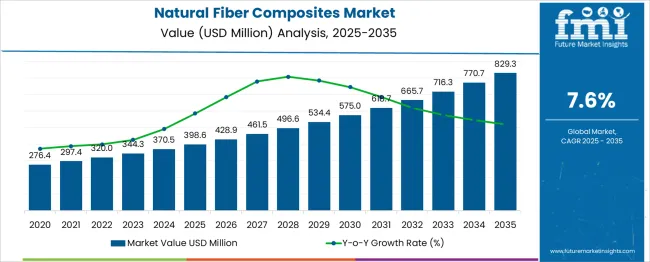

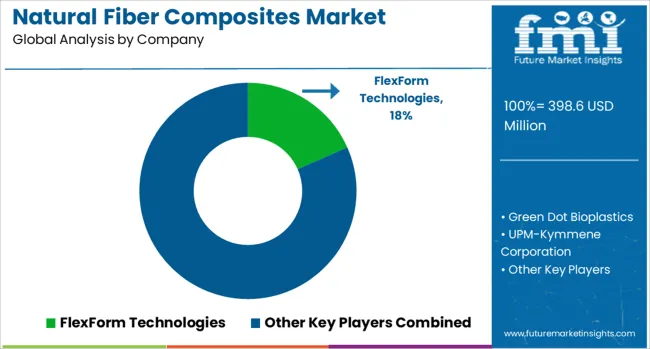

The Natural Fiber Composites Market is estimated to be valued at USD 398.6 million in 2025 and is projected to reach USD 829.3 million by 2035, registering a compound annual growth rate (CAGR) of 7.6% over the forecast period.

| Metric | Value |

|---|---|

| Natural Fiber Composites Market Estimated Value in (2025 E) | USD 398.6 million |

| Natural Fiber Composites Market Forecast Value in (2035 F) | USD 829.3 million |

| Forecast CAGR (2025 to 2035) | 7.6% |

Increasing environmental awareness, coupled with stringent regulations on synthetic composites and carbon emissions, has accelerated the shift toward natural alternatives. These composites offer a favorable strength-to-weight ratio, reduced environmental impact, and cost-effective processing, making them attractive for automotive, construction, and consumer goods applications. Innovations in fiber treatment and matrix compatibility have improved durability, moisture resistance, and mechanical performance, enabling broader acceptance.

Future growth is expected to be reinforced by increased R&D in hybrid composite structures and the integration of automation in composite manufacturing. As global manufacturers adopt circular economy models and prioritize bio-based materials, natural fiber composites are poised to play a critical role in sustainable product engineering.

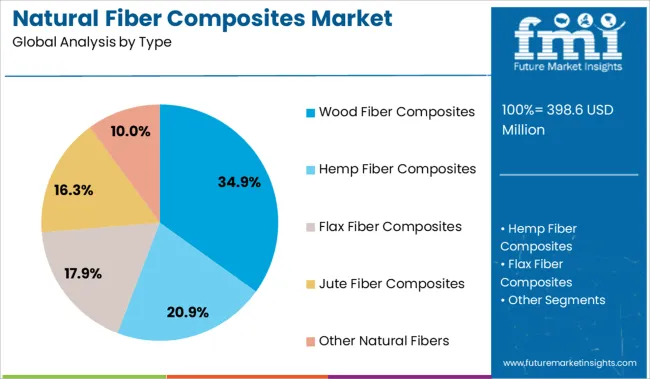

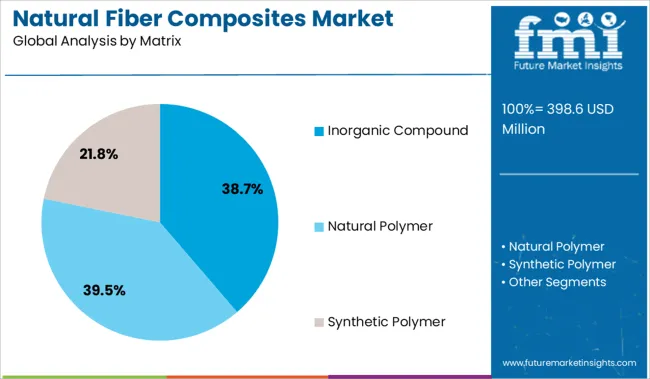

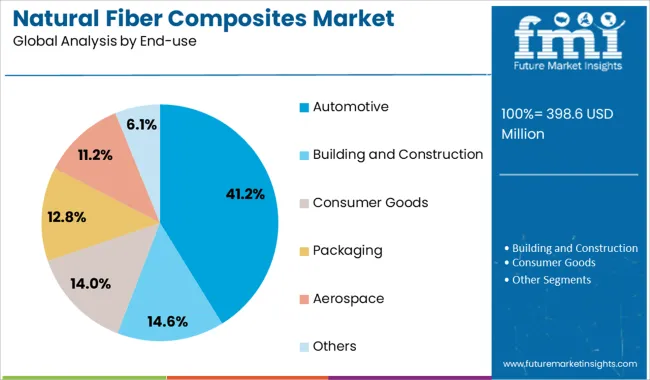

The natural fiber composites market is segmented by type, matrix, and end-use and geographic regions. The natural fiber composites market is divided by type into Wood Fiber Composites, Hemp Fiber Composites, Flax Fiber Composites, Jute Fiber Composites, and Other Natural Fibers. In terms of the matrix, the natural fiber composites market is classified into Inorganic Compound, Natural Polymer, and Synthetic Polymer. The natural fiber composites market is segmented based on end-use into Automotive, Building and Construction, Consumer Goods, Packaging, Aerospace, and Others. Regionally, the natural fiber composites industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The wood fiber composites segment leads the type category with a 34.9% market share, reflecting its dominance as the most widely used natural fiber composite. Known for their cost-effectiveness, availability, and aesthetic appeal, wood fiber composites are extensively used in construction, automotive, and consumer product applications.

Their compatibility with both thermoplastic and thermoset resins enhances their versatility in molding and structural design. The segment’s growth is further supported by rising demand for recyclable, low-emission materials and increased preference for wood-polymer composites in decking, paneling, and furniture.

Technological advancements have enabled improved mechanical strength, weather resistance, and dimensional stability, strengthening their market presence. As industries seek eco-friendly alternatives to conventional materials, wood fiber composites are expected to maintain strong momentum, supported by global trends toward bio-based innovation and resource conservation.

The inorganic compound segment holds a leading 38.7% share within the matrix category, driven by its ability to enhance thermal stability, fire resistance, and structural integrity of natural fiber composites. These matrices are particularly suited for high-performance applications where conventional organic matrices may underperform under extreme conditions.

Inorganic matrices such as cement and ceramic-based compounds are widely adopted in construction, infrastructure, and heavy-duty automotive parts, offering longevity and resistance to environmental degradation. The segment benefits from increased research into hybrid composites that combine bio-based fibers with inorganic matrices for superior load-bearing and thermal insulation properties.

As building codes and safety standards grow more stringent, the demand for durable and fire-resistant materials continues to support this segment’s expansion. The use of inorganic matrices is expected to remain prevalent, especially in sectors requiring enhanced durability and compliance with safety regulations.

The automotive segment dominates the end-use category with a 41.2% market share, highlighting the sector’s growing reliance on natural fiber composites for lightweighting and sustainability goals. Automakers are increasingly incorporating these materials into interior panels, dashboards, seat backs, and trunk liners to reduce vehicle weight and improve fuel efficiency.

The shift toward electric and hybrid vehicles has further amplified demand for materials that contribute to lower emissions and enhanced energy performance. Natural fiber composites offer vibration damping, biodegradability, and ease of processing, aligning well with the automotive industry’s design and environmental objectives.

Regulatory mandates on recyclability and carbon footprint reduction are prompting OEMs to adopt bio-based materials across their supply chains. As the global automotive industry pivots toward greener technologies, natural fiber composites are expected to gain greater traction, supported by advancements in fiber treatment, molding techniques, and supply chain scalability.

Natural fiber composites are increasingly adopted in automotive and construction for lightweight, durable components that support cost and emission goals. Their role in consumer goods and electronics is expanding due to aesthetic appeal, strength-to-weight benefits, and compatibility with advanced molding processes.

The use of natural fiber composites has been driven by their lightweight characteristics and mechanical strength, which have been preferred in automotive and construction sectors for structural components and interior panels. Manufacturers have integrated natural fibers into thermoset and thermoplastic matrices to enhance performance while reducing dependency on synthetic materials. Government regulations favoring reduced emissions have influenced automakers to replace heavier metal components with fiber-reinforced composites. In construction, natural fiber composites have been selected for panels, decking, and insulation due to their durability and cost-efficiency. Increased awareness regarding material safety and low processing energy has encouraged wider adoption across industrial applications where design flexibility and weight reduction remain critical requirements

Natural fiber composites have found growing applications in consumer goods, electronics, and sports equipment owing to their favorable strength-to-weight ratio and eco-friendly profile. Brands have adopted these composites for products such as furniture, cases, and accessories where aesthetic appeal and functional resilience are demanded. Enhanced compatibility with polymer blends and advanced molding techniques has allowed manufacturers to produce complex shapes and finishes suitable for premium segments. Electronics companies have incorporated these materials in casings and enclosures, emphasizing performance along with lightweight construction. Growing demand for renewable resources and cost optimization strategies within manufacturing operations has further accelerated the integration of natural fiber composites in diversified consumer-centric applications.

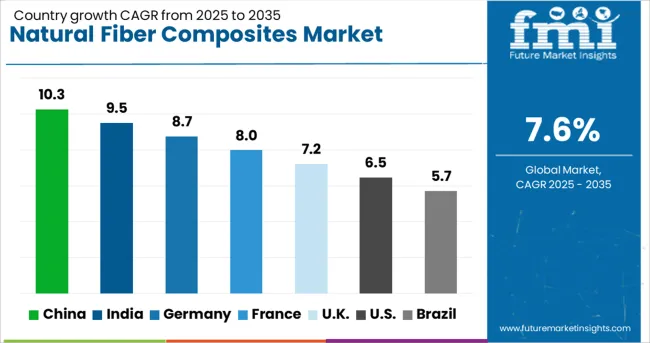

| Country | CAGR |

|---|---|

| China | 10.3% |

| India | 9.5% |

| Germany | 8.7% |

| France | 8.0% |

| UK | 7.2% |

| USA | 6.5% |

| Brazil | 5.7% |

The natural fiber composites market, expected to grow at a global CAGR of 7.6% from 2025 to 2035, is experiencing strong growth momentum across major economies. China leads with a CAGR of 10.3%, driven by automotive light weighting programs, large-scale construction activity, and rising consumer preference for eco-friendly materials. India follows at 9.5%, supported by government-backed housing initiatives, automotive component manufacturing, and increasing application in furniture and consumer goods. Germany posts 8.7%, benefiting from advanced material engineering, EU circular economy goals, and integration of natural fiber composites in premium automotive and industrial sectors. The UK records 7.2%, with growth influenced by demand for sustainable building materials and marine applications, though moderated by high processing costs. The USA shows a CAGR of 6.5%, supported by innovation in bio composite technologies and strong adoption in niche automotive and aerospace sectors. BRICS economies are driving scale-oriented adoption of low-cost solutions, while OECD markets emphasize product innovation, recyclability, and advanced processing technologies. The report includes comprehensive insights across 40+ countries, with the five fastest-growing markets highlighted as reference points.

The UK market for natural fiber composites recorded a CAGR of 6.2% during 2020-2024, driven by limited adoption in core automotive and construction applications due to higher costs and slower R&D integration. Demand during this period was primarily supported by niche sustainability-driven policies and select OEM collaborations, which kept volume growth restrained. From 2025-2035, CAGR rises to 7.2%, closely with the global trajectory of 7.6%, supported by stricter carbon compliance frameworks and mandates on recycled materials in structural components. Increased government procurement for eco-friendly infrastructure projects and rapid incorporation in decking and insulation panels boosted demand. Major automotive brands prioritized lightweight interiors using hemp and flax-based composites. The CAGR will shift broader industry adoption due to improved mechanical properties and reduced processing costs.

The Chinese market registered a CAGR of 8.5% from 2020–2024, propelled by initial applications in automotive and basic construction uses. The period saw provincial mandates for low-weight vehicles and expansion in domestic composite manufacturing hubs in Jiangsu and Shandong. By 2025-2035, CAGR escalates to 10.3%, outpacing the global average, supported by accelerated demand from electric vehicle platforms, large-scale public infrastructure projects, and government-backed raw material sourcing initiatives. The transition also includes strategic investments in flax, jute, and kenaf fiber supply chains, improving material availability for domestic OEMs. Enhanced process automation in composite molding further supported cost optimization, leading to expanded adoption in automotive interiors and lightweight consumer goods.

India recorded a CAGR of 8.1% during 2020-2024, supported by limited yet growing usage of composites in small-scale construction, furniture, and low-end automotive interiors. High dependency on imports and a lack of domestic fiber processing capacity restricted broader adoption. The CAGR accelerates to 9.5% for 2025–2035, supported by increased manufacturing localization, government-led eco-material promotion schemes, and expanding demand from two-wheeler and passenger vehicle interiors. Growth has also been influenced by new composite molding facilities in Gujarat and Maharashtra, improving domestic cost competitiveness. Public infrastructure projects, including bridges and rural housing schemes, have integrated fiber-reinforced boards and panels to enhance durability while maintaining cost advantages.

Germany posted a CAGR of 7.1% between 2020–2024, influenced by selective adoption in premium automotive segments and controlled penetration in construction markets. Limited resin-fiber compatibility and high unit costs slowed early-stage deployment. In 2025–2035, CAGR rises to 8.7%, driven by advancements in polymer compatibility and OEM-level mandates to reduce vehicle weight for emission compliance. The industrial sector also embraced composites for structural panels and insulation boards in response to stricter EU directives on material sustainability. Improved processing efficiency and a strong supply chain for hemp and flax reinforced Germany’s position as a key European market for high-performance composite components.

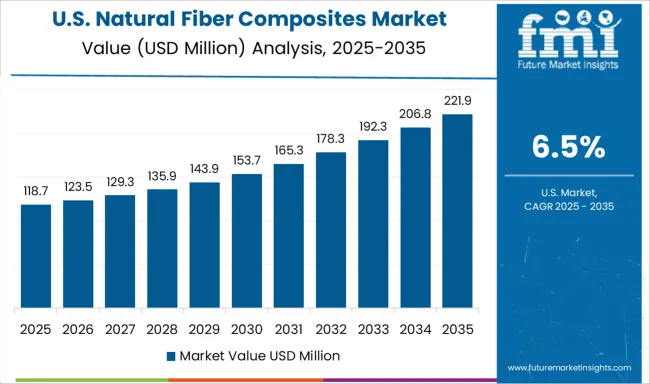

The USA market achieved a CAGR of 5.8% during 2020–2024, limited by inconsistent regulatory mandates and higher material costs compared to synthetic composites. Adoption was mostly concentrated in premium automotive interiors and small-scale residential decking projects. For 2025-2035, CAGR moves up to 6.5%, supported by improved manufacturing capabilities, tax incentives for low-carbon materials, and partnerships between automotive OEMs and composite producers for lightweighting initiatives. Expansion into sports equipment, furniture, and select industrial panels further improved market visibility. Cost competitiveness gained momentum with large-scale fiber processing hubs and increased jute and hemp imports from Latin America, enabling broader downstream application development.

In the natural fiber composites sector, prominent manufacturers are focusing on material performance optimization and expanded application in automotive, construction, and consumer goods industries. Companies like FlexForm Technologies and Green Dot Bioplastics are emphasizing plant-based fiber integration with thermoplastic and thermoset matrices for lightweight structural components. UPM-Kymmene Corporation and Trex Company have prioritized decking and building products using natural fiber blends to replace conventional wood-polymer systems, ensuring cost efficiency and durability in high-load environments. Fiberon LLC and Fiberon Composites have expanded product portfolios in outdoor decking and railing systems, supported by advancements in weather-resistant fiber formulations. GreenCore Composites and Tecnaro GmbH specialize in biopolymer-based compounds, offering enhanced molding capabilities for automotive and furniture components. Procotex Corporation SA remains a key supplier of processed natural fibers, ensuring consistency in fiber quality for downstream manufacturers across multiple industrial segments.

In August 2024, Green Dot Bioplastics launched a new “frac melt compostable bioplastic” resin tailored for extrusion and thermoforming applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 398.6 Million |

| Type | Wood Fiber Composites, Hemp Fiber Composites, Flax Fiber Composites, Jute Fiber Composites, and Other Natural Fibers |

| Matrix | Inorganic Compound, Natural Polymer, and Synthetic Polymer |

| End-use | Automotive, Building and Construction, Consumer Goods, Packaging, Aerospace, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | FlexForm Technologies, Green Dot Bioplastics, UPM-Kymmene Corporation, Trex Company, Fiberon LLC, Fiberon Composites, GreenCore Composites, Tecnaro GmbH, and Procotex Corporation SA |

| Additional Attributes | Dollar sales, share by application segments, raw material sourcing trends, cost competitiveness, regional demand shifts, OEM partnerships, pricing benchmarks, regulatory standards, and growth projections for automotive, construction, and consumer goods sectors. |

The global natural fiber composites market is estimated to be valued at USD 398.6 million in 2025.

The market size for the natural fiber composites market is projected to reach USD 829.3 million by 2035.

The natural fiber composites market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in natural fiber composites market are wood fiber composites, hemp fiber composites, flax fiber composites, jute fiber composites and other natural fibers.

In terms of matrix, inorganic compound segment to command 38.7% share in the natural fiber composites market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Natural Antioxidant Market Size and Share Forecast Outlook 2025 to 2035

Natural Disaster Detection IoT Market Forecast Outlook 2025 to 2035

Natural Cosmetic Color Market Size and Share Forecast Outlook 2025 to 2035

Natural Food Preservatives Market Size and Share Forecast Outlook 2025 to 2035

Natural Polymer Market Size and Share Forecast Outlook 2025 to 2035

Natural Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Natural Mineral Oil Coolant Market Size and Share Forecast Outlook 2025 to 2035

Natural Synthetic Cytokinin (Anti-zeatin Riboside) Market Size and Share Forecast Outlook 2025 to 2035

Natural Food Flavors Market Size and Share Forecast Outlook 2025 to 2035

Natural Silicone Alternative Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Natural Skincare Preservatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Natural Surfactant Market Size and Share Forecast Outlook 2025 to 2035

Natural Bitterness Blockers Market Analysis - Size And Share Forecast Outlook 2025 To 2035

Naturally Fermented Food Market Size and Share Forecast Outlook 2025 to 2035

Natural Refrigerants Market Size and Share Forecast Outlook 2025 to 2035

Natural Ferulic Acid Market Size and Share Forecast Outlook 2025 to 2035

Natural Vitamin E Product Market Size and Share Forecast Outlook 2025 to 2035

Natural Oil Polyols NOP Market Size and Share Forecast Outlook 2025 to 2035

Natural Rubber Market Size and Share Forecast Outlook 2025 to 2035

Natural Language Processing in Finance Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA