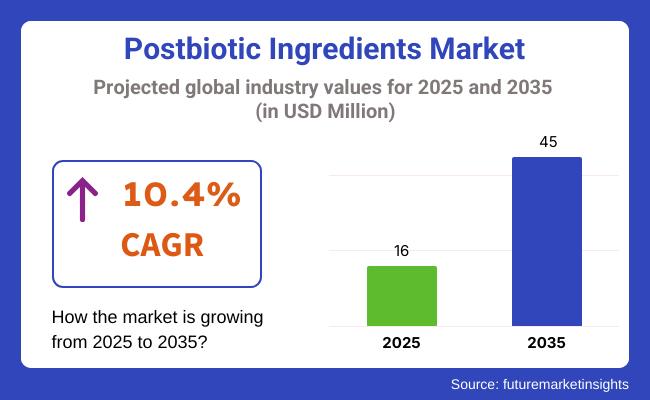

The postbiotic ingredients market is projected to attain a valuation of USD 16 million in 2025 and is anticipated to escalate to USD 45 million by 2035. This growth trajectory reflects a robust CAGR of 10.4% over the forecast period. Postbiotics non-viable bacterial products or metabolic byproducts from probiotic microorganisms are gaining traction due to their stability, safety, and promising health benefits. Unlike probiotics, postbiotics do not require refrigeration, making them more resilient in formulation and supply chain conditions. This advantage has led to their increased adoption across the functional food, nutraceutical, and personal care industries.

The growing demand for gut health care and immune system support, especially in the wake of recent global health crises, has significantly contributed to the growth of the postbiotic ingredients market. Shoppers are increasingly leaning towards clean-label, scientifically validated products with health benefits at no expense to stability or shelf-life. The rising demand for functional food ingredients is significantly driving the growth of the postbiotic ingredients market.

Additionally, advances in microbiome science and greater knowledge of the gut-brain axis are fueling demand for bioactive compounds with the capacity to support metabolic, cognitive, and immune function. This has spurred research and development by leading ingredient suppliers to develop highly targeted, application-specific postbiotic solutions. Furthermore, growing interest in sustainable and ethical sourcing is tilting the scales in favor of postbiotics in plant-based and sustainable applications.

Regulatory conditions across North America, Europe, and parts of the Asia-Pacific region are gradually being modified to favor postbiotic classification and utilization, facilitating producers to achieve even more accurate product positioning.

Increasing competition will prompt innovation in encapsulation technology, formulation compatibility, and efficacy optimization to remain among the main drivers of success. The postbiotic ingredients market is poised for a dynamic decade fueled by the needs of consumers for health, technological advancements, and growing applications in functional foods, dermo cosmetics, and medical nutrition industries.

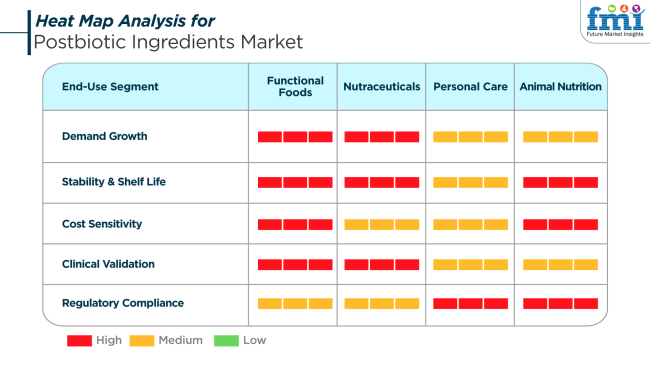

Analysis on the consumption trends includes purchasing criteria across key end-user segments. Top demand drivers for postbiotics include functional food and beverage producers, nutraceutical manufacturers, personal care brands, and animal nutrition sectors. The table below shows a heat map of demand generated and estimated across major end-user segments in the industry.

The functional food and beverage industry continues to be the front-runner in demand growth as consumers increasingly seek products that provide digestive and immune benefits without the presence of live bacteria. Postbiotics' stability and shelf-life benefits have them well-positioned for inclusion in snacks, dairy substitutes, and drinks.

In the nutraceuticals industry, postbiotics are more frequently incorporated into supplement formulations addressing metabolic and intestinal health, particularly among older people. The skin care industry, especially in North America and Asia, is experiencing increasing demand for postbiotic products as they are consistent with microbiome-friendly and dermatologically safe trends. Applications in animal nutrition are also being developed, with postbiotics providing antimicrobial and growth-enhancing benefits as substitutes for antibiotics.

Buying decisions in these segments are governed by several measures like clinical acceptance, regulatory approval, cost-effectiveness, formula compatibility, and consumer label transparency. For example, whereas cost sensitivity is moderate in nutraceuticals and skincare, cost sensitivity is high in the case of functional foods because of the scale of manufacturing limitations. Likewise, regulatory acceptability is more critical in animal and personal care segments, where safety testing is rigorous.

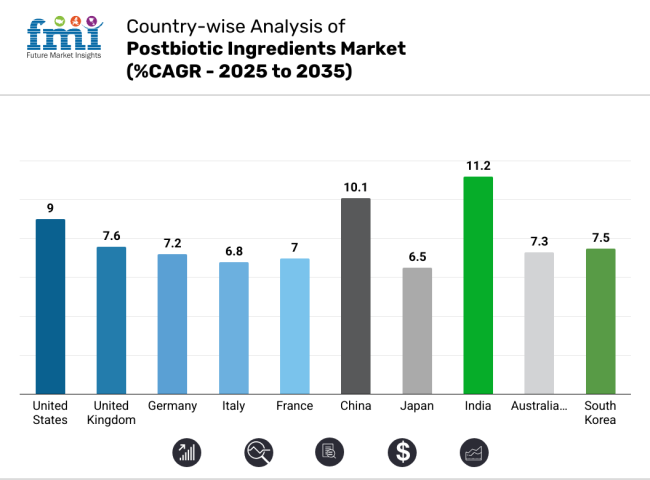

The postbiotic ingredients sector exhibits robust expansion across global regions, driven by increasing interest in gut health, immunity, and microbiome-targeted solutions. Producers and formulators can optimize growth strategies by targeting high-opportunity industries with strong consumer and clinical interest in functional foods. India is projected as the fastest-growing country, followed closely by China and the USA, highlighting Asia-Pacific and North America as the strategic focal points for innovation and scale. The chart below showcases the top ten countries poised to influence the evolution of the consumption and development.

The United States postbiotic ingredients market is poised to grow at 9% CAGR during the forecast period. The country has the most mature and extensive postbiotic ingredients market, driven by a robust functional food industry, increased consumer awareness, and higher demand for advanced gut health products.

Population aging and increased prevalence of chronic lifestyle-related diseases have also witnessed more attention being directed toward preventive healthcare interventions, with this supporting the application of postbiotic-enriched food and supplement products.

Producers are constantly investing in innovation, leveraging biotechnological advancements to manufacture more targeted postbiotic products. Regulatory clarity and established food safety protocols provide an enabling environment for industry entry and expansion.

The United States consumer industry is increasingly health-oriented, with clean-label, science-based products being the most sought-after choice. These trends contribute significantly to the top spot of the United States in the global postbiotic ingredients market.

The United Kingdom postbiotic ingredients market is expected to grow at 7.6% CAGR during the study period. The demand in the United Kingdom is increasing because of the shift in consumer preference towards preventive and functional nutrition, primarily in the form of fortified foods and beverages. The industry is backed by a mature retail system and an efficient regulatory system that facilitates the easing of product approvals and transparency in labeling.

Increased understanding of gut health, particularly immune and metabolic function, is driving the use of postbiotic-based solutions. Large brands in the UK are focusing on plant-derived and sustainable sources of postbiotics, reflecting the country's broader shift towards green and ethical consumption. Research studies in human microbiome science by academics and clinicians have also contributed to increasing trust among consumers and healthcare providers in the efficacy of postbiotic solutions.

The postbiotic ingredients market in France is expected to record a growth of 7% CAGR during the study period. France is well placed in the industry due to its long-standing reputation in food science, nutrition, and microbiology. The native population shows a growing demand for immune and digestive health, underpinning value-added product demand in dietary supplements as well as functional foods.

French companies are partnering with research institutions to develop proprietary postbiotic solutions tailored to specific health requirements such as gastrointestinal relief, anti-inflammatory, and metabolic health. Industry support also comes from a healthy natural and organic products segment in good harmony with clean label postbiotic development. As more French consumers are looking for trusted and natural-derived health remedies, postbiotics are gaining mainstream industry acceptance.

The postbiotic ingredients marketin Germany is predicted to grow at a 7.2% CAGR during the forecast period. With one of the largest and health-oriented economies in Europe, Germany provides a perfect environment for postbiotic ingredient development. Developed pharmaceutical and nutraceutical industries in the country are instrumental in developing new delivery forms and formulations for postbiotics, including capsules, sachets, and functional beverages.

The foray of microbiome science into consumer health is picking up pace, and German consumers are increasingly open to postbiotics on the back of mounting scientific evidence. Retailers and online channels are introducing postbiotic-fortified products into their portfolios, making them more accessible and visible. The emphasis on gut-brain axis research is also providing diversified uses for postbiotics in mental health and mood management

The postbiotic ingredients market in Italy is expected to grow at 6.8% CAGR during the study period. Italy's historical culture of traditional nutrition and health habits creates a conducive environment for postbiotic ingredients, particularly in the context of natural digestive supplements. While the industry is still in its development stage relative to Western European markets, awareness of gut health and its systemic impact is increasing.

Italian consumers increasingly express confidence in dietary supplements and food additives to enhance well-being without synthetic ingredients. Domestic dairy and fermented food product categories, which are strong culturally and are a great opportunity for postbiotic integration, are being promoted by local players. Supportive regulatory policies promoting preventive healthcare are also helping propel demand for microbiome-friendly ingredients.

South Korea’spostbiotic ingredients market will develop at 7.5% CAGR during the forecast period. South Korea is poised at the intersection of fast-paced innovation and high consumer sophistication in the health and wellness sector. With an active approach towards functional foods, the country is embracing postbiotic ingredients as part of regular dietary practices, particularly among urban consumers.

The correlation between aesthetic health and gut health is one of the prime drivers of growth, made possible by South Korea's world-famous beauty and skincare sector. Leading indigenous brands are adding postbiotics to nutraceutical and cosmeceutical products, including beverages, powders, and skin supplements. The convergence of technology-favored marketing and science-favored substantiation is helping postbiotic offerings to turn popular across local and export-oriented industries.

Japan’spostbiotic ingredients market is set to record 6.5% CAGR during the study period. Japan's aging population and high interest in longevity and preventive health offer a good foundation for postbiotic ingredient adoption. Consumers are highly informed regarding the health benefits of fermented foods and functional beverages, offering a low barrier to postbiotic incorporation.

The Japanese industry is characterized by product specificity and government compliance, providing the consumer with a high level of confidence. Companies are also conducting novel formulation technologies and delivery systems that enhance postbiotic stability and performance. Collaborations between food-tech companies and healthcare institutions are also expanding clinical applications of postbiotics for the immune system, digestive system, and skin.

Demand for postbiotic ingredients in China is expected to rise at 10.1% CAGR during the forecast period. China is rapidly emerging as a major hotspot for postbiotic ingredient creation and commercialization, driven by increasing middle-class earnings, urbanization, and health awareness. Food safety-promoting government policies and wellness consciousness further boost demand.

Domestic players and foreign entrants are leveraging the rich heritage of fermented foods and the growing trend toward probiotic and postbiotic ideas. Online platforms are the key to delivering postbiotic-fortified foods and supplements to tech-savvy consumers. The scale of the population and receptivity to functional ingredients guarantee that China will be among the most vibrant and high-growth industries in the next decade.

The Australia-New Zealand postbiotic ingredients market will progress at a 7.3% CAGR over the research timeframe. The two countries equally embrace a progressive mind towards natural health and clarity of regulation, resulting in an auspicious place for postbiotic ingredients. Customers in the industry have tremendous interest in products regarding gut health, supported by health enthusiasts as well as well-being experts.

The industry is moving towards clean-label, plant-based, and allergen-free offerings with a special interest in gut-brain and gut-skin health. Domestic producers are adopting native botanicals and unique fermentation methods to differentiate their offerings. Regulatory frameworks of both countries favor scientifically backed product claims, fostering consumer trust and propelling industry development.

A mix of multinational nutrition corporations, specialty biotechs, and clinical formulation suppliers marks the postbiotic ingredients market. Tier 1 players like Cargill, Incorporated, DSM, and BASF SE hold global industry share with strong R&D infrastructure, fermentation capabilities, and pharma-grade production capacity. These players place focus on scalable solutions in dietary supplements, functional food, and the clinical nutrition space.

Tier 2 players like ADM (Archer Daniels Midland) and Kerry Group plc have a lot going for them in terms of regional, cross-category strength. Their R&D pipelines revolve around microencapsulated SCFAs, inactivated microbial cell fragments, and postbiotic-peptide complexes focused on immune function, gut balance, and metabolic health.

Tier 3 manufacturers such as Probi AB, Thorne Health Tech, and Lallem and Inc. focus on targeted consumer solutions, from women's health and sports recovery to probiotic-enriched blends for individualized nutrition. These companies are quick to serve niche health industries, clean-label product requirements, and plant-based trends with proprietary development.

Market Share by Company (2025)

| Company Name | Estimated Market Share (%) |

|---|---|

| Cargill, Incorporated | 20% |

| DSM | 18% |

| BASF SE | 15% |

| ADM (Archer Daniels Midland) | 12% |

| Kerry Group plc | 10% |

| Others Combined | 25% |

The postbiotics industry is growing fast with the synergy of gut health science, immune resistance, and consumer interest in shelf-stable functional ingredients. Cargill heads the global industry through a commitment to SCFA integration with customized encapsulated blends for applications in medical foods, performance supplements, and functional beverages. Its dominance is due to extensive investment in fermentation technology and gut microbiome collaborations.

DSM is a solid player, especially via its Althaeo™ portfolio, which provides pharma-grade fermentation-derived postbiotics suitable for clinical trials, gut-brain axis research, and regulated nutraceuticals. It is focused on strains supported by patents, synergy with prebiotic fibers, and traceable manufacturing.

BASF SE is the dominating company in the category by extending its usage into topical health and cosmeceuticals, postbiotics compatible with skin microbiomes, and oral-skin wellness platforms. Its precision in targeting inflammatory modulation postbiotic peptides and metabolites places BASF in a hybrid leadership role between nutrition and personal care.

Using its agrifood biotechnology might, ADM delivers microencapsulated SCFAs, postbiotic amino acid derivatives, and application-ready concentrates for nutritional and metabolic wellness. It caters to brands interested in scaling up the highest RTD hydration forms, immunity blends targeting the gut, and functionality of low-GI metabolic support.

The Well munepostbiotic platform of Kerry Group operates within the global nutraceutical and functional beverage channels in the synergy of claims regarding immunity with the versatility of formulation. The company is committed to ingredient safety, worldwide regulatory clearance, and shelf-stable stability, which accredits its expansion in infant, sports, and elderly nutrition segments.

Success in the industry relies on several interrelated drivers combined to formulate long-term competitiveness and innovation. Perhaps one of the most decisive components is scientific justification and regulation coherence. Organizations securing agency approval with EFSA, FDA, and TGA for postbiotic strains, as well as relevant health claims, enable speedier introduction to clinical nutrition, therapeutic delivery systems, and functional medicine arenas.

Multi-functional properties are also very important factors. Currently very popular are postbiotic combinations that provide diverse benefits covering gut health, immune modulation, and skin integrity, as they allow brands to cover multiple wellness categories through one formula.

Consumer appeal for sustainability and clean labels has grown rapidly in importance for all brands. More recently, brands emphasizing non-GMO ingredients, vegan-friendly options, and open-fermentation methodologies have gained traction, particularly among direct-to-consumer brands and high-end retail chains.

Technology is instrumental in the success of an industry. Companies that invest in encapsulation, heat stabilization, and postbiotic-prebiotic-probiotic synergisms are better positioned to provide stable and shelf-stable outcomes and to stand out in crowded product categories.

Finally, collaboration with academic institutions, digital health platforms, and global nutraceutical brands enhances credibility and facilitates co-branded development based on unique local or demographic health needs. The interaction of these factors presents the industry leaders and drives the industry's uptake of postbiotics.

The postbiotic ingredients marketis driving commercial momentum around the world as industries turn to heat-stable, science-backed alternatives to probiotics. Postbiotics such as SCFAs, inactivated microbial cells, and fermentation-derived metabolites are increasingly incorporated into supplements, functional foods, and digestive wellness products.

Consumer interest in gut health support and immune modulation continues to drive innovation. Among the most impactful industry segments are short-chain fatty acids (SCFAs) as central active ingredients, digestive health uses as the chief functional driver, and the dietary supplements industry as the preeminent delivery mechanism. Firms such as Cargill, DSM, and Archer Daniels Midland (ADM) are investing in future-proofing solutions to gain access to the expanding industry.

Short-chain fatty acids such as butyrate, acetate, and propionate are anticipated to contribute 44% of the industry share in 2025. They are top bioactives included in postbiotic combinations because they have been shown to reduce gastrointestinal inflammation, stimulate mucosal immunity, and promote colonocyte metabolism.

SCFAs are predominantly used in gut-targeting capsules, digestive powders, and functional shooters. Cargill, Incorporated, leads the application of encapsulated mixtures of SCFAs in therapeutic nutrition and medical foods. ADM is the expert in microencapsulation technologies for advanced targeted delivery of SCFAs in sports nutrition and overall gut health foods.

DSM's Althaeo portfolio offers fermentation-derived SCFAs in pharma-grade quality that are suitable for clinical applications. With broad-ranging benefits throughout the intestinal microbiota, SCFAs continue to be the anchor ingredient in most postbiotic platforms, offering efficacy and cross-platform compatibility.

With 52% of all postbiotic ingredient applications, digestive health is the leading use case worldwide. This is driven by increasing consumer interest in the gut-brain connection, IBS management, and microbiome maintenance. Formulas addressing bloating, irregularity, and gut flora imbalance utilize postbiotic blends that include inactivated microbial cells, SCFAs, and peptide metabolites.

Companies such as Thorne HealthTech and BioGaia AB have launched shelf-stable capsules that combine SCFAs and bacterial lysates to lower gut inflammation. Kerry Group's Wellmune® platform combines postbiotic ingredients with immune-stimulating effects for gut-resilient products.

DSM and Lallem and Inc. keep working on patented paraprobiotics (non-viable microbial cells) strains that have been shown to maintain gut lining integrity. With consumer demand and clinical trials aligned, digestive health remains the strongest and most expanding postbiotic category.

The industry for dietary supplements accounts for approximately 48% of the total industrial uses of postbiotic materials. With the leading demand in gastrointestinal health, immune function, and metabolic health, the industry utilizes capsules, sachets, stick packs, and tablets as main delivery systems.

Sabinsa Corporation and Lesaffre Group are among the companies that are developing multi-biotic products that combine postbiotics with prebiotics and probiotics for synergistic benefits. Probi AB provides shelf-stable SCFA complexes in chewable and fast-dissolve tablets for convenience use.

Novozymes A/S is moving into sports recovery and women's health supplements with postbiotic additives that modulate the gut's immune and metabolic response. Formulations typically contain heat-treated Bifidobacterium and SCFA complexes in combination with fibers such as inulin. With e-commerce and direct-to-consumer platforms on the rise, dietary supplements offer the most nimble and lucrative avenue for postbiotic ingredient expansion.

The postbiotic ingredients market is growing strongly, with consumers increasingly demanding natural, science-supported wellness products with greater consciousness of the role of gut health. Growth is being driven by functional food innovation, individualized nutrition, and pet wellness product innovation.

Probiotics and postbiotic supplements still pose a threat to growth with their competition and regulatory complexity, still presenting a significant challenge. Companies need to continue innovating and complying to keep growing in the long run.

Increased Demand for Gut Health Solutions

The postbiotic ingredients market is pushed by growing consumer interest in digestive wellness. In contrast to probiotics, postbiotic ingredients for gut health provide benefits without viability issues, and they are shelf-stable and suitable for multifaceted formulations.

The use of postbiotic ingredients in functional foods and beverages is becoming popular. The demand for immune support is also on the increase, particularly in supplement forms targeting inflammation. With the aging populace looking for aids to digestion and the pet healthcare segment adopting postbiotic products, the industry is witnessing greater applications.

Internet-based platforms again increase accessibility. With increasing customer demand for natural and clean-label products, postbiotic peptides are finding larger use in health programs. Companies are spending capital on R&D to enhance good performance, flavor, and bioavailability.

Regulatory and Market Challenges

Despite increasing trends, there are numerous barriers to progress. Regulatory frameworks for postbiotics are presently scattered and undefined, and there is no one uniform global definition. Adapting to global health supplement regulation complicates life for industry players. Confusion between consumers on postbiotics, probiotics, and postbiotic metabolites persists.

Education to develop differentiation and trust is fundamental. Exponential costs of manufacture and production influence price and affordability. Strict quality control is a requirement given the biologically active nature of biologically derived products. Industry entry continues to be challenging for smaller competitors as they are confronted by entrenched postbiotic supplements and branded probiotic offerings. Inadequate clinical evidence of long-term safety could slow approval and product labeling in certain industries.

Expanding Applications and Opportunities

New industries are opening doors to opportunity for postbiotic innovation. Postbiotic ingredients in functional foods continue to see robust demand growth, especially for beverages and digestive wellness-focused bars. Personalized nutrition products use postbiotic peptides to deliver targeted health effects.

Postbiotic ingredients for skin health attract attention in dermatological and cosmetics uses. Animal nutrition is emerging as a spotlight segment through use of postbiotic ingredients for immune support in feed additives. Increased e-commerce platforms have expanded industries to niche consumer groups.

Natural health trends and curiosity regarding evidence-based alternatives are creating innovation. Collaborations with education and ingredient providers is increasing discovery of new uses. With more research verifying more advantages, postbiotic ingredients market trends enable global commercial growth.

Competitive Pressures and Market Risks

Probiotics and prebiotics remain omnipotent with greater consumer awareness than emerging terms like postbiotic compounds. Resistance to the latter holds the possibility of conversion delay. Mature industries are reaching industry saturation levels, with price sensitivity growing when economic headwinds hit. Disruption of supply chains from microbial strain procurement to downstream processing is fraught with danger.

Environmental concerns are also posed with respect to ingredient sustainability. Misinformation on postbiotic metabolites has the possibility to undermine trust. To remain competitive, brands need to focus on transparent labeling, science-supported benefits, and tactical marketing. Education is still essential to explaining distinctions in the microbiome supplement category. CXOs need to employ nimble, research-based tactics to gain industry share and meet changing consumer needs.

The industry includes Short-Chain Fatty Acids (SCFAs), inactivated microbial cells, cell wall fragments, and metabolites such as peptides and enzymes.

Core application areas include digestive health, immunity enhancement, skin health, and metabolic wellness across human and animal health.

Key industries served include dietary supplements, functional food & beverages, personal care products, and animal nutrition.

The industry is segmented geographically into North America, Latin America, Europe, East Asia, South Asia & Oceania, and the Middle East & Africa.

The industry is slated to reach USD 16 million in 2025.

The industry is predicted to reach a size of USD 45 million by 2035.

Key companies include Cargill, Incorporated, ADM (Archer Daniels Midland), Kerry Group plc, DuPont (IFF Health), Chr. Hansen Holding A/S, Lesaffre Group, Probi AB, BioGaia AB, Novozymes A/S, Thorne HealthTech, Sabinsa Corporation, and Lallemand Inc.

Postbiotics offer stability, safety, and proven efficacy without the viability issues seen in probiotics.

Digestive health, immunity, and skin wellness are core areas boosting demand.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Postbiotic Feed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Postbiotic Supplements Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ingredients Market for Plant-based Food & Beverages Size and Share Forecast Outlook 2025 to 2035

Overview of Key Trends Shaping Postbiotic Pet Food Industry.

UK Postbiotic Pet Food Market Growth – Trends, Demand & Innovations 2025-2035

USA Postbiotic Pet Food Market Insights – Growth & Demand 2025-2035

Pet Postbiotics Supplement Market – Trends, Demand & Pet Wellness

Bean Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Milk Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Malt Ingredients Market Analysis by Raw Material, Product Type, Grade, End-use, and Region through 2035

Aroma Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredients Market Analysis – Size, Share, and Forecast 2025 to 2035

ASEAN Postbiotic Pet Food Market Analysis – Demand, Growth & Forecast 2025-2035

Smoke Ingredients for Food Market Analysis - Size, Share & Forecast 2025 to 2035

Bakery Ingredients Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Biotin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Baking Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Almond Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Savory Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA