The UK postbiotic pet food market is projected to expand steadily, reaching a market value of USD 71.5 million by 2025. Over the next decade, demand is expected to rise, pushing the industry’s worth to USD 107.7 million by 2035. This equates to a compound annual growth rate (CAGR) of 4.2% from 2025 to 2035, driven by increasing pet owner awareness regarding gut health benefits and the rising trend of functional pet nutrition.

| Attributes | Values |

|---|---|

| Estimated UK Industry Size (2025) | USD 71.5 million |

| Projected UK Value (2035) | USD 107.7 million |

| Value-based CAGR (2025 to 2035) | 4.2% |

The UK postbiotic pet food market is emerging as a result of pet parent's increased attention toward their pets' gut health and immunity. Pets, especially dogs and cats, have shown a growing demand for specific functional foods, accounting for half the market share. An increase is being observed in the overall consumption of wet and dry postbiotic foods, while snacks and nutraceuticals are also starting to pick in popularity.

Some of the most prominent drivers are the shift to online shopping for pet foods, dietary premiumization, and weighted expansion of scientifically formulated veterinarian tested nutrition. Major companies like Purina/Nestlé, Mars Petcare, and Royal Canin are creating brand loyalty through proprietary postbiotic blends.

In contrast, local companies like Lily’s Kitchen and Pets at Home are tapping into the trend of formulating clean pet food through natural and organic ingredients. The market is still very concentrated because global corporations dominate the space, but there is still room for local companies to grow through differentiated strategies.

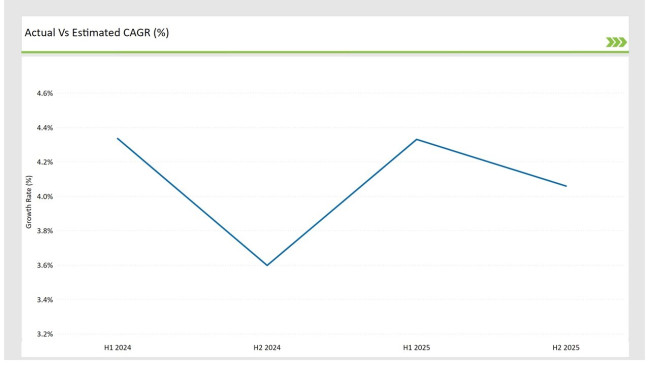

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Postbiotic Pet Food market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Year | 2024 |

|---|---|

| H1 Growth Rate (%) | 4.3% |

| H2 Growth Rate (%) | 3.6% |

| Year | 2025 |

|---|---|

| H1 Growth Rate (%) | 4.3% |

| H2 Growth Rate (%) | 4.1% |

For the UK market, the Postbiotic Pet Food sector is projected to grow at a CAGR of 4.3% during the first half of 2024, with an increase to 3.6% in the second half of the same year. In 2025, the growth rate is anticipated to slightly rise to 4.3% in H1 and reach 4.1% in H2.

| Date | Details |

|---|---|

| Dec-2024 | Mars Petcare UK launched a new line of postbiotic-enriched premium dog food. The products contain heat-treated probiotic metabolites shown to improve gut health in clinical trials. |

| Oct-2024 | Nestlé Purina opened a postbiotic research and production facility in Northumberland. The center focuses on developing novel postbiotic ingredients for pet food applications. |

| Aug-2024 | ADM Animal Nutrition partnered with UK veterinary chain Medivet to develop therapeutic postbiotic pet foods. The collaboration aims to create specialized diets for pets with digestive issues. |

| June-2024 | ProBiome UK secured £8M funding to expand their postbiotic production facility in Leeds. The expansion will focus on producing novel postbiotic compounds from British-sourced ingredients. |

| Mar-2024 | Royal Canin introduced a new range of cat food containing specialized postbiotic compounds. The products demonstrate improved digestibility and reduced hairball formation in feeding trials. |

Growing Demand for Functional Nutrition in Pet Diets

In the UK, pet parents are adopting new trends by choosing functional pet food that is supplemented with postbiotics that aid in gut health, immunity, and digestion. Half of the market share is held by dog food manufacturers who are spearheading the movement through dry and wet foods fortified with probiotics and postbiotics.

At the same time, there is an increased demand for cat specific formulations as concern towards feline gut health increases. There is intense competition among premium pet food brands as focus shifts to scientifically formulated food which increases nutrient absorption and overall wellness of pets.

E-commerce Surge in Postbiotic Pet Food Sales

The use of online retail channels for the purchase of pet food has noticeably transformed purchasing habits. 35% of UK consumers now purchase pet food online. This is further aided by subscription based delivery services that provide easy access to a wider variety of premium postbiotic pet food.

Traditional pet specialty retailers and supermarkets are being pressured by larger e-commerce platforms like Amazon, Zooplus, and Pets At Home online to increase their digital presence and DTC investment.

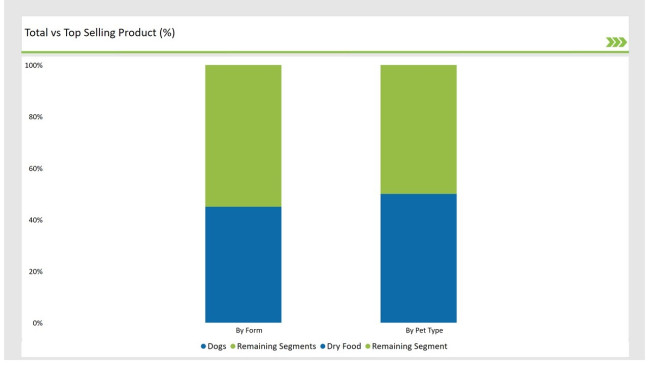

| By Pet Type | Market Share |

|---|---|

| Dogs | 50% |

| Remaining Segments | 50% |

Canines are the considerable segment of the postbiotic pet food market in the UK as they are more attuned to the needs of pet owners, who are increasingly concerned about a dog’s dietary and intestinal health.

Likewise, cats, who already have a 40 percent share of the market, are gaining rapidly, as nutrition brands are emerging focusing on feline gut health. Other animals, such as small rodents and birds, hold a little share in this market category, as there is little need for postbiotic products in this group.

| By Form Type | Market Share |

|---|---|

| Dry Food | 45% |

| Remaining Segments | 55% |

Dry pet food has led the market for the longest time, currently holding 45% market share, with the longest shelf life, convenience, and lower price. It is notable that wet food holding 40% of the market is on the rise as pet owners are becoming more concerned with their pets’ hydration and overall health.

The treats and supplements segment (15%) emerged recently to feed pet parent’s appetite for easy-to-use and customized nutritional support beyond the base diet. The future for dry food seems to be bright, but the same cannot be said for functional supplements, especially for pets with gravest and most specific digestive and feeding issues.

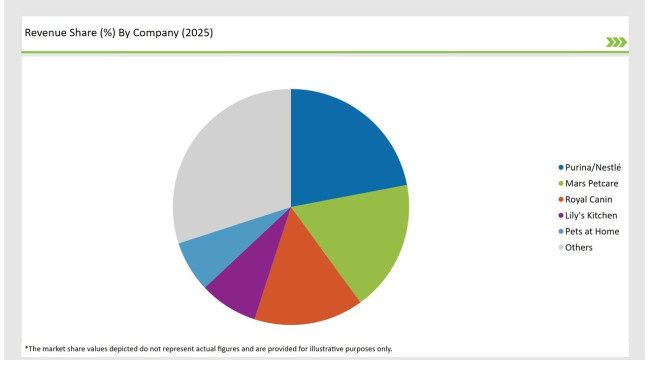

Due to robust R&D spending and existing supply chains, MNCs dominate the UK postbiotic pet food market. Brands owning a sizable share such as Purina/Nestlé, Mars Petcare and Royal Canin Pet Beau use their international bulk selling and strong retail presence to gain an advantage.

On the other hand, region-niche brands like Lily’s Kitchen and Pets at Home are responding to the rising demand for healthy, natural, or organic pet food by providing UK based functional nutrition pet food. There is a structural concentration of larger companies at the expense of MNCs, and niche brands are slowly emerging in the market from premium and DTC sales channels.

| Company Name | Market Share |

|---|---|

| Purina/Nestlé | 22% |

| Mars Petcare | 18% |

| Royal Canin | 15% |

| Lily’s Kitchen | 8% |

| Pets at Home | 7% |

| Other Players | 30% |

UK manufacturers of postbiotic pet food focus on high quality ingredient sourcing, expansion of e-commerce business models, and collaboration with veternaries. Royal Canin makes quality assurance strategies, while maintaining relationships with european ingredient suppliers.

At the same time, Mars Petcare and Purina Nestle have agglomeration of production facilities in England and Scotland, serving both local and international markets. Also, Lily’s Kitchen and Pets At Home claim to source their ingredients mainly from UK farms in order to meet the growing demand for natural and organic products. There is a growing reliance on DTC sales because subscription-based feeding of pets is becoming more commonplace.

Dogs, Cats, Other Pets

Dry Food, Wet Food, Treats & Supplements

Pet Specialty Stores, Online Retail, Veterinary Clinics, Supermarkets/Hypermarkets

By 2025, the UK postbiotic pet food market is projected to grow at a CAGR of 4.2%, supported by increasing consumer preference for gut health-enhancing pet nutrition.

By 2035, the UK postbiotic pet food industry is forecasted to reach USD 107.7 million, expanding from its 2025 valuation of USD 71.5 million.

The market is fueled by rising awareness of pet gut health, growing demand for functional nutrition, and the shift toward clean-label pet food. Additionally, veterinary recommendations and scientific backing for postbiotic benefits contribute to market growth.

Within the UK, London and the South East lead in postbiotic pet food consumption, driven by higher disposable income, urban pet ownership, and demand for premium pet nutrition.

Prominent manufacturers in the UK postbiotic pet food market include Purina/Nestlé, Mars Petcare, Royal Canin, Lily’s Kitchen, Pets at Home, Forthglade, Butcher’s Pet Care, Natures Menu, Arden Grange, and Wagg Foods.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Overview of Key Trends Shaping Postbiotic Pet Food Industry.

UK Plant-Based Pet Food Market Insights – Trends, Demand & Growth 2025-2035

USA Postbiotic Pet Food Market Insights – Growth & Demand 2025-2035

ASEAN Postbiotic Pet Food Market Analysis – Demand, Growth & Forecast 2025-2035

Europe Postbiotic Pet Food Market Insights – Growth, Innovations & Forecast 2025-2035

Australia Postbiotic Pet Food Market Trends – Size, Demand & Forecast 2025-2035

Latin America Postbiotic Pet Food Market Analysis – Trends, Demand & Forecast 2025-2035

UK Food Emulsifier Market Analysis – Size, Share & Forecast 2025–2035

UK Food Testing Services Market Report – Trends, Demand & Industry Forecast 2025–2035

UK Food Service Equipment Market Trends – Growth, Demand & Forecast 2025–2035

UK Food Stabilizers Market Insights – Demand, Size & Industry Trends 2025–2035

UK Pet Grooming Market Analysis - Size, Demand & Forecast 2025 to 2035

UK Pet Dietary Supplement Market Growth – Trends, Demand & Forecast 2025-2035

Pet Food Collagen Market Size, Share, Trends, and Forecast 2025 to 2035

Pet Food Pulverizer Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

PET Food Trays Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA