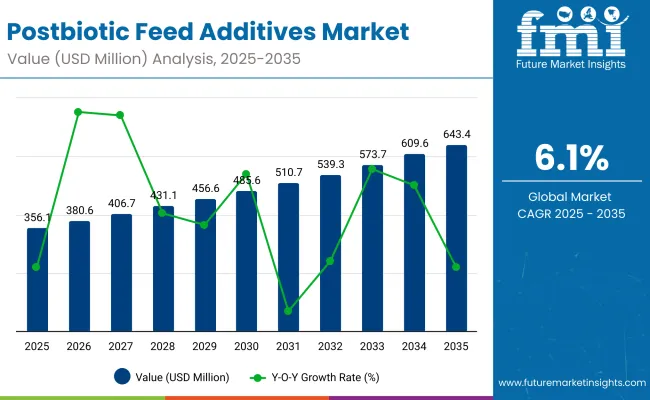

The Postbiotic Feed Additives Market is expected to record a valuation of USD 0.36 billion in 2025 and USD 0.64 billion in 2035, with an increase of USD 0.28 billion, which equals a growth of 77.9% over the decade. The overall expansion represents a CAGR of 6.1% and a near 1.8X increase in market size.

Postbiotic Feed Additives Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 0.3561 billion |

| Market Forecast Value in (2035F) | USD 3.61 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

During the first five-year period from 2025 to 2030, the market increases from USD 0.36 billion to USD 0.49 billion, adding USD 0.13 billion, which accounts for 46.4% of the total decade growth. This phase records steady adoption in poultry and swine feed, driven by the need to replace antibiotic growth promoters, improve gut health, and optimize nutrient absorption. Inactivated microbial cells dominate this period as they account for nearly 18% of the total market, offering a stable and effective solution for feed formulations.

The second half from 2030 to 2035 contributes USD 0.15 billion, equal to 53.6% of total growth, as the market jumps from USD 0.49 billion to USD 0.64 billion. This acceleration is powered by increased integration of metabolite-based postbiotics, cell-free supernatants, and fermentation extracts into livestock diets. Aquaculture and ruminant applications rise significantly, while microbial-derived sources continue to dominate. Specialty blends that combine postbiotics with probiotics and organic acids create new opportunities, pushing adoption further. By the end of the decade, regional demand is led by North America (30%) and Europe (28%), supported by regulatory mandates and sustainable livestock production initiatives.

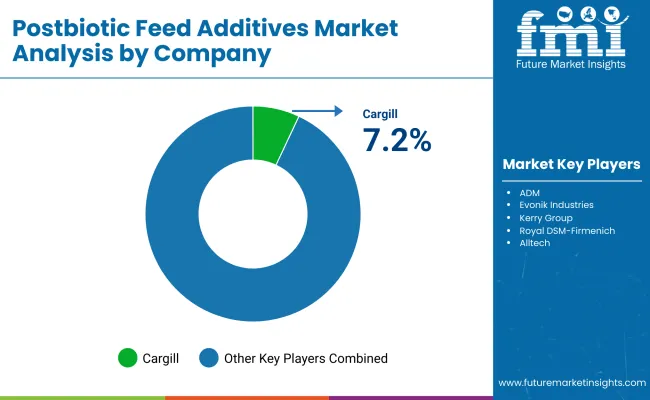

From 2020 to 2024, the Postbiotic Feed Additives Market expanded steadily, supported by the replacement of antibiotic growth promoters (AGPs) and rising demand for gut-health enhancers in poultry and swine. During this period, the competitive landscape was dominated by multinational feed additive suppliers controlling nearly 70-75% of revenues, with leaders such as Cargill, DSM-Firmenich, and Evonik focusing on large-scale microbial fermentation and cost-efficient formulations. Competitive differentiation relied on microbial strain diversity, coating and encapsulation efficiency, and integration into premixes, while plant- and yeast-derived solutions remained supplementary. Service-driven adoption, such as feed mill consulting or tailored on-farm inclusion programs, accounted for less than 10% of overall value.

Demand for postbiotics will expand to USD 0.36 billion in 2025, with the revenue mix shifting toward specialty blends combining postbiotics, probiotics, and organic acids. Traditional leaders face growing competition from innovators specializing in fermentation extracts, cell-free supernatants, and metabolite-based formulations. Major incumbents are pivoting to hybrid portfolios, integrating gut health, immunity, and performance-enhancement functionalities to maintain market relevance. Regional players in Asia-Pacific are also gaining share, particularly in poultry and aquaculture feed. Competitive advantage is moving away from single-function solutions toward ecosystem strength, species-specific efficacy, and recurring integration into feed formulations.

Advances in microbial fermentation and encapsulation technologies have improved the stability, functionality, and delivery of postbiotics, making them highly effective across diverse livestock feed applications. Inactivated microbial cells have gained strong adoption due to their proven role in improving gut health and immunity without the risks linked to live probiotics. Similarly, metabolite-based postbiotics, cell-free supernatants, and short-chain fatty acids are expanding their applications in nutrient absorption, pathogen control, and growth performance. These innovations align closely with the global ban on antibiotic growth promoters (AGPs), positioning postbiotics as sustainable alternatives.

Rising demand in poultry, swine, and aquaculture feed is fueling market growth as producers seek efficiency gains and compliance with animal health regulations. Postbiotics are increasingly being integrated into precision nutrition programs, where they support feed cost optimization and species-specific dietary requirements. Specialty blends that combine postbiotics with probiotics and organic acids are creating new opportunities, especially in premium feed formulations targeted at export-driven markets.

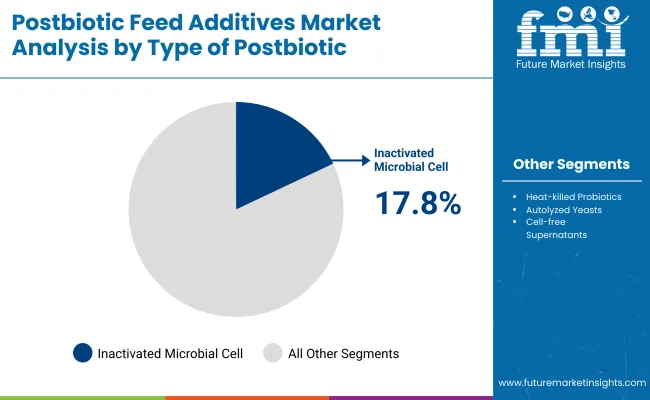

The Postbiotic Feed Additives Market is segmented by type, source, functionality, livestock type, delivery format, application method, sales channel, and region. By type, the market includes inactivated microbial cells, heat-killed probiotics, autolyzed yeasts, cell-free supernatants, metabolite-based postbiotics, short-chain fatty acids, organic acids, bacteriocins, enzymes and peptides, and fermentation extracts. Inactivated microbial cells dominate with 17.8% share in 2025, reflecting their effectiveness in poultry and swine feed for gut health and nutrient utilization.

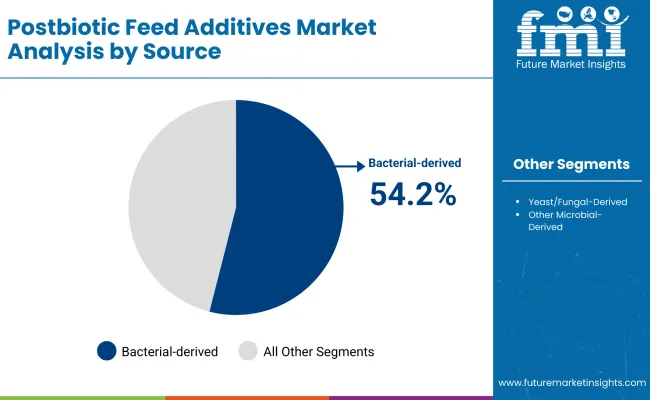

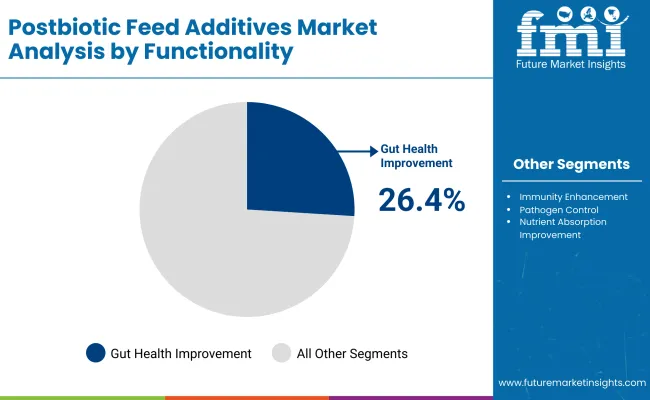

By source, bacterial-derived postbiotics hold the majority share at 54.2%, supported by efficient microbial fermentation platforms, while yeast and fungal-derived variants contribute 28.4%. Functionality segmentation highlights gut health improvement as the leading application with 26.4% share, followed by immunity enhancement and pathogen control, underlining the role of postbiotics in replacing antibiotic growth promoters.

Livestock adoption is led by poultry, supported by intensive production systems, with aquaculture emerging as a high-growth area in Asia-Pacific. Delivery formats span dry powders, encapsulated forms, and liquid concentrates, with encapsulation gaining importance for stability and targeted release. Feed inclusion remains the primary application method, though water-soluble additives are rising in aquaculture and poultry. Regionally, North America leads with 30% share, Europe follows at 28%, and Asia-Pacific emerges as the fastest-growing market with 37% share.

| Type Segment | Value Share (%) |

|---|---|

| Inactivated Microbial Cells | 17.80% |

| Heat-killed Probiotics | 14.60% |

| Autolyzed Yeasts | 8.90% |

| Cell-free Supernatants | 7.50% |

| Metabolite-based Postbiotics | 12.80% |

| Short-chain Fatty Acids | 9.40% |

| Organic Acids | 8.10% |

| Bacteriocins | 7.20% |

| Enzymes & Peptides | 6.50% |

| Fermentation Extracts | 7.20% |

Inactivated microbial cells lead the market with a 17.8% share in 2025, followed by heat-killed probiotics and metabolite-based postbiotics as other prominent categories. This leadership is driven by their proven efficacy in enhancing gut health, immunity, and nutrient utilization across poultry and swine production, making them a preferred choice in large-scale feed formulations. The segment’s growth is also supported by technological advancements in microbial fermentation and encapsulation, which enhance stability and performance under diverse feed processing conditions. As demand for natural alternatives to antibiotic growth promoters accelerates, inactivated microbial cells remain central to postbiotic adoption. Multifunctional applications, cost-effectiveness, and compatibility with precision nutrition programs further strengthen their role as the backbone of the postbiotic feed additives market.

| Source Segment | Value Share (%) |

|---|---|

| Bacterial-derived | 54.20% |

| Yeast/Fungal-derived | 28.40% |

| Other Microbial-derived | 17.40% |

Bacterial-derived postbiotics lead the market with a 54.2% share in 2025, significantly outpacing yeast/fungal-derived and other microbial-derived categories. Their dominance is driven by scalability in fermentation processes, wide strain availability, and proven efficacy in enhancing gut health, nutrient absorption, and immunity across poultry, swine, and ruminant feed. Bacterial strains such as Lactobacillus and Bifidobacterium have established credibility in livestock nutrition, enabling consistent performance improvements and compliance with antibiotic reduction mandates.

The growth of this segment is further supported by technological advancements in microbial inactivation, which preserve beneficial metabolites while eliminating risks associated with live organisms. Cost efficiency and versatility in formulation make bacterial-derived postbiotics highly adaptable for both dry powder and encapsulated delivery formats. As global livestock producers shift toward sustainable, health-focused feed strategies, bacterial-derived solutions are expected to remain the cornerstone of postbiotic innovation and adoption.

| Segment | Value Share (%) |

|---|---|

| Gut Health Improvement | 26.40% |

| Immunity Enhancement | 21.30% |

| Pathogen Control | 18.50% |

| Nutrient Absorption Improvement | 14.80% |

| Growth Performance Enhancement | 12.60% |

| Stress Reduction (Heat, Transport) | 6.40% |

Gut health improvement leads the functionality segment with a 26.4% share in 2025, reflecting its critical role in optimizing livestock performance and reducing reliance on antibiotic growth promoters. This dominance is driven by the increasing need to maintain a balanced gut microbiota, enhance nutrient digestibility, and strengthen immunity, particularly in poultry and swine production. Producers prioritize gut health solutions as they directly improve feed conversion ratios and support overall animal welfare, aligning with global regulatory pressures for sustainable animal nutrition.

The segment’s leadership is reinforced by strong demand for bacterial-derived postbiotics, which provide metabolites and cell components that positively influence intestinal health. Complementary benefits such as improved pathogen resistance and reduced incidence of gastrointestinal disorders make gut health products indispensable in intensive farming systems. As precision nutrition strategies expand, gut health improvement postbiotics are expected to remain the backbone of feed formulations, ensuring consistent productivity and resilience across multiple livestock sectors.

The Postbiotic Feed Additives Market is evolving under the dual forces of innovation and structural constraints. Scientific advancements are unlocking novel applications, while cost and scalability factors continue to reshape adoption priorities across global livestock and aquaculture nutrition systems.

Regulatory Shift Toward Antibiotic-Free Nutrition

Expansion in the Postbiotic Feed Additives Market is being propelled by stringent regulatory directives that mandate reduced antibiotic use in livestock production. Postbiotics are being positioned as compliant alternatives, offering reproducible benefits without the variability of probiotics or chemical additives. This shift is expected to elevate demand from poultry and swine sectors, where performance outcomes must be balanced with safety and sustainability compliance. As animal protein supply chains face closer scrutiny, regulatory momentum is anticipated to embed postbiotics as indispensable components in feed formulations, establishing a pathway for recurring, regulation-driven market growth.

Limited Standardization in Efficacy Validation

Adoption is being restricted by the absence of standardized methodologies for validating postbiotic efficacy across species and geographies. While promising outcomes are documented, inconsistency in trial design and lack of universally accepted biomarkers are constraining trust among integrators and feed formulators. This gap is expected to slow large-scale penetration, particularly in cost-sensitive markets, where performance guarantees are demanded before substitution of conventional additives. Unless harmonized validation frameworks are developed, product differentiation will remain fragmented, and consolidation opportunities will be delayed. Vendors capable of producing robust, evidence-backed trials are projected to secure early credibility and dominate in future procurement cycles.

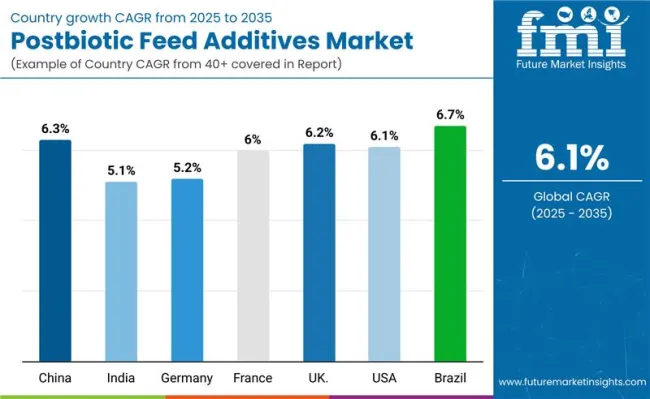

| Countries | CAGR |

|---|---|

| China | 6.30% |

| India | 5.16% |

| Germany | 5.22% |

| France | 6.06% |

| UK | 6.22% |

| USA | 5.19% |

| Brazil | 6.72% |

The global Postbiotic Feed Additives Market demonstrates notable regional variations in adoption, shaped by livestock production intensity, regulatory enforcement, and sustainability priorities. Asia-Pacific emerges as the fastest-growing region, led by China with a CAGR of 6.3% and India at 5.2%. Expansion is being fueled by large-scale poultry and aquaculture systems, government-backed initiatives for antibiotic-free animal nutrition, and investments in advanced feed formulations. In China, regulatory momentum to curb antibiotic usage has reinforced adoption of bacterial-derived postbiotics and fermentation extracts, while India’s growth reflects increased uptake by poultry integrators and tier-2 feed producers seeking export competitiveness and compliance with global residue standards.

Europe maintains a strong growth trajectory, anchored by Germany (5.2%), France (6.1%), and the UK (6.2%). Adoption is driven by stringent animal welfare policies, sustainability reporting requirements, and a mature ecosystem of multinational feed manufacturers embedding postbiotics into functional blends. Postbiotics are being increasingly positioned as premium additives for poultry and swine, aligned with the region’s leadership in sustainable agriculture.

North America represents 30% of global market share, supported by a consolidated livestock industry and early adoption of gut health solutions. Growth in the USA (5.1%) is service-oriented, focusing on tailored formulations, precision nutrition, and integration of encapsulated postbiotics into advanced feeding programs.

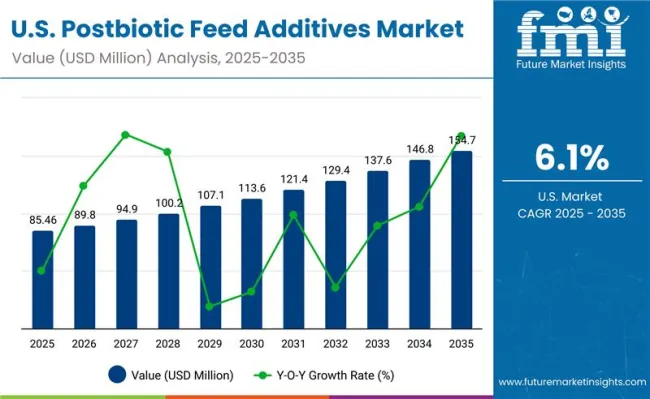

| Year | USA Postbiotic Feed Additives Market (USD Million) |

|---|---|

| 2025 | 85.46 |

| 2026 | 89.8 |

| 2027 | 94.9 |

| 2028 | 100.2 |

| 2029 | 107.1 |

| 2030 | 113.6 |

| 2031 | 121.4 |

| 2032 | 129.4 |

| 2033 | 137.6 |

| 2034 | 146.8 |

| 2035 | 154.7 |

The Postbiotic Feed Additives Market in the United States is projected to grow at a CAGR of 5.1% between 2025 and 2035, supported by the country’s advanced livestock sector and strong regulatory push toward antibiotic-free nutrition. Adoption has been reinforced by poultry and swine integrators seeking proven alternatives to antibiotic growth promoters, with inactivated microbial cells and bacterial-derived formulations gaining widespread traction. The USA dairy sector is also increasingly adopting postbiotics to improve nutrient absorption and enhance immunity in high-yielding cattle.

Poultry integrators are embedding postbiotics into feed formulations to optimize feed conversion and gut health, while swine producers are adopting metabolite-based solutions to reduce pathogen prevalence and improve herd resilience. Encapsulation technologies are being prioritized by feed manufacturers to ensure postbiotic stability during pelleting, creating opportunities for premium solutions. Additionally, tailored blends that combine postbiotics with probiotics and organic acids are attracting interest among large integrators aiming for multi-functional benefits. With sustained emphasis on animal health, regulatory compliance, and consumer demand for antibiotic-free meat, the USA market is positioned to remain a cornerstone for global postbiotic expansion.

The Postbiotic Feed Additives Market in the United Kingdom is projected to grow at a CAGR of 6.2% through 2035, supported by the country’s progressive policies on animal welfare and sustainability. Poultry and swine feed producers are actively adopting bacterial-derived and encapsulated postbiotics to improve gut health, nutrient absorption, and overall animal resilience. The shift is also influenced by the UK’s role as an exporter of high-quality animal protein, where antibiotic-free production standards are increasingly demanded. Universities and industry bodies are collaborating to validate the efficacy of postbiotics, ensuring credibility and accelerating adoption across integrators. Government-backed sustainability programs and innovation grants are reinforcing investment in advanced feed solutions, positioning the UK market as a leader in Europe.

The Postbiotic Feed Additives Market in India is forecast to expand at a CAGR of 5.2% through 2035, reflecting rapid adoption across poultry and aquaculture feed sectors. Rising regulatory emphasis on antibiotic-free production, combined with increasing consumer preference for safe animal protein, is accelerating market penetration. Poultry integrators are focusing on bacterial-derived and metabolite-based postbiotics to reduce pathogen prevalence and enhance feed efficiency, while aquaculture producers are adopting fermentation extracts and short-chain fatty acids to improve water stability and fish survival. Smaller feed mills in tier-2 and tier-3 cities are gradually integrating postbiotics as awareness of international export standards grows. Educational institutions are also including advanced animal nutrition practices in vocational training, embedding long-term familiarity with postbiotic technologies.

The Postbiotic Feed Additives Market in China is expected to grow at a CAGR of 6.3%, the highest among major economies. This growth is underpinned by the country’s large-scale poultry and swine production systems, regulatory restrictions on antibiotic usage, and increasing investments in sustainable feed technologies. Bacterial-derived postbiotics dominate, supported by strong domestic production capacity and advanced fermentation technologies. Municipal programs focused on food safety and sustainability are incentivizing integrators to adopt postbiotics, while competitive pricing by local players is expanding adoption among smaller feed producers. Aquaculture has also emerged as a key driver, with encapsulated postbiotics being deployed to enhance gut health and improve yields in fish farming. The emphasis on export-quality meat production further reinforces China’s role as a growth engine in Asia-Pacific.

| Countries | 2025 |

|---|---|

| UK | 20.33% |

| Germany | 21.79% |

| Italy | 10.56% |

| France | 14.30% |

| Spain | 10.37% |

| BNELUX | 6.58% |

| Nordic | 5.14% |

| Rest of Europe | 11% |

| Countries | 2035 |

|---|---|

| UK | 19.42% |

| Germany | 20.37% |

| Italy | 9.69% |

| France | 14.62% |

| Spain | 10.98% |

| BNELUX | 5.56% |

| Nordic | 5.93% |

| Rest of Europe | 13% |

The Postbiotic Feed Additives Market in Germany is projected to grow at a CAGR of 5.2% through 2035, supported by the country’s advanced livestock industry and stringent EU regulatory framework promoting antibiotic-free production. Poultry and swine producers are leading adopters, prioritizing bacterial-derived and encapsulated postbiotics to improve nutrient absorption, immunity, and feed conversion efficiency. Germany’s position as a hub for precision agriculture and high-quality protein production has reinforced its role in shaping standardized feed additive adoption across Europe. Integration of postbiotics into full-spectrum feed blends is being accelerated by multinational feed manufacturers operating in the country, supported by strong collaboration with research institutions to validate efficacy through controlled animal trials. Compliance with EU safety standards and sustainability reporting requirements further incentivizes large-scale adoption. Germany’s market is therefore poised to remain a key contributor to European growth, offering both scale and innovation leadership.

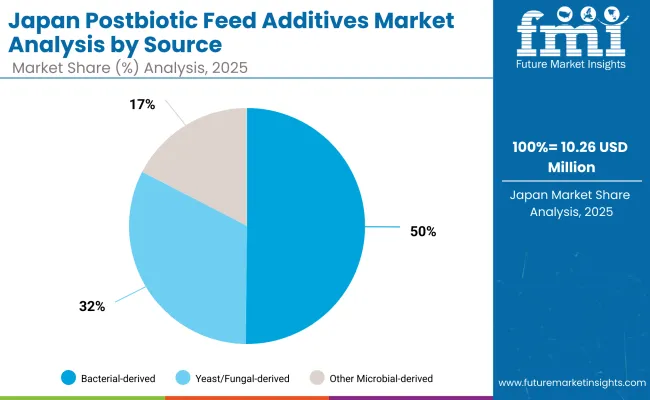

| Source Segment | Value Share (%) |

|---|---|

| Bacterial-derived | 50.20% |

| Yeast/Fungal-derived | 32.40% |

| Other Microbial-derived | 17.40% |

The Postbiotic Feed Additives Market in Japan is projected at USD 10.26 million in 2025, supported by its dominance in East Asia’s feed additive adoption. Bacterial-derived postbiotics, holding 50.20% share, are positioned as the backbone of the market, reflecting their reliability in enhancing gut health, nutrient absorption, and pathogen resistance across poultry and swine production. Yeast and fungal-derived postbiotics, at 32.40%, are being steadily adopted in aquaculture and ruminant nutrition, where functional blends are expected to improve performance and sustainability outcomes. Other microbial-derived solutions, though smaller at 17.40%, are expanding rapidly, driven by innovation in metabolite-based formulations that support stress reduction and immunity.

The Japanese market outlook is underpinned by increasing demand for antibiotic-free livestock systems and strong regulatory alignment with sustainable food production. Advanced fermentation technologies, combined with encapsulation methods, are projected to further improve stability and adoption rates. As animal nutrition frameworks transition toward precision feeding, integrated postbiotic solutions are expected to emerge as critical components of long-term productivity.

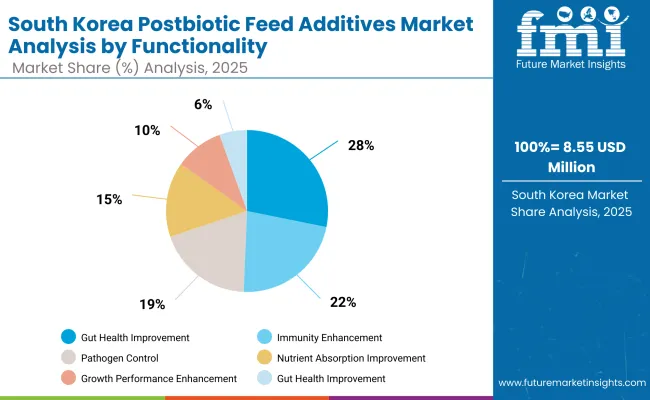

| Functionality Segment | Value Share (%) |

|---|---|

| Gut Health Improvement | 28.60% |

| Immunity Enhancement | 22.80% |

| Pathogen Control | 19.40% |

| Nutrient Absorption Improvement | 15.20% |

| Growth Performance Enhancement | 9.80% |

| Stress Reduction (Heat, Transport) | 4.20% |

The Postbiotic Feed Additives Market in South Korea is projected at USD 8.55 million in 2025, holding around 2.4% of the global market. Gut health improvement dominates with a 28.6% share, highlighting its critical role in enhancing digestive efficiency and overall livestock resilience in intensive production systems. Immunity enhancement follows at 22.8%, driven by the country’s transition toward antibiotic-free livestock farming and the growing importance of natural disease prevention. Pathogen control accounts for 19.4%, reflecting stringent biosecurity requirements in poultry and swine sectors. Nutrient absorption improvement, with 15.2%, is being supported by precision feeding strategies and innovations in metabolite-based formulations.

South Korea’s market outlook is shaped by high livestock productivity standards, increasing consumer demand for antibiotic-free meat, and strong government emphasis on food safety. With advancements in feed innovation and research-backed validation of postbiotics, their integration into full-spectrum functional feed blends is expected to accelerate. By 2035, South Korea is projected to emerge as a key adopter of postbiotic solutions aligned with sustainability and Industry 4.0 frameworks in agriculture.

The Postbiotic Feed Additives Market is moderately fragmented, with global feed-additive leaders, mid-sized innovators, and regional specialists competing across multiple livestock and functional segments. Global leaders such as Cargill, ADM, and Royal DSM-Firmenich hold significant market presence, supported by large-scale fermentation capacity, advanced microbial platforms, and integrated distribution through premix and compound feed networks. Their strategies are increasingly oriented toward heat-stable postbiotic formulations, encapsulation technologies, and multifunctional blends designed to deliver gut health, immunity, and performance benefits in a single additive.

Established mid-sized players, including Evonik Industries, Kerry Group, Novus International, and Adisseo, cater to demand for species-specific and performance-driven solutions. These companies are accelerating adoption through metabolite-based postbiotics, short-chain fatty acid formulations, and encapsulated yeast derivatives, which provide stability across feed processing conditions. Their portfolios are aligned with poultry, swine, and aquaculture integrators that require precision nutrition and measurable return on investment.

Specialized providers such as Lallemand Animal Nutrition and Arm & Hammer Animal and Food Production focus on customized, application-specific postbiotic programs that target regional livestock challenges such as heat stress, transport stress, and localized pathogen pressure. Their strength lies in customization, advisory services, and regional adaptability rather than global scale.

Competitive differentiation is shifting away from single-strain, low-cost formulations toward integrated ecosystems of bacterial-, yeast-, and metabolite-derived solutions, often combined with probiotics and organic acids. Vendors are competing on scientific validation, sustainability credentials, and ability to deliver bundled programs that align with regulatory mandates for antibiotic-free livestock production.

Key Developments in Postbiotic Feed Additives Market

| Item | Value |

|---|---|

| Quantitative Units | USD 0.36 Billion |

| Type of Postbiotic | Inactivated Microbial Cells, Heat-killed Probiotics (e.g., Lactobacillus, Bifidobacterium), Autolyzed Yeasts (e.g., Saccharomyces cerevisiae), Cell-free Supernatants, Metabolite-based Postbiotics, Short-chain Fatty Acids (Butyrate, Propionate), Organic Acids, Bacteriocins, Enzymes & Peptides, Fermentation Extracts |

| Source | Bacterial-derived, Yeast/Fungal-derived, Other Microbial-derived |

| Functionality | Gut Health Improvement, Immunity Enhancement, Pathogen Control, Nutrient Absorption Improvement, Growth Performance Enhancement, Stress Reduction (Heat, Transport) |

| Livestock Type | Poultry, Swine, Ruminants (Dairy, Beef, Small Ruminants), Aquaculture, Pets |

| Delivery Format | Dry Powder, Encapsulated Form, Liquid Concentrate |

| Application Method | Feed Inclusion (Premix, Compound Feed), Water-soluble Additives |

| Sales Channel | Direct to Integrators/Farms, Through Feed Manufacturers/Premix Companies, Distributors & Dealers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cargill, ADM, Evonik Industries, Kerry Group, Royal DSM- Firmenich, Novus International, Alltech, Adisseo, Lallemand Animal Nutrition, Arm & Hammer Animal and Food Production |

| Additional Attributes | Dollar sales by type, source, functionality, livestock category, and delivery format; adoption trends in poultry, swine, aquaculture, and ruminants; encapsulation and heat-stability innovations; validation of gut health and immunity enhancement functions; regulatory drivers for antibiotic-free animal production; regional penetration analysis; product bundling with probiotics and organic acids. |

The global Postbiotic Feed Additives Market is estimated at USD 0.36 billion (USD 356.1 million) in 2025.

The market size is projected to reach USD 0.64 billion (USD 643.4 million) by 2035.

The market is expected to expand at a 6.1% CAGR during 2025-2035.

Key product types include Inactivated Microbial Cells (17.8% share in 2025), Heat-killed Probiotics (14.6%), and Metabolite-based Postbiotics (12.8%), along with Autolyzed Yeasts, Cell-free Supernatants, SCFAs, Organic Acids, Bacteriocins, Enzymes & Peptides, and Fermentation Extracts.

Gut Health Improvement is the leading functionality, accounting for 26.4% share in 2025, followed by Immunity Enhancement (21.3%) and Pathogen Control (18.5%).

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Postbiotic Supplements Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Overview of Key Trends Shaping Postbiotic Pet Food Industry.

Postbiotic Ingredients Market Insights – Size, Trends & Forecast 2025–2035

UK Postbiotic Pet Food Market Growth – Trends, Demand & Innovations 2025-2035

USA Postbiotic Pet Food Market Insights – Growth & Demand 2025-2035

Pet Postbiotics Supplement Market – Trends, Demand & Pet Wellness

ASEAN Postbiotic Pet Food Market Analysis – Demand, Growth & Forecast 2025-2035

Europe Postbiotic Pet Food Market Insights – Growth, Innovations & Forecast 2025-2035

Australia Postbiotic Pet Food Market Trends – Size, Demand & Forecast 2025-2035

Demand for Postbiotic Supplements in EU Size and Share Forecast Outlook 2025 to 2035

Latin America Postbiotic Pet Food Market Analysis – Trends, Demand & Forecast 2025-2035

Feeder Container Market Size and Share Forecast Outlook 2025 to 2035

Feed Additive Nosiheptide Premix Market Size and Share Forecast Outlook 2025 to 2035

Feed Machine Market Forecast Outlook 2025 to 2035

Feed Pigment Market Forecast and Outlook 2025 to 2035

Feed Mixer Market Forecast and Outlook 2025 to 2035

Feed Grade Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Feed Electrolytes Market Size and Share Forecast Outlook 2025 to 2035

Feed Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA