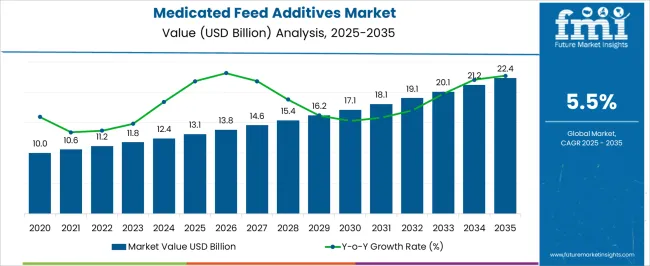

The Medicated Feed Additives Market is estimated to be valued at USD 13.1 billion in 2025 and is projected to reach USD 22.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Medicated Feed Additives Market Estimated Value in (2025 E) | USD 13.1 billion |

| Medicated Feed Additives Market Forecast Value in (2035 F) | USD 22.4 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The Medicated Feed Additives market is gaining strong momentum as livestock producers increasingly rely on enhanced nutritional and therapeutic supplements to improve animal health and optimize productivity. Rising demand for high-quality meat and dairy products has pushed the adoption of feed additives that provide both preventive and curative benefits against infections, while also supporting faster growth rates. The shift toward intensive farming practices, especially in developing economies, is driving greater usage of additives to ensure livestock resilience against diseases.

Technological advancements in formulation science and improved delivery systems are enabling higher efficacy, cost efficiency, and compliance with regulatory standards. The growing emphasis on reducing the use of antibiotics while maintaining animal welfare is further boosting demand for alternative medicated additives.

With increasing investments in veterinary healthcare infrastructure and rising awareness among farmers about sustainable livestock management practices, the market is expected to expand steadily Global supply chain integration and innovation in amino acid, enzyme, and probiotic-based formulations are poised to drive growth as producers seek effective, scalable, and safe medicated feed solutions.

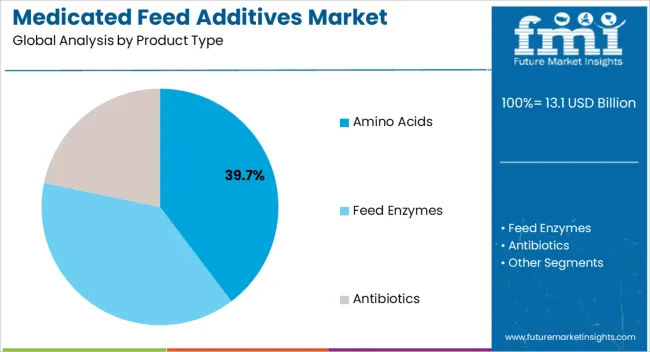

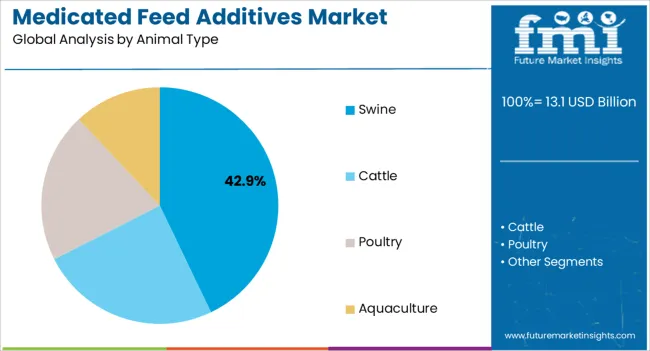

The medicated feed additives market is segmented by product type, animal type, and geographic regions. By product type, medicated feed additives market is divided into Amino Acids, Feed Enzymes, and Antibiotics. In terms of animal type, medicated feed additives market is classified into Swine, Cattle, Poultry, and Aquaculture. Regionally, the medicated feed additives industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The amino acids segment is projected to hold 39.7% of the Medicated Feed Additives market revenue in 2025, securing its position as the leading product type. This leadership is being supported by the critical role amino acids play in improving protein synthesis, growth performance, and immunity in livestock. Farmers and producers are increasingly adopting amino acid-based additives as they provide targeted nutritional support and reduce the dependence on conventional antibiotics, aligning with evolving regulatory guidelines.

The consistent demand for efficient protein conversion, especially in poultry and swine production, has further reinforced the adoption of these additives. Continuous improvements in synthetic amino acid formulations are allowing for better absorption, cost reduction, and consistent quality outcomes.

Additionally, amino acids contribute to reducing feed wastage, thereby enhancing overall efficiency for producers As the industry shifts toward sustainable and performance-oriented feed solutions, the segment’s adaptability and proven benefits are expected to ensure its continued dominance, driven by rising global protein consumption and the need for effective animal nutrition strategies.

The swine segment is anticipated to account for 42.9% of the Medicated Feed Additives market revenue in 2025, making it the leading animal type. Growth in this segment is being driven by the expanding global demand for pork, which remains one of the most widely consumed sources of animal protein. Swine production systems are particularly vulnerable to bacterial and viral infections, creating a consistent need for medicated additives that enhance resistance, improve growth performance, and ensure higher survival rates.

Farmers are increasingly incorporating feed additives that combine therapeutic benefits with nutritional support to achieve optimal productivity. Rising commercialization of pig farming, particularly in Asia Pacific and parts of Europe, has heightened reliance on medicated feed solutions. In addition, ongoing concerns about zoonotic diseases and their economic impact are reinforcing investments in feed health management.

The ability of medicated additives to reduce mortality rates and improve feed efficiency positions them as an indispensable component in swine production This segment is expected to remain dominant as demand for safe, high-quality pork continues to expand globally.

Feed additives are the add-ons to the feed for animals that are intended to improve the quality of feed and other nutritional aspects for better animal health and performance. Additives can improve production levels, efficiency of animals along with their health.

Medicated feed additives are appropriate for cattle cow-calf and for stocker grazing along with other various types of animals that can fulfill human demand for food, milk and other agricultural operations. The primary use of medicated feed additives is to maintain animal health and promoting better growth and feed efficiency.

However, the medicated feeds should be manufactured with proper terms with valid prescription and should be withdrawn accordingly if shows un-appropriate growth symptoms. Some feed additives may also affect the incidence of bloat or coccidiosis.

Other feed additives also suppress estrus and reduce liver abscesses. There are various types if medicated feed additives available that varies in the action of the ingredients on the body. For instance, there are rumen fermentation modifiers such as ionophores, buffers, yeast cultures and bloat prevention aid.

They further contains various chemicals and naturally extracted ingredients used as medicated feed such as sodium bicarbonate and saccharomyces cerevisiae respectively.

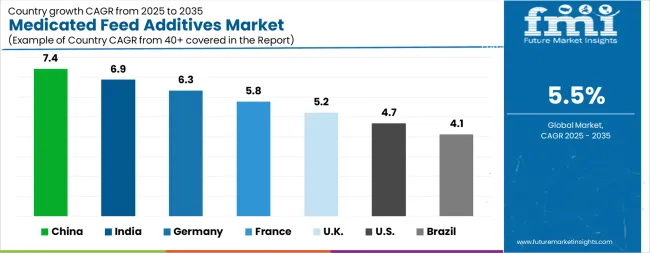

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The Medicated Feed Additives Market is expected to register a CAGR of 5.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.4%, followed by India at 6.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.1%, yet still underscores a broadly positive trajectory for the global Medicated Feed Additives Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.3%. The USA Medicated Feed Additives Market is estimated to be valued at USD 4.7 billion in 2025 and is anticipated to reach a valuation of USD 7.4 billion by 2035. Sales are projected to rise at a CAGR of 4.7% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 605.8 million and USD 408.0 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.1 Billion |

| Product Type | Amino Acids, Feed Enzymes, and Antibiotics |

| Animal Type | Swine, Cattle, Poultry, and Aquaculture |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

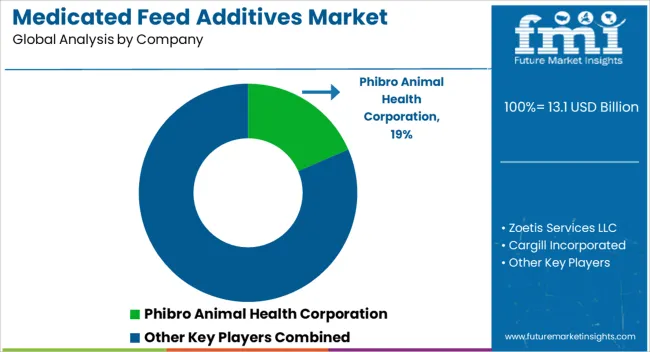

| Key Companies Profiled | Phibro Animal Health Corporation, Zoetis Services LLC, Cargill Incorporated, ADM, Hipro Animal Nutrtion, Adisseo, Kemin Industries, and Alltech Inc. |

The global medicated feed additives market is estimated to be valued at USD 13.1 billion in 2025.

The market size for the medicated feed additives market is projected to reach USD 22.4 billion by 2035.

The medicated feed additives market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in medicated feed additives market are amino acids, _tryptophan, _lysine, _methionine, _threonine, _other amino acids, feed enzymes, _phytase, _non-starch polysaccharides, _other enzymes, antibiotics, _acidifiers, _antioxidants, _natural and _synthetic.

In terms of animal type, swine segment to command 42.9% share in the medicated feed additives market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medicated Bath Additive Market Size and Share Forecast Outlook 2025 to 2035

Medicated Shampoo Market Analysis – Growth & Forecast 2024-2034

Feed Pigment Market Size and Share Forecast Outlook 2025 to 2035

Feed Mixer Market Forecast and Outlook 2025 to 2035

Feed Grade Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Feed Electrolytes Market Size and Share Forecast Outlook 2025 to 2035

Feed Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Flavors Market Size and Share Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Mycotoxin Binders Market Size and Share Forecast Outlook 2025 to 2035

Feed Phytogenics Market Size and Share Forecast Outlook 2025 to 2035

Feed Carbohydrase Market Size and Share Forecast Outlook 2025 to 2035

Feed Grade Oils Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Packaging Market Size, Share & Forecast 2025 to 2035

Feed Mycotoxin Detoxifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Premix Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Feed Phytogenic Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Feed Attractants Market Analysis by Composition, Functionality, Livestock, Packaging Type and Sales Channel Through 2035

Feed Encapsulation Market Analysis- Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA