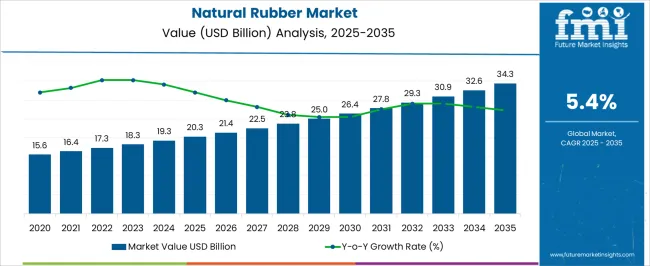

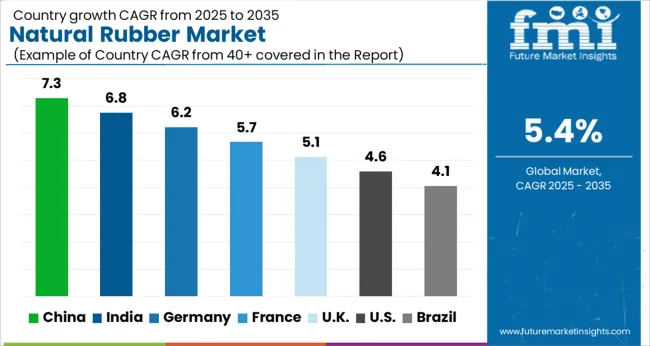

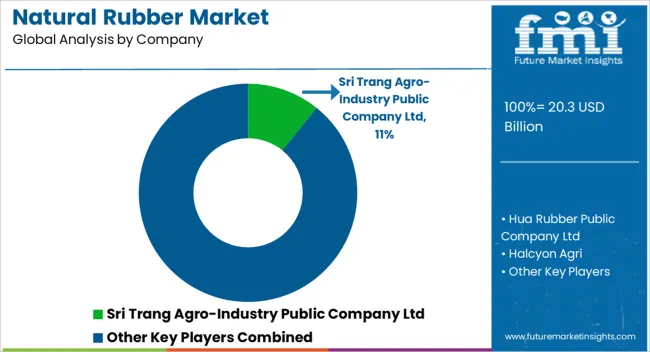

The Natural Rubber Market is estimated to be valued at USD 20.3 billion in 2025 and is projected to reach USD 34.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

| Metric | Value |

|---|---|

| Natural Rubber Market Estimated Value in (2025 E) | USD 20.3 billion |

| Natural Rubber Market Forecast Value in (2035 F) | USD 34.3 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The Natural Rubber market is showing stable expansion, backed by steady demand from key industrial sectors and consistent global supply chain activities. The market’s current growth is being supported by its critical role in manufacturing, particularly in regions where natural rubber is preferred for its elasticity, durability, and environmental compatibility. Industry announcements and investor briefings have emphasized increasing demand from tire and component manufacturers, especially in emerging economies with rising automotive production.

Additionally, government programs encouraging sustainable and eco-friendly raw material sourcing are creating favorable conditions for long-term growth. Supply-side dynamics have also improved due to expanded cultivation and advancements in tapping techniques.

As highlighted in industry journals and public-sector updates, the emphasis on reducing dependency on synthetic alternatives due to environmental concerns is adding further momentum Looking ahead, the market is likely to benefit from regulatory shifts, industrial expansion in Asia, and innovation in material processing technologies, solidifying natural rubber's role in global manufacturing supply chains.

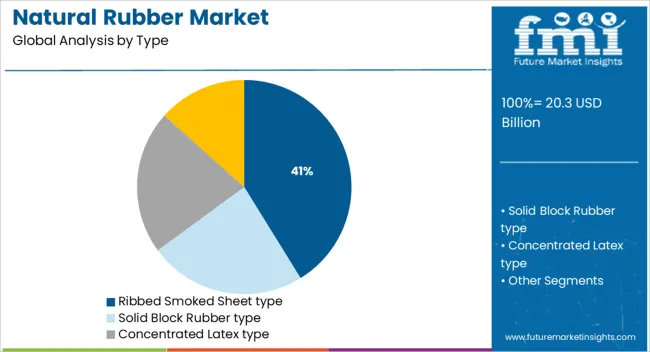

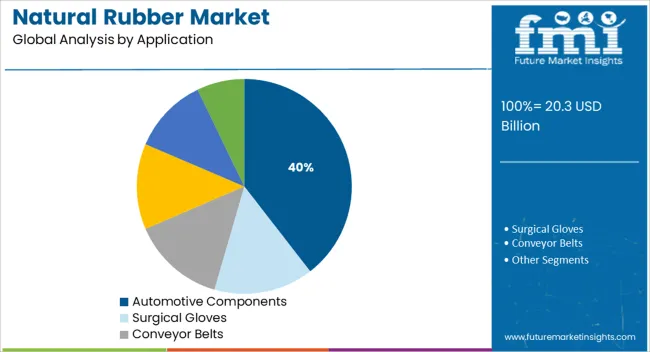

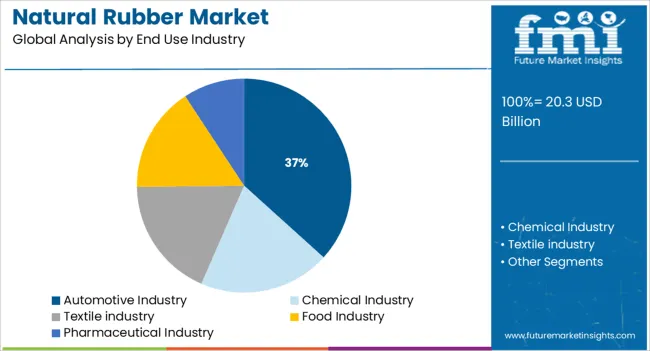

The market is segmented by Type, End Use Industry, and Application and region. By Type, the market is divided into Ribbed Smoked Sheet type, Solid Block Rubber type, Concentrated Latex type, and Others (e.g Reclaimed Rubber, Crepe Rubber). In terms of End Use Industry, the market is classified into Automotive Industry, Chemical Industry, Textile industry, Food Industry, and Pharmaceutical Industry. Based on Application, the market is segmented into Automotive Components, Surgical Gloves, Conveyor Belts, Foot Wear, Latex Products, and Rubber Pipes and other general products. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ribbed smoked sheet type is expected to account for 41.2% of the Natural Rubber market revenue share in 2025, making it the leading type segment. This dominance is being driven by its superior physical properties, cost-effectiveness, and widespread availability in key producing regions. Industry-focused publications have highlighted that ribbed smoked sheets offer high tensile strength, resilience, and durability, making them a preferred choice in multiple industrial applications.

As noted in trade communications and exporter briefings, their standardized grading and consistent quality allow for reliable downstream processing, especially in tire manufacturing. The segment’s growth has been further supported by improvements in production efficiency and post-harvest handling, resulting in better supply chain reliability.

Demand from both domestic and international buyers has remained strong due to its adaptability and compliance with global standards These attributes have positioned ribbed smoked sheet type as the most commercially viable and operationally preferred form of natural rubber in the current market.

The automotive components segment is projected to hold 39.5% of the Natural Rubber market revenue share in 2025, emerging as the dominant application segment. This leadership has been reinforced by increasing production of vehicles and the essential role of natural rubber in components like hoses, belts, seals, and gaskets. Automotive industry updates and manufacturing briefings indicate that natural rubber is favored due to its flexibility, heat resistance, and vibration absorption qualities, all critical for engine and suspension components.

Furthermore, OEMs have continued to adopt natural rubber for its compatibility with advanced engineering needs and its contribution to performance longevity. Supply chain news sources report that the shift toward lightweight and sustainable materials has supported natural rubber’s use in under-the-hood applications.

The segment’s growth is also being driven by its integral role in ensuring safety and efficiency, along with its proven field performance under varying climatic conditions These factors have sustained the segment’s leading share in the market.

The automotive industry segment is anticipated to capture 36.7% of the Natural Rubber market revenue share in 2025, maintaining its position as the leading end use industry. This growth is being driven by robust demand from the global mobility sector, particularly in emerging economies where vehicle ownership is rising rapidly. Annual reports and manufacturing outlooks have shown that natural rubber is an indispensable raw material in tire manufacturing and a wide array of automotive components.

It has been widely adopted due to its natural elasticity, wear resistance, and ability to perform under high stress. The segment’s momentum is further reinforced by OEM demand for sustainable material sourcing in compliance with environmental and product safety regulations.

Corporate briefings from major tire manufacturers also reflect significant investment in upgrading rubber processing facilities to support consistent quality and volume requirements These operational and strategic developments have continued to strengthen the automotive industry’s role as the largest consumer of natural rubber in the global market.

During the historical period of 2020 to 2025, the natural rubber market has witnessed a CAGR of 4.7% and top a valuation of US$ 17,334.6 million by the end of 2025. The global lockdown implemented to curb the effect of COVID-19 caused a decrease in production and consumption level in the major end-users of natural rubbers. However, as per the latest estimates by Future Market Insights, the future growth outlook for natural rubber is anticipated to remain around 5.4% from 2025 to 2035.

Growth in demand is attributed to the growth in various factors like increasing production of automobiles, rising construction activities, high demand for footwear, and an increase in airplane production. Besides, natural rubber is a key raw material used in the manufacturing of a variety of end-use items such as medical equipment, industrial components, surgical gloves, vehicle tires, garments, pacifiers, toys, mattresses, and so on.

Irrespective of characteristic features and several applications, the market is expected to face certain challenges in the coming years, especially from its counterpart synthetic rubber. With the rise in the application of synthetic rubber along with the availability of various types of synthetic rubber, several end users are increasing their purchase quantity of synthetic rubber instead natural ones. This is expected to remain a key challenge for the natural rubber market over the forecast period.

Growing production of automotive across the globe will drive the demand for natural rubber

Natural rubber, which has excellent elasticity, flexibility, and resistance to abrasion, is a useful raw material for making vehicle tires, floor mats, window seals, and shock absorbers. Due to technological advancements and the high demand for passenger automobiles, there has been an increase in the volume of natural rubber used in the automotive industry.

For instance, according to the International Organization of Motor Vehicle Manufacturers, 19.3 million passenger vehicles will be produced worldwide in 2024, up from 19.3 million units in 2024. As the number of passenger vehicles manufactured globally rises, so will the use of natural rubber polymer in making tires and other automotive accessories. As a result, the natural rubber industry will prosper.

Increasing adoption of natural rubber in construction materials to boost sales

The growing global population and rapid rates of urbanization are driving the building and construction industry across the globe. Key players in these sectors also invest the research and development to improve the quality and reduce the cost of the materials. In view of this, natural rubber is proving worthy in the construction industry to provide strength and economic benefits.

For instance, cement is combined with bonding agents composed of natural rubber polymer and isoprene compounds while repairing concrete and plastered surfaces. Rapid growth in residential and commercial development brought on by the increased demand for housing units and infrastructural improvements is anticipated to boost the usage of natural rubber in the construction industry.

Negative impact on health and the environment may hamper the natural rubber market growth

Natural rubber is harmful to latex-allergic people. Natural latex can produce anaphylactic shock, a life-threatening allergic reaction. As a result, natural rubber production consumes a significant amount of water, energy, and chemicals, which, when released as waste and effluents, produce environmental issues such as chemical-containing wastewater and thermal emission.

Natural rubber's negative effects on human health and the environment may limit its use. This could slow the expansion of the global natural rubber business.

South Asia region to lead the global production and consumption of natural rubber

According to the FMI analysis, the South Asia region dominates the global production and consumption of natural rubber. The suitable climate conditions in the region have boosted the growth prospects of the market. Farmers in ASEAN countries prefer high-profit rubber plantations, as a result, the ASEAN countries account for the largest share in the production of natural rubber in south Asia.

However, India and other East Asian countries such as China, Japan, and South Korea are also investing significantly to flourish natural rubber production. The growth in end-use industries like automotive and textiles are creating lucrative opportunities for the natural rubber market across these countries.

Thriving end-use industries will boost the natural rubber demand across north America

North America is a key region in the global natural rubber market due to its high consumption from end-use industries. The automotive, textile, and chemical industry in the USA is highly developed and competitive. The end users in these domains invest significantly in improving the quality of their products through research-driven innovations.

Thus consumption of natural rubber from these industries has been growing for many years. In the forecast period, the USA is expected to dominate the consumption of natural rubber in North America.

The Natural Rubbers market is highly competitive in the Asia-Pacific region. This is due to the huge production of latex and natural rubber in the region and the enormous value chains established by the players. Major corporations are also employing a range of corporate growth strategies to broaden their reach on a regional and international level.

Some of the key participants present in the global demand of the Natural Rubbers market include Sri Trang Agro-Industry Public Company Ltd, Southland Rubber Co., Yunnan State Farms Group Co., Num Rubber & Latex Co., Ltd, Ltd, Von Bundit Co., Hua Rubber Public Company Ltd, Halcyon Agri, Ltd, Sinochem Group Co. Ltd., Ltd, Apcotex Industries Ltd., and Firestone Natural Rubber Company, among others.

Recent Developments:

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5.4% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million, Volume in Tons, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered |

Type, End Use Industry, Application |

| Regions Covered |

North America; Latin America; Europe; East Asia; South Asia & Pacific; Middle East and Africa |

| Key Countries Covered |

USA, Canada, Mexico, Brazil, Germany, United Kingdom, France, Italy, Spain, Russia, China, Japan, India, ASIAN, GCC Countries, Australia, Turkey, South Africa |

| Key Companies Profiled |

Sri Trang Agro-Industry Public Company Ltd; Hua Rubber Public Company Ltd; Halcyon Agri; Southland Rubber Co., Ltd; Sinochem Group Co. Ltd.; Num Rubber & Latex Co., Ltd; Yunnan State Farms Group Co., Ltd; Von Bundit Co., Ltd; Apcotex Industries Ltd.; Firestone Natural Rubber Company |

The global natural rubber market is estimated to be valued at USD 20.3 billion in 2025.

The market size for the natural rubber market is projected to reach USD 34.3 billion by 2035.

The natural rubber market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in natural rubber market are ribbed smoked sheet type, solid block rubber type, concentrated latex type and others (e.g reclaimed rubber, crepe rubber).

In terms of end use industry, automotive industry segment to command 36.7% share in the natural rubber market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Natural Antioxidant Market Size and Share Forecast Outlook 2025 to 2035

Natural Disaster Detection IoT Market Forecast Outlook 2025 to 2035

Natural Cosmetic Color Market Size and Share Forecast Outlook 2025 to 2035

Natural Food Preservatives Market Size and Share Forecast Outlook 2025 to 2035

Natural Polymer Market Size and Share Forecast Outlook 2025 to 2035

Natural Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Natural Mineral Oil Coolant Market Size and Share Forecast Outlook 2025 to 2035

Natural Synthetic Cytokinin (Anti-zeatin Riboside) Market Size and Share Forecast Outlook 2025 to 2035

Natural Food Flavors Market Size and Share Forecast Outlook 2025 to 2035

Natural Silicone Alternative Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Natural Skincare Preservatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Natural Surfactant Market Size and Share Forecast Outlook 2025 to 2035

Natural Bitterness Blockers Market Analysis - Size And Share Forecast Outlook 2025 To 2035

Naturally Fermented Food Market Size and Share Forecast Outlook 2025 to 2035

Natural Refrigerants Market Size and Share Forecast Outlook 2025 to 2035

Natural Ferulic Acid Market Size and Share Forecast Outlook 2025 to 2035

Natural Vitamin E Product Market Size and Share Forecast Outlook 2025 to 2035

Natural Oil Polyols NOP Market Size and Share Forecast Outlook 2025 to 2035

Natural Language Processing in Finance Market Size and Share Forecast Outlook 2025 to 2035

Naturally Derived Fatty Alcohol Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA