The Europe Aqua Feed Additives market is set to grow from an estimated USD 529.0 million in 2025 to USD 857.7 million by 2035, with a compound annual growth rate (CAGR) of 5.0% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 529.0 million |

| Projected Europe Value (2035F) | USD 857.7 million |

| Value-based CAGR (2025 to 2035) | 5.0% |

Increased demand for high-quality seafood products, growth in the aquaculture segment, and growing concerns over sustainable farming practices are those factors that favour its growth. Aqua feed additives are demands for achieving the maximum improvement of health, growth, and production efficiency of aquatic species such as fish, shrimp, and shellfish and, therefore, become constituent parts of modern aquaculture operations.

It consists of vitamins, minerals, amino acids, enzymes, probiotics, and other functional ingredients for better quality and quantity of aquatic species through improving immune health and resisting diseases. Europe has been seen to house the leading fish-producing aquaculture nations worldwide, which includes Norway, Spain, and Denmark.

The companies that have not overcome the addiction to fishmeal are starting to shift by using the newest innovations that are coming upstream, such as plant-based additives, algae-based products, and supplements obtained through advanced biotechnology.

The new R&D and the acquisition and further development strategy of these products into manufacturing have maintained market leadership by the companies DSM Nutritional Products, Cargill, and Evonik Industries.

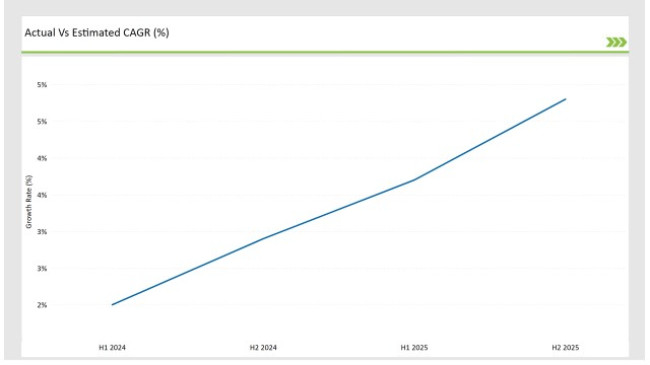

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Aqua Feed Additives market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 2023 (2023 to 2033) | 2.0% |

| H2 2023 (2023 to 2033) | 2.9% |

| H1 2024 (2024 to 2034) | 3.7% |

| H2 2024 (2024 to 2034) | 4.8% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Aqua Feed Additives market, the sector is predicted to grow at a CAGR of 2.0% during the first half of 2023, with an increase to 2.9% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 3.7% in H1 but is expected to rise to 4.8% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2023 to the first half of 2024, followed by an increase of 20 basis points in the second half of 2024 compared to the second half of 2023.

| Date | Development/M&A Activity & Details |

|---|---|

| April 2024 | Launch of New Aqua Feed Additive Solutions - DSM Nutritional Products introduced a new line of Omega-3 rich feed additives aimed at improving fish health and growth. |

| March 2024 | Collaboration with European Aquaculture Farms - Evonik Industries announced a partnership with European aquaculture farms to promote sustainable practices in fish farming through the integration of novel feed additives. |

| February 2024 | Acquisition of Feed Supplement Company - Cargill acquired a leading European supplier of aqua feed additives, expanding its product portfolio to include specialized products for shrimp farming. |

Use plant-based additives instead of fishmeal.

Growing concern over sustainability has led to an overdue shift in the use of aqua feed additives towards more natural, plant-based alternatives. While fishmeal has traditionally been the cornerstone of aquaculture feed, controversies surrounding its effect on marine ecosystems and exhausting wild fish stocks through continued fishing have lately placed the burden of criticism squarely against it.

As such, most companies engaged in the European market have included soy, algae, and microalgae among others as the alternative. Algae sources of plant-based omega-3 fatty acids have for example been accepted widely as an environment-friendly substitute for fish oil feed.

The benefits of plant-based additives go beyond sustainability and into the health and disease resistance of aquatic species. Companies such as Cargill, Evonik, and DSM have been investing actively in developing these plant-based products, thereby positioning themselves at the forefront of the sustainable aquaculture space.

Innovation in Functional Feed Additives for Disease Prevention

The innovation for this growth spurt has stemmed from increased threats in disease breakouts for aquaculture. The European aquafeed additive market has developed innovations in functional feed additives. Aqua feed additives refer to products that prevent diseases and reinforce the immunity power of aquatic organisms.

The use of probiotics, prebiotics, and immunostimulants in aqua feed has become popular since they can enhance gut health, improve nutrient uptake, and raise resistance to pathogens. These functional additives minimize the necessity of antibiotics and chemicals, thus corresponding with one of the main European Union's priorities: reducing antimicrobial resistance in food production.

For example, Evonik has developed a portfolio on additive optimization of gut microbiota for healthy fish and shrimp. Others, like DSM, invest in research so that feed additives can be made to enhance the immune response of aquatic animals so that the struggle against various environmental factors and diseases can be improved.

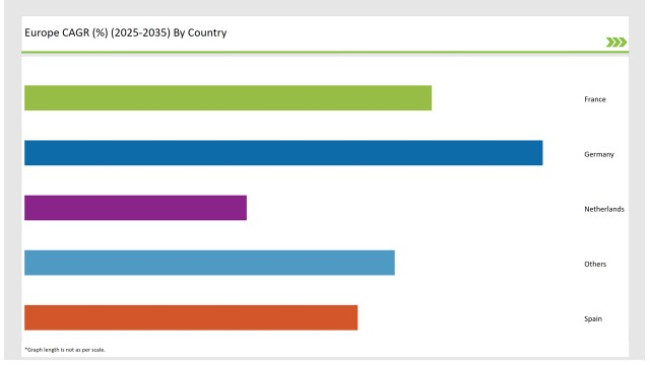

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 28% |

| France | 22% |

| Spain | 18% |

| Netherlands | 12% |

| Others | 20% |

Aquaculture in Norway is now a global hub, especially in its production of salmon, and played a very important role in the European Aqua Feed Additives market. It's the first country to adopt and implement sustainable practices within the aquaculture industry.

Regulations regarding fish farming are stringent, making sure high-quality feed additives are used for farmed fish to ensure health and welfare. Norwegian aquaculture companies are increasingly looking for specialized additives, such as algae-based omega-3 fatty acids and probiotics, to enhance the growth and disease resistance of their salmon.

The government's commitment to sustainability has also prompted significant investments in innovative feed solutions that reduce the environmental impact of fish farming, such as feed additives that promote the efficient use of nutrients and reduce waste.

The result has thus been a great demand for such high-quality aqua feed additives in Norway, which companies, such as Skretting and Marine Harvest, have pioneered; they have embraced these additives, integrating them in their feed formula to meet these requirements and client expectations for responsibility in sourcing seafood.

The growth in Aqua Feed Additives market in Spain is another prominent European country that is growing in this market mainly due to expansion in shrimp farming and increasing demand for sustainable aquaculture products.

The production of aquaculture in Spain has increased over the years, especially in shrimp and shellfish farming, thus increasing the demand for specialized feed additives. Some of the most important developments have been in shrimp farming, where effort is put into meeting increased consumer demand in Spain for this popular seafood.

High-quality feed additives, such as probiotics, vitamins, and minerals, are therefore essential to maintaining shrimp health and the efficiency of farming operations. Spain's focus on sustainable aquaculture practices like antibiotic reduction, along with a drive towards ecologically friendly feed ingredients, have added to the market growth.

Companies such as BioMar and Pescanova from Spain are among the industry leaders in applying new additives for the formulation of shrimp feeds with a view toward improved health and growth, enhanced immunity, etc.

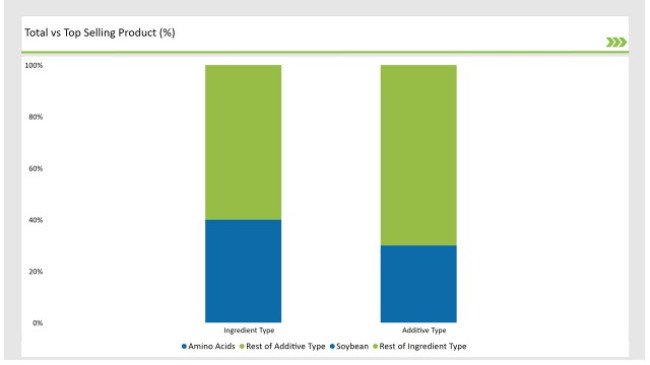

% share of Individual Categories Additive Type and Ingredient Type in 2025

| Main Segment | Market Share (%) |

|---|---|

| Additive Type ( Amino Acids ) | 30% |

| Remaining segments | 70% |

Amino acids hold the largest percentage share in Europe's aqua feed additive market. The reason is the growing importance and importance attributed to the recognition of the specific function of these amino acids being required for their growth and maintenance.

Aquatic species need increasingly demanding necessity of high-quality feeds that allow them to maximize the growth rate efficiency with improved feed efficiency that achieves better overall fish health. Amino acids are very important in many physiological activities among which include protein synthesis, immune response, and metabolic activities.

This increasing awareness among aqua producers regarding the advantages of amino acid addition to their formulation is also boosting growth in this segment. For the past years, increasing demand for sustainable aqua farming has led to the use of amino acid-based supplements to minimize dependency on fishmeal levels and acquire improved nutritional performance in feeds.

| Main Segment | Market Share (%) |

|---|---|

| Ingredient Type ( Soybean ) | 40% |

| Remaining segments | 60% |

Soybean is the fastest-growing product in the Europe aqua feed additive market, holding a significant share in the ingredient market. This is mainly because of the rising demand for plant-based protein sources within aquaculture, which looks forward to giving more nutritional value towards the fish feed and limit its dependency on the traditional fishmeal.

Soybean contains all the necessary amino acids hence it is an ideal component of a well-formulated diet. Its production and well-being will also contribute to aquatic animals. Advances in processing technologies have enhanced the digestibility and nutritional value of soybean meal, making it even more attractive to aquaculture producers. Expectations are that the soybean segment will increase significantly in size as the industry continues to focus on issues related to sustainable feeding strategies and efficiency.

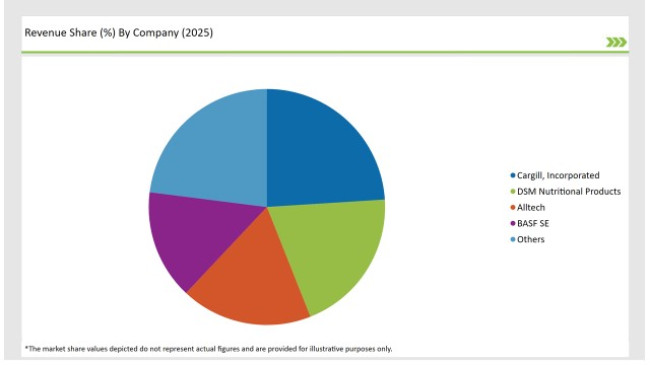

2025 Market share of Europe Aqua Feed Additives manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Cargill, Incorporated | 24% |

| DSM Nutritional Products | 20% |

| Alltech | 18% |

| BASF SE | 15% |

| Nutreco | 10% |

| Others | 13% |

Note: The above chart is indicative in nature

European markets are moderately concentrated, with the range of global players covering that of local-level players at all levels. Tier 1 companies dominate the market with highly significant shares including comprehensive portfolios, established networks for distribution, and R&D capability.

The main Leaders of Tier-1 are DSM Nutritional Products, Cargill, and Evonik Industries. These companies have been highly innovative and eco-friendly by designing new feed additives to cater to the increasing demand for healthy and high-quality aquaculture products. DSM has used acquisitions of smaller feed additive companies, whereas Evonik has started strategic tie-ups with aquaculture farms to encourage sustainability.

Tier 2 players are regional compatriots and focus on specialized offerings for particular species or conditions. The players appear to be regional in presence but have developed into significant contributors to the market growth.

Tier 3 companies are those smaller regional players that help address niche segments and support localized solutions. While not as large players with R&D, these firms do play an important role in satisfying the demands of niche markets and supporting aquaculture local businesses.

As per Additive Type, the industry has been categorized into Amino Acids, Vitamins, Minerals, Antibiotics, Acidifiers, Antioxidants, Others.

As per Species Type, the industry has been categorized into Salmonids, Tilapia, Catfish, Crustaceans, Carp, Molluscs, Mullet.

As per Ingredient Type, the industry has been categorized into Soybean, Corn, Fish Oil, Peas, Sunflower seed, Others.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Aqua Feed Additives market is projected to grow at a CAGR of 5.0% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 857.7 million.

Key factors driving the European aqua feed additives market include the rising demand for sustainable aquaculture practices that enhance fish health and growth, alongside increasing consumer awareness of the nutritional quality of seafood. Additionally, advancements in feed formulation technologies and a shift towards plant-based ingredients are further propelling market growth.

Germany, Norway, and France are the key countries with high consumption rates in the European Aqua Feed Additives market.

Leading manufacturers include Cargill, Incorporated, DSM Nutritional Products, Alltech, BASF SE, and Nutreco known for their innovative and sustainable production techniques and a variety of product lines.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aqua Feed Additives Market Analysis by Species Type, Ingredient and Other Additives Types Through 2035

A detailed global analysis of Brand Share Analysis for Aqua Feed Additives Industry

USA Aqua Feed Additives Market Trends – Growth, Demand & Forecast 2025–2035

Europe Animal Feed Additives Market Insights – Size, Trends & Forecast 2025–2035

Australia Aqua Feed Additives Market Insights – Size, Share & Trends 2025-2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Aquafeed Market Size and Share Forecast Outlook 2025 to 2035

Aquafeed Enzyme Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Europe Animal Feed Alternative Protein Market Insights – Demand, Trends & Forecast 2025–2035

Novel Feed Additives Market – Trends, Demand & Livestock Innovations

Animal Feed Additives Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Analyzing Animal Feed Additives Market Share & Industry Leaders

Natural Feed Additives Market Analysis - Size, Growth, and Forecast 2025 to 2035

Medicated Feed Additives Market Size and Share Forecast Outlook 2025 to 2035

UK Animal Feed Additives Market Trends – Growth, Demand & Forecast 2025–2035

Microbial Feed Additives Market – Growth, Probiotics & Livestock Nutrition

Phytogenic Feed Additives Market Size and Share Forecast Outlook 2025 to 2035

Postbiotic Feed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

Western Europe Insect Feed Market Analysis by Insect Type, Application, and Country Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA