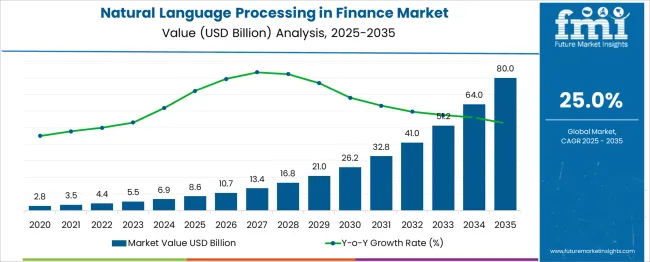

The Natural Language Processing in Finance Market is estimated to be valued at USD 8.6 billion in 2025 and is projected to reach USD 80.0 billion by 2035, registering a compound annual growth rate (CAGR) of 25.0% over the forecast period.

The Natural Language Processing in Finance Market shows a remarkable growth trajectory, expanding from USD 2.8 billion in 2021 to USD 21.0 billion by 2030, representing an absolute dollar increase of USD 18.2 billion and an exceptional CAGR exceeding 25% during the period. Yearly values highlight strong compounding effects: 2021 (USD 2.8B) rises to 2022 (USD 3.5B), 2023 (USD 4.4B), and 2024 (USD 5.5B), driven by rapid adoption in fraud detection, sentiment analysis, and automated report generation. The market crosses USD 6.9 billion by 2025, marking more than double its size from 2021, underscoring strong institutional demand for real-time analytics and compliance automation.

The second half of the decade demonstrates accelerated adoption, scaling to USD 8.6 billion in 2026, USD 10.7 billion in 2027, and surpassing USD 13.4 billion in 2028, largely driven by AI-integrated trading systems, conversational banking interfaces, and advanced risk modeling. The upward momentum peaks as the market achieves USD 16.8 billion in 2029 and USD 21.0 billion by 2030, reflecting financial institutions’ shift toward deep-learning-powered language solutions for regulatory filings, customer engagement, and algorithmic trading strategies.

This exponential expansion reflects a structural transformation in financial services, where linguistic AI is central to operational efficiency, real-time compliance, and predictive analytics. Organizations leveraging domain-specific NLP, explainable AI frameworks, and multi-lingual sentiment engines will dominate this high-growth segment, especially as automation and precision-driven decision-making become non-negotiable in global finance ecosystems.

| Metric | Value |

|---|---|

| Natural Language Processing in Finance Market Estimated Value in (2025 E) | USD 8.6 billion |

| Natural Language Processing in Finance Market Forecast Value in (2035 F) | USD 80.0 billion |

| Forecast CAGR (2025 to 2035) | 25.0% |

The natural language processing (NLP) in finance market represents a key component within broader sectors such as financial analytics software, risk management solutions, fraud detection systems, customer experience platforms, and regulatory compliance technologies. Within the financial analytics software category, NLP accounts for nearly 14 %, driven by its role in extracting actionable insights from unstructured data such as reports and earnings calls.

In risk management solutions, its share is about 11 %, as NLP aids in detecting anomalies and identifying early warning signals from text-heavy data sources. Fraud detection systems represent approximately 9 %, leveraging NLP for real-time analysis of communication patterns and transaction descriptions to identify irregularities. Within customer experience platforms, NLP holds close to 10 %, enhancing chatbots, sentiment analysis, and voice-based services for banking clients.

For regulatory compliance technologies, its share stands at 8 %, supporting automated document review and monitoring for adherence to evolving policies. This integration is reshaping financial services by reducing manual intervention, accelerating decision-making, and improving accuracy in high-volume data environments. With expanding applications in algorithmic trading, ESG reporting, and personalized banking, the demand for NLP-powered solutions is set to intensify. Vendors focusing on hybrid AI models, multilingual processing, and cloud-based deployment will secure competitive advantages as financial institutions prioritize automation and predictive intelligence to meet operational and regulatory requirements globally.

The Natural Language Processing (NLP) in Finance market is witnessing robust growth as financial institutions increasingly turn to AI-driven tools for automating processes, enhancing decision-making accuracy, and extracting actionable insights from unstructured data. The integration of NLP solutions is reshaping front-office, middle-office, and back-office operations by enabling real-time customer interaction, regulatory compliance automation, and high-frequency sentiment analysis from vast textual sources.

This trend is being reinforced by the expanding availability of cloud-based AI infrastructure, enterprise APIs, and scalable language models tailored for finance-specific use cases. Regulatory mandates demanding transparency and risk traceability are further promoting the deployment of NLP to improve documentation, audit trails, and compliance screening.

Financial entities are also leveraging NLP in fraud detection, algorithmic trading, and customer sentiment tracking, supported by a surge in fintech collaboration and internal digital transformation mandates. As language models become more context-aware and data pipelines more integrated, the NLP in Finance market is poised to scale further, offering precision, cost-efficiency, and operational resilience across the financial ecosystem.

The natural language processing in the finance market is segmented by component, technology, application, industry vertical, and geographic regions. The components of natural language processing in the finance market are divided into Software and Services. In terms of technology of natural language processing in the finance market, it is classified into Deep learning, Machine learning, Natural language generation, Text classification, Topic modeling, Emotion detection, and Others.

Based on the application of natural language processing in finance market is segmented into Sentiment analysis, Risk management and fraud detection, Cybersecurity and threat detection, Trade surveillance, Investment analysis, Financial news and market analysis, Customer service and support, Document and contract analysis, Speech recognition and transcription, Language translation, and Others. The industry vertical of natural language processing in the finance market is segmented into Banking, Insurance, Financial Services, and Others. Regionally, the natural language processing in finance industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

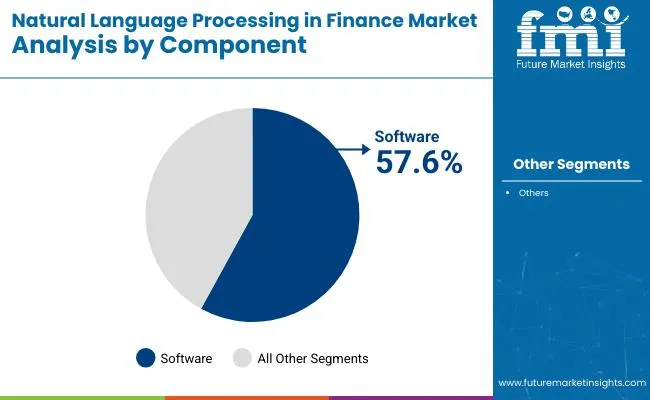

The software component is expected to account for 57.6% of the overall revenue share in the Natural Language Processing in Finance market in 2025, reflecting its foundational role in enabling NLP functionalities across various financial platforms. The growing complexity of financial language processing has necessitated the deployment of customizable software libraries, APIs, and cloud-native NLP engines capable of parsing domain-specific data with high accuracy.

Software-based solutions are being widely adopted for applications such as automated report generation, sentiment analysis, risk profiling, and customer service chatbots, driven by their scalability and real-time responsiveness. Their dominance has also been reinforced by advancements in natural language understanding, named entity recognition, and contextual language modeling, all of which are critical in parsing financial documents and market commentary.

Financial institutions are prioritizing software-led NLP deployments that offer seamless integration with existing IT infrastructure, faster model iteration, and the flexibility to update language frameworks in response to evolving market conditions and regulatory expectations.

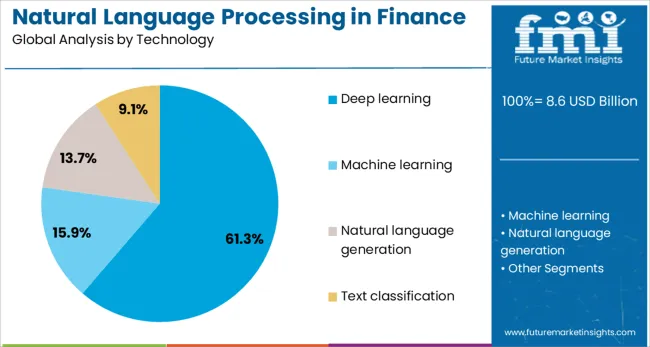

Deep learning technology is anticipated to command 61.3% of the total revenue share in the Natural Language Processing in Finance market in 2025, underlining its pivotal contribution to enhancing language comprehension capabilities. The dominance of this segment is driven by its unmatched ability to model complex linguistic patterns, extract contextual meaning, and support sophisticated prediction algorithms in real-time financial applications.

Financial entities are deploying deep learning-based NLP to automate earnings call analysis, risk sentiment detection, and contract analytics, where precision and scale are critical. The evolution of transformer-based architectures, pre-trained language models, and advanced embeddings has further strengthened the ability of deep learning to process large volumes of financial data with domain-specific understanding.

Its integration into cloud platforms and enterprise data lakes has made it highly scalable, while the ability to retrain and fine-tune models based on firm-specific language and tone has improved model relevance. These capabilities are enabling financial firms to gain faster, data-driven insights and stay competitive in a rapidly digitizing industry.

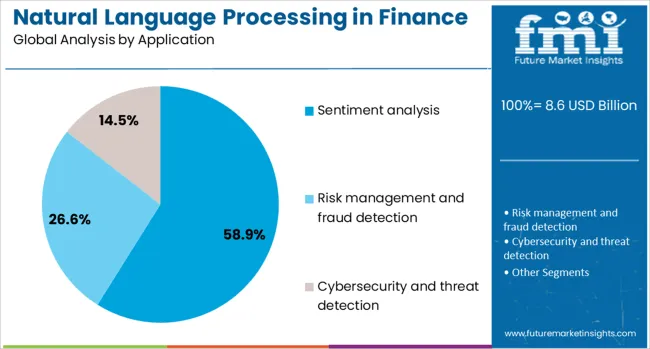

Sentiment analysis is forecast to represent 58.9% of the total revenue share in the Natural Language Processing in Finance market in 2025, establishing itself as the most influential application. This segment’s growth is being propelled by the increasing reliance on real-time market sentiment indicators, derived from news feeds, earnings transcripts, social media, and analyst commentary.

Financial institutions are leveraging sentiment analysis to enhance trading strategies, predict market movements, and assess investor behavior with greater granularity. The use of NLP in quantifying emotional tone and linguistic cues from massive unstructured datasets is enabling firms to uncover early market signals and potential risk exposures.

The accuracy and relevance of these insights have been elevated through fine-tuned models trained on financial lexicons, sentiment scoring systems, and dynamic contextual interpretations. The incorporation of sentiment data into investment platforms, risk dashboards, and portfolio optimization systems is further driving the segment’s demand as firms seek a competitive edge through predictive analytics and market intelligence.

NLP is transforming finance through AI-driven risk analysis, regulatory compliance, and real-time market prediction. It is further advancing customer engagement and automation via chatbots, advisory tools, and document processing for cost efficiency and fraud prevention.

Natural Language Processing is being adopted in finance to manage unstructured data from reports, social media, and customer interactions. Financial institutions are leveraging NLP for sentiment evaluation, fraud detection, and automated credit assessments. Regulatory compliance requirements are being handled through NLP models for document interpretation and anomaly detection, reducing manual review time. Market behavior prediction is being improved as NLP supports real-time data analysis, helping traders identify investment opportunities. The growing availability of pre-trained language models is influencing adoption as these models enable faster implementation. Banking and insurance sectors are considering NLP essential for optimizing decision-making and minimizing financial risks.

NLP is influencing the design of chatbots and virtual assistants for financial services, offering improved customer interactions and operational efficiency. Banks are deploying NLP-based chatbots for real-time query resolution and personalized recommendations, reducing dependency on call centers. Automation in financial advisory services is being achieved through NLP-powered tools that interpret client data and deliver portfolio insights. Document processing for loan approvals and claim settlements is being automated through NLP algorithms, enhancing speed and accuracy. Payment processors and fintech platforms are prioritizing NLP integration for fraud alerts and transaction monitoring. These applications are being seen as critical for reducing costs and improving client engagement in competitive financial markets.

The adoption of natural language processing in finance is accelerating as institutions seek automation for regulatory compliance and risk assessment. NLP tools enable rapid extraction and interpretation of complex legal and policy documents, reducing time and errors associated with manual reviews. Financial firms use NLP-driven platforms for anti-money laundering checks, fraud detection, and real-time monitoring of suspicious communication patterns, ensuring adherence to compliance standards. The ability to analyze unstructured text from reports, emails, and contracts is transforming traditional risk frameworks. These applications provide operational agility and safeguard against penalties, making NLP a strategic asset for modern financial ecosystems worldwide.

Customer engagement is becoming a major growth driver for NLP in finance, as firms leverage conversational AI, chatbots, and sentiment analysis to enhance client experiences. These tools process real-time inquiries, interpret natural speech, and deliver personalized financial advice with improved accuracy. Beyond customer service, NLP supports predictive analytics in trading and investment advisory, enabling data-driven strategies by analyzing earnings transcripts, market news, and investor sentiments. Automated summarization and voice-based authentication are also streamlining decision-making processes. This dual role in improving user experience and enabling advanced analytics positions NLP as an indispensable technology for banks, asset managers, and fintech companies aiming for competitive differentiation.

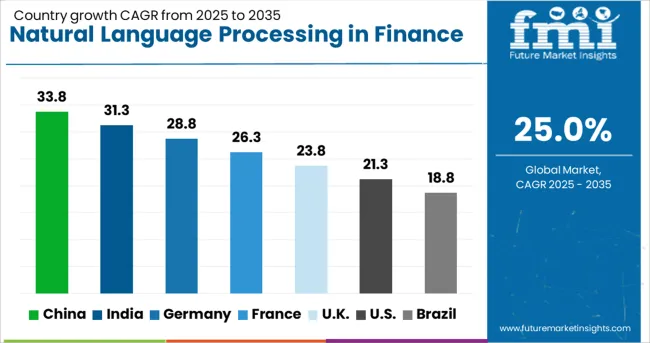

| Country | CAGR |

|---|---|

| China | 33.8% |

| India | 31.3% |

| Germany | 28.8% |

| France | 26.3% |

| UK | 23.8% |

| USA | 21.3% |

| Brazil | 18.8% |

The natural language processing in the finance industry is projected to register a global CAGR of 25.0% from 2025 to 2035, with significant differences across major economies. A strong 33.8% CAGR is being exhibited by China, a BRICS member, where large-scale investments in AI applications for trading and compliance are accelerating growth. India, also part of BRICS, is recording a 31.3% CAGR driven by the rapid digitalization of banking operations and increasing fintech adoption.

Germany, an OECD member, is experiencing a 28.8% CAGR, supported by the integration of NLP tools in risk management and regulatory reporting. The United Kingdom is expected to maintain a 23.8% CAGR as financial firms prioritize automation of advisory and customer service processes. The United States is reporting a 21.3% CAGR, influenced by advanced financial ecosystems and early adoption of machine learning models in credit analysis and fraud detection. The report includes a comprehensive review of more than 40 countries, with the top five growth markets highlighted above as reference.

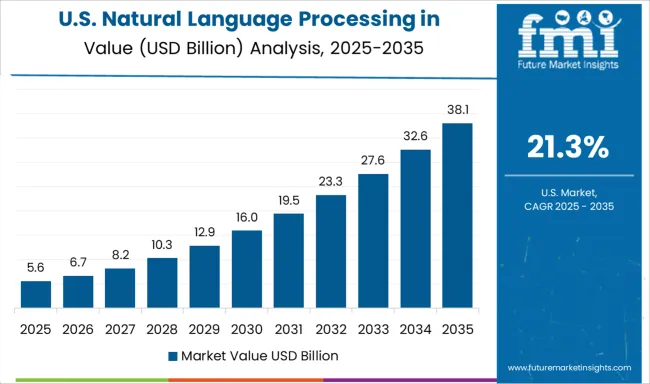

The CAGR of the NLP in finance market in the United States expanded from nearly 14.2% during 2020–2024 to 21.3% for 2025–2035, supported by deeper integration of machine learning tools into fraud prevention, compliance reporting, and credit assessment systems. Increased utilization of sentiment-driven analytics enhanced algorithmic trading and investment recommendations across institutional portfolios. Financial institutions in the USA accelerated AI-driven strategies for document interpretation and risk scoring to meet regulatory expectations efficiently. Partnerships between fintech firms and traditional banks created strong demand for scalable NLP-based automation frameworks.

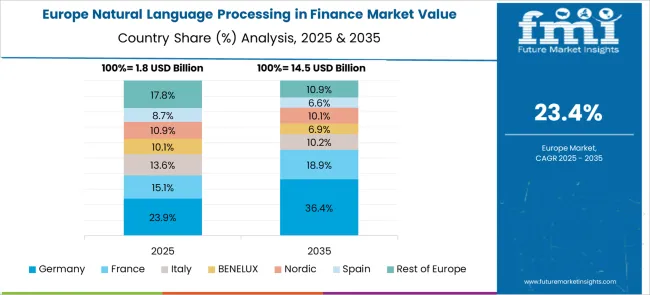

The CAGR in Germany advanced from 13.1% in 2020–2024 to 28.8% for 2025–2035, encouraged by robust adoption of advanced language models for compliance and reporting across the banking ecosystem. Regulatory digitization reforms in Europe prompted German financial entities to automate internal audit and documentation procedures using NLP frameworks. Institutional investment platforms adopted NLP-based predictive analytics to strengthen portfolio risk control and credit allocation processes. Strong momentum was observed in leveraging chatbots and digital assistants for retail banking services to improve user interaction efficiency.

The CAGR for the United Kingdom moved from approximately 12.4% during 2020–2024 to 23.8% in 2025–2035, supported by increased automation in wealth management and retail banking functions. NLP-driven chatbots and cognitive virtual assistants became critical in enhancing real-time customer service within major financial institutions. Regulatory technology solutions powered by NLP facilitated streamlined compliance reporting and document analysis, reducing audit cycle times. Adoption of language-based risk models allowed lenders to process credit evaluations faster while improving accuracy in fraud detection, especially in digital banking ecosystems.

China’s CAGR surged from roughly 18.7% during 2020–2024 to 33.8% for 2025–2035, driven by the rapid deployment of AI-powered automation in large state-owned banks and emerging fintech ecosystems. Financial institutions adopted NLP-based document processing for loan disbursements, KYC verification, and cross-border transaction compliance. Expansion of digital-only banks in China supported heavy integration of NLP into fraud alert systems and algorithmic trading platforms. Strategic government-backed AI initiatives significantly boosted local innovation in financial analytics and risk mitigation, enhancing data processing accuracy for high-frequency trading and credit scoring models.

The CAGR in India accelerated from 16.2% during 2020–2024 to 31.3% for 2025–2035, with strong momentum in fintech adoption and digitization of lending ecosystems. NLP applications for credit assessment, document verification, and compliance automation were integrated into major private banking systems. Startups and NBFCs utilized AI-driven chatbots for customer engagement and loan servicing across semi-urban and rural markets, reducing operational costs. Regulatory bodies endorsed automated frameworks for KYC and fraud detection to enhance financial transparency. Cloud-based NLP services became widely implemented across payment platforms, reinforcing efficiency in real-time transaction monitoring.

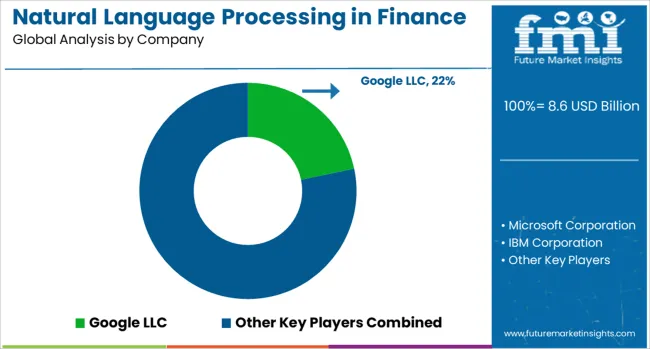

The financial NLP sector is driven by leading technology firms and emerging innovators delivering AI-powered tools for compliance, risk mitigation, and enhanced customer engagement. Google LLC provides advanced NLP capabilities through its Cloud AI platform, enabling financial institutions to automate document interpretation, regulatory audits, and sentiment analysis for market insights. Microsoft Corporation leverages Azure Cognitive Services to deliver real-time language processing for fraud detection, conversational banking, and compliance monitoring. IBM Corporation offers Watson-based NLP models with deep learning capabilities for credit risk assessment, KYC automation, and anti-money laundering processes.

Amazon Web Services, Inc. focuses on scalable NLP services integrated with big data frameworks, empowering financial enterprises with predictive analytics and multilingual capabilities. SAS Institute Inc. continues to specialize in statistical NLP applications, including sentiment analysis for financial forecasting and modeling for portfolio management strategies. Emerging companies such as Uniphore Technologies Inc. are transforming client engagement with advanced voice analytics, speech-to-text solutions, and AI-powered virtual assistants that streamline transactions and improve security. Veritone, Inc. is gaining momentum with its proprietary AI platform enabling real-time transcription, risk identification, and compliance checks, addressing high-demand use cases in banking and insurance. Collectively, these companies are emphasizing cloud-based deployment, data security, and model customization to cater to evolving regulatory frameworks and customer-centric requirements, positioning NLP as a transformative force in the financial services landscape.

In April 2024, Microsoft launched “Release Wave 1” across Dynamics 365 and Power Platform, introducing hundreds of AI-powered capabilities, including Microsoft Copilot for Finance, enabling natural language processing, AI recommendations, and automation in finance workflow.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.6 Billion |

| Component | Software and Services |

| Technology | Deep learning, Machine learning, Natural language generation, Text classification, Topic modeling, Emotion detection, and Others |

| Application | Sentiment analysis, Risk management and fraud detection, Cybersecurity and threat detection, Trade surveillance, Investment analysis, Financial news and market analysis, Customer service and support, Document and contract analysis, Speech recognition and transcription, Language translation, and Others |

| Industry Vertical | Banking, Insurance, Financial services, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Google LLC, Microsoft Corporation, IBM Corporation, Amazon Web Services, Inc., SAS Institute Inc., Uniphore Technologies Inc., and Veritone, Inc. |

| Additional Attributes | Dollar sales, share, adoption by banking and fintech segments, regional growth hotspots, competitive positioning, pricing models, regulatory compliance impact, and enterprise deployment trends. |

The global natural language processing in finance market is estimated to be valued at USD 8.6 billion in 2025.

The market size for the natural language processing in finance market is projected to reach USD 80.0 billion by 2035.

The natural language processing in finance market is expected to grow at a 25.0% CAGR between 2025 and 2035.

The key product types in natural language processing in finance market are software, _rule-based nlp software, __regular expression (regex), __finite state machines (fsms), __named entity recognition (ner), __part-of-speech (pos) tagging, _statistical nlp software, __naive bayes, __logistics regression, __support vector machines (svms), __recurrent neural networks (rnns), _hybrid nlp software, __latent dirichlet allocation (lda), __hidden markov models (hmms), __conditional random fields (crfs), services, _professional services, __training and consulting, __system integration and implementation, __support and maintenance and _managed services.

In terms of technology, deep learning segment to command 61.3% share in the natural language processing in finance market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Natural Refrigerant Chiller Market Size and Share Forecast Outlook 2025 to 2035

Natural Antioxidant Market Size and Share Forecast Outlook 2025 to 2035

Natural Disaster Detection IoT Market Forecast Outlook 2025 to 2035

Natural Cosmetic Color Market Size and Share Forecast Outlook 2025 to 2035

Natural Food Preservatives Market Size and Share Forecast Outlook 2025 to 2035

Natural Polymer Market Size and Share Forecast Outlook 2025 to 2035

Natural Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Natural Food Flavors Market Size and Share Forecast Outlook 2025 to 2035

Natural Silicone Alternative Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Natural Surfactant Market Size and Share Forecast Outlook 2025 to 2035

Natural Bitterness Blockers Market Analysis - Size And Share Forecast Outlook 2025 To 2035

Naturally Fermented Food Market Size and Share Forecast Outlook 2025 to 2035

Natural Refrigerants Market Size and Share Forecast Outlook 2025 to 2035

Natural Ferulic Acid Market Size and Share Forecast Outlook 2025 to 2035

Natural Oil Polyols NOP Market Size and Share Forecast Outlook 2025 to 2035

Natural Rubber Market Size and Share Forecast Outlook 2025 to 2035

Naturally Derived Fatty Alcohol Market Size and Share Forecast Outlook 2025 to 2035

Natural Fiber Composites Market Size and Share Forecast Outlook 2025 to 2035

Natural Food Colors Market Analysis - Size, Share, and Forecast 2025 to 2035

Naturally Derived Sweeteners Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA