The UK Food Service Equipment market is estimated to be worth USD 2,495.7 million by 2025 and is projected to reach a value of USD 3,329.3 million by 2035, growing at a CAGR of 5% over the assessment period 2025 to 2035.

| Attributes | Values |

|---|---|

| Estimated UK Industry Size in 2025 | USD 2,495.7 million |

| Projected UK Value in 2035 | USD 3,329.3 million |

| Value-based CAGR from 2025 to 2035 | 5% |

The UK food service equipment market is currently on an incredible growth trajectory, which is the result of the constant increase in the foodservice sector and the change in consumer dining habits. Food service equipment is an umbrella term for the various devices and appliances that are necessary to be used in a commercial kitchen to increase efficiency for operations that are done in restaurants, hotels, and catering businesses.

This market is crucial in the process of integration of new technologies in kitchens, to enabling the businesses to onboard and deliver the very best dining experiences, as it includes devices and appliances for food preparation, storage, and cooking.

Food preparation equipment is the largest product category in the market and contains products such as slicers, grinders, mixers, food processors, and blenders. The use of this equipment is critical in providing food products with the same taste and in meeting deadlines on time.

This practice is particularly crucial for casual dining restaurants that have a lot of customers visiting their premises. Nowadays, consumers care more about eating quickly and with less inconvenience on their side, so the equipment turnover has also changed with this demand of restaurants for effective and trustworthy appliances.

The food service equipment market is mainly backed by casual dining restaurants. These restaurants are located between the fast-food and fine dining categories and they are heavily reliant on the constantly updated food processors to be able to satisfy customers’ needs.

Restaurants also benefit from the use of the high-quality preparation tools to keep their menu consistent even at peak times. The UK food service equipment market is headed by Rational, Hobart, and Electrolux Professional, which are the manufacturers with the utmost market share.

Continuous innovation has been a key factor as these companies work on developing energy-efficient, compact, and technologically-fledged gadgets. Sustainability along with following strict rules of health and safety have been the triggers for the manufacturers to innovate their range of products, which has, in turn, resulted in the market becoming very competitive and dynamic.

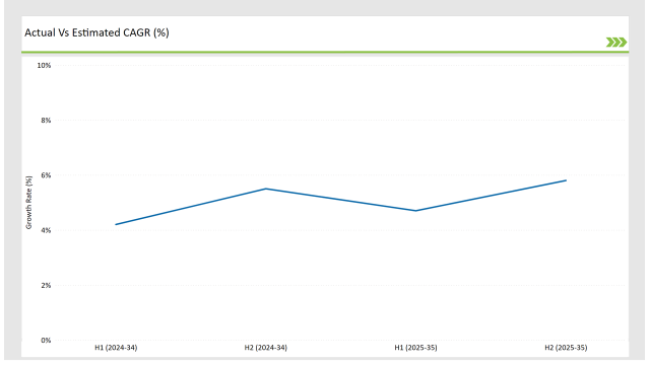

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the UK Food Service Equipment market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| May 28, 2024 | Bunzl completed the acquisition of an 80% stake in Nisbets, a leading catering equipment supplier, for £339 million, aiming to strengthen its position in the food service equipment sector. |

| December 18, 2024 | The Foodservice Equipment Association (FEA) successfully obtained an exemption to new F-Gas regulations for refrigeration equipment, ensuring continued availability of essential appliances for the industry. |

| September 20, 2024 | ITW, parent company of brands like Hobart and Foster Refrigerator, reported its UK food equipment division's turnover exceeded £220 million for the first time, highlighting significant growth in the market. |

| December 5, 2024 | The UK restaurant market is projected to grow by 1.3% in 2024, reaching a total market value of £19.0 billion, indicating a positive outlook for the food service equipment sector. |

| December 16, 2024 | The Foodservice Equipment Association (FEA) scheduled a combi oven training day to enhance industry knowledge and promote best practices in equipment usage. |

The Trend of Multifunctional Equipment

Casual restaurants in the UK are making a shift to the use of multifunctional food processing machines in a bid to solve the problems of space limitation whilst increasing operational efficiency.

Combination mixers and food processors, which can perform different tasks like chopping, grinding, and blending, are examples of products that are trending among restaurant owners. Hobart is a brand that produces high-tech multifunctional that responds to the operational demands of casual dining and therefore help them to save on time and labor costs.

Food Preparation Technological Growth

The introduction of technology into the food preparation equipment creation has led to reshaping of the market. Smart machines that can be set programmatically and automatics controls are enabling the restaurants to increase efficiency and improve their products' consistency.

As an illustration, the latest food processors that are intelligent from Rational have a mode automatically that will match the type of food to the correct settings rather than, as it is needed in other models, for the cook to input them. These developments are very helpful especially for casual diners where quick service and the right food servings are paramount during busy hours.

The Use of Energy-Efficient Equipment Becoming a Trend

As the cost of energy goes up and the focus on sustainability rises, there has been enormous demand for energy-efficient food processing equipment. Manufacturers like Electrolux Professional are creating instruments that are environmentally friendly by means of designating less energy without any influence on their performance.

This is particularly desirable for casual dining restaurants that are attempting to cut down on expenses while reaching output targets. Energy-efficient tools serve both the purpose of achieving sustainability goals as well as contributing to the profitability of the business.

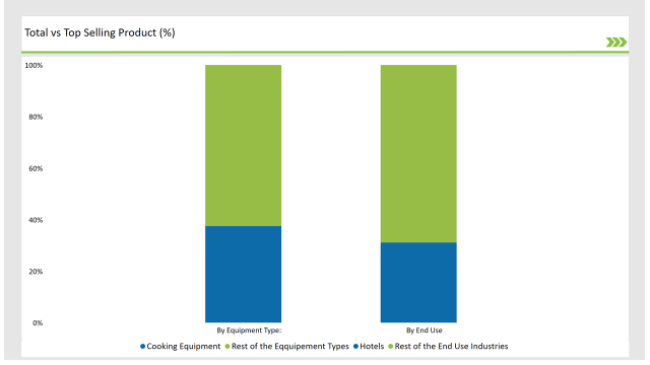

% share of Individual categories by Product Type and Applications in 2025

Food preparation equipment accounts for the major part of the UK food service equipment market due to its impact on the commercial kitchens' efficiency and consistency. These tools comprise mixers, food processors, slicers, and peelers and they are imperative in the streamlining of operations in the environments with high demands.

The leading companies in the market like Hobart and Electrolux Professional are spending a lot of energy on producing robust, ergonomic, and uncomplicated to use equipment that integrates programmable controls, compact structures, and maintenance simplicity. The invention of equipment that combines several utilities like slicing, grinding, and mixing without any users' intervention has also enlarged this product group.

The ones who use the most food service equipment are casual dining restaurants in the UK. They greatly depend on the processing machines of the highest caliber to meet their patrons’ expectations of receiving their orders quickly and in the best quality.

Because of the need for verification of the food offering variety and the fact that many advances have come up in food preparation machines have made these investments the major issue to deal with. Rational is a manufacturer who offers the equipment that combines speed, accuracy, and convenience of use all in one product, thus, has good solutions for this segment to cope with larger customer visibility without the reduction of service quality.

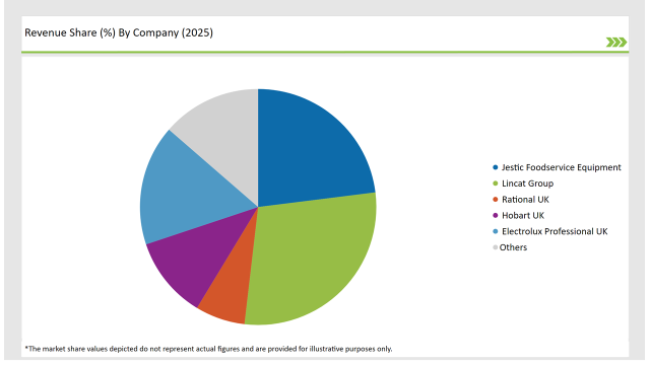

2025 Market share of UK Food Service Equipment suppliers

Note: above chart is indicative in nature

The UK food service equipment sector is characterized by intense competition, with Rational, Hobart, and Electrolux Professional being dominant players. These firms prioritize the formulation of an idea, a product, or technology that is both robust and user-friendly through two main objectives: innovating and promoting multifunctional and energy-efficient food processing equipment which are tailor-made for casual dining restaurants.

Besides, Rational is moving along that particular path as they are promoting smart and automated solutions in order to make the kitchens, for their part, more efficient, while Hobart is focused on durable and sustainable tools that cope with the heavier duty applications.

Moreover, Electrolux Professional sees the sustainability aspect in their energy-efficient designs. Sequential agreements with restaurant chains as well as the issuing of upgraded compact machines are the ways these companies manage to have a successful market presence.

Food and Drink Preparation Equipment, Cooking Equipment, Heating and Holding Equipment, Dishwasher and Sanitation Equipment, Refrigerators and Chillers, Baking Equipment, Food Packaging and Wrapping Equipment.

Hotels, Fast Food Restaurants, Commercial Kitchens (Catering), Insitutional Canteens and Cafeteria, and others

The UK foodservice equipment market is driven by the growing demand for efficient, energy-efficient, and technologically advanced equipment that can streamline operations and enhance the dining experience.

Prominent players in the UK Food Service Equipment manufacturing include Jestic Foodservice Equipment Lincat Group Rational UK Hobart UK Electrolux Professional UK Meiko UK Charvet Premier Ranges Falcon Foodservice Equipment Parry Gram UK.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Market Share Distribution Among Food Service Equipment Companies

UK Food Testing Services Market Report – Trends, Demand & Industry Forecast 2025–2035

USA Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Food Service Equipment Market Trends – Growth, Demand & Forecast 2025–2035

Europe Food Service Equipment Market Outlook – Size, Trends & Forecast 2025–2035

Australia Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Commercial Food Service Equipment Market Growth – Trends & Forecast 2024-2034

Latin America Food Service Equipment Market Trends – Growth, Demand & Forecast 2025–2035

UK Food Emulsifier Market Analysis – Size, Share & Forecast 2025–2035

UK Food Stabilizers Market Insights – Demand, Size & Industry Trends 2025–2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Foodservice Paper Bag Companies

Europe Foodservice Disposables Market Insights – Growth & Trends 2024-2034

Foodservice Disposable Market Growth & Trends Forecast 2024-2034

Food Service Industry - Size, Share, and Forecast 2025 to 2035

Food Service Coffee Market Analysis by Type and End User Through 2035

UK Frozen Food Market Growth – Size, Share & Forecast 2025–2035

Food Holding Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food Serving Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA