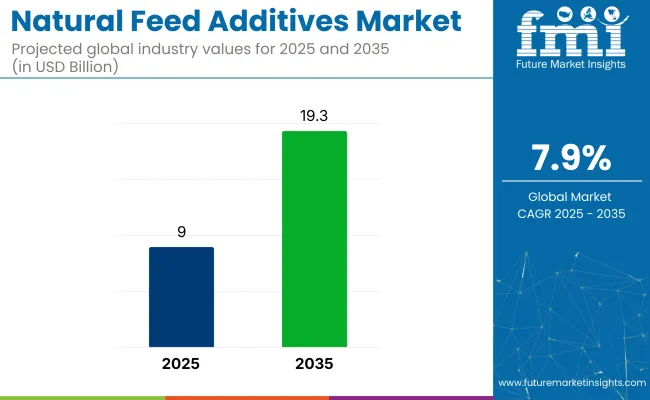

The global natural feed additives market is valued at USD 9.0 billion in 2025 and is expected to reach USD 19.3 billion by 2035, reflecting a CAGR of 7.9%. Factors driving this growth include the increasing demand for protein-rich animal products, rising consumer preference for chemical-free livestock nutrition, and the adoption of sustainable farming practices.

| Metric | Value |

|---|---|

| Estimated Size (2025) | USD 9.0 billion |

| Projected Value (2035) | USD 19.3 billion |

| CAGR (2025-2035) | 7.9% |

Furthermore, the emphasis on precision animal nutrition and functional feed additives is expected to support the market’s expansion across developing and developed economies alike.

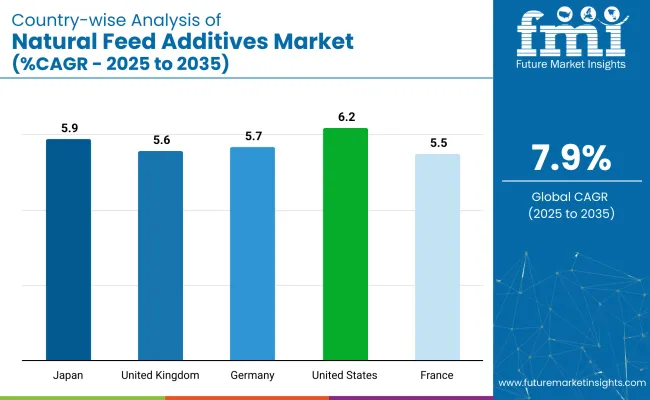

The USA is expected to remain the largest consumer in the natural feed additives market through 2035, flourishing at a CAGR of 6.2%, driven by its large-scale livestock production and high demand for premium meat and dairy. Meanwhile, Japan and Germany closely follow this rapid growth with prominent CAGRs of 5.9% and 5.7% respectively.

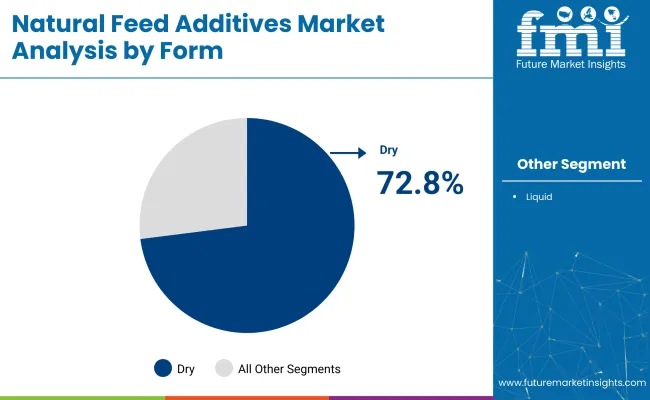

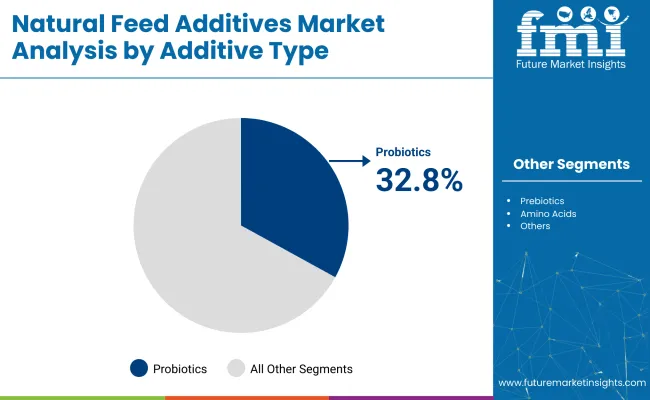

Dry form additives will retain their dominance with a 72.8% market share in 2025, while probiotics are expected to lead the additive type category due to their proven role in enhancing digestion and immunity in livestock.

The natural feed additives market holds approximately 20-25% of the broader feed additives market, reflecting the ongoing shift toward sustainable and chemical-free livestock nutrition. Within the animal feed market, it accounts for roughly 8-10%, as conventional additives still dominate in volume.

In the livestock nutrition market, natural feed additives contribute around 15%, driven by demand for species-specific, health-boosting formulations. Its share in the sustainable agriculture market is modest, estimated at 5-7%, as it represents just one input category. Overall, the market’s influence is growing steadily as regulatory pressures and consumer preferences increasingly favor natural and eco-friendly feed solutions.

The path forward is marked by increased emphasis on plant-based ingredients, functional additives, and eco-friendly solutions, including algae-based and seaweed-based formulations. Innovations in extraction technologies, precision nutrition systems, and regulatory encouragement for clean-label feed inputs are driving the market. Supportive policies aimed at reducing antibiotic use and enhancing animal welfare are expected to accelerate further product innovation and global adoption of natural feed additives across all livestock categories.

The market is segmented based on livestock, form, additive type, and region. In terms of livestock, the market is categorized into ruminant, poultry, swine, aquaculture, and pets. By form, the segmentation includes dry and liquid formulations.

The additive type segment comprises prebiotics, probiotics, vitamins & minerals, amino acids, enzymes, and others, where "others" includes organic acids, essential oils, and herbal extracts. Regionally, the market is analyzed across North America, Latin America, Western Europe, Eastern Europe, the Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Poultry is projected to remain the dominant livestock category due to its high demand in global meat and egg production. Rising health concerns and affordability of poultry protein are prompting producers to invest in advanced natural feed solutions to boost immune function, gut health, and feed efficiency in broilers and layers.

The dry form is expected to dominate the form type with 72.8% of the market share due to advantages in handling, stability, and ease of dosage. Dry additives are favored in large-scale livestock operations because they reduce the risk of spoilage and simplify storage and transportation. The longer shelf-life and consistent nutrient delivery make dry formulations ideal for commercial use across all livestock categories, particularly poultry and swine.

Probiotics are likely to be the most adopted additive type due to their multifunctional benefits, such as improved digestion, immune modulation, and reduced disease incidence. Their effectiveness in intensive livestock farming, particularly poultry and swine, has led to widespread adoption. The trend toward replacing antibiotics with natural gut-health enhancers also favors probiotics.

Recent Trends in the Natural Feed Additives Market

Key Challenges in the Natural Feed Additives Market

Among the top five countries in the natural feed additives market, the USA leads in overall market size with a CAGR of 6.2% from 2025 to 2035, driven by strong consumer demand for antibiotic-free protein. Japan follows with a CAGR of 5.9%, supported by innovation in marine-based additives and precision feeding.

Germany and the UK exhibit steady growth at 5.7% and 5.6% respectively, reflecting robust regulations and sustainability initiatives. France, with a CAGR of 5.5%, shows slightly slower but stable expansion. While the USA leads in volume, Japan shows the fastest innovation-led growth per capita within this segment.

The report covers an in-depth analysis of 40+ countries, five top-performing OECD countries are highlighted below.

The natural feed additives revenue in the USA is anticipated to grow at a CAGR of 6.2% from 2025 to 2035. The country remains one of the largest consumers of natural feed additives due to its expansive livestock industry and strong consumer demand for antibiotic-free meat, dairy, and eggs.

The sales of natural feed additives in the UK are projected to expand at a CAGR of 5.6% between 2025 and 2035. Demand is largely driven by consumer preferences for ethically sourced meat and dairy products, which has led to increased adoption of herbal and plant-based feed additives.

The natural feed additives market in Germany is slated to grow at a CAGR of 5.7% through 2035. The country’s leadership in biotechnology and sustainable agriculture positions it as a hub for innovation in feed solutions.

The revenue from natural feed additives in France is anticipated to growat a CAGR of 5.5% between 2025 and 2035. With a well-established livestock sector and heightened consumer focus on sustainable farming, France is investing in advanced feed technologies.

The natural feed additives market in Japan is forecast to expand at a CAGR of 5.9% from 2025 to 2035. With limited arable land, the country relies heavily on efficient livestock nutrition to optimize productivity.

The market is moderately consolidated, with multinational players such as Cargill, DSM-Firmenich, Evonik, BASF, and ADM commanding a significant portion of global revenue. These top-tier companies lead the industry through expansive global footprints, technological innovation, and strategic collaborations. Mid-sized players like Nutreco, Kemin Industries, and Novozymes also maintain strong regional positions by focusing on specialized additives and species-specific formulations.

Company strategies have increasingly emphasized sustainable sourcing, plant-based solutions, and post-antibiotic alternatives to meet growing consumer and regulatory demands. Leading suppliers are investing in proprietary probiotic strains, postbiotic innovation, precision nutrition platforms, and digitized feed management systems.

Firms are also restructuring operations to improve cost-efficiency amid commodity price volatility. Collaborations with agri-tech firms and biotechnology providers have accelerated the rollout of high-value feed solutions targeting specific animal health benefits and performance metrics.

Recent Natural Feed Additives Industry News

Cargill launched the NOTOX brand, including Notox AMA, a new anti-mycotoxin agent designed to protect poultry gut health and improve animal performance. This innovation was presented at the World Mycotoxin Forum in April 2025, based on research from over 400,000 global feed analyses.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 9.0 billion |

| Projected Market Size (2035) | USD 19.3 billion |

| CAGR (2025 to 2035) | 7.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions/Volume in Kilotons |

| By Livestock | Ruminant, Poultry, Swine, Aquaculture, Pets |

| By Form | Dry, Liquid |

| By Additive Type | Prebiotics, Probiotics, Vitamins & Minerals, Amino Acids, Enzymes, Others (organic acids, essential oils, herbal extracts) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Cargill, Incorporated, Archer Daniels Midland Co, DuPont de Nemours, Inc, Evonik Industries AG, Koninklijke DSM N.V., For Farmers, Pestell Nutrition, BASF, Novozymes, CHR. Hensen, Tegasa, BRF Ingredients, Nutreco, Kemin Industries, Bentoli |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

By livestock industry has been categorised into Ruminant, Poultry, Swine, Aquaculture and Pets.

Two different forms Dry and Liquid are included in the report.

Additive types like Prebiotics, Probiotics, Vitamins & Minerals, Amino Acids, Enzymes and Others are considered after an exhaustive research.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, and Oceania

The market is valued at USD 9.0 billion in 2025.

The market is expected to reach USD 19.3 billion by 2035, reflecting a CAGR of 7.9%.

Dry form additives are projected to lead with a 72.8% market share in 2025.

Probiotics are anticipated to dominate with a 32.8% share in 2025.

The USA is expected to be the fastest-growing market with a CAGR of 6.2% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Natural Antioxidant Market Size and Share Forecast Outlook 2025 to 2035

Natural Disaster Detection IoT Market Forecast Outlook 2025 to 2035

Natural Cosmetic Color Market Size and Share Forecast Outlook 2025 to 2035

Natural Food Preservatives Market Size and Share Forecast Outlook 2025 to 2035

Natural Polymer Market Size and Share Forecast Outlook 2025 to 2035

Natural Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Natural Mineral Oil Coolant Market Size and Share Forecast Outlook 2025 to 2035

Natural Synthetic Cytokinin (Anti-zeatin Riboside) Market Size and Share Forecast Outlook 2025 to 2035

Natural Food Flavors Market Size and Share Forecast Outlook 2025 to 2035

Natural Silicone Alternative Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Natural Skincare Preservatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Natural Surfactant Market Size and Share Forecast Outlook 2025 to 2035

Natural Bitterness Blockers Market Analysis - Size And Share Forecast Outlook 2025 To 2035

Naturally Fermented Food Market Size and Share Forecast Outlook 2025 to 2035

Natural Refrigerants Market Size and Share Forecast Outlook 2025 to 2035

Natural Ferulic Acid Market Size and Share Forecast Outlook 2025 to 2035

Natural Vitamin E Product Market Size and Share Forecast Outlook 2025 to 2035

Natural Oil Polyols NOP Market Size and Share Forecast Outlook 2025 to 2035

Natural Rubber Market Size and Share Forecast Outlook 2025 to 2035

Natural Language Processing in Finance Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA