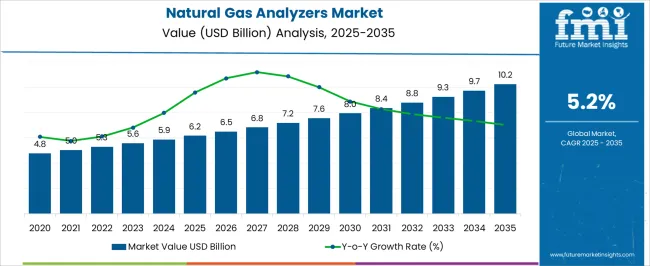

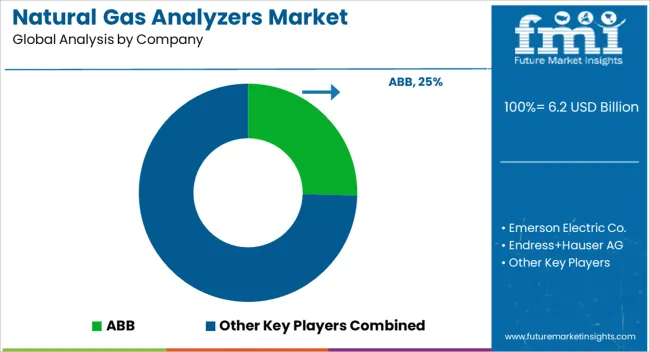

The Natural Gas Analyzers Market is estimated to be valued at USD 6.2 billion in 2025 and is projected to reach USD 10.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

| Metric | Value |

|---|---|

| Natural Gas Analyzers Market Estimated Value in (2025 E) | USD 6.2 billion |

| Natural Gas Analyzers Market Forecast Value in (2035 F) | USD 10.2 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The Natural Gas Analyzers market is experiencing steady growth driven by the increasing need for accurate and real-time monitoring of natural gas composition across multiple industries. The current market scenario reflects heightened adoption in sectors prioritizing process efficiency, safety, and regulatory compliance. Demand is being propelled by the need to ensure precise quality measurement of natural gas, optimize combustion processes, and reduce operational risks in energy generation and industrial applications.

Rising investments in upstream and downstream natural gas infrastructure and growing focus on environmental monitoring and emission control are shaping the market outlook. Technological advancements in analyzer precision, compact design, and integration with digital monitoring systems are enhancing operational efficiency and enabling remote monitoring capabilities.

Future growth opportunities are expected to emerge from the adoption of automated, software-driven analyzers that can support multiple measurement parameters and provide predictive analytics As energy markets continue to expand globally and stricter quality regulations are enforced, the Natural Gas Analyzers market is projected to witness sustained growth driven by both industrial and commercial requirements.

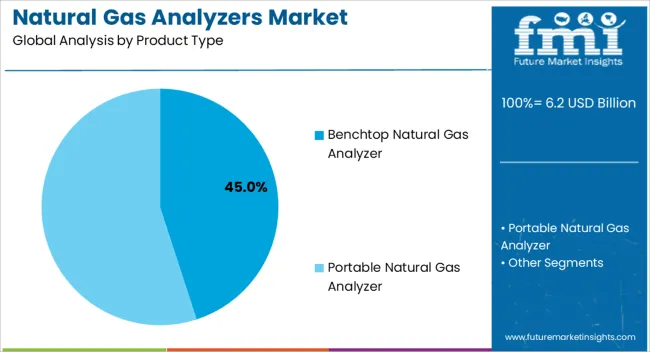

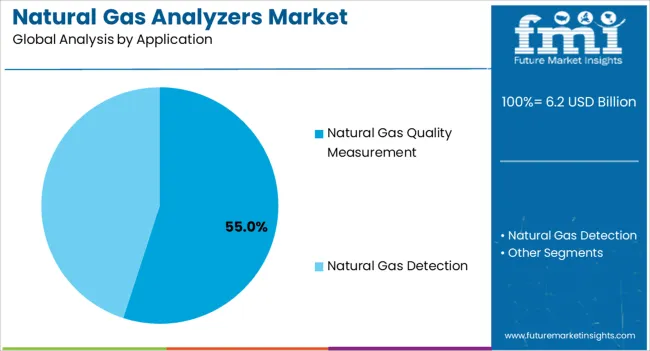

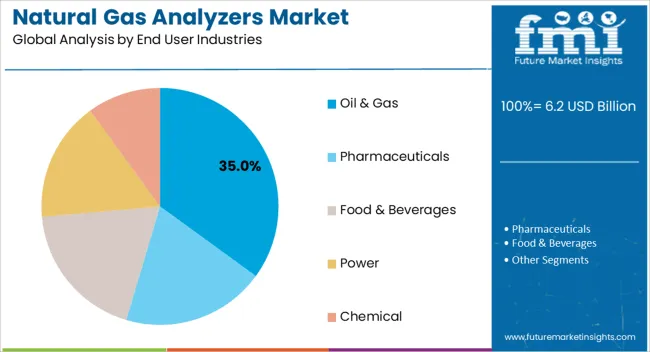

The natural gas analyzers market is segmented by product type, application, end user industries, and geographic regions. By product type, natural gas analyzers market is divided into Benchtop Natural Gas Analyzer and Portable Natural Gas Analyzer. In terms of application, natural gas analyzers market is classified into Natural Gas Quality Measurement and Natural Gas Detection. Based on end user industries, natural gas analyzers market is segmented into Oil & Gas, Pharmaceuticals, Food & Beverages, Power, and Chemical. Regionally, the natural gas analyzers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Benchtop Natural Gas Analyzer product type is projected to hold 45.00% of the overall market revenue in 2025, positioning it as the leading segment in the market. This dominance is being attributed to its high accuracy, reliability, and versatility in laboratory and field-based applications.

Benchtop analyzers are widely adopted for precise natural gas characterization, calibration, and testing where consistent measurement performance is critical. The growth of this segment has been reinforced by the increasing need for compact, portable, and user-friendly instruments that allow rapid deployment and repeatable results.

Their capability to integrate with data logging systems and support multi-component analysis has further driven adoption across energy production and research laboratories As natural gas quality requirements become more stringent and operational safety regulations tighten, benchtop analyzers are expected to remain the preferred choice for operators seeking reliable, software-assisted measurement solutions that provide actionable insights and support decision-making processes efficiently.

The Natural Gas Quality Measurement application segment is expected to capture 55.00% of total market revenue in 2025, emerging as the leading application area. This leadership is being driven by the increasing importance of monitoring gas composition for combustion efficiency, emissions control, and regulatory compliance.

The segment’s growth has been supported by technological developments in real-time monitoring, sensor accuracy, and multi-parameter analysis that enable precise characterization of natural gas streams. Companies and energy operators are prioritizing quality measurement to optimize process performance, reduce operational risk, and ensure adherence to environmental and safety standards.

The rising demand for natural gas in power generation, transportation, and industrial processes has intensified the need for reliable quality measurement, reinforcing this application as a critical segment As the adoption of advanced analyzers continues to expand and regulatory standards become more stringent, the Natural Gas Quality Measurement segment is expected to maintain its leading position in the market.

The Oil and Gas end-user industry segment is anticipated to hold 35.00% of the Natural Gas Analyzers market revenue in 2025, establishing it as the largest consumer of these analyzers. This leadership is being driven by the need for accurate and continuous monitoring of natural gas during production, transmission, and distribution processes. The segment’s growth has been facilitated by increasing investments in upstream and downstream infrastructure, growing emphasis on energy efficiency, and the enforcement of safety and quality standards.

Natural gas analyzers are extensively used to assess calorific value, detect impurities, and monitor emissions, ensuring compliance with operational and regulatory requirements. Their deployment supports process optimization, risk reduction, and resource management across the value chain.

Additionally, the adoption of automated and software-driven analyzer systems allows real-time monitoring and predictive analytics, reducing operational downtime and improving decision-making efficiency As global energy demand rises and natural gas becomes an increasingly important component of the energy mix, the Oil and Gas segment is expected to sustain its leading market share.

Natural gas is a naturally occurring hydrocarbon gas mixture that primarily consists of methane and may also contain trace amounts of other higher alkanes, as well as a trace amount of carbon dioxide, nitrogen, hydrogen sulphide, or helium. Because natural gas is colorless and odorless, a sulfur-smell is usually added to detect leaks early.

Natural gas analyzers are used to determine the chemical compositions, quality, quantity, and concentration of chemicals in natural gas. Natural gas analyzers are used in remote monitoring to detect leaks and the flow of natural gas in natural gas pipelines while it is being transported. Natural gas analyzers are used in the oil and gas industry to monitor the collection, production, transportation, and distribution of natural gas.

Furthermore, the power, pharmaceutical, and food and beverage industries consume the most natural gas. Natural gas analyzers are an essential product for analyzing natural gas quality standards, which leads to an increase in demand for natural gas analyzers among natural gas distributors and end users.

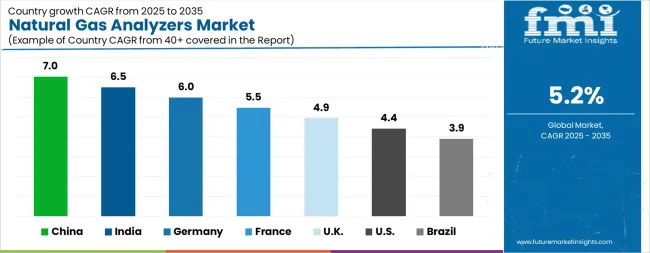

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| U.K. | 4.9% |

| U.S. | 4.4% |

| Brazil | 3.9% |

The Natural Gas Analyzers Market is expected to register a CAGR of 5.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.0%, followed by India at 6.5%. Developed markets such as Germany, France, and the U.K. continue to expand steadily, while the U.S. is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.9%, yet still underscores a broadly positive trajectory for the global Natural Gas Analyzers Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.0%. The U.S. Natural Gas Analyzers Market is estimated to be valued at USD 2.3 billion in 2025 and is anticipated to reach a valuation of USD 3.6 billion by 2035. Sales are projected to rise at a CAGR of 4.4% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 334.7 million and USD 180.9 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.2 Billion |

| Product Type | Benchtop Natural Gas Analyzer and Portable Natural Gas Analyzer |

| Application | Natural Gas Quality Measurement and Natural Gas Detection |

| End User Industries | Oil & Gas, Pharmaceuticals, Food & Beverages, Power, and Chemical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Emerson Electric Co., Endress+Hauser AG, GE (General Electric), Teledyne Technologies Incorporated, Yokogawa Electric Corporation, and AMETEK, Inc. |

The global natural gas analyzers market is estimated to be valued at USD 6.2 billion in 2025.

The market size for the natural gas analyzers market is projected to reach USD 10.2 billion by 2035.

The natural gas analyzers market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in natural gas analyzers market are benchtop natural gas analyzer and portable natural gas analyzer.

In terms of application, natural gas quality measurement segment to command 55.0% share in the natural gas analyzers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Natural Refrigerant Chiller Market Size and Share Forecast Outlook 2025 to 2035

Natural Antioxidant Market Size and Share Forecast Outlook 2025 to 2035

Natural Disaster Detection IoT Market Forecast Outlook 2025 to 2035

Natural Cosmetic Color Market Size and Share Forecast Outlook 2025 to 2035

Natural Food Preservatives Market Size and Share Forecast Outlook 2025 to 2035

Natural Polymer Market Size and Share Forecast Outlook 2025 to 2035

Natural Mineral Oil Coolant Market Size and Share Forecast Outlook 2025 to 2035

Natural Synthetic Cytokinin (Anti-zeatin Riboside) Market Size and Share Forecast Outlook 2025 to 2035

Natural Food Flavors Market Size and Share Forecast Outlook 2025 to 2035

Natural Silicone Alternative Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Natural Skincare Preservatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Natural Surfactant Market Size and Share Forecast Outlook 2025 to 2035

Natural Bitterness Blockers Market Analysis - Size And Share Forecast Outlook 2025 To 2035

Naturally Fermented Food Market Size and Share Forecast Outlook 2025 to 2035

Natural Refrigerants Market Size and Share Forecast Outlook 2025 to 2035

Natural Ferulic Acid Market Size and Share Forecast Outlook 2025 to 2035

Natural Vitamin E Product Market Size and Share Forecast Outlook 2025 to 2035

Natural Oil Polyols NOP Market Size and Share Forecast Outlook 2025 to 2035

Natural Rubber Market Size and Share Forecast Outlook 2025 to 2035

Natural Language Processing in Finance Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA