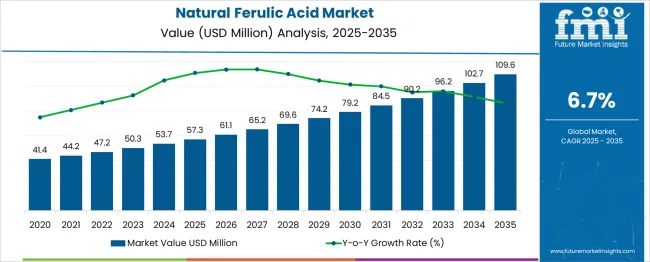

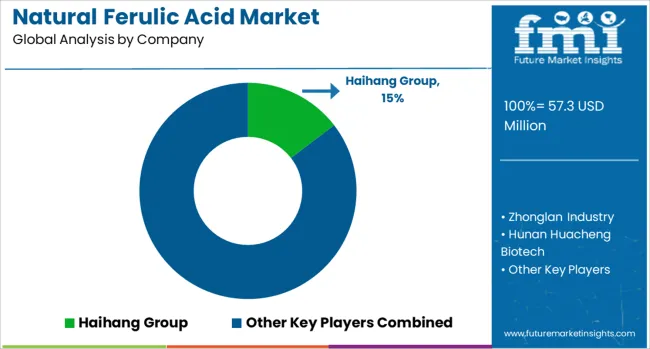

The Natural Ferulic Acid Market is estimated to be valued at USD 57.3 million in 2025 and is projected to reach USD 109.6 million by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period. The first breakpoint in the market occurs around 2024, where growth transitions from steady adoption to accelerated demand. During this period, an absolute dollar opportunity arises from increasing utilization in cosmetics, nutraceuticals, and functional foods, driven by rising consumer preference for natural antioxidants. Between 2020 and 2024, incremental revenue accumulation highlights gradual market education, regulatory support, and initial commercial-scale adoption, setting a strong foundation for subsequent growth. The second critical breakpoint emerges between 2030 and 2035, as the market approaches USD 109.6 million. This stage reflects broad market acceptance and heightened application across diverse end-use industries. The absolute dollar opportunity during this phase is substantial, estimated at over USD 25 million, driven by innovation in extraction techniques, formulation development, and penetration into emerging markets. Companies investing strategically in R&D, production efficiency, and distribution expansion are well-positioned to maximize returns. Overall, the breakpoints illustrate the market’s evolution from niche adoption to mainstream integration, highlighting periods of high growth and investment potential for stakeholders.

| Metric | Value |

|---|---|

| Natural Ferulic Acid Market Estimated Value in (2025 E) | USD 57.3 million |

| Natural Ferulic Acid Market Forecast Value in (2035 F) | USD 109.6 million |

| Forecast CAGR (2025 to 2035) | 6.7% |

The natural ferulic acid market is witnessing sustained growth, driven by increasing consumer preference for plant-derived, antioxidant-rich ingredients used in cosmetics, nutraceuticals, and dermatological formulations. Derived primarily from rice bran, corn, and other lignocellulosic biomass, natural ferulic acid is being recognized for its UV-stabilizing, anti-inflammatory, and free-radical neutralizing properties. These characteristics have positioned it as a functional compound in anti-aging skincare products and sun protection solutions.

Stringent regulations across Europe and North America favoring natural over synthetic ingredients, along with rising awareness of ingredient transparency, have further supported the market's expansion. Biotechnological advancements enabling eco-efficient extraction and purification methods have improved yield and purity consistency, making commercial production more scalable.

As global cosmetics and wellness brands intensify their focus on sustainability and active ingredient efficacy, natural ferulic acid is emerging as a preferred compound in premium formulations. The market outlook remains positive with anticipated growth across both developed and emerging economies, driven by clean beauty trends and innovations in biobased ingredient sourcing.

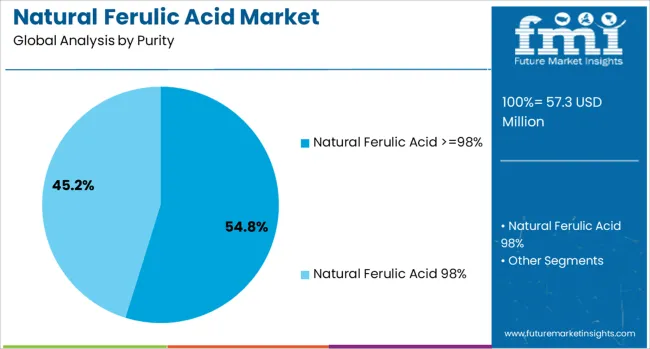

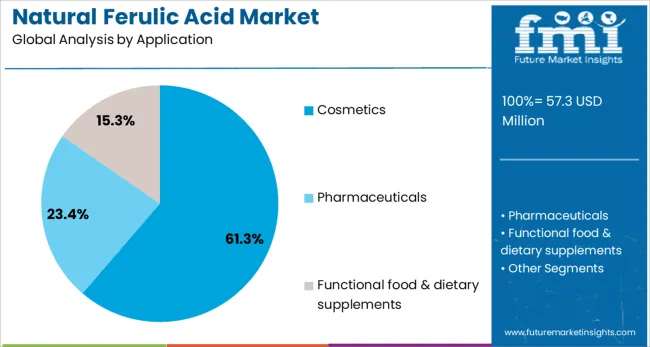

The natural ferulic acid market is segmented by purity, application, and geographic regions. By purity, the natural ferulic acid market is divided into Natural Ferulic Acid >= 98% and Natural Ferulic Acid 98%. In terms of application, the natural ferulic acid market is classified into Cosmetics, Pharmaceuticals, Functional food & dietary supplements. Regionally, the natural ferulic acid industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The purity grade of natural ferulic acid equal to or greater than 98% is projected to hold 54.8% of the market share in 2025, reflecting its position as the most in-demand grade in commercial formulations. The dominance of this subsegment is supported by the compound’s high efficacy at elevated purity levels, which enhances its performance in antioxidant activity and photostability.

This purity standard has become a benchmark for formulators seeking consistent and effective incorporation in high-end skincare and cosmeceutical products. Regulatory expectations around ingredient safety and performance have driven manufacturers to focus on sourcing and producing ≥98% pure ferulic acid, which minimizes contaminants and supports superior shelf stability.

Moreover, biotech-enabled purification processes and green extraction methods have made this grade more accessible to global producers. Its compatibility with other bioactive compounds like vitamins C and E has further encouraged its inclusion in anti-aging and photoprotective product ranges, reinforcing its commercial viability across the skincare industry.

The cosmetics application segment is anticipated to contribute 61.3% of the total revenue share in the natural ferulic acid market by 2025, making it the most prominent end-use category. This leadership is attributed to the compound’s growing utilization in skin-brightening, anti-aging, and sun-protective formulations due to its proven antioxidant and photostabilizing properties.

Demand has been propelled by consumer shifts toward natural and functional beauty solutions, prompting formulators to incorporate bioactives like ferulic acid into serums, creams, and lotions. Its ability to enhance the stability and efficacy of other active ingredients has made it a cornerstone in premium cosmetic lines targeting oxidative stress and environmental damage.

Additionally, the clean-label movement and regulatory scrutiny over synthetic additives have reinforced the preference for naturally sourced ferulic acid. The global expansion of the personal care industry, combined with digital marketing of science-backed beauty products, has further intensified the demand for high-performance natural antioxidants, positioning ferulic acid as a central component in innovative cosmetic solutions.

The natural ferulic acid market is expanding as consumer preference shifts toward plant-based ingredients with antioxidant and skin-protective properties. Derived primarily from rice bran, wheat, and corn, ferulic acid finds applications in dietary supplements, cosmetics, and pharmaceuticals. Growing awareness of anti-aging, UV protection, and oxidative stress reduction drives demand across global markets. North America and Europe lead due to high consumer awareness and established wellness industries, while Asia-Pacific shows rapid adoption driven by rising disposable income and natural personal care trends. Innovations such as stabilized formulations, enhanced bioavailability, and multifunctional product integration support premium product positioning and market growth.

Natural ferulic acid is widely incorporated in skin care, anti-aging products, and dietary supplements due to its potent antioxidant properties. It protects cells from free radical damage, reduces visible signs of aging, and enhances the efficacy of vitamins C and E in cosmetic formulations. In dietary supplements, it supports cardiovascular and neurological health, appealing to health-conscious consumers. Rising consumer preference for clean-label, plant-derived ingredients is driving the inclusion of ferulic acid in premium personal care and wellness products. North America and Europe are key markets due to mature cosmetic industries, while Asia-Pacific adoption grows with urbanization and increased health awareness. Manufacturers are exploring innovative delivery systems, such as nanoemulsions and encapsulation, to improve stability and skin penetration, further boosting product performance and market adoption.

Advances in extraction methods and formulation techniques are shaping the market for natural ferulic acid. Optimized solvent extraction, enzymatic hydrolysis, and biotechnological approaches enhance yield and purity from plant sources. Stabilization techniques improve shelf life and compatibility with cosmetic and nutraceutical formulations. Manufacturers focus on combining ferulic acid with other antioxidants or bioactive compounds to create multifunctional products. Encapsulation and nano-delivery systems increase bioavailability and effectiveness in skin care and dietary applications. Collaborations with research institutions support validation of health benefits and regulatory compliance. Product differentiation through high-purity, standardized extracts provides a competitive edge. Continued innovation in extraction and formulation ensures consistent quality, efficacy, and broader applicability across cosmetics, supplements, and pharmaceutical segments.

The natural ferulic acid market is witnessing growth across North America, Europe, and Asia-Pacific. North America and Europe dominate due to established wellness and personal care industries, high consumer awareness, and regulatory support for plant-based ingredients. Asia-Pacific is emerging as a high-growth region, driven by increasing disposable income, rising urban populations, and preference for natural cosmetic and dietary products. Market players focus on region-specific product customization, education campaigns, and partnerships with distributors and research institutions to strengthen adoption. Local sourcing of plant materials, such as rice bran and wheat, supports regional supply chains. Regional growth is shaped by consumer demand, regulatory frameworks, and product innovation, ensuring wider market penetration and sustained adoption of natural ferulic acid globally.

Natural ferulic acid offers operational benefits to manufacturers by enabling premium product differentiation and higher value formulations. Its antioxidant and UV-protective properties allow brands to position products as science-backed and multifunctional. Stable, standardized extracts reduce variability in product performance and ensure compliance with label claims. Suppliers gain competitive advantage by offering versatile ingredients suitable for cosmetics, supplements, and pharmaceutical applications. Efficient sourcing from agricultural by-products, such as rice bran and corn husk, reduces raw material costs and supports sustainable supply chains. Manufacturers benefit from enhanced consumer trust, improved brand equity, and increased willingness to pay for natural, functional ingredients. Reliable supply, standardized quality, and demonstrated efficacy are critical to maintaining commercial advantages and supporting market expansion globally.

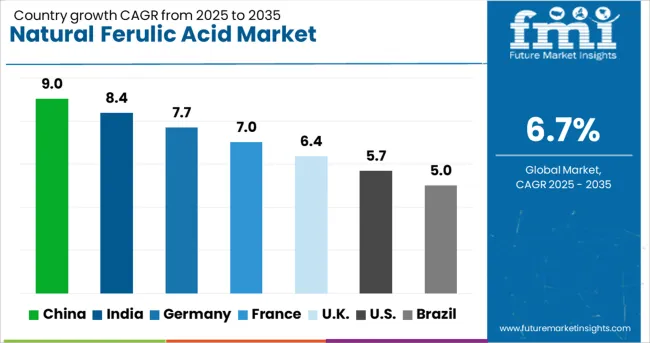

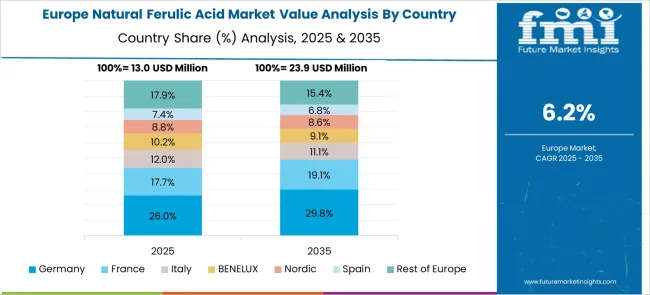

| Country | CAGR |

|---|---|

| China | 9.0% |

| India | 8.4% |

| Germany | 7.7% |

| France | 7.0% |

| UK | 6.4% |

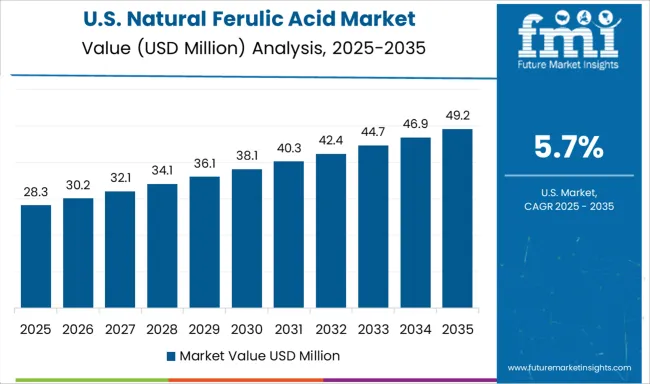

| USA | 5.7% |

| Brazil | 5.0% |

The natural ferulic acid market is projected to grow at a CAGR of 6.7%, driven by increasing demand in cosmetics, pharmaceuticals, and food preservation. China leads with 9.0% growth, supported by strong manufacturing infrastructure and extensive raw material availability. India follows at 8.4%, with growth fueled by expanding herbal and natural product industries. Germany records 7.7% growth, reflecting a focus on high-quality extraction processes and strict regulatory compliance. The UK shows 6.4% growth, driven by consumer interest in natural antioxidants and dietary supplements. The United States grows at 5.7%, highlighting research and applications in nutraceuticals and skincare. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the natural ferulic acid market with a 9.0% growth rate. Rising demand in cosmetics, pharmaceuticals, and food preservation drives market adoption. Compared to India, China benefits from advanced extraction technologies and large-scale manufacturing capacity. Skincare and anti-aging product formulations are major contributors to growth due to high domestic and export demand. The food and beverage industry also uses ferulic acid as a natural preservative, boosting consumption. Government policies supporting green extraction methods and plant-based ingredient research encourage sustainable production. Continuous R&D investments focus on higher purity and cost-effective processes. Strategic collaborations between manufacturers and research institutions further accelerate innovation. Overall, China combines industrial scale, technological expertise, and regulatory support, maintaining leadership in the global natural ferulic acid market.

Natural ferulic acid market grows at 8.4%, fueled by increasing use in pharmaceuticals and nutraceuticals. Compared to Germany, India emphasizes cost-effective extraction from rice bran and corn byproducts. Skincare and anti-aging products are key growth drivers, as consumer preference shifts toward natural ingredients. Local manufacturers are investing in modern extraction technologies and high-purity formulations to serve both domestic and international markets. Government initiatives promoting plant-based compounds encourage research and innovation. Partnerships between universities and private companies enhance product development and application in food and cosmetic industries. Expanding e-commerce and growing awareness of natural ingredients among consumers further support market growth. Overall, India balances affordability and innovation to expand adoption of ferulic acid across multiple industries.

Germany shows steady growth at 7.7% in the natural ferulic acid market. The country emphasizes high-quality, standardized formulations for cosmetics and pharmaceuticals. Compared to the United Kingdom, Germany focuses on rigorous quality control and eco-friendly extraction methods. Skincare and anti-aging products remain major contributors, while nutraceuticals demand consistent purity levels. R&D activities target innovative applications in food preservation and dietary supplements. Collaborations between chemical manufacturers and research institutes ensure technological advancement. Government regulations support natural and sustainable production processes. Export demand across Europe also sustains market growth. Overall, Germany combines innovation, regulatory compliance, and environmental considerations to maintain a competitive position in the global natural ferulic acid market.

The United Kingdom natural ferulic acid market grows at 6.4%, driven by cosmetics, nutraceuticals, and functional foods. Compared to the United States, the UK emphasizes regulatory compliance and product safety. Skincare products and dietary supplements increasingly use ferulic acid for antioxidant benefits. Manufacturers focus on sustainable sourcing and green extraction technologies. Research initiatives enhance product quality and efficacy for pharmaceutical and food applications. Consumer demand for natural ingredients supports market expansion. Partnerships between suppliers, formulators, and retailers improve market reach and adoption. Overall, the UK market combines sustainability, innovation, and regulatory adherence to steadily grow the natural ferulic acid market.

The United States advances in the natural ferulic acid market at 5.7%, supported by skincare, pharmaceutical, and food industries. Compared to China, the US focuses on premium, high-purity formulations to meet consumer and regulatory standards. Antioxidant and anti-aging applications in cosmetics are primary growth drivers. Nutraceutical and functional food sectors increasingly use ferulic acid for health benefits. Manufacturers invest in sustainable extraction and green chemistry methods to reduce environmental impact. Collaboration between academic research centers and industry promotes innovative applications. Market expansion is also supported by rising awareness of natural and plant-based ingredients among consumers. Overall, the United States leverages technology, regulatory frameworks, and sustainability initiatives to ensure steady growth in the natural ferulic acid market.

The natural ferulic acid market is evolving swiftly, with Delekang Biotechnology, Hubei Yuancheng Technology, and Shaanxi Guanjie Technology commanding the natural extraction segment by offering high-purity products, particularly derived from cereal grains—positioning themselves as leaders in pharmaceutical and premium cosmetics applications. Hubei Yuancheng, in particular, emphasizes cost-effective medium-purity production tailored for functional foods. Shaanxi Guanjie is boosting extraction efficiency by optimizing yields from wheat bran, reinforcing sustainability credentials. Healthful International and Natural Field Bio-Technique are carving niches in the clean-label domain: the former by launching UV-protective, anti-aging skincare formulations; the latter by developing fruit- and vegetable-derived ferulic acid for natural food and cosmetic lines.

On the synthetic front, companies like Zhejiang Tianxin Biotechnology, CM Fine Chemicals, and TSUNO Group focus on scalable and affordable lab-based production, servicing industrial and bulk-preservative needs. DSM Nutritional Products differentiates itself by enhancing bioavailability in nutraceutical formulations, while Hunan Huacheng Biotech explores applications in sustainable agriculture, such as plant growth enhancement. Emerging application-driven innovations include Syngenta’s patented use of ferulic acid as a UV absorber in sunscreens and Evonik–BASF’s collaboration to create advanced skincare-grade ferulic acid formulations. Across all tiers, strategies converge on three main axes: prioritizing purity levels (high purity for cosmetics/pharma vs medium for food vs low cost for industry), sourcing methods (natural extraction from cereals/fruits vs synthetic routes), and targeted end-use innovation (anti-aging skincare, clean-label food, nutraceuticals, agricultural inputs).

| Item | Value |

|---|---|

| Quantitative Units | USD 57.3 Million |

| Purity | Natural Ferulic Acid >=98% and Natural Ferulic Acid 98% |

| Application | Cosmetics, Pharmaceuticals, and Functional food & dietary supplements |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Haihang Group, Zhonglan Industry, Hunan Huacheng Biotech, Kingherbs, Oryza Oil & Fat Chemical, Cayman Chemical, Jiangxi Sincere Biochemical, Biosynth Carbosynth, Zhejiang Yongyang Biological, and Fuyang Biotech |

| Additional Attributes | Dollar sales in the natural ferulic acid market vary by source including wheat, rice bran, and corn, application across cosmetics, pharmaceuticals, and food & beverages, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising demand for natural antioxidants, anti-aging products, and functional food ingredients. |

The global natural ferulic acid market is estimated to be valued at USD 57.3 million in 2025.

The market size for the natural ferulic acid market is projected to reach USD 109.6 million by 2035.

The natural ferulic acid market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in natural ferulic acid market are natural ferulic acid >=98% and natural ferulic acid 98%.

In terms of application, cosmetics segment to command 61.3% share in the natural ferulic acid market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ferulic Acid Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Market Share Breakdown of Ferulic Acid Suppliers

Natural L-Lactic Acid Market

Australia Ferulic Acid Market Growth – Size, Demand & Forecast 2025-2035

Palm Kernel Oil and Coconut Oil Based Natural Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Natural Refrigerant Chiller Market Size and Share Forecast Outlook 2025 to 2035

Natural Antioxidant Market Size and Share Forecast Outlook 2025 to 2035

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Natural Disaster Detection IoT Market Forecast Outlook 2025 to 2035

Natural Cosmetic Color Market Size and Share Forecast Outlook 2025 to 2035

Natural Food Preservatives Market Size and Share Forecast Outlook 2025 to 2035

Natural Polymer Market Size and Share Forecast Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Natural Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Natural Mineral Oil Coolant Market Size and Share Forecast Outlook 2025 to 2035

Natural Synthetic Cytokinin (Anti-zeatin Riboside) Market Size and Share Forecast Outlook 2025 to 2035

Natural Food Flavors Market Size and Share Forecast Outlook 2025 to 2035

Natural Silicone Alternative Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Natural Skincare Preservatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA