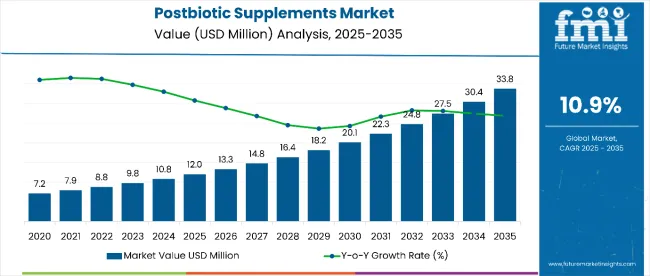

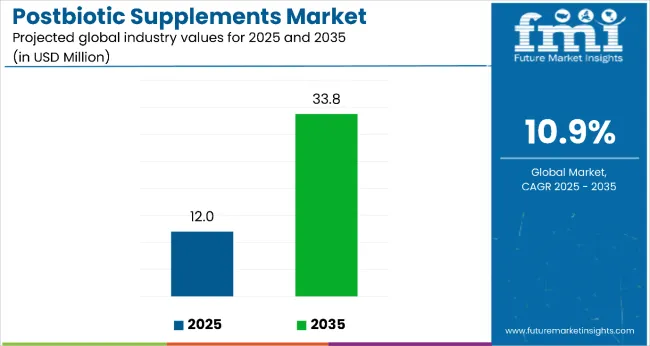

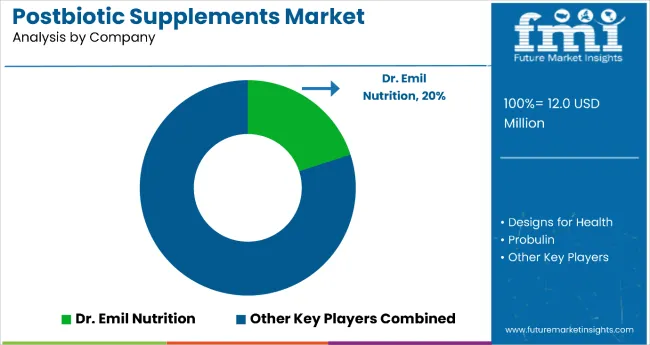

The postbiotic supplements market is estimated to be valued at USD 12 million in 2025. It is projected to reach USD 33.8 million by 2035, registering a compound annual growth rate (CAGR) of 10.9% over the forecast period. The market is projected to add an absolute dollar opportunity of USD 21.8 million over the forecast period. This reflects a 2.82 times growth at a compound annual growth rate of 10.9%. The market's evolution is expected to be shaped by the rising awareness about gut health benefits, innovative postbiotic formulations, advanced metabolite delivery systems, and growing demand for convenient supplement formats, particularly where digestive wellness and immune support are required.

By 2030, the market is likely to reach USD 20.1 million, accounting for USD 8 million in incremental value over the first half of the decade. The remaining USD 14 million is expected to be realized during the second half, suggesting a moderately accelerated growth pattern. Product innovation in soft-gel formulations, chewable formats, and specialized postbiotic strains is gaining traction.

Companies such as Dr. Emil Nutrition and Designs for Health are advancing their competitive positions through investment in postbiotic research, product development programs, and specialized distribution networks. Rising health consciousness, expanding awareness of microbiome science, and improved access to functional supplements are supporting expansion into drug stores, health & beauty retailers, and online retail applications. Market performance will remain anchored in clinical efficacy standards, bioavailability profiles, and consumer convenience benchmarks.

The market holds a small but rapidly growing share across its parent markets. Within the global dietary supplements market, it accounts for 2.1% due to its emerging nature and specialized benefits. In the probiotics segment, it commands a 3.8% share, supported by growing consumer education about the advantages of postbiotics. It contributes nearly 1.9% to the gut health supplements market and 4.2% to the functional foods segment. In digestive wellness products, postbiotic supplements hold around 5.1% share, driven by their convenience and stability advantages over live probiotics. Across the immune support supplements market, its share is close to 2.7%, owing to its position as an innovative approach to microbiome support.

The market is undergoing a strategic transformation driven by rising demand for convenient gut health solutions, microbiome-stable products, and science-backed wellness supplements. Advanced formulation technologies using metabolite stabilization, targeted delivery systems, and innovative form factors have enhanced product efficacy, consumer acceptance, and market accessibility, making postbiotic supplements viable alternatives to traditional probiotic products. Manufacturers are introducing specialized formulations, including chewable formats for children and concentrated soft-gels for adults, expanding their role beyond basic gut support to comprehensive digestive and immune wellness. Strategic collaborations between supplement companies and microbiome research institutions have accelerated innovation in product development and market penetration.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 12 million |

| Projected Value (2035F) | USD 33.8 million |

| CAGR (2025 to 2035) | 10.9% |

The postbiotic supplements market's exceptional growth is driven by increasing consumer awareness of gut health, innovative product formulations, and expanding retail accessibility, making it an attractive category for supplement manufacturers and health-conscious consumers seeking convenient digestive wellness solutions. The rising understanding of microbiome science, improved product stability compared to probiotics, and growing demand for convenient supplement formats appeal to consumers and healthcare providers prioritizing effective gut health management and immune support.

A growing focus on preventive healthcare, personalized nutrition approaches, and evidence-based wellness products is further propelling adoption, particularly in health-conscious demographics, sports nutrition, and functional food segments. Rising disposable income, expanding retail distribution, and regulatory clarity for postbiotic ingredients are also enhancing product availability and market penetration.

As functional foods and targeted nutrition continue to gain momentum across consumer markets and gut health awareness becomes increasingly important, the market outlook remains highly favorable. With consumers and practitioners prioritizing product efficacy, convenience, and scientific validation, postbiotic supplements are well-positioned to expand across various retail, online, and specialty distribution channels.

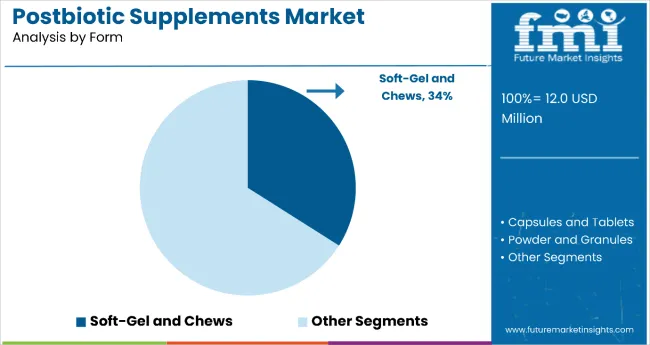

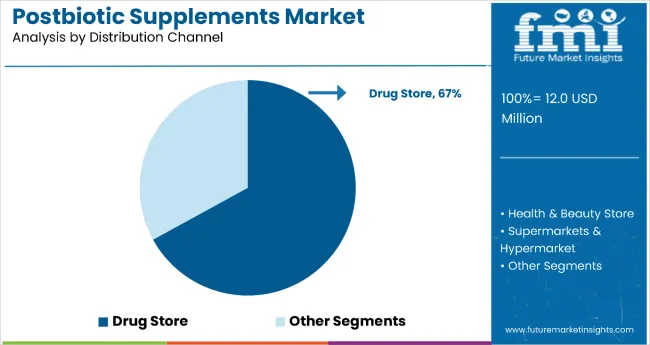

The market is segmented by form, distribution channel, and region. By form, the market is divided into soft-gel and chews, capsules and tablets, and powder and granules. Based on distribution channel, the market is categorized into drug stores, health & beauty stores, supermarkets & hypermarkets, and online retailing. Regionally, the market is classified into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The soft-gel and chews segment holds a dominant position with 34% of the market share in the form category, owing to its superior consumer acceptance, enhanced bioavailability, and convenience for daily supplementation. Soft-gels and chewable formats are widely preferred across retail and online channels due to their palatability, ease of consumption, and appeal to consumers who have difficulty swallowing traditional capsules or tablets.

This format enables manufacturers and consumers to achieve optimal product experience while maintaining excellent stability and potency in various storage conditions. As demand for consumer-friendly supplement formats, convenient dosing options, and palatable formulations grows, the soft-gel and chews segment continues to gain preference in both adult and pediatric supplement markets.

Manufacturers are investing in advanced soft-gel technology, natural flavoring systems, and enhanced chewable formulations to improve taste profiles, extend shelf life, and broaden consumer appeal. The segment is poised to grow further as global consumer preferences favor convenient and enjoyable supplement experiences.

Drug stores remain the core distribution channel with 67% of the market share in 2025, as they provide professional guidance, trusted product recommendations, and convenient access to health-conscious consumers seeking digestive wellness solutions. Their pharmaceutical expertise supports product education, dosage recommendations, and integration with other health management approaches in consumers requiring comprehensive wellness support.

Drug stores also ensure proper product storage, pharmacist consultation, and quality assurance for postbiotic supplements, while offering convenient locations and established consumer trust in health-related purchases. This makes them indispensable in modern supplement distribution and consumer healthcare environments.

Ongoing demand for professional health guidance and the specialization required for microbiome-related products are key trends driving the sustained relevance of drug stores in this supplement category.

In 2024, global postbiotic supplement adoption grew by 15% year-on-year, with North America and Europe taking significant market shares. Applications include digestive health support, immune system enhancement, and sports nutrition. Manufacturers are introducing specialized formulations and convenient delivery formats that deliver superior stability profiles and consumer-centered experiences. Soft-gel formulations now support premium positioning. Evidence-based health claims and consumer education initiatives support retailer confidence. Technology providers increasingly supply advanced encapsulation systems with enhanced bioavailability to improve product effectiveness.

Microbiome Science Innovation Accelerates Postbiotic Supplement Demand

Supplement manufacturers and health retailers are choosing postbiotic formulations to achieve superior product stability, enhance consumer outcomes, and meet growing demands for science-backed, convenient gut health solutions. In clinical applications, postbiotic supplements deliver consistent benefits without the storage and viability concerns associated with live probiotic cultures. Products formulated with postbiotics maintain potency throughout extended shelf life periods and diverse storage conditions. In retail environments, postbiotic supplements help reduce inventory complexity while maintaining efficacy standards. These advantages help explain why postbiotic adoption rates in the supplement industry rose significantly in 2024 across developed markets.

Cost Considerations and Consumer Education Requirements Limit Growth

Market expansion faces constraints due to higher production costs compared to basic probiotics, limited consumer awareness, and the need for educational marketing investments. Postbiotic supplement production costs can be 25-40% higher than standard probiotic formulations, depending on extraction methods and quality standards, impacting retail pricing strategies. Consumer education requirements add significant marketing costs to establish product understanding and differentiation from probiotics. Limited clinical research specific to postbiotic supplements creates challenges in substantiating health claims. These constraints make market development challenging despite growing scientific interest and potential benefits.

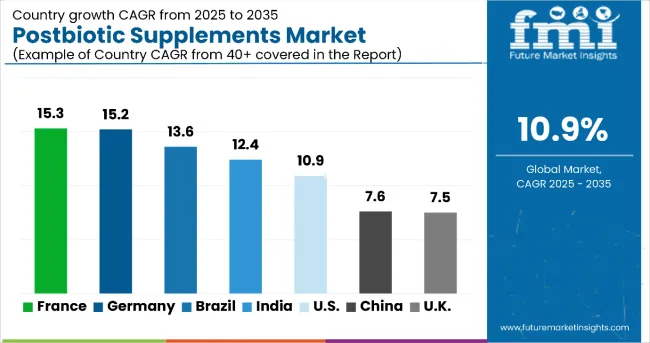

| Country | CAGR (2025 to 2035) |

|---|---|

| France | 15.3% |

| Germany | 15.2% |

| Brazil | 13.6% |

| India | 12.4% |

| USA | 10.9% |

| China | 7.6% |

| UK | 7.5% |

In the postbiotic supplements market, France leads with the highest projected CAGR of 15.3% from 2025 to 2035, driven by advanced functional food markets, strong consumer health awareness, and comprehensive regulatory support for nutraceuticals. Germany follows closely with a CAGR of 15.2%, supported by health-conscious populations and established supplement infrastructure. Brazil demonstrates strong growth at 13.6%, benefiting from emerging market dynamics and expanding middle-class health consciousness. India shows robust expansion at 12.4%, driven by urbanization trends and rising disposable income. The USA, with a CAGR of 10.9%, serves as the global benchmark with mature market characteristics. China and the UK, with CAGRs of 7.6% and 7.5% respectively, represent mature markets with steady but more conservative growth patterns, reflecting established competition and market saturation factors.

The report provides an in-depth analysis of over 40 countries, with seven top-performing OECD countries highlighted below.

Revenue from postbiotic supplements in France is projected to grow at a CAGR of 15.3% from 2025 to 2035, significantly exceeding the global average. Growth is fueled by strong consumer demand for functional foods, advanced healthcare awareness, and increasing acceptance of microbiome science across major urban centers, including Paris, Lyon, and Marseille. French retail systems are increasingly adopting innovative supplement categories as consumer education improves and specialty health stores expand.

Key Statistics:

The postbiotic supplements market in Germany is anticipated to expand at a CAGR of 15.2% from 2025 to 2035, reflecting strong consumer health consciousness and established supplement infrastructure. Growth is centered on health-conscious demographics and wellness-focused retail expansion in Berlin, Munich, and Hamburg regions. Advanced consumer education and pharmaceutical-grade quality standards are being deployed for premium supplement positioning and comprehensive health management.

Key Statistics:

Sales of postbiotic supplements in Brazil are slated to flourish at a CAGR of 13.6% from 2025 to 2035, reflecting strong emerging market dynamics. Growth has been concentrated in urban health consciousness and expanding middle-class purchasing power in São Paulo, Rio de Janeiro, and Brasília regions. Consumer adoption is shifting from basic supplements toward innovative functional health products. Local retail expansion and international brand partnerships are leading commercial deployment strategies.

Key Statistics:

Demand for postbiotic supplements in India is expected to increase at a CAGR of 12.4% from 2025 to 2035, driven by urbanization trends, rising disposable income, and growing health awareness. Demand is concentrated in metropolitan healthcare markets and expanding middle-class demographics in Mumbai, Delhi, and Bangalore regions. Evidence-based wellness products and modern retail formats are increasingly adopting postbiotic supplements for health-conscious consumers.

Key Statistics:

Revenue from postbiotic supplements in the United States is projected to rise at a CAGR of 10.9% from 2025 to 2035, serving as the global benchmark with mature market characteristics. Growth is driven by established supplement infrastructure, consumer education initiatives, and comprehensive retail distribution in California, Texas, and New York markets. Advanced product formulations and e-commerce platforms are expanding accessibility while healthcare providers incorporate gut health solutions into wellness programs.

Key Statistics:

The postbiotic supplements market in China is expected to grow at a CAGR of 7.6% from 2025 to 2035, reflecting mature market dynamics with regulatory considerations. Growth is supported by the expansion of health consciousness and modern retail development in the Beijing, Shanghai, and Shenzhen regions. Traditional wellness concepts are gradually integrating with modern microbiome science, while regulatory frameworks support the development of safe products and consumer protection.

Key Statistics:

Demand for postbiotic supplements in the UK is projected to expand at a CAGR of 7.5% from 2025 to 2035, reflecting steady mature market growth. Growth is driven by established wellness culture and comprehensive retail networks in the London, Manchester, and Edinburgh regions. NHS wellness initiatives and private healthcare expansion are supporting consumer education, while retailers incorporate evidence-based supplements into comprehensive health programs.

Key Statistics:

The postbiotic supplements market is growing rapidly as consumer awareness of gut health, immune function, and microbiome science accelerates the adoption of advanced digestive health products. Dr. Emil Nutrition and Probulin are leading players, offering clinically formulated postbiotic blends that support intestinal balance, inflammation control, and overall wellness. Their focus on scientifically validated strains and precision formulations positions them strongly in the functional nutrition segment.

Designs for Health Inc. and MaryRuth Organics LLC contribute to market expansion through clean-label, plant-based postbiotic supplements designed for digestive support and metabolic health. Their emphasis on transparent ingredient sourcing and synergistic nutrient profiles appeals to health-conscious consumers. Beekeeper’s Naturals Inc. and POSTBIOTICA SRL integrate postbiotics with natural bioactive compounds like propolis and fermented extracts, promoting immune resilience and microbial balance.

Essential Formulas Incorporated (Dr. Ohhira’s Probiotics) and Glac Biotech Co. Ltd. are pioneers in combining probiotic fermentation with stabilized postbiotic metabolites to enhance gut health efficacy and product shelf life. Korea Biopharm Co. Ltd., Pro Formulations MD, and MRM Nutrition diversify the competitive landscape with clinically backed, multi-strain postbiotic formulations targeting immunity and digestive comfort. Overall, innovation in fermentation technology and rising preventive health trends are driving sustained market growth worldwide.

| Items | Value |

|---|---|

| Quantitative Units (2025) | USD 12 Million |

| Form | Soft-Gel and Chews, Capsules and Tablets, Powder and Granules |

| Distribution Channel | Drug Store, Health & Beauty Store, Supermarkets & Hypermarkets, Online Retailing |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, France, China, Japan, India, United Kingdom, Brazil, Canada and 40+ Countries |

| Key Companies Profiled |

Dr. Emil Nutrition, Probulin, Designs for Health Inc., Beekeeper's Naturals Inc., MaryRuth Organics LLC, POSTBIOTICA SRL, Essential Formulas Incorporated (Dr. Ohhira’s Probiotics), Glac Biotech Co. Ltd., Korea Biopharm Co. Ltd., Pro Formulations MD, MRM Nutrition |

| Additional Attributes | Dollar sales by application and formulation type, regional demand trends, competitive landscape, consumer preferences for natural versus synthetic postbiotics, integration with regulatory standards, and innovations in extraction, formulation, and quality standardization |

The global postbiotic supplements market is estimated to be valued at USD 12 million in 2025.

The market size for postbiotic supplements is projected to reach USD 33.8 million by 2035.

The postbiotic supplements market is expected to grow at a 10.9% CAGR between 2025 and 2035.

The soft-gel and chews segment is projected to lead the postbiotic supplements market with a 34% share in 2025.

In terms of distribution, drug stores are projected to command 67% share in the postbiotic supplements market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Postbiotic Supplements in EU Size and Share Forecast Outlook 2025 to 2035

Postbiotic Feed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Overview of Key Trends Shaping Postbiotic Pet Food Industry.

Postbiotic Ingredients Market Insights – Size, Trends & Forecast 2025–2035

UK Postbiotic Pet Food Market Growth – Trends, Demand & Innovations 2025-2035

USA Postbiotic Pet Food Market Insights – Growth & Demand 2025-2035

Pet Postbiotics Supplement Market – Trends, Demand & Pet Wellness

ASEAN Postbiotic Pet Food Market Analysis – Demand, Growth & Forecast 2025-2035

Europe Postbiotic Pet Food Market Insights – Growth, Innovations & Forecast 2025-2035

Australia Postbiotic Pet Food Market Trends – Size, Demand & Forecast 2025-2035

Latin America Postbiotic Pet Food Market Analysis – Trends, Demand & Forecast 2025-2035

Supplements And Nutrition Packaging Market

ACF Supplements Market Size and Share Forecast Outlook 2025 to 2035

PDRN Supplements Market Size and Share Forecast Outlook 2025 to 2035

Feed Supplements Market Analysis - Size, Share & Forecast 2025 to 2035

Gummy Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fiber Supplements Market Size and Share Forecast Outlook 2025 to 2035

Vegan Supplements Market Analysis by Ingredient Type, Form, Customer Orientation , Sales Channel and Health Concer Through 2035

Andro Supplements Market

Beauty Supplements Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA