FMI Research indicates the United States Aqua Feed Additives market will touch USD 382.7 million in 2025 and is forecasted to reach USD 660.5 million by 2035, showing a CAGR of 5.6%, as the industry is driven by innovations in aquafeed formulations and rising demand for sustainable aquaculture practices.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size in 2025 | USD 382.7 Million |

| Projected USA Industry Value in 2035 | USD 660.5 Million |

| Value-based CAGR from 2025 to 2035 | 5.6% |

The USA Aqua Feed Additives market is experiencing profound changes due to technology and an increase in the understanding of aquaculture feed as an essential commodity. Key trends in the market are the use of functional feed additives like amino acids and acidifiers, specific formulation for certain species of fish, and sustainability along the entire chain of production. The companies involved in this market are investing in research and development in order to innovate and bring eco-friendly products with enhanced nutrition in feeds.

The market is concentrated in nature; however, moderate due to players such as Tier-1 in Alltech, Cargill, and DSM Animal Nutrition. Emerging regional players can contribute to that through niche categories like mollusks and mullet feed additives. The dynamism in this competitive scenario leads to innovating and drives the product pipeline of offerings catered to emerging requirements in aquaculture.

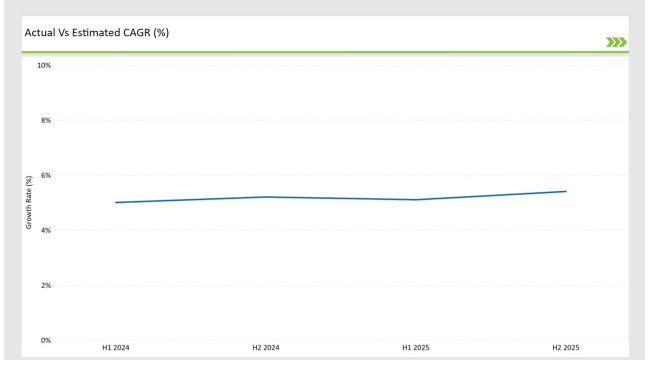

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the USA Aqua Feed Additives market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Year | 2023 |

|---|---|

| H1 Growth Rate (%) | 5.0% |

| H2 Growth Rate (%) | 5.2% |

| Year | 2024 |

|---|---|

| H1 Growth Rate (%) | 5.1% |

| H2 Growth Rate (%) | 5.4% |

For the USA market, the Aqua Feed Additives sector is predicted to grow at a CAGR of 5.0% during the first half of 2023, with an increase to 5.2% in the second half of the same year. In 2024, the growth rate is anticipated to slightly increase to 5.1% in H1 and is expected to rise further to 5.4% in H2.

These figures illustrate the dynamic and evolving nature of the USA Aqua Feed Additives market, impacted by factors such as the growing adoption of functional additives, increasing regulatory focus on sustainable feed practices, and rising investments in aquaculture production. This semi-annual breakdown provides critical insights for stakeholders aiming to align their strategies with market growth dynamics.

| Date | Development/M&A Activity & Details |

|---|---|

| Oct-2024 | Alltech launched a new acidifier product targeting enhanced digestibility for salmon and tilapia. |

| Sep-2024 | Cargill introduced a new sustainable vitamin blend designed for crustaceans to improve growth rates. |

| Jun-2024 | DSM partnered with a biotechnology firm to develop advanced amino acid solutions for species-specific feed. |

| Apr-2024 | Kemin Industries expanded its antioxidant portfolio with the launch of a natural product for catfish feed. |

| Jan-2024 | Evonik Industries announced a USD 50 million investment in a new facility for producing high-purity feed additives. |

Growth of Functional Additives for Targeted Nutrition

Functional feed additives are gaining preference in the USA based on their scope to address nutritional needs of any species. Optimal growth and immune response enhancement in species such as salmon and tilapia would be achieved in products like amino acids, acidifiers, and vitamins.

Trends are supported with research advancements towards precise customization of the feed formulation. For example, those like methionine and lysine are used to concentrate specific deficiencies to promote efficient growth. With growing interest in functional additives, the modern aquaculture demands accuracy in feed, optimizing feed efficiency, and livestock health.

Sustainability as a Core Focus in Feed Additive Development

Sustainability is emerging as the central driver in the USA Aqua Feed Additives market. Companies are investing in renewable feedstocks such as soybean and fish oil to reduce the carbon footprint of aquafeed production. Enzymatic extraction of natural antioxidants is making the development of environmentally friendly solutions possible.

The demand for sustainability in seafood also fits with the pressure from regulation. This has resulted in benefitting the manufacturers by not relying on synthetic additives as much, while enabling the health and robustness of aquatic species for long-term industry growth and environmental preservation.

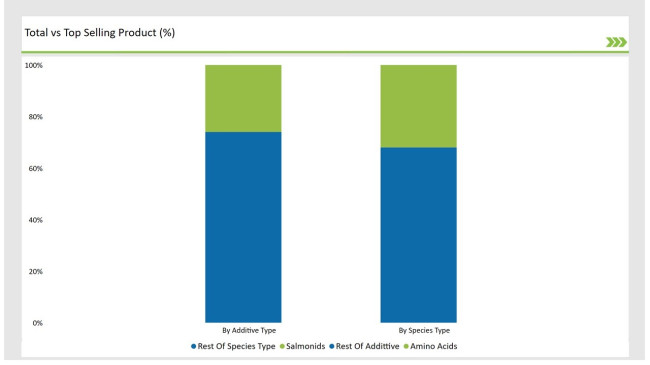

| Additive Type | Market Share (2025) |

|---|---|

| Amino Acids | 26% |

| Remaining segments | 74% |

Amino acids are the leading additive type, as they have been proven to enhance growth performance and feed conversion ratios. Advances in amino acid formulations are providing species-specific solutions, like methionine-enriched feed for salmon. Vitamins and minerals are also equally important, as they support the immune system and metabolic functions.

Acidifiers and antioxidants are becoming more popular natural alternatives to antibiotics, which responds to regulatory shifts and consumer demands for chemical-free aquaculture. This, in turn, points out the commitment of the industry towards a balance between performance and sustainability.

| Species Type | Market Share (2025) |

|---|---|

| Salmonids | 32% |

| Remaining segments | 68% |

Salmonids are the leading species type, driven by their economic importance and the high protein requirements of these fish. Tilapia and catfish are also major contributors, as these species have adapted well to intensive farming systems.

Crustaceans and mollusks are smaller segments but are gaining in importance with increased demand for premium seafood and the sensitivity of these species to improvements in feed quality. Species-specific innovations in feeds, such as vitamin blends specifically designed for tilapia, are enhancing the overall productivity of these aquaculture systems.

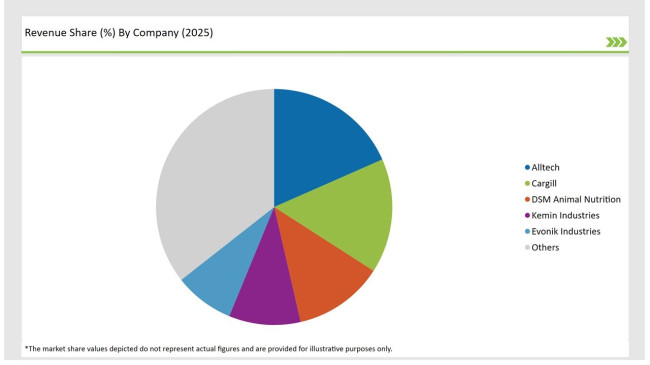

The market for USA Aqua Feed Additives is moderately concentrated, with the Tier-1 players such as Alltech, Cargill, and DSM Animal Nutrition comprising more than 46% market share. Their strong R&D capabilities, impressive distribution networks, and economies of scale help to maintain their leading edge. Take, for example, Alltech's innovations into acidifiers, and Cargill's efforts in sustainable vitamin blends.

Novus International and ADM, Tier-2 firms, focus on regional markets as well as niche product segments. These companies are making investments in organic formulations and specialty additives customized to the smaller species of aquaculture.

Tier-3 emerging players are targeting underrepresented markets such as mollusks and mullet with innovative feed solutions available at competitive prices. Such a tiered competitive setup will be characterized by an evolving market landscape that is borne out of innovation and sustainability as growth drivers.

| Company Name | Market Share (%) |

|---|---|

| Alltech | 18.4% |

| Cargill | 15.7% |

| DSM Animal Nutrition | 12.3% |

| Kemin Industries | 9.8% |

| Evonik Industries | 8.2% |

| Others | 35.6% |

By 2025, the USA Aqua Feed Additives market is expected to grow at a CAGR of 5.6%.

By 2035, the sales value of the USA Aqua Feed Additives industry is expected to reach USD 660.5 million.

Key factors include increasing demand for sustainable aquaculture practices, advancements in feed formulations, and regulatory support for eco-friendly additives.

Regions with significant aquaculture activity, such as the Southeast and Pacific Northwest, dominate consumption.

Prominent players include Alltech, Cargill, DSM Animal Nutrition, Kemin Industries, and Evonik Industries.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

United States Tartrazine Market Report – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA