UK Food Stabilizers sales will reach approximately USD 105.3 million by the end of 2025. Forecasts suggest the market will achieve a 4.7% compound annual growth rate (CAGR) and exceed USD 166.4 million in value by 2035

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 105.3 million |

| Industry Value (2035F) | USD 166.4 million |

| CAGR (2025 to 2035) | 4.7% |

The UK food stabilizers market is undergoing a slow and steady expansion partially due to the mounting customer desire for quality, consistent, and longer-lasting food products. Stabilizers play a pivotal role in enhancing texture, stability, and shelf life in different food types like dairy, bakery, confectionery, sauces, and ready-to-eat meals.

As producers are inclined to improve their recipes, food stabilizers are becoming the important constituents enforcing blend quality and are responsible for keeping the ingredients mixed.

The UK market is powered mainly by top manufacturers like Cargill, DuPont, Kerry Group, Tate & Lyle, BASF, and Ingredion who lead through product innovation and diversification. They are investing in specially formulated stabilizers that address the clean-label, plant-based, and allergen-free product trends.

The increasing consumer demand for natural and organic food additives has been a principal factor driving the rise in pectin, xanthan gum, and agar-based stabilizers production. Regulatory constraints apply with UK Food Standards Agency (FSA) reinforcing the regulations with respect to safety and labeling of food stabilizers.

Complimentary product deals seen by players investing in the devising of multifunctional stabilizers like saving food waste and increasing the shelf life of products. The sustainable growth of the UK food stabilizers market will be seen in years to come, thanks to the added resources in formulation technology and ingredient optimization.

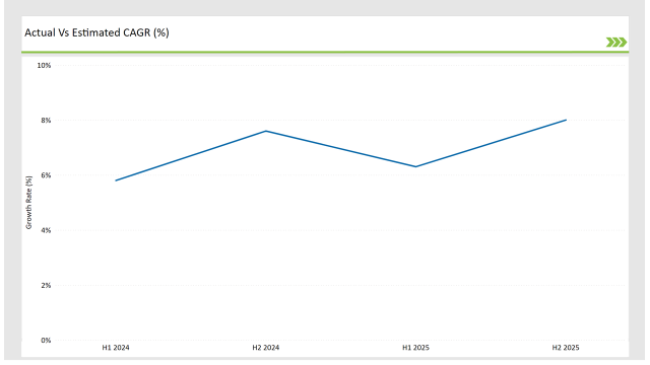

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Food Stabilizers market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| Nov 2024 | Cargill introduced a clean-label pectin stabilizer aimed at enhancing texture in plant-based dairy products. The stabilizer is designed to replace synthetic alternatives while maintaining product consistency. |

| Oct 2024 | Kerry Group launched a multi-functional stabilizer system for the bakery sector, improving moisture retention and shelf life. The company aims to cater to the rising demand for extended freshness in packaged baked goods. |

| Sep 2024 | DuPont expanded its UK research facility to focus on developing natural stabilizer blends for dairy and confectionery applications. The facility will support product innovation in the clean-label segment. |

| Aug 2024 | Tate & Lyle introduced a modified starch stabilizer to improve viscosity and stability in sauces and dressings. This product is designed to withstand temperature variations in processed foods. |

| Jul 2024 | Ingredion partnered with UK food manufacturers to create customized stabilizer solutions that align with clean-label and allergen-free food trends. The company is focusing on naturally derived hydrocolloids to meet consumer preferences. |

Rise of Clean-Label and Natural Stabilizers

The massive drive for clean-label foods has been changing the landscape of the UK food stabilizers market. Consumers are becoming more and more concerned with the elements in their food such as moving towards natural instead of synthetic stabilizers, that has been the root of the growth of the respective solutions for example: pectin, agar, and xanthan gum.

The focus of the manufacturers lies in the reformulation of processed foods demonstrating label clarity and maintaining good functionality. The dairy sector shows a strong positive side of the clean-label trend, as well as in bakery and plant-based products, where natural stabilizers exert an effect on the level of mouthfeel, texture, and stabilization of the shelf.

Expanded Use of Multi-Functional Stabilizers

The outmoded approach is being quickly replaced with the assembly of multi-functional stabilizers that yield a number of functions in a single product. The stabilizers not only emulsify but also help to retain moisture, increase freeze-thaw stability, and enhance the texture of products.

The tendency toward hybrid stabilizer systems is on the rise, as the industry is on the path of commonality by reducing the complexity of label requirements, while at the same time, it is still physically effective. Furthermore, businesses pour resources into the research and development of the next generation of stabilizers as well as up-scaling the production process of existing products to improve the texture and shelf life without adding flavors.

Surge in Demand for Sustainable and Eco-Friendly Stabilizers

Sustainability has become a major issue in the food industry at large resulting in substantial investment in plant-derived and bio-degradable stabilizers. Goals for the food producers' target of sustainability emphasize the reduction of food waste through the implication of stabilizers that, in turn, prolong original product shelf life.

Moreover, firms are innovating with eco-friendly extraction of pectin and other hydrocolloids with minimal environmental impact. This similarity is particularly notable in the ready-meals-food and dairy sectors, where the lengthening of the shelf life plays a key role in cutting down food waste.

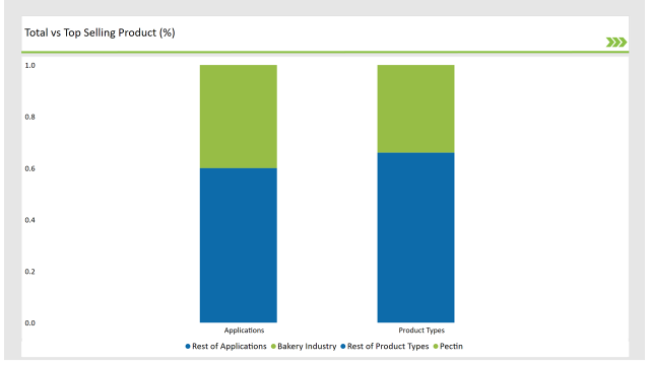

% share of Individual categories by Product Type and Applications in 2025

Pectin is one of the most commonly used stabilizers in the UK, leading the league with a 34% market share because it is derived from natural sources, has a clean-label appeal, and has gelling properties that are far superior.

It is, particularly, a fond choice for dairy, and fruit-based products together with confectionery items due to its unique feature of creating long smooth textures and balancing moisture levels. Innovative efforts such as the citrus and apple-derived pectin extraction techniques have enabled the manufacturers to derive new kinds of stabilizers that meet the specific requirements of the product.

The sector of bakery is a contributory factor to 40% of the UK food stabilizers market, and the achievement of that is because the stabilizers acted as the pin in the wheel of dough consistency, freshness extension, and ingredient mix separation.

Gluten-free and high-protein bakery products have become more prevalent, which has warranted even more advanced stabilizer solutions. The manufacturers are in the process of creating unique blends of stabilizers which, among other things, will change the crumb structure, regulate the moisture, and add freeze-thaw stability to both frozen and packaged bakery products.

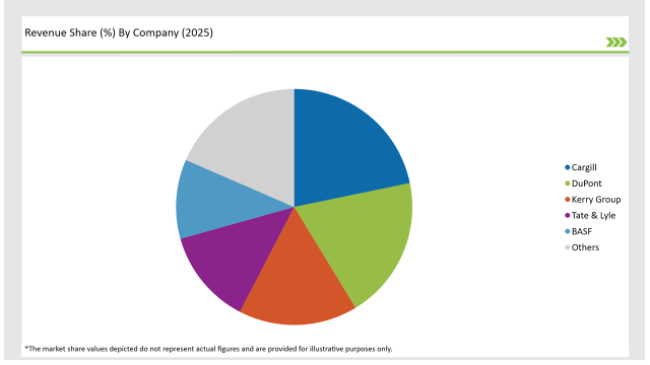

2025 Market share of UK Food Stabilizers suppliers

Note: above chart is indicative in nature

The UK food stabilizers market is comprised of a competitive group of manufacturers and they are mainly concerned with product development, clean label formulations, and strategic collaborations. Dominant pillars in the market like Cargill, DuPont, Kerry Group, Tate & Lyle, BASF, and Ingredion brand names are being set up on the advanced stabilizers that meet both consumer health and environmental sustainability requirements.

Due to the increasing popularity of plant-based and allergen-free stabilizers, companies are working on tailor-made solutions for the bakery, dairy, and plant-based food sectors.

The market is undergoing the process of strategic alliances between stabilizer manufacturers and food producers which have the objective of developing specific ingredient solutions that directly improve product stability, texture, and shelf life. Besides that, the landscape of the competition is affected by the growth of research hubs and investment in eco-friendly stabilizer technologies.

Within the Forecast Period, the UK Food Stabilizers market is expected to grow at a CAGR of 4.7%.

By 2035, the sales value of the UK Food Stabilizers industry is expected to reach USD 166.4 million.

Key factors propelling the UK Food Stabilizers market include clean-label demand, multi-functional stabilizer innovations, and the expansion of sustainable food additives.

Prominent players in the UK Food Stabilizers manufacturing include Sensient Technologies Corporation, Archer Daniels Midland, Döhler GmbH, Chr. Hansen Holding A/S, and Kalsec Inc. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

UK Cruise Tourism Market Size and Share Forecast Outlook 2025 to 2035

UK Outbound Travel Market Analysis – Size, Share, and Forecast 2025 to 2035

United Kingdom Sweetener Market Trends – Size, Demand & Forecast 2025–2035

United Kingdom Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Frozen Ready Meals Market Analysis – Growth, Trends & Forecast 2025–2035

United Kingdom Tartrazine Market Outlook – Growth, Trends & Forecast 2025–2035

United Kingdom Wood Vinegar Market Insights – Growth, Trends & Forecast 2025–2035

United Kingdom Vinegar and Vinaigrette Market Insights – Demand & Forecast 2025–2035

United Kingdom Bakery Ingredients Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

United Kingdom Chitin Market Trends – Size, Share & Forecast 2025–2035

UK Non-Alcoholic Malt Beverages Market Analysis from 2025 to 2035

United Kingdom Non-Dairy Creamer Market Insights – Demand, Growth & Forecast 2025–2035

UK Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

UK Banking as a Service (BaaS) Platform Market Growth - Trends & Forecast 2025 to 2035

UK Stationary Battery Storage Industrial Market Growth - Trends & Forecast 2025 to 2035

UK Animal Feed Alternative Protein Market Growth – Trends, Demand & Innovations 2025–2035

UK Chickpea Protein Market Insights – Demand, Size & Industry Trends 2025–2035

UK Pulses Market Growth – Trends, Demand & Innovations 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA