced tailored vaccine formulations targeting salmon-specific disease profiles, further supporting adoption.

The expansion of cold-water aquaculture operations in established and emerging markets has also been observed to drive sustained growth. Collectively, these factors have positioned salmon as the primary species driving vaccine utilization in aquaculture.

Increasing Demand for Disease Control in Aquaculture is driving the Aquaculture Vaccines Market Growth

Over the past few years, infectious diseases have been affecting fish farming to a greater extent, which underlines the urgent need for effective and sustainable prevention strategies. Disease outbreaks reduce fish harvests but heavily affect the financial success of fish farms. Vaccines have become a key solution by making farmed fish immune to these diseases, thus lowering infection rates and severity.

Unlike antibiotics, which are limited to treating bacterial infections and may lead to resistance, vaccines prevent diseases from occurring in the first place, offering a proactive approach to managing fish health.

Governments and fish farming organizations globally are advocating for vaccines as part of comprehensive plans to improve farm biosecurity and minimize risks. Furthermore, vaccines are economically advantageous for large-scale operations as they decrease fish mortality and enhance feed conversion efficiency.

Shift Toward Antibiotic-Free Farming Practices is driving Revenue Growth for Aquaculture Vaccines

The main concern with excessive antibiotic use in aquaculture is the risk of developing resistance pathogens, leading to risks of pathogen infections on animals and potentially in humans as well. The sustainability of this method is feasible as vaccines could prevent infections rather than using antibiotics.

It corresponds to consumer demands for sustainably farmed seafood products and also to retailer demand for antibiotic-free certifications. This is further pushed by governments and international organizations in the form of encouraging vaccination as a primary mode of disease management.

For instance, there are some incentives to farmers in some countries by introducing vaccination programs and adherence to biosecurity standards. The market demand together with this regulatory push is pushing forward the vaccines throughout the industry.

Besides, the practice of antibiotics free makes the products of aquaculture more globally competitive and allows new export markets for the producers. Due to this shift toward sustainability, the trend is likely to continue to act as a driver for the aquaculture vaccines market.

Advancements in Vaccine Delivery Systems is Creating Opportunities in the Market

Advancements in oral and immersion vaccine technologies are transforming the landscape by making vaccine administration more efficient and accessible. Oral vaccines can be included in fish feed, which is a very convenient method for farmers since it does not require manual handling of fish. Immersion vaccines are also immersed in a vaccine solution and allow for the immunization of large groups at once.

They not only save time and reduce labor costs but also minimize stress on the fish, further improving health outcomes. These innovations are a great boon for small and medium-scale farmers, who would otherwise do not have the wherewithal to invest into traditional vaccination approaches.

The market participants can expand accessibility of vaccines while tapping into less-visited areas and thus reap new growth potential, by investing in these technologies and solving various logistical and financial problems in the industry.

High Costs for Small-Scale Farmers and Regulatory Challenges may Restrict Market Growth

While vaccines play a big role in disease prevention, it is a great challenge for the small-scale fish farmers. Getting the vaccines can be expensive since one has to purchase them and store them in the right temperatures of cold. There is also a cost of having the skilled manpower to administer these vaccines.

They are very significant players in the fish farming business but operate with very thin profit margins. Vaccines require a specific temperature to remain active; therefore, the lack of cold storage in far-flung or poor economies creates a significant problem for farmers.

Lacking proper training and technical assistance, farmers may not administer vaccines correctly, which decreases their effectiveness and discourages future use. To address these challenges, solutions like government subsidies, partnerships with vaccine manufacturers, and more affordable delivery systems are needed. Without this kind of support, small farmers are unlikely to adopt vaccines, which restricts the growth potential of the market.

Tier 1 companies are the industry leaders with 43.5% of the global industry. These companies stand out for having a large product portfolio and a high production capacity. These industry leaders also stand out for having a wide geographic reach, a strong customer base, and substantial experience in manufacturing and having enough financial resources, which enables them to enhance their research and development efforts and expand into new industries.

The companies within tier 1 have a good reputation and high brand value. Prominent companies within tier 1 include Zoetis Inc., Merck Animal Health, Elanco Animal Health and HIPRA

Tier 2 companies are relatively smaller as compared with tier 1 players. The tier 2 companies hold a market share of 36.5% worldwide. These firms may not have cutting-edge technology or a broad global reach, but they do ensure regulatory compliance and have good technology. The players are more competitive when it comes to pricing and target niche markets. Key Companies under this category include Benchmark Holdings, Pharmaq, Veterquimica among others

Compared to Tiers 1 and 2, Tier 3 companies offer outsourced testing services, but with smaller revenue and less influence. These companies mostly operate in one or two countries and have limited customer base. They specialize in specific products and cater to niche markets, adding diversity to the industry.

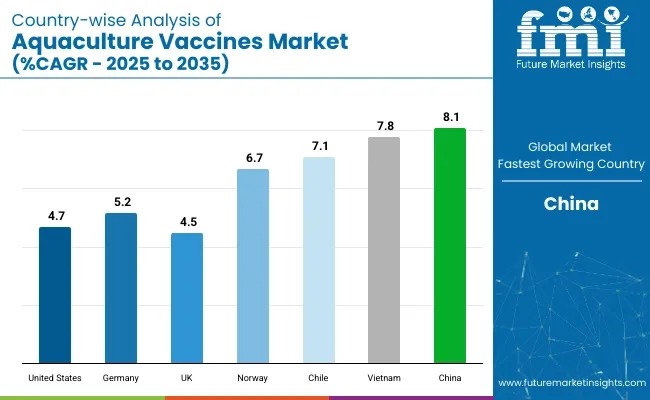

The market analysis for aquaculture vaccines in various nations is covered in the section below. An analysis of important nations in North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and Middle East & Africa of the world has been mentioned below. It is projected that the United States will maintain its leading position in North America through 2035, holding a value share of 89.8%. By 2035, China aquaculture vaccines market is expected to experience a CAGR of 8.1% in the Asia-Pacific region.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 4.7% |

| Germany | 5.2% |

| UK | 4.5% |

| Norway | 6.7% |

| Chile | 7.1% |

| Vietnam | 7.8% |

| China | 8.1% |

Germany's aquaculture vaccine market is strong due to its strict regulations and commitment to sustainable farming. As a leader in the EU, Germany enforces measures to cut antibiotic use and support sustainable aquaculture. The country follows EU rules by banning certain antibiotics and monitoring antibiotic resistance, which has led to more vaccine use for preventing fish diseases.

Germany's advanced research facilities have significantly improved vaccine technology, creating vaccines that protect against more diseases.

The rising demand for high-quality, antibiotic-free seafood in Germany further increases vaccine adoption. Efficient systems for keeping vaccines cold and strong veterinary support ensure smooth distribution and use. Government, research institutions, and private companies work together to innovate and expand vaccination programs, particularly for valuable fish like trout and carp.

These efforts, along with Germany's focus on environmental sustainability and animal welfare, drive the growth of the aquaculture vaccine market.

Chile, one of the world's largest producers of farmed salmon, has seen rapid growth in its aquaculture vaccines market due to the pressing need for disease control in its salmon farming industry. Outbreaks of infectious diseases such as infectious salmon anemia (ISA) and salmonid rickettsial septicemia (SRS) have caused significant economic losses, prompting the industry to prioritize vaccination programs.

The government of Chile has taken a proactive role in promoting biosecurity measures, offering subsidies and technical support to encourage vaccine adoption.

Additionally, the country's strong export orientation, particularly to markets in North America and Europe, drives compliance with international sustainability standards, which emphasize reduced antibiotic usage. Chile's collaboration with global pharmaceutical companies has led to the development of tailored vaccines for local aquaculture conditions, further improving disease management.

The emergence of innovative vaccine delivery systems, such as immersion and oral vaccines, is addressing logistical challenges, making vaccination more accessible to small and medium-scale farmers. The combination of governmental support, international market demands, and ongoing innovation positions Chile as a key player in the global aquaculture vaccines market.

China is the world's largest producer of farmed fish and seafood and has a rapidly developing vaccines market, driven by that country's high production of fish and seafood and adoption of environmentally sustainable farming practices. Diseases, largely bacterial and viral, pose a strong threat to production, affecting mainly carp, tilapia, and shrimp.

To address these issues, the Chinese government has enacted policies aimed at reducing antibiotic use in fish farming, aligning with international efforts to combat antibiotic resistance and guarantee the safety of seafood exports. The provision of financial incentives and subsidies for vaccine research and implementation has also propelled market growth.

High-quality and affordable, the vaccines would henceforth be manufactured within China; China's far-stretching aquaculture and biotechnologies further helped manufacture and make cheaper to the people such vaccines as farmers needed vaccines, and, increasing consumer appetite for safe seafood antibiotic free, including Artificial intelligence in fish farms, particularly regarding disease-monitoring and controlling software for better effectuation of immunoprophylactics.

The aquaculture vaccines market has been shaped by the presence of specialized animal health companies and biotechnology firms competing to address infectious disease challenges across high-value fish species. A significant concentration of market share has been observed among established players who have developed broad vaccine portfolios targeting bacterial, viral, and parasitic pathogens.

Emphasis has been placed on the development of oil-adjuvant injectable vaccines, immersion vaccines, and oral delivery systems designed to improve ease of administration and enhance protective efficacy under diverse farming conditions. Continuous investments in research and development have been directed toward novel antigens and multivalent formulations to expand disease coverage and reduce handling stress on aquatic species.

Regulatory frameworks governing vaccine registration and biosecurity compliance have been identified as critical determinants of competitive positioning, particularly in export-oriented markets.

Developments

In March 2025, AquaTactics received USFDA clearance for their new autogenous aquaculture vaccines.

In July 2024, Fischer Medical Ventures Ltd collaborated with Bio Angle Vacs Sdn Bhd to introduce its innovative vaccines to India. These vaccines are designed to lower the death rates in livestock and aquaculture significantly.

| Report Attributes | Details |

|---|---|

| Estimated Size, 2025 | USD 473.8 million |

| Projected Size, 2035 | USD 1,079.6 million |

| CAGR (2025 to 2035) | 8.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and kilotons for volume |

| Vaccine Types Analyzed | Inactivated Vaccines, DNA and Recombinant Vaccines, Live Attenuated Vaccines, Subunit Vaccines, Others |

| Fish Species Analyzed | Salmon, Tilapia, Catfish, Carp, Shrimp, Other Species |

| Pathogens Analyzed | Bacteria, Virus, Others |

| End-User Categories Analyzed | Commercial Aquaculture Farms, Small-scale Farmers in Emerging Markets, Government and Cooperative Programs, Research Institutions and Diagnostic Labs |

| Regions Covered | North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Middle East and Africa (MEA) |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, GCC Countries, South Africa |

| Key Players influencing the Market | Zoetis Inc., Merck Animal Health, Elanco Animal Health, HIPRA, Benchmark Holdings, Pharmaq, Veterquimica, Pear Therapeutics, Centrovet, Weihai Weihao Bioengineering, PHARMAQ, AquaGen, Others |

| Additional Attributes | Dollar sales by vaccine type (inactivated, DNA, live attenuated, etc.), Dollar sales by fish species (salmon, tilapia, shrimp, etc.), Trends in pathogen-specific vaccines, Growth of commercial aquaculture versus small-scale farms, Regional variations in demand for aquaculture vaccines, Innovations in vaccine technologies for aquaculture |

In terms of vaccine type, the industry is divided into Inactivated Vaccines, DNA and Recombinant Vaccines, Live Attenuated Vaccines, Subunit Vaccines among Others

In terms of fish species, the industry is segregated into Salmon, Tilapia, Catfish, Carp, Shrimp and Other Species.

In terms of pathogen, the industry is segregated into bacteria, virus and others.

In terms of end user, the industry is divided into commercial aquaculture farms, small-scale farmers in emerging markets, government and cooperative programs, research institutions and diagnostic labs.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA) have been covered in the report.

The global aquaculture vaccines industry is projected to witness CAGR of 8.6% between 2025 and 2035.

The global aquaculture vaccines industry stood at USD 440.9 million in 2024.

The global aquaculture vaccines industry is anticipated to reach USD 1,079.6 million by 2035 end.

China is expected to show a CAGR of 8.1% in the assessment period.

The key players operating in the global aquaculture vaccines industry are Zoetis Inc. , Merck Animal Health, Elanco Animal Health, HIPRA, Benchmark Holdings, Pharmaq, Veterquimica, Pear Therapeutics, Centrovet, Weihai Weihao Bioengineering, PHARMAQ, AquaGen among others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

China Aquaculture Vaccines Market Outlook – Growth & Forecast 2025-2035

Chile Aquaculture Vaccines Market Insights – Size, Demand & Forecast 2025-2035

Norway Aquaculture Vaccines Market Insights – Size, Demand & Growth 2025-2035

Vietnam Aquaculture Vaccines Market Trends – Growth & Demand 2025-2035

Australia and New Zealand Aquaculture Vaccines Market Report – Key Trends & Forecast 2025-2035

Aquaculture Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aquaculture Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Aquaculture Market – Growth, Demand & Sustainable Practices

Global Aquaculture Immunostimulants Market Analysis – Size, Share & Forecast 2024-2034

Precision Aquaculture Market Size and Share Forecast Outlook 2025 to 2035

Bacterial Diagnostics in Aquaculture Market Insights - Growth & Forecast 2025 to 2035

Vaccines Market Insights - Trends, Growth & Forecast 2025 to 2035

Cat Vaccines Market Size and Share Forecast Outlook 2025 to 2035

Fish Vaccines Market

Live Vaccines Market

Nasal vaccines Market

Travel Vaccines Market Size and Share Forecast Outlook 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Dengue Vaccines Analysis by Product Type by Product, By Age Group and by Distribution Channel through 2035

Varicella Vaccines Market Insights - Growth, Trends & Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA