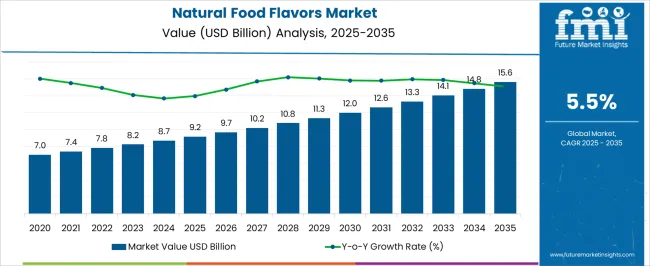

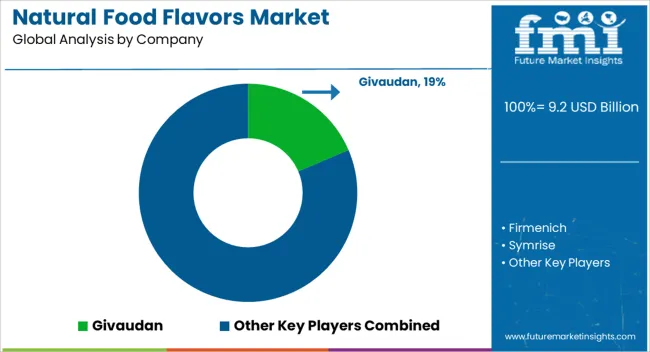

The natural food flavors market is estimated to be valued at USD 9.2 billion in 2025 and is projected to reach USD 15.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

The natural food flavors market, estimated at USD 9.2 billion in 2025 and projected to reach USD 15.6 billion by 2035 at a CAGR of 5.5%, exhibits marked regional growth disparities driven by consumer preferences, regulatory frameworks, and production capabilities. Asia-Pacific is poised to register the fastest expansion within the forecast period, fueled by rising demand for clean-label and naturally sourced flavoring agents in processed foods, beverages, and bakery applications. Cultural culinary diversity and increased industrial food production amplify the adoption of natural flavors, positioning the region as a significant contributor to global market growth.

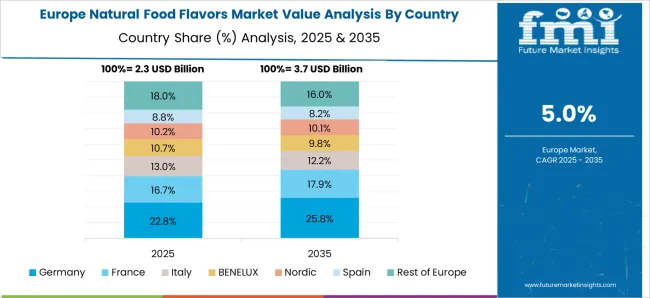

Europe demonstrates steady growth, supported by stringent food safety regulations, high consumer awareness, and established flavor manufacturing infrastructure. Regulatory standards such as the European Food Safety Authority (EFSA) guidelines ensure product quality, reinforcing consumer trust and encouraging adoption across packaged food and beverage segments. The region’s preference for premium, natural, and certified organic flavors sustains moderate yet consistent growth.

North America, while maintaining a mature market profile, shows relatively slower growth compared to Asia-Pacific due to market saturation and stable consumption patterns. The presence of large flavor manufacturers, strong distribution networks, and innovative product development in functional and health-oriented foods ensure continued relevance. The regional growth imbalance is evident, with Asia-Pacific emerging as the most dynamic region, Europe maintaining steady expansion, and North America exhibiting moderate incremental growth, collectively shaping the projected increase from USD 9.2 billion to USD 15.6 billion by 2035.

| Metric | Value |

|---|---|

| Natural Food Flavors Market Estimated Value in (2025 E) | USD 9.2 billion |

| Natural Food Flavors Market Forecast Value in (2035 F) | USD 15.6 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The natural food flavors market represents a specialized segment within the global food ingredients and flavoring industry, emphasizing taste enhancement, clean-label positioning, and consumer health preferences. Within the broader food ingredients sector, it accounts for about 5.7%, driven by demand from processed foods, beverages, and bakery products. In the flavoring agents and additives segment, it holds nearly 5.0%, reflecting adoption of plant-derived, organic, and minimally processed flavor compounds. Across the natural and functional food products market, the share is 4.3%, supporting incorporation into health-oriented and fortified products.

Within the culinary and food service ingredients category, it represents 3.9%, highlighting its role in enhancing sensory experiences in restaurants, ready-to-eat meals, and catering. In the beverage and nutritional supplements sector, it secures 3.5%, emphasizing compatibility with beverages, protein formulations, and dietary applications. Recent developments in this market have focused on extraction efficiency, flavor stability, and clean-label innovation. Innovations include natural extraction techniques such as cold-pressing, steam distillation, and enzymatic extraction to retain authentic flavor profiles.

Key players are collaborating with food manufacturers, beverage companies, and functional food brands to develop tailored flavor solutions. Adoption of encapsulation technologies, water-soluble flavors, and heat-stable compounds is gaining traction to expand application versatility. The global sourcing of exotic fruits, herbs, and spices, and formulation of allergen-free, non-GMO flavors are being deployed to meet consumer demand for natural and safe products. These trends demonstrate how quality, authenticity, and functionality are shaping the market.

The natural food flavors market is expanding steadily due to increasing consumer preference for clean label products, rising awareness about health and wellness, and regulatory support for natural ingredient usage. Manufacturers are focusing on sourcing plant based extracts and essential oils to meet growing demand for authentic taste profiles without synthetic additives.

Technological advancements in flavor extraction, encapsulation, and preservation are improving product stability and taste consistency, further enhancing market adoption. Additionally, the rise of plant forward diets, coupled with a surge in functional and fortified foods, is creating new opportunities for innovation in natural flavors.

As the food and beverage industry continues to align with sustainability goals and transparency standards, natural flavors are gaining prominence as a key differentiator in product positioning and brand loyalty.

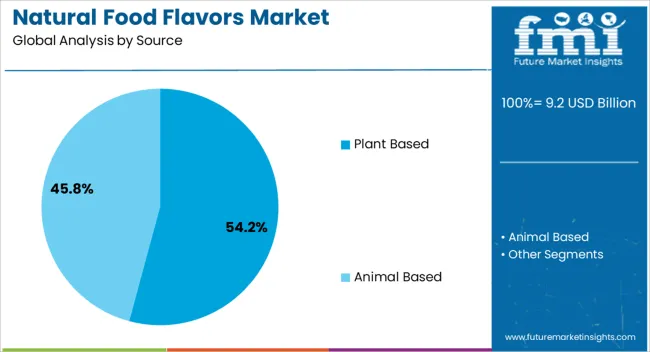

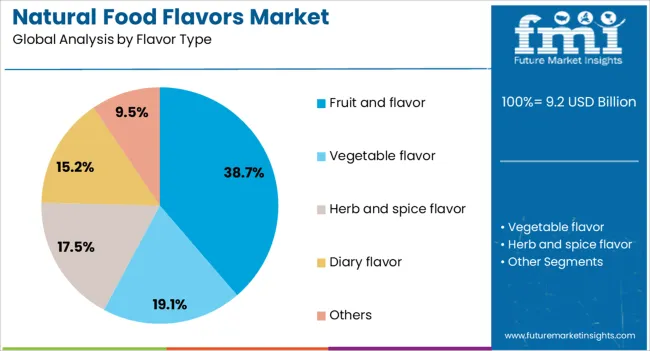

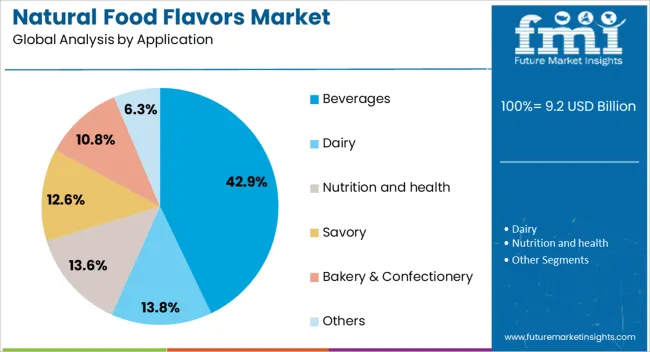

The natural food flavors market is segmented by source, flavor type, application, and geographic regions. By source, natural food flavors market is divided into plant based and animal based. In terms of flavor type, natural food flavors market is classified into fruit and flavor, vegetable flavor, herb and spice flavor, diary flavor, and others. Based on application, natural food flavors market is segmented into beverages, dairy, nutrition and health, savory, bakery & confectionery, and others. Regionally, the natural food flavors industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plant based source segment is projected to hold 54.2% of total revenue by 2025, making it the leading source category. This dominance is supported by the growing shift toward vegetarian and vegan diets, heightened interest in botanical extracts, and the increasing availability of advanced extraction technologies.

Consumers perceive plant based flavors as healthier and more environmentally friendly, prompting food producers to reformulate products with such ingredients.

The versatility of plant derived flavors across diverse product categories has further boosted adoption, solidifying their leadership position in the source segment.

The fruit and flavor segment is expected to account for 38.7% of total market revenue by 2025, positioning it as the most significant flavor type. This growth is driven by consumer preference for familiar, refreshing, and naturally sweet taste profiles, which enhance both indulgence and perceived health benefits.

Fruits offer a broad spectrum of flavor notes that can be adapted for multiple applications, from beverages to confectionery.

Continuous innovation in natural fruit essence extraction has maintained flavor integrity while reducing sugar dependency, thereby increasing their relevance in health oriented product lines.

The beverages application segment is projected to contribute 42.9% of total market revenue by 2025, making it the dominant application area. Demand is being fueled by the surge in flavored water, functional drinks, and ready to drink teas that utilize natural flavors for differentiation.

Manufacturers are leveraging these flavors to cater to consumer demand for refreshing, low calorie, and nutrient enriched beverages.

The ability of natural flavors to provide authenticity and complexity in taste without artificial additives has reinforced their leadership in the beverages application segment.

The market has been experiencing robust growth due to rising consumer preference for clean label and naturally sourced ingredients. These flavors are widely used in beverages, dairy products, baked goods, confectionery, and savory snacks to enhance taste and aroma while reducing reliance on synthetic additives. Growth has been driven by increasing health awareness, regulatory encouragement for natural ingredients, and expansion of the global food and beverage industry. Manufacturers have been investing in research to develop stable, high-intensity natural flavors that can withstand processing conditions.

Consumer demand for natural, minimally processed, and chemical-free food products has been a primary driver for the natural food flavors market. People are increasingly avoiding artificial additives, leading food manufacturers to reformulate products with plant-derived, fruit-based, and botanical flavor extracts. This trend has been particularly pronounced in beverages, dairy, and confectionery, where taste and sensory experience are critical. Transparency in labeling and health claims has further strengthened the shift toward natural ingredients. Flavor manufacturers have responded by developing concentrated extracts, encapsulated powders, and blends that maintain stability and consistency, enabling food companies to meet evolving consumer expectations while preserving product quality.

Technological innovations have enhanced the quality, stability, and versatility of natural food flavors. Advanced extraction techniques such as supercritical CO2, cold-press, and enzymatic methods have allowed the preservation of volatile compounds and bioactive components. Encapsulation technologies have improved shelf life and controlled release of flavors during processing. High-performance analytical tools and chromatography techniques have enabled accurate profiling and quality assurance of natural extracts. These advancements have allowed manufacturers to expand applications across various food and beverage segments, providing consistent flavor intensity even under extreme heat, pH variations, or storage conditions. As a result, product appeal and consumer satisfaction have been significantly enhanced.

The natural food flavors market has benefited from increasing applications across diverse food and beverage categories. Bakery products, confectionery, dairy, beverages, sauces, and ready-to-eat meals have increasingly incorporated natural flavor extracts to meet consumer demand. Plant-based and functional foods have emerged as a key segment requiring flavors that complement taste without compromising nutritional value. Beverage producers have adopted natural fruit, herb, and spice flavors to diversify product portfolios and meet clean label trends. The growing adoption of organic, vegan, and health-oriented products has further broadened the application scope, creating new market opportunities for flavor manufacturers and ingredient suppliers.

Despite strong growth, the market faces challenges related to cost and supply chain stability. Natural flavor extracts are often more expensive than synthetic alternatives due to raw material availability, seasonal variations, and complex extraction processes. Geographic concentration of key crops and environmental factors can lead to supply volatility. The maintaining consistent quality and stability across batches requires advanced processing and quality control measures. These challenges may hinder adoption, particularly among small and mid-sized food manufacturers. Strategic sourcing, investment in alternative raw materials, and development of scalable extraction technologies are considered essential to address these limitations and ensure broader market penetration.

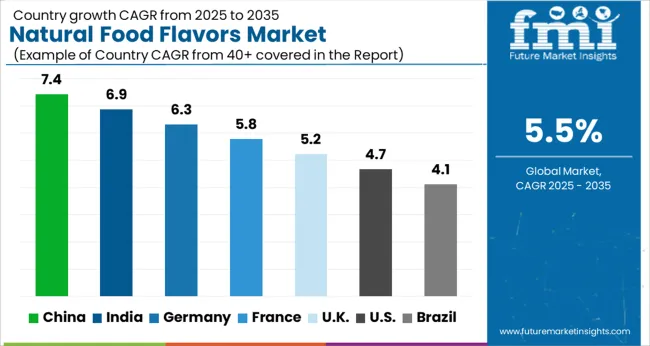

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The market is projected to grow at a CAGR of 5.5% from 2025 to 2035, driven by increasing demand in processed foods, beverages, and culinary applications. Germany recorded 6.3%, supported by adoption of clean-label and natural flavor solutions in food manufacturing. China reached 7.4%, reflecting growth in the food and beverage sector and rising consumer preference for natural ingredients. India achieved 6.9%, where expansion in packaged foods and functional beverages contributed to market development. The United Kingdom posted 5.2%, driven by research and deployment of natural flavor formulations. The United States reached 4.7%, supported by innovation in flavor extraction and incorporation in processed foods. Together, these countries highlight global trends in production, deployment, and innovation of natural food flavors. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expected to grow at a CAGR of 7.4%, driven by increasing demand for clean label foods, bakery, and beverage products. Adoption has been reinforced by domestic manufacturers producing natural extracts, essential oils, and flavor compounds to meet consumer preference for healthy and authentic taste profiles. Imports of high purity international flavors supplement domestic offerings. Growth is further strengthened by the rise of food processing industries and expanding organized retail distribution channels.

India is projected to expand at a CAGR of 6.9%, supported by rising processed food production and preference for natural ingredients in snacks, beverages, and confectionery. Domestic manufacturers focus on cost effective natural extracts and essential oils, while international flavors are imported to meet high end applications. Increasing health awareness and regulatory support for natural ingredients further drives adoption across retail and food service channels.

Germany is expected to grow at a CAGR of 6.3%, driven by consumer preference for natural and clean label foods, including dairy, beverages, and confectionery. Adoption has been reinforced by stringent regulations on artificial additives and focus on high quality flavor solutions. Domestic manufacturers emphasize innovation, R&D, and high purity natural extracts. Imports from other European countries supplement specialized flavors required by premium food producers.

The United Kingdom market is projected to grow at a CAGR of 5.2%, supported by increasing demand for bakery, beverages, and snack products with natural flavoring. Imports dominate the supply of premium and specialty flavors, while domestic manufacturers supply mid tier applications. Growth is reinforced by consumer trends favoring clean label and health oriented products.

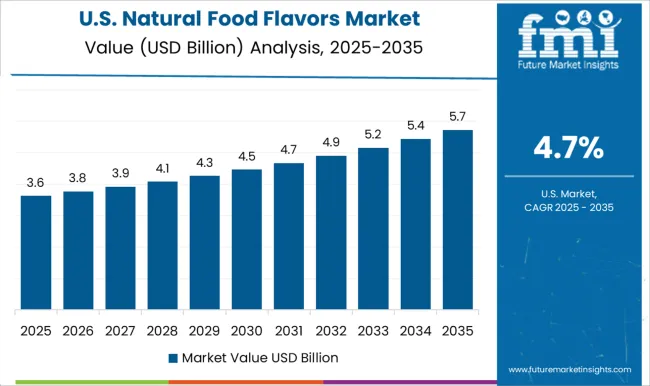

The United States is anticipated to grow at a CAGR of 4.7%, driven by strong adoption of clean label foods, beverages, and processed products. Domestic manufacturers focus on high quality natural extracts and organic flavor solutions, while imports supplement specialty and exotic flavors. Rising awareness of healthy ingredients and regulatory compliance continues to support steady adoption across food service and retail channels.

The market is dominated by a mix of global flavor houses, ingredient suppliers, and specialty manufacturers that provide natural extracts, essential oils, and flavor compounds for food and beverage applications. Givaudan, Firmenich, and Symrise lead the industry through extensive R&D capabilities, strong customer relationships, and diversified product portfolios that cover beverages, dairy, confectionery, and savory segments. International Flavors & Fragrances (IFF) combines technology-driven innovation with strategic acquisitions to expand its natural flavor offerings, focusing on clean-label and sustainable solutions.

Kerry Group and Archer Daniels Midland (ADM) leverage their strong supply chains and agricultural expertise to provide scalable natural flavor ingredients for global food manufacturers. BASF and Sensient Technologies offer functional and sensory-enhancing natural solutions, addressing evolving consumer preferences for organic, plant-based, and health-conscious products. Smaller players such as Takasago, Huabao International, Robertet SA, and MANE SA focus on niche, high-value flavor profiles and region-specific specialties, providing customization and flexibility to clients. Market competitiveness is increasingly shaped by innovation in natural extraction technologies, clean-label compliance, and the ability to provide sustainable and traceable flavor solutions while meeting stringent regulatory standards worldwide.

| Items | Values |

|---|---|

| Quantitative Units | USD 9.2 billion |

| Source | Plant Based and Animal Based |

| Flavor Type | Fruit and flavor, Vegetable flavor, Herb and spice flavor, Diary flavor, and Others |

| Application | Beverages, Dairy, Nutrition and health, Savory, Bakery & Confectionery, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Givaudan, Firmenich, Symrise, International Flavors & Fragrances (IFF), Kerry Group, Archer Daniels Midland (ADM), BASF, Sensient Technologies, Takasago International Corporation, Huabao International Holdings Limited, Robertet SA, and MANE SA |

| Additional Attributes | Dollar sales by flavor type and application, demand dynamics across food, beverage, and confectionery sectors, regional trends in clean-label and natural ingredient adoption, innovation in extraction methods, flavor stability, and formulation versatility, environmental impact of sourcing and processing, and emerging use cases in plant-based products, functional foods, and premium culinary applications. |

The global natural food flavors market is estimated to be valued at USD 9.2 billion in 2025.

The market size for the natural food flavors market is projected to reach USD 15.6 billion by 2035.

The natural food flavors market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in natural food flavors market are plant based and animal based.

In terms of flavor type, fruit and flavor segment to command 38.7% share in the natural food flavors market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Natural Antioxidant Market Size and Share Forecast Outlook 2025 to 2035

Natural Disaster Detection IoT Market Forecast Outlook 2025 to 2035

Natural Cosmetic Color Market Size and Share Forecast Outlook 2025 to 2035

Natural Polymer Market Size and Share Forecast Outlook 2025 to 2035

Natural Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Natural Mineral Oil Coolant Market Size and Share Forecast Outlook 2025 to 2035

Natural Synthetic Cytokinin (Anti-zeatin Riboside) Market Size and Share Forecast Outlook 2025 to 2035

Natural Silicone Alternative Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Natural Skincare Preservatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Natural Surfactant Market Size and Share Forecast Outlook 2025 to 2035

Natural Bitterness Blockers Market Analysis - Size And Share Forecast Outlook 2025 To 2035

Natural Refrigerants Market Size and Share Forecast Outlook 2025 to 2035

Natural Ferulic Acid Market Size and Share Forecast Outlook 2025 to 2035

Natural Vitamin E Product Market Size and Share Forecast Outlook 2025 to 2035

Natural Oil Polyols NOP Market Size and Share Forecast Outlook 2025 to 2035

Natural Rubber Market Size and Share Forecast Outlook 2025 to 2035

Natural Language Processing in Finance Market Size and Share Forecast Outlook 2025 to 2035

Naturally Derived Fatty Alcohol Market Size and Share Forecast Outlook 2025 to 2035

Natural Fiber Composites Market Size and Share Forecast Outlook 2025 to 2035

Naturally Derived Sweeteners Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA